Market Analysis and Insights

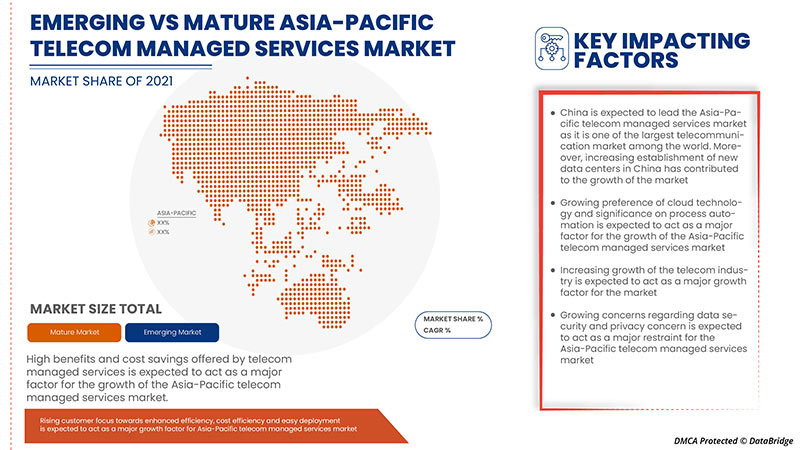

The role of telecom managed services is to assist the organization in inducing focus towards operational efficiency by managing business activities and strategies. The telecom managed services help organizations maintain the IT infrastructure and further provide business-critical service functions. The rising adoption of cloud computing technologies by small and medium-scale enterprises and rising advancement in technology such as mobility services and big data services to improve operational efficiency are the major factors responsible for the growth of the Asia-Pacific telecom managed services market. However, a dearth of skilled professionals or trained personnel may restrain the Asia-Pacific telecom managed services market growth.

Data Bridge Market Research analyses that the Asia-Pacific telecom managed services market is expected to reach the value of USD 14,365.10 million by 2029, at a CAGR of 14.8% during the forecast period. "Managed data center services" accounts for the largest system segment in the telecom managed services market. The telecom managed services market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million, Pricing in USD |

|

Segments Covered |

By Type (Managed Data Center Services, Managed Network Services, Managed Communication and Collaboration Services, Managed Security Services, Managed Mobility Services, and Others), Managed Information Service (MIS) (Business Process Management, Managed Operational Support Systems/Business Support Systems, Project & Portfolio Management, and Others), Deployment Model (On-Premise and Cloud), Organization Size (Large Enterprises and Small and Medium Enterprises (SMES)) |

|

Countries Covered |

China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific |

|

Market Players Covered |

FUJITSU, DXC Technology Company, IBM Corporation, Cognizant, Wipro Limited, Capgemini, Accenture, Tata Consultancy Services Limited, HCL Technologies Limited, NTT DATA Corporation, Verizon, Cisco Systems, Inc., ZTE Corporation, Huawei Technologies Co., Ltd., Telefonaktiebolaget LM Ericsson, AT&T Intellectual Property, Nokia Corporation, Lumen Technologies, RACKSPACE TECHNOLOGY, INC., Comarch SA, Tech Mahindra Limited, Infosys Limited, GTT Communications, Inc., BT, Unisys, among others |

Market Definition

A managed service is the task handled by a third party, frequently in the context of the business it services. Managed services are used to cut expenses, enhance service quality, or free up internal teams to work on duties that are unique to the specific company, and it is a means to delegate general chores to a specialist. A managed service provider is a business that offers these services. A managed services provider is often an IT services provider that manages and assumes responsibility for providing a defined set of services to its clients.

Telecom managed services enable organizations to reduce their costs in business operations, which allows them to concentrate more on essential business exercises and fundamental techniques, cut down dangers related to business operations, and upgrade operational effectiveness and precision.

Asia-Pacific Telecom Managed Services Market Dynamics

- Increasing need for business agility

Business agility has the capability to sustain its maximum potential both its terms of profits and its employees amidst a dynamic external and internal environment. It enables organizations to innovate and deliver more effectively, thus turning market disruption into a competitive advantage while thriving in complex environments.

- Rising customer focus towards enhanced efficiency, cost efficiency, and easy deployment

Managed services are a very cost-effective practice used widely in today's digitization world. It further enables the business owners to reduce the burden of work and concentrate on other core aspects of their operation. Developed countries such as Japan, China, and India always prefer outsourcing their business processes.

- Growing preference for cloud technology and its significance in process automation

Digital technologies have created new opportunities for business leaders. Traditional operations and business process management models are reinventing into more intelligent workflows using automation, artificial intelligence, the internet of things (IoT), the cloud, and other new technologies. Businesses must constantly evolve to more intelligent, fully orchestrated processes that consider clients, employees, suppliers and business partners alike to remain relevant and continue their growth.

- Surging demand for data centers

COVID-19 has led to a high generation of data as people have started working from home, organizations are getting digitally transformed, and organization is adopting various digital technologies. The increasing flow of data needs to be operated and stored, aided by data centers. Thus, a number of data centers are increasing the demand for their management services, which is one of the major factors for the market growth in the forecast period.

Opportunity

-

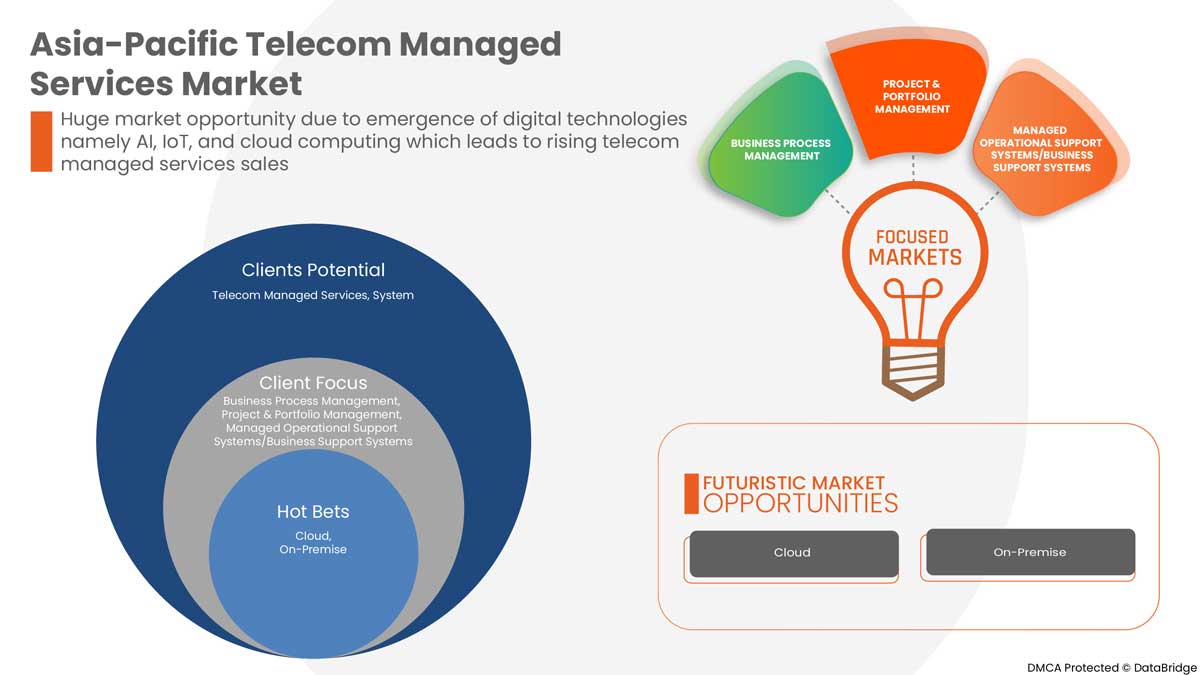

Emergence of digital technologies, namely AI, IoT, and cloud computing

Cloud computing has turned out to be a major driving force for digital transformation across industries. Not only does it provide unparalleled agility, but it also reduces operational and management overheads. Several governments and businesses are starting to leverage this technology and slowly gaining popularity across several verticals. The potential has become so open that the notion of the cloud is limited to only IT functions has completely changed. This is further integrated with other technologies such as artificial intelligence (AI), the internet of things (IoT), and edge computing, among others.

Restraints/Challenges

- Growing concerns regarding data security and privacy concerns

Data security has become more important than ever, leaving many people curious about how companies handle data security. While business process outsourcing is increasing in popularity, many organizations fear working with a third-party company could put their data at risk. In essence, the rising data security concerns due to external hacks and internal security lapses are a major factor that may hinder the growth of the telecom managed services market.

COVID-19 Impact on Asia-Pacific Telecom Managed Services Market

COVID-19 significantly impacted the managed service market as almost every country has opted for the shutdown of corporate facilities. So companies faced issues while operating remotely in the initial phase.

However, the growth of the managed service market post-pandemic period is attributed to the increasing demand for digital skills in underdeveloped economies.

Service providers are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple research and development activities to improve these services' technology. With this, the companies will bring advanced technologies to the market.

Recent Developments

- In September 2021, Huawei Technologies Co., Ltd. announced they had signed an ICT and managed services agreement with Ooredoo Oman. Under this, the company will provide Ooredoo with network performance management services and operations and maintenance. Thus, the company is expanding its client base in the market

- In November 2020, Telefonaktiebolaget LM Ericsson announced they had opened a new managed services center in Turkey. The company will promote high-value engineering and design solutions based on next-generation technologies, including Artificial Intelligence (AI) and Machine Learning. Thus with this, the company will expand its business in the region

Asia-Pacific Telecom Managed Services Market Scope

The Asia-Pacific telecom managed services market is segmented based on type, managed information service (MIS), deployment model, and organization size. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Managed Data Center Services

- Managed Network Services

- Managed Communication And Collaboration Services

- Managed Security Services

- Managed Mobility Services

- Others

On the basis of type, the Asia-Pacific telecom managed services market is segmented into managed data center services, managed network services, managed communication and collaboration services, managed security services, managed mobility services, and others.

Managed Information Service (MIS)

- Business Process Management

- Managed Operational Support Systems/Business Support Systems

- Project & Portfolio Management

- Others

On the basis of managed information service (MIS), the Asia-Pacific telecom managed services market is segmented into business process management, managed operational support systems/business support systems, project & portfolio management, and others.

Deployment Model

- Cloud

- On-Premise

On the basis of deployment model, the Asia-Pacific telecom managed services market has been segmented into on-premise and cloud.

Organization Size

- Large Enterprises

- Small And Medium Enterprises (SMES)

On the basis of organization size, the Asia-Pacific telecom managed services market is segmented into large enterprises and small and medium enterprises (SMES).

Asia-Pacific Telecom Managed Services Market

The Asia-Pacific telecom managed services market is analyzed, and market size insights and trends are provided by country, type, managed information service (MIS), deployment model, and organization size as referenced above.

Asia-Pacific telecom managed services market covers countries such as China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific.

China is expected to dominate the Asia-Pacific telecom managed services market as it is one of the largest telecommunication markets in the world. Also, increasing internet and mobile services and the establishment of new data centers in China, India, Singapore, and Australia have led to the huge growth of the Asia-Pacific telecom managed services market.

The country section of the Asia-Pacific telecom managed services market report also provides individual market impacting factors and domestic regulation changes that impact the market's current and future trends. Data points such as new sales, replacement sales, country demographics, disease epidemiology, and import-export tariffs are some of the significant pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Asia-Pacific Telecom Managed Services Market Share Analysis

Asia-Pacific telecom managed services market competitive landscape provides details of the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, regional presence, production sites and facilities, production capacities, company strengths and weaknesses, solution launch, product width and breadth, application dominance. The above data points are only related to the companies' focus on the Asia-Pacific telecom managed services market.

Some of the major players operating in the Asia-Pacific telecom managed services market are FUJITSU, DXC Technology Company, IBM Corporation, Cognizant, Wipro Limited, Capgemini, Accenture, Tata Consultancy Services Limited, HCL Technologies Limited, NTT DATA Corporation, Verizon, Cisco Systems, Inc., ZTE Corporation, Huawei Technologies Co., Ltd., Telefonaktiebolaget LM Ericsson, AT&T Intellectual Property, Nokia Corporation, Lumen Technologies, RACKSPACE TECHNOLOGY, INC., Comarch SA, Tech Mahindra Limited, Infosys Limited, GTT Communications, Inc., BT, Unisys, among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC TELECOM MANAGED SERVICES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TYPE TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 REGULATORY FRAMEWORK

4.1.1 REGULATIONS FOR U.S.

4.1.2 REGULATIONS FOR U.K.

4.1.3 REGULATIONS FOR SPAIN

4.1.4 REGULATIONS FOR NETHERLANDS

4.1.5 REGULATIONS FOR JAPAN

4.2 PESTEL ANALYSIS

4.2.1 POLITICAL FACTORS:

4.2.2 ECONOMIC FACTORS:

4.2.3 SOCIAL FACTORS:

4.2.4 TECHNOLOGICAL FACTORS:

4.2.5 ENVIRONMENTAL FACTORS:

4.2.6 LEGAL FACTORS:

4.3 PORTERS MODEL

4.4 TECHNOLOGICAL ANALYSIS

4.4.1 BIG DATA AND ANALYTICS

4.4.2 CLOUD COMPUTING

4.4.3 ARTIFICIAL INTELLIGENCE

4.4.4 MACHINE LEARNING

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING NEED FOR BUSINESS AGILITY

5.1.2 RISING CUSTOMER FOCUS TOWARDS ENHANCED COST, EFFICIENCY, AND EASY DEPLOYMENT

5.1.3 GROWING PREFERENCE FOR CLOUD TECHNOLOGY AND ITS SIGNIFICANCE IN PROCESS AUTOMATION

5.1.4 SURGING DEMAND FOR DATA CENTERS

5.1.5 HEIGHTENED DEPENDENCY ON CLOUD IDENTITY AND ACCESS MANAGEMENT SOLUTIONS

5.1.6 RAPID GROWTH IN DIGITALIZATION ACROSS BUSINESS

5.2 RESTRAINT

5.2.1 GROWING DATA SECURITY AND PRIVACY CONCERNS

5.3 OPPORTUNITIES

5.3.1 FOCUS ON MULTI-WORKFLOW SCHEDULING OF BUSINESS

5.3.2 EMERGENCE OF DIGITAL TECHNOLOGIES, NAMELY AI, IOT, AND CLOUD COMPUTING

5.3.3 GROWING DEMAND FOR DIGITAL SKILLS IN UNDERDEVELOPED ECONOMIES

5.3.4 INCREASING GROWTH IN THE TELECOM INDUSTRY

5.4 CHALLENGE

5.4.1 LACK OF SKILLED WORKFORCE AND HIGH ATTRITION RATE

6 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET, BY TYPE

6.1 OVERVIEW

6.2 MANAGED DATA CENTER SERVICES

6.2.1 STORAGE MANAGEMENT

6.2.2 SERVER MANAGEMENT

6.2.3 MANAGED PRINT SERVICES

6.2.4 OTHERS

6.3 MANAGED NETWORK SERVICES

6.3.1 MANAGED WIDE AREA NETWORK

6.3.2 NETWORK MONITORING

6.3.3 MANAGED NETWORK SECURITY

6.3.4 MANAGED LOCAL AREA NETWORK

6.3.5 MANAGED WIRELESS FIDELITY

6.3.6 MANAGED VIRTUAL PRIVATE NETWORK

6.4 MANAGED COMMUNICATION AND COLLABORATION SERVICES

6.4.1 MANAGED VOICE OVER INTERNET PROTOCOL (VOIP)

6.4.2 MANAGED UNIFIED COMMUNICATION AS A SERVICE (UCAAS)

6.4.3 OTHERS

6.5 MANAGED SECURITY SERVICES

6.5.1 MANAGED IDENTITY AND ACCESS MANAGEMENT

6.5.2 MANAGED FIREWALL

6.5.3 MANAGED ANTIVIRUS/ANTIMALWARE

6.5.4 MANAGED INTRUSION DETECTION SYSTEMS/INTRUSION PREVENTION SYSTEMS

6.5.5 MANAGED VULNERABILITY MANAGEMENT

6.5.6 MANAGED UNIFIED THREAT MANAGEMENT

6.5.7 MANAGED RISK AND COMPLIANCE MANAGEMENT

6.5.8 MANAGED ENCRYPTION

6.5.9 MANAGED SECURITY INFORMATION AND EVENT MANAGEMENT

6.5.10 OTHERS

6.6 MANAGED MOBILITY SERVICES

6.6.1 APPLICATION MANAGEMENT

6.6.2 DEVICE LIFE CYCLE MANAGEMENT

6.7 OTHERS

7 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET, BY MANAGED INFORMATION SERVICE (MIS)

7.1 OVERVIEW

7.2 BUSINESS PROCESS MANAGEMENT

7.3 MANAGED OPERATIONAL SUPPORT SYSTEMS/BUSINESS SUPPORT SYSTEMS

7.4 PROJECT & PORTFOLIO MANAGEMENT

7.5 OTHERS

8 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL

8.1 OVERVIEW

8.2 CLOUD

8.3 ON-PREMISE

9 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET, BY ORGANIZATION SIZE

9.1 OVERVIEW

9.2 LARGE ENTERPRISES

9.2.1 CLOUD

9.2.2 ON-PREMISE

9.3 SMALL AND MEDIUM ENTERPRISES (SMES)

9.3.1 CLOUD

9.3.2 ON-PREMISE

10 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET, BY REGION

10.1 ASIA-PACIFIC

10.1.1 CHINA

10.1.2 JAPAN

10.1.3 SOUTH KOREA

10.1.4 INDIA

10.1.5 AUSTRALIA

10.1.6 SINGAPORE

10.1.7 THAILAND

10.1.8 INDONESIA

10.1.9 MALAYSIA

10.1.10 PHILIPPINES

10.1.11 REST OF ASIA-PACIFIC

11 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 IBM CORPORATION

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 SERVICE PORTFOLIO

13.1.5 RECENT DEVELOPMENTS

13.2 ACCENTURE

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 SERVICE PORTFOLIO

13.2.5 RECENT DEVELOPMENTS

13.3 HUAWEI TECHNOLOGIES CO., LTD.

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENT

13.4 AT&T INTELLECTUAL PROPERTY

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 COMPANY SHARE ANALYSIS

13.4.4 PRODUCT PORTFOLIO

13.4.5 RECENT DEVELOPMENT

13.5 VERIZON

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT DEVELOPMENTS

13.6 TELEFONAKTIEBOLAGET LM ERICSSON

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT DEVELOPMENT

13.7 BT

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 PRODUCT PORTFOLIO

13.7.4 RECENT DEVELOPMENT

13.8 CAPGEMINI

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 SERVICE PORTFOLIO

13.8.4 RECENT DEVELOPMENTS

13.9 CISCO SYSTEMS, INC.

13.9.1 COMPANY SNAPSHOT

13.9.2 REVENUE ANALYSIS

13.9.3 PRODUCT PORTFOLIO

13.9.4 RECENT DEVELOPMENTS

13.1 COGNIZANT

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 SERVICE PORTFOLIO

13.10.4 RECENT DEVELOPMENTS

13.11 COMARCH SA

13.11.1 COMPANY SNAPSHOT

13.11.2 REVENUE ANALYSIS

13.11.3 PRODUCT PORTFOLIO

13.11.4 RECENT DEVELOPMENT

13.12 DXC TECHNOLOGY COMPANY

13.12.1 COMPANY SNAPSHOT

13.12.2 REVENUE ANALYSIS

13.12.3 SERVICE PORTFOLIO

13.12.4 RECENT DEVELOPMENT

13.13 FUJITSU

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT DEVELOPMENT

13.14 GTT COMMUNICATIONS, INC.

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT DEVELOPMENT

13.15 HCL TECHNOLOGIES LIMITED

13.15.1 COMPANY SNAPSHOT

13.15.2 REVENUE ANALYSIS

13.15.3 PRODUCT PORTFOLIO

13.15.4 RECENT DEVELOPMENT

13.16 INFOSYS LIMITED

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENUE ANALYSIS

13.16.3 PRODUCT PORTFOLIO

13.16.4 RECENT DEVELOPMENTS

13.17 LUMEN TECHNOLOGIES

13.17.1 COMPANY SNAPSHOT

13.17.2 REVENUE ANALYSIS

13.17.3 PRODUCT PORTFOLIO

13.17.4 RECENT DEVELOPMENT

13.18 NOKIA CORPORATION

13.18.1 COMPANY SNAPSHOT

13.18.2 REVENUE ANALYSIS

13.18.3 PRODUCT PORTFOLIO

13.18.4 RECENT DEVELOPMENT

13.19 NTT DATA CORPORATION

13.19.1 COMPANY SNAPSHOT

13.19.2 REVENUE ANALYSIS

13.19.3 SERVICES PORTFOLIO

13.19.4 RECENT DEVELOPMENT

13.2 RACKSPACE TECHNOLOGY, INC.

13.20.1 COMPANY SNAPSHOT

13.20.2 REVENUE ANALYSIS

13.20.3 PRODUCT PORTFOLIO

13.20.4 RECENT DEVELOPMENT

13.21 TATA CONSULTANCY SERVICES LIMITED

13.21.1 COMPANY SNAPSHOT

13.21.2 REVENUE ANALYSIS

13.21.3 SERVICE PORTFOLIO

13.21.4 RECENT DEVELOPMENTS

13.22 TECH MAHINDRA LIMITED

13.22.1 COMPANY SNAPSHOT

13.22.2 REVENUE ANALYSIS

13.22.3 PRODUCT PORTFOLIO

13.22.4 RECENT DEVELOPMENTS

13.23 UNISYS

13.23.1 COMPANY SNAPSHOT

13.23.2 REVENUE ANALYSIS

13.23.3 PRODUCT PORTFOLIO

13.23.4 RECENT DEVELOPMENT

13.24 WIPRO LIMITED

13.24.1 COMPANY SNAPSHOT

13.24.2 REVENUE ANALYSIS

13.24.3 PRODUCT PORTFOLIO

13.24.4 RECENT DEVELOPMENTS

13.25 ZTE CORPORATION

13.25.1 COMPANY SNAPSHOT

13.25.2 REVENUE ANALYSIS

13.25.3 PRODUCT PORTFOLIO

13.25.4 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

List of Table

TABLE 1 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 2 ASIA PACIFIC MANAGED DATA CENTER SERVICES IN TELECOM MANAGED SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 ASIA PACIFIC MANAGED DATA CENTER SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC MANAGED NETWORK SERVICES IN TELECOM MANAGED SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC MANAGED NETWORK SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC MANAGED COMMUNICATION AND COLLABORATION SERVICES IN TELECOM MANAGED SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC MANAGED COMMUNICATION AND COLLABORATION SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC MANAGED SECURITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC MANAGED SECURITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC MANAGED MOBILITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC MANAGED MOBILITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC OTHERS IN TELECOM MANAGED SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET, BY MANAGED INFORMATION SERVICE (MIS), 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC BUSINESS PROCESS MANAGEMENT IN TELECOM MANAGED SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC MANAGED OPERATIONAL SUPPORT SYSTEMS/BUSINESS SUPPORT SYSTEMS IN TELECOM MANAGED SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC PROJECT & PORTFOLIO MANAGEMENT IN TELECOM MANAGED SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC OTHERS IN TELECOM MANAGED SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC CLOUD IN TELECOM MANAGED SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC ON-PREMISE IN TELECOM MANAGED SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC LARGE ENTERPRISES IN TELECOM MANAGED SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC LARGE ENTERPRISES IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC SMALL AND MEDIUM ENTERPRISES (SMES) IN TELECOM MANAGED SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 ASIA PACIFIC SMALL AND MEDIUM ENTERPRISES (SMES) IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 26 ASIA-PACIFIC TELECOM MANAGED SERVICES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 27 ASIA-PACIFIC TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 28 ASIA-PACIFIC MANAGED DATA CENTER SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 29 ASIA-PACIFIC MANAGED NETWORK SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 30 ASIA-PACIFIC MANAGED COMMUNICATION AND COLLABORATION SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 31 ASIA-PACIFIC MANAGED SECURITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 32 ASIA-PACIFIC MANAGED MOBILITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 33 ASIA-PACIFIC TELECOM MANAGED SERVICES MARKET, BY MANAGED INFORMATION SERVICE (MIS), 2020-2029 (USD MILLION)

TABLE 34 ASIA-PACIFIC TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 35 ASIA-PACIFIC TELECOM MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 36 ASIA-PACIFIC LARGE ENTERPRISES IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 37 ASIA-PACIFIC SMALL AND MEDIUM ENTERPRISES (SMES) IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 38 CHINA TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 CHINA MANAGED DATA CENTER SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 CHINA MANAGED NETWORK SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 CHINA MANAGED COMMUNICATION AND COLLABORATION SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 CHINA MANAGED SECURITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 CHINA MANAGED MOBILITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 CHINA TELECOM MANAGED SERVICES MARKET, BY MANAGED INFORMATION SERVICE (MIS), 2020-2029 (USD MILLION)

TABLE 45 CHINA TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 46 CHINA TELECOM MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 47 CHINA LARGE ENTERPRISES IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 48 CHINA SMALL AND MEDIUM ENTERPRISES (SMES) IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 49 JAPAN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 JAPAN MANAGED DATA CENTER SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 JAPAN MANAGED NETWORK SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 JAPAN MANAGED COMMUNICATION AND COLLABORATION SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 53 JAPAN MANAGED SECURITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 JAPAN MANAGED MOBILITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 JAPAN TELECOM MANAGED SERVICES MARKET, BY MANAGED INFORMATION SERVICE (MIS), 2020-2029 (USD MILLION)

TABLE 56 JAPAN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 57 JAPAN TELECOM MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 58 JAPAN LARGE ENTERPRISES IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 59 JAPAN SMALL AND MEDIUM ENTERPRISES (SMES) IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 60 SOUTH KOREA TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 SOUTH KOREA MANAGED DATA CENTER SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 SOUTH KOREA MANAGED NETWORK SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 SOUTH KOREA MANAGED COMMUNICATION AND COLLABORATION SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 SOUTH KOREA MANAGED SECURITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 SOUTH KOREA MANAGED MOBILITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 SOUTH KOREA TELECOM MANAGED SERVICES MARKET, BY MANAGED INFORMATION SERVICE (MIS), 2020-2029 (USD MILLION)

TABLE 67 SOUTH KOREA TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 68 SOUTH KOREA TELECOM MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 69 SOUTH KOREA LARGE ENTERPRISES IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 70 SOUTH KOREA SMALL AND MEDIUM ENTERPRISES (SMES) IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 71 INDIA TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 INDIA MANAGED DATA CENTER SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 INDIA MANAGED NETWORK SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 74 INDIA MANAGED COMMUNICATION AND COLLABORATION SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 INDIA MANAGED SECURITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 INDIA MANAGED MOBILITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 INDIA TELECOM MANAGED SERVICES MARKET, BY MANAGED INFORMATION SERVICE (MIS), 2020-2029 (USD MILLION)

TABLE 78 INDIA TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 79 INDIA TELECOM MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 80 INDIA LARGE ENTERPRISES IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 81 INDIA SMALL AND MEDIUM ENTERPRISES (SMES) IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 82 AUSTRALIA TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 AUSTRALIA MANAGED DATA CENTER SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 AUSTRALIA MANAGED NETWORK SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 AUSTRALIA MANAGED COMMUNICATION AND COLLABORATION SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 AUSTRALIA MANAGED SECURITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 AUSTRALIA MANAGED MOBILITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 AUSTRALIA TELECOM MANAGED SERVICES MARKET, BY MANAGED INFORMATION SERVICE (MIS), 2020-2029 (USD MILLION)

TABLE 89 AUSTRALIA TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 90 AUSTRALIA TELECOM MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 91 AUSTRALIA LARGE ENTERPRISES IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 92 AUSTRALIA SMALL AND MEDIUM ENTERPRISES (SMES) IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 93 SINGAPORE TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 94 SINGAPORE MANAGED DATA CENTER SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 95 SINGAPORE MANAGED NETWORK SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 96 SINGAPORE MANAGED COMMUNICATION AND COLLABORATION SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 SINGAPORE MANAGED SECURITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 98 SINGAPORE MANAGED MOBILITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 99 SINGAPORE TELECOM MANAGED SERVICES MARKET, BY MANAGED INFORMATION SERVICE (MIS), 2020-2029 (USD MILLION)

TABLE 100 SINGAPORE TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 101 SINGAPORE TELECOM MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 102 SINGAPORE LARGE ENTERPRISES IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 103 SINGAPORE SMALL AND MEDIUM ENTERPRISES (SMES) IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 104 THAILAND TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 105 THAILAND MANAGED DATA CENTER SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 THAILAND MANAGED NETWORK SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 107 THAILAND MANAGED COMMUNICATION AND COLLABORATION SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 108 THAILAND MANAGED SECURITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 109 THAILAND MANAGED MOBILITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 THAILAND TELECOM MANAGED SERVICES MARKET, BY MANAGED INFORMATION SERVICE (MIS), 2020-2029 (USD MILLION)

TABLE 111 THAILAND TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 112 THAILAND TELECOM MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 113 THAILAND LARGE ENTERPRISES IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 114 THAILAND SMALL AND MEDIUM ENTERPRISES (SMES) IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 115 INDONESIA TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 116 INDONESIA MANAGED DATA CENTER SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 117 INDONESIA MANAGED NETWORK SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 118 INDONESIA MANAGED COMMUNICATION AND COLLABORATION SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 119 INDONESIA MANAGED SECURITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 INDONESIA MANAGED MOBILITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 121 INDONESIA TELECOM MANAGED SERVICES MARKET, BY MANAGED INFORMATION SERVICE (MIS), 2020-2029 (USD MILLION)

TABLE 122 INDONESIA TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 123 INDONESIA TELECOM MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 124 INDONESIA LARGE ENTERPRISES IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 125 INDONESIA SMALL AND MEDIUM ENTERPRISES (SMES) IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 126 MALAYSIA TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 127 MALAYSIA MANAGED DATA CENTER SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 128 MALAYSIA MANAGED NETWORK SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 129 MALAYSIA MANAGED COMMUNICATION AND COLLABORATION SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 130 MALAYSIA MANAGED SECURITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 131 MALAYSIA MANAGED MOBILITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 132 MALAYSIA TELECOM MANAGED SERVICES MARKET, BY MANAGED INFORMATION SERVICE (MIS), 2020-2029 (USD MILLION)

TABLE 133 MALAYSIA TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 134 MALAYSIA TELECOM MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 135 MALAYSIA LARGE ENTERPRISES IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 136 MALAYSIA SMALL AND MEDIUM ENTERPRISES (SMES) IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 137 PHILIPPINES TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 138 PHILIPPINES MANAGED DATA CENTER SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 139 PHILIPPINES MANAGED NETWORK SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 140 PHILIPPINES MANAGED COMMUNICATION AND COLLABORATION SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 141 PHILIPPINES MANAGED SECURITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 142 PHILIPPINES MANAGED MOBILITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 143 PHILIPPINES TELECOM MANAGED SERVICES MARKET, BY MANAGED INFORMATION SERVICE (MIS), 2020-2029 (USD MILLION)

TABLE 144 PHILIPPINES TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 145 PHILIPPINES TELECOM MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 146 PHILIPPINES LARGE ENTERPRISES IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 147 PHILIPPINES SMALL AND MEDIUM ENTERPRISES (SMES) IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 148 REST OF ASIA-PACIFIC TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET: SEGMENTATION

FIGURE 10 RISING CUSTOMER FOCUS TOWARD ENHANCED COST EFFICIENCY AND EASY DEPLOYMENT IS EXPECTED TO DRIVE THE ASIA PACIFIC TELECOM MANAGED SERVICES MARKET IN THE FORECAST PERIOD

FIGURE 11 MANAGED DATA CENTER SERVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF ASIA PACIFIC TELECOM MANAGED SERVICES MARKET IN 2022 & 2029

FIGURE 12 NORTH AMERICA IS EXPECTED TO DOMINATE, AND ASIA-PACIFIC IS THE FASTEST-GROWING REGION IN THE ASIA PACIFIC TELECOM MANAGED SERVICES MARKET IN THE FORECAST PERIOD

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC TELECOM MANAGED SERVICES MARKET

FIGURE 14 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET: BY TYPE, 2021

FIGURE 15 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET: BY MANAGED INFORMATION SERVICE (MIS), 2021

FIGURE 16 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET: BY DEPLOYMENT MODEL, 2021

FIGURE 17 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET: BY ORGANIZATION SIZE, 2021

FIGURE 18 ASIA-PACIFIC TELECOM MANAGED SERVICES MARKET: SNAPSHOT (2021)

FIGURE 19 ASIA-PACIFIC TELECOM MANAGED SERVICES MARKET: BY COUNTRY (2021)

FIGURE 20 ASIA-PACIFIC TELECOM MANAGED SERVICES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 21 ASIA-PACIFIC TELECOM MANAGED SERVICES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 22 ASIA-PACIFIC TELECOM MANAGED SERVICES MARKET: BY TYPE (2022-2029)

FIGURE 23 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET: COMPANY SHARE 2021 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.