Europe Anti Friction Coating Market

Market Size in USD Million

CAGR :

%

USD

370.95 Million

USD

686.61 Million

2025

2033

USD

370.95 Million

USD

686.61 Million

2025

2033

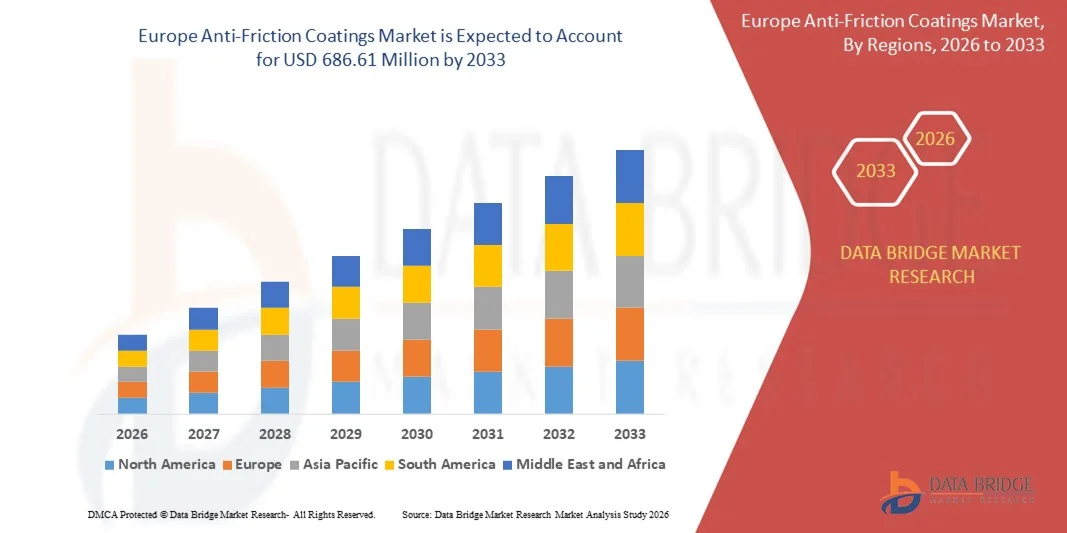

| 2026 –2033 | |

| USD 370.95 Million | |

| USD 686.61 Million | |

|

|

|

|

Europe Anti-Friction Coatings Market Size

- The Europe anti-friction coatings market size was valued at USD 370.95 million in 2025 and is expected to reach USD 686.61 million by 2033, at a CAGR of 8.0% during the forecast period

- The market growth is largely fueled by the increasing demand for enhanced component durability, energy efficiency, and reduced wear across automotive, industrial, aerospace, and healthcare sectors, where anti-friction coatings play a critical role in minimizing mechanical losses and extending equipment service life

- Furthermore, rising focus on operational efficiency, lower maintenance costs, and compliance with stringent environmental and performance standards is accelerating the adoption of advanced anti-friction coating solutions, thereby significantly supporting overall market expansion

Europe Anti-Friction Coatings Market Analysis

- Anti-friction coatings, designed to reduce surface friction, wear, and material degradation, have become essential in modern manufacturing and engineering applications due to their ability to improve performance, reliability, and lifespan of critical components operating under demanding conditions

- The growing demand for these coatings is primarily driven by increasing industrial automation, advancements in coating technologies, and expanding use of lightweight and high-performance materials across key end-use industries, reinforcing the market’s steady growth trajectory

- Germany dominated the anti-friction coatings market in 2025, due to its strong automotive, industrial manufacturing, and mechanical engineering base, along with high demand for performance-enhancing surface treatments across powertrain, machinery, and precision components

- U.K. is expected to be the fastest growing region in the anti-friction coatings market during the forecast period due to rising investments in aerospace, automotive engineering, and advanced manufacturing

- PTFE segment dominated the market 56.22% in 2025, due to its excellent low-friction properties, chemical resistance, and wide applicability across automotive, industrial, and aerospace components. PTFE coatings are preferred for enhancing performance, reducing wear, and extending the service life of critical machinery, particularly in applications requiring consistent lubrication and resistance to aggressive operating environments

Report Scope and Anti-Friction Coatings Market Segmentation

|

Attributes |

Anti-Friction Coatings Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Anti-Friction Coatings Market Trends

Rising Adoption of Environment-Friendly Anti-Friction Coatings

- A significant trend in the anti-friction coatings market is the growing adoption of environment-friendly and low-VOC coating solutions, driven by tightening environmental regulations and increasing sustainability commitments across automotive, industrial, and aerospace sectors. Manufacturers are actively shifting toward water-based, PFAS-controlled, and solvent-reduced formulations to align with regulatory frameworks while maintaining coating performance and durability

- For instance, DuPont has been expanding its portfolio of advanced, low-friction coatings with improved environmental profiles that support reduced emissions and compliance with evolving global chemical regulations. These developments are enabling end users to meet sustainability targets without compromising wear resistance and friction reduction performance

- Automotive manufacturers are increasingly integrating eco-friendly anti-friction coatings to improve fuel efficiency and reduce mechanical losses while adhering to emission reduction mandates. This trend is strengthening the role of sustainable coatings in next-generation vehicle platforms and powertrain systems

- Industrial equipment manufacturers are also prioritizing environmentally responsible coatings to improve workplace safety and meet stricter industrial compliance requirements. This is accelerating the adoption of water-based and advanced solid lubricant coatings across large-scale manufacturing environments

- The aerospace sector is progressively incorporating environment-friendly anti-friction coatings to balance lightweight design requirements with durability and regulatory compliance. This shift is reinforcing demand for coatings that offer long service life while reducing environmental impact

- Overall, the rising emphasis on sustainability, regulatory alignment, and performance optimization is positioning environment-friendly anti-friction coatings as a key trend shaping future market development

Europe Anti-Friction Coatings Market Dynamics

Driver

Increasing Demand for Improved Component Durability and Energy Efficiency

- The increasing demand for improved component durability and energy efficiency across automotive, industrial machinery, and aerospace applications is a major driver of the anti-friction coatings market. These coatings significantly reduce surface wear, frictional losses, and energy consumption, supporting longer equipment lifecycles and improved operational efficiency

- For instance, Parker Hannifin applies advanced anti-friction coating technologies to enhance the durability and efficiency of motion and control components used in industrial and mobile equipment. Such applications help reduce maintenance frequency and energy losses in high-load operating conditions

- Automotive manufacturers are increasingly relying on anti-friction coatings to improve fuel economy and extend engine and drivetrain component life. This demand is directly linked to stricter efficiency standards and the need to lower total cost of ownership

- In industrial automation and power transmission systems, coatings play a critical role in minimizing downtime and improving mechanical efficiency. This is driving consistent adoption across high-precision manufacturing and heavy-duty machinery

- The healthcare and medical device sectors are also contributing to this driver, as durable, low-friction coatings enhance reliability and performance of surgical instruments and implantable devices. The sustained focus on efficiency, reliability, and lifecycle optimization continues to reinforce this driver, supporting steady market growth across multiple end-use industries

Restraint/Challenge

High Production Costs and Complex Application Processes

- The anti-friction coatings market faces challenges related to high production costs and complex application processes that require specialized equipment, skilled labor, and controlled processing environments. These factors increase manufacturing expenses and limit cost flexibility for coating providers

- For instance, CARL BECHEM GMBH utilizes advanced formulation and application techniques to deliver high-performance anti-friction coatings for industrial and automotive uses. Such precision-driven processes raise operational costs and create barriers for large-scale cost reduction

- Achieving consistent coating thickness, adhesion, and performance often involves multi-step application and curing processes. These requirements extend production timelines and increase overall manufacturing complexity

- The use of specialized raw materials and solid lubricants further contributes to cost volatility and supply chain challenges. Manufacturers must balance material performance with economic feasibility

- Collectively, high costs and technical complexity continue to challenge widespread adoption, compelling industry participants to invest in process optimization and cost-efficient application technologies to sustain long-term growth

Europe Anti-Friction Coatings Market Scope

The market is segmented on the basis of product, nature, application, and end use.

- By Product

On the basis of product, the market is segmented into MOS2, PTFE, Graphite, FEP, PFA, and Tungsten Disulfide. The PTFE segment held the largest market revenue share in 2025, driven by its excellent low-friction properties, chemical resistance, and wide applicability across automotive, industrial, and aerospace components. PTFE coatings are preferred for enhancing performance, reducing wear, and extending the service life of critical machinery, particularly in applications requiring consistent lubrication and resistance to aggressive operating environments.

The MOS2 segment is expected to witness the fastest growth rate from 2026 to 2033, driven by its superior load-bearing capacity and high-temperature stability, making it ideal for heavy-duty applications in automotive engines, power transmission items, and industrial machinery. MOS2 coatings are particularly popular for reducing friction under extreme conditions, improving operational efficiency, and minimizing maintenance costs in systems exposed to high pressure and fluctuating thermal loads.

- By Nature

On the basis of nature, the market is segmented into solvent based and water based. The water-based segment held the largest share in 2025, fueled by growing environmental regulations and preference for eco-friendly coating solutions. Water-based coatings offer reduced VOC emissions, improved workplace safety, and compliance with sustainability standards, making them increasingly suitable for large-scale industrial and automotive coating operations.

The solvent-based segment is expected to witness the fastest growth from 2026 to 2033, driven by its strong adhesion, high performance under harsh conditions, and suitability for critical industrial and automotive applications. Solvent-based coatings continue to be favored where durability and extreme operational resistance are required, especially in applications involving high temperatures, heavy loads, and corrosive environments.

- By Application

On the basis of application, the market is segmented into automotive parts, power transmission items, bearings, ammunition components, valve components & actuators, and others. The automotive parts segment held the largest market share in 2025 due to increasing demand for lightweight, high-performance components and stringent automotive efficiency standards. Anti-friction coatings improve fuel efficiency, reduce wear, and enhance the reliability of automotive systems, supporting longer service intervals and improved vehicle performance.

The power transmission items segment is expected to witness the fastest growth from 2026 to 2033, driven by increasing industrial automation and demand for high-efficiency gearboxes and machinery. Coatings reduce friction, improve energy efficiency, and minimize downtime, making them crucial in modern industrial operations where productivity and reliability are key priorities.

- By End Use

On the basis of end use, the market is segmented into automotive, aerospace, marine, construction, healthcare, and others. The automotive segment held the largest revenue share in 2025, propelled by growing vehicle production, adoption of fuel-efficient technologies, and focus on reducing maintenance costs. Anti-friction coatings enhance engine performance, component lifespan, and overall vehicle efficiency, contributing to improved durability and reduced operational losses.

The aerospace segment is expected to witness the fastest growth from 2026 to 2033, driven by the increasing need for lightweight, high-performance components capable of withstanding extreme temperatures and stresses. Coatings provide superior lubrication, wear resistance, and energy efficiency, which are critical for aerospace applications requiring high reliability and long operational lifecycles.

Europe Anti-Friction Coatings Market Regional Analysis

- Germany dominated the anti-friction coatings market with the largest revenue share in 2025, driven by its strong automotive, industrial manufacturing, and mechanical engineering base, along with high demand for performance-enhancing surface treatments across powertrain, machinery, and precision components

- The country’s extensive presence of automotive OEMs, industrial equipment manufacturers, and chemical producers, supported by advanced R&D capabilities and strict quality standards, sustains consistent demand for high-performance anti-friction coatings in both production and aftermarket applications

- Increasing focus on energy efficiency, component longevity, and compliance with environmental regulations, supported by established players such as DuPont and CARL BECHEM GMBH, reinforces Germany’s leading position. Continuous investments in advanced manufacturing technologies and sustainable coating formulations ensure Germany’s dominance in the European anti-friction coatings market

U.K. Anti-Friction Coatings Market Insight

The U.K. is projected to register the fastest CAGR in the Europe anti-friction coatings market from 2026 to 2033, supported by rising investments in aerospace, automotive engineering, and advanced manufacturing. For instance, Parker Hannifin supplies anti-friction and surface treatment solutions for motion control systems used across U.K. industrial and aerospace applications, strengthening local demand. Increasing adoption of automation, emphasis on reducing maintenance costs, and growing use of lightweight, high-efficiency components across industrial and defense sectors are accelerating market growth. Strong innovation ecosystems, expanding aerospace programs, and focus on performance optimization position the U.K. as the fastest-growing market in the region.

France Anti-Friction Coatings Market Insight

France is expected to witness steady growth during 2026–2033, driven by consistent demand from automotive manufacturing, aerospace production, and industrial equipment sectors. Strong emphasis on component reliability, wear reduction, and operational efficiency supports continued adoption of anti-friction coatings across critical applications. The presence of established aerospace and industrial suppliers, along with growing use of advanced surface engineering solutions, strengthens market penetration. Ongoing modernization of manufacturing facilities, stable industrial output, and alignment with EU sustainability and performance regulations reinforce France’s steady growth within the Europe anti-friction coatings market.

Europe Anti-Friction Coatings Market Share

The anti-friction coatings industry is primarily led by well-established companies, including:

- DuPont (U.S.)

- Parker Hannifin Corp (U.S.)

- CARL BECHEM GMBH (Germany)

- ASV Mutichemie Private Limited (India)

- Whitmore Manufacturing LLC (U.S.)

- FUCHS LUBRITECH GmbH (Germany)

- Lubrizol Corporation (U.S.)

- Klüber Lubrication (Germany)

- Royal DSM N.V. (Netherlands)

- Evonik Industries AG (Germany)

Latest Developments in Europe Anti-Friction Coatings Market

- In January 2026, SSG announced the establishment of a medical coatings facility in Costa Rica with a long-term investment exceeding $10 million for land acquisition and dedicated facility construction, a move that is expected to significantly enhance its production capacity for specialized anti-friction coatings while strengthening its presence in the healthcare segment, improving supply chain efficiency, and supporting rising demand for biocompatible and high-precision coating solutions

- In May 2025, PPG Industries introduced a new generation of ultra-low-friction, copper-free anti-friction coatings alongside ongoing manufacturing capacity expansion efforts. The development is anticipated to reinforce the company’s market leadership by meeting stringent environmental regulations, supporting sustainability goals, and addressing increasing performance requirements across aerospace, industrial, and automotive applications

- In April 2025, Orion Industries unveiled advanced anti-friction coating solutions designed for aerospace and defense applications, highlighting the industry’s shift toward high-durability and wear-resistant technologies that reduce friction under extreme operating conditions, extend component service life, and improve reliability in critical, high-stress environments

- In May 2021, DuPont launched MOLYKOTE G-1079 grease, a noise-reducing anti-friction coating specifically designed for sliding-contact applications in actuators, including next-generation electric vehicles. The new formulation enhances performance under both high-load fast movements and low-load slow movements, improving operational efficiency and component longevity. This innovation strengthens DuPont’s product portfolio and is expected to boost market sales by meeting the growing demand for advanced, high-performance lubricants in the automotive and industrial sectors

- In April 2021, Whitmore Manufacturing, LLC introduced Lustor, a scalable lubrication storage and dispensing system. The compact and durable unit extends the life of lubricants while fitting into nearly any industrial location, offering improved efficiency and ease of use. This development supports operational optimization for industrial clients and enhances Whitmore Manufacturing’s market presence, contributing positively to revenue growth and adoption of advanced lubrication solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Europe Anti Friction Coating Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Anti Friction Coating Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Anti Friction Coating Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.