Customized Wound Care Biologics Market

Market Size in USD Billion

CAGR :

%

USD

2.80 Billion

USD

5.91 Billion

2024

2032

USD

2.80 Billion

USD

5.91 Billion

2024

2032

| 2025 –2032 | |

| USD 2.80 Billion | |

| USD 5.91 Billion | |

|

|

|

|

Customized Wound Care Biologics Market Size

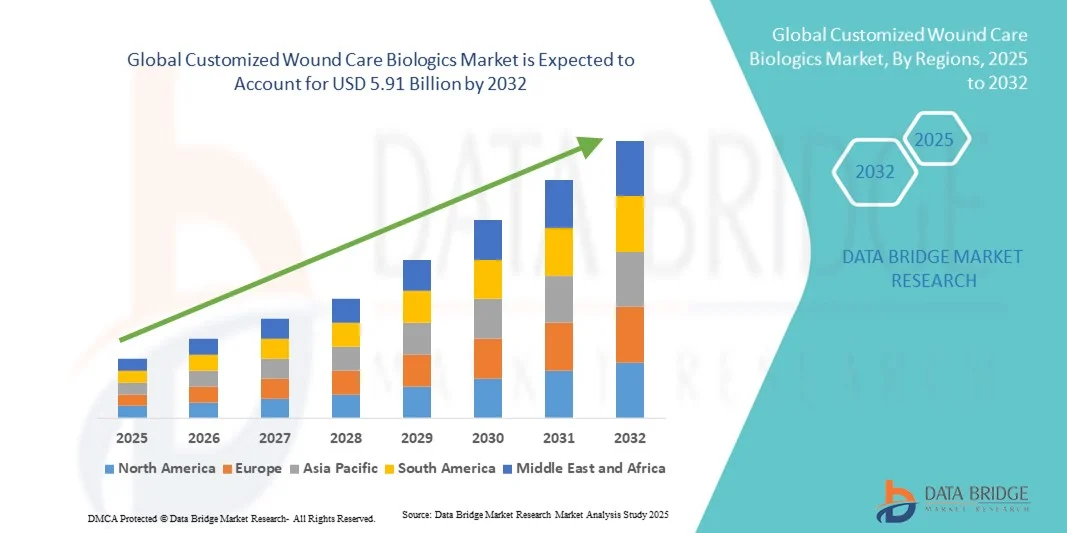

- The global customized wound care biologics market size was valued at USD 2.80 billion in 2024 and is expected to reach USD 5.91 billion by 2032, at a CAGR of 9.80% during the forecast period

- The market growth is largely fueled by the rising prevalence of chronic and hard-to-heal wounds, coupled with the increasing adoption of advanced biologic therapies such as growth factors, skin substitutes, and cellular-based products for personalized wound management. Technological advancements in tissue engineering and regenerative medicine are further supporting the development of customized wound care biologics tailored to individual patient needs

- Furthermore, the growing demand for effective, patient-specific wound healing solutions—especially among diabetic and geriatric populations—is driving greater investment and innovation in biologically derived wound care products. These converging factors are accelerating the uptake of customized wound care biologics solutions, thereby significantly boosting the industry's growth

Customized Wound Care Biologics Market Analysis

- Customized wound care biologics, encompassing advanced products such as growth factors, skin substitutes, and biological dressings, are increasingly becoming essential components of modern wound management in both acute and chronic cases due to their ability to accelerate healing, reduce infection risks, and improve patient outcomes

- The escalating demand for customized wound care biologics is primarily fueled by the rising prevalence of chronic wounds such as diabetic ulcers, pressure ulcers, and venous leg ulcers, along with growing awareness regarding personalized and regenerative treatment approaches across hospitals, ambulatory centers, and home care settings

- North America dominated the customized wound care biologics market with the largest revenue share of 42.7% in 2024, characterized by advanced healthcare infrastructure, early adoption of biologic-based therapies, and a strong presence of key market players. The U.S. has witnessed substantial growth in biologics utilization, particularly across wound care centers and specialized clinics, supported by favorable reimbursement policies, technological advancements in tissue-engineered products, and increasing investments in R&D for next-generation wound healing solutions

- Asia-Pacific is expected to be the fastest growing region in the customized wound care biologics market during the forecast period, with a projected CAGR of 9.4% from 2025 to 2032, driven by a rising diabetic population, growing healthcare expenditure, and expanding access to advanced wound management treatments in countries such as China, India, and Japan. The region’s focus on localized biologic manufacturing and government initiatives to modernize healthcare systems further support market acceleration

- The biologic skin substitutes segment dominated the customized wound care biologics market with the largest revenue share of 46.8% in 2024, driven by the growing demand for tissue-engineered products that accelerate wound healing and reduce infection risks

Report Scope and Customized Wound Care Biologics Market Segmentation

|

Attributes |

Customized Wound Care Biologics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Customized Wound Care Biologics Market Trends

Advancements in Regenerative Medicine and Personalized Therapies

- A key emerging trend in the global customized wound care biologics market is the rapid advancement in regenerative medicine and the increasing adoption of personalized treatment approaches. These innovations are reshaping the wound management landscape by enabling therapies that address specific patient needs based on wound type, severity, and underlying health conditions

- For instance, in September 2023, MiMedx Group, Inc. introduced an advanced amniotic tissue-based allograft designed to enhance natural healing responses and improve outcomes for chronic wound patients. This reflects the industry’s ongoing shift toward biologically active products that support tissue regeneration and angiogenesis

- Manufacturers are increasingly investing in developing next-generation biologics that combine growth factors, stem cells, and biomaterials to create customized wound healing environments. These biologics not only accelerate wound closure but also minimize the risk of infection and scarring

- Furthermore, the integration of regenerative technologies with precision medicine principles allows clinicians to tailor treatments for each patient, optimizing healing outcomes and reducing recovery times. This is particularly relevant for patients with complex wounds, such as those resulting from diabetes or vascular complications

- This trend toward personalized, biologically derived therapies is driving strong innovation and competition within the market, with companies focusing on advanced formulations, tissue-engineered matrices, and autologous cell-based products to achieve superior healing efficiency and patient satisfaction

Customized Wound Care Biologics Market Dynamics

Driver

Rising Prevalence of Chronic and Surgical Wounds Driving Market Growth

- The growing incidence of chronic wounds, including diabetic foot ulcers, pressure ulcers, and venous leg ulcers, is a primary factor driving the demand for customized wound care biologics globally. The rising burden of diabetes, obesity, and vascular diseases has led to an increased need for advanced, personalized wound healing solutions

- For instance, in February 2024, Smith+Nephew announced the expansion of its biologics portfolio with new regenerative wound care solutions designed to accelerate healing in chronic wounds, particularly in diabetic and post-surgical patients. Such innovations underscore the industry's focus on improving patient-specific outcomes

- In addition, the surge in surgical procedures and trauma cases worldwide has created a substantial demand for effective wound management solutions that promote faster healing and minimize infection risk. Customized wound care biologics—such as growth factor therapies, bioengineered skin substitutes, and autologous cell-based products—are increasingly preferred due to their ability to stimulate natural tissue regeneration and reduce recovery times

- Furthermore, advancements in biotechnology and tissue engineering have enabled the development of next-generation biologics tailored to individual patient needs. The integration of personalized treatment approaches in wound care aligns with the growing emphasis on precision medicine across healthcare systems

- Healthcare providers are also adopting customized biologics due to their potential to reduce long-term care costs by minimizing wound recurrence and hospital readmissions, ultimately enhancing patient quality of life

Restraint/Challenge

High Cost of Biologic Therapies and Limited Reimbursement Policies

- Despite their clinical advantages, the high cost associated with customized wound care biologics remains a significant barrier to widespread adoption, particularly in developing and cost-sensitive healthcare markets. The production of advanced biologics involves complex manufacturing processes, specialized storage conditions, and rigorous regulatory compliance, all of which contribute to higher product pricing

- In many countries, reimbursement policies for biologic wound care products are still limited, which discourages both healthcare providers and patients from opting for these advanced treatments. For instance, while North America and parts of Europe have established reimbursement frameworks for select biologics, coverage remains inconsistent in several Asia-Pacific and Latin American regions

- In addition, the lack of standardized clinical guidelines for the use of customized biologics in wound management creates uncertainty among practitioners regarding optimal product selection and application

- Another challenge lies in the need for extensive clinical evidence to demonstrate the cost-effectiveness and long-term benefits of customized biologics compared to conventional wound care options. Manufacturers must invest heavily in clinical trials to substantiate product efficacy, which can delay market entry and increase development costs

- Addressing these challenges through broader reimbursement coverage, strategic pricing models, and continuous clinical validation will be essential for expanding the global adoption of customized wound care biologics in the coming years

Customized Wound Care Biologics Market Scope

The market is segmented on the basis of product, wound type, and end user.

- By Product

On the basis of product, the customized wound care biologics market is segmented into biologic skin substitutes and topical agents. The biologic skin substitutes segment dominated the market with the largest revenue share of 46.8% in 2024, driven by the growing demand for tissue-engineered products that accelerate wound healing and reduce infection risks. These substitutes, which include acellular dermal matrices, allografts, and xenografts, are widely used in chronic and complex wounds such as diabetic ulcers and burns. Advancements in biotechnology and regenerative medicine have further boosted product adoption, as they enable faster tissue regeneration and minimal scarring. Hospitals and wound care clinics are increasingly integrating biologic skin substitutes into advanced treatment protocols. In addition, collaborations between biotechnology firms and research institutions have enhanced product innovation, expanding clinical applications across both developed and emerging economies. The segment continues to gain strong regulatory approvals, supporting its market leadership position globally.

The topical agents segment is anticipated to witness the fastest growth rate of 9.2% CAGR from 2025 to 2032, fueled by increasing patient preference for cost-effective, easy-to-apply wound care formulations. Topical biologics such as growth factor gels, platelet-derived formulations, and enzymatic debriders are gaining traction due to their efficacy in managing mild to moderate chronic wounds. These agents support faster re-epithelialization and reduce inflammation, making them ideal for outpatient and homecare use. Rising awareness of early-stage wound management and the development of bioactive topical formulations enhance segment adoption. Moreover, the growing geriatric and diabetic populations globally contribute to a steady rise in chronic wound incidences, boosting demand for innovative and accessible topical biologics.

- By Wound Type

On the basis of wound type, the customized wound care biologics market is segmented into ulcers, surgical and traumatic wounds, and burns. The ulcers segment dominated the market with the largest revenue share of 41.3% in 2024, primarily driven by the increasing global prevalence of diabetic foot ulcers, venous leg ulcers, and pressure ulcers. The rising incidence of diabetes, obesity, and vascular diseases has resulted in greater dependence on biologic therapies to prevent amputations and accelerate tissue recovery. Healthcare systems across North America and Europe are expanding chronic wound programs focusing on biologic skin substitutes and growth factor-based treatments. The development of next-generation biomaterials that promote angiogenesis and cell proliferation has further strengthened segment demand. In addition, government initiatives supporting diabetic wound management and reimbursement for advanced wound biologics significantly enhance adoption in clinical settings.

The surgical and traumatic wounds segment is projected to register the fastest CAGR of 8.8% from 2025 to 2032, driven by increasing surgical volumes, accident-related injuries, and post-operative complications requiring advanced wound healing solutions. The segment benefits from growing use of biologic dressings and growth factor-infused products to accelerate healing and minimize infection risks in post-surgical wounds. Continuous innovation in autologous and allogenic biologics, along with strong R&D funding in regenerative medicine, is driving clinical uptake. Furthermore, the shift toward minimally invasive and reconstructive surgeries in hospitals and ambulatory surgical centers is expected to sustain robust demand growth for biologic wound management products during the forecast period.

- By End User

On the basis of end user, the customized wound care biologics market is segmented into hospitals, ambulatory surgical centers (ASCs), burn centers, and wound clinics. The hospital segment dominated the market with the largest revenue share of 48.5% in 2024, driven by the high patient inflow for acute and chronic wound management, and the availability of advanced infrastructure for biologic therapies. Hospitals remain the primary setting for complex wound treatments, including ulcers, burns, and post-surgical wounds, owing to access to multidisciplinary care teams and advanced biologic dressings. The segment’s dominance is also attributed to expanding healthcare expenditure, reimbursement for biologic products, and continuous introduction of innovative wound care biologics by key players. Leading hospitals are increasingly establishing specialized wound care departments equipped with growth factor therapies, stem cell-based treatments, and bioengineered skin substitutes. The integration of AI-based wound monitoring and telemedicine platforms further enhances hospital-based wound management efficiency.

The ambulatory surgical centers (ASCs) and wound clinics segment is expected to record the fastest CAGR of 9.7% from 2025 to 2032, driven by the rising preference for outpatient wound treatment and the need to reduce hospitalization costs. ASCs and specialized wound clinics offer faster, cost-efficient biologic interventions for patients with moderate wounds, diabetic ulcers, or post-operative complications. Increasing adoption of biologic dressings and platelet-rich plasma (PRP) therapies in these settings supports segment expansion. In addition, favorable government initiatives promoting home-based and ambulatory wound care, coupled with the introduction of portable biologic application devices, are accelerating the shift toward decentralized wound management. This evolution positions ASCs and wound clinics as a crucial growth driver in the global biologics-based wound care ecosystem.

Customized Wound Care Biologics Market Regional Analysis

- North America dominated the customized wound care biologics market with the largest revenue share of 42.7% in 2024, characterized by advanced healthcare infrastructure, early adoption of biologic-based therapies, and a strong presence of key market players

- The market has witnessed substantial growth in biologics utilization, particularly across wound care centers and specialized clinics

- Supported by favorable reimbursement policies, technological advancements in tissue-engineered products, and increasing investments in R&D for next-generation wound healing solutions

U.S. Customized Wound Care Biologics Market Insight

The U.S. customized wound care biologics market captured the largest revenue share within North America in 2024, fueled by the rapid integration of biologic therapies in hospitals, outpatient clinics, and specialized wound care centers. Increasing prevalence of chronic wounds, rising healthcare expenditure, and growing awareness among clinicians about advanced wound care solutions are driving the market’s expansion.

Europe Customized Wound Care Biologics Market Insight

The Europe customized wound care biologics market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by rising adoption of advanced biologic treatments, increasing prevalence of chronic wounds, and expanding hospital and clinic networks. The region is witnessing strong growth across specialized clinics, hospitals, and homecare setups, with healthcare providers increasingly adopting tissue-engineered and autologous biologic therapies.

U.K. Customized Wound Care Biologics Market Insight

The U.K. customized wound care biologics market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing government initiatives to promote advanced wound care, rising prevalence of diabetic and pressure ulcers, and expanding outpatient and home healthcare services. Investment in portable and low-frequency biologic therapies further supports rapid adoption.

Germany Customized Wound Care Biologics Market Insight

The Germany customized wound care biologics market is expected to expand at a considerable CAGR during the forecast period, fueled by advanced healthcare infrastructure, early adoption of innovative biologics, and a strong presence of leading market players. The country has seen substantial installations of biologic therapies in hospitals and specialized clinics, reinforced by robust government healthcare programs, clinician training, and favorable reimbursement policies.

Asia-Pacific Customized Wound Care Biologics Market Insight

The Asia-Pacific customized wound care biologics market is poised to grow at the fastest CAGR of 9.4% during the forecast period from 2025 to 2032, driven by the rising diabetic population, increasing healthcare expenditure, and expanding access to advanced wound management treatments in countries such as China, India, and Japan. The region’s focus on localized biologic manufacturing and government initiatives to modernize healthcare systems further support market acceleration.

Japan Customized Wound Care Biologics Market Insight

The Japan customized wound care biologics market is gaining momentum due to the country’s advanced healthcare system, high technological adoption in clinical care, and growing demand for efficient wound management solutions. Expansion of outpatient care services and increasing focus on personalized biologic therapies are contributing to growth.

China Customized Wound Care Biologics Market Insight

The China customized wound care biologics market accounted for the largest revenue share within Asia-Pacific in 2024, driven by rising healthcare expenditure, expanding hospital networks, and increasing adoption of modern wound management technologies. Government initiatives to improve chronic wound care, coupled with investments in domestic biologics manufacturing, are key factors propelling market growth.

Customized Wound Care Biologics Market Share

The customized wound care biologics industry is primarily led by well-established companies, including:

- Smith + Nephew (U.K.)

- Mölnlycke Health Care AB (Sweden)

- ConvaTec Group Plc (U.K.)

- Organogenesis Holdings Inc. (U.S.)

- Integra LifeSciences Corporation (U.S.)

- 3M (U.S.)

- Coloplast A/S (Denmark)

- Avita Medical, Inc. (U.S.)

- Osiris Therapeutics, Inc. (U.S.)

- Medline Industries, LP (U.S.)

- Regenity (U.S.)

- Tissue Regenix (U.K.)

- MIMEDX Group, Inc. (U.S.)

- SKINGENIXUSA (U.S.)

- AlloSource (U.S.)

- BioTissue (U.S.)

- Reapplix A/S (Denmark)

Latest Developments in Global Customized Wound Care Biologics Market

- In November 2023, the FDA proposed a new rule classifying certain wound dressings and liquid wound washes containing antimicrobials and/or other chemical preservatives into Class II or III medical devices. This proposal aims to address the high level of antimicrobial resistance (AMR) concern associated with these products

- In March 2024, the U.S. FDA authorized the marketing of the Medline Autologous Regeneration of Tissue (ART) Skin Harvesting System, a first-of-its-kind handheld, semi-automated device intended to obtain skin tissue from a healthy (donor) site on a patient’s body and deposit it onto that patient’s wound where a skin graft would be appropriate

- In October 2024, Royal Wound-X, a division of Royal Biologics, launched two cutting-edge wound healing technologies: the Peak Powder Collagen Matrix and the ElectroFiber 3D. The ElectroFiber 3D is a bioengineered, electrospun synthetic polymer matrix designed for accelerating healing of wounds, while the Peak Powder Collagen Matrix is a next-generation collagen-based wound care solution for enhancing healing of surgical and non-surgical wounds

- In March 2025, BioTissue announced that its birth tissue donation program, Sharing Miracles, will collaborate with Mt. Sinai Medical Center to launch a groundbreaking program designed to streamline the birth tissue donation process at the Miami hospital. This collaboration aims to educate expectant mothers about the benefits birth tissue donation provides to patients in need of regenerative therapies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.