Australia And New Zealand Concrete Admixture Market

Market Size in USD Billion

CAGR :

%

USD

339,203.34 Billion

USD

483,271.85 Billion

2022

2030

USD

339,203.34 Billion

USD

483,271.85 Billion

2022

2030

| 2023 –2030 | |

| USD 339,203.34 Billion | |

| USD 483,271.85 Billion | |

|

|

|

Australia and New Zealand Concrete Admixture Market Analysis and Size

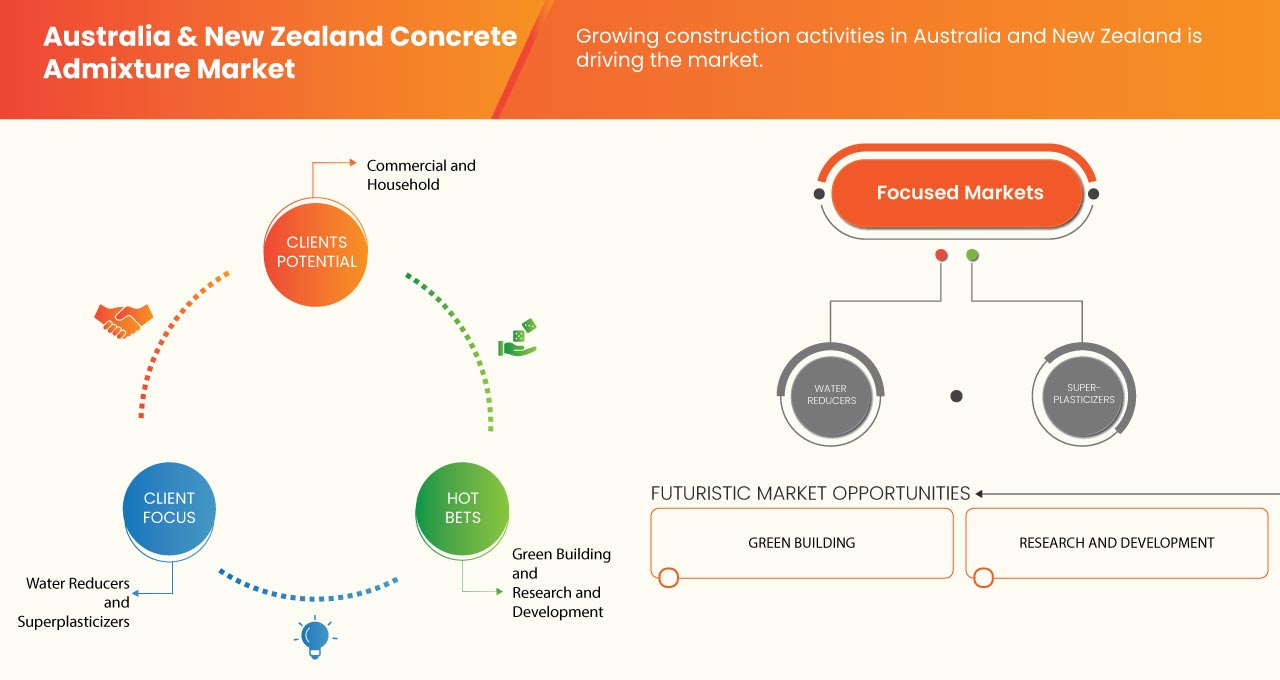

Australia & New Zealand concrete admixture market is expected to reach USD 483,271.85 thousand by 2030 from USD 339,203.34 thousand in 2022, growing with a substantial CAGR of 4.6% in the forecast period of 2023 to 2030. The major factor driving the growth of the concrete admixture market is the growing construction activities in Australia & New Zealand.

The concrete admixture market is experiencing steady growth and increasing demand driven by factors such as the expanding construction sector, increasing investment in sustainable construction, rising population in the two countries, increase in the construction of housing and building, and the rise of using concrete admixtures in infrastructural activities like airports, dams, railways and metro, and others. The market is characterized by intense competition among key players, driving innovation and technological advancements in terms of features, formulation, and sustainability. Moreover, the growing focus on sustainability and eco-friendly solutions is influencing product development and consumer buying patterns. Overall, the concrete admixture market is expected to continue its upward trajectory in the coming years.

Australia & New Zealand concrete admixture market report provides details of market share, new developments, and the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an analyst brief. Our team will help you create a revenue-impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Thousand and Volume in Tons |

|

Segments Covered |

Product (Water Reducers, Superplasticizers, Retarders, Specialty Admixtures, Accelerators, and Air Entrainers), Application (Residential, Infrastructure, and Commercial) |

|

Countries Covered |

Australia & New Zealand |

|

Market Players Covered |

Sika AG (Switzerland), Fosroc International Limited (U.K.), Master Builders Solutions (Germany), GCP Applied Technologies (a subsidiary of Saint-Gobain) (U.S.), Tremco Incorporated (a subsidiary of RPM International Inc.) (U.S.), Xypex Chemical Corporation (Canada), Normet (Finland), MAPEI S.p.A. (Italy), Yara (Norway), Rockbond (New Zealand), Cemix Products Limited (New Zealand), and Permacolour (New Zealand), among others. |

Market Definition

Admixtures for concrete are substances, either artificial or natural, that are added to the mixture at any time. The major goal of adding these admixtures is to provide structural features like corrosion resistance, workability, durability, compressive strength, and finish ability. The use of concrete will be accelerated by the quickly expanding building sector, which raises the need for admixtures. The capacity of the product to reduce the amount of time that hardened concrete needs to cure, in combination with quick infrastructure construction, will further fuel market expansion throughout the anticipated time period.

Australia & New Zealand Concrete Admixture Market Dynamics

This section deals with understanding the market drivers, advantages, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Growing construction activities in Australia & New Zealand

The construction industry in Australia & New Zealand has seen rapid growth in recent years, resulting in a significant increase in demand for concrete admixtures. Housing demand has increased as a result of population growth and urbanization. Residential construction projects, such as apartment complexes, townhouses, and single-family homes, have been steadily increasing. To meet the growing demand for high-quality, long-lasting residential structures, builders have turned to concrete admixtures to improve concrete performance.

The commercial and industrial sectors have also been experiencing significant growth. The construction of office buildings, shopping centers, warehouses, and industrial facilities has created a substantial market for concrete admixtures. These projects often require specialized concrete formulations to meet specific performance criteria, such as strength, durability, and fire resistance.

- Increasing investment in sustainable construction

People are becoming more aware of how the construction industry affects the environment, including energy use, greenhouse gas emissions, and resource depletion. To limit these environmental concerns and encourage more eco-friendly products, there is a growing investment in sustainable construction. The governments of Australia & New Zealand have implemented incentives and policies to encourage sustainable building. This includes tax breaks, grants, financial incentives, and streamlined approval procedures for green building projects. The government's support encourages investments in sustainable construction projects.

Finally, growing investments in sustainable construction practices in Australia & New Zealand have created favorable conditions for the Concrete Admixture industry. The emphasis on green building certifications, energy efficiency, carbon footprint reduction, waste management, water conservation, durability, and government support has increased demand for admixtures that improve the sustainability and performance of concrete. The industry's continuous innovation and research efforts align with the region's commitment to sustainable development, positioning concrete admixtures as critical components in achieving sustainable construction goals.

Opportunities

- Supportive outlook towards green building initiatives

The availability of sustainable construction products, such as eco-friendly concrete admixtures, has increased in both countries' construction industries. Manufacturers and suppliers are investing in research and development to create innovative, low-carbon, and environmentally friendly admixture solutions that align with the industry's green initiatives. Both Australia & New Zealand are becoming more aware of the environmental impact of construction activities. Stakeholders, including government agencies, industry associations, developers, and contractors, are becoming more aware of the need for sustainable construction practices to address environmental issues such as climate change, resource depletion, and pollution. The general public is becoming more aware of environmental issues and the significance of sustainable construction. Homeowners, tenants, and businesses are increasingly preferring eco-friendly buildings that provide energy efficiency, indoor air quality, and reduced environmental impact. This demand for green buildings has influenced construction stakeholders to adopt sustainable practices and incorporate environmentally friendly products such as concrete admixtures.

- Rising R&D spending in the concrete admixture segment

To improve sustainability, the construction industry is embracing new technologies and solutions such as self-healing concrete, CCU and others. Concrete admixture advancements have resulted in the development of eco-friendly options that improve the durability, performance, and environmental attributes of concrete. The competitive nature of the construction industry drives companies to invest in R&D to gain a competitive advantage. Admixture manufacturers and suppliers work hard to create one-of-a-kind, high-performance products that meet the market's changing demands, and such products are superplasticizers, accelerators etc. This competitive environment encourages continuous R&D efforts to improve existing formulations, develop new admixtures, and investigate advanced manufacturing techniques.

Restraints/Challenges

- Implementation of stringent rules and regulations for construction

Stricter rules and regulations require construction companies to use admixtures in accordance with safety standards. This includes the proper handling, storage, and application of admixtures to avoid accidents, injuries, or health hazards to building workers and occupants. Compliance with safety regulations ensures a safe working environment and reduces the risks associated with the use of admixtures. Admixture usage must be documented and reported in accordance with strict regulations. Construction companies are frequently required to keep records of the admixtures used, as well as their sources and specifications. Implementing stringent regulations may raise the cost of construction projects. Construction companies may need training, equipment, or additional testing to ensure compliance. Compliant admixtures that meet the required standards may be more expensive. These additional costs can pose financial difficulties, especially for smaller construction firms or projects with limited budgets.

- Supply Chain Disruptions

Natural disasters such as earthquakes, floods, and bushfires are common in Australia & New Zealand. These events can damage infrastructure, disrupt transportation networks, and cause temporary closures of manufacturing facilities, affecting the supply chain. Labor shortages are common in Australia & New Zealand's construction industries, which can disrupt production and delivery schedules. Insufficient workforce availability or a lack of skilled workers can cause delays in the manufacturing and delivery of concrete admixtures. Furthermore, changes in trade policies, tariff imposition, or trade disputes can all have an impact on the import and export of raw materials and finished goods. These disruptions can cause delays, increased costs, and inefficiencies in the supply chain.

Recent Developments

- In May 2023, the acquisition of MBCC Group by Sika AG was completed. As a result, Sika is now stronger in all geographic areas, including the U.S., the U.K., Australia, and New Zealand. It has also expanded its portfolio of products and services to cover the entire construction life cycle and is accelerating the sustainable transformation of the construction sector. The combined innovative capabilities of Sika and MBCC will hasten the construction sector’s overall sustainable transformation.

- In September 2022, the transaction to be bought by Saint-Gobain has finalized, according to a statement from GCP Applied Technologies. In a deal worth around USD 2.3 billion, Saint-Gobain has purchased all of the outstanding shares of GCP Applied Technologies for USD 32.00 per share in cash. Saint-CertainTeed Gobain’s and Chryso businesses will be integrated with GCP’s well-known brands and decades of expertise.

Australia & New Zealand Concrete Admixture Market Scope

The Australia & New Zealand concrete admixture market is segmented into two notable segments based on product and application. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Product

- Water Reducers

- Superplasticizers

- Retarders

- Specialty Admixtures

- Accelerators

- Air Entrainers

On the basis of product, the market is segmented into water reducers, superplasticizers, retarders, specialty admixtures, accelerators, and air entrainers.

Application

- Residential

- Infrastructure

- Commercial

On the basis of application, the market is segmented into residential, infrastructure, and commercial.

Competitive Landscape and Australia & New Zealand Concrete Admixture Market Share Analysis

The Australia & New Zealand concrete admixture market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to the Australia & New Zealand concrete admixture market.

Some of the major market players operating in the market are Sika AG (Switzerland), Fosroc International Limited (U.K.), Master Builders Solutions (Germany), GCP Applied Technologies (a subsidiary of Saint-Gobain) (U.S.), Tremco Incorporated (a subsidiary of RPM International Inc.) (U.S.), Xypex Chemical Corporation (Canada), Normet (Finland), MAPEI S.p.A. (Italy), Yara (Norway), Rockbond (New Zealand), Cemix Products Limited (New Zealand), and Permacolour (New Zealand), among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 APPLICATION LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS:

4.1.2 ECONOMIC FACTORS:

4.1.3 SOCIAL FACTORS:

4.1.4 TECHNOLOGICAL FACTORS:

4.1.5 LEGAL FACTORS:

4.1.6 ENVIRONMENTAL FACTORS:

4.2 PORTER’S FIVE FORCES:

4.2.1 THREAT OF NEW ENTRANTS:

4.2.2 THE THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 VENDOR SELECTION CRITERIA

4.4 CLIMATE CHANGE SCENARIO

4.4.1 ENVIRONMENTAL CONCERNS

4.4.2 INDUSTRY RESPONSE

4.4.3 GOVERNMENT’S ROLE

4.4.4 ANALYST RECOMMENDATION

4.5 IMPORT EXPORT SCENARIO

4.6 PRICE INDEX SCENARIO

4.7 PRODUCTION CONSUMPTION ANALYSIS

4.8 PRODUCTION CAPACITY OVERVIEW

4.9 RAW MATERIAL COVERAGE

4.9.1 RETARDERS

4.9.2 ACCELERATORS

4.9.3 WATER-REDUCERS

4.9.4 AIR-ENTERTAINERS

4.9.5 SUPER-PLASTICIZERS

4.9.6 WATERPROOFING

4.9.7 ANTI-FREEZERS

4.1 SUPPLY CHAIN ANALYSIS

4.10.1 OVERVIEW

4.10.2 LOGISTIC COST SCENARIO

4.10.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.11 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING CONSTRUCTION ACTIVITIES IN AUSTRALIA AND NEW ZEALAND

6.1.2 INCREASING INVESTMENT IN SUSTAINABLE CONSTRUCTION

6.2 RESTRAINTS

6.2.1 LIMITED AWARENESS OF USING CONCRETE ADMIXTURE

6.2.2 COST SENSITIVITY OF PRODUCTS IN AUSTRALIA AND NEW ZEALAND

6.3 OPPORTUNITIES

6.3.1 SUPPORTIVE OUTLOOK TOWARDS GREEN BUILDING INITIATIVES

6.3.2 RISING R&D SPENDING IN THE CONCRETE ADMIXTURE SEGMENT

6.4 CHALLENGES

6.4.1 IMPLEMENTATION OF STRINGENT RULES AND REGULATIONS FOR CONSTRUCTION

6.4.2 SUPPLY CHAIN DISRUPTIONS

7 AUSTRALIA & NEW ZEALAND CONCRETE ADMIXTURE MARKET, BY COUNTRY

7.1 AUSTRALIA

7.2 NEW ZEALAND

8 COMPANY SHARE ANALYSIS: AUSTRALIA & NEW ZEALAND

8.1 ACQUISITION

8.2 NEW FACILITY

8.3 PRODUCT LAUNCH

8.4 AGREEMENT

9 COMPANY PROFILES

9.1 GCP APPLIED TECHNOLOGIES INC. (A SUBSIDIARY OF SAINT-GOBAIN)

9.1.1 COMPANY SNAPSHOT

9.1.2 SWOT ANALYSIS

9.1.3 PRODUCT PORTFOLIO

9.1.4 RECENT DEVELOPMENT

9.2 MASTER BUILDERS SOLUTIONS

9.2.1 COMPANY SNAPSHOT

9.2.2 SWOT ANALYSIS

9.2.3 PRODUCT PORTFOLIO

9.2.4 RECENT DEVELOPMENT

9.3 YARA

9.3.1 COMPANY SNAPSHOT

9.3.2 REVENUE ANALYSIS

9.3.3 PRODUCT PORTFOLIO

9.3.4 SWOT ANALYSIS

9.3.5 RECENT DEVELOPMENT

9.4 SIKA AG

9.4.1 COMPANY SNAPSHOT

9.4.2 REVENUE ANALYSIS

9.4.3 PRODUCT PORTFOLIO

9.4.4 SWOT ANALYSIS

9.4.5 RECENT DEVELOPMENT

9.5 MAPEI S.P.A

9.5.1 COMPANY SNAPSHOT

9.5.2 REVENUE ANALYSIS

9.5.3 PRODUCT PORTFOLIO

9.5.4 SWOT ANALYSIS

9.5.5 RECENT DEVELOPMENT

9.6 CEMIX PRODUCTS LIMITED

9.6.1 COMPANY SNAPSHOT

9.6.2 SWOT ANALYSIS

9.6.3 PRODUCT PORTFOLIO

9.6.4 RECENT DEVELOPMENT

9.7 FOSROC INTERNATIONAL LIMITED

9.7.1 COMPANY SNAPSHOT

9.7.2 SWOT ANALYSIS

9.7.3 PRODUCT PORTFOLIO

9.7.4 RECENT DEVELOPMENT

9.8 NORMET

9.8.1 COMPANY SNAPSHOT

9.8.2 REVENUE ANALYSIS

9.8.3 SWOT ANALYSIS

9.8.4 PRODUCT PORTFOLIO

9.8.5 RECENT DEVELOPMENTS

9.9 PERMACOLOUR.

9.9.1 COMPANY SNAPSHOT

9.9.2 SWOT ANALYSIS

9.9.3 PRODUCT PORTFOLIO

9.9.4 RECENT DEVELOPMENT

9.1 ROCKBOND

9.10.1 COMPANY SNAPSHOT

9.10.2 SWOT ANALYSIS

9.10.3 PRODUCT PORTFOLIO

9.10.4 RECENT DEVELOPMENT

9.11 XYPEX CHEMICAL CORPORATION

9.11.1 COMPANY SNAPSHOT

9.11.2 SWOT ANALYSIS

9.11.3 PRODUCT PORTFOLIO

9.11.4 RECENT DEVELOPMENTS

9.12 TREMCO INCORPORATED

9.12.1 COMPANY SNAPSHOT

9.12.2 SWOT ANALYSIS

9.12.3 PRODUCT PORTFOLIO

9.12.4 RECENT DEVELOPMENT

10 QUESTIONNAIRE

11 RELATED REPORTS

List of Table

TABLE 1 REGULATORY COVERAGE

TABLE 2 AUSTRALIA & NEW ZEALAND CONCRETE ADMIXTURE MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 3 AUSTRALIA & NEW ZEALAND CONCRETE ADMIXTURE MARKET, BY COUNTRY, 2021-2030 (TONS)

TABLE 4 AUSTRALIA & NEW ZEALAND CONCRETE ADMIXTURE MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 5 AUSTRALIA & NEW ZEALAND CONCRETE ADMIXTURE MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 6 AUSTRALIA & NEW ZEALAND SPECIALTY ADMIXTURES IN CONCRETE ADMIXTURE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 7 AUSTRALIA & NEW ZEALAND CONCRETE ADMIXTURE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 8 AUSTRALIA & NEW ZEALAND CONCRETE ADMIXTURE MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 9 AUSTRALIA & NEW ZEALAND RESIDENTIAL IN CONCRETE ADMIXTURE MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 10 AUSTRALIA & NEW ZEALAND INFRASTRUCTURE IN CONCRETE ADMIXTURE MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 11 AUSTRALIA & NEW ZEALAND COMMERCIAL IN CONCRETE ADMIXTURE MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 12 AUSTRALIA & NEW ZEALAND RETAIL IN CONCRETE ADMIXTURE MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 13 AUSTRALIA & NEW ZEALAND OFFICES IN CONCRETE ADMIXTURE MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 14 AUSTRALIA CONCRETE ADMIXTURE MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 15 AUSTRALIA CONCRETE ADMIXTURE MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 16 AUSTRALIA SPECIALTY ADMIXTURES IN CONCRETE ADMIXTURE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 17 AUSTRALIA CONCRETE ADMIXTURE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 18 AUSTRALIA CONCRETE ADMIXTURE MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 19 AUSTRALIA RESIDENTIAL IN CONCRETE ADMIXTURE MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 20 AUSTRALIA INFRASTRUCTURE IN CONCRETE ADMIXTURE MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 21 AUSTRALIA COMMERCIAL IN CONCRETE ADMIXTURE MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 22 AUSTRALIA RETAIL IN CONCRETE ADMIXTURE MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 23 AUSTRALIA OFFICES IN CONCRETE ADMIXTURE MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 24 NEW ZEALAND CONCRETE ADMIXTURE MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 25 NEW ZEALAND CONCRETE ADMIXTURE MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 26 NEW ZEALAND SPECIALTY ADMIXTURES IN CONCRETE ADMIXTURE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 27 NEW ZEALAND CONCRETE ADMIXTURE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 28 NEW ZEALAND CONCRETE ADMIXTURE MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 29 NEW ZEALAND RESIDENTIAL IN CONCRETE ADMIXTURE MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 30 NEW ZEALAND COMMERCIAL IN CONCRETE ADMIXTURE MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 31 NEW ZEALAND RETAIL IN CONCRETE ADMIXTURE MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 32 NEW ZEALAND OFFICES IN CONCRETE ADMIXTURE MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 33 NEW ZEALAND INFRASTRUCTURE IN CONCRETE ADMIXTURE MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

List of Figure

FIGURE 1 AUSTRALIA & NEW ZEALAND CONCRETE ADMIXTURE MARKET

FIGURE 2 AUSTRALIA & NEW ZEALAND CONCRETE ADMIXTURE MARKET: DATA TRIANGULATION

FIGURE 3 AUSTRALIA & NEW ZEALAND CONCRETE ADMIXTURE MARKET: DROC ANALYSIS

FIGURE 4 AUSTRALIA & NEW ZEALAND CONCRETE ADMIXTURE MARKET: COUNTRIES MARKET ANALYSIS

FIGURE 5 AUSTRALIA & NEW ZEALAND CONCRETE ADMIXTURE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 AUSTRALIA & NEW ZEALAND CONCRETE ADMIXTURE MARKET: THE APPLICATION LIFE LINE CURVE

FIGURE 7 AUSTRALIA & NEW ZEALAND CONCRETE ADMIXTURE MARKET: MULTIVARIATE MODELLING

FIGURE 8 AUSTRALIA & NEW ZEALAND CONCRETE ADMIXTURE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 AUSTRALIA & NEW ZEALAND CONCRETE ADMIXTURE MARKET: DBMR MARKET POSITION GRID

FIGURE 10 AUSTRALIA & NEW ZEALAND CONCRETE ADMIXTURE MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 AUSTRALIA & NEW ZEALAND CONCRETE ADMIXTURE MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 AUSTRALIA & NEW ZEALAND CONCRETE ADMIXTURE MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 AUSTRALIA & NEW ZEALAND CONCRETE ADMIXTURE MARKET: SEGMENTATION

FIGURE 14 GROWING CONSTRUCTION ACTIVITIES IN AUSTRALIA AND NEW ZEALAND ARE EXPECTED TO DRIVE THE AUSTRALIA & NEW ZEALAND CONCRETE ADMIXTURE MARKET IN THE FORECAST PERIOD

FIGURE 15 THE WATER REDUCERS ARE EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE AUSTRALIA & NEW ZEALAND CONCRETE ADMIXTURE MARKET IN 2023 AND 2030

FIGURE 16 VENDOR SELECTION CRITERIA

FIGURE 17 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 18 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE AUSTRALIA & NEW ZEALAND CONCRETE ADMIXTURE MARKET

FIGURE 20 AUSTRALIA & NEW ZEALAND CONCRETE ADMIXTURE MARKET: COMPANY SHARE 2022 (%)

Australia And New Zealand Concrete Admixture Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Australia And New Zealand Concrete Admixture Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Australia And New Zealand Concrete Admixture Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.