Market Analysis and Size

Torque vectoring solutions are most important and crucial systems which ensure safety and help in improving the car’s performance. These systems basically provide or distribute torque between the wheels which allows the vehicle to effectively turn over a bend or curve. Torque vectoring is a holistic, predictive approach to vehicle dynamics using a combination of hardware and electronic systems. The Global torque vectoring market is growing rapidly due to emergence of EVS & and its torque vectoring system. The companies are even launching new products to gain a larger market share.

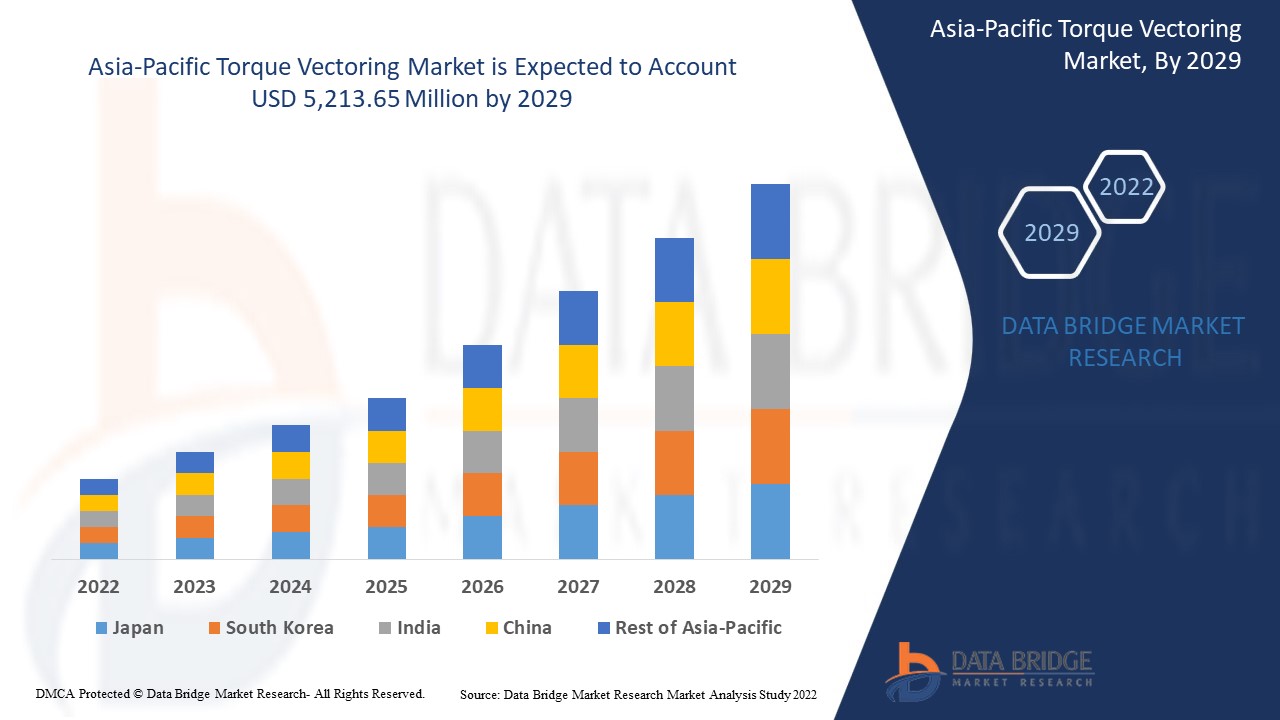

Data Bridge Market Research analyses that the Torque vectoring market is expected to reach the value of USD 5,213.65 million by 2029. "Hardware" accounts for the most prominent component segment. The torque vectoring market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Year |

2020 |

|

Quantitative Units |

USD Million |

|

Segments Covered |

By Component (Hardware and Services), Technology (Active Torque Vectoring Systems (ATVS) and Passive Torque Vectoring Systems (PTVS)), Clutch Actuation Type (Electric and Hydraulic), Driving Wheel Type (Front-Wheel Drive (FWD), All-Wheel Drive/Four-Wheel Drive (AWD/4WD) and Rear-Wheel Drive (RWD)), Vehicle Type (Passenger Cars, Commercial Vehicles and Off Road Vehicle), Propulsion Type(Diesel/Petrol/CNG and Electric Vehicle) |

|

Countries Covered |

China, Japan, South Korea, Australia and New Zealand, India, Singapore, Malaysia, Thailand, Indonesia, Taiwan, Vietnam, Philippines and Rest of Asia-Pacific |

|

Market Players Covered |

BorgWarner Inc., Eaton, American Axle & Manufacturing, Inc., Dana Limited, JTEKT Corporation, Magna International Inc., Robert Bosch GmbH, UNIVANCE CORPORATION, Protean,, Continental AG, Modelon, GKN Automotive Limited, MITSUBISHI MOTORS CORPORATION, Haldex, Schaeffler AG, THE TIMKEN COMPANY, Linamar Corporation, Ricardo, ZF Friedrichshafen AG among others |

Market Definition

Torque vectoring solutions are most important and crucial systems which ensures safety and helps in improving the car’s performance. These systems basically provide or distributes torque between the wheels which allows the vehicle to effectively turn over a bend or curve. Torque vectoring is a holistic, predictive approach to vehicle dynamics using a combination of hardware and electronic systems. It provides the most suitable distribution of torque to a wheel at any point based on the driver’s intentions and the driving conditions. There basically two types which are prominently used, one brake-based torque vectoring and the other one is electric-based torque vectoring.

Torque Vectoring Market Dynamics

This section deals with understanding the market drivers, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

- Increase in Population & Rapid Urbanization

Over a decade, industrialization and urbanization have played a significant role in the emergence and growth of the automotive industry. The growing global population and the majority of the population shifting towards urban areas for a better opportunity and better living standards plays a vital role in shaping the automotive industry sector.

- Emergence of EVS & and its Torque Vectoring System

The automotive industry has shown enormous growth due to the rising demand for luxurious electric vehicles. All-electric vehicles (E.V.s) are called battery electric vehicles that use a battery to store the electrical energy that powers the vehicles. Some of the factors driving the sales of electric vehicles include stringent government regulations towards vehicle emissions and increasing demand for fuel-efficient, high performance, and low emission vehicles. This adds to the adoption of electric vehicles as all-electric vehicles as zero-emission, which effectively minimizes carbon emission.

- Intelligent Torque Vectoring Approach for ADAS Vehicles

Advanced driver-assistance systems (ADAS) are electronic systems implanted in automobiles to assist driving vehicles or self-driving cars. This system uses sensors such as radars and cameras for analysis and takes automatic action based on the vehicle's surroundings. This system implemented in automobiles enables the enhancement of safety systems in terms of driving by avoiding collisions, adopting cruise control, anti-locking of brakes, automation in lighting, pedestrian crash avoidance mitigation (PCAM), and many others.

- Upsurge In Demand for Luxury And Performance Vehicles

A luxury smart connected vehicle can connect over a wireless network to nearby devices with advanced luxury features such as higher-quality interior materials, engines, transmissions, sound systems, telematics, and safety features. These vehicles have features that aren't available on lower-priced models of vehicles.

Restraints/Challenges

- High Cost Associated With Implementing Torque Vectoring/AWD/4WD Systems

Torque vectoring solutions are the most crucial systems which ensure safety and help in improving the car's performance. These systems distribute torque between the wheels, allowing the vehicle to bend or curve effectively. Two types are prominently used brake-based torque vectoring and the other is electric-based torque vectoring. Pricing of both the system are different Electron-based torque vectoring is slightly more expensive than the other with a difference of USD 1,000 to USD 2,000, due to the usage of more electronic components and electromagnetic principle.

- High Carbon Footprint of The Automotive Sector

A carbon footprint is the total amount of greenhouse gases (including carbon dioxide and methane) generated by a system or a process that drastically affects the environment. Climate change and sustainability have become important factors that play a growing role in business management. Worldwide there is more and more pressure on companies to limit their greenhouse gas emissions and take action to become more environmentally friendly.

Post COVID-19 Impact on Torque Vectoring Market

COVID-19 created a major impact on the torque vectoring market as almost every country has opted for the shutdown for every production facility except the ones dealing in producing the essential goods. The government has taken some strict actions such as the shutdown of production and sale of non-essential goods, blocked international trade, and many more to prevent the spread of COVID-19. The only business which is dealing in this pandemic situation is the essential services that are allowed to open and run the processes.

The growth of the torque vectoring market is rising due to the government policies to boost international trade post COVID. Also the benefits offered by Torque Vectoring market for fishing market and seafood demand is rising the demand for Torque Vectoring market in the market. However, factors such as congestion associated with trade routes and trade restrictions between some nations are restraining the market growth. The shutdown of production facilities during the pandemic situation has had a significant impact on the market.

Manufacturers are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple research and development activities to improve the technology involved in the torque vectoring market. With this, the companies will bring advanced and accurate solutions to the market. In addition, the government initiatives to boost international trade has led to the market's growth.

Recent Development

- In October 2021, MITSUBISHI MOTORS CORPORATION launched advanced electric torque vectoring systems for Outlander crossover SUV. All-wheel control technologies included for the vehicle will help the vehicle to be stable, offer better control and operational. This allowed the company to expand its torque vectoring systems offering, capabilities and portfolio across all regions.

Asia-Pacific Torque Vectoring Market Scope

Torque vectoring market is segmented on the basis of component, technology, clutch actuation type, driving wheel type, vehicle type and propulsion type. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

By Component

- Hardware

- Services

On the basis of system, the Asia-Pacific torque vectoring market is segmented into Hardware and services.

By Technology

- Active Torque Vectoring Systems (ATVS)

- Passive Torque Vectoring Systems (PTVS)

On the basis of technology, the Asia-Pacific torque vectoring market has been segmented into Active Torque Vectoring Systems (ATVS) and Passive Torque Vectoring Systems (PTVS).

By Clutch Actuation Type

- Electric

- Hydraulic

On the basis of clutch actuation type, the Asia-Pacific torque vectoring market has been segmented into electric, and hydraulic.

By Driving Wheel Type

- Front-Wheel Drive (FWD)

- All-Wheel Drive/Four-Wheel Drive (AWD/4WD)

- Rear-Wheel Drive (RWD)

On the basis of driving wheel type, the Asia-Pacific torque vectoring market has been segmented into Front-Wheel Drive (FWD), All-Wheel Drive/Four-Wheel Drive (AWD/4WD), and Rear-Wheel Drive (RWD).

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Off Road Vehicle

On the basis of vehicle type, the Asia-Pacific torque vectoring market has been segmented into passenger cars, commercial vehicles, and off road vehicle.

By Propulsion Type

- Diesel/Petrol/CNG

- Electric Vehicle

On the basis of propulsion type, the Asia-Pacific torque vectoring market has been segmented into diesel/petrol/CNG, and electric vehicle.

Torque Vectoring Market Regional Analysis/Insights

The torque vectoring market is analysed and market size insights and trends are provided by country, component, technology, clutch actuation type, driving wheel type, vehicle type and propulsion type as referenced above.

The countries covered in the torque vectoring market report are China, Japan, South Korea, Australia and New Zealand, India, Singapore, Malaysia, Thailand, Indonesia, Taiwan, Vietnam, Philippines and Rest of Asia-Pacific.

China dominates the Asia-Pacific torque vectoring market. China is likely to be the fastest-growing Asia-Pacific torque vectoring market. The rising infrastructure, commercial, and industrial developments in emerging countries such as China and Japan are credited with the market's dominance. China dominates the Asia-Pacific region due to the high manufacturing and outsourced manufacturing capacities of major companies leading to exports from the region.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Torque Vectoring Market Share Analysis

The torque vectoring market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Asia-Pacific presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to torque vectoring market.

Some of the major players operating in the Torque Vectoring market areBorgWarner Inc., Eaton, American Axle & Manufacturing, Inc., Dana Limited, JTEKT Corporation, Magna International Inc., Robert Bosch GmbH, UNIVANCE CORPORATION, Protean,, Continental AG, Modelon, GKN Automotive Limited, MITSUBISHI MOTORS CORPORATION, Haldex, Schaeffler AG, THE TIMKEN COMPANY, Linamar Corporation, Ricardo, ZF Friedrichshafen AG among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC TORQUE VECTORING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMRMARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 COMPONENT TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER FIVE FORCES ANALYSIS

4.2 REGULATORY FRAMEWORK

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN POPULATION & RAPID URBANIZATION

5.1.2 EMERGENCE OF EVS & AND ITS TORQUE VECTORING SYSTEM

5.1.3 INTELLIGENT TORQUE VECTORING APPROACH FOR ADAS VEHICLES

5.1.4 UPSURGE IN DEMAND FOR LUXURY AND PERFORMANCE VEHICLES

5.2 RESTRAINTS

5.2.1 HIGH COST ASSOCIATED WITH IMPLEMENTING TORQUE VECTORING/AWD/4WD SYSTEMS

5.2.2 HIGH CARBON FOOTPRINT OF THE AUTOMOTIVE SECTOR

5.3 OPPORTUNITIES

5.3.1 HEAVING ADOPTION OF TORQUE VECTORING SYSTEM IN OFF-ROAD VEHICLES

5.3.2 GROWING AWARENESS ABOUT ENHANCED SAFETY AND VEHICLE DYNAMICS

5.4 CHALLENGES

5.4.1 HAMPERED SUPPLY OF SEMICONDUCTOR EQUIPMENT LIMITS TORQUE VECTORING SYSTEM

5.4.2 CHANGING AUTOMOTIVE PRODUCT LIFE CYCLE AND LONG PRODUCTION CYCLE OF AUTOMOTIVE VEHICLES

6 ASIA PACIFIC TORQUE VECTORING MARKET, BY COMPONENT

6.1 OVERVIEW

6.2 HARDWARE

6.2.1 DRIVE CONTROL UNIT (DCU)

6.2.2 MOTOR CONTROLLERS

6.2.3 SENSORS

6.2.4 MOTOR

6.2.5 CAN BUS

6.2.6 OTHERS

6.3 SERVICES

7 ASIA PACIFIC TORQUE VECTORING MARKET, BY TECHNOLOGY

7.1 OVERVIEW

7.2 ACTIVE TORQUE VECTORING SYSTEMS (ATVS)

7.3 PASSIVE TORQUE VECTORING SYSTEMS (PTVS)

8 ASIA PACIFIC TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE

8.1 OVERVIEW

8.2 ELECTRIC

8.3 HYDRAULIC

9 ASIA PACIFIC TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE

9.1 OVERVIEW

9.2 FRONT-WHEEL DRIVE (FWD)

9.3 ALL-WHEEL DRIVE/FOUR-WHEEL DRIVE (AWD/4WD)

9.4 REAR-WHEEL DRIVE (RWD)

10 ASIA PACIFIC TORQUE VECTORING MARKET, BY VEHICLE TYPE

10.1 OVERVIEW

10.2 PASSENGER CARS

10.2.1 BY TYPE

10.2.1.1 SEDAN

10.2.1.2 HATCHBACK

10.2.1.3 CROSSOVERS

10.2.1.4 SUV

10.2.1.5 OTHERS

10.2.2 BY TECHNOLOGY

10.2.2.1 ACTIVE TORQUE VECTORING SYSTEMS (ATVS)

10.2.2.2 PASSIVE TORQUE VECTORING SYSTEMS (PTVS)

10.3 COMMERCIAL VEHICLES

10.3.1 BY TYPE

10.3.1.1 LIGHT COMMERCIAL VEHICLE

10.3.1.2 HEAVY COMMERCIAL VEHICLE

10.3.1.2.1 BUS

10.3.1.2.2 TRUCKS

10.3.2 BY TECHNOLOGY

10.3.2.1 ACTIVE TORQUE VECTORING SYSTEMS (ATVS)

10.3.2.2 PASSIVE TORQUE VECTORING SYSTEMS (PTVS)

10.4 OFF ROAD VEHICLE

10.4.1 BY TECHNOLOGY

10.4.1.1 ACTIVE TORQUE VECTORING SYSTEMS (ATVS)

10.4.1.2 PASSIVE TORQUE VECTORING SYSTEMS (PTVS)

11 ASIA PACIFIC TORQUE VECTORING MARKET, BY PROPULSION TYPE

11.1 OVERVIEW

11.2 DIESEL/PETROL/CNG

11.3 ELECTRIC VEHICLE

11.3.1 BATTERY ELECTRIC VEHICLE (BEV)

11.3.2 HYBRID ELECTRIC VEHICLE (HEV)

12 ASIA PACIFIC TORQUE VECTORING MARKET, BY REGION

12.1 ASIA-PACIFIC

12.1.1 CHINA (LEFT HAND DRIVE)

12.1.2 JAPAN (RIGHT HAND DRIVE)

12.1.3 SOUTH KOREA (LEFT HAND DRIVE)

12.1.4 AUSTRALIA AND NEW ZEALAND (RIGHT HAND DRIVE)

12.1.5 INDIA (RIGHT HAND DRIVE)

12.1.6 SINGAPORE (RIGHT HAND DRIVE)

12.1.7 MALAYSIA (RIGHT HAND DRIVE)

12.1.8 THAILAND (RIGHT HAND DRIVE)

12.1.9 INDONESIA (RIGHT HAND DRIVE)

12.1.10 TAIWAN (LEFT HAND DRIVE)

12.1.11 VIETNAM (LEFT HAND DRIVE)

12.1.12 PHILIPPINES (LEFT HAND DRIVE)

12.1.13 REST OF ASIA-PACIFIC

13 ASIA PACIFIC TORQUE VECTORING MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 AMERICAN AXLE & MANUFACTURING, INC.

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY PROFILE

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 CONTINENTAL AG

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 EATON

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 SCHAEFFLER AG

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 JTEKT CORPORATION

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 BORGWARNER INC.

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 DANA LIMITED

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENTS

15.8 DRAKO MOTORS, INC.

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCTS PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 GKN AUTOMOTIVE LIMITED

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCTS PORTFOLIO

15.9.4 RECENT DEVELOPMENTS

15.1 HALDEX

15.10.1 COMPANY SNPASHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENT

15.11 HEWLAND ENGINEERING LTD

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 LINAMAR CORPORATION

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENTS

15.13 MAGNA INTERNATIONAL INC.

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENTS

15.14 MITSUBISHI MOTORS CORPORATION

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCTS PORTFOLIO

15.14.4 RECENT DEVELOPMENT

15.15 MODELON

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENT

15.16 PRODRIVE HOLDINGS LIMITED

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCTS PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 PROTEAN

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 RICARDO

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENTS

15.19 ROBERT BOSCH GMBH

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 PRODUCT PORTFOLIO

15.19.4 RECENT DEVELOPMENT

15.2 THE TIMKEN COMPANY

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

15.21 UNIVANCE CORPORATION

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENT

15.22 ZF FRIEDRICHSHAFEN AG

15.22.1 COMPANY SNAPSHOT

15.22.2 SOLUTION PORTFOLIO

15.22.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 PERFORMANCE TABLE

TABLE 2 CARBON EMISSION LEVEL OF VARIOUS TYPES OF CARS & SUVS

TABLE 3 ASIA PACIFIC TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC HARDWARE IN TORQUE VECTORING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC SERVICES IN TORQUE VECTORING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC ACTIVE TORQUE VECTORING SYSTEMS (ATVS) IN TORQUE VECTORING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC PASSIVE TORQUE VECTORING SYSTEMS (PTVS) IN TORQUE VECTORING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC ELECTRIC IN TORQUE VECTORING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC HYDRAULIC IN TORQUE VECTORING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC FRONT-WHEEL DRIVE (FWD) IN TORQUE VECTORING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC ALL-WHEEL DRIVE/FOUR-WHEEL DRIVE (AWD/4WD) IN TORQUE VECTORING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC REAR-WHEEL DRIVE (RWD) IN TORQUE VECTORING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC PASSENGER CARS IN TORQUE VECTORING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC COMMERCIAL VEHICLES IN TORQUE VECTORING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 25 ASIA PACIFIC OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 ASIA PACIFIC OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 27 ASIA PACIFIC TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 28 ASIA PACIFIC DIESEL/PETROL/CNG IN TORQUE VECTORING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 ASIA PACIFIC ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 ASIA PACIFIC ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 31 ASIA-PACIFIC TORQUE VECTORING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 32 ASIA-PACIFIC (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 33 ASIA-PACIFIC (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 34 ASIA-PACIFIC TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 35 ASIA-PACIFIC HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 ASIA-PACIFIC TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 37 ASIA-PACIFIC TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 38 ASIA-PACIFIC TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 39 ASIA-PACIFIC TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 40 ASIA-PACIFIC PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 ASIA-PACIFIC PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 42 ASIA-PACIFIC COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 ASIA-PACIFIC HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 ASIA-PACIFIC COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 45 ASIA-PACIFIC OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 46 ASIA-PACIFIC TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 47 ASIA-PACIFIC ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 48 CHINA (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 49 CHINA (LEFT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 CHINA (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 51 CHINA (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 52 CHINA (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 53 CHINA (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 54 CHINA (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 CHINA (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 56 CHINA (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 CHINA (LEFT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 CHINA (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 59 CHINA (LEFT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 60 CHINA (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 61 CHINA (LEFT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 62 JAPAN (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 63 JAPAN (RIGHT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 JAPAN (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 65 JAPAN (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 66 JAPAN (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 67 JAPAN (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 68 JAPAN (RIGHT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 JAPAN (RIGHT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 70 JAPAN (RIGHT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 JAPAN (RIGHT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 JAPAN (RIGHT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 73 JAPAN (RIGHT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 74 JAPAN (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 75 JAPAN (RIGHT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 76 SOUTH KOREA (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 77 SOUTH KOREA (LEFT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 SOUTH KOREA (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 79 SOUTH KOREA (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 80 SOUTH KOREA (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 81 SOUTH KOREA (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 82 SOUTH KOREA (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 SOUTH KOREA (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 84 SOUTH KOREA (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 SOUTH KOREA (LEFT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 SOUTH KOREA (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 87 SOUTH KOREA (LEFT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 88 SOUTH KOREA (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 89 SOUTH KOREA (LEFT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 90 AUSTRALIA AND NEW ZEALAND (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 91 AUSTRALIA AND NEW ZEALAND (RIGHT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 92 AUSTRALIA AND NEW ZEALAND (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 93 AUSTRALIA AND NEW ZEALAND (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 94 AUSTRALIA AND NEW ZEALAND (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 95 AUSTRALIA AND NEW ZEALAND (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 96 AUSTRALIA AND NEW ZEALAND (RIGHT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 AUSTRALIA AND NEW ZEALAND (RIGHT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 98 AUSTRALIA AND NEW ZEALAND (RIGHT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 99 AUSTRALIA AND NEW ZEALAND (RIGHT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 AUSTRALIA AND NEW ZEALAND (RIGHT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 101 AUSTRALIA AND NEW ZEALAND (RIGHT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 102 AUSTRALIA AND NEW ZEALAND (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 103 AUSTRALIA AND NEW ZEALAND (RIGHT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 104 INDIA (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 105 INDIA (RIGHT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 INDIA (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 107 INDIA (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 108 INDIA (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 109 INDIA (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 110 INDIA (RIGHT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 INDIA (RIGHT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 112 INDIA (RIGHT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 113 INDIA (RIGHT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 114 INDIA (RIGHT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 115 INDIA (RIGHT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 116 INDIA (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 117 INDIA (RIGHT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 118 SINGAPORE (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 119 SINGAPORE (RIGHT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 SINGAPORE (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 121 SINGAPORE (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 122 SINGAPORE (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 123 SINGAPORE (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 124 SINGAPORE (RIGHT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 125 SINGAPORE (RIGHT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 126 SINGAPORE (RIGHT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 127 SINGAPORE (RIGHT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 128 SINGAPORE (RIGHT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 129 SINGAPORE (RIGHT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 130 SINGAPORE (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 131 SINGAPORE (RIGHT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 132 MALAYSIA (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 133 MALAYSIA (RIGHT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 134 MALAYSIA (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 135 MALAYSIA (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 136 MALAYSIA (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 137 MALAYSIA (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 138 MALAYSIA (RIGHT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 139 MALAYSIA (RIGHT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 140 MALAYSIA (RIGHT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 141 MALAYSIA (RIGHT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 142 MALAYSIA (RIGHT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 143 MALAYSIA (RIGHT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 144 MALAYSIA (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 145 MALAYSIA (RIGHT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 146 THAILAND (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 147 THAILAND (RIGHT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 148 THAILAND (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 149 THAILAND (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 150 THAILAND (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 151 THAILAND (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 152 THAILAND (RIGHT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 153 THAILAND (RIGHT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 154 THAILAND (RIGHT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 155 THAILAND (RIGHT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 156 THAILAND (RIGHT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 157 THAILAND (RIGHT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 158 THAILAND (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 159 THAILAND (RIGHT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 160 INDONESIA (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 161 INDONESIA (RIGHT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 162 INDONESIA (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 163 INDONESIA (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 164 INDONESIA (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 165 INDONESIA (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 166 INDONESIA (RIGHT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 167 INDONESIA (RIGHT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 168 INDONESIA (RIGHT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 169 INDONESIA (RIGHT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 170 INDONESIA (RIGHT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 171 INDONESIA (RIGHT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 172 INDONESIA (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 173 INDONESIA (RIGHT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 174 TAIWAN (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 175 TAIWAN (LEFT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 176 TAIWAN (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 177 TAIWAN (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 178 TAIWAN (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 179 TAIWAN (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 180 TAIWAN (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 181 TAIWAN (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 182 TAIWAN (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 183 TAIWAN (LEFT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 184 TAIWAN (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 185 TAIWAN (LEFT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 186 TAIWAN (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 187 TAIWAN (LEFT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 188 VIETNAM (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 189 VIETNAM (LEFT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 190 VIETNAM (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 191 VIETNAM (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 192 VIETNAM (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 193 VIETNAM (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 194 VIETNAM (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 195 VIETNAM (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 196 VIETNAM (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 197 VIETNAM (LEFT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 198 VIETNAM (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 199 VIETNAM (LEFT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 200 VIETNAM (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 201 VIETNAM (LEFT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 202 PHILIPPINES (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 203 PHILIPPINES (LEFT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 204 PHILIPPINES (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 205 PHILIPPINES (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 206 PHILIPPINES (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 207 PHILIPPINES (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 208 PHILIPPINES (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 209 PHILIPPINES (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 210 PHILIPPINES (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 211 PHILIPPINES (LEFT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 212 PHILIPPINES (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 213 PHILIPPINES (LEFT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 214 PHILIPPINES (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 215 PHILIPPINES (LEFT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 216 REST OF ASIA-PACIFIC TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 ASIA PACIFIC TORQUE VECTORING MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC TORQUE VECTORING MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC TORQUE VECTORING MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC TORQUE VECTORING MARKET: ASIA PACIFIC VS REGIONAL ANALYSIS

FIGURE 5 ASIA PACIFIC TORQUE VECTORING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC TORQUE VECTORING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC TORQUE VECTORING MARKET: DBMRMARKET POSITION GRID

FIGURE 8 ASIA PACIFIC TORQUE VECTORING MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ASIA PACIFIC TORQUE VECTORING MARKET: SEGMENTATION

FIGURE 10 INTELLIGENT TORQUE VECTORING APPROACH FOR ADAS VEHICLES IS EXPECTED TO DRIVE ASIA PACIFIC TORQUE VECTORING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 HARDWARE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF ASIA PACIFIC TORQUE VECTORING MARKET IN 2022 & 2029

FIGURE 12 NORTH AMERICA IS EXPECTED TO DOMINATE AND ASIA-PACIFIC IS THE FASTEST GROWING REGION IN THE ASIA PACIFIC TORQUE VECTORING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC TORQUE VECTORING MARKET

FIGURE 14 PERCENTAGE OF URABANIZATION ACROSS THE GLOBE

FIGURE 15 AVAILABILITY OF ADAS TECHNOLOGY IN NEW VEHICLE MODELS

FIGURE 16 ROAD TRANSPORT EMISSIONS

FIGURE 17 ASIA PACIFIC TORQUE VECTORING MARKET: BY COMPONENT, 2021

FIGURE 18 ASIA PACIFIC TORQUE VECTORING MARKET: BY TECHNOLOGY, 2021

FIGURE 19 ASIA PACIFIC TORQUE VECTORING MARKET: BY CLUTCH ACTUATION TYPE, 2021

FIGURE 20 ASIA PACIFIC TORQUE VECTORING MARKET: BY DRIVING WHEEL TYPE, 2021

FIGURE 21 ASIA PACIFIC TORQUE VECTORING MARKET: BY VEHICLE TYPE, 2021

FIGURE 22 ASIA PACIFIC TORQUE VECTORING MARKET: BY PROPULSION TYPE, 2021

FIGURE 23 ASIA-PACIFIC TORQUE VECTORING MARKET: SNAPSHOT (2021)

FIGURE 24 ASIA-PACIFIC TORQUE VECTORING MARKET: BY COUNTRY (2021)

FIGURE 25 ASIA-PACIFIC TORQUE VECTORING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 26 ASIA-PACIFIC TORQUE VECTORING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 27 ASIA-PACIFIC TORQUE VECTORING MARKET: BY COMPONENT (2022-2029)

FIGURE 28 ASIA PACIFIC TORQUE VECTORING MARKET: COMPANY SHARE 2021 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.