Asia-Pacific Unmanned Surface Vehicle (USV) Market Analysis and Size

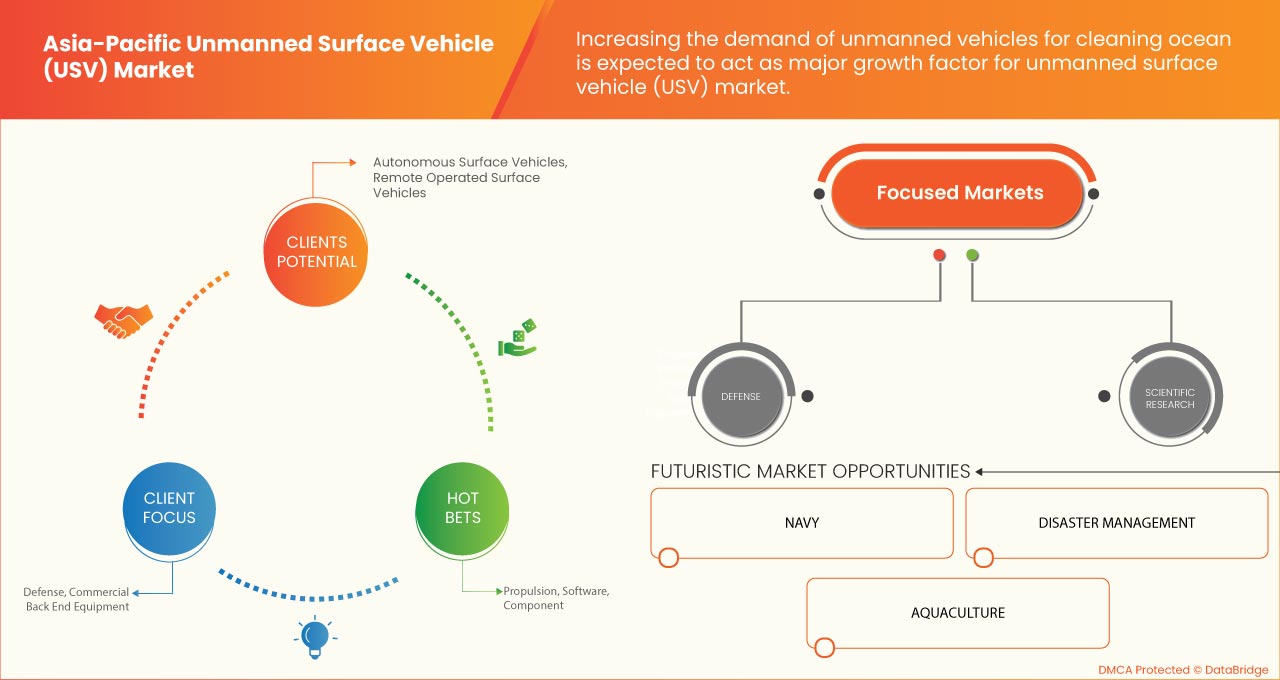

The increasing use of solar batteries to power the autonomous surface vehicle (ASV) is accelerating the growth of unmanned surface vehicles (USV). The growing demand for water quality monitoring due to increased levels of pollution and ocean data mapping, which allows scientists to study past climatic conditions, is boosting the growth of unmanned surface vehicles (USV). In addition, rising maritime security threats are prompting Asia-Pacific navies to induce autonomous surface vehicles (ASV) in their fleet, giving them an edge, and further accelerating the Asia-Pacific unmanned surface vehicle (USV) market growth. Their diversifying uses in disaster management services especially in search and rescue and preventive maintenance, for protecting the integrity of territorial and enclosed water areas. The rapid adoption in the aquaculture industry, which allows them for real-time monitoring to cater to the growing demand for worldwide fishery products, is expected to create strong opportunities for the Asia-Pacific unmanned surface vehicle (USV) market. However, nascent collision detection technologies and further technological complexities associated with making them truly autonomous pose a challenge to the growth of the Asia-Pacific unmanned surface vehicle (USV) market.

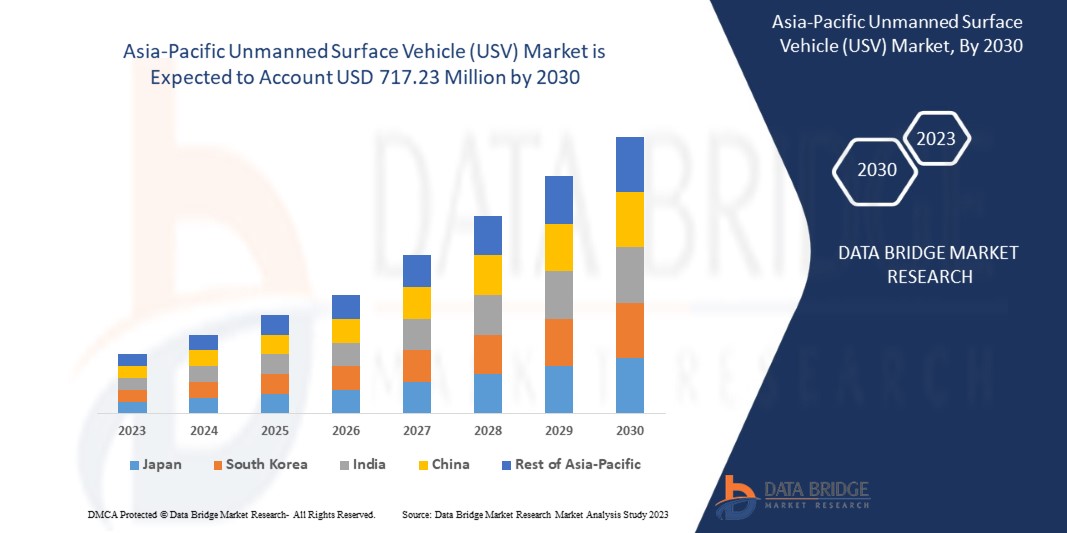

Data Bridge Market Research analyses that the Asia-Pacific unmanned surface vehicle (USV) market is expected to reach the value of USD 717.23 million by 2030, at a CAGR of 13.2% during the forecast period. The unmanned surface vehicle (USV) market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2020 - 2016) |

|

Quantitative Units |

Revenue in USD Million, Pricing in USD |

|

Segments Covered |

By Type (Surface and Sub-Surface), Application (Defense, Commercial, Scientific Research, and Others), Endurance (100-500 Hours, <100 Hours, 500-1000 Hours, and >1000 Hours), Operation (Remote Operated Surface Vehicle and Autonomous Surface Vehicle), System (Propulsion, Chassis Material, Payload, Component, Software, and Communication), Hull Type (Catamaran (Twin Hulls), Kayak (Single Hull), Trimaran (Triple Hulls), and Rigid Inflatable Hull), Size (Medium (4 to 8 M), Small (Less than 4 M), Large (8 to 12 M), and Extra-Large (Above 12 M)). |

|

Countries Covered |

China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC). |

|

Market Players Covered |

Elbit Systems Ltd., Rafael Advanced Defense Systems Ltd., Boeing, Saildrone, Inc., Deep Ocean Engineering, Inc., Zhuhai Yunzhou Intelligent Technology Co., Ltd., KONGSBERG, L3Harris Tecnologies, Inc., OCIUS, ATLAS ELEKTRONIK GmbH, Clearpath Robotics Inc., Teledyne Technologies Incorporated, Textron Inc., ECA GROUP, and iXblue SAS among others.

|

Market Definition

The unmanned surface vehicle (USV) is a water-borne vessel that can operate without the requirement of human onboard operators. They can be either remotely operated by an operator or are pre-programmed to be able to run on their own. It is usually powered by rapidly rechargeable lithium-ion batteries or solar energy and is mainly used for ocean exploration and maritime purposes.

The unmanned surface vehicle offers various advantages, which can be used for different kinds of applications such as commercial and research, defense purposes, search and rescue, and many more. Its adoption is steadily growing across various industry verticals, such as aquaculture, and has a huge potential to be an ideal vehicle that can be used for disaster management purposes.

Asia-Pacific Unmanned Surface Vehicle (USV) Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail as below:

Drivers

- Increasing demand for unmanned vehicles for cleaning oceans

Marine pollution, or the contamination of oceans, has been growing over the years. Moreover, about 75% of Earth's surface has been covered by water, of which 97.5% is occupied by the ocean and 2.5% by fresh water. The rapidly increasing population has led to a growing need for fresh water for drinking and other purposes.

Although, the growth in industrialization and Asia-Pacific has led to a surge in water pollution. A huge amount of plastic waste is being deployed in the ocean which is contaminating the water. In addition, the history of oil and gas exploration and transportation has witnessed several oil spills which have destroyed the aquatic life and quality of water. Along with this, chemical contamination is concerning for health, environmental, and economic reasons which have led to the demand for cleaning such water resources.

- Increasing asymmetric threats and use of unmanned surface vehicle (USV) in defense

Unmanned surface vehicles are being revolutionized for naval purposes for the past few years. These vehicles have been evolving from tools to carry out many tasks to systems capable of operating with a high degree of autonomy. Moreover, most countries are facing asymmetric warfare because of different strategies framed by different defense departments.

However, asymmetric warfare can describe conflicts. Such conflicts often involve strategies and tactics of unconventional warfare. The resources of asymmetric threats can be referred to as the attack by individuals, organizations, or nations to target any government, military or some valuable asset in order to acquire the asset or destroy the state. These attacks need to be continuously monitored by countries in order to protect them from any form of attack or any other type of applications such as illegal drug trafficking, air crash, maritime search investigations, payload delivery, and many others.

Opportunities

- Growing demand for USV for disaster management

Disasters, whether natural or man-made, have ruthless consequences for human lives, environments, and also artificial constructions. Man-made disasters can range from oil spills to heavy metals to forest fires, namely the deep water horizon oil spill (2010), Chernobyl disaster (1986), and the California wildfires (2018) among others.

The awareness has been growing regarding disasters over the years, and even though the ground, aerial and underwater robots have been used for disaster management (DM), surface vehicles are only starting to gain popularity. Although they are predominantly used for search and rescue purposes, they can be used for the detection of crustal deformation with the help of onboard seismometers and other seaboard pressure sensors.

Restraints/Challenges

- Lack of collision detection capability of unmanned surface vehicle (USV)

The usage of unmanned surface vehicle (USV) is increasing with its wide range of commercial, military, and research applications. These vehicles can work on their own and be fully autonomous, or an operator can control them to navigate their course and control their functioning.

Autonomous vehicles are facing the technological complexity of collision detection. As these vehicles can easily collide with any other marine vehicle, the lack of any proper collision system in the vehicle is acting as a major restraint for the market.

- Increasing investments by governments and private players

More than half a century ago, wars were fought by show of force as countries focused on full-force attacks. However, as times progressed and technologies advanced, various economies developed simultaneously, and they relied more on other factors like reconnaissance and surveillance. Thus, Asia-Pacific leaders have shifted their focus to Autonomous Surface Vehicles (ASV) to make them more efficient. They can be generally used to accompany large warships and battleships as well as detect underwater mines and traps.

It is becoming essential to increase investment in unmanned platforms with an impenetrable command network. USVs have the potential to become the centerpiece for various maritime operations. This is further propelled by rising skirmishes between various economies resulting in trade wars, illegal land captures, and surveillance. As a result, rising investments by Asia-Pacific naval forces to strengthen their capability, as well as investments by private entities is the factor that will create an opportunity for growth of the market.

Post-COVID-19 Impact on Asia-Pacific Unmanned Surface Vehicle (USV) Market

COVID-19 created a negative impact on the unmanned surface vehicle (USV) market owing to the rapid shutdown of manufacturing facilities across all industries.

The COVID-19 pandemic has impacted the unmanned surface vehicle (USV) market to an extent in a negative manner. Increasing adoption of USVs for ocean mapping has helped the market to grow after the pandemic. Also, it is expected that there will be considerable sectoral growth in the near future.

Manufacturers and solution providers are making various strategic decisions to enhance their offerings in the post-COVID-19 scenario. The players are conducting multiple research and development activities to improve the technology involved in the unmanned surface vehicle (USV). With this, the companies will bring advanced technologies to the market.

Recent Development

- In October 2022, ECA GROUP designed Critical Design Review to promote autonomous robotic systems in the 3rd generation MCM program. This product has helped the company to expand its product portfolio and enhance the offerings to the customers

- In April 2019, KONGSBERG launched a brand-new unmanned surface vehicle (USV) and sounder USV System. The sounder USV system is a multipurpose platform that was designed to work across different market segments, including surveys. This has helped the company to enhance its product offerings and to grow in the market

Asia-Pacific Unmanned Surface Vehicle (USV) Market Scope

Asia-Pacific unmanned surface vehicle (USV) market is segmented into six notable segments, which are based on type, application, endurance, operation, system, hull type, and size. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Surface

- Sub-Surface

On the basis of type, the Asia-Pacific unmanned surface vehicle (USV) market is segmented into surface and sub-surface.

Application

- Defense

- Commercial

- Scientific Research

- Others

On the basis of application, the Asia-Pacific unmanned surface vehicle (USV) market is segmented into defense, commercial, scientific research, and others.

Endurance

- 100-500 Hours

- <100 Hours

- 500-1000 Hours

- >1000 Hours

On the basis of endurance, the Asia-Pacific unmanned surface vehicle (USV) market is segmented into 100-500 hours, <100 hours, 500-1000 hours, and >1000 hours.

Operation

- Remote Operated Surface Vehicle

- Autonomous Surface Vehicle

On the basis of operation, the Asia-Pacific unmanned surface vehicle (USV) market is segmented into remote operated surface vehicle and autonomous surface vehicle.

System

- Propulsion

- Chassis Material

- Payload

- Component

- Software

- Communication

On the basis of the system, the Asia-Pacific unmanned surface vehicle (USV) market is segmented into propulsion, chassis material, payload, component, software, and communication.

Hull Type

- Catamaran (Twin Hulls)

- Kayak (Single Hull)

- Trimaran (Triple Hulls)

- Rigid Inflatable Hull

On the basis of hull type, the Asia-Pacific unmanned surface vehicle (USV) market is segmented into catamaran (twin hulls), kayak (single hull), trimaran (triple hulls), and rigid inflatable hull.

Size

- Medium (4 to 8 M)

- Small (Less than 4 M)

- Large (8 to 12 M)

- Extra-Large (Above 12 M)

On the basis of size, the Asia-Pacific unmanned surface vehicle (USV) market is segmented into medium (4 to 8 m), small (less than 4 m), large (8 to 12 m), and extra-large (above 12 m).

Asia-Pacific Unmanned Surface Vehicle (USV) Market Regional Analysis/Insights

The Asia-Pacific unmanned surface vehicle (USV) market is analyzed, and market size insights and trends are provided by country, type, application, endurance, operation, system, hull type, and size as referenced above.

The countries covered in the unmanned surface vehicle (USV) market report are China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, rest of Asia-Pacific.

In 2023, China is expected to dominate the Asia-Pacific region due to increasing demand for large USVs for commercial and defense applications such as combat operations, cargo transportation, and others.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like downstream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Asia-Pacific Unmanned Surface Vehicle (USV) Market Share Analysis

Asia-Pacific unmanned surface vehicle (USV) market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Asia-Pacific presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus related to the unmanned surface vehicle (USV) market.

Some of the major players operating in the Asia-Pacific unmanned surface vehicle (USV) market are Elbit Systems Ltd., Rafael Advanced Defense Systems Ltd., Boeing, Saildrone, Inc., Deep Ocean Engineering, Inc., Zhuhai Yunzhou Intelligent Technology Co., Ltd., KONGSBERG, L3Harris Tecnologies, Inc., OCIUS, ATLAS ELEKTRONIK GmbH, Clearpath Robotics Inc., Teledyne Technologies Incorporated, Textron Inc., ECA GROUP, and iXblue SAS among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC UNMANNED SURFACE VEHICLE (USV) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 MARKET APPLICATION COVERAGE GRID

2.1 TYPE TIMELINE CURVE

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING DEMAND FOR UNMANNED VEHICLES FOR CLEANING OCEAN

5.1.2 INCREASING ASYMMETRIC THREATS AND USE OF UNMANNED SURFACE VEHICLES (USV) IN DEFENSE

5.1.3 INCREASING USE OF UNMANNED SURFACE VEHICLES (USV) IN COMMERCIAL EXPLORATION

5.1.4 INCREASING USE OF UNMANNED SURFACE VEHICLE (USV) FOR OCEANOGRAPHY

5.2 RESTRAINTS

5.2.1 AVAILABILITY OF UNMANNED UNDERWATER VEHICLE (UUV) AS AN ALTERNATIVE

5.2.2 LACK OF COLLISION DETECTION CAPABILITY OF UNMANNED SURFACE VEHICLE (USV)

5.3 OPPORTUNITIES

5.3.1 GROWING DEMAND FOR USV FOR DISASTER MANAGEMENT

5.3.2 APPLICATION IN TERRITORIAL AND PROTECTED WATERS

5.3.3 INCREASING INVESTMENTS BY GOVERNMENTS AND PRIVATE PLAYERS

5.3.4 REAL TIME MONITORING OF AQUACULTURE ENVIRONMENTS

5.4 CHALLENGES

5.4.1 DECREASING NAVY BUDGET OF VARIOUS COUNTRIES

6 ASIA PACIFIC UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE

6.1 OVERVIEW

6.2 SURFACE

6.3 SUB-SURFACE

7 ASIA PACIFIC UNMANNED SURFACE VEHICLE (USV) MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 DEFENSE

7.2.1 TYPE

7.2.1.1 SURFACE

7.2.1.2 SUB-SURFACE

7.3 COMMERCIAL

7.3.1 BY PURPOSE

7.3.1.1 OCEANOGRAPHY AND ENVIRONMENTAL SCIENCES

7.3.1.2 OIL AND GAS

7.3.1.3 EXPLORATION

7.3.2 BY TYPE

7.3.2.1 SURFACE

7.3.2.2 SUB-SURFACE

7.4 SCIENTIFIC RESEARCH

7.4.1 TYPE

7.4.1.1 SURFACE

7.4.1.2 SUB-SURFACE

7.5 OTHERS

8 ASIA PACIFIC UNMANNED SURFACE VEHICLE (USV) MARKET, BY ENDURANCE

8.1 OVERVIEW

8.2 100-500 HOURS

8.3 <100 HOURS

8.4 500-1000 HOURS

8.5 >1000 HOURS

9 ASIA PACIFIC UNMANNED SURFACE VEHICLE (USV) MARKET, BY OPERATION

9.1 OVERVIEW

9.2 REMOTE OPERATED SURFACE VEHICLE

9.3 AUTONOMOUS SURFACE VEHICLE

10 ASIA PACIFIC UNMANNED SURFACE VEHICLE (USV) MARKET, BY SYSTEM

10.1 OVERVIEW

10.2 PROPULSION

10.3 CHASSIS MATERIAL

10.4 PAYLOAD

10.5 COMPONENT

10.6 SOFTWARE

10.7 COMMUNICATION

11 ASIA PACIFIC UNMANNED SURFACE VEHICLE (USV) MARKET, BY HULL TYPE

11.1 OVERVIEW

11.2 CATAMARAN (TWIN HULLS)

11.3 KAYAK (SINGLE HULL)

11.4 TRIMARAN (TRIPLE HULLS)

11.5 RIGID INFLATABLE HULL

12 ASIA PACIFIC UNMANNED SURFACE VEHICLE (USV) MARKET, BY SIZE

12.1 OVERVIEW

12.2 MEDIUM (4 TO 8 M)

12.3 SMALL (LESS THAN 4 M)

12.4 LARGE (8 TO 12 M)

12.5 EXTRA LARGE (ABOVE 12 M)

13 ASIA PACIFIC UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION

13.1 ASIA-PACIFIC

13.1.1 CHINA

13.1.2 JAPAN

13.1.3 INDIA

13.1.4 SOUTH KOREA

13.1.5 AUSTRALIA

13.1.6 SINGAPORE

13.1.7 THAILAND

13.1.8 MALAYSIA

13.1.9 INDONESIA

13.1.10 PHILIPPINES

13.1.11 REST OF ASIA-PACIFIC

14 ASIA PACIFIC UNMANNED SURFACE VEHICLE (USV) MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 L3HARRIS TECHNOLOGIES, INC.

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 BOEING

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENT

16.3 RAFAEL ADVANCED DEFENSE SYSTEMS LTD.

16.3.1 COMPANY SNAPSHOT

16.3.2 COMPANY SHARE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENTS

16.4 KONGSBERG

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 TEXTRON, INC.

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENT

16.6 5G MARINE

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 ATLAS ELEKTRONIK GMBH

16.7.1 COMPANY SNAPSHOT

16.7.2 SOLUTION PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 CLEARPATH ROBOTICS INC.

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 DEEP OCEAN ENGINEERING, INC.

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 ECA GROUP

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 ELBIT SYSTEMS LTD.

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENTS

16.12 IXBLUE SAS

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 MARITIME ROBOTICS AS

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 OCIUS

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 SAILDRONE, INC.

16.15.1 COMPANY SNAPSHOT

16.15.2 TECHNOLOGY PORTFOLIO

16.15.3 RECENT DEVELOPMENTS

16.16 SEAFLOOR SYSTEMS, INC.

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 SEAROBOTICS CORPORATION

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 TELEDYNE TECHNOLOGIES INCORPORATED

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT DEVELOPMENTS

16.19 ZHUHAI YUNZHOU INTELLIGENT TECHNOLOGY CO., LTD.

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 ASIA PACIFIC UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 2 ASIA PACIFIC SURFACE IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 3 ASIA PACIFIC SUB-SURFACE IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 4 ASIA PACIFIC UNMANNED SURFACE VEHICLE (USV) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 5 ASIA PACIFIC DEFENSE IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 ASIA PACIFIC DEFENSE IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 7 ASIA PACIFIC COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 8 ASIA PACIFIC COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY PURPOSE, 2021-2030 (USD MILLION)

TABLE 9 ASIA PACIFIC COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 10 ASIA PACIFIC SCIENTIFIC RESEARCH IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 11 ASIA PACIFIC SCIENTIFIC RESEARCH IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 12 ASIA PACIFIC OTHERS IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 13 ASIA PACIFIC UNMANNED SURFACE VEHICLE (USV) MARKET, BY ENDURANCE, 2021-2030 (USD MILLION)

TABLE 14 ASIA PACIFIC 100-500 HOURS IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 15 ASIA PACIFIC <100 HOURS IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 ASIA PACIFIC 500-1000 HOURS IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 ASIA PACIFIC >1000 HOURS IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 ASIA PACIFIC UNMANNED SURFACE VEHICLE (USV) MARKET, BY OPERATION, 2021-2030 (USD MILLION)

TABLE 19 ASIA PACIFIC REMOTE OPERATED SURFACE VEHICLE IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 ASIA PACIFIC AUTONOMOUS SURFACE VEHICLE IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 21 ASIA PACIFIC UNMANNED SURFACE VEHICLE (USV) MARKET, BY SYSTEM, 2021-2030 (USD MILLION)

TABLE 22 ASIA PACIFIC PROPULSION IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 23 ASIA PACIFIC CHASSIS MATERIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 ASIA PACIFIC PAYLOAD IN UNMANNED SURFACE VEHICLES (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 25 ASIA PACIFIC COMPONENT IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 26 ASIA PACIFIC SOFTWARE IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 27 ASIA PACIFIC COMMUNICATION IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 ASIA PACIFIC UNMANNED SURFACE VEHICLE (USV) MARKET, BY HULL TYPE, 2021-2030 (USD MILLION)

TABLE 29 ASIA PACIFIC CATAMARAN (TWIN HULLS) IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 30 ASIA PACIFIC KAYAK (SINGLE HULL) IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 31 ASIA PACIFIC TRIMARAN (TRIPLE HULLS) IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 32 ASIA PACIFIC RIGID INFLATABLE HULL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 33 ASIA PACIFIC UNMANNED SURFACE VEHICLE (USV) MARKET, BY SIZE, 2021-2030 (USD MILLION)

TABLE 34 ASIA PACIFIC MEDIUM (4 TO 8 M) SEGMENT IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 35 ASIA PACIFIC SMALL (LESS THAN 4 M) IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 36 ASIA PACIFIC LARGE (8 TO 12 M) IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 37 ASIA PACIFIC EXTRA LARGE (ABOVE 12 M) IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 38 ASIA-PACIFIC UNDERWATER UNMANNED VEHICLE MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 39 ASIA PACIFIC UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 40 ASIA PACIFIC UNMANNED SURFACE VEHICLE (USV) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 41 ASIA PACIFIC DEFENSE IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 42 ASIA PACIFIC COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY PURPOSE, 2021-2030 (USD MILLION)

TABLE 43 ASIA PACIFIC COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 44 ASIA PACIFIC SCIENTIFIC RESEARCH IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 45 ASIA PACIFIC UNMANNED SURFACE VEHICLE (USV) MARKET, BY ENDURANCE, 2021-2030 (USD MILLION)

TABLE 46 ASIA PACIFIC UNMANNED SURFACE VEHICLE (USV) MARKET, BY OPERATION, 2021-2030 (USD MILLION)

TABLE 47 ASIA PACIFIC UNMANNED SURFACE VEHICLE (USV) MARKET, BY SYSTEM, 2021-2030 (USD MILLION)

TABLE 48 ASIA PACIFIC UNMANNED SURFACE VEHICLE (USV) MARKET, BY HULL TYPE, 2021-2030 (USD MILLION)

TABLE 49 ASIA PACIFIC UNMANNED SURFACE VEHICLE (USV) MARKET, BY SIZE (LENGTH IN METERS), 2021-2030 (USD MILLION)

TABLE 50 CHINA UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 51 CHINA UNMANNED SURFACE VEHICLE (USV) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 52 CHINA DEFENSE IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 53 CHINA COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY PURPOSE, 2021-2030 (USD MILLION)

TABLE 54 CHINA COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 55 CHINA SCIENTIFIC RESEARCH IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 56 CHINA UNMANNED SURFACE VEHICLE (USV) MARKET, BY ENDURANCE, 2021-2030 (USD MILLION)

TABLE 57 CHINA UNMANNED SURFACE VEHICLE (USV) MARKET, BY OPERATION, 2021-2030 (USD MILLION)

TABLE 58 CHINA UNMANNED SURFACE VEHICLE (USV) MARKET, BY SYSTEM, 2021-2030 (USD MILLION)

TABLE 59 CHINA UNMANNED SURFACE VEHICLE (USV) MARKET, BY HULL TYPE, 2021-2030 (USD MILLION)

TABLE 60 CHINA UNMANNED SURFACE VEHICLE (USV) MARKET, BY SIZE (LENGTH IN METERS), 2021-2030 (USD MILLION)

TABLE 61 JAPAN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 62 JAPAN UNMANNED SURFACE VEHICLE (USV) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 63 JAPAN DEFENSE IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 64 JAPAN COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY PURPOSE, 2021-2030 (USD MILLION)

TABLE 65 JAPAN COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 66 JAPAN SCIENTIFIC RESEARCH IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 67 JAPAN UNMANNED SURFACE VEHICLE (USV) MARKET, BY ENDURANCE, 2021-2030 (USD MILLION)

TABLE 68 JAPAN UNMANNED SURFACE VEHICLE (USV) MARKET, BY OPERATION, 2021-2030 (USD MILLION)

TABLE 69 JAPAN UNMANNED SURFACE VEHICLE (USV) MARKET, BY SYSTEM, 2021-2030 (USD MILLION)

TABLE 70 JAPAN UNMANNED SURFACE VEHICLE (USV) MARKET, BY HULL TYPE, 2021-2030 (USD MILLION)

TABLE 71 JAPAN UNMANNED SURFACE VEHICLE (USV) MARKET, BY SIZE (LENGTH IN METERS), 2021-2030 (USD MILLION)

TABLE 72 INDIA UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 73 INDIA UNMANNED SURFACE VEHICLE (USV) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 74 INDIA DEFENSE IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 75 INDIA COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY PURPOSE, 2021-2030 (USD MILLION)

TABLE 76 INDIA COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 77 INDIA SCIENTIFIC RESEARCH IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 78 INDIA UNMANNED SURFACE VEHICLE (USV) MARKET, BY ENDURANCE, 2021-2030 (USD MILLION)

TABLE 79 INDIA UNMANNED SURFACE VEHICLE (USV) MARKET, BY OPERATION, 2021-2030 (USD MILLION)

TABLE 80 INDIA UNMANNED SURFACE VEHICLE (USV) MARKET, BY SYSTEM, 2021-2030 (USD MILLION)

TABLE 81 INDIA UNMANNED SURFACE VEHICLE (USV) MARKET, BY HULL TYPE, 2021-2030 (USD MILLION)

TABLE 82 INDIA UNMANNED SURFACE VEHICLE (USV) MARKET, BY SIZE (LENGTH IN METERS), 2021-2030 (USD MILLION)

TABLE 83 SOUTH KOREA UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 84 SOUTH KOREA UNMANNED SURFACE VEHICLE (USV) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 85 SOUTH KOREA DEFENSE IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 86 SOUTH KOREA COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY PURPOSE, 2021-2030 (USD MILLION)

TABLE 87 SOUTH KOREA COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 88 SOUTH KOREA SCIENTIFIC RESEARCH IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 89 SOUTH KOREA UNMANNED SURFACE VEHICLE (USV) MARKET, BY ENDURANCE, 2021-2030 (USD MILLION)

TABLE 90 SOUTH KOREA UNMANNED SURFACE VEHICLE (USV) MARKET, BY OPERATION, 2021-2030 (USD MILLION)

TABLE 91 SOUTH KOREA UNMANNED SURFACE VEHICLE (USV) MARKET, BY SYSTEM, 2021-2030 (USD MILLION)

TABLE 92 SOUTH KOREA UNMANNED SURFACE VEHICLE (USV) MARKET, BY HULL TYPE, 2021-2030 (USD MILLION)

TABLE 93 SOUTH KOREA UNMANNED SURFACE VEHICLE (USV) MARKET, BY SIZE (LENGTH IN METERS), 2021-2030 (USD MILLION)

TABLE 94 AUSTRALIA UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 95 AUSTRALIA UNMANNED SURFACE VEHICLE (USV) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 96 AUSTRALIA DEFENSE IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 97 AUSTRALIA COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY PURPOSE, 2021-2030 (USD MILLION)

TABLE 98 AUSTRALIA COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 99 AUSTRALIA SCIENTIFIC RESEARCH IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 100 AUSTRALIA UNMANNED SURFACE VEHICLE (USV) MARKET, BY ENDURANCE, 2021-2030 (USD MILLION)

TABLE 101 AUSTRALIA UNMANNED SURFACE VEHICLE (USV) MARKET, BY OPERATION, 2021-2030 (USD MILLION)

TABLE 102 AUSTRALIA UNMANNED SURFACE VEHICLE (USV) MARKET, BY SYSTEM, 2021-2030 (USD MILLION)

TABLE 103 AUSTRALIA UNMANNED SURFACE VEHICLE (USV) MARKET, BY HULL TYPE, 2021-2030 (USD MILLION)

TABLE 104 AUSTRALIA UNMANNED SURFACE VEHICLE (USV) MARKET, BY SIZE (LENGTH IN METERS), 2021-2030 (USD MILLION)

TABLE 105 SINGAPORE UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 106 SINGAPORE UNMANNED SURFACE VEHICLE (USV) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 107 SINGAPORE DEFENSE IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 108 SINGAPORE COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY PURPOSE, 2021-2030 (USD MILLION)

TABLE 109 SINGAPORE COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 110 SINGAPORE SCIENTIFIC RESEARCH IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 111 SINGAPORE UNMANNED SURFACE VEHICLE (USV) MARKET, BY ENDURANCE, 2021-2030 (USD MILLION)

TABLE 112 SINGAPORE UNMANNED SURFACE VEHICLE (USV) MARKET, BY OPERATION, 2021-2030 (USD MILLION)

TABLE 113 SINGAPORE UNMANNED SURFACE VEHICLE (USV) MARKET, BY SYSTEM, 2021-2030 (USD MILLION)

TABLE 114 SINGAPORE UNMANNED SURFACE VEHICLE (USV) MARKET, BY HULL TYPE, 2021-2030 (USD MILLION)

TABLE 115 SINGAPORE UNMANNED SURFACE VEHICLE (USV) MARKET, BY SIZE (LENGTH IN METERS), 2021-2030 (USD MILLION)

TABLE 116 THAILAND UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 117 THAILAND UNMANNED SURFACE VEHICLE (USV) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 118 THAILAND DEFENSE IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 119 THAILAND COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY PURPOSE, 2021-2030 (USD MILLION)

TABLE 120 THAILAND COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 121 THAILAND SCIENTIFIC RESEARCH IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 122 THAILAND UNMANNED SURFACE VEHICLE (USV) MARKET, BY ENDURANCE, 2021-2030 (USD MILLION)

TABLE 123 THAILAND UNMANNED SURFACE VEHICLE (USV) MARKET, BY OPERATION, 2021-2030 (USD MILLION)

TABLE 124 THAILAND UNMANNED SURFACE VEHICLE (USV) MARKET, BY SYSTEM, 2021-2030 (USD MILLION)

TABLE 125 THAILAND UNMANNED SURFACE VEHICLE (USV) MARKET, BY HULL TYPE, 2021-2030 (USD MILLION)

TABLE 126 THAILAND UNMANNED SURFACE VEHICLE (USV) MARKET, BY SIZE (LENGTH IN METERS), 2021-2030 (USD MILLION)

TABLE 127 MALAYSIA UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 128 MALAYSIA UNMANNED SURFACE VEHICLE (USV) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 129 MALAYSIA DEFENSE IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 130 MALAYSIA COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY PURPOSE, 2021-2030 (USD MILLION)

TABLE 131 MALAYSIA COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 132 MALAYSIA SCIENTIFIC RESEARCH IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 133 MALAYSIA UNMANNED SURFACE VEHICLE (USV) MARKET, BY ENDURANCE, 2021-2030 (USD MILLION)

TABLE 134 MALAYSIA UNMANNED SURFACE VEHICLE (USV) MARKET, BY OPERATION, 2021-2030 (USD MILLION)

TABLE 135 MALAYSIA UNMANNED SURFACE VEHICLE (USV) MARKET, BY SYSTEM, 2021-2030 (USD MILLION)

TABLE 136 MALAYSIA UNMANNED SURFACE VEHICLE (USV) MARKET, BY HULL TYPE, 2021-2030 (USD MILLION)

TABLE 137 MALAYSIA UNMANNED SURFACE VEHICLE (USV) MARKET, BY SIZE (LENGTH IN METERS), 2021-2030 (USD MILLION)

TABLE 138 INDONESIA UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 139 INDONESIA UNMANNED SURFACE VEHICLE (USV) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 140 INDONESIA DEFENSE IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 141 INDONESIA COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY PURPOSE, 2021-2030 (USD MILLION)

TABLE 142 INDONESIA COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 143 INDONESIA SCIENTIFIC RESEARCH IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 144 INDONESIA UNMANNED SURFACE VEHICLE (USV) MARKET, BY ENDURANCE, 2021-2030 (USD MILLION)

TABLE 145 INDONESIA UNMANNED SURFACE VEHICLE (USV) MARKET, BY OPERATION, 2021-2030 (USD MILLION)

TABLE 146 INDONESIA UNMANNED SURFACE VEHICLE (USV) MARKET, BY SYSTEM, 2021-2030 (USD MILLION)

TABLE 147 INDONESIA UNMANNED SURFACE VEHICLE (USV) MARKET, BY HULL TYPE, 2021-2030 (USD MILLION)

TABLE 148 INDONESIA UNMANNED SURFACE VEHICLE (USV) MARKET, BY SIZE (LENGTH IN METERS), 2021-2030 (USD MILLION)

TABLE 149 PHILIPPINES UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 150 PHILIPPINES UNMANNED SURFACE VEHICLE (USV) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 151 PHILIPPINES DEFENSE IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 152 PHILIPPINES COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY PURPOSE, 2021-2030 (USD MILLION)

TABLE 153 PHILIPPINES COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 154 PHILIPPINES SCIENTIFIC RESEARCH IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 155 PHILIPPINES UNMANNED SURFACE VEHICLE (USV) MARKET, BY ENDURANCE, 2021-2030 (USD MILLION)

TABLE 156 PHILIPPINES UNMANNED SURFACE VEHICLE (USV) MARKET, BY OPERATION, 2021-2030 (USD MILLION)

TABLE 157 PHILIPPINES UNMANNED SURFACE VEHICLE (USV) MARKET, BY SYSTEM, 2021-2030 (USD MILLION)

TABLE 158 PHILIPPINES UNMANNED SURFACE VEHICLE (USV) MARKET, BY HULL TYPE, 2021-2030 (USD MILLION)

TABLE 159 PHILIPPINES UNMANNED SURFACE VEHICLE (USV) MARKET, BY SIZE (LENGTH IN METERS), 2021-2030 (USD MILLION)

TABLE 160 REST OF ASIA PACIFIC UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

List of Figure

FIGURE 1 ASIA PACIFIC UNMANNED SURFACE VEHICLE (USV) MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC UNMANNED SURFACE VEHICLE (USV) MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC UNMANNED SURFACE VEHICLE (USV) MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC UNMANNED SURFACE VEHICLE (USV) MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC UNMANNED SURFACE VEHICLE (USV) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC UNMANNED SURFACE VEHICLE (USV) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC UNMANNED SURFACE VEHICLE (USV) MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC UNMANNED SURFACE VEHICLE (USV) MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ASIA PACIFIC UNMANNED SURFACE VEHICLE (USV) MARKET: MULTIVARIATE MODELING

FIGURE 10 ASIA PACIFIC UNMANNED SURFACE VEHICLE (USV) MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 ASIA PACIFIC UNMANNED SURFACE VEHICLE (USV) MARKET: TYPE TIMELINE CURVE

FIGURE 12 ASIA PACIFIC UNMANNED SURFACE VEHICLE (USV) MARKET: SEGMENTATION

FIGURE 13 INCREASING USE OF UNMANNED SURFACE VEHICLES (USV) IN COMMERCIAL EXPLORATION IS EXPECTED TO DRIVE THE ASIA PACIFIC UNMANNED SURFACE VEHICLE (USV) MARKET IN THE FORECAST PERIOD

FIGURE 14 SURFACE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC UNMANNED SURFACE VEHICLE (USV) MARKET IN 2023 & 2030

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC UNMANNED SURFACE VEHICLE (USV) MARKET

FIGURE 16 PLASTICS PRODUCTION ACROSS GLOBE

FIGURE 17 CRUDE OIL PRODUCTION DATA, BY REGION

FIGURE 18 DEFENCE EXPENDITURE ACROSS THE GLOBE

FIGURE 19 ASIA PACIFIC UNMANNED SURFACE VEHICLE (USV) MARKET: BY TYPE, 2022

FIGURE 20 ASIA PACIFIC UNMANNED SURFACE VEHICLE (USV) MARKET: BY APPLICATION, 2022

FIGURE 21 ASIA PACIFIC UNMANNED SURFACE VEHICLE (USV) MARKET: BY ENDURANCE, 2022

FIGURE 22 ASIA PACIFIC UNMANNED SURFACE VEHICLE (USV) MARKET: BY OPERATION, 2022

FIGURE 23 ASIA PACIFIC UNMANNED SURFACE VEHICLE (USV) MARKET: BY SYSTEM, 2022

FIGURE 24 ASIA PACIFIC UNMANNED SURFACE VEHICLE (USV) MARKET: BY HULL TYPE, 2022

FIGURE 25 ASIA PACIFIC UNMANNED SURFACE VEHICLE (USV) MARKET: BY SIZE, 2022

FIGURE 26 ASIA-PACIFIC UNMANNED SURFACE VEHICLE (USV) MARKET: SNAPSHOT (2022)

FIGURE 27 ASIA-PACIFIC UNMANNED SURFACE VEHICLE (USV) MARKET: BY COUNTRY (2022)

FIGURE 28 ASIA-PACIFIC UNMANNED SURFACE VEHICLE (USV) MARKET: BY COUNTRY (2023 & 2030)

FIGURE 29 ASIA-PACIFIC UNMANNED SURFACE VEHICLE (USV) MARKET: BY COUNTRY (2022 & 2030)

FIGURE 30 ASIA-PACIFIC UNMANNED SURFACE VEHICLE (USV) MARKET: BY TYPE (2023-2030)

FIGURE 31 ASIA PACIFIC UNMANNED SURFACE VEHICLE (USV) MARKET: COMPANY SHARE 2022 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.