Europe Acrylic Resin Dispersion Based Primers In Construction Market

Market Size in USD Million

CAGR :

%

USD

398,204.90 Million

USD

699,687.92 Million

2022

2030

USD

398,204.90 Million

USD

699,687.92 Million

2022

2030

| 2023 –2030 | |

| USD 398,204.90 Million | |

| USD 699,687.92 Million | |

|

|

|

Europe Acrylic Resin Dispersion Based Primers in Construction Market Analysis and Size

The essential factors contributing to the growth of the acrylic resin dispersion based primers in construction market in the forecast period of 2023 to 2030 include ease of application and extensive protection properties. Moreover, acrylic resin dispersion-based primers offer excellent adhesion properties, which is significantly contributing to the market's growth.

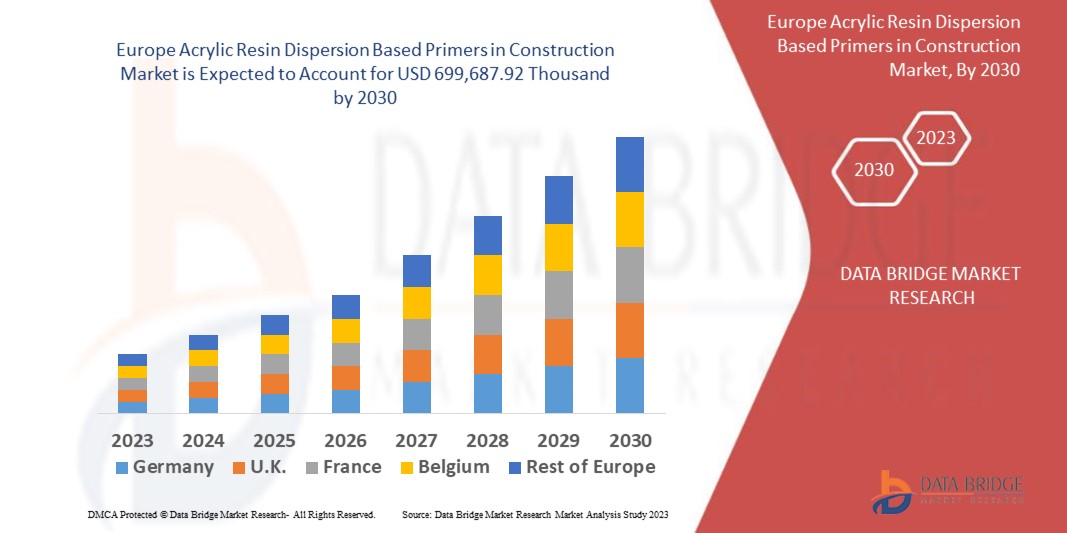

Data Bridge Market Research analyses that the acrylic resin dispersion based primers in construction market which was USD 398,204.90 thousand in 2022, is expected to reach USD 699,687.92 thousand by 2030, growing at a CAGR of 7.30% during the forecast period of 2023 to 2030. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Europe Acrylic Resin Dispersion Based Primers in Construction Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Material (Absorbent Substrate, Non-Absorbent Substrate), Surface (Cement, Concrete, Plaster, Plastic, Flooring Tiles, and Others), Type (Water Based and Solvent Based), Application (Before Interior Paints, Before Skim Coats and Renders, Before Thermal Insulation Façade System, Under Self-Levelling Compounds, Under Tile Adhesives, In Dry Wall System on Gypsum Boards), End-Use (New Residential Construction, New Non-Residential Construction, New Civil Engineering, Civil Engineering Renovation, Non-Residential Renovation, and Residential Renovation) |

|

Countries Covered |

Germany, France, U.K., Italy, Russia, Spain, Switzerland, Belgium, Netherlands, Turkey, Rest of Europe |

|

Market Players Covered |

PPG Industries, Inc. (U.S.), Axalta (U.S.), Henkel Adhesives Technologies India Private Limited (Germany), The Sherwin-Williams Company (U.S.), Sika Deutschland GmbH (Germany), Nippon Paint Holdings Co., Ltd. (Japan), Akzo Nobel N.V. (Netherlands), Hempel A/S (Denmark), Baumit (Germany), ATLAS Sp. z o.o. (Poland), Rust-Oleum (U.S.), among others |

|

Market Opportunities |

|

Market Definition

Acrylic dispersions are surfactant-free acrylic resins used for various coating applications. These acrylic resins are often used in coating formulations to impart robust performance benefits, including hardness, chemical resistance, and corrosion inhibition.

Europe Acrylic Resin Dispersion Based Primers in Construction Market Dynamics

Drivers

- Ease of application

Acrylic resin dispersion-based primers are typically easy to apply, offering good flow and leveling properties. They can be applied by brush, roller, or spray application methods, providing flexibility and convenience for construction professionals.

- Extensive protection and adhesion properties

Acrylic resin dispersion-based primers offer excellent adhesion properties, allowing them to bond effectively to various substrates commonly found in construction, such as concrete, masonry, wood, and metals. This strong bonding capability ensures proper substrate preparation and enhances the overall performance of subsequent coatings or finishes.

Opportunities

- Expansion of infrastructure and construction industry

The construction industry is expanding as emerging economies experience economic growth, urbanization, and an expanding middle class. This drives the growth of acrylic resin dispersion-based primers in the construction market, as these ingredients are extensively used in various personal care products.

- Favorable environmental considerations

Due to their low VOC (Volatile Organic Compound) content, acrylic resin dispersion-based primers are often preferred in construction. They are considered more environmentally friendly than solvent-based primers, aligning with the industry's increasing focus on sustainability and green building practices.

Restraints/Challenges

- High costs and price volatility

Acrylic resin dispersion-based primers can be relatively more expensive than other types available in the market. This higher cost may limit their adoption, particularly in projects with tight budgets or cost-sensitive applications.

- Restrictions regarding application in certain environmental conditions

Acrylic resin dispersion-based primers may have limitations when applied under certain environmental conditions. Factors such as temperature, humidity, and substrate moisture content can impact these primers' performance and drying/curing characteristics, potentially affecting their application and overall effectiveness.

This acrylic resin dispersion based primers in construction market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the acrylic resin dispersion based primers in construction market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Development

- In 2021, the Axalta coating systems launched a new Cromac XP product, a solvent-borne base coat. The company expects to improve its portfolio and launch highly efficient products to expand production and revenue-related outcomes

Europe Acrylic Resin Dispersion based Primers in Construction Market Scope

The acrylic resin dispersion based primers in construction market is segmented on the basis of material, surface, type application, and end-use. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Material

- Absorbent Substrate

- Non-Absorbent Substrate

Surface

- Cement

- Concrete

- Plaster

- Plastic

- Flooring Tiles

- Others

Type

- Water Based

- Solvent Based

Application

- Before Interior Paints

- Before Skim Coats and Renders

- Before Thermal Insulation Façade System

- Under-Self Levelling Compounds

- Under Tile Adhesives

- In Dry Wall System On Gypsum Boards

End-Use

- New Residential Construction

- New Non-Residential Construction

- New Civil Engineering

- Civil Engineering Renovation

- Non-Residential Renovation

- Residential Renovation

Europe Acrylic Resin Dispersion based Primers in Construction Market Regional Analysis/Insights

The acrylic resin dispersion based primers in construction market is analysed and market size insights and trends are provided by material, surface, type application, and end-use as referenced above.

The countries covered in the Europe acrylic resin dispersion based primers in construction market report are Germany, France, U.K., Italy, Russia, Spain, Switzerland, Belgium, Netherlands, Turkey, rest of Europe

Germany is fastest growing and expected to dominate the Europe acrylic resin dispersion based primers in construction market owing to vast expansion of construction sector.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Europe Acrylic Resin Dispersion based Primers in Construction Market Share Analysis

The acrylic Resin dispersion based primers in construction market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to acrylic resin dispersion based primers in construction market.

Some of the major players operating in the acrylic resin dispersion based primers in construction market are:

- PPG Industries, Inc. (U.S.)

- Axalta (U.S.)

- Henkel Adhesives Technologies India Private Limited (Germany)

- The Sherwin-Williams Company (U.S.)

- Sika Deutschland GmbH (Germany)

- Nippon Paint Holdings Co., Ltd. (Japan)

- Akzo Nobel N.V. (Netherlands)

- Hempel A/S (Denmark)

- Baumit (Germany)

- ATLAS Sp. z o.o. (Poland)

- Rust-Oleum (U.S.), among others

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

- introduction

- OBJECTIVES OF THE STUDY

- MARKET DEFINITION

- OVERVIEW of the Europe Acrylic Resin Dispersion based Primers in Construction Market

- LIMITATIONs

- MARKETS COVERED

- MARKET SEGMENTATION

- MARKETS COVERED

- geographical scope

- years considered for the study

- currency and pricing

- DBMR TRIPOD DATA VALIDATION MODEL

- material LIFELINE CURVE

- MULTIVARIATE MODELLING

- primary interviews with key opinion leaders

- DBMR MARKET POSITION GRID

- DBMR MARKET CHALLENGE MATRIX

- secondary sourcEs

- assumptions

- EXECUTIVE SUMMARY

- premium insights

- Market Overview

- drivers

- GROWING DEMAND FOR PRIMERS IN NEW RESIDENTIAL CONSTRUCTION

- SUBSTANTIAL RISE IN THE ECONOMIC AND LIVING STANDARDS

- RestrainTs

- PRESENCE OF VOLATILE ORGANIC COMPOUNDS COULD RESULT IN TOXICITY AND HEALTH HAZARDS

- AVAILABILITY OF ALTERNATIVES SUCH AS PLASTERS AND WHITE CEMENT

- opportunities

- INCREASING NUMBER OF OFFICE ESTABLISHMENTS DUE TO DIGITALIZATION AND GLOBALIZATION

- RISING DEMAND FOR MORE RESIDENTIAL BUILDINGS AND COMPLEXES

- GROWTH IN THE TOURISM INDUSTRY

- challenge

- COMMERCIALIZATION OF VARIOUS TYPE OF PAINTS WHICH DON’T REQUIRE PRIMERS

- COVID-19 Impact on Europe Acrylic Resin Dispersion based Primers in Construction Market

- ANALYSIS ON IMPACT OF COVID-19 ON the Market

- AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE Market

- STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

- PRICE IMPACT

- IMPACT ON DEMAND

- IMPACT ON SUPPLY CHAIN

- CONCLUSION

- Europe acrylic resin dispersion based primers in construction market, BY material

- overview

- Absorbent Substrate

- Non Absorbent Substrate

- Europe acrylic resin dispersion based primers in construction market, BY Surface

- overview

- Cement

- Plaster

- Concrete

- Plastic

- Flooring Tiles

- Others

- Europe acrylic resin dispersion based primers in construction market, BY type

- overview

- Solvent Based

- Water Based

- Europe acrylic resin dispersion based primers in construction market, BY Application

- overview

- Before Interior Paints

- Before Skim Coats And Renders

- Before Thermal Insulation Facade System

- Under Self-Levelling Compounds

- Under Tile Adhesives

- In Dry Wall System On Gypsum Boards

- Europe acrylic resin dispersion based primers in construction market, BY End User

- overview

- New Residential Construction

- New Non-Residential Construction

- New Civil Engineering

- Civil Engineering Renovation

- Residential Renovation

- Non-Residential Renovation

- Latin America Acrylic Resin Dispersion Based Primers in Construction market: by region

- Europe

- germany

- U.K

- france

- italy

- poland

- Romania

- czech republic

- Europe Acrylic resin dispersion based primers in Construction Market: COMPANY landscape

- company share analysis: Europe

- company share analysis: latin america

- Swot analysis

- company profile

- Henkel AG & Co. KGaA

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT UPDATE

- Jotun

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT UPDATE

- PPG INDUSTRIES, INC.

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT UPDATE

- Hempel A/S

- COMPANY SNAPSHOT

- Revenue Analysis

- PRODUCT PORTFOLIO

- RECENT UPDATE

- Nippon Paint Holdings Co., Ltd.

- COMPANY SNAPSHOT

- Revenue Analysis

- PRODUCT PORTFOLIO

- RECENT UPDATE

- Baumit

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT UPDATE

- sika Deutschland gmbh

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT UPDATE

- atlas sp z.o.o

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT UPDATE

- rust-oleum (As a subsidiary of RPM international inc.)

- COMPANY SNAPSHOT

- Revenue Analysis

- product portfolio

- RECENT UPDATE

- THE SHERWIN-WILLIAMS COMPANY

- COMPANY SNAPSHOT

- Revenue Analysis

- PRODUCT PORTFOLIO

- RECENT UPDATE

- Axalta Coating Systems

- COMPANY SNAPSHOT

- Revenue Analysis

- PRODUCT PORTFOLIO

- RECENT UPDATE

- TIKKURILA OYJ

- COMPANY SNAPSHOT

- Revenue Analysis

- PRODUCT PORTFOLIO

- RECENT UPDATE

- AKZO NOBEL N.V

- COMPANY SNAPSHOT

- Revenue Analysis

- PRODUCT PORTFOLIO

- RECENT UPDATE

- Fixall

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT UPDATE

- questionnaire

- related reports

List of Table

TABLE 1 The annual quantity and growth of import of primers

TABLE 2 Maximum voc content limit values for paints and varnishes (U.K.)

TABLE 3 Maximum voc content limit values inPrimers (U.S.)

TABLE 4 Maximum voc content limit values for paints and varnishes

TABLE 5 Europe acrylic resin dispersion based primers in construction market, BY material, 2019-2028 (USD Thousand)

TABLE 6 Europe acrylic resin dispersion based primers in construction market, BY material, 2019-2028 (Tons)

TABLE 7 Europe acrylic resin dispersion based primers in construction market, BY Surface, 2019-2028 (USD Thousand)

TABLE 8 Europe acrylic resin dispersion based primers in construction market, BY type, 2019-2028 (USD Thousand)

TABLE 9 Europe acrylic resin dispersion based primers in construction market, BY Application, 2019-2028 (USD Thousand)

TABLE 10 Europe acrylic resin dispersion based primers in construction market, BY End User, 2019-2028 (USD Thousand)

TABLE 11 europe Acrylic Resin Dispersion Based Primers in Construction market, By COUNTRY, 2019-2028 (Tons)

TABLE 12 europe Acrylic Resin Dispersion Based Primers in Construction market, By COUNTRY, 2019-2028 (USD Thousand)

TABLE 13 europe Acrylic Resin Dispersion Based Primers in Construction market, By Material, 2019-2028 (Tons)

TABLE 14 europe Acrylic Resin Dispersion Based Primers in Construction market, By Material, 2019-2028 (USD Thousand)

TABLE 15 europe Acrylic Resin Dispersion Based Primers in Construction Market, By Surface, 2019-2028 (USD Thousand)

TABLE 16 europe Acrylic Resin Dispersion Based Primers in Construction Market, By Type, 2019-2028 (USD Thousand)

TABLE 17 europe Acrylic Resin Dispersion Based Primers in Construction Market, By Application, 2019-2028 (USD Thousand)

TABLE 18 europe Acrylic Resin Dispersion Based Primers in Construction Market, By End User, 2019-2028 (USD Thousand)

TABLE 19 Germany Acrylic Resin Dispersion Based Primers in Construction market, By Material, 2019-2028 (Tons)

TABLE 20 Germany Acrylic Resin Dispersion Based Primers in Construction market, By Material, 2019-2028 (USD Thousand)

TABLE 21 Germany Acrylic Resin Dispersion Based Primers in Construction Market, By Surface, 2019-2028 (USD Thousand)

TABLE 22 Germany Acrylic Resin Dispersion Based Primers in Construction Market, By Type, 2019-2028 (USD Thousand)

TABLE 23 Germany Acrylic Resin Dispersion Based Primers in Construction Market, By Application, 2019-2028 (USD Thousand)

TABLE 24 Germany Acrylic Resin Dispersion Based Primers in Construction Market, By End User, 2019-2028 (USD Thousand)

TABLE 25 U.K Acrylic Resin Dispersion Based Primers in Construction market, By Material, 2019-2028 (Tons)

TABLE 26 U.K Acrylic Resin Dispersion Based Primers in Construction market, By Material, 2019-2028 (USD Thousand)

TABLE 27 U.K Acrylic Resin Dispersion Based Primers in Construction Market, By Surface, 2019-2028 (USD Thousand)

TABLE 28 U.K Acrylic Resin Dispersion Based Primers in Construction Market, By Type, 2019-2028 (USD Thousand)

TABLE 29 U.K Acrylic Resin Dispersion Based Primers in Construction Market, By Application, 2019-2028 (USD Thousand)

TABLE 30 U.K Acrylic Resin Dispersion Based Primers in Construction Market, By End User, 2019-2028 (USD Thousand)

TABLE 31 France Acrylic Resin Dispersion Based Primers in Construction market, By Material, 2019-2028 (Tons)

TABLE 32 France Acrylic Resin Dispersion Based Primers in Construction market, By Material, 2019-2028 (USD Thousand)

TABLE 33 France Acrylic Resin Dispersion Based Primers in Construction Market, By Surface, 2019-2028 (USD Thousand)

TABLE 34 France Acrylic Resin Dispersion Based Primers in Construction Market, By Type, 2019-2028 (USD Thousand)

TABLE 35 France Acrylic Resin Dispersion Based Primers in Construction Market, By Application, 2019-2028 (USD Thousand)

TABLE 36 France Acrylic Resin Dispersion Based Primers in Construction Market, By End User, 2019-2028 (USD Thousand)

TABLE 37 Italy Acrylic Resin Dispersion Based Primers in Construction market, By Material, 2019-2028 (Tons)

TABLE 38 Italy Acrylic Resin Dispersion Based Primers in Construction market, By Material, 2019-2028 (USD Thousand)

TABLE 39 Italy Acrylic Resin Dispersion Based Primers in Construction Market, By Surface, 2019-2028 (USD Thousand)

TABLE 40 Italy Acrylic Resin Dispersion Based Primers in Construction Market, By Type, 2019-2028 (USD Thousand)

TABLE 41 Italy Acrylic Resin Dispersion Based Primers in Construction Market, By Application, 2019-2028 (USD Thousand)

TABLE 42 Italy Acrylic Resin Dispersion Based Primers in Construction Market, By End User, 2019-2028 (USD Thousand)

TABLE 43 poland Acrylic Resin Dispersion Based Primers in Construction market, By Material, 2019-2028 (Tons)

TABLE 44 poland Acrylic Resin Dispersion Based Primers in Construction market, By Material, 2019-2028 (USD Thousand)

TABLE 45 poland Acrylic Resin Dispersion Based Primers in Construction Market, By Surface, 2019-2028 (USD Thousand)

TABLE 46 poland Acrylic Resin Dispersion Based Primers in Construction Market, By Type, 2019-2028 (USD Thousand)

TABLE 47 poland Acrylic Resin Dispersion Based Primers in Construction Market, By Application, 2019-2028 (USD Thousand)

TABLE 48 poland Acrylic Resin Dispersion Based Primers in Construction Market, By End User, 2019-2028 (USD Thousand)

TABLE 49 Romania Acrylic Resin Dispersion Based Primers in Construction market, By Material, 2019-2028 (Tons)

TABLE 50 Romania Acrylic Resin Dispersion Based Primers in Construction market, By Material, 2019-2028 (USD Thousand)

TABLE 51 Romania Acrylic Resin Dispersion Based Primers in Construction Market, By Surface, 2019-2028 (USD Thousand)

TABLE 52 Romania Acrylic Resin Dispersion Based Primers in Construction Market, By Type, 2019-2028 (USD Thousand)

TABLE 53 Romania Acrylic Resin Dispersion Based Primers in Construction Market, By Application, 2019-2028 (USD Thousand)

TABLE 54 Romania Acrylic Resin Dispersion Based Primers in Construction Market, By End User, 2019-2028 (USD Thousand)

TABLE 55 Czech republic Acrylic Resin Dispersion Based Primers in Construction market, By Material, 2019-2028 (Tons)

TABLE 56 Czech republic Acrylic Resin Dispersion Based Primers in Construction market, By Material, 2019-2028 (USD Thousand)

TABLE 57 Czech republic Acrylic Resin Dispersion Based Primers in Construction Market, By Surface, 2019-2028 (USD Thousand)

TABLE 58 Czech republic Acrylic Resin Dispersion Based Primers in Construction Market, By Type, 2019-2028 (USD Thousand)

TABLE 59 Czech republic Acrylic Resin Dispersion Based Primers in Construction Market, By Application, 2019-2028 (USD Thousand)

TABLE 60 Czech republic Acrylic Resin Dispersion Based Primers in Construction Market, By End User, 2019-2028 (USD Thousand)

List of Figure

FIGURE 1 Europe Acrylic Resin Dispersion based Primers in Construction Market segmentation

FIGURE 2 Europe Acrylic Resin Dispersion based Primers in Construction Market : data triangulation

FIGURE 3 Europe Acrylic Resin Dispersion based Primers in Construction Market: DROC ANALYSIS

FIGURE 4 Europe Acrylic Resin Dispersion based Primers in Construction Market: REGIONAL VS. country MARKET ANALYSIS

FIGURE 5 Europe Acrylic Resin Dispersion based Primers in Construction Market: COMPANY RESEARCH ANALYSIS

FIGURE 6 Europe Acrylic Resin Dispersion based Primers in Construction Market: THE material LIFELINE CURVE

FIGURE 7 Europe Acrylic Resin Dispersion based Primers in Construction Market: INTERVIEW DEMOGRAPHICS

FIGURE 8 Europe Acrylic Resin Dispersion based Primers in Construction Market: DBMR MARKET POSITION GRID

FIGURE 9 EUROPE ACRYLIC RESIN DISPERSION BASED PRIMERS IN CONSTRUCTION MARKET : THE MARKET CHALLENGE MATRIX

FIGURE 10 Europe Acrylic Resin Dispersion based Primers in Construction Market : SEGMENTATION

FIGURE 11 Growing demand of primers in new residential construction IS EXPECTED TO DRIVE THE Acrylic PRIMERS in construction MARKET IN THE FORECAST PERIOD of 2021 to 2028

FIGURE 12 Absorbent segment is expected to account for the largest share of the Europe Acrylic Resin Dispersion based Primers in Construction Market in 2021 & 2028

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGE OF Europe Primers in Construction Market

FIGURE 14 Private new housing contributed the most to the rise in new work in recent year

FIGURE 15 PRIVATE NEW HOUSING CONTRIBUTED THE MOST TO THE RISE IN NEW WORK IN RECENT YEAR

FIGURE 16 Mean Equivalized Net Income (Euros) for sweden, iceland and u.k.

FIGURE 17 MEAN EQUIVALIZED NET INCOME (EUROS) FOR ICELAND

FIGURE 18 Private new housing contributed the most to the rise in new work in recent years

FIGURE 19 PRIVATE NEW HOUSING CONTRIBUTED THE MOST TO THE RISE IN NEW WORK IN RECENT YEAR

FIGURE 20 Europe acrylic resin dispersion based primers in construction market: BY material, 2020

FIGURE 21 Europe acrylic resin dispersion based primers in construction market: BY Surface, 2020

FIGURE 22 Europe acrylic resin dispersion based primers in construction market: BY type, 2020

FIGURE 23 Europe acrylic resin dispersion based primers in construction market: BY Application, 2020

FIGURE 24 Europe acrylic resin dispersion based primers in construction market: BY End User, 2020

FIGURE 25 Europe Acrylic Resin Dispersion Based Primers in Construction market: SNAPSHOT (2020)

FIGURE 26 Europe Acrylic Resin Dispersion Based Primers in Construction market: BY COUNTRY (2020)

FIGURE 27 Europe Acrylic Resin Dispersion Based Primers in Construction market: BY COUNTRY (2021 & 2028)

FIGURE 28 Europe Acrylic Resin Dispersion Based Primers in Construction market: BY COUNTRY (2021 & 2028)

FIGURE 29 Europe Acrylic Resin Dispersion Based Primers in Construction market: BY Material (2019-2028)

FIGURE 30 Europe Acrylic resin dispersion based primers in Construction Market: company share 2020 (%)

FIGURE 31 LATIN AMERICA Acrylic resin dispersion based primers in Construction Market: company share 2020 (%)

Europe Acrylic Resin Dispersion Based Primers In Construction Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Acrylic Resin Dispersion Based Primers In Construction Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Acrylic Resin Dispersion Based Primers In Construction Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.