Europe 3d Printing Materials Market

Market Size in USD Million

CAGR :

%

USD

901.50 Million

USD

3,850.54 Million

2024

2032

USD

901.50 Million

USD

3,850.54 Million

2024

2032

| 2025 –2032 | |

| USD 901.50 Million | |

| USD 3,850.54 Million | |

|

|

|

|

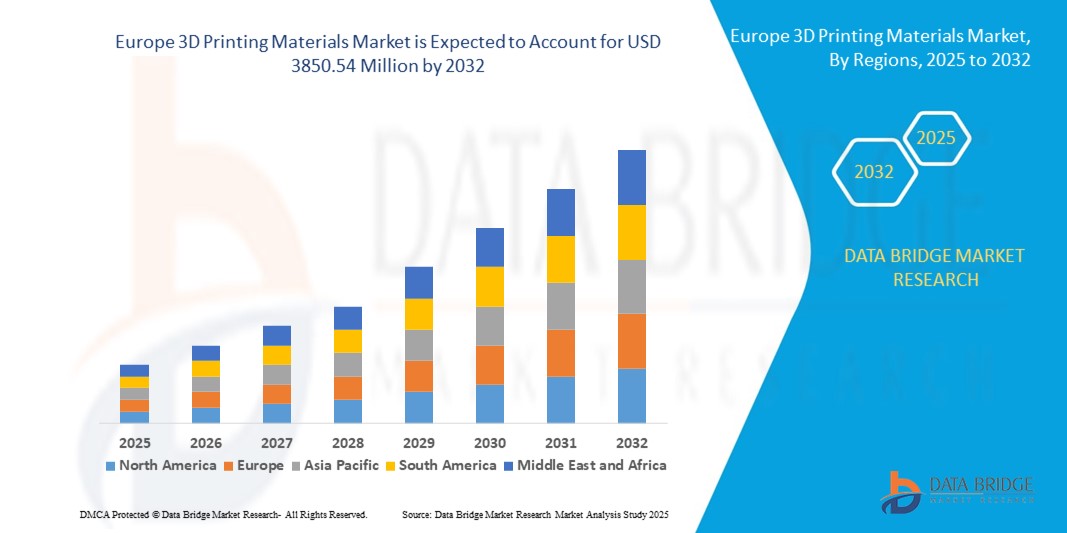

What is the Europe 3D Printing Materials Market Size and Growth Rate?

- The Europe 3D printing materials market size was valued at USD 901.50 million in 2024 and is expected to reach USD 3850.54 million by 2032, at a CAGR of 19.90% during the forecast period

- Increased adoption of 3D printing in various industries, rise in prototyping and rapid tooling, and the expanding accessibility and affordability of 3D printing technologies universally are some of the driving factors expected to propel the market growth

What are the Major Takeaways of Europe 3D Printing Materials Market?

- There is a corresponding surge in demand for materials that can meet the diverse requirements of this innovative manufacturing process as industries embrace the revolutionary capabilities of 3D printing. The versatility of 3D printing, also known as additive manufacturing, spans industries such as aerospace, healthcare, automotive, and consumer goods, where the technology is employed for rapid prototyping, customized production, and intricate design fabrication

- The factor contributing to the demand for 3D printing materials is the technology's ability to produce complex and highly customized components. Traditional manufacturing methods is not much efficient and fast as industries seek more complicated and precisely designed parts. 3D printing addresses this gap by allowing the creation of geometrically complex structures with enhanced efficiency

- The demand for specialized materials is increasing with the evolving needs of industrial sectors such as aerospace, healthcare, automotive, and consumer goods implementing this transformative technology, as 3D printing continues to revolutionize manufacturing processes. Therefore, increased adoption of 3D printing in various industries is driving the market growth

- Germany 3D printing materials market held the largest share of 28.11%in Europe in 2024 of the regional revenue. Growth is fueled by the demand for high-tech security systems, energy-efficient smart homes, and digital infrastructure upgrades

- U.K. 3D printing materials market is expected to grow at a robust CAGR of 12.23% during the forecast period, driven by rising concerns about residential and commercial security, the popularity of DIY smart home setups, and strong retail and online penetration

- The Plastics/Polymers segment dominated the market with the largest revenue share of 45.8% in 2024, owing to their versatility, affordability, and widespread adoption across prototyping and industrial applications

Report Scope and Europe 3D Printing Materials Market Segmentation

|

Attributes |

Europe 3D Printing Materials Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Europe 3D Printing Materials Market?

Shift Toward High-Performance and Functional Materials

- A defining trend in the 3D printing materials market is the growing development and adoption of high-performance and functional materials, including composites, metal alloys, and bio-based polymers, which expand the range of industrial, medical, and consumer applications

- For instance, companies such as Markforged and EOS are introducing carbon-fiber-reinforced filaments and high-temperature polymer powders that allow production of lightweight yet durable parts for aerospace, automotive, and industrial machinery

- Functional 3D Printing Materials are increasingly enabling multi-material printing, embedding electronics, or incorporating conductive pathways, thereby transforming conventional manufacturing workflows into integrated additive processes

- The trend also includes bio-inks and biocompatible polymers for medical 3D printing, including tissue scaffolds, implants, and customized prosthetics, providing enhanced precision, patient-specific designs, and faster production cycles

- As industries move toward digital manufacturing and on-demand production, companies such as Formlabs and 3D Systems are developing specialized resins and powders for advanced prototyping, tooling, and end-use applications, driving innovation across sectors

- The increasing adoption of functional, durable, and industry-ready 3D Printing Materials is reshaping user expectations and expanding applications across automotive, healthcare, aerospace, and consumer electronics

What are the Key Drivers of Europe 3D Printing Materials Market?

- Rising demand for lightweight, high-strength, and customized parts in industries such as aerospace, automotive, and healthcare is a major driver of the 3D printing materials market

- For instance, in March 2024, Stratasys launched high-temperature, flame-retardant thermoplastics designed for aerospace and industrial tooling, enhancing durability and regulatory compliance

- The growing adoption of additive manufacturing in prototyping, small-batch production, and complex geometries is fueling material innovation, enabling precise customization while reducing waste and lead times

- Furthermore, sustainability initiatives are pushing the use of bio-based filaments and recyclable polymers, aligning with ESG goals and reducing environmental impact

- Integration of 3D printing materials with automated and industrial-scale 3D printers, including multi-material and continuous fiber systems, is driving efficiency, cost-effectiveness, and broader adoption across multiple end-use industries

Which Factor is Challenging the Growth of the Europe 3D Printing Materials Market?

- High cost and limited availability of advanced 3D printing materials, particularly functional composites, metal powders, and biocompatible resins, are significant barriers to widespread adoption

- For instance, premium metal powders for aerospace and medical applications often come with high procurement costs and require specialized storage and handling, limiting usage to high-value applications

- Material performance consistency, quality control, and standardization remain challenges, especially for industrial-grade parts requiring strict regulatory compliance and mechanical integrity

- In addition, a lack of trained professionals and technical expertise in handling specialized 3D Printing Materials restricts adoption in emerging markets and smaller enterprises

- Overcoming these challenges through cost reduction, material innovation, and training programs will be critical to enabling broader adoption and sustained market growth globally

How is the Europe 3D Printing Materials Market Segmented?

The market is segmented on the basis of type, form, technology, and end-use.

- By Type

On the basis of type, the 3D printing materials market is segmented into Plastics/Polymers, Metal, Ceramic, and Others. The Plastics/Polymers segment dominated the market with the largest revenue share of 45.8% in 2024, owing to their versatility, affordability, and widespread adoption across prototyping and industrial applications. Plastics/Polymers are preferred for lightweight parts, functional prototypes, and consumer products due to easy processing, good mechanical properties, and compatibility with multiple 3D printing technologies.

The Metal segment is projected to grow at the fastest CAGR from 2025 to 2032, driven by demand in aerospace, automotive, and medical industries for high-strength, heat-resistant, and durable components. Metal powders and alloys allow for production of complex, load-bearing structures that traditional manufacturing cannot easily achieve. Ceramic materials, meanwhile, are gaining traction for high-temperature and biocompatible applications in healthcare and electronics, though adoption remains limited by higher costs and specialized equipment requirements.

- By Form

On the basis of form, the 3D printing materials market is segmented into Powder, Filament, and Liquid. The Filament segment held the largest market revenue share of 52.3% in 2024, supported by its widespread use in Fused Deposition Modeling (FDM) printers, ease of handling, and affordability for both industrial and consumer applications. Filaments are available in thermoplastics, composites, and bio-based polymers, offering versatility for prototyping, tooling, and functional end-use parts.

The Powder form is expected to witness the fastest CAGR from 2025 to 2032, largely due to its critical role in Selective Laser Sintering (SLS), Direct Metal Laser Sintering (DMLS), and other high-precision metal and polymer additive manufacturing processes. Liquid 3D Printing Materials, used primarily in Stereolithography (SLA) and resin-based printers, are favored for high-resolution parts and intricate geometries but are limited by cost and post-processing requirements.

- By Technology

On the basis of technology, the 3D printing materials market is segmented into Fused Deposition Modeling (FDM), Selective Laser Sintering (SLS), Stereolithography (SLA), Direct Metal Laser Sintering (DMLS), Big Area Additive Manufacturing (BAAM), Wire Arc Additive Manufacturing (WAAM), ColorJet, and Others. The FDM segment dominated the market with the largest revenue share of 40.9% in 2024, driven by its accessibility, affordability, and ability to process a wide variety of thermoplastics and composites. FDM is widely used for prototyping, functional testing, and educational purposes, making it popular across multiple industries.

SLS and DMLS are expected to witness the fastest growth from 2025 to 2032, given their ability to produce high-strength, intricate parts for aerospace, automotive, and medical applications. SLA, BAAM, WAAM, and ColorJet cater to niche applications requiring high precision, speed, or large-scale production, further expanding the market’s technological reach.

- By End-Use

On the basis of end-use, the 3D printing materials market is segmented into Industrial Manufacturing, Automotive, Aerospace & Defense, Healthcare, Consumer Goods, Electronics, Education, Construction, and Others. The Industrial Manufacturing segment held the largest market revenue share of 38.6% in 2024, driven by rapid adoption of additive manufacturing for prototyping, tooling, jigs, and production parts. Industries leverage 3D Printing Materials to reduce lead times, optimize designs, and improve efficiency.

The Healthcare and Aerospace & Defense segments are projected to grow at the fastest CAGR from 2025 to 2032, fueled by rising demand for customized implants, prosthetics, lightweight structural components, and mission-critical parts. Education and consumer applications are supporting awareness and adoption of 3D printing, while electronics and construction segments are gradually integrating 3D printing for specialized components, large-scale structures, and customized products.

Which Region Holds the Largest Share of the Europe 3D Printing Materials Market?

- Germany 3D printing materials market held the largest share of 28.11%in Europe in 2024 of the regional revenue. Growth is fueled by the demand for high-tech security systems, energy-efficient smart homes, and digital infrastructure upgrades

- Consumers prefer products compatible with popular smart home platforms such as Alexa and Google Assistant, while the country’s emphasis on sustainability and innovation further accelerates market adoption

France 3D Printing Materials Market Insight

France’s 3D printing materials market is expanding steadily, supported by urbanization, smart home adoption, and consumer awareness of digital security solutions. Government incentives for energy-efficient building upgrades and the growing presence of smart home integrators encourage both residential and commercial adoption.

Italy 3D Printing Materials Market Insight

Italy 3D printing materials market is projected to register significant growth, driven by increasing use of connected home devices, rising consumer interest in home automation, and modernization of older residential buildings. Integration with voice-controlled platforms and smartphone applications enhances market appeal.

Which Country is the Fastest Growing in the Europe 3D Printing Materials Market?

U.K. 3D printing materials market is expected to grow at a robust CAGR of 12.23% during the forecast period, driven by rising concerns about residential and commercial security, the popularity of DIY smart home setups, and strong retail and online penetration. The adoption of keyless entry and connected systems in offices, apartments, and multi-family housing is further boosting demand.

Poland 3D Printing Materials Market Insight

Poland market is gaining momentum due to urban expansion, growing adoption of smart homes, and rising interest in energy-efficient, secure access systems. Polish consumers are increasingly integrating 3D printing materials with IoT-enabled devices for convenience and security.

Which are the Top Companies in Europe 3D Printing Materials Market?

The Europe 3D printing materials industry is primarily led by well-established companies, including:

- Formlabs (U.S.)

- EOS (Germany)

- ENVISIONTEC US LLC (U.S.)

- American Elements (U.S.)

- Höganäs AB (Sweden)

- UltiMaker (Netherlands)

- Carbon, Inc. (U.S.)

- KRAIBURG TPE GmbH & Co. KG (Germany)

- Covestro AG (Germany)

- Markforged, Inc. (U.S.)

- Stratasys (U.S.)

- ExOne (U.S.)

- Arkema (France)

- 3D Systems, Inc. (U.S.)

- Evonik Industries AG (Germany)

- Materialise (Belgium)

- BASF SE (Germany)

- Sandvik AB (Sweden)

- Solvay (Belgium)

What are the Recent Developments in Europe 3D Printing Materials Market?

- In October 2023, EOS launched its Digital Foam Architects network, designed to accelerate the development and additive manufacturing (AM) of consumer, medical and industrial products featuring Digital Foam applications. Digital Foam is not a product, rather it is an approach to 3D printing foam-like products. It will provide a new direction to the company in 3D printing materials

- In October 2023, Arkema announced new partnerships with industry leaders such as EOS, HP and Stratasys to design the next generation of 3D printed materials and solutions. This will favour their innovative capabilities and enhance their product portfolio

- In February 2023, Bauer Hockey, the Europe leader in hockey equipment innovation, and industrial 3D printing industry pioneer and market leader, EOS, have collaborated to incorporate additive manufacturing (AM, or 3D printing) into Bauer’s MyBauer custom equipment program. EOS and its patented Digital Foam approach to printing polymers gave Bauer a distinct advantage. It will strengthen the market presence for EOS in the Europe 3D printing materials market

- In November 2021, Covestro AG introduced four new 3D printing materials at Formnext 2021, covering diverse technologies. Among them is Addigy FPC SOL1 HT, a soluble support material for FDM printing of high-temperature materials, offering easy removal and sustainability. Arnitel AM3001 (P) for SLS, a soft material with high energy return, achieved successful 3D printing with compliance with Toy Safety standards. Covestro also launched SLS and HSS versions of its TPU powder, Addigy PPU 86AW6, known for rebound, easy post-processing, and high reuse rate. These additions expand Covestro's polymer choices for 3D printing, following its acquisition of DSM's additive manufacturing business earlier this year

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Europe 3d Printing Materials Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe 3d Printing Materials Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe 3d Printing Materials Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.