Asia Pacific Veterinary Infusion Pumps Market

Market Size in USD Million

CAGR :

%

USD

65.69 Million

USD

188.70 Million

2025

2033

USD

65.69 Million

USD

188.70 Million

2025

2033

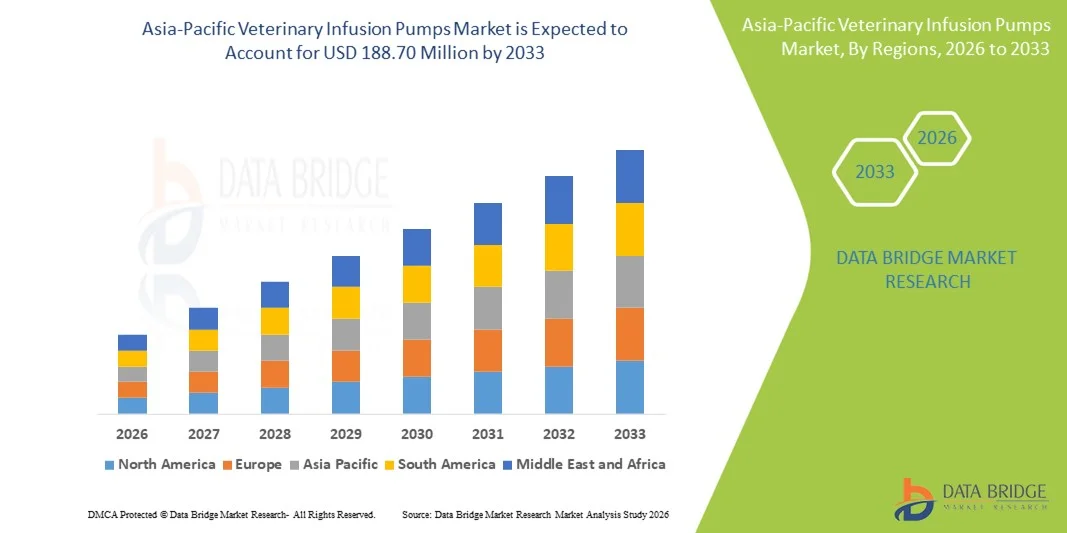

| 2026 –2033 | |

| USD 65.69 Million | |

| USD 188.70 Million | |

|

|

|

|

Asia-Pacific Veterinary Infusion Pumps Market Size

- The Asia-Pacific veterinary infusion pumps market size was valued at USD 65.69 million in 2025 and is expected to reach USD 188.70 million by 2033, at a CAGR of 14.1% during the forecast period

- The market growth is largely fueled by increasing pet ownership, rising awareness of animal health, and expanding veterinary healthcare infrastructure across key Asia‑Pacific countries such as China, India, and Japan, which is driving demand for precision fluid delivery solutions in both companion animal and livestock care settings

- Furthermore, government initiatives supporting livestock health, the modernization of veterinary clinics, and rising disposable incomes are encouraging veterinary practices to adopt advanced infusion pump technologies, positioning these devices as essential tools for fluid therapy, anesthesia, and pain management

Asia-Pacific Veterinary Infusion Pumps Market Analysis

- Veterinary infusion pumps, providing precise and automated fluid delivery for animals, are becoming increasingly vital components of modern veterinary care in both companion animal and livestock settings due to their accuracy, safety, and ease of use

- The escalating demand for veterinary infusion pumps is primarily fueled by growing pet ownership, rising awareness of animal health, and modernization of veterinary healthcare infrastructure, alongside the increasing adoption of continuous and intermittent infusion types for diverse therapeutic needs

- China dominated the Asia-Pacific veterinary infusion pumps market in 2025, with a revenue share of 25.4%, characterized by rapid expansion of veterinary clinics, rising disposable incomes, and adoption of both stationary and portable models, with hospitals, veterinary clinics, and homecare settings experiencing substantial growth in pump installations driven by advanced technology and multi-channel infusion capabilities

- India is expected to be the fastest-growing markets during the forecast period, driven by increasing investments in companion and food production animal care, government initiatives supporting livestock health, and expanding distribution channels including direct tenders, retail pharmacies, and online sales

- Device segment dominated the veterinary infusion pumps market in 2025 with a market share of 58.7%, reflecting the high preference for advanced pumps offering multiple infusion modes and single or multi-channel options, ensuring precise, customizable, and reliable therapy for veterinary applications

Report Scope and Asia-Pacific Veterinary Infusion Pumps Market Segmentation

|

Attributes |

Asia-Pacific Veterinary Infusion Pumps Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Asia-Pacific Veterinary Infusion Pumps Market Trends

Growing Adoption of Portable and IoT-Enabled Pumps

- A significant and accelerating trend in the Asia-Pacific veterinary infusion pumps market is the increasing adoption of portable devices and IoT-enabled smart pumps, enhancing precision, monitoring, and mobility in veterinary care for both companion animals and livestock

- For instance, the VETGuard portable infusion pump integrates wireless monitoring and real-time alerts, allowing veterinarians to track infusion status remotely and adjust therapy as needed

- IoT integration enables features such as automatic infusion rate adjustments, activity tracking, and error alerts, improving treatment efficiency and reducing human error in fluid administration

- The seamless integration of veterinary infusion pumps with clinic management software and monitoring systems allows centralized management of multiple devices, ensuring consistent therapy and better data analytics for patient care

- This trend towards smarter, connected, and portable infusion devices is reshaping user expectations for veterinary treatment, prompting companies such as InfuVet to develop AI-enabled pumps with dose customization, automatic alerts, and remote monitoring capabilities

- The demand for portable, smart, and automated veterinary infusion pumps is growing rapidly across veterinary clinics, hospitals, and homecare settings, as practitioners increasingly prioritize treatment accuracy, convenience, and monitoring efficiency

- Development of battery-operated and energy-efficient models is also gaining traction, supporting uninterrupted operation in areas with unreliable power supply

Asia-Pacific Veterinary Infusion Pumps Market Dynamics

Driver

Rising Demand Driven by Pet Ownership and Livestock Healthcare Needs

- The increasing prevalence of companion animals and livestock, coupled with expanding veterinary infrastructure, is a significant driver for the heightened demand for veterinary infusion pumps

- For instance, in March 2025, Vetronics announced deployment of smart infusion pumps in urban veterinary clinics in India, aiming to improve precision therapy and treatment efficiency

- As pet ownership grows and livestock production intensifies, infusion pumps provide automated, accurate, and consistent fluid therapy, making them essential over manual methods

- Furthermore, rising adoption of continuous and intermittent infusion types and the availability of both stationary and portable models are making these devices indispensable in modern veterinary practice

- The convenience of remote monitoring, multi-channel infusion, and automated dose delivery are key factors propelling adoption across hospitals, veterinary clinics, laboratories, and homecare settings

- Increasing investments in companion animal health and livestock productivity programs are driving adoption of advanced infusion technologies across Asia-Pacific countries

- Growing preference for multi-channel and customizable infusion pumps among veterinary specialists for complex treatments is further boosting market demand

Restraint/Challenge

High Cost and Regulatory Compliance Hurdles

- The relatively high price of advanced veterinary infusion pumps, particularly IoT-enabled and multi-channel models, poses a challenge for broader adoption, especially in price-sensitive rural veterinary practices

- For instance, smaller clinics in Southeast Asia often hesitate to purchase premium pumps due to budget constraints, limiting market penetration in developing areas

- Regulatory compliance for veterinary medical devices across multiple countries adds another layer of complexity, requiring adherence to safety, calibration, and animal-use guidelines before product launch

- While costs are gradually decreasing for basic models, premium features such as smart monitoring, automated dosing, and wireless connectivity often carry a higher price tag, potentially restricting adoption

- Overcoming these challenges through affordable product offerings, local manufacturing, and streamlined regulatory approvals will be vital for sustained market growth

- Limited technical training and awareness among veterinary staff can hinder effective use of advanced infusion pumps, impacting adoption rates in smaller clinics

- Supply chain constraints, particularly availability of pump accessories and administration sets, can also pose challenges for timely deployment and maintenance of infusion devices

Asia-Pacific Veterinary Infusion Pumps Market Scope

The market is segmented on the basis of type, infusion type, model type, mobility, infusion mode, channel type, animal type, end user, and distribution channel.

- By Type

On the basis of type, the market is segmented into devices and administration sets & pump accessories. The devices segment dominated the market in 2025 with a revenue share of 58.7%, driven by high adoption of advanced pumps offering multi-channel capabilities and programmable infusion modes. Veterinary hospitals and clinics prefer devices for their accuracy, durability, and ability to integrate with monitoring systems, making them indispensable in daily operations. Devices are widely used in both companion animal and livestock care due to their reliability and consistent performance. IoT-enabled and battery-operated devices further increase operational efficiency and flexibility. Rising awareness about precision therapy and reduced human error also supports dominance.

The administration sets and pump accessories segment is expected to witness the fastest growth from 2026 to 2033, fueled by increasing use of multi-channel and continuous infusion therapies. Accessories such as tubing sets, sensors, and adapters enhance device functionality and allow customization for different animal types. Veterinary professionals increasingly recognize the importance of compatible administration sets to improve infusion accuracy. The segment benefits from growing homecare adoption and rural veterinary applications where easy-to-replace accessories are critical. Manufacturers are innovating with disposable and reusable options to meet diverse needs. Increasing investments in livestock and companion animal care further drive growth.

- By Infusion Type

On the basis of infusion type, the market is segmented into continuous and intermittent infusion. The continuous infusion segment dominated in 2025, due to its extensive use in surgeries, anesthesia, and long-duration therapies for both companion animals and livestock. Continuous infusion pumps ensure precise and steady drug or fluid delivery, reducing risks of under- or over-dosing. Hospitals and veterinary clinics prefer continuous infusion for critical care and intensive treatments. The segment also benefits from compatibility with multi-channel and IoT-enabled pumps. Improved workflow management and reduced veterinary staff workload further strengthen dominance. Reliable performance and integration with monitoring software make continuous infusion the preferred choice.

The intermittent infusion segment is expected to witness the fastest CAGR from 2026 to 2033, driven by flexibility for short-term therapies, outpatient care, and home-based treatments. Intermittent infusion is preferred in companion animal care and smaller clinics where precise dosing over short intervals is required. Portable and battery-operated intermittent pumps enhance convenience. Veterinary professionals increasingly adopt intermittent pumps for pain management, rehabilitation, and emergency treatments. Advances in programmable devices allow customization for multiple animal types. Growing homecare adoption and rural veterinary expansion support rapid segment growth.

- By Model Type

On the basis of model type, the market is segmented into with power cord and battery-operated models. The with power cord segment dominated in 2025, reflecting its high reliability and suitability for stationary setups in hospitals and clinics. Corded pumps provide uninterrupted operation for long-duration infusions and are preferred in critical care and multi-animal treatments. They are compatible with multi-channel devices and IoT-enabled monitoring systems. Robust performance, lower maintenance, and operational efficiency make them essential in large veterinary facilities. High adoption in companion animal and livestock therapies contributes to dominance. Reliability and precision make corded models a long-term investment for clinics.

The battery-operated segment is expected to witness the fastest growth from 2026 to 2033, fueled by demand for portable solutions in homecare, field veterinary services, and rural livestock treatment. Battery pumps offer mobility, flexibility, and uninterrupted therapy in areas with inconsistent power supply. Technological improvements, such as longer battery life and energy efficiency, further drive adoption. They are widely used for companion animals, livestock farms, and emergency care. Battery models integrate with IoT-enabled monitoring for remote supervision. Rising demand for at-home therapy supports rapid growth in this segment.

- By Mobility

On the basis of mobility, the market is segmented into stationary and portable pumps. The stationary segment dominated in 2025, due to extensive use in hospitals and large veterinary clinics for long-duration and multi-animal treatments. Stationary pumps provide high precision, durability, and integration with monitoring systems. They are ideal for critical care, surgeries, and intensive care therapies. Multi-channel and programmable infusion modes further strengthen their adoption. Veterinary professionals rely on stationary models for operational efficiency and workflow management. The segment also benefits from growing urban veterinary infrastructure and investments in hospital-grade devices.

The portable segment is expected to witness the fastest growth from 2026 to 2033, driven by adoption in homecare, rural veterinary services, and field treatments. Portable pumps offer flexibility, mobility, and IoT-enabled remote monitoring. They are increasingly preferred for companion animal homecare and livestock management in remote farms. Battery-operated and lightweight designs enhance usability. Multi-channel portable pumps allow simultaneous treatment of multiple animals. Rising rural veterinary adoption supports segment growth across Asia-Pacific.

- By Infusion Mode

On the basis of infusion mode, the market is segmented into rate mode, time mode, dose mode, and others. The rate mode segment dominated in 2025, owing to precision in maintaining consistent fluid delivery and extensive use in critical care. Rate mode reduces dosing errors and improves treatment efficiency. Hospitals and veterinary clinics prefer rate mode for multi-animal therapies. Compatibility with multi-channel and IoT-enabled devices strengthens adoption. Veterinary professionals rely on rate mode for automated therapy and workflow efficiency. Continuous monitoring and integration with clinic software support the dominance of this segment.

The dose mode segment is expected to witness the fastest growth from 2026 to 2033, driven by demand for customizable and species-specific dosing. Dose mode is widely used for companion animals, specialized medications, and high-precision therapy. Programmable pumps allow simultaneous treatment of multiple animals. Adoption is growing in homecare, outpatient care, and smaller clinics. Integration with IoT and smart monitoring enhances accuracy. Rising awareness among veterinary staff about precision dosing further drives growth.

- By Channel Type

On the basis of channel type, the market is segmented into single-channel and multi-channel pumps. The single-channel segment dominated in 2025, due to simplicity, cost-effectiveness, and widespread use in standard veterinary therapies. Single-channel pumps are reliable for companion animals and basic livestock care. They are easy to operate, maintain, and compatible with both continuous and intermittent infusion. Veterinary staff prefer single-channel pumps for routine treatments. Adoption is strong in small clinics and outpatient care. The segment benefits from affordability and lower technical requirements.

The multi-channel segment is expected to witness the fastest growth from 2026 to 2033, driven by demand for simultaneous infusion of multiple fluids or drugs. Multi-channel pumps improve efficiency, save time, and enhance treatment precision. Large veterinary hospitals and advanced clinics increasingly adopt multi-channel devices. Integration with IoT-enabled monitoring supports real-time tracking. Veterinary professionals rely on multi-channel pumps for complex surgeries and critical care. Increasing adoption in companion animal and livestock care boosts growth.

- By Animal Type

On the basis of animal type, the market is segmented into food production animals and companion animals. The companion animal segment dominated in 2025, owing to rising pet ownership, increased veterinary visits, and higher spending on advanced care. Companion animals require specialized therapies, making advanced infusion pumps essential. Hospitals and clinics prioritize IoT-enabled and portable devices for these patients. Homecare treatments for pets further enhance adoption. Multi-channel and programmable pumps are widely used. Integration with monitoring software supports accuracy and efficiency.

The food production animal segment is expected to witness the fastest growth from 2026 to 2033, driven by expanding livestock farms, government initiatives, and rising adoption of precision infusion therapy. Multi-channel and portable pumps enable simultaneous treatment of multiple animals. Efficiency, productivity, and disease management are key adoption drivers. Rural farms increasingly rely on portable and battery-operated devices. Adoption is supported by training programs and awareness campaigns. Technological advancements further accelerate segment growth.

- By End User

On the basis of end user, the market is segmented into hospitals, veterinary clinics, homecare settings, laboratories, and others. The veterinary clinics segment dominated in 2025, due to their role in routine and specialized care for companion and food production animals. Clinics invest in advanced devices for continuous and intermittent infusion therapies. Multi-channel and IoT-enabled pumps are widely adopted. High patient volume and efficiency needs make clinics the largest segment. Urbanization and rising disposable incomes support growth. Clinics also benefit from integrated monitoring and automated therapy features.

The homecare segment is expected to witness the fastest growth from 2026 to 2033, driven by portable, battery-operated, and IoT-enabled pumps for outpatient and at-home therapy. Pet owners and rural livestock farmers increasingly prefer homecare treatments. Devices allow remote monitoring and automated infusion, enhancing treatment quality. Growing awareness about animal health and convenience further supports adoption. Online channels and e-commerce facilitate accessibility. Multi-channel and dose mode pumps increase the appeal of homecare solutions.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tender, retail pharmacy, online pharmacy, and others. The direct tender segment dominated in 2025, owing to bulk procurement by hospitals, clinics, and livestock farms. Direct tenders ensure timely supply, post-sales support, and contract reliability. High-volume adoption in veterinary institutions supports dominance. Multi-channel pumps are often included in institutional tenders. Integration with IoT-enabled monitoring and programmable devices adds value. Clinics and hospitals favor direct tender for warranty and maintenance support.

The online pharmacy segment is expected to witness the fastest growth from 2026 to 2033, fueled by e-commerce adoption, convenience of doorstep delivery, and awareness of veterinary infusion devices. Rural and semi-urban regions increasingly rely on online purchases. Portable and battery-operated pumps are easily accessible through digital channels. Rising internet penetration and digital literacy support segment growth. Homecare treatments and smaller clinics benefit from direct delivery and cost efficiency. Technological advancements in pumps increase adoption via online channels.

Asia-Pacific Veterinary Infusion Pumps Market Regional Analysis

- China dominated the Asia-Pacific veterinary infusion pumps market in 2025, with a revenue share of 25.4%, characterized by rapid expansion of veterinary clinics, rising disposable incomes, and adoption of both stationary and portable models

- Veterinary clinics, hospitals, and livestock farms across China increasingly adopt IoT-enabled, portable, and battery-operated infusion pumps, enabling precise fluid delivery, automated dosing, and remote monitoring for improved animal health outcomes

- This widespread adoption is further supported by growing disposable incomes, increasing awareness of veterinary care, and strong government initiatives promoting livestock health and companion animal wellness, establishing China as the largest market for veterinary infusion pumps in Asia-Pacific

The China Veterinary Infusion Pumps Market Insight

The China veterinary infusion pumps market captured the largest revenue share of 25.4% in 2025, driven by rapid urbanization, rising pet ownership, and significant investments in veterinary healthcare infrastructure for both companion animals and livestock. Clinics and hospitals are increasingly adopting IoT-enabled, portable, and battery-operated infusion pumps, enabling precise fluid delivery, automated dosing, and remote monitoring for improved treatment outcomes. Government initiatives promoting livestock health and modernization of veterinary practices further support market expansion. High disposable incomes and awareness of animal health care are encouraging both companion animal owners and commercial farms to invest in advanced infusion devices. Integration with smart monitoring systems and multi-channel pumps is becoming a standard in large veterinary hospitals. The consistent demand for precision therapy and automation reinforces China’s dominant position in Asia-Pacific.

Japan Veterinary Infusion Pumps Market Insight

The Japan veterinary infusion pumps market is growing steadily, driven by the country’s high-tech veterinary culture, advanced healthcare infrastructure, and increasing focus on companion animal care. Japanese veterinary clinics prioritize portable and smart infusion devices that integrate with monitoring systems to enhance treatment efficiency and accuracy. The country’s aging population is fueling demand for homecare veterinary services, increasing adoption of battery-operated and IoT-enabled pumps. Integration with clinic management software allows veterinarians to monitor infusion therapy remotely and manage multiple animals efficiently. High awareness of animal wellness and premium pet care spending contributes to market growth. Moreover, Japan’s emphasis on technological innovation encourages adoption of multi-channel and programmable infusion pumps.

India Veterinary Infusion Pumps Market Insight

The India veterinary infusion pumps market accounted for the largest revenue share in Asia-Pacific after China in 2025, fueled by rapid urbanization, growing middle-class pet ownership, and expanding livestock healthcare programs. Veterinary clinics, hospitals, and homecare providers are increasingly adopting portable and battery-operated infusion devices, supporting both companion animal care and livestock management. Government initiatives for smart farming and livestock health promote adoption of precision infusion technology. The rising number of veterinary clinics and increasing awareness about animal welfare drive growth. IoT-enabled monitoring and multi-channel pumps are gaining traction for enhanced treatment accuracy. Affordable devices and increasing domestic manufacturing are further expanding accessibility in India’s veterinary market.

Australia Veterinary Infusion Pumps Market Insight

The Australia veterinary infusion pumps market is witnessing steady growth, driven by well-developed veterinary healthcare infrastructure and high pet ownership rates. Clinics and hospitals in Australia are increasingly adopting multi-channel, IoT-enabled, and portable infusion pumps to improve accuracy and efficiency in companion animal care. The growing trend of homecare and mobile veterinary services is driving demand for battery-operated devices. Government regulations and animal welfare initiatives promote adoption of advanced infusion technologies. Veterinary professionals prefer smart infusion pumps with automated dosing and monitoring features. Rising disposable incomes and willingness to invest in high-quality animal healthcare support market expansion.

Asia-Pacific Veterinary Infusion Pumps Market Share

The Asia-Pacific Veterinary Infusion Pumps industry is primarily led by well-established companies, including:

- Shenzhen Mindray Animal Medical Technology Co., LTD (China)

- Digicare Biomedical (U.S.)

- Eitan Medical Ltd. (U.K.)

- Instech Laboratories, Inc. (U.S.)

- B. Braun SE (Germany)

- Avante Health Solutions (U.S.)

- Antech Diagnostics, Inc. (U.S.)

- iVet Medical (UAE)

- Guangzhou MeCan Medical Limited (China)

- Grady Medical Systems (U.S.)

- Jorgensen Laboratories (U.S.)

- SAI Infusion Technologies (U.S.)

- Kent Scientific (U.S.)

- Opto Circuits (India)

- ICU Medical (U.S.)

- Smiths Group (U.K.)

- VetPro Medical (U.S.)

- Norwell Veterinary Hospital Equipment (U.S.)

- Burtons Veterinary (U.K.)

What are the Recent Developments in Asia-Pacific Veterinary Infusion Pumps Market?

- In April 2025, ICU Medical introduced a new category of precision IV pumps with FDA clearance of its Plum Solo™ and Plum Duo™ precision IV pumps, expanding its product portfolio with devices that deliver ±3% accuracy, positioning the technology for eventual adoption in veterinary settings in Asia‑Pacific where precision infusion is increasingly critical

- In October 2024, Mindray Animal Medical broke ground on the new Mindray Animal Tech Park in Shenzhen, China, establishing a world-class innovation hub for animal healthcare technology including research, development, manufacturing, and advanced product lines such as veterinary infusion devices marking a strategic investment into veterinary technology expansion in Asia-Pacific

- In September 2024, major veterinary equipment brands including those with infusion pump technologies participated in global veterinary gatherings in Suzhou, creating opportunities for local and international adoption of advanced infusion systems, strengthening Asia-Pacific’s role in the animal healthcare technology landscape

- In September 2024, announcements around the Mindray “Orange Label” series launch, including infusion pumps and other veterinary solutions, circulated widely online, indicating the company’s expanded focus on the veterinary segment and signaling future product developments and adoption growth in Asia-Pacific markets

- In February 2023, Mindray launched its BeneFusion i Series and u Series infusion systems, featuring high precision, adaptive customization, and user‑friendly operation that improve infusion safety and efficiency in clinical settings a move that supports broader adoption of advanced infusion technology in veterinary and human markets globally, including potential Asia‑Pacific rollout

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.