Europe Alcoholic Beverages Market

Market Size in USD Billion

CAGR :

%

USD

248.52 Billion

USD

368.58 Billion

2024

2032

USD

248.52 Billion

USD

368.58 Billion

2024

2032

| 2025 –2032 | |

| USD 248.52 Billion | |

| USD 368.58 Billion | |

|

|

|

|

Alcoholic Beverages Market Size

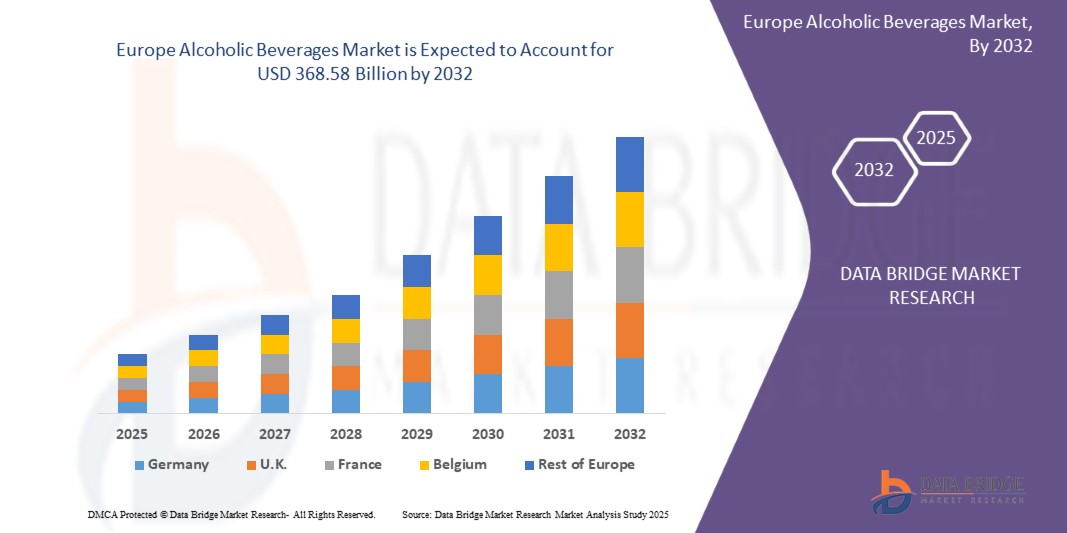

- The Europe Alcoholic Beverages market size was valued at USD 248.52 billion in 2024 and is expected to reach USD 368.58 billion by 2032, at a CAGR of 4.0% during the forecast period

- The market growth is largely fueled by rising demand for premium and craft beverages, increasing disposable incomes, evolving consumer preferences toward flavored and low-alcohol options, urbanization, expanding hospitality sectors, and greater access through online retail and diverse distribution channels.

- Furthermore, growing health awareness has spurred demand for low-calorie and organic alcoholic drinks, while innovative packaging, product diversification, and experiential marketing strategies continue to attract and retain a broader consumer base.

Alcoholic Beverages Market Analysis

- There is a noticeable shift toward premiumization, flavored variants, and low or no-alcohol options. Consumers are seeking quality experiences, health-conscious choices, and sustainable products, driving innovation and product diversification in the alcoholic beverages market.

- The rise of online retailing, modern trade formats, and specialty stores has enhanced product accessibility. Alcoholic beverages are increasingly marketed through digital platforms, with personalized promotions and broad availability fueling market penetration and competitive growth across Europe.

- Germany dominates the Alcoholic Beverages market with a 26% revenue share in 2025, driven by its strong beer heritage, high consumption rates, thriving craft and premium segments, robust production infrastructure, and expanding distribution through retail and online channels.

- Additionally, Germany's innovation in low- and no-alcohol beverages, strong export potential, rising health-conscious consumers, and government support for sustainable brewing practices contribute to its market strength, reinforcing its leadership in the evolving European alcoholic beverages landscape.

- The Beer segment is expected to dominate the Alcoholic Beverages market with a significant share of around 45% in 2025, driven by strong consumer preference, extensive variety of craft and premium beers, and cultural popularity across key European countries.

Report Scope and Alcoholic Beverages Market Segmentation

|

Attributes |

Alcoholic Beverages Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Alcoholic Beverages Market Trends

“Increasing preference for flavored and health-conscious drink options”

- Consumers are shifting towards flavored alcoholic beverages that offer unique taste experiences, such as fruit-infused beers, flavored spirits, and cocktails, driven by a desire for variety and novelty in drinking occasions across all age groups.

- Health-conscious consumers prefer low-calorie, low-sugar, and organic alcoholic drinks, prompting manufacturers to develop options with natural ingredients, reduced alcohol content, and clean-label certifications to meet growing demand for wellness-oriented products.

- The rise of non-alcoholic and low-alcohol beverages reflects a broader trend towards mindful drinking, as consumers seek to balance social enjoyment with health goals, leading to innovative product launches that cater to this segment.

- Functional alcoholic beverages enriched with vitamins, antioxidants, or botanicals are gaining traction, appealing to consumers looking for added health benefits and differentiation in a crowded market focused on holistic wellness.

- Packaging innovations, including transparent labeling of nutritional information and eco-friendly materials, support consumer trust and reinforce the health-conscious image of flavored and better-for-you alcoholic beverages, driving stronger market adoption.

Alcoholic Beverages Market Dynamics

Driver

“Rising consumer demand for healthier, innovative alcoholic beverage options”

- Increasing health awareness motivates consumers to choose alcoholic drinks with lower calories, reduced sugar, and natural ingredients, pushing brands to innovate healthier formulations that align with wellness trends without compromising taste or experience.

- Millennials and Gen Z consumers prioritize transparency and clean labels, encouraging manufacturers to develop beverages free from artificial additives, preservatives, and allergens, enhancing trust and attracting a more health-conscious audience.

- The growing popularity of fitness and lifestyle movements fuels demand for functional alcoholic drinks containing added vitamins, antioxidants, and botanicals, blending indulgence with perceived health benefits and creating new market niches.

- Innovation in flavors and formats, such as ready-to-drink (RTD) cocktails and infused spirits, caters to consumers seeking convenience alongside healthier ingredient profiles, driving product diversification and expanding market reach.

- Increased availability of low- and no-alcohol options reflects a cultural shift towards mindful drinking, encouraging producers to invest in research and development for healthier alternatives that satisfy consumer preferences while maintaining social appeal.

Restraint/Challenge

“Strict regulations and allergen concerns limit market growth potential”

- Complex and varying alcohol regulations across European countries create compliance challenges for manufacturers, increasing costs and slowing product launches, particularly for innovative or functional alcoholic beverages that require extensive testing and approvals.

- Allergen labeling requirements and consumer sensitivity, especially regarding nut- and gluten-based ingredients, restrict product formulations and limit market reach, forcing companies to invest in reformulation or risk losing consumer trust and facing legal repercussions.

- Advertising and marketing restrictions on alcoholic beverages, including limits on health claims and digital promotions, reduce brand visibility and consumer engagement, making it harder for companies to differentiate products and drive demand in competitive markets.

- Stringent packaging and sustainability regulations compel manufacturers to adopt eco-friendly materials and reduce waste, which can increase production costs and complicate supply chains, impacting profit margins and scalability for smaller producers.

- The rise of anti-alcohol advocacy and stricter drinking age enforcement in certain regions constrains consumer base growth, influencing market dynamics and challenging companies to adapt strategies to changing societal attitudes and legal frameworks.

Alcoholic Beverages Market Scope

The market is segmented on the basis of product type, alcoholic content, flavor, category, packaging and distribution channel.

- By Product Type

On the basis of product type, the Alcoholic Beverages market is segmented into beer, wine, distilled spirits, and others. The beer segment dominates the largest market revenue share of approximately 45% in 2025, driven by strong cultural preferences, growing craft beer popularity, diverse flavor innovations, and widespread availability across traditional and modern retail channels.

The beer segment is anticipated to witness the fastest growth rate of around 5.2% CAGR from 2025 to 2032, fueled by rising craft beer demand, innovative flavors, increasing premiumization, and growing consumer interest in low- and no-alcohol beer options.

- By Alcoholic Content

On the basis of alcoholic content, the Alcoholic Beverages market is segmented in to high, medium, and low. The high segment drives the Alcoholic Beverages market due to consumer preference for stronger flavors, increasing popularity of premium spirits, rising cocktail culture, and demand for high-quality, aged products that offer unique taste experiences and status appeal.

The high segment is expected to witness the fastest CAGR from 2025 to 2032, driven by growing demand for premium and craft spirits, rising cocktail culture, consumer willingness to pay for quality, and innovations in flavor and aging techniques.

- By Flavor

On the basis of flavor, the Alcoholic Beverages market is segmented in to unflavored and flavored. The unflavored segment drives the Alcoholic Beverages market due to its broad consumer appeal, versatility in mixing drinks, strong traditional consumption patterns, lower production costs, and widespread availability across multiple beverage categories, supporting consistent demand globally.

The unflavored segment is expected to witness the fastest CAGR from 2025 to 2032, driven by increasing preference for classic, versatile drinks, growth in cocktail culture, demand for neutral bases in mixed beverages, and expanding markets in emerging regions.

- By Category

On the basis of category, the Alcoholic Beverages market is segmented in to mass and premium. The mass segment drives the Alcoholic Beverages market due to its affordability, wide consumer base, extensive distribution networks, strong brand recognition, and consistent demand in both urban and rural areas, making it the backbone of overall market volume and revenue.

The mass segment is expected to witness the fastest CAGR from 2025 to 2032, driven by rising disposable incomes in emerging markets, expanding retail penetration, increased brand accessibility, and growing consumer preference for affordable, everyday alcoholic beverage options.

- By Packaging

On the basis of packaging, the Alcoholic Beverages market is segmented in to plastic bottles, glass bottles, and tins. The plastic bottles segment drives the Alcoholic Beverages market due to its lightweight nature, cost-effectiveness, convenience for on-the-go consumption, reduced breakage risk, and growing adoption in ready-to-drink products, enhancing portability and appeal among younger, active consumers.

The plastic bottles segment is expected to witness the fastest CAGR from 2025 to 2032, driven by increasing demand for convenient, portable packaging, growth of ready-to-drink beverages, cost advantages, and rising consumer preference for lightweight, recyclable, and shatterproof containers.

- By Distribution Channel

On the basis of distribution channel, the Alcoholic Beverages market is segmented in modern trade, convenience stores, specialty stores, online retailers, hotels/restaurants/bars, commercial stores, on premises, liquor stores, grocery shops, internet retailing, and supermarkets. The modern trade segment drives the Alcoholic Beverages market due to its wide product assortment, competitive pricing, organized retail formats, enhanced shopping experience, efficient supply chains, and growing consumer preference for one-stop convenience and access to premium and international alcoholic beverages.

The modern trade segment is expected to witness the fastest CAGR from 2025 to 2032, driven by expanding supermarket and hypermarket chains, increasing urbanization, digital integration, loyalty programs, and consumers’ preference for convenience, variety, and competitive pricing in a single shopping destination.

Alcoholic Beverages Market Regional Analysis

- Germany dominates the Alcoholic Beverages market with a 26% revenue share in 2025, driven by its strong beer heritage, high consumption rates, thriving craft and premium segments, robust production infrastructure, and expanding distribution through retail and online channels.

- The market’s growth is also supported by thriving craft and premium segments, strong production infrastructure, and expanding distribution networks including modern retail and e-commerce platforms, enabling wider consumer access and reinforcing Germany’s leadership in the European alcoholic beverages market.

- Additionally, rising consumer demand for low- and no-alcohol alternatives, increasing health consciousness, and government initiatives promoting sustainable brewing practices further drive Germany’s alcoholic beverages market, enhancing innovation and aligning products with evolving European consumer preferences.

U.K. Alcoholic Beverages Market Insight

The U.K. alcoholic beverages market captured the largest revenue share of approximately 22% within Asia-Pacific (APAC) in 2025, driven by strong demand for premium spirits, growing cocktail culture, increasing disposable incomes, and expanding distribution through modern retail and online channels.

The U.K. market is projected to expand at a substantial CAGR due to rising consumer preference for craft and flavored beverages, growing health-conscious trends, increasing tourism, innovation in low- and no-alcohol products, and expanding e-commerce and on-trade distribution channels.

Alcoholic Beverages Market Share

The Alcoholic Beverages industry is primarily led by well-established companies, including:

- Anheuser-Busch InBev (Belgium)

- Heineken N.V. (Netherlands)

- Diageo plc (United Kingdom)

- Pernod Ricard (France)

- Carlsberg Group (Denmark)

- Molson Coors Beverage Company (United States, strong European presence)

- Asahi Group Holdings (Japan, active in Europe)

- SABMiller (United Kingdom, now part of AB InBev)

- Brown-Forman Corporation (United States, active in Europe)

- Campari Group (Italy)

- Bacardi Limited (Bermuda, strong European market)

- Rémy Cointreau (France)

- S.Pellegrino (Italy)

- Tennent Caledonian Breweries (United Kingdom)

- Grupo Mahou-San Miguel (Spain)

Latest Developments in Europe Alcoholic Beverages Market

- In May 2025, Strongbow launched its new strawberry-flavored cider in the UK, marking its first flavor innovation in over a decade. The move aims to attract younger consumers and revitalize the brand's presence in the competitive cider market.

- In June 2024, Indian spirits group Radico Khaitan entered a partnership with Danish distribution platform Bemakers to enhance its presence in Europe. The collaboration focuses on expanding Radico Khaitan's brand portfolio across European markets, tapping into the growing demand for diverse spirits.

- In August 2025, Oyster Gin launched Wild Citrus, a limited-edition gin blending wild citrus fruits to offer a fresh, vibrant flavor. This new release targets the rising consumer interest in unique, artisanal spirits across Europe, aiming to capture market share by appealing to those seeking innovative and high-quality gin options.

- In October 2025, Neurita Tequila partnered with European distributors to expand its presence across key markets. This collaboration aims to increase brand visibility and accessibility, capitalizing on the growing popularity of premium tequila in Europe. The partnership strengthens Neurita’s distribution network and positions the brand for significant growth across the continent.

- In November 2025, Glenmorangie launched Infinita 18 Years Old, a premium single malt whisky aged for 18 years. This sophisticated expression targets whisky connoisseurs seeking depth and elegance in flavor. The release reinforces Glenmorangie’s reputation for craftsmanship and quality, catering to the increasing demand for luxury spirits within the European whisky market.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.