Europe AGM Batteries for Cars Market Analysis and Size

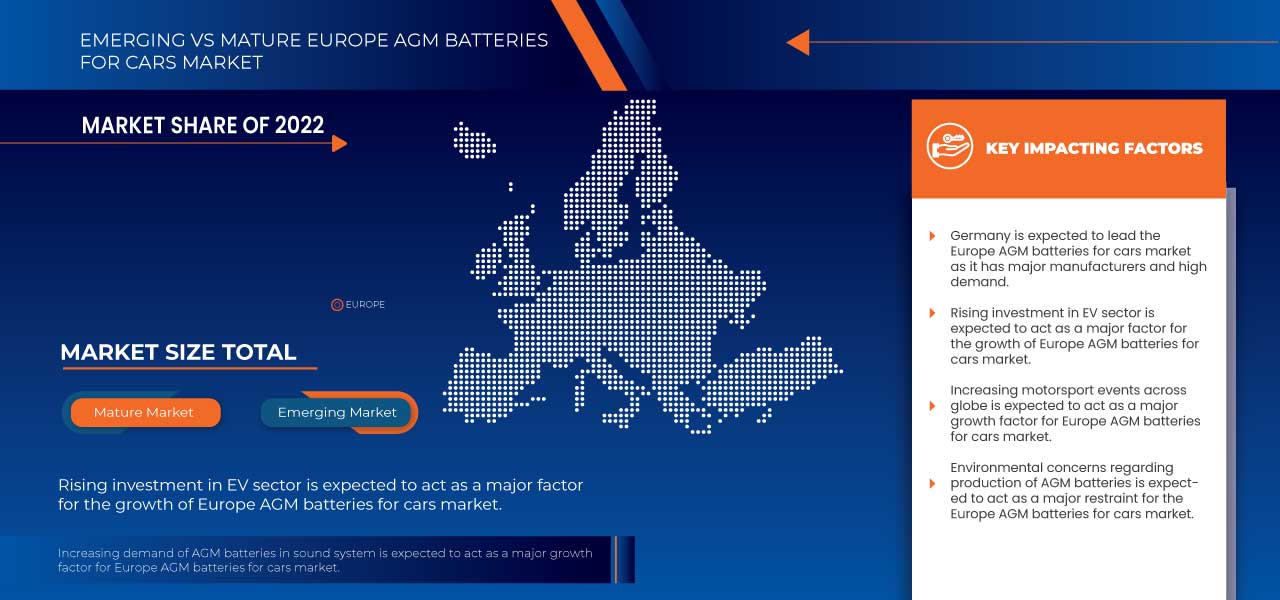

The Europe AGM batteries for cars market is growing substantially due to the rising demand for AGM batteries in the automobile sector. The rising demand for AGM batteries in the automobile sector is expected to drive the market's growth. Superior characteristic of AGM batteries is expected to heave the market's growth. On the other hand, the high cost associated with AGM batteries is expected to be a major restraint for the market's growth. Innovation in battery technology is expected to provide a lucrative opportunity for the market's growth. However, the lack of skilled professionals is expected to act as a major challenge to the market's growth.

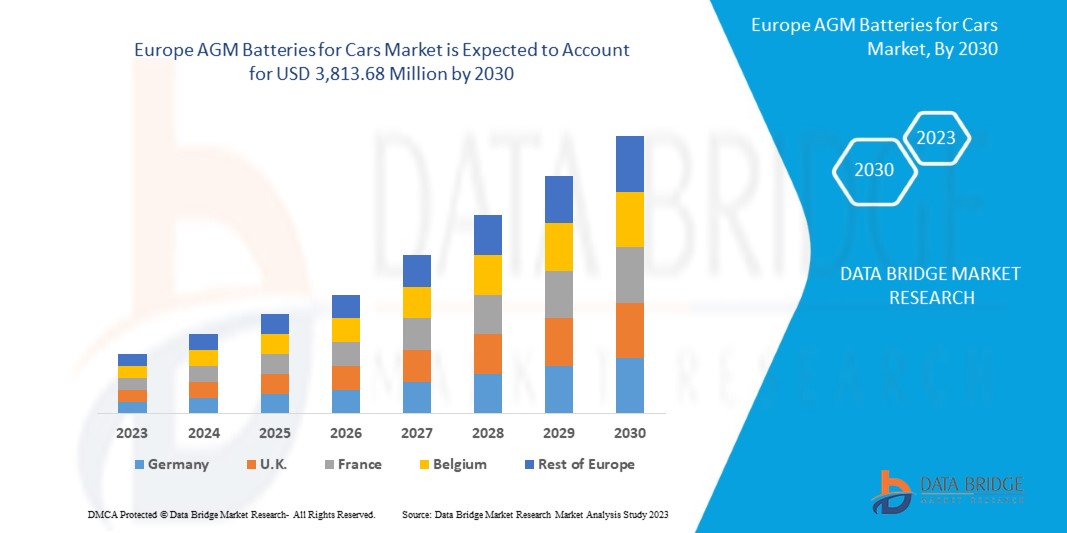

Data Bridge Market Research analyses that the Europe AGM batteries for cars market is expected to reach the value of USD 3,813.68 million by 2030, at a CAGR of 4.4% during the forecast period. The Europe AGM batteries for cars market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2020-2016) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

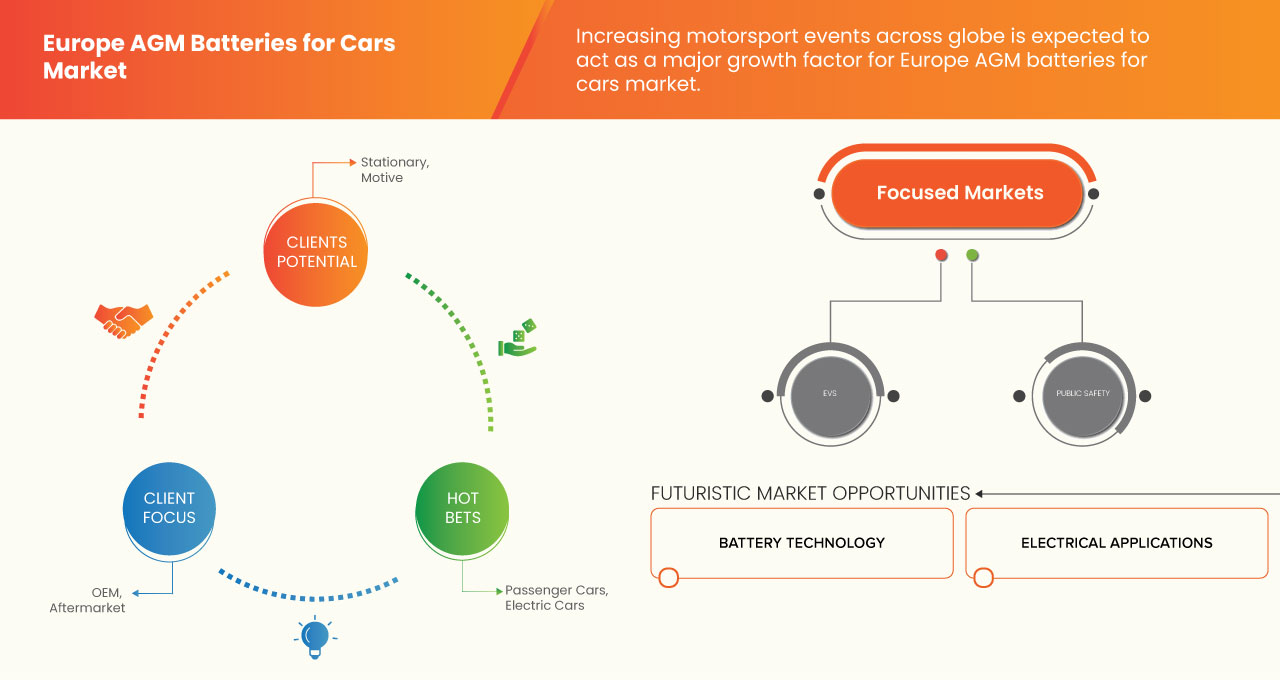

By Type (Stationary, Motive), Voltage (Less than 10 Volts, 10 Volts to 12 Volts, and Above 12 Volts) Engine Type (IC Engines, Electric Vehicles), Sales Channel (OEM, Aftermarket), Vehicle Type (Passenger Cars, Electric Cars). |

|

Countries Covered |

Germany, France, U.K., Italy, Spain, Russia, Turkey, Belgium, Netherlands, Switzerland, and the rest Of Europe. |

|

Market Players Covered |

Clarios, East Penn Manufacturing Company, ENERSYS, leoch International Technology Limited Inc., Jiangxi JingJiu Power Science& Technology Co.,LTD, FIAMM Energy Technology S.p.A, Guangdong Aokly Group Co.,Ltd, ACDelco, Robert Bosch LLC, Exide Technologies, Fullriver Battery, Duracell, Renogy, VMAX USA, Power Sonic Corporation, Renogy, Universal Power Group, and Zeus Battery Products among others. |

Market Definition

AGM or Absorbent Glass Mat is an advanced lead-acid battery that provides superior power to support the higher electrical demands of vehicles and start-stop applications. AGM batteries are extremely resistant to vibration, are totally sealed, non-spillable, and maintenance-free. AGM batteries offer better cycling performance, minimal gassing, and acid leakage when compared with conventional lead-acid batteries.

Europe AGM Batteries for Cars Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail as below:

Drivers

- Rising demand for AGM batteries in the automobile sector

AGM batteries are being used in a growing number of new vehicles not only because of their increased longevity but also because they perform better with high electrical loads and stop/start systems. Over the next couple of years, up to 40 percent of new cars may be equipped with fuel-saving stop/start systems and AGM batteries. AGM batteries are a great choice for high-end and advanced fuel-efficient vehicles with high power demands and for people who seek greater reliability and longer life in auto batteries. Powerful electronic features such as GPS, heated seats, and audio systems all add to the demand for more power from the battery. An AGM battery can withstand long standstill times, as with this technology, layering cannot occur in the electrolyte, which is bound in the separator, so there is less sulfurization. This suggests that an AGM battery is easier to recharge than a wet battery after a long standstill period. Thus, due to the high period longevity and good performance of AGM batteries, the demand for AGM batteries in the automobile sector has increased significantly.

- Superior characteristic of AGM batteries

AGM batteries are resistant to vibration, sealed, non-spillable, and are maintenance-free. AGM batteries offer better cycling performance, minimal gassing, and acid leakage when compared with conventional lead-acid batteries. The result of all the features of AGM technology is superior life performance. Over their lifespan, AGM batteries can start an engine more than 60,000 times. That is more than three times the starts one gets out of a conventional battery, and AGM batteries recharge faster than typical batteries. One of the biggest pros of going with AGM batteries is that they are known as maintenance-free batteries. The AGM has a lower self-discharge rate that lasts much longer than the flooded lead-acid batteries. The AGM has a lifespan of up to seven years if well maintained, much compared to other batteries that last for three to five years. Therefore, the AGMs last longer and will serve better than any other batteries

Opportunity

- Increasing demand for AGM batteries in sound system

The AGM battery is an excellent battery choice for car electrical systems, and its demand is increasing among people, especially for car sound systems. It is designed to hold a large amount of power, making it ideal for cars that are used for long-distance travel. As there are two things to be considered by consumers when buying a new battery for a vehicle which are cranking power and reserve capacity; If a consumer needs a powerful battery that is capable enough for all the electrical applications in the car (climate-controlled seats, powered lift gates, and accessory lighting among other), it is recommended to have an AGM battery for the vehicle by an expert.

Restraint/Challenge

- High cost associated with AGM batteries

The AGM battery has a smaller tolerance to overcharging and high voltages when compared to flooded batteries. AGM batteries are higher expensive than traditional batteries as they cost high to manufacture. As technology going to advance, vehicles need more and more power to operate all of these new features. In Consumer Reports battery ratings, AGM batteries cost 40 to 100 percent more than traditional batteries. The main disadvantage of an AGM battery is the up-front cost when compared to a traditional flooded lead-acid battery. In AGM batteries, glass mats are used. Glass mats are extra-level coating on lithium ion rods and lead acid rods. This extra coating offers extra cost for the AGM battery manufacturer. Hence, the cost of AGM batteries increases. This higher cost of AGM batteries, as compared to other types of batteries, is expected to act as a restraint for the market.

Post COVID-19 Impact on Europe AGM Batteries for Cars Market

COVID-19 negatively impacted the Europe AGM batteries for cars market due to the shutdown of the Europe manufacturing sector, logistics and transportation, and lack of testing for the product.

The COVID-19 pandemic has impacted the Europe AGM batteries for cars market to an extent in a negative manner. However, the rise in demand for energy storage solutions for high current applications and innovation in battery technology is expected to act as a driving factor for the growth of the market and also has helped the market to grow during and after the pandemic. Also, the growth has been high since the market opened after COVID-19, and it is expected that there will be considerable growth in the sector. The market players are conducting multiple research and development activities to improve the technology involved in the product. With this, the companies will bring advancement and innovation to the market. In addition, government funding for AGM batteries has led the market growth.

Recent Development

- In July 2022, Exide Technologies launched all battery range automotive brochures. This brochure includes all the information related to automotive batteries and related products. It will help customers and distributors to know the company's offerings. Hence, it is expected to create a good impact on the growth of Europe AGM batteries for cars market.

- In May 2020, Power Sonic Corporation launched models of small high rate lithium batteries (PSL-SH) and 16 models of series collection capable lithium batteries (PSL-SC). This new product innovation in the battery segment enhanced the growth of the company as well as the Europe AGM batteries for cars market.

Europe AGM Batteries for Cars Market Scope

The Europe AGM batteries for cars market is segmented on the basis of the type, engine type, vehicle type, sales channel, and voltage. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

BY TYPE

- Stationary

- Motive

On the basis of type, the market is segmented into stationary and motive.

BY VOLTAGE

- Less than 10 volts

- 10 volts to 12 volts

- Above 12 volts

On the basis of voltage, the market is segmented into less than 10 volts, 10 volts to 12 volts, and above 12 volts.

BY ENGINE TYPE

- IC engines

- Electric vehicles

On the basis of engine type, the market is segmented into IC engines and electric vehicles

BY SALES CHANNEL

- OEM

- Aftermarket

On the basis of sales channel, the market is segmented into OEM and aftermarket

BY VEHICLE TYPE

- Passenger cars

- Electric cars

On the basis of vehicle type, the market is segmented into passenger cars and electric cars.

Regional Analysis/Insights

The Europe AGM batteries for cars market is analyzed, and market size insights and trends are provided by country, type, engine type, vehicle type, sales channel, and voltage as referenced above.

The countries covered in the Europe AGM batteries for cars market report are Germany, U.K., Italy, France, Spain, Switzerland, Netherlands, Belgium, Russia, Turkey, Denmark, Sweden, Poland, Norway, Finland, Rest of Europe.

- In 2023, Germany is expected to dominate the Europe AGM batteries for cars market as the region has a higher demand for automotive and automation in the manufacturing industry compared to other countries.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like downstream and upstream value chain analysis, technical trends, porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Europe brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Europe AGM Batteries for Cars Market Share Analysis

Europe AGM batteries for cars market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Europe presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus related to the Europe AGM batteries for cars market.

Some of the major players operating in the Europe AGM batteries for cars market are Clarios, East Penn Manufacturing Company, ENERSYS, leoch International Technology Limited Inc., Jiangxi JingJiu Power Science& Technology Co.,LTD, FIAMM Energy Technology S.p.A, Guangdong Aokly Group Co.,Ltd, ACDelco, Robert Bosch LLC, Exide Technologies, Fullriver Battery, Duracell, Renogy, VMAX USA, Power Sonic Corporation, Renogy, Universal Power Group, and Zeus Battery Products among others

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE EUROPE AGM BATTERIES FOR CARS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TYPE TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 TECHNOLOGY ANALYSIS

4.2 VALUE CHAIN ANALYSIS

4.3 PRICING ANALYSIS

4.4 PORTER’S FIVE FORCE ANALYSIS

4.5 BENEFITS AND FUTURE OF AGM BATTERIES FOR CARS

4.6 EVOLUTION OF AUTOMOTIVE BATTERY

5 REGIONAL SUMMARY

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING DEMAND FOR AGM BATTERIES IN THE AUTOMOBILE SECTOR

6.1.2 INCREASING MOTORSPORT EVENTS ACROSS GLOBE

6.1.3 SUPERIOR CHARACTERISTIC OF AGM BATTERIES

6.1.4 RISE IN DEMAND OF ENERGY STORAGE SOLUTIONS FOR HIGH CURRENT APPLICATION

6.2 RESTRAINTS

6.2.1 HIGH COST ASSOCIATED WITH AGM BATTERIES

6.2.2 ENVIRONMENTAL CONCERNS REGARDING THE PRODUCTION OF AGM BATTERIES

6.3 OPPORTUNITIES

6.3.1 INNOVATION IN BATTERY TECHNOLOGY

6.3.2 RISING INVESTMENT IN EV SECTOR

6.3.3 GROWING PARTNERSHIP, ACQUISITION, AND COLLABORATION AMONG MARKET PLAYERS

6.3.4 INCREASING DEMAND FOR AGM BATTERIES IN SOUND SYSTEM

6.4 CHALLENGES

6.4.1 LACK OF SKILLED PERSONNE

6.4.2 AVAILABILITY OF ALTERNATIVES TO AGM

7 EUROPE AGM BATTERIES FOR CARS MARKET, BY TYPE

7.1 OVERVIEW

7.2 STATIONARY

7.3 MOTIVE

8 EUROPE AGM BATTERIES FOR CARS MARKET, BY VOLTAGE

8.1 OVERVIEW

8.2 ABOVE 12 VOLTS

8.3 10 VOLTS TO 12 VOLTS

8.4 LESS THAN 10 VOLTS

9 EUROPE AGM BATTERIES FOR CARS MARKET, BY ENGINE TYPE

9.1 OVERVIEW

9.2 ELECTRIC VEHICLES

9.3 IC ENGINES

9.3.1 DIESEL

9.3.2 PETROL

10 EUROPE AGM BATTERIES FOR CARS MARKET, BY SALES CHANNEL

10.1 OVERVIEW

10.2 OEM

10.3 AFTERMARKET

11 EUROPE AGM BATTERIES FOR CARS MARKET, BY VEHICLE TYPE

11.1 OVERVIEW

11.2 ELECTRIC CARS

11.3 PASSENGER CARS

11.3.1 HATCHBACK

11.3.2 SEDAN

11.3.3 SUV

11.3.4 MPV

11.3.5 CROSSOVER

11.3.6 COUPE

11.3.7 CONVERTIBLE

11.3.8 OTHERS

12 EUROPE AGM BATTERIES FOR CARS MARKET, BY REGION

12.1 EUROPE

12.1.1 GERMANY

12.1.2 U.K.

12.1.3 FRANCE

12.1.4 ITALY

12.1.5 SPAIN

12.1.6 TURKEY

12.1.7 RUSSIA

12.1.8 NETHERLANDS

12.1.9 BELGIUM

12.1.10 SWITZERLAND

12.1.11 DENMARK

12.1.12 SWEDEN

12.1.13 POLAND

12.1.14 NORWAY

12.1.15 FINLAND

12.1.16 REST OF EUROPE

13 EUROPE AGM BATTERIES FOR CARS MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: EUROPE

13.2 COMPANY SHARE ANALYSIS: GERMANY

13.3 COMPANY SHARE ANALYSIS: U.K.

13.4 COMPANY SHARE ANALYSIS: FRANCE

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 CLARIOS

15.1.1 COMPANY SNAPSHOT

15.1.2 COMPANY SHARE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENTS

15.2 EAST PENN MANUFACTURING COMPANY

15.2.1 COMPANY SNAPSHOT

15.2.2 COMPANY SHARE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENTS

15.3 ENERSYS

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 LEOCH INTERNATIONAL TECHNOLOGIES LIMITED INC.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 JIANXI JINGJIU POWER SCIENCE AND TECHNOLOGY CO.,LTD.

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT DEVELOPMENTS

15.6 ACDELCO

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENTS

15.7 BRAILLE BATTERY

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENTS

15.8 DURACELL AUTOMOBILE

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 EXIDE TECHNOLOGIES

15.9.1 COMPANY SNAPSHOT

15.9.2 SOLUTION PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 FIAMM ENERGY TECHNOLOGY S.P.A.

15.10.1 COMPANY SNAPSHOT

15.10.2 SOLUTION PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

15.11 FULLRIVER BATTERY

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 GUANGDONG AOKLY GROUP CO., LTD.

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 MIGHTY MAX BATTERY

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 POWER SONIC CORPORATION

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 RENOGY

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

15.16 ROBERT BOSCH LLC

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENTS

15.17 UNIVERSAL POWER GROUP

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 VMAX USA

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 XINFU TECHNOLOGY (CHINA) CO., LIMITED

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

15.2 XS POWER BATTERIES

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENTS

15.21 ZEUS BATTERY PRODUCTS

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 PRICES OF AGM BATTERIES WITH SPECIFICATIONS FROM VARIOUS ONLINE DISTRIBUTORS AND MANUFACTURERS (IN USD)

TABLE 2 EUROPE AGM BATTERIES FOR CARS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 3 EUROPE STATIONARY IN AGM BATTERIES FOR CARS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 4 EUROPE MOTIVE IN AGM BATTERIES FOR CARS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 5 EUROPE AGM BATTERIES FOR CARS MARKET, BY VOLTAGE, 2021-2030 (USD MILLION)

TABLE 6 EUROPE ABOVE 12 VOLTS IN AGM BATTERIES FOR CARS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 7 EUROPE 10 VOLTS TO 12 VOLTS IN AGM BATTERIES FOR CARS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 8 EUROPE LESS THAN 10 VOLTS IN AGM BATTERIES FOR CARS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 9 EUROPE AGM BATTERIES FOR CARS MARKET, BY ENGINE TYPE, 2021-2030 (USD MILLION)

TABLE 10 EUROPE ELECTRIC VEHICLES IN AGM BATTERIES FOR CARS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 11 EUROPE IC ENGINES IN AGM BATTERIES FOR CARS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 EUROPE IC ENGINE AGM BATTERIES FOR CARS MARKET, BY ENGINE TYPE, 2021-2030 (USD MILLION)

TABLE 13 EUROPE AGM BATTERIES FOR CARS MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 14 EUROPE AGM BATTERIES FOR CARS MARKET, BY SALES CHANNEL, 2021-2030 (THOUSAND UNIT)

TABLE 15 EUROPE OEM IN AGM BATTERIES FOR CARS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 EUROPE AFTERMARKET IN AGM BATTERIES FOR CARS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 EUROPE AGM BATTERIES FOR CARS MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 18 EUROPE ELECTRIC CARS IN AGM BATTERIES FOR CARS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 EUROPE PASSENGER CARS IN AGM BATTERIES FOR CARS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 EUROPE PASSENGER CARS AGM BATTERIES FOR CARS MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 21 EUROPE AGM BATTERIES FOR CARS MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 22 EUROPE AGM BATTERIES FOR CARS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 23 EUROPE AGM BATTERIES FOR CARS MARKET, BY VOLTAGE, 2021-2030 (USD MILLION)

TABLE 24 EUROPE AGM BATTERIES FOR CARS MARKET, BY ENGINE TYPE, 2021-2030 (USD MILLION)

TABLE 25 EUROPE IC ENGINE AGM BATTERIES FOR CARS MARKET, BY ENGINE TYPE, 2021-2030 (USD MILLION)

TABLE 26 EUROPE AGM BATTERIES FOR CARS MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 27 EUROPE AGM BATTERIES FOR CARS MARKET, BY SALES CHANNEL, 2021-2030 (THOUSAND UNIT)

TABLE 28 EUROPE AGM BATTERIES FOR CARS MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 29 EUROPE PASSENGER CARS AGM BATTERIES FOR CARS MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 30 GERMANY AGM BATTERIES FOR CARS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 31 GERMANY AGM BATTERIES FOR CARS MARKET, BY VOLTAGE, 2021-2030 (USD MILLION)

TABLE 32 GERMANY AGM BATTERIES FOR CARS MARKET, BY ENGINE TYPE, 2021-2030 (USD MILLION)

TABLE 33 GERMANY IC ENGINE AGM BATTERIES FOR CARS MARKET, BY ENGINE TYPE, 2021-2030 (USD MILLION)

TABLE 34 GERMANY AGM BATTERIES FOR CARS MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 35 GERMANY AGM BATTERIES FOR CARS MARKET, BY SALES CHANNEL, 2021-2030 (THOUSAND UNIT)

TABLE 36 GERMANY AGM BATTERIES FOR CARS MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 37 GERMANY PASSENGER CARS AGM BATTERIES FOR CARS MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 38 U.K. AGM BATTERIES FOR CARS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 39 U.K. AGM BATTERIES FOR CARS MARKET, BY VOLTAGE, 2021-2030 (USD MILLION)

TABLE 40 U.K. AGM BATTERIES FOR CARS MARKET, BY ENGINE TYPE, 2021-2030 (USD MILLION)

TABLE 41 U.K. IC ENGINE AGM BATTERIES FOR CARS MARKET, BY ENGINE TYPE, 2021-2030 (USD MILLION)

TABLE 42 U.K. AGM BATTERIES FOR CARS MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 43 U.K. AGM BATTERIES FOR CARS MARKET, BY SALES CHANNEL, 2021-2030 (THOUSAND UNIT)

TABLE 44 U.K. AGM BATTERIES FOR CARS MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 45 U.K. PASSENGER CARS AGM BATTERIES FOR CARS MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 46 FRANCE AGM BATTERIES FOR CARS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 47 FRANCE AGM BATTERIES FOR CARS MARKET, BY VOLTAGE, 2021-2030 (USD MILLION)

TABLE 48 FRANCE AGM BATTERIES FOR CARS MARKET, BY ENGINE TYPE, 2021-2030 (USD MILLION)

TABLE 49 FRANCE IC ENGINE AGM BATTERIES FOR CARS MARKET, BY ENGINE TYPE, 2021-2030 (USD MILLION)

TABLE 50 FRANCE AGM BATTERIES FOR CARS MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 51 FRANCE AGM BATTERIES FOR CARS MARKET, BY SALES CHANNEL, 2021-2030 (THOUSAND UNIT)

TABLE 52 FRANCE AGM BATTERIES FOR CARS MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 53 FRANCE PASSENGER CARS AGM BATTERIES FOR CARS MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 54 ITALY AGM BATTERIES FOR CARS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 55 ITALY AGM BATTERIES FOR CARS MARKET, BY VOLTAGE, 2021-2030 (USD MILLION)

TABLE 56 ITALY AGM BATTERIES FOR CARS MARKET, BY ENGINE TYPE, 2021-2030 (USD MILLION)

TABLE 57 ITALY IC ENGINE AGM BATTERIES FOR CARS MARKET, BY ENGINE TYPE, 2021-2030 (USD MILLION)

TABLE 58 ITALY AGM BATTERIES FOR CARS MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 59 ITALY AGM BATTERIES FOR CARS MARKET, BY SALES CHANNEL, 2021-2030 (THOUSAND UNIT)

TABLE 60 ITALY AGM BATTERIES FOR CARS MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 61 ITALY PASSENGER CARS AGM BATTERIES FOR CARS MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 62 SPAIN AGM BATTERIES FOR CARS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 63 SPAIN AGM BATTERIES FOR CARS MARKET, BY VOLTAGE, 2021-2030 (USD MILLION)

TABLE 64 SPAIN AGM BATTERIES FOR CARS MARKET, BY ENGINE TYPE, 2021-2030 (USD MILLION)

TABLE 65 SPAIN IC ENGINE AGM BATTERIES FOR CARS MARKET, BY ENGINE TYPE, 2021-2030 (USD MILLION)

TABLE 66 SPAIN AGM BATTERIES FOR CARS MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 67 SPAIN AGM BATTERIES FOR CARS MARKET, BY SALES CHANNEL, 2021-2030 (THOUSAND UNIT)

TABLE 68 SPAIN AGM BATTERIES FOR CARS MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 69 SPAIN PASSENGER CARS AGM BATTERIES FOR CARS MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 70 TURKEY AGM BATTERIES FOR CARS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 71 TURKEY AGM BATTERIES FOR CARS MARKET, BY VOLTAGE, 2021-2030 (USD MILLION)

TABLE 72 TURKEY AGM BATTERIES FOR CARS MARKET, BY ENGINE TYPE, 2021-2030 (USD MILLION)

TABLE 73 TURKEY IC ENGINE AGM BATTERIES FOR CARS MARKET, BY ENGINE TYPE, 2021-2030 (USD MILLION)

TABLE 74 TURKEY AGM BATTERIES FOR CARS MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 75 TURKEY AGM BATTERIES FOR CARS MARKET, BY SALES CHANNEL, 2021-2030 (THOUSAND UNIT)

TABLE 76 TURKEY AGM BATTERIES FOR CARS MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 77 TURKEY PASSENGER CARS AGM BATTERIES FOR CARS MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 78 RUSSIA AGM BATTERIES FOR CARS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 79 RUSSIA AGM BATTERIES FOR CARS MARKET, BY VOLTAGE, 2021-2030 (USD MILLION)

TABLE 80 RUSSIA AGM BATTERIES FOR CARS MARKET, BY ENGINE TYPE, 2021-2030 (USD MILLION)

TABLE 81 RUSSIA IC ENGINE AGM BATTERIES FOR CARS MARKET, BY ENGINE TYPE, 2021-2030 (USD MILLION)

TABLE 82 RUSSIA AGM BATTERIES FOR CARS MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 83 RUSSIA AGM BATTERIES FOR CARS MARKET, BY SALES CHANNEL, 2021-2030 (THOUSAND UNIT)

TABLE 84 RUSSIA AGM BATTERIES FOR CARS MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 85 RUSSIA PASSENGER CARS AGM BATTERIES FOR CARS MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 86 NETHERLANDS AGM BATTERIES FOR CARS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 87 NETHERLANDS AGM BATTERIES FOR CARS MARKET, BY VOLTAGE, 2021-2030 (USD MILLION)

TABLE 88 NETHERLANDS AGM BATTERIES FOR CARS MARKET, BY ENGINE TYPE, 2021-2030 (USD MILLION)

TABLE 89 NETHERLANDS IC ENGINE AGM BATTERIES FOR CARS MARKET, BY ENGINE TYPE, 2021-2030 (USD MILLION)

TABLE 90 NETHERLANDS AGM BATTERIES FOR CARS MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 91 NETHERLANDS AGM BATTERIES FOR CARS MARKET, BY SALES CHANNEL, 2021-2030 (THOUSAND UNIT)

TABLE 92 NETHERLANDS AGM BATTERIES FOR CARS MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 93 NETHERLANDS PASSENGER CARS AGM BATTERIES FOR CARS MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 94 BELGIUM AGM BATTERIES FOR CARS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 95 BELGIUM AGM BATTERIES FOR CARS MARKET, BY VOLTAGE, 2021-2030 (USD MILLION)

TABLE 96 BELGIUM AGM BATTERIES FOR CARS MARKET, BY ENGINE TYPE, 2021-2030 (USD MILLION)

TABLE 97 BELGIUM IC ENGINE AGM BATTERIES FOR CARS MARKET, BY ENGINE TYPE, 2021-2030 (USD MILLION)

TABLE 98 BELGIUM AGM BATTERIES FOR CARS MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 99 BELGIUM AGM BATTERIES FOR CARS MARKET, BY SALES CHANNEL, 2021-2030 (THOUSAND UNIT)

TABLE 100 BELGIUM AGM BATTERIES FOR CARS MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 101 BELGIUM PASSENGER CARS AGM BATTERIES FOR CARS MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 102 SWITZERLAND AGM BATTERIES FOR CARS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 103 SWITZERLAND AGM BATTERIES FOR CARS MARKET, BY VOLTAGE, 2021-2030 (USD MILLION)

TABLE 104 SWITZERLAND AGM BATTERIES FOR CARS MARKET, BY ENGINE TYPE, 2021-2030 (USD MILLION)

TABLE 105 SWITZERLAND IC ENGINE AGM BATTERIES FOR CARS MARKET, BY ENGINE TYPE, 2021-2030 (USD MILLION)

TABLE 106 SWITZERLAND AGM BATTERIES FOR CARS MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 107 SWITZERLAND AGM BATTERIES FOR CARS MARKET, BY SALES CHANNEL, 2021-2030 (THOUSAND UNIT)

TABLE 108 SWITZERLAND AGM BATTERIES FOR CARS MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 109 SWITZERLAND PASSENGER CARS AGM BATTERIES FOR CARS MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 110 DENMARK AGM BATTERIES FOR CARS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 111 DENMARK AGM BATTERIES FOR CARS MARKET, BY VOLTAGE, 2021-2030 (USD MILLION)

TABLE 112 DENMARK AGM BATTERIES FOR CARS MARKET, BY ENGINE TYPE, 2021-2030 (USD MILLION)

TABLE 113 DENMARK IC ENGINE AGM BATTERIES FOR CARS MARKET, BY ENGINE TYPE, 2021-2030 (USD MILLION)

TABLE 114 DENMARK AGM BATTERIES FOR CARS MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 115 DENMARK AGM BATTERIES FOR CARS MARKET, BY SALES CHANNEL, 2021-2030 (THOUSAND UNIT)

TABLE 116 DENMARK AGM BATTERIES FOR CARS MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 117 DENMARK PASSENGER CARS AGM BATTERIES FOR CARS MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 118 SWEDEN AGM BATTERIES FOR CARS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 119 SWEDEN AGM BATTERIES FOR CARS MARKET, BY VOLTAGE, 2021-2030 (USD MILLION)

TABLE 120 SWEDEN AGM BATTERIES FOR CARS MARKET, BY ENGINE TYPE, 2021-2030 (USD MILLION)

TABLE 121 SWEDEN IC ENGINE AGM BATTERIES FOR CARS MARKET, BY ENGINE TYPE, 2021-2030 (USD MILLION)

TABLE 122 SWEDEN AGM BATTERIES FOR CARS MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 123 SWEDEN AGM BATTERIES FOR CARS MARKET, BY SALES CHANNEL, 2021-2030 (THOUSAND UNIT)

TABLE 124 SWEDEN AGM BATTERIES FOR CARS MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 125 SWEDEN PASSENGER CARS AGM BATTERIES FOR CARS MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 126 POLAND AGM BATTERIES FOR CARS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 127 POLAND AGM BATTERIES FOR CARS MARKET, BY VOLTAGE, 2021-2030 (USD MILLION)

TABLE 128 POLAND AGM BATTERIES FOR CARS MARKET, BY ENGINE TYPE, 2021-2030 (USD MILLION)

TABLE 129 POLAND IC ENGINE AGM BATTERIES FOR CARS MARKET, BY ENGINE TYPE, 2021-2030 (USD MILLION)

TABLE 130 POLAND AGM BATTERIES FOR CARS MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 131 POLAND AGM BATTERIES FOR CARS MARKET, BY SALES CHANNEL, 2021-2030 (THOUSAND UNIT)

TABLE 132 POLAND AGM BATTERIES FOR CARS MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 133 POLAND PASSENGER CARS AGM BATTERIES FOR CARS MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 134 NORWAY AGM BATTERIES FOR CARS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 135 NORWAY AGM BATTERIES FOR CARS MARKET, BY VOLTAGE, 2021-2030 (USD MILLION)

TABLE 136 NORWAY AGM BATTERIES FOR CARS MARKET, BY ENGINE TYPE, 2021-2030 (USD MILLION)

TABLE 137 NORWAY IC ENGINE AGM BATTERIES FOR CARS MARKET, BY ENGINE TYPE, 2021-2030 (USD MILLION)

TABLE 138 NORWAY AGM BATTERIES FOR CARS MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 139 NORWAY AGM BATTERIES FOR CARS MARKET, BY SALES CHANNEL, 2021-2030 (THOUSAND UNIT)

TABLE 140 NORWAY AGM BATTERIES FOR CARS MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 141 NORWAY PASSENGER CARS AGM BATTERIES FOR CARS MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 142 FINLAND AGM BATTERIES FOR CARS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 143 FINLAND AGM BATTERIES FOR CARS MARKET, BY VOLTAGE, 2021-2030 (USD MILLION)

TABLE 144 FINLAND AGM BATTERIES FOR CARS MARKET, BY ENGINE TYPE, 2021-2030 (USD MILLION)

TABLE 145 FINLAND IC ENGINE AGM BATTERIES FOR CARS MARKET, BY ENGINE TYPE, 2021-2030 (USD MILLION)

TABLE 146 FINLAND AGM BATTERIES FOR CARS MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 147 FINLAND AGM BATTERIES FOR CARS MARKET, BY SALES CHANNEL, 2021-2030 (THOUSAND UNIT)

TABLE 148 FINLAND AGM BATTERIES FOR CARS MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 149 FINLAND PASSENGER CARS AGM BATTERIES FOR CARS MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 150 REST OF EUROPE AGM BATTERIES FOR CARS MARKET, BY TYPE, 2021-2030 (USD MILLION)

List of Figure

FIGURE 1 EUROPE AGM BATTERIES FOR CARS MARKET: SEGMENTATION

FIGURE 2 EUROPE AGM BATTERIES FOR CARS MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE AGM BATTERIES FOR CARS MARKET: DROC ANALYSIS

FIGURE 4 EUROPE AGM BATTERIES FOR CARS MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE AGM BATTERIES FOR CARS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE AGM BATTERIES FOR CARS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE AGM BATTERIES FOR CARS MARKET :DBMR MARKET POSITION GRID

FIGURE 8 EUROPE AGM BATTERIES FOR CARS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE AGM BATTERIES FOR CARS MARKET: SEGMENTATION

FIGURE 10 THE INHERENT ADVANTAGES OF AGM BATTERIES & RISING ADOPTION OF HIGH-PERFORMANCE ENGINE STARTER BATTERIES IN VEHICLES ARE BOOSTING THE GROWTH OF AGM BATTERIES FOR CARS MARKET IN THE FORECAST PERIOD OF 2023 -2030

FIGURE 11 STATIONARY IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF EUROPE AGM BATTERIES FOR CARS MARKET IN 2023 - 2030

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF EUROPE AGM BATTERIES FOR CARS MARKET

FIGURE 13 EUROPE AGM BATTERIES FOR CARS MARKET: BY TYPE, 2022

FIGURE 14 EUROPE AGM BATTERIES FOR CARS MARKET: BY VOLTAGE, 2022

FIGURE 15 EUROPE AGM BATTERIES FOR CARS MARKET: BY ENGINE TYPE, 2022

FIGURE 16 EUROPE AGM BATTERIES FOR CARS MARKET: BY SALES CHANNEL, 2022

FIGURE 17 EUROPE AGM BATTERIES FOR CARS MARKET: BY VEHICLE TYPE, 2022

FIGURE 18 EUROPE AGM BATTERIES FOR CARS MARKET: SNAPSHOT (2022)

FIGURE 19 EUROPE AGM BATTERIES FOR CARS MARKET: BY COUNTRY (2022)

FIGURE 20 EUROPE AGM BATTERIES FOR CARS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 21 EUROPE AGM BATTERIES FOR CARS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 22 EUROPE AGM BATTERIES FOR CARS MARKET: BY TYPE (2023-2030)

FIGURE 23 EUROPE AGM BATTERIES FOR CARS MARKET: COMPANY SHARE 2022(%)

FIGURE 24 GERMANY AGM BATTERIES FOR CARS MARKET: COMPANY SHARE 2022(%)

FIGURE 25 U.K. AGM BATTERIES FOR CARS MARKET: COMPANY SHARE 2022(%)

FIGURE 26 FRANCE AGM BATTERIES FOR CARS MARKET: COMPANY SHARE 2022(%)

Europe Agm Batteries For Cars Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Agm Batteries For Cars Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Agm Batteries For Cars Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.