Asia Pacific Vaccines Market

Market Size in USD Million

CAGR :

%

USD

9,048.51 Million

USD

18,031.69 Million

2022

2030

USD

9,048.51 Million

USD

18,031.69 Million

2022

2030

| 2023 –2030 | |

| USD 9,048.51 Million | |

| USD 18,031.69 Million | |

|

|

|

Asia-Pacific Vaccines Market Analysis and Insights

The increasing prevalence of infectious diseases, including bacterial and viral diseases, provides the market with lucrative growth. Along with this, increasing government support and launching newer vaccines are also boosting the vaccine market. Another factor boosting the vaccine market growth is increasing vaccination awareness and demand for effective COVID-19 vaccines.

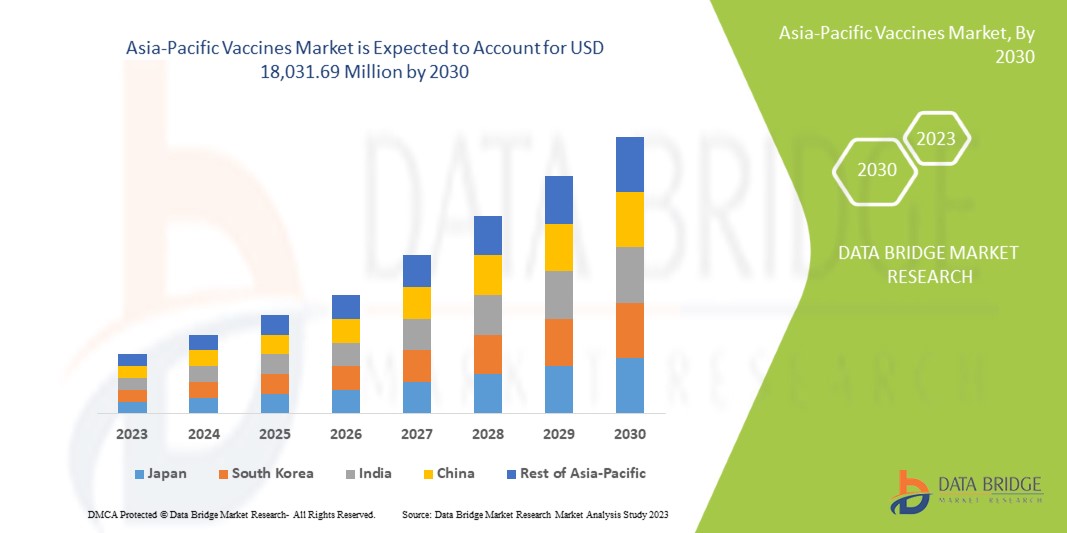

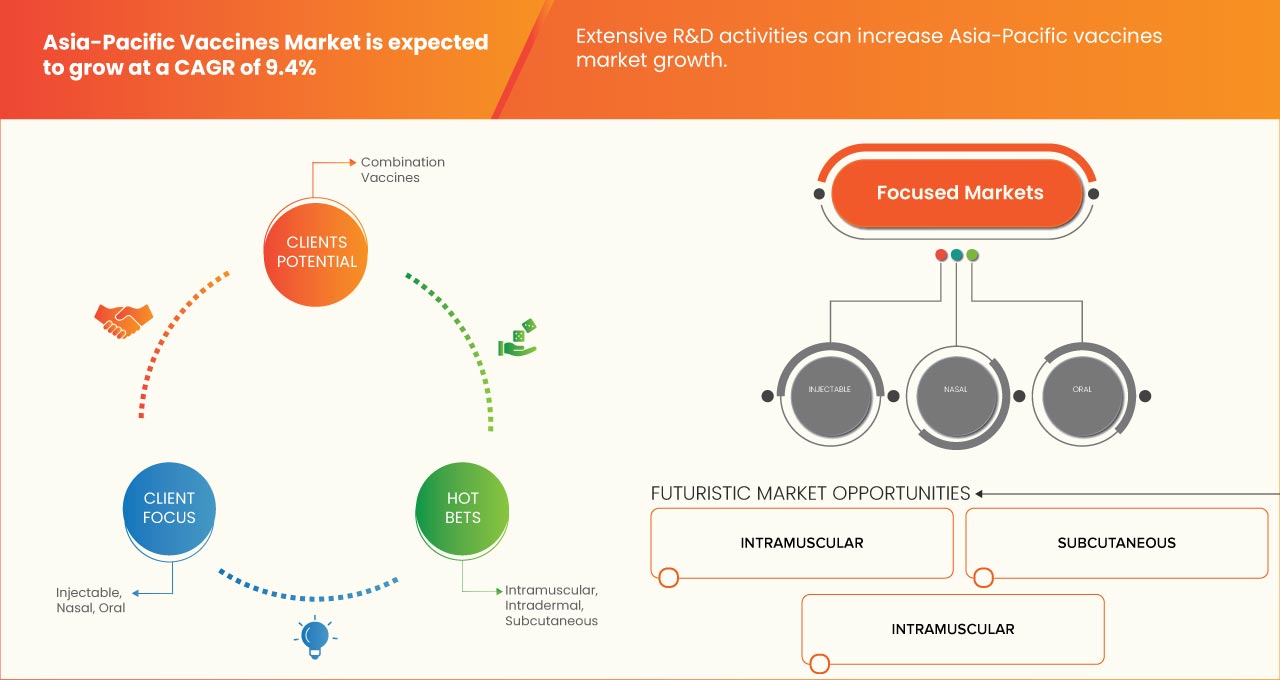

The Asia-Pacific vaccines market is expected to grow in the forecast period of 2023 to 2030. Data Bridge Market Research analyses that the market is growing with a CAGR of 9.4% in the forecast period of 2023 to 2030 and is expected to reach USD 18,031.69 Million by 2030 from USD 9,048.51 million in 2022.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customisable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

By Composition (Combination Vaccines and Mono Vaccines), Type (Subunit, Recombinant, Polysaccharide, and Conjugate Vaccines, Live-Attenuated Vaccines, Inactivated Vaccines, and Toxoid Vaccines), Kind (Routine Vaccine, Recommended Vaccine, and Required Vaccine), Age of Administration (Pediatric Vaccine and Adult Vaccine), Diseases (Pneumococcal Disease, Measles, Mumps & Varicella, DPT, Hepatitis, Influenza, Typhoid, Meningococcal, Rabies, Japanese Encephalitis, Yellow Fever, and Others), Route of Administration (Injectable, Oral, and Nasal), End User (Community Hospitals, Hospitals, Specialty Centres, Clinics, and Others), Distribution Channel (Hospital Pharmacy, Retail Pharmacy, and Online Pharmacy) |

|

Countries Covered |

Japan, China, Australia, India, South Korea, Singapore, Indonesia, Thailand, Malaysia, Philippines, Vietnam, and Rest of Asia-Pacific |

|

Market Players Covered |

Bharat Biotech, Biological E Limited, Bio Farma, Serum Institute of India Pvt. Ltd., Takeda Pharmaceutical Company Limited, Merck Sharp & Dohme Corp. (a subsidiary of Merck & Co., Inc.), Abbott, AstraZeneca, Sanofi, Pfizer Inc., Janssen Global Services, LLC (a subsidiary of Johnson & Johnson Services, Inc.), F. Hoffmann-La Roche Ltd, Panacea Biotec Ltd, and BAXTER VACCINES (a subsidiary of Baxter), among others |

Market Definition of Asia-Pacific Vaccines Market

Vaccines are product that stimulates the individual immune system to induce immunity against a particular disease. Vaccines work on the principle of memory and recognition. When weakened or killed microbes are injected into a body, these microbes cause B cells, memory cells of the immune system, to recognize the pathogen. In the future, if the same pathogen attacks the body, it works against those. Vaccines have been discovered for infectious diseases, including pneumococcal disease, measles, mumps, rubella, hepatitis, influenza, typhoid, varicella, and rabies.

Vaccines are of two types: combination vaccines (containing different strains of the pathogen) and monovaccines (containing a single strain of the pathogen). Different kinds of vaccines have been developed based on the material extracted from the pathogen, which can be polysaccharide coat, DNA, RNA, and the whole organism, either inactivated or live.

These are the vaccines that resulted in the eradication of diseases such as polio. As per the preference and efficiency of vaccines, these can be injected via several routes of administration that can be injectable, oral, or nasal. However, the injectable route of vaccine administration is highly preferred as it induces a systemic response. Vaccination can be achieved at hospitals, community clinics, and specialty clinics, among others, by trained personnel having appropriate knowledge about vaccine administration devices.

The increasing prevalence of infectious diseases, including bacterial and viral diseases, provides the market with lucrative growth. Along with this, increasing government support and the launch of newer vaccines also boost the vaccine market. Another factor boosting the vaccine market growth is increasing vaccination awareness and demand for effective COVID-19 vaccines.

Asia-Pacific Vaccines Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

DRIVERS

GROWTH IN THE IMMUNIZATION PROGRAMS AND CAMPAIGNS

Immunization programs and campaigns are increasing worldwide because of an increasing number of chronic diseases. As hepatitis, diphtheria, pertussis, and polio, among other infectious diseases, are prevailing in the environment, there is an urgent need to increase awareness regarding vaccination which can be achieved by launching several campaigns and programs. This has been reported that the number of immunization programs is increasing with an increase in infectious diseases. Immunization coverage is also increasing worldwide, intending to fight against debilitating diseases.

Still, around 20 million people remain unvaccinated and under-vaccinated, raising a great demand for vaccination. The prevalence of chronic diseases is increasing worldwide. Hence the need to get vaccinated is great. This signifies that a growing immunization program and the campaign are expected to grow the vaccine market.

HIGH PREVALENCE OF CHRONIC CONDITIONS SUCH AS FLU, INFECTIOUS AND VIRAL DISEASES

The prevalence of infectious diseases is increasing worldwide, and this has been seen that flu and bacterial infectious disease are surging rapidly. This increasing rate of infectious diseases has created the need for disease prevention which can be prevented by vaccination or immunization. As diseases are increasing significantly, there is an urgent need for mass vaccination. Mass vaccinations require many diseases, hence expected to provide the vaccine market with lucrative growth.

As the disease cases are increasing, the focus on mass vaccination is also increasing to prevent large population size. Many people who have not received vaccination at a younger age are immunized worldwide. So, to cater such needs, the demand for novel vaccines is increasing and hence expected to act as a driver in the Asia-Pacific vaccines market.

RESTRAINT

UNAVAILABILITY OF REGISTERED VACCINES

The strict regulatory approvals and time taking development procedures for the vaccines are some of the factors that are responsible for the unavailability of registered vaccines. The regulatory authorities find difficulties in the vaccines' assessment, licensure, control, and surveillance. The world supply of vaccines is delayed due to these regulations.

Therefore, the regulation processes and document formation of the manufacturing companies in different countries can act as a restrain and hamper the growth of the vaccines market.

OPPORTUNITY

STRATEGIC INITIATIVES BY THE MARKET PLAYERS

Market players adopt various strategic initiatives in the vaccines market that involve expansion, collaboration, and acquisition. These initiatives allow them to increase the company's product portfolio, leading to market expansion and enhancing the product demand among customers, which ultimately allows the market players to earn maximum revenue.

As the demand for effective and novel vaccines is increasing worldwide, these strategic initiatives taken by top market players aim at enhancing business operations and earning more profitability in the market.

Various strategic initiatives adopted by the market players allowed them to expand its root in vaccines and earn more market growth. Thus, the market players operating in vaccines are adopting several strategic initiatives expected to act as an opportunity for the vaccine market growth.

CHALLENGE

SIDE EFFECTS CAUSED BY VACCINES

The vaccine is a medical product that helps in preventing different diseases. But sometimes, side effects arise due to the use of the vaccines. Some of them are mild side effects which are redness, soreness, or swelling at the injection site. But the adverse side effects of the vaccines are rare but are life-threatening.

The life-threatening side effects can give rise to fear in the population's mind. Moreover, it impacts the credibility of vaccine manufacturers, affecting product sales. This thus suggests that side effects caused by vaccines may hamper the growth of the vaccines market.

Recent Developments

- In October 2022, Indonesia Launched its First Home-Grown COVID-19 Vaccine. IndoVac vaccine has been developed jointly by Indonesia's state-owned pharmaceutical company Bio Farma and the Baylor College of Medicine, an independent health sciences center in Houston, Texas

- In November 2020, Merck Sharp & Dohme Corp., a Merck & Co., Inc. subsidiary, signed an agreement to acquire OncoImmune, a clinical-stage biopharmaceutical company. The OncoImmune Company is highly focused on the development of COVID-19 treatment options. Through this agreement, the company is expecting to develop new vaccine candidates

- In September 2020, Sanofi and GSK signed an agreement with the government of Canada to supply 72 million doses of COVID-19 vaccines. There is a high demand for COVID-19 vaccines, and the demand is increasing with the increasing pandemic. This agreement allowed the company to ensure future potential

Asia-Pacific Vaccines Market Scope

Asia-Pacific vaccines market is segmented into composition, type, kind, age of administration, diseases, route of administration, end user, and distribution channel. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

COMPOSITION

- Combination vaccines

- Mono vaccines

On the basis of composition, the Asia-Pacific vaccines market is segmented into combination vaccines and monovaccines.

TYPE

- Subunit, recombinant, polysaccharide and conjugate vaccines

- Live-attenuated vaccines

- Inactivated vaccines

- Toxoid vaccines

On the basis of type, the Asia-Pacific vaccines market is segmented into subunit, recombinant, polysaccharide, and conjugate vaccines, live-attenuated vaccines, inactivated vaccines, and toxoid vaccines.

KIND

- Routine vaccine

- Recommended vaccine

- Required vaccine

On the basis of kind, the Asia-Pacific vaccines market is segmented into routine vaccine, recommended vaccine, and required vaccine.

AGE OF ADMINISTRATION

- Pediatric vaccine

- Adult vaccine

On the basis of age of administration, the Asia-Pacific vaccines market is segmented into pediatric vaccine and adult vaccine

DISEASES

- Pneumococcal disease

- Measles, mumps & varicella

- DPT

- Hepatitis

- Influenza

- Typhoid

- Meningococcal

- Varicella

- Rabies

- Japanese encephalitis

- Yellow fever

- Others

On the basis of diseases, the Asia-Pacific vaccines market is segmented into pneumococcal disease, measles, mumps, and varicella, DPT, hepatitis, influenza, typhoid, meningococcal, rabies, Japanese encephalitis, yellow fever, and others.

ROUTE OF ADMINISTRATION

- Injectable

- Nasal

- Oral

On the basis of route of administration, the Asia-Pacific vaccines market is segmented into injectable, oral, and nasal.

END USER

- Community hospitals

- Hospitals

- Specialty centres

- Clinics

- Others

On the basis of end user, the Asia-Pacific vaccines market is segmented into community hospitals, hospitals, specialty centres, clinics, and others.

DISTRIBUTION CHANNEL

- Hospital pharmacy

- Retail pharmacy

- Online pharmacy

On the basis of distribution channel, the Asia-Pacific vaccines market is segmented into hospital pharmacy, retail pharmacy, and online pharmacy.

Asia-Pacific Vaccines Market Regional Analysis/Insights

Asia-Pacific vaccines market is analyzed, and market size insights and trends are provided by country, composition, type, kind, age of administration, diseases, route of administration, end user, and distribution channel, as referenced above.

The countries covered in this market report are Japan, China, South Korea, India, Australia, Singapore, Thailand, Malaysia, Indonesia, Philippines, Vietnam, and the rest of Asia-Pacific.

Japan is expected to dominate the Asia-Pacific vaccine market regarding market share and revenue and will continue to flourish its dominance during the forecast period. This is due to a rising preference for preventive health check-ups.

The country section of the report also provides individual market-impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of Global brands and their challenges faced due to competition from local and domestic brands and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Asia-Pacific Vaccines Market Share Analysis

The vaccines market competitive landscape provides details of a competitor. Details include company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points are only related to the companies' focus on the vaccine market.

Some of the major players operating in the Asia-Pacific vaccines market are Bharat Biotech, Biological E Limited, Bio Farma, Serum Institute of India Pvt. Ltd., Takeda Pharmaceutical Company Limited, Merck Sharp & Dohme Corp. (a subsidiary of Merck & Co., Inc.), Abbott, AstraZeneca, Sanofi, Pfizer Inc., Janssen Global Services, LLC (a subsidiary of Johnson & Johnson Services, Inc.), F. Hoffmann-La Roche Ltd, Panacea Biotec Ltd, and BAXTER VACCINES (a subsidiary of Baxter), among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE ASIA-PACIFIC VACCINES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 COMPOSITION LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PESTEL MODEL

4.2 PORTER'S FIVE FORCES

4.3 EPIDEMIOLOGY

4.4 INDUSTRIAL INSIGHTS:

4.5 PIPELINE ANALYSIS

4.6 ASIA-PACIFIC VACCINES MARKET: SUPPLY CHAIN MANAGEMENT OF VACCINES

4.6.1 COLD CHAIN STORAGE:

4.6.2 PROCESS OF LOGISTICS

5 REGULATORY FRAMEWORK

5.1 JAPAN

5.2 CHINA

5.3 SOUTH KOREA

5.4 INDIA

5.5 AUSTRALIA

5.6 SINGAPORE

5.7 THAILAND

5.8 MALAYSIA

5.9 INDONESIA

5.1 VIETNAM

5.11 PHILIPPINES

5.12 REST OF ASIA-PACIFIC

5.12.1 TAIWAN

5.12.2 CAMBODIA

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING IMMUNIZATION PROGRAMS AND CAMPAIGNS

6.1.2 HIGH PREVALENCE OF CHRONIC CONDITIONS SUCH AS FLU, INFECTIOUS AND VIRAL DISEASES

6.1.3 IMPROVEMENT IN TREATMENT

6.1.4 LAUNCH OF NEWER VACCINES

6.1.5 INCREASING GOVERNMENT SUPPORT

6.2 RESTRAINTS

6.2.1 UNAVAILABILITY OF REGISTERED VACCINES

6.2.2 DIFFICULTIES ASSOCIATED WITH THE TRANSPORT AND PRODUCTION OF VACCINES

6.3 OPPORTUNITIES

6.3.1 STRATEGIC INITIATIVES BY THE MARKET PLAYERS

6.3.2 PRESENCE OF PIPELINE PRODUCTS

6.3.3 RISE IN EXPENDITURE IN THE HEALTHCARE SECTOR

6.3.4 INCREASING AWARENESS FOR VACCINATION

6.4 CHALLENGES

6.4.1 SIDE EFFECTS CAUSED BY VACCINES

6.4.2 FEAR AMONG PATIENTS RELATED TO INJECTIONS AND NEEDLE STICKS

6.4.3 PRODUCT RECALL

7 ASIA-PACIFIC VACCINES MARKET, BY COMPOSITION

7.1 OVERVIEW

7.2 COMBINATION VACCINES

7.3 MONO VACCINES

8 ASIA-PACIFIC VACCINES MARKET, BY TYPE

8.1 OVERVIEW

8.2 SUBUNIT, RECOMBINANT, POLYSACCHARIDE, AND CONJUGATE VACCINES

8.2.1 PNEUMOCOCCAL DISEASE

8.2.2 HIB (HAEMOPHILUS INFLUENZA TYPE B) DISEASE

8.2.3 HPV (HUMAN PAPILLOMA VIRUS)

8.2.4 HEPATITIS B

8.2.5 MENINGOCOCCAL

8.2.6 SHINGLES

8.2.7 WHOOPING COUGH

8.2.8 OTHERS

8.3 LIVE-ATTENUTAED VACCINES

8.3.1 ROTAVIRUS

8.3.2 MEASLES

8.3.3 MUMPS

8.3.4 RUBELLA

8.3.5 SMALLPOX

8.3.6 YELLOW FEVER

8.3.7 OTHERS

8.4 INACTIVATED VACCINES

8.4.1 FLU (SHOT ONLY)

8.4.2 POLIO (SHOT ONLY)

8.4.3 HEPATITIS A

8.4.4 RABIES

8.4.5 OTHERS

8.5 TOXOID VACCINES

8.5.1 DIPHTHERIA, TETANUS & PERTUSSIS (DTP)

8.5.2 OTHERS

9 ASIA-PACIFIC VACCINES MARKET, BY KIND

9.1 OVERVIEW

9.2 ROUTINE VACCINES

9.2.1 PNEUMOCOCCAL DISEASES

9.3 DIPTHERIA, TETANUS & PERTUSIS(DPT)

9.3.1 HIB (HAEMOPHILUS INFLUENZA TYPE B) DISEASE

9.3.2 MEASLES

9.3.3 MUMPS

9.3.4 HEPATITIS B

9.3.5 RUBELLA

9.3.6 POLIO

9.3.7 OTHERS

9.4 RECOMMENDED VACCINE

9.4.1 TYPHOID FEVER VACCINE

9.5 HEPATITIS A

9.5.1 RABIES

9.5.2 JAPANESE ENCEPHALITIS

9.5.3 TICK-BORNE ENCEPHALITIS

9.5.4 CHOLERA

9.5.5 OTHERS

9.6 REQUIRED VACCINE

9.6.1 MENINGOCOCCAL

9.7 YELLOW FEVER

9.7.1 OTHERS

10 ASIA-PACIFIC VACCINES MARKET, BY AGE OF ADMINISTRATION

10.1 OVERVIEW

10.2 PEDIATRIC VACCINE

10.2.1 PNEUMOCOCCAL DISEASES

10.3 MEASLES, MUMPS & RUBELLA

10.3.1 DIPTHERIA, TETANUS & PERTUSIS (DPT)

10.3.2 ROTAVIRUS

10.3.3 MENINGOCOCCAL

10.3.4 VARICELLA

10.3.5 POLIO

10.3.6 TUBERCULOSIS

10.3.7 MALARIA

10.3.8 OTHERS

10.4 ADULT VACCINE

10.4.1 INFLUENZA

10.5 HPV (HUMAN PAPILLOMA VIRUS)

10.5.1 TYPHOID

10.5.2 HEPATITIS B

10.5.3 JAPANESE ENCEPHALITIS

10.5.4 YELLOW FEVER

10.5.5 CANCER

10.5.6 OTHERS

11 ASIA-PACIFIC VACCINES MARKET, BY DISEASES

11.1 OVERVIEW

11.2 PNEUMOCCOCAL DISEASE

11.3 MEASLES, MUMPS & RUBELLA

11.4 DPT

11.5 HEPATITIS

11.6 INFLUENZA

11.7 TYPHOID

11.8 MENINGOCOCCAL

11.9 VARICELLA

11.1 RABIES

11.11 JAPANESE ENCEPHALITIS

11.12 YELLOW FEVER

11.13 OTHERS

12 ASIA-PACIFIC VACCINES MARKET, BY ROUTE OF ADMINISTRATION

12.1 OVERVIEW

12.2 INJECTABLE

12.2.1 INTRAMUSCULAR

12.2.2 SUBCUTANEOUS

12.2.3 INTRADERMAL

12.3 ORAL

12.4 NASAL

13 ASIA-PACIFIC VACCINES MARKET, BY END USER

13.1 OVERVIEW

13.2 COMMUNITY HOSPITALS

13.3 HOSPITALS

13.4 SPECIALTY CENTERS

13.5 CLINICS

13.6 OTHERS

14 ASIA-PACIFIC VACCINES MARKET, BY DISTRIBUTION CHANNEL

14.1 OVERVIEW

14.2 HOSPITAL PHARMACY

14.3 RETAIL PHARMACY

14.4 ONLINE PHARMACY

15 ASIA-PACIFIC VACCINE MARKET

15.1 ASIA-PACIFIC

15.1.1 JAPAN

15.1.2 CHINA

15.1.3 AUSTRALIA

15.1.4 INDIA

15.1.5 SOUTH KOREA

15.1.6 SINGAPORE

15.1.7 MALAYSIA

15.1.8 THAILAND

15.1.9 INDONESIA

15.1.10 PHILIPPINES

15.1.11 VIETNAM

15.1.12 REST OF ASIA PACIFIC

16 ASIA-PACIFIC VACCINES MARKET: COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

16.2 DISEASE SHARE ANALYSIS: PFIZER, INC.

16.3 COUNTRY SHARE ANALYSIS: PFIZER, INC.

16.4 DISEASE SHARE ANALYSIS: MERCK SHARP & DOHME CORP. (A SUBSIDIARY OF MERCK & CO., INC.)

16.5 COUNTRY SHARE ANALYSIS: MERCK SHARP & DOHME CORP. (A SUBSIDIARY OF MERCK & CO., INC.)

16.6 DISEASE SHARE ANALYSIS: GLAXOSMITHKLINE PLC

16.7 COUNTRY SHARE ANALYSIS: GLAXOSMITHKLINE PLC.

16.8 DISEASE SHARE ANALYSIS: SANOFI

16.9 COUNTRY SHARE ANALYSIS: SANOFI

16.1 DISEASE SHARE ANALYSIS: SERUM INSTITUTE OF INDIA PVT. LTD.

16.11 COUNTRY SHARE ANALYSIS: SERUM INSTITUTE OF INDIA PVT. LTD.

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 PFIZER INC.

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 PRODUCT PORTFOLIO

18.1.4 RECENT DEVELOPMENTS

18.2 MERCK SHARP & DOHME CORP. (A SUBSIDIARY OF MERCK & CO., INC.)

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 COMPANY WEBSITE AND PRESS RELEASES

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENTS

18.3 GLAXOSMITHKLINE PLC.

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 PRODUCT PORTFOLIO

18.3.4 RECENT DEVELOPMENTS

18.4 SANOFI

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 PRODUCT PORTFOLIO

18.4.4 RECENT DEVELOPMENTS

18.5 SERUM INSTITUTE OF INDIA PVT. LTD.

18.5.1 COMPANY SNAPSHOT

18.5.2 PRODUCT PORTFOLIO

18.5.3 RECENT DEVELOPMENTS

18.6 ABBOTT

18.6.1 COMPANY SNAPSHOT

18.6.2 REVENUE ANALYSIS

18.6.3 PRODUCT PORTFOLIO

18.6.4 RECENT DEVELOPMENTS

18.7 ASTRAZENECA (2022)

18.7.1 COMPANY SNAPSHOT

18.7.2 REVENUE ANALYSIS

18.7.3 PRODUCT PORTFOLIO

18.7.4 RECENT DEVELOPMENTS

18.8 ALK

18.8.1 COMPANY SNAPSHOT

18.8.2 REVENUE ANALYSIS

18.8.3 PRODUCT PORTFOLIO

18.8.4 RECENT DEVELOPMENTS

18.9 BAXTER VACCINES (A SUBSIDIARY OF BAXTER)

18.9.1 COMPANY SNAPSHOT

18.9.2 REVENUE ANALYSIS

18.9.3 PRODUCT PORTFOLIO

18.9.4 RECENT DEVELOPMENT

18.1 BHARAT BIOTECH

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENTS

18.11 BIO FARMA

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENTS

18.12 BIOLOGICAL E LIMITED

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT DEVELOPMENTS

18.13 DAIICHI SANKYO COMPANY, LIMITED

18.13.1 COMPANY SNAPSHOT

18.13.2 REVENUE ANALYSIS

18.13.3 PRODUCT PORTFOLIO

18.13.4 RECENT DEVELOPMENTS

18.14 F. HOFFMANN-LA ROCHE LTD

18.14.1 COMPANY SNAPSHOT

18.14.2 REVENUE ANALYSIS

18.14.3 PRODUCT PORTFOLIO

18.14.4 RECENT DEVELOPMENT

18.15 JANSSEN GLOBAL SERVICES, LLC (A SUBSIDIARY OF JOHNSON & JOHNSON SERVICES, INC.)

18.15.1 COMPANY SNAPSHOT

18.15.2 REVENUE ANALYSIS

18.15.3 PRODUCT PORTFOLIO

18.15.4 RECENT DEVELOPMENTS

18.16 LANZHOU BIOLOGICAL PRODUCTS RESEARCH INSTITUTE CO., LTD.,

18.16.1 COMPANY SNAPSHOT

18.16.2 PRODUCT PORTFOLIO

18.16.3 RECENT DEVELOPMENTS

18.17 PANACEA BIOTEC LTD

18.17.1 COMPANY SNAPSHOT

18.17.2 REVENUE ANALYSIS

18.17.3 PRODUCT PORTFOLIO

18.17.4 RECENT DEVELOPMENTS

18.18 SEQIRUS (A SUBSIDIARY OF CSL LIMITED)

18.18.1 COMPANY SNAPSHOT

18.18.2 REVENUE ANALYSIS

18.18.3 PRODUCT PORTFOLIO

18.18.4 RECENT DEVELOPMENTS

18.19 TAKEDA PHARMACEUTICAL COMPANY LIMITED

18.19.1 COMPANY SNAPSHOT

18.19.2 REVENUE ANALYSIS

18.19.3 COMPANY WEBSITE AND PRESS RELEASES

18.19.4 PRODUCT PORTFOLIO

18.19.5 RECENT DEVELOPMENTS

19 QUESTIONNAIRE

20 RELATED REPORTS

List of Table

TABLE 1 ASIA-PACIFIC VACCINES MARKET, PIPELINE ANALYSIS

TABLE 2 RECOMMENDED TEMPERATURE AND STORAGE LENGTH AT VARIOUS LEVELS OF THE COLD CHAIN.

TABLE 3 LOGISTICS PROCESS ACROSS DIFFERENT REGIONS.

TABLE 4 LAWS AND REGULATIONS IN TAIWAN

TABLE 5 VACCINES UNDER CLINICAL TRIAL

TABLE 6 THE SIDE EFFECTS RELATED TO THE VACCINES

TABLE 7 ASIA-PACIFIC VACCINES MARKET, BY COMPOSITION, 2021-2030 (USD MILLION)

TABLE 8 ASIA-PACIFIC VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 9 ASIA-PACIFIC SUBUNIT, RECOMBINANT, POLYSACCHARIDE & CONJUGATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 10 ASIA-PACIFIC LIVE-ATTENUATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 11 ASIA-PACIFIC INACTIVATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 12 ASIA-PACIFIC TOXOID VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 13 ASIA-PACIFIC VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 14 ASIA-PACIFIC ROUTINE VACCINES IN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 15 ASIA-PACIFIC RECOMMENDED VACCINE IN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 16 ASIA-PACIFIC REQUIRED VACCINE IN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 17 ASIA-PACIFIC VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 18 ASIA-PACIFIC PEDIATRIC VACCINE IN VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 19 ASIA-PACIFIC ADULT VACCINE IN VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 20 ASIA-PACIFIC VACCINES MARKET, BY DISEASE, 2021-2030 (USD MILLION)

TABLE 21 ASIA-PACIFIC VACCINES MARKET, BY ROUTE OF ADMINISTRATION, 2022-2030 (USD MILLION)

TABLE 22 ASIA-PACIFIC INJECTABLE IN VACCINES MARKET, BY ROUTE OF ADMINISTRATION, 2022-2030 (USD MILLION)

TABLE 23 ASIA-PACIFIC VACCINES MARKET, BY END USER, 2022-2030 (USD MILLION)

TABLE 24 ASIA-PACIFIC VACCINES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 25 ASIA-PACIFIC KNEE CARTILAGE REPAIR MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 26 JAPAN VACCINES MARKET, BY COMPOSITION, 2021-2030 (USD MILLION)

TABLE 27 JAPAN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 28 JAPAN SUBUNIT, RECOMBINANT, POLYSACCHARIDE & CONJUGATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 29 JAPAN LIVE-ATTENUATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 30 JAPAN INACTIVATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 31 JAPAN TOXOID VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 32 JAPAN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 33 JAPAN ROUTINE VACCINE IN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 34 JAPAN RECOMMENDED VACCINE IN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 35 JAPAN REQUIRED VACCINE IN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 36 JAPAN VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 37 JAPAN PEDIATRIC VACCINE IN VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 38 JAPAN ADULT IN VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 39 JAPAN VACCINES MARKET, BY DISEASE, 2021-2030 (USD MILLION)

TABLE 40 JAPAN VACCINES MARKET, BY ROUTE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 41 JAPAN INJECTABLE IN VACCINES MARKET, BY ROUTE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 42 JAPAN VACCINES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 43 JAPAN VACCINES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 44 CHINA VACCINES MARKET, BY COMPOSITION, 2021-2030 (USD MILLION)

TABLE 45 CHINA VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 46 CHINA SUBUNIT, RECOMBINANT, POLYSACCHARIDE & CONJUGATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 47 CHINA LIVE-ATTENUATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 48 CHINA INACTIVATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 49 CHINA TOXOID VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 50 CHINA VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 51 CHINA ROUTINE VACCINE IN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 52 CHINA RECOMMENDED VACCINE IN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 53 CHINA REQUIRED VACCINE IN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 54 CHINA VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 55 CHINA PEDIATRIC VACCINE IN VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 56 CHINA ADULT IN VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 57 CHINA VACCINES MARKET, BY DISEASE, 2021-2030 (USD MILLION)

TABLE 58 CHINA VACCINES MARKET, BY ROUTE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 59 CHINA INJECTABLE IN VACCINES MARKET, BY ROUTE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 60 CHINA VACCINES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 61 CHINA VACCINES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 62 AUSTRALIA VACCINES MARKET, BY COMPOSITION, 2021-2030 (USD MILLION)

TABLE 63 AUSTRALIA VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 64 AUSTRALIA SUBUNIT, RECOMBINANT, POLYSACCHARIDE & CONJUGATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 65 AUSTRALIA LIVE-ATTENUATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 66 AUSTRALIA INACTIVATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 67 AUSTRALIA TOXOID VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 68 AUSTRALIA VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 69 AUSTRALIA ROUTINE VACCINE IN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 70 AUSTRALIA RECOMMENDED VACCINE IN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 71 AUSTRALIA REQUIRED VACCINE IN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 72 AUSTRALIA VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 73 AUSTRALIA PEDIATRIC VACCINE IN VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 74 AUSTRALIA ADULT IN VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 75 AUSTRALIA VACCINES MARKET, BY DISEASE, 2021-2030 (USD MILLION)

TABLE 76 AUSTRALIA VACCINES MARKET, BY ROUTE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 77 AUSTRALIA INJECTABLE IN VACCINES MARKET, BY ROUTE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 78 AUSTRALIA VACCINES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 79 INDIA VACCINES MARKET, BY COMPOSITION, 2021-2030 (USD MILLION)

TABLE 80 INDIA VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 81 INDIA SUBUNIT, RECOMBINANT, POLYSACCHARIDE & CONJUGATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 82 INDIA LIVE-ATTENUATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 83 INDIA INACTIVATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 84 INDIA TOXOID VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 85 INDIA VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 86 INDIA ROUTINE VACCINE IN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 87 INDIA RECOMMENDED VACCINE IN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 88 INDIA REQUIRED VACCINE IN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 89 INDIA VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 90 INDIA PEDIATRIC VACCINE IN VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 91 INDIA ADULT IN VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 92 INDIA VACCINES MARKET, BY DISEASE, 2021-2030 (USD MILLION)

TABLE 93 INDIA VACCINES MARKET, BY ROUTE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 94 INDIA INJECTABLE IN VACCINES MARKET, BY ROUTE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 95 INDIA VACCINES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 96 INDIA VACCINES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 97 SOUTH KOREA VACCINES MARKET, BY COMPOSITION, 2021-2030 (USD MILLION)

TABLE 98 SOUTH KOREA VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 99 SOUTH KOREA SUBUNIT, RECOMBINANT, POLYSACCHARIDE & CONJUGATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 100 SOUTH KOREA LIVE-ATTENUATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 101 SOUTH KOREA INACTIVATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 102 SOUTH KOREA VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 103 SOUTH KOREA ROUTINE VACCINE IN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 104 SOUTH KOREA RECOMMENDED VACCINE IN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 105 SOUTH KOREA REQUIRED VACCINE IN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 106 SOUTH KOREA VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 107 SOUTH KOREA PEDIATRIC VACCINE IN VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 108 SOUTH KOREA ADULT IN VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 109 SOUTH KOREA VACCINES MARKET, BY DISEASE, 2021-2030 (USD MILLION)

TABLE 110 SOUTH KOREA VACCINES MARKET, BY ROUTE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 111 SOUTH KOREA INJECTABLE IN VACCINES MARKET, BY ROUTE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 112 SOUTH KOREA VACCINES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 113 SOUTH KOREA VACCINES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 114 SINGAPORE VACCINES MARKET, BY COMPOSITION, 2021-2030 (USD MILLION)

TABLE 115 SINGAPORE SUBUNIT, RECOMBINANT, POLYSACCHARIDE & CONJUGATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 116 SINGAPORE LIVE-ATTENUATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 117 SINGAPORE INACTIVATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 118 SINGAPORE TOXOID VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 119 SINGAPORE VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 120 SINGAPORE ROUTINE VACCINE IN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 121 SINGAPORE RECOMMENDED VACCINE IN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 122 SINGAPORE REQUIRED VACCINE IN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 123 SINGAPORE VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 124 SINGAPORE PEDIATRIC VACCINE IN VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 125 SINGAPORE ADULT IN VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 126 SINGAPORE VACCINES MARKET, BY DISEASE, 2021-2030 (USD MILLION)

TABLE 127 SINGAPORE VACCINES MARKET, BY ROUTE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 128 SINGAPORE INJECTABLE IN VACCINES MARKET, BY ROUTE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 129 SINGAPORE VACCINES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 130 SINGAPORE VACCINES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 131 MALAYSIA VACCINES MARKET, BY COMPOSITION, 2021-2030 (USD MILLION)

TABLE 132 MALAYSIA VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 133 MALAYSIA SUBUNIT, RECOMBINANT, POLYSACCHARIDE & CONJUGATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 134 MALAYSIA LIVE-ATTENUATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 135 MALAYSIA INACTIVATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 136 MALAYSIA TOXOID VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 137 MALAYSIA VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 138 MALAYSIA ROUTINE VACCINE IN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 139 MALAYSIA RECOMMENDED VACCINE IN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 140 MALAYSIA REQUIRED VACCINE IN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 141 MALAYSIA VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 142 MALAYSIA PEDIATRIC VACCINE IN VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 143 MALAYSIA ADULT IN VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 144 MALAYSIA VACCINES MARKET, BY DISEASE, 2021-2030 (USD MILLION)

TABLE 145 MALAYSIA VACCINES MARKET, BY ROUTE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 146 MALAYSIA INJECTABLE IN VACCINES MARKET, BY ROUTE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 147 MALAYSIA VACCINES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 148 MALAYSIA VACCINES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 149 THAILAND VACCINES MARKET, BY COMPOSITION, 2021-2030 (USD MILLION)

TABLE 150 THAILAND VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 151 THAILAND SUBUNIT, RECOMBINANT, POLYSACCHARIDE & CONJUGATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 152 THAILAND LIVE-ATTENUATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 153 THAILAND INACTIVATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 154 THAILAND TOXOID VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 155 THAILAND VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 156 THAILAND RECOMMENDED VACCINE IN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 157 THAILAND REQUIRED VACCINE IN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 158 THAILAND VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 159 THAILAND PEDIATRIC VACCINE IN VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 160 THAILAND ADULT IN VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 161 THAILAND VACCINES MARKET, BY DISEASE, 2021-2030 (USD MILLION)

TABLE 162 THAILAND VACCINES MARKET, BY ROUTE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 163 THAILAND INJECTABLE IN VACCINES MARKET, BY ROUTE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 164 THAILAND VACCINES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 165 THAILAND VACCINES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 166 INDONESIA VACCINES MARKET, BY COMPOSITION, 2021-2030 (USD MILLION)

TABLE 167 INDONESIA VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 168 INDONESIA SUBUNIT, RECOMBINANT, POLYSACCHARIDE & CONJUGATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 169 INDONESIA LIVE-ATTENUATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 170 INDONESIA INACTIVATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 171 INDONESIA TOXOID VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 172 INDONESIA VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 173 INDONESIA ROUTINE VACCINE IN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 174 INDONESIA RECOMMENDED VACCINE IN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 175 INDONESIA REQUIRED VACCINE IN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 176 INDONESIA VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 177 INDONESIA PEDIATRIC VACCINE IN VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 178 INDONESIA ADULT IN VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 179 INDONESIA VACCINES MARKET, BY DISEASE, 2021-2030 (USD MILLION)

TABLE 180 INDONESIA VACCINES MARKET, BY ROUTE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 181 INDONESIA INJECTABLE IN VACCINES MARKET, BY ROUTE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 182 INDONESIA VACCINES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 183 INDONESIA VACCINES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 184 PHILIPPINES VACCINES MARKET, BY COMPOSITION, 2021-2030 (USD MILLION)

TABLE 185 PHILIPPINES VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 186 PHILIPPINES SUBUNIT, RECOMBINANT, POLYSACCHARIDE & CONJUGATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 187 PHILIPPINES LIVE-ATTENUATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 188 PHILIPPINES INACTIVATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 189 PHILIPPINES TOXOID VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 190 PHILIPPINES VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 191 PHILIPPINES ROUTINE VACCINE IN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 192 PHILIPPINES RECOMMENDED VACCINE IN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 193 PHILIPPINES REQUIRED VACCINE IN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 194 PHILIPPINES VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 195 PHILIPPINES PEDIATRIC VACCINE IN VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 196 PHILIPPINES ADULT IN VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 197 PHILIPPINES VACCINES MARKET, BY DISEASE, 2021-2030 (USD MILLION)

TABLE 198 PHILIPPINES VACCINES MARKET, BY ROUTE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 199 PHILIPPINES INJECTABLE IN VACCINES MARKET, BY ROUTE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 200 PHILIPPINES VACCINES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 201 PHILIPPINES VACCINES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 202 VIETNAM VACCINES MARKET, BY COMPOSITION, 2021-2030 (USD MILLION)

TABLE 203 VIETNAM VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 204 VIETNAM SUBUNIT, RECOMBINANT, POLYSACCHARIDE & CONJUGATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 205 VIETNAM LIVE-ATTENUATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 206 VIETNAM INACTIVATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 207 VIETNAM TOXOID VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 208 VIETNAM VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 209 VIETNAM ROUTINE VACCINE IN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 210 VIETNAM RECOMMENDED VACCINE IN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 211 VIETNAM REQUIRED VACCINE IN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 212 VIETNAM VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 213 VIETNAM PEDIATRIC VACCINE IN VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 214 VIETNAM ADULT IN VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 215 VIETNAM VACCINES MARKET, BY DISEASE, 2021-2030 (USD MILLION)

TABLE 216 VIETNAM VACCINES MARKET, BY ROUTE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 217 VIETNAM INJECTABLE IN VACCINES MARKET, BY ROUTE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 218 VIETNAM VACCINES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 219 VIETNAM VACCINES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 220 REST OF ASIA-PACIFIC VACCINES MARKET, BY COMPOSITION, 2021-2030 (USD MILLION)

List of Figure

FIGURE 1 ASIA-PACIFIC VACCINES MARKET: SEGMENTATION

FIGURE 2 ASIA-PACIFIC VACCINES MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC VACCINES MARKET: DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC VACCINES MARKET: ASIA-PACIFIC VS COUNTRY MARKET ANALYSIS

FIGURE 5 ASIA-PACIFIC VACCINES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC VACCINES MARKET: MULTIVARIATE MODELLING

FIGURE 7 ASIA-PACIFIC VACCINES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 ASIA-PACIFIC VACCINES MARKET: DBMR MARKET POSITION GRID

FIGURE 9 ASIA-PACIFIC VACCINES MARKET: SEGMENTATION

FIGURE 10 GROWING IMMUNIZATION PROGRAMS AND CAMPAIGNS AND THE HIGH PREVALENCE OF CHRONIC CONDITIONS SUCH AS FLU AND BACTERIAL INFECTIOUS DISEASES ARE DRIVING THE ASIA-PACIFIC VACCINES MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 11 THE COMBINATION VACCINES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA-PACIFIC VACCINES MARKET IN 2023 & 2030

FIGURE 12 FDA REGULATORY REVIEW PROCESS OF VACCINES

FIGURE 13 PROCESS OF SPECIAL APPROVAL ON VACCINES DURING THE 2019 H1N1PDM PANDEMIC

FIGURE 14 REGULATION OVERVIEW FOR THERAPEUTICS IN SINGAPORE

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE ASIA-PACIFIC VACCINES MARKET

FIGURE 16 ASIA-PACIFIC VACCINES MARKET: BY COMPOSITION, 2022

FIGURE 17 ASIA-PACIFIC VACCINES MARKET: BY COMPOSITION, 2023-2030 (USD MILLION)

FIGURE 18 ASIA-PACIFIC VACCINES MARKET: BY COMPOSITION, CAGR (2023-2030)

FIGURE 19 ASIA-PACIFIC VACCINES MARKET: BY COMPOSITION, LIFELINE CURVE

FIGURE 20 ASIA-PACIFIC VACCINES MARKET: BY TYPE, 2022

FIGURE 21 ASIA-PACIFIC VACCINES MARKET: BY TYPE, 2023-2030 (USD MILLION)

FIGURE 22 ASIA-PACIFIC VACCINES MARKET: BY TYPE, CAGR (2023-2030)

FIGURE 23 ASIA-PACIFIC VACCINES MARKET: BY TYPE, LIFELINE CURVE

FIGURE 24 ASIA-PACIFIC VACCINES MARKET: BY KIND, 2022

FIGURE 25 ASIA-PACIFIC VACCINES MARKET: BY KIND, 2023-2030 (USD MILLION)

FIGURE 26 ASIA-PACIFIC VACCINES MARKET: BY KIND, CAGR (2023-2030)

FIGURE 27 ASIA-PACIFIC VACCINES MARKET: BY KIND, LIFELINE CURVE

FIGURE 28 ASIA-PACIFIC VACCINES MARKET: BY AGE OF ADMINISTRATION, 2022

FIGURE 29 ASIA-PACIFIC VACCINES MARKET: BY AGE OF ADMINISTRATION, 2023-2030 (USD MILLION)

FIGURE 30 ASIA-PACIFIC VACCINES MARKET: BY AGE OF ADMINISTRATION, CAGR (2023-2030)

FIGURE 31 ASIA-PACIFIC VACCINES MARKET: BY AGE OF ADMINISTRATION, LIFELINE CURVE

FIGURE 32 ASIA-PACIFIC VACCINES MARKET: BY DISEASES, 2022

FIGURE 33 ASIA-PACIFIC VACCINES MARKET: BY DISEASES, 2023-2030 (USD MILLION)

FIGURE 34 ASIA-PACIFIC VACCINES MARKET: BY DISEASES, CAGR (2023-2030)

FIGURE 35 ASIA-PACIFIC VACCINES MARKET: BY DISEASES, LIFELINE CURVE

FIGURE 36 ASIA-PACIFIC VACCINES MARKET: BY ROUTE OF ADMINISTRATION, 2022

FIGURE 37 ASIA-PACIFIC VACCINES MARKET: BY ROUTE OF ADMINISTRATION, 2023-2030 (USD MILLION)

FIGURE 38 ASIA-PACIFIC VACCINES MARKET: BY ROUTE OF ADMINISTRATION, CAGR (2023-2030)

FIGURE 39 ASIA-PACIFIC VACCINES MARKET: BY ROUTE OF ADMINISTRATION, LIFELINE CURVE

FIGURE 40 ASIA-PACIFIC VACCINES MARKET: BY END USER, 2022

FIGURE 41 ASIA-PACIFIC VACCINES MARKET: BY END USER, 2023-2030 (USD MILLION)

FIGURE 42 ASIA-PACIFIC VACCINES MARKET: BY END USER, CAGR (2023-2030)

FIGURE 43 ASIA-PACIFIC VACCINES MARKET: BY END USER, LIFELINE CURVE

FIGURE 44 ASIA-PACIFIC VACCINES MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 45 ASIA-PACIFIC VACCINES MARKET: BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 46 ASIA-PACIFIC VACCINES MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 47 ASIA-PACIFIC VACCINES MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 48 ASIA-PACIFIC VACCINE MARKET: SNAPSHOT (2022)

FIGURE 49 ASIA-PACIFIC VACCINE MARKET: BY COUNTRY (2022)

FIGURE 50 ASIA-PACIFIC VACCINE MARKET: BY COUNTRY (2023 & 2030)

FIGURE 51 ASIA-PACIFIC VACCINE MARKET: BY COUNTRY (2022 & 2030)

FIGURE 52 ASIA-PACIFIC VACCINE MARKET: BY COMPOSITION (2023-2030)

FIGURE 53 ASIA-PACIFIC VACCINES MARKET: COMPANY SHARE 2022 (%)

FIGURE 54 PFIZER, INC., ASIA-PACIFIC VACCINES MARKET: DISEASE SHARE 2022 (%)

FIGURE 55 PFIZER, INC., ASIA-PACIFIC VACCINES MARKET: COUNTRY SHARE 2022 (%)

FIGURE 56 MERCK SHARP & DOHME CORP. (A SUBSIDIARY OF MERCK & CO., INC.) ASIA-PACIFIC VACCINES MARKET: DISEASE SHARE 2022 (%)

FIGURE 57 MERCK SHARP & DOHME CORP. (A SUBSIDIARY OF MERCK & CO., INC.) ASIA-PACIFIC VACCINES MARKET: COUNTRY SHARE 2022 (%)

FIGURE 58 GLAXOSMITHKLINE PLC, ASIA-PACIFIC VACCINES MARKET: DISEASE SHARE 2022 (%)

FIGURE 59 GLAXOSMITHKLINE PLC, ASIA-PACIFIC VACCINES MARKET: COMPANY SHARE 2022 (%)

FIGURE 60 SANOFI, ASIA-PACIFIC VACCINES MARKET: DISEASE SHARE 2022 (%)

FIGURE 61 SANOFI ASIA-PACIFIC VACCINES MARKET: COUNTRY SHARE 2022 (%)

FIGURE 62 SERUM INSTITUTE OF INDIA PVT. LTD., ASIA-PACIFIC VACCINES MARKET: DISEASE SHARE 2022 (%)

FIGURE 63 SERUM INSTITUTE OF INDIA PVT. LTD. ASIA-PACIFIC VACCINES MARKET: COUNTRY SHARE 2022 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.