Asia-Pacific Viscosupplementation Market Analysis and Insights

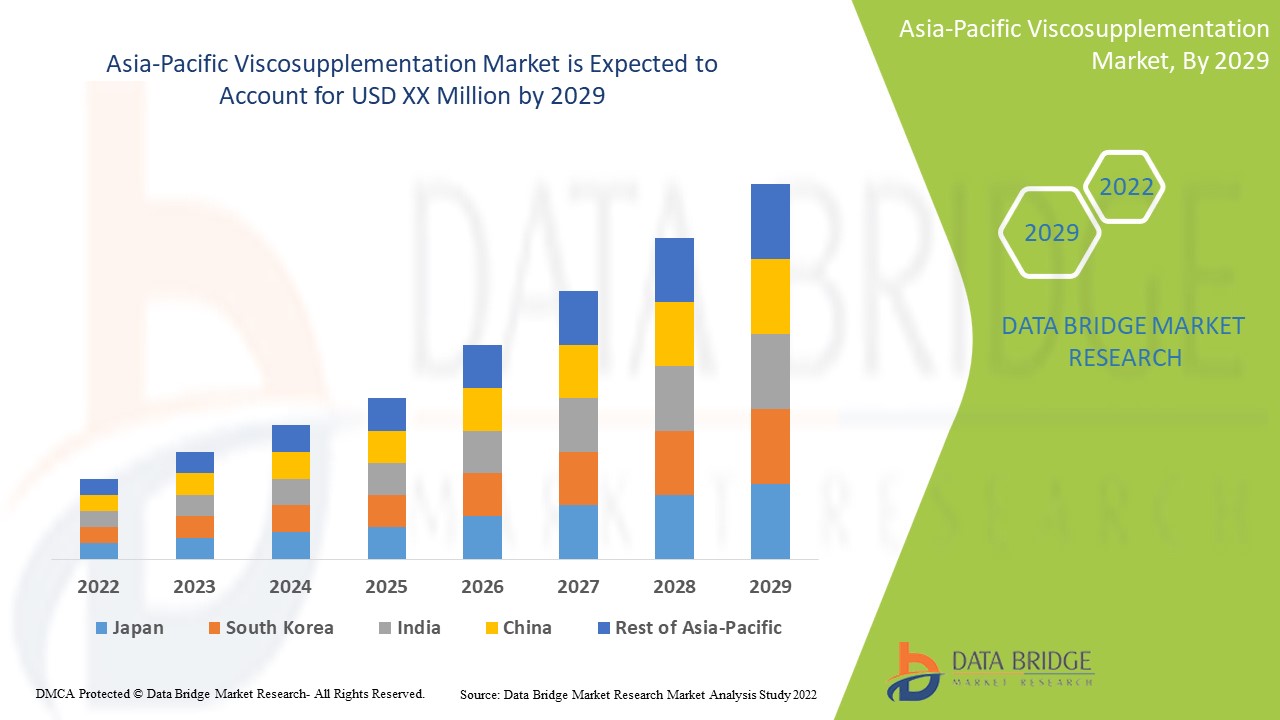

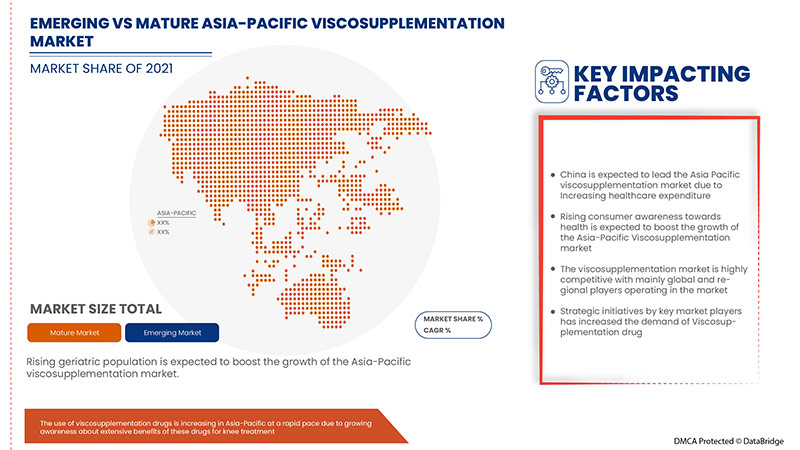

Asia-Pacific viscosupplementation market is expected to gain market growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 9.6% in the forecast period of 2022 to 2029. Technological advancements in viscosupplementation treatments rise in the healthcare sector are another factor that drives the growth of the Asia-Pacific viscosupplementation market in the forecast period.

However, the high cost associated with the treatments and side effects such as temporary injection, site pain, swelling, heat, and redness loss will restrain the market's growth. Adoption of strategic alliances like partnerships and acquisitions by key market players act as an opportunity for the growth of the Asia-Pacific viscosupplementation market.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 |

|

Quantitative Units |

Revenue in USD Million Volumes in Units, Pricing in USD |

|

Segments Covered |

By Source (Animal Origin And Non-Animal Origin), Age Group (Geriatric And Adults), Injection (Single Injection, Three Injections, And Five Injections), Molecular Weight (Intermediate Molecular Weight, Low Molecular Weight And High Molecular Weight), End User (Hospital, Orthopedic Clinics, Ambulatory Care Centers, And Others), Distribution Channel (Direct Tender And Retail Sales) |

|

Countries Covered |

China, Japan, India, South Korea, Singapore, Australia, Thailand, Vietnam, Malaysia, Taiwan, Indonesia, Philippines, and Rest of Asia-Pacific |

|

Market Players Covered |

Some of the key players operating in the Asia-Pacific viscosupplementation market are Anika Therapeutics, Inc., SEIKAGAKU CORPORATION, Bioventus, Fidia Farmaceutici S.P.A, Ferring B.V, sanofi-aventis U.S. LLC, Zimmer Biomet, OrthogenRx, Inc. (a subsidiary of AVNS), APTISSEN, Johnson & Johnson Services, Inc., L.G. Chem., Viatris Inc., IBSA Institut Biochimique SA, Ortobrand International, TRB CHEMEDICA SA, Teva Pharmaceutical Industries Ltd., Lifecore (a subsidiary of Landec Corporation), VIRCHOW BIOTECH, Zuventus HealthCare Ltd. (a subsidiary of Emcure Pharmaceuticals), among others. |

Market Definition

The development of the therapeutic paradigm viscosupplementation for long-lasting pain relief in human and animal joints with osteoarthritis or traumatic arthritis was based on the finding that in arthritic conditions, the average molecular weight and concentration of hyaluronan decreased. Consequently, the elastoviscous properties of the synovial fluid are substantially reduced. Viscosupplementation is a therapeutic process in which the pathological synovial fluid or effusion is removed from the joint by arthrocentesis and is replaced with a highly purified hyaluronan solution which has a 16- to 30-times greater concentration than the pathological joint fluid, and a 2- to 5-times greater concentration than that of the hyaluronan in the healthy synovial fluid. In some preparations of hyaluronan used today for therapeutic purposes, the rheological properties (viscosity and elasticity) are low. Therefore the elastoviscosity of the fluid is similar to that of fluid removed from an arthritic joint. Another preparation available to patients worldwide is composed of hyaluronan derivatives (hylans) with substantially greater elastoviscosity than hyaluronan solutions. It has comparable rheological properties to the fluid found in young, healthy individuals. The clinical benefit of viscosupplementation is long-lasting pain relief in arthritic joints.

Furthermore, the increasing demand for non-surgical treatments for osteoarthritis, the prevalence of lifestyle-induced disorders, and advancements in the development of hyaluronic acid-based therapies are some of the factors expected to drive the market.

Market Dynamics

Drivers

- Rising geriatric population

With this increasing age comes a reciprocal increase in the elderly patients admitted to the hospitals due to fatal traumatic injuries. The rising prevalence of knee osteoarthritis diseases increases the demand for diagnosis and treatment. With the growing population, the pressure on the healthcare system is rising. The increasing need for the proper treatment proportionally surges the demand for care, services, and technologies for the prevention and treatment of knee osteoarthritis conditions such as sarcopenia, osteoporosis, osteopenia, and other complications. The elderly population is more prone to these conditions leading to fragile bones and joints. In such patients, viscosupplementation is used in the procedure to provide them with immediate and efficient benefits associated with their bodies.

With this increasing age and rising prevalence of osteoarthritis, the demand for early diagnosis of the diseases is also increasing. Therefore, the need for viscosupplementation is rising for the treatment in the healthcare system across the globe.

- Increasing risk of osteoporosis and osteoarthritis

Osteoporosis is a disease of bone that progresses due to less bone mineral density and bone mass or due to some variation in the quality or structure of bone. Osteoporosis could increase the risk of fractures leading to broken bones due to decreased bone strength. It is more observed in women as compared to men. The post-menstrual women often get bone fractures due to osteoporosis as the disease is silent and typically shows no symptoms. Mostly older people are more prone to osteoporosis. Osteoarthritis is a joint disease or an inflammation of the joints and surrounding tissues. The mobility of a person is affected when such conditions occur.

The silent diseases such as osteoporosis and osteoarthritis show no symptoms and weaken the person's bone, leading to major fatalities such as spine malformation, fracture, sudden fall, or breakage of bone, among others. Thus, the increased risks of these conditions directly enhance the demand for viscosupplementation required to treat the malformations due to such conditions. Therefore, the increasing risk of osteoporosis and osteoarthritis is anticipated to drive the growth of the Asia-Pacific viscosupplementation market.

Restraint

- Lack of technical expertise

Finding, attracting, and hiring talent is also the first step in building a professional bench of engineers and technicians. Even in the best of circumstances, this procedure can be challenging. Manufacturing existing workforce is rapidly aging and retiring. In the medical industry, there is a scarcity of STEM (science, technology, engineering, and mathematics) skills. Although demand for skilled tradespeople (technicians) and undergraduate/post-graduate skills (engineers) remains strong in manufacturing, the number of people with the necessary skills is approaching a trickle. Only trained professionals should perform viscosupplementation, but this number is much less across the globe as these procedures are complex.

However, putting together a good additive manufacturing (AM) workforce entails more than just finding and recruiting qualified candidates. Employees must be qualified to remain current and maintain required skills as technology shift and grow. Even with their STEM-focused education, newly minted engineers would certainly need on-the-job training in AM techniques, which is one of the major challenges of recruiting and hiring them. Indeed, many undergraduate engineering programs provide little in the way of AM-specific education, and as a result, many graduates can lack the AM skills that employers seek.

Thus, the lack of technical expertise may act as a restraint for the market's growth.

Opportunity

-

Safety and effectiveness of intra-articular hyaluronic acid (IAHA)

There are several types of hyaluronic acid injections, also called viscosupplementation, which are used for knee osteoarthritis. They are made from either rooster or chicken combs or are derived from bacteria and are injected directly into the joint. Intra-articular hyaluronic acid is a U.S. Food and Drug Administration-approved treatment for knee osteoarthritis (O.A.). Intra-articular hyaluronic acid (IAHA) injection presents an alternative local treatment option providing symptomatic benefit without the systemic A.E.s associated with I.A. corticosteroids. Numerous RCTs and meta-analyses have sought to assess the efficacy and safety of IAHA, with mixed results and conclusions. IAHA is demonstrated to have a positive effect on pain and joint function. There is also mounting data showing that multiple courses of IAHA can impact long-term outcomes, including a reduction in concomitant analgesia use and a delay in the need for total knee replacement surgery.

Challenge

- Stringent government policies for THE USE OF viscosupplementation

The commercialization of viscosupplementation across the globe by various key market players is facilitated by compliance with the regulatory frameworks established by many countries across the globe. The pre-market approval of various medical devices varies from one country to another. The U.S. Food, Drug, and Cosmetic Act ("FD&C Act") classify medical devices in the U.S. The European Union (E.U.) regulates medical devices in Europe. However, the rapid development of privacy policies and regulations are being made in the Asia-Pacific and EMEA, including India, Russia, China, South Korea, Singapore, Hong Kong, and Australia.

The viscosupplementation is regulated by a structure of laws, rules, and regulations that are extensive and complex to safeguard them from use in any potential harmful treatment.

The viscosupplementation act as a replacement for the damaged, injured, or infected body parts in cases of osteoarthritis conditions or sports accidents among patients, along with maintaining the patient's demand for good body movement. However, any misguidance will affect the patient's safety and body structure.

Therefore, the stringent rules & regulations for the use of viscosupplementation may act as a challenge to the growth of the market.

Post COVID-19 Impact on Asia-Pacific Viscosupplementation Market

COVID-19 has resulted in a substantial increase in demand for medical supplies from healthcare professionals and the general public for precautionary measures. Manufacturers of these items have an opportunity to take advantage of the increased demand for medical supplies by ensuring a steady supply of personal protective equipment on the market. COVID-19 is anticipated to have a big impact on the Asia-Pacific viscosupplementation market.

Asia-Pacific Viscosupplementation Market Scope and Market Size

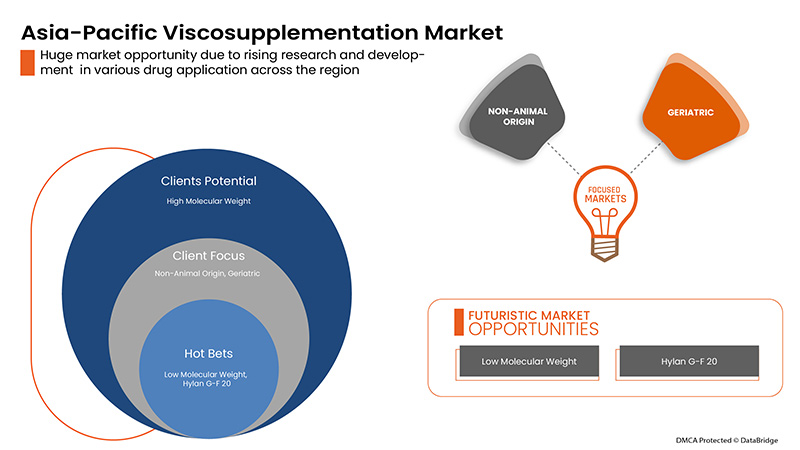

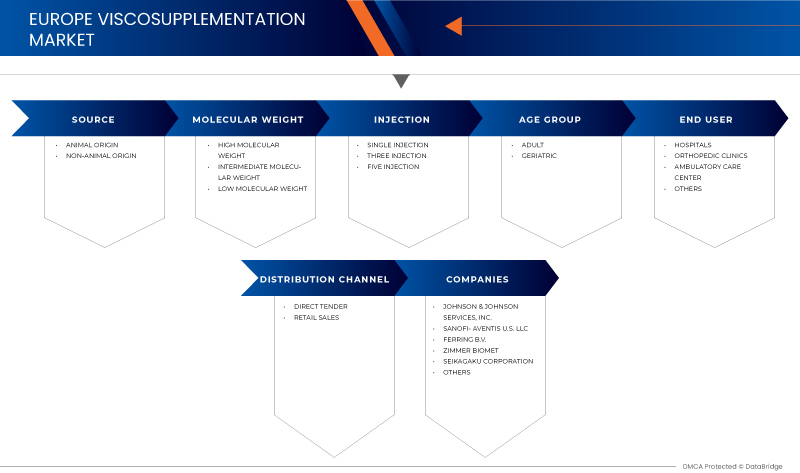

Asia-Pacific viscosupplementation market is segmented on the basis of source, age group, molecular weight, injection, end user, and distribution channel. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the Difference in your target markets.

BY SOURCE

- ANIMAL ORIGIN

- NON-ANIMAL ORIGIN

On the basis of source, the viscosupplementation market is segmented into the animal origin and non-animal origin.

BY MOLECULAR WEIGHT

- HIGH MOLECULAR WEIGHT

- LOW MOLECULAR WEIGHT

- INTERMEDIATE MOLECULAR WEIGHT

On the basis of molecular weight, the viscosupplementation market is segmented into intermediate molecular weight, low molecular weight, and high molecular weight.

BY INJECTION

- SINGLE INJECTION

- THREE INJECTION

- FIVE INJECTION

On the basis of injection, the viscosupplementation market is segmented into single injection, three injections, and five injections.

BY AGE GROUP

- ADULTS

- GERIATRICS

On the basis of age group, the viscosupplementation market is segmented into geriatric and adults.

END-USER

- HOSPITALS

- ORTHOPEDIC CLINIC

- HOME HEALTHCARE

- OTHERS

On the basis of end-user, the viscosupplementation market is segmented into hospital, orthopedic clinics, ambulatory care centers, and others.

BY DISTRIBUTION CHANNEL

- DIRECT TENDER

- RETAIL SALES

On the basis of distribution channel, the viscosupplementation market is segmented into direct tender and retail sales.

Viscosupplementation Market Country Level Analysis

The viscosupplementation market is analyzed, and market size information is provided by source, age group, molecular weight, injection, end user, and distribution channel.

The countries covered in the viscosupplementation market report are the China, Japan, India, South Korea, Singapore, Australia, Thailand, Vietnam, Malaysia, Taiwan, Indonesia, Philippines, and Rest of Asia-Pacific.

In 2022, China is dominating due to the increasing demand for non-surgical treatments for osteoarthritis with high GDP. China is expected to grow due to the rise in technological advancement in drug treatments.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands impact on sales channels are considered while providing forecast analysis of the country data.

Viscosupplementation market also provides you with a detailed market analysis of every country growth in the healthcare industry. Moreover, it provides detailed information regarding healthcare services and treatments, the impact of regulatory scenarios, and trending parameters regarding the viscosupplementation market.

Competitive Landscape and Asia-Pacific Viscosupplementation Market Share Analysis

Viscosupplementation market competitive landscape provides details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus related to viscosupplementation treatments.

The major companies which are dealing in the viscosupplementation market are Anika Therapeutics, Inc., SEIKAGAKU CORPORATION, Bioventus, Fidia Farmaceutici S.P.A, Ferring B.V, sanofi-aventis U.S. LLC, Zimmer Biomet, OrthogenRx, Inc. (a subsidiary of AVNS), APTISSEN, Johnson & Johnson Services, Inc., L.G. Chem., Viatris Inc., IBSA Institut Biochimique SA, Ortobrand International, TRB CHEMEDICA SA, Teva Pharmaceutical Industries Ltd., Lifecore (a subsidiary of Landec Corporation), VIRCHOW BIOTECH, Zuventus HealthCare Ltd. (a subsidiary of Emcure Pharmaceuticals), among others

Strategic alliances like mergers, acquisitions, and agreements by the key market players are further expected to accelerate the growth of viscosupplementation treatments.

For instance,

- In May 2022, Fidia Farmaceutici S.p.A. harnesses the regenerative power of hyaluronic acid with its innovative portfolio launched in Spain

Fidia Farmaceutici S.p.A. presented its Aesthetic Care portfolio with a scientific symposium on its innovative ACP (Auto-Crosslinked Polymer) technology at the 20th Aesthetic & Anti-aging Medicine World Congress 2022 (AMWC) in Monte Carlo. The company has launched its complete Hyal System and Hy-Tissue portfolio in Spain. This has helped the company to showcase its research for hyaluronic acid

- In June 2022, Johnson & Johnson announced new data from Phase 3 studies demonstrating patients treated with medicine achieved consistent, long-term efficacy through two years across the domains of active psoriatic arthritis (PsA) – including joint, skin, enthesitis, a dactylitis,b spinal pain, and disease severityc endpoints – irrespective of baseline characteristics. This has helped the company to showcase its progress

- In November 2021, L.G. Chem initiated clinical development for the development of new next-generation osteoarthritis treatment. L.G. Chem announced that the Company had received approval from the Korean Ministry of Food and Drug Safety for the Phase 1b/2 clinical trials based on the positive pre-clinical results of LG00034053, a new drug candidate for the treatment of osteoarthritis. L.G. Chem plans to accelerate the development of new drugs by designing clinical trials which link Phases 1 and 2

This has helped the company go for new drugs to treat osteoarthritis.

- In November 2020, Viatris Inc. launched a successful combination of Mylan N.V. and Pfizer's Upjohn business. By combining these two complementary legacy companies, Viatris has the scientific, manufacturing, and distribution expertise with proven regulatory, medical, and Asia-Pacific commercial capabilities to deliver high-quality medicines to patients in more than 165 countries and territories. This has helped the company to expand its business

Collaboration, product launch, business expansion, award and recognition, joint ventures, and other strategies by the market player enhance the company's footprints in the Asia-Pacific viscosupplementation market, which also benefits the organization’s profit growth.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, Asia-Pacific vs. Regional, and Vendor Share Analysis. Please request an analyst call in case of further inquiry.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC VISCOSUPPLEMENTATION MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 SOURCE LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PESTEL

4.2 PORTER'S FIVE FORCES MODEL

5 EPIDEMIOLOGY

6 INDUSTRIAL INSIGHTS

7 PIPELINE ANALYSIS FOR ASIA PACIFIC VISCOSUPPLEMENTATION MARKET

8 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: REGULATIONS

9 MARKET OVERVIEW

9.1 DRIVERS

9.1.1 RISING GERIATRIC POPULATION

9.1.2 INCREASING RISK OF OSTEOPOROSIS AND OSTEOARTHRITIS

9.1.3 TECHNOLOGICAL ADVANCEMENT IN VISCOSUPPLEMENTATION

9.1.4 LOW PRODUCTION COST OF VISCOSUPPLEMENTATION PRODUCTS

9.2 RESTRAINTS

9.2.1 LACK OF TECHNICAL EXPERTISE

9.2.2 PRODUCT RECALL PROCEDURES

9.2.3 LIMITED APPLICATIONS OF VISCOSUPPLEMENTATION

9.3 OPPORTUNITIES

9.3.1 SAFETY AND EFFECTIVENESS OF INTRA-ARTICULAR HYALURONIC ACID (IAHA)

9.3.2 RISING HEALTHCARE INFRASTRUCTURE

9.3.3 INCREASE IN DEMAND FOR MINIMALLY INVASIVE PROCEDURES

9.3.4 INCREASING NUMBER OF JOINT REPLACEMENTS AND SPORTS ACCIDENT

9.4 CHALLENGES

9.4.1 STRINGENT GOVERNMENT POLICIES FOR THE USE OF VISCOSUPPLEMENTATION

9.4.2 SIDE-EFFECTS OF VISCOSUPPLEMENTATION

10 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET, BY SOURCE

10.1 OVERVIEW

10.2 NON-ANIMAL ORIGIN

10.2.1 ORTHOVISC

10.2.2 EUFLEXXA

10.2.3 MONOVISC

10.2.4 DUROLANE

10.2.5 GEL-ONE

10.2.6 SUPARTZ

10.2.7 GELSYN-3

10.2.8 CINGAL

10.2.9 SULPLASYN

10.2.10 VISCOSEAL

10.2.11 OSTEONIL

10.2.12 OTHERS

10.3 ANIMAL ORIGIN

10.3.1 HYLAN G-F 20

10.3.2 SYNVIC ONE

10.3.3 SYNVIC

10.3.4 OTHERS

10.3.5 HYALURONANS

10.3.6 HYALGAN

10.3.7 OTHERS

11 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET, BY MOLECULAR WEIGHT

11.1 OVERVIEW

11.2 INTERMEDIATE MOLECULAR WEIGHT

11.2.1 ORTHOVISC

11.2.2 EUFLEXXA

11.2.3 MONOVISC

11.2.4 DUROLANE

11.2.5 VISCOSEAL

11.2.6 OSTEONIL

11.2.7 OTHERS

11.3 LOW MOLECULAR WEIGHT

11.3.1 HYLAGAN

11.3.2 SUPARTZ

11.3.3 GELSYN-3

11.3.4 CINGAL

11.3.5 SULPLASYN

11.3.6 OTHERS

11.4 HIGH MOLECULAR WEIGHT

11.4.1 SYNVIC ONE

11.4.2 SYNVIC

11.4.3 OTHERS

12 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET, BY INJECTION

12.1 OVERVIEW

12.2 SINGLE INJECTION

12.3 THREE INJECTION

12.4 FIVE INJECTION

13 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET, BY AGE GROUP

13.1 OVERVIEW

13.2 ADULTS

13.3 GERIATRIC

14 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET, BY END USER

14.1 OVERVIEW

14.2 HOSPITALS

14.3 ORTHOPEDIC CLINICS

14.4 AMBULATORY CARE CENTERS

14.5 OTHERS

15 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET, BY DISTRIBUTION CHANNEL

15.1 OVERVIEW

15.2 RETAIL SALES

15.3 DIRECT TENDER

16 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET, BY REGION

16.1 ASIA-PACIFIC

16.1.1 CHINA

16.1.2 INDIA

16.1.3 JAPAN

16.1.4 AUSTRALIA

16.1.5 MALAYSIA

16.1.6 THAILAND

16.1.7 SINGAPORE

16.1.8 SOUTH KOREA

16.1.9 INDONESIA

16.1.10 PHILIPPINES

16.1.11 TAIWAN

16.1.12 VIETNAM

16.1.13 REST OF ASIA-PACIFIC

17 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

18 SWOT ANALYSIS

19 COMPANY PROFILE

19.1 JOHNSON & JOHNSON SERVICES, INC.

19.1.1 COMPANY SNAPSHOT

19.1.2 REVENUE ANALYSIS

19.1.3 COMPANY SHARE ANALYSIS

19.1.4 PRODUCT PORTFOLIO

19.1.5 RECENT DEVELOPMENTS

19.2 BIOVENTUS

19.2.1 COMPANY SNAPSHOT

19.2.2 REVENUE ANALYSIS

19.2.3 COMPANY SHARE ANALYSIS

19.2.4 PRODUCT PORTFOLIO

19.2.5 RECENT DEVELOPMENTS

19.3 FERRING B.V.

19.3.1 COMPANY SNAPSHOT

19.3.2 COMPANY SHARE ANALYSIS

19.3.3 PRODUCT PORTFOLIO

19.3.4 RECENT DEVELOPMENT

19.4 SANOFI-AVENTIS U.S. LLC

19.4.1 COMPANY SNAPSHOT

19.4.2 REVENUE ANALYSIS

19.4.3 COMPANY SHARE ANALYSIS

19.4.4 PRODUCT PORTFOLIO

19.4.5 RECENT DEVELOPMENTS

19.5 ZIMMER BIOMET

19.5.1 COMPANY SNAPSHOT

19.5.2 REVENUE ANALYSIS

19.5.3 COMPANY SHARE ANALYSIS

19.5.4 PRODUCT PORTFOLIO

19.5.5 RECENT DEVELOPMENTS

19.6 SEIKAGAKU CORPORATION

19.6.1 COMPANY SNAPSHOT

19.6.2 REVENUE ANALYSIS

19.6.3 PRODUCT PORTFOLIO

19.6.4 RECENT DEVELOPMENTS

19.7 ANIKA THERAPEUTICS, INC.

19.7.1 COMPANY SNAPSHOT

19.7.2 REVENUE ANALYSIS

19.7.3 PRODUCT PORTFOLIO

19.7.4 RECENT DEVELOPMENTS

19.8 FIDIA FARMACEUTICI S.P.A

19.8.1 COMPANY SNAPSHOT

19.8.2 REVENUE ANALYSIS

19.8.3 PRODUCT PORTFOLIO

19.8.4 RECENT DEVELOPMENT

19.9 APTISSEN

19.9.1 COMPANY SNAPSHOT

19.9.2 PRODUCT PORTFOLIO

19.9.3 RECENT DEVELOPMENT

19.1 IBSA INSTITUT BIOCHIMIQUE SA

19.10.1 COMPANY SNAPSHOT

19.10.2 PRODUCT PORTFOLIO

19.10.3 RECENT DEVELOPMENT

19.11 LG CHEM.

19.11.1 COMPANY SNAPSHOT

19.11.2 REVENUE ANALYSIS

19.11.3 PRODUCT PORTFOLIO

19.11.4 RECENT DEVELOPMENTS

19.12 LIFECORE (A SUBSIDIARY OF LANDEC CORPORATION)

19.12.1 COMPANY SNAPSHOT

19.12.2 REVENUE ANALYSIS

19.12.3 PRODUCT PORTFOLIO

19.12.4 RECENT DEVELOPMENTS

19.13 ORTHOGENRX, INC. (A SUBSIDIARY OF AVNS)

19.13.1 COMPANY SNAPSHOT

19.13.2 REVENUE ANALYSIS

19.13.3 PRODUCT PORTFOLIO

19.13.4 RECENT DEVELOPMENTS

19.14 ORTOBRAND INTERNATIONAL

19.14.1 COMPANY SNAPSHOT

19.14.2 PRODUCT PORTFOLIO

19.14.3 RECENT DEVELOPMENT

19.15 TEVA PHARMACEUTICAL INDUSTRIES LTD.

19.15.1 COMPANY SNAPSHOT

19.15.2 REVENUE ANALYSIS

19.15.3 PRODUCT PORTFOLIO

19.15.4 RECENT DEVELOPMENTS

19.16 TRB CHEMEDICA SA

19.16.1 COMPANY SNAPSHOT

19.16.2 PRODUCT PORTFOLIO

19.16.3 RECENT DEVELOPMENTS

19.17 VIATRIS INC.

19.17.1 COMPANY SNAPSHOT

19.17.2 REVENUE ANALYSIS

19.17.3 PRODUCT PORTFOLIO

19.17.4 RECENT DEVELOPMENTS

19.18 VIRCHOW BIOTECH

19.18.1 COMPANY SNAPSHOT

19.18.2 PRODUCT PORTFOLIO

19.18.3 RECENT DEVELOPMENT

19.19 ZUVENTUS HEALTHCARE LTD. (A SUBSIDIARY OF EMCURE PHARMACEUTICALS)

19.19.1 COMPANY SNAPSHOT

19.19.2 REVENUE ANALYSIS

19.19.3 PRODUCT PORTFOLIO

19.19.4 RECENT DEVELOPMENT

20 QUESTIONNAIRE

21 RELATED REPORTS

List of Table

TABLE 1 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 2 ASIA PACIFIC NON-ANIMAL IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 ASIA PACIFIC NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 5 ASIA PACIFIC ANIMAL IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 9 ASIA PACIFIC HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 11 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET, BY MOLECULAR WEIGHT, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC INTERMEDIATE MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC INTERMEDIATE MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC LOW MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC LOW MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC HIGH MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC HIGH MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET, BY INJECTION, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC SINGLE INJECTION IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC THREE INJECTION IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC FIVE INJECTION IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC ADULT IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC GERIATRIC IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 26 ASIA PACIFIC HOSPITALS IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 ASIA PACIFIC ORTHOPEADIC CLINICS IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 ASIA PACIFIC AMBULATORY CARE CENTERS IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 ASIA PACIFIC OTHERS IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 31 ASIA PACIFIC RETAIL SALES IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 ASIA PACIFIC DIRECT TENDER IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 ASIA-PACIFIC VISCOSUPPLEMENTATION MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 34 ASIA-PACIFIC VISCOSUPPLEMENTATION MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 35 ASIA-PACIFIC NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 36 ASIA-PACIFIC NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 37 ASIA-PACIFIC ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 ASIA-PACIFIC HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 39 ASIA-PACIFIC HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 40 ASIA-PACIFIC HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 41 ASIA-PACIFIC HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 42 ASIA-PACIFIC VISCOSUPPLEMENTATION MARKET, BY MOLECULAR WEIGHT, 2020-2029 (USD MILLION)

TABLE 43 ASIA-PACIFIC INTERMEDIATE MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 44 ASIA-PACIFIC LOW MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 45 ASIA-PACIFIC HIGH MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 46 ASIA-PACIFIC VISCOSUPPLEMENTATION MARKET, BY INJECTION, 2020-2029 (USD MILLION)

TABLE 47 ASIA-PACIFIC VISCOSUPPLEMENTATION MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 48 ASIA-PACIFIC VISCOSUPPLEMENTATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 49 ASIA-PACIFIC VISCOSUPPLEMENTATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 50 CHINA VISCOSUPPLEMENTATION MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 51 CHINA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 52 CHINA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 53 CHINA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 54 CHINA ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 CHINA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 56 CHINA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 57 CHINA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 58 CHINA VISCOSUPPLEMENTATION MARKET, BY MOLECULAR WEIGHT, 2020-2029 (USD MILLION)

TABLE 59 CHINA INTERMEDIATE MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 60 CHINA LOW MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 61 CHINA HIGH MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 62 CHINA VISCOSUPPLEMENTATION MARKET, BY INJECTION, 2020-2029 (USD MILLION)

TABLE 63 CHINA VISCOSUPPLEMENTATION MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 64 CHINA VISCOSUPPLEMENTATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 65 CHINA VISCOSUPPLEMENTATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 66 INDIA VISCOSUPPLEMENTATION MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 67 INDIA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 68 INDIA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 69 INDIA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 70 INDIA ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 INDIA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 72 INDIA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 73 INDIA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, VOLUME, 2020-2029 (ASP, USD)

TABLE 74 INDIA HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 75 INDIA HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 76 INDIA HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 77 INDIA VISCOSUPPLEMENTATION MARKET, BY MOLECULAR WEIGHT, 2020-2029 (USD MILLION)

TABLE 78 INDIA INTERMEDIATE MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 79 INDIA LOW MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 80 INDIA HIGH MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 81 INDIA VISCOSUPPLEMENTATION MARKET, BY INJECTION, 2020-2029 (USD MILLION)

TABLE 82 INDIA VISCOSUPPLEMENTATION MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 83 INDIA VISCOSUPPLEMENTATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 84 INDIA VISCOSUPPLEMENTATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 85 JAPAN VISCOSUPPLEMENTATION MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 86 JAPAN NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 87 JAPAN NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 88 JAPAN NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 89 JAPAN ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 90 JAPAN HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 91 JAPAN HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 92 JAPAN HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, VOLUME, 2020-2029 (ASP, USD)

TABLE 93 JAPAN VISCOSUPPLEMENTATION MARKET, BY MOLECULAR WEIGHT, 2020-2029 (USD MILLION)

TABLE 94 JAPAN INTERMEDIATE MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 95 JAPAN HIGH MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 96 JAPAN VISCOSUPPLEMENTATION MARKET, BY INJECTION, 2020-2029 (USD MILLION)

TABLE 97 JAPAN VISCOSUPPLEMENTATION MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 98 JAPAN VISCOSUPPLEMENTATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 99 JAPAN VISCOSUPPLEMENTATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 100 AUSTRALIA VISCOSUPPLEMENTATION MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 101 AUSTRALIA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 102 AUSTRALIA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 103 AUSTRALIA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 104 AUSTRALIA ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 105 AUSTRALIA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 106 AUSTRALIA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 107 AUSTRALIA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, VOLUME, 2020-2029 (ASP, USD)

TABLE 108 AUSTRALIA VISCOSUPPLEMENTATION MARKET, BY MOLECULAR WEIGHT, 2020-2029 (USD MILLION)

TABLE 109 AUSTRALIA INTERMEDIATE MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 110 AUSTRALIA LOW MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 111 AUSTRALIA HIGH MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 112 AUSTRALIA VISCOSUPPLEMENTATION MARKET, BY INJECTION, 2020-2029 (USD MILLION)

TABLE 113 AUSTRALIA VISCOSUPPLEMENTATION MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 114 AUSTRALIA VISCOSUPPLEMENTATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 115 AUSTRALIA VISCOSUPPLEMENTATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 116 MALAYSIA VISCOSUPPLEMENTATION MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 117 MALAYSIA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 118 MALAYSIA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 119 MALAYSIA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 120 MALAYSIA ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 121 MALAYSIA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 122 MALAYSIA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 123 MALAYSIA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, VOLUME, 2020-2029 (ASP, USD)

TABLE 124 MALAYSIA HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 125 MALAYSIA HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 126 MALAYSIA HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 127 MALAYSIA VISCOSUPPLEMENTATION MARKET, BY MOLECULAR WEIGHT, 2020-2029 (USD MILLION)

TABLE 128 MALAYSIA INTERMEDIATE MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 129 MALAYSIA LOW MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 130 MALAYSIA HIGH MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 131 MALAYSIA VISCOSUPPLEMENTATION MARKET, BY INJECTION, 2020-2029 (USD MILLION)

TABLE 132 MALAYSIA VISCOSUPPLEMENTATION MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 133 MALAYSIA VISCOSUPPLEMENTATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 134 MALAYSIA VISCOSUPPLEMENTATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 135 THAILAND VISCOSUPPLEMENTATION MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 136 THAILAND NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 137 THAILAND NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 138 THAILAND NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 139 THAILAND ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 140 THAILAND HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 141 THAILAND HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 142 THAILAND HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, VOLUME, 2020-2029 (ASP, USD)

TABLE 143 THAILAND HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 144 THAILAND HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 145 THAILAND HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 146 THAILAND VISCOSUPPLEMENTATION MARKET, BY MOLECULAR WEIGHT, 2020-2029 (USD MILLION)

TABLE 147 THAILAND INTERMEDIATE MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 148 THAILAND LOW MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 149 THAILAND HIGH MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 150 THAILAND VISCOSUPPLEMENTATION MARKET, BY INJECTION, 2020-2029 (USD MILLION)

TABLE 151 THAILAND VISCOSUPPLEMENTATION MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 152 THAILAND VISCOSUPPLEMENTATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 153 THAILAND VISCOSUPPLEMENTATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 154 SINGAPORE VISCOSUPPLEMENTATION MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 155 SINGAPORE NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 156 SINGAPORE NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 157 SINGAPORE NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 158 SINGAPORE ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 159 SINGAPORE HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 160 SINGAPORE HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 161 SINGAPORE HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, VOLUME, 2020-2029 (ASP, USD)

TABLE 162 SINGAPORE HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 163 SINGAPORE HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 164 SINGAPORE HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 165 SINGAPORE VISCOSUPPLEMENTATION MARKET, BY MOLECULAR WEIGHT, 2020-2029 (USD MILLION)

TABLE 166 SINGAPORE INTERMEDIATE MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 167 SINGAPORE LOW MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 168 SINGAPORE HIGH MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 169 SINGAPORE VISCOSUPPLEMENTATION MARKET, BY INJECTION, 2020-2029 (USD MILLION)

TABLE 170 SINGAPORE VISCOSUPPLEMENTATION MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 171 SINGAPORE VISCOSUPPLEMENTATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 172 SINGAPORE VISCOSUPPLEMENTATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 173 SOUTH KOREA VISCOSUPPLEMENTATION MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 174 SOUTH KOREA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 175 SOUTH KOREA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 176 SOUTH KOREA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 177 SOUTH KOREA ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 178 SOUTH KOREA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 179 SOUTH KOREA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 180 SOUTH KOREA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, VOLUME, 2020-2029 (ASP, USD)

TABLE 181 SOUTH KOREA VISCOSUPPLEMENTATION MARKET, BY MOLECULAR WEIGHT, 2020-2029 (USD MILLION)

TABLE 182 SOUTH KOREA INTERMEDIATE MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 183 SOUTH KOREA HIGH MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 184 SOUTH KOREA VISCOSUPPLEMENTATION MARKET, BY INJECTION, 2020-2029 (USD MILLION)

TABLE 185 SOUTH KOREA VISCOSUPPLEMENTATION MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 186 SOUTH KOREA VISCOSUPPLEMENTATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 187 SOUTH KOREA VISCOSUPPLEMENTATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 188 INDONESIA VISCOSUPPLEMENTATION MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 189 INDONESIA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 190 INDONESIA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 191 INDONESIA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 192 INDONESIA ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 193 INDONESIA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 194 INDONESIA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 195 INDONESIA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, VOLUME, 2020-2029 (ASP, USD)

TABLE 196 INDONESIA HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 197 INDONESIA HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 198 INDONESIA HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 199 INDONESIA VISCOSUPPLEMENTATION MARKET, BY MOLECULAR WEIGHT, 2020-2029 (USD MILLION)

TABLE 200 INDONESIA INTERMEDIATE MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 201 INDONESIA LOW MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 202 INDONESIA HIGH MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 203 INDONESIA VISCOSUPPLEMENTATION MARKET, BY INJECTION, 2020-2029 (USD MILLION)

TABLE 204 INDONESIA VISCOSUPPLEMENTATION MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 205 INDONESIA VISCOSUPPLEMENTATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 206 INDONESIA VISCOSUPPLEMENTATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 207 PHILIPPINES VISCOSUPPLEMENTATION MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 208 PHILIPPINES NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 209 PHILIPPINES NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 210 PHILIPPINES NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 211 PHILIPPINES ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 212 PHILIPPINES HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 213 PHILIPPINES HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 214 PHILIPPINES HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, VOLUME, 2020-2029 (ASP, USD)

TABLE 215 PHILIPPINES HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 216 PHILIPPINES HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 217 PHILIPPINES HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 218 PHILIPPINES VISCOSUPPLEMENTATION MARKET, BY MOLECULAR WEIGHT, 2020-2029 (USD MILLION)

TABLE 219 PHILIPPINES INTERMEDIATE MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 220 PHILIPPINES LOW MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 221 PHILIPPINES HIGH MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 222 PHILIPPINES VISCOSUPPLEMENTATION MARKET, BY INJECTION, 2020-2029 (USD MILLION)

TABLE 223 PHILIPPINES VISCOSUPPLEMENTATION MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 224 PHILIPPINES VISCOSUPPLEMENTATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 225 PHILIPPINES VISCOSUPPLEMENTATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 226 TAIWAN VISCOSUPPLEMENTATION MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 227 TAIWAN NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 228 TAIWAN NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 229 TAIWAN NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 230 TAIWAN ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 231 TAIWAN HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 232 TAIWAN HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 233 TAIWAN HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, VOLUME, 2020-2029 (ASP, USD)

TABLE 234 TAIWAN HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 235 TAIWAN HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 236 TAIWAN HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 237 TAIWAN VISCOSUPPLEMENTATION MARKET, BY MOLECULAR WEIGHT, 2020-2029 (USD MILLION)

TABLE 238 TAIWAN INTERMEDIATE MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 239 TAIWAN LOW MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 240 TAIWAN HIGH MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 241 TAIWAN VISCOSUPPLEMENTATION MARKET, BY INJECTION, 2020-2029 (USD MILLION)

TABLE 242 TAIWAN VISCOSUPPLEMENTATION MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 243 TAIWAN VISCOSUPPLEMENTATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 244 TAIWAN VISCOSUPPLEMENTATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 245 VIETNAM VISCOSUPPLEMENTATION MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 246 VIETNAM NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 247 VIETNAM NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 248 VIETNAM NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 249 VIETNAM ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 250 VIETNAM HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 251 VIETNAM HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 252 VIETNAM HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, VOLUME, 2020-2029 (ASP, USD)

TABLE 253 VIETNAM HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 254 VIETNAM HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 255 VIETNAM HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 256 VIETNAM VISCOSUPPLEMENTATION MARKET, BY MOLECULAR WEIGHT, 2020-2029 (USD MILLION)

TABLE 257 VIETNAM INTERMEDIATE MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 258 VIETNAM LOW MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 259 VIETNAM HIGH MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 260 VIETNAM VISCOSUPPLEMENTATION MARKET, BY INJECTION, 2020-2029 (USD MILLION)

TABLE 261 VIETNAM VISCOSUPPLEMENTATION MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 262 VIETNAM VISCOSUPPLEMENTATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 263 VIETNAM VISCOSUPPLEMENTATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 264 REST OF ASIA-PACIFIC VISCOSUPPLEMENTATION MARKET, BY SOURCE, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: DBMR MARKET POSITION GRID

FIGURE 9 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: SEGMENTATION

FIGURE 11 NORTH AMERICA IS ANTICIPATED TO DOMINATE THE ASIA PACIFIC VISCOSUPPLEMENTATION MARKET, AND ASIA-PACIFIC IS ESTIMATED TO BE GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 THE INCREASING DEMAND FOR NON-SURGICAL TREATMENTS FOR OSTEOARTHRITIS AND ADVANCEMENTS IN THE DEVELOPMENT OF HYALURONIC ACID-BASED THERAPIES IS EXPECTED TO DRIVE THE ASIA PACIFIC VISCOSUPPLEMENTATION MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 NON-ANIMAL ORIGIN IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC VISCOSUPPLEMENTATION MARKET IN 2022 & 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC VISCOSUPPLEMENTATION MARKET

FIGURE 15 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY SOURCE, 2021

FIGURE 16 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY SOURCE, 2022-2029 (USD MILLION)

FIGURE 17 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY SOURCE, CAGR (2022-2029)

FIGURE 18 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY SOURCE, LIFELINE CURVE

FIGURE 19 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY MOLECULAR WEIGHT, 2021

FIGURE 20 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY MOLECULAR WEIGHT, 2022-2029 (USD MILLION)

FIGURE 21 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY MOLECULAR WEIGHT, CAGR (2022-2029)

FIGURE 22 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY MOLECULAR WEIGHT, LIFELINE CURVE

FIGURE 23 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY INJECTION, 2021

FIGURE 24 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY INJECTION, 2022-2029 (USD MILLION)

FIGURE 25 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY INJECTION, CAGR (2022-2029)

FIGURE 26 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY INJECTION, LIFELINE CURVE

FIGURE 27 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY AGE GROUP, 2021

FIGURE 28 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY AGE GROUP, 2022-2029 (USD MILLION)

FIGURE 29 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY AGE GROUP, CAGR (2022-2029)

FIGURE 30 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY AGE GROUP, LIFELINE CURVE

FIGURE 31 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY END USER, 2021

FIGURE 32 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 33 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY END USER, CAGR (2022-2029)

FIGURE 34 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY END USER, LIFELINE CURVE

FIGURE 35 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 36 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 37 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 38 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 39 ASIA-PACIFIC VISCOSUPPLEMENTATION MARKET: SNAPSHOT (2021)

FIGURE 40 ASIA-PACIFIC VISCOSUPPLEMENTATION MARKET: BY COUNTRY (2021)

FIGURE 41 ASIA-PACIFIC VISCOSUPPLEMENTATION MARKET: BY COUNTRY (2022 & 2029)

FIGURE 42 ASIA-PACIFIC VISCOSUPPLEMENTATION MARKET: BY COUNTRY (2021 & 2029)

FIGURE 43 ASIA-PACIFIC VISCOSUPPLEMENTATION MARKET: BY SOURCE (2022-2029)

FIGURE 44 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: COMPANY SHARE 2021 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.