Europe Antimicrobial Coating for Medical Devices Market, By Product Type (Silver Antimicrobial Coating, Copper Antimicrobial Coating, Others), Coating (Silver, Chitosan, Titanium Dioxide, Aluminium, Copper, Zinc, Gallium, Others), Type (Escherichia Coli, Pseudomonas, Listeria, Others), Additives (Silver Ion Antimicrobial Additives, Organic Antimicrobial Additives, Copper Antimicrobial Additives, Zinc Antimicrobial Additives), Material (Graphene Materials, Silver Nanoparticles, Polycationic Hydrogel, Polymer Brushes, Dendrimers, Others), Resin Type (Epoxy, Acrylic, Polyurethane, Polyester, Others), Form (Liquid, Powder, Aerosol), Application (Surgical Instruments, Implantable Devices, Guidewires, Mandrels & Molds, Catheters, Others), Industry Trends and Forecast to 2029.

Market Analysis and Insights

Nowadays, healthcare providers are continually tasked with improving patient health while reducing the risk of infection. The prominence of hospital acquired infections has fuelled the need for strategies and products that actively reduce the risk of patient infections. As such, the incorporation of antimicrobial additives into healthcare furnishings and medical equipment is increasingly being viewed as part of the solution to infection prevention and control in healthcare environments. Moreover, the rising demand for implantable devices has surged also surged the demand for antimicrobial coating for medical devices. However, the limitations of silver ion coating may hamper the growth of market to some extent.

Growing technological advancement in antimicrobial coating are creating an opportunity for the growth of Europe antimicrobial coating for medical devices market whereas adverse effect of antimicrobial coating on human health may create challenge for the growth of the market.

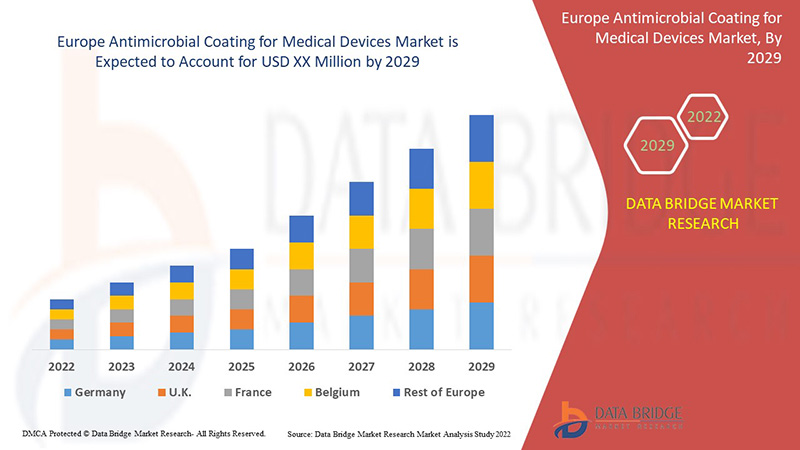

Increasing use of antimicrobial coating for medical devices coupled with growing awareness regarding hospital acquired infections has surged its demand. Data Bridge Market Research analyses that the antimicrobial coating for medical devices market will grow at a CAGR of 12.4% during the forecast period of 2022 to 2029.

|

Report Metric

|

Details

|

|

forecast Period

|

2022 to 2029

|

|

Base Year

|

2021

|

|

Historic Years

|

2020 (Customizable to 2020 - 2014)

|

|

Quantitative Units

|

Revenue in USD Million, Volumes in Kilo Tons, Pricing in USD

|

|

Segments Covered

|

By Product Type (Silver Antimicrobial Coating, Copper Antimicrobial Coating, Others), Coating (Silver, Chitosan, Titanium Dioxide, Aluminum, Copper, Zinc, Gallium, Others), Type (Escherichia Coli, Pseudomonas, Listeria, Others), Additives (Silver Ion Antimicrobial Additives, Organic Antimicrobial Additives, Copper Antimicrobial Additives, Zinc Antimicrobial Additives), Material (Graphene Materials, Silver Nanoparticles, Polycationic Hydrogel, Polymer Brushes, Dendrimers, Others), Resin Type (Epoxy, Acrylic, Polyurethane, Polyester, Others), Form (Liquid, Powder, Aerosol), Application (Surgical Instruments, Implantable Devices, Guidewires, Mandrels & Molds, Catheters, Others)

|

|

Countries Covered

|

Germany, U.K., Italy, France, Spain, Russia, Turkey, Switzerland, Belgium, Netherlands, Luxemburg, rest of Europe

|

|

Market Players Covered

|

DSM, PPG Industries, Inc., Akzo Nobel N.V., Specialty Coating Systems Inc, Covalon Technologies Ltd., AST Products, Inc., Hydromer, Sciessent LLC, Microban International, Axalta Coating Systems, LLC, Biointeractions Ltd, Sika, Harland Medical Systems, Inc., Biomerics, BioCote Limited amongst others

|

Antimicrobial Coating for Medical Devices Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

- Rise in awareness regarding hospital-acquired infections

Rising incidences of hospital-acquired infection have increased the burden on the healthcare system rising concerns for the healthcare industry. The increasing number of hospital infected diseases has relatively increased the burden on the healthcare sector. The antimicrobial coating help reduce hospital-acquired infections as they have various properties such as biocompatibility

- Rise in demand for implantable devices Europe

The demand for implantable devices is increased owing to the increasing prevalence of chronic diseases coupled with the rapidly aging population, the surge in road accidents, and improvements in active implanted medical devices. According to the Association for Safe International Road Travel, approximately 4.4 million are injured seriously enough to require medical attention.

Opportunities

- The rising healthcare sector in emerging economies

The rising healthcare sector in emerging economies such as India and China is anticipated to create the opportunity for antimicrobial coating products demand in medical devices. Factors such as the growing population, changed lifestyles, rising elderly population, especially in China, and increasing medical tourism are some of the major factors behind driving the growth of the healthcare sector. According to the article published by India Brand Equity Foundation (IBEF), in March 2022, About 6, 97,300 foreign tourists came to India for medical treatment in the year 2019 and also revealed that India holds 10th rank out of 46 destinations in Medical Tourism Index (MTI) for the 2020-2021 year.

Restraints/Challenges

However, the limitation of silver ion coating, and unfavourable U.S. health reforms the market growth rate. Low production capacity of emerging economies will also pose a major challenge.

This antimicrobial coating for medical devices market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on antimicrobial coating for medical devices market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Post COVID-19 Impact on Antimicrobial Coating for Medical Devices Market

Coronavirus disease (COVID-19) is an infectious disease caused by a newly discovered SARS-CoV-2 virus while a large pool of the population is affected by the COVID-19 virus. The people affected with the COVID-19 virus will experience mild-to-moderate respiratory illness and recover without requiring special treatment. However, coronavirus (COVID-19) spread is expanding Europely for the last few months and the patient population is hugely boomed.

For instance,

- According to the World Health Organization (WHO) till 31st March 2022, 481,756,671 confirmed cases of COVID-19 have been found including 6,127,981 deaths. Whereas, Europe has a high pace of COVID-19 spread in comparison to other regions. Till 31st March 2022, there have been 199,889,200 confirmed cases of COVID-19 in Europe

The pandemic of COVID-19 has adversely affected supply chain and manufacturing activities. Additionally, as the world came to a standstill and transportation services were halted across the globe, the borders were sealed to prevent the spread of the virus. The trade practices also faced significant challenges during the pandemic. Consequently, the supply of implants, their import, export, and local transportation, and supply of raw materials were gravely affected.

Recent Developments

- In September 2021, BioCote Limited, showcased innovative antimicrobial coating technology, including their latest developments for plastic antimicrobial coating products. This enhanced the company’s annual revenue

- In January 2022, the company has inaugurated its second manufacturing plant located in Costa Rica. The plant will involve in manufacturing medical device solution for extrusion, injection molding, micromachining metals processing, and final assembly processes in cleanrooms. This move was taken to meet the increasing demand for medical device solution in the market

- In May 2021, Hydromer has announced that it has been selected as a key coating and services partner for the company name Avinger, Inc. This move helps the company to propel its growth in the market

Europe Antimicrobial Coating for Medical Devices Market Scope

The antimicrobial coating for medical devices market is segmented into product type, coating, type, additives, materials, resin type, form, and application. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Product Type

- Silver Antimicrobial Coatings

- Copper Antimicrobial Coatings

- Others

On the basis of product type, the Europe antimicrobial coating for medical devices market is segmented into silver antimicrobial coatings, copper antimicrobial coatings, and others.

Coating

- Silver

- Copper

- Zinc

- Gallium

- Aluminium

- Titanium Dioxide

- Others

On the basis of coating, the Europe antimicrobial coating for medical devices market is segmented into silver, copper, zinc, gallium, aluminium, titanium dioxide, and others.

Type

- Escherichia Coli

- Pseudomonas

- Listeria

- Others

On the basis of type, the Europe antimicrobial coating for medical devices market is segmented into escherichia coli, pseudomonas, listeria, and others.

Additive

- Small Size Silver ion antimicrobial additives

- Zinc antimicrobial additives

- Copper antimicrobial additives

- Organic antimicrobial additives

On the basis of additive, the Europe antimicrobial coating for medical devices market is segmented into silver ion antimicrobial additives, zinc antimicrobial additives, copper antimicrobial additives, and organic antimicrobial additives.

Material

- Graphene materials

- Polycationic hydrogel

- Silver nanoparticles

- Polymer brushes

- Dendrimers

- Others

On the basis of material, the Europe antimicrobial coating for medical devices market is segmented into graphene materials, polycationic hydrogel, silver nanoparticles, polymer brushes, dendrimers, and others.

Resin Type

- Acrylic

- Polyester

- Polyurethane

- Epoxy

- Others

On the basis of resin type, the Europe antimicrobial coating for medical devices market is segmented into acrylic, polyester, polyurethane, epoxy, and others.

Form

- Liquid

- Aerosol

- Powder

On the basis of form, the Europe antimicrobial coating for medical devices market is segmented into liquid, aerosol, and powder.

Application

- Surgical instruments

- Guidewires

- Implantable devices

- Catheters

- Mandrels & molds

- Others

On the basis of application, the Europe antimicrobial coating for medical devices market is segmented into surgical instruments, guidewires, implantable devices, catheters, mandrels & molds, and others.

Antimicrobial Coating for Medical Devices Market Regional Analysis/Insights

The antimicrobial coating for medical devices market is analysed and market size insights and trends are provided by country, product type, coating, material, additives, type, resin type, type, and application.

The countries covered in the Europe antimicrobial coating for medical devices market report are Germany, U.K., Italy, France, Spain, Russia, Switzerland, Turkey, Belgium, Netherlands, Luxemburg, and the rest of Europe.

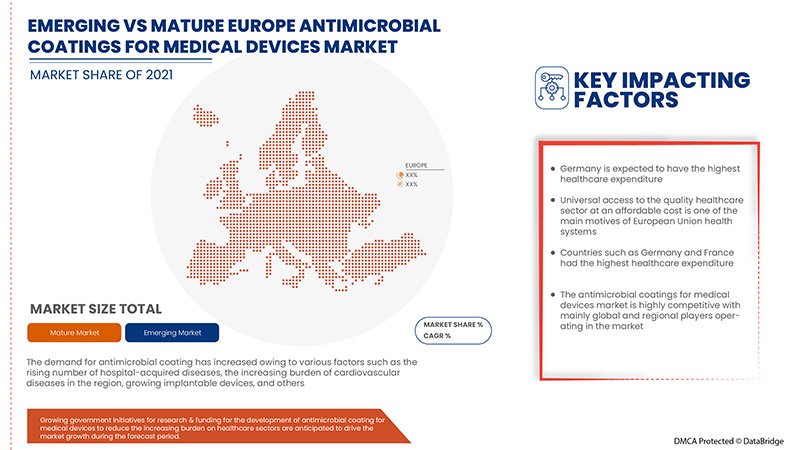

Germany dominates the Europe antimicrobial coating for medical devices market in terms of market share and market revenue and will continue to flourish its dominance during the forecast period. This is attributed to because countries such as Germany and France had the highest healthcare expenditure. Universal access to the quality healthcare sector at an affordable cost is one of the main motives of European Union health systems. The growing elderly population coupled with rising chronic diseases cases is anticipated to drive the demand for medical devices, which is likely to drive the demand for antimicrobial coating in medical devices.

The country section of the report also provides individual market impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of Europe brands and their challenges faced due to high competition from local and domestic brands, and impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Antimicrobial Coating for Medical Devices Market Share Analysis

The antimicrobial coating for medical devices market competitive landscape provides details by the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, GCC presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus on antimicrobial coating for medical devices market.

Some of the major players operating in the antimicrobial coating for medical devices market are DSM, PPG Industries, Inc., Akzo Nobel N.V., Specialty Coating Systems Inc, Covalon Technologies Ltd., AST Products, Inc., Hydromer, Sciessent LLC, Microban International, Axalta Coating Systems, LLC, Biointeractions Ltd, Sika, Harland Medical Systems, Inc., Biomerics, BioCote Limited, and amongst others.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In adition, market share analysis and key trend analysis are the major success factors in the market report.. The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, GCCVsRegional and Vendor Share Analysis. Please request analyst call in case of further inquiry.

SKU-