Asia Pacific Surgical Power Tools Market

Market Size in USD Million

CAGR :

%

USD

399.50 Million

USD

594.75 Million

2025

2033

USD

399.50 Million

USD

594.75 Million

2025

2033

| 2026 –2033 | |

| USD 399.50 Million | |

| USD 594.75 Million | |

|

|

|

|

Asia-Pacific Surgical Power Tools Market Size

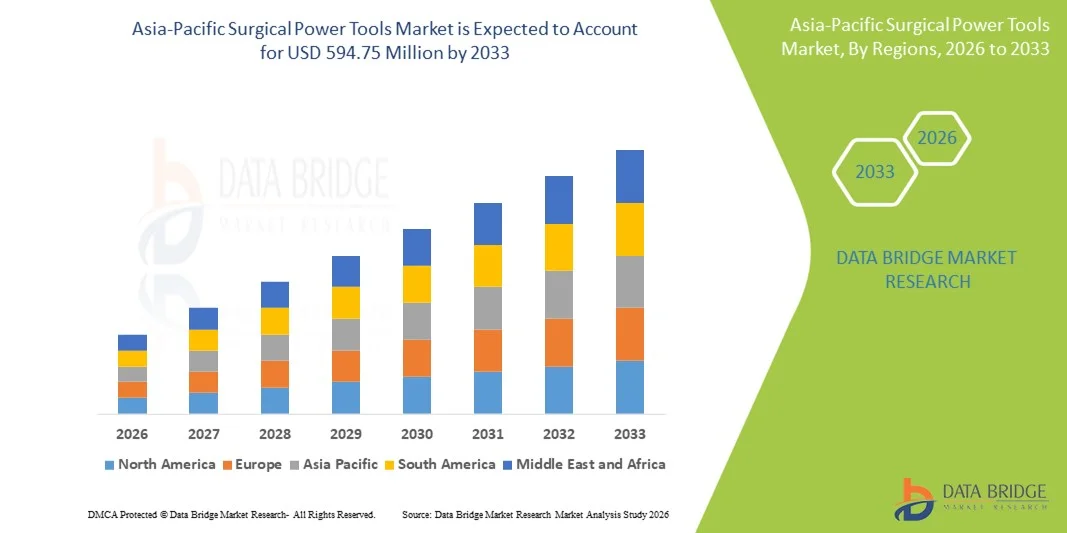

- The Asia-Pacific surgical power tools market size was valued at USD 399.50 million in 2025 and is expected to reach USD 594.75 million by 2033, at a CAGR of 5.10% during the forecast period

- The market growth is largely fueled by the increasing number of orthopedic and neurosurgical procedures in the region, coupled with ongoing advancements in minimally invasive surgical technologies and ergonomic, battery-powered surgical tools

- Furthermore, rising investments in healthcare infrastructure, increasing hospital penetration in emerging economies, and the growing focus on reducing surgery time and enhancing precision are driving the adoption of surgical power tools. These converging factors are accelerating the uptake of surgical power tools, thereby significantly boosting the industry's growth

Asia-Pacific Surgical Power Tools Market Analysis

- Surgical power tools, including drills, saws, and reamers, are increasingly vital components of modern orthopedic, neurosurgical, and maxillofacial procedures in both hospitals and ambulatory surgical centers due to their enhanced precision, efficiency, and ergonomic designs

- The escalating demand for surgical power tools is primarily fueled by the rising number of surgical procedures, growing preference for minimally invasive surgeries, and technological advancements such as cordless, battery-powered, and smart-integrated surgical instruments

- Japan dominated the Asia-Pacific surgical power tools market with the largest revenue share of 28.5% in 2025, characterized by advanced healthcare infrastructure, high adoption of robotic-assisted surgeries, and the presence of leading medical device manufacturers, with Japanese hospitals experiencing substantial growth in orthopedic and spinal procedures driven by innovations in motorized and automated surgical devices

- China is expected to be the fastest growing country in the Asia-Pacific surgical power tools market during the forecast period, due to increasing healthcare investments, expanding hospital networks, rising patient awareness, and growing demand for advanced surgical solutions in both urban and semi-urban centers

- Orthopedic Surgery segment dominated the Asia-Pacific surgical power tools market with a market share of 50% in 2025, driven by the high prevalence of musculoskeletal disorders, trauma cases, and the established reliance on power-assisted tools for joint replacement and fracture fixation procedures

Report Scope and Asia-Pacific Surgical Power Tools Market Segmentation

|

Attributes |

Asia-Pacific Surgical Power Tools Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Asia-Pacific Surgical Power Tools Market Trends

Enhanced Precision Through Ergonomic and Smart Integration

- A significant and accelerating trend in the Asia-Pacific surgical power tools market is the integration of ergonomic designs with smart features such as motorized control, battery-powered operation, and digital monitoring, enhancing precision and efficiency in surgical procedures

- For instance, the Stryker System 8 surgical drill integrates advanced motor control and ergonomic grip design, allowing surgeons to operate with improved accuracy and reduced fatigue during orthopedic procedures

- Smart integration in surgical power tools enables features such as automatic speed adjustment based on bone density, torque feedback, and surgical data tracking. For instance, DePuy Synthes’ Power Tools can provide real-time feedback to optimize drilling and cutting for safer and faster surgeries

- The seamless integration of surgical power tools with hospital IT systems and surgical planning software facilitates centralized monitoring and procedural control. Through a single interface, surgical teams can track tool usage, battery life, and patient-specific parameters, improving workflow efficiency

- This trend towards more intelligent, precise, and ergonomically designed surgical tools is fundamentally reshaping surgeon expectations for operating room efficiency. Consequently, companies such as Zimmer Biomet are developing smart orthopedic drills and saws with features such as torque-sensing feedback and data connectivity

- The demand for surgical power tools with advanced smart integration and ergonomic design is growing rapidly across hospitals and ambulatory surgical centers, as healthcare providers increasingly prioritize surgical precision, reduced operating times, and improved patient outcomes

- Integration of IoT-enabled surgical power tools with cloud-based data platforms is allowing hospitals to analyze usage patterns and optimize equipment allocation, improving overall operational efficiency

Asia-Pacific Surgical Power Tools Market Dynamics

Driver

Increasing Surgical Procedures and Minimally Invasive Surgeries

- The rising number of orthopedic, spinal, and neurosurgical procedures, coupled with the growing preference for minimally invasive surgeries, is a significant driver for the heightened demand for surgical power tools

- For instance, in March 2025, Stryker introduced a new line of battery-powered drills optimized for minimally invasive orthopedic surgeries, aimed at reducing operating time and improving precision

- As hospitals aim to improve procedural efficiency and patient outcomes, surgical power tools offer advanced features such as variable speed control, torque sensing, and ergonomic design, providing a compelling upgrade over manual surgical instruments

- Furthermore, the growing focus on reducing surgery duration and enhancing safety in high-volume hospitals is making surgical power tools an integral component of modern operating rooms, allowing seamless integration with other surgical devices

- The increasing adoption of technologically advanced surgical instruments, along with government initiatives to modernize healthcare infrastructure, is propelling the uptake of surgical power tools across both public and private hospitals in Asia-Pacific

- Growing medical tourism in countries such as India and Thailand is driving demand for high-quality surgical instruments to meet international standards, boosting adoption of advanced surgical power tools

- Rising investments in hospital expansion and renovation projects across Asia-Pacific, especially in urban centers, are creating new opportunities for surgical power tool manufacturers

Restraint/Challenge

High Cost and Maintenance Complexity

- The relatively high initial cost of advanced surgical power tools, along with maintenance and sterilization requirements, poses a significant challenge to broader market adoption, especially in smaller hospitals and clinics

- For instance, high-end systems such as Medtronic’s powered neurosurgical drills require specialized training and routine maintenance, which can be resource-intensive for hospitals with budget constraints

- Addressing these challenges through cost-effective product offerings, simplified maintenance protocols, and training programs is crucial for broader adoption. Companies such as DePuy Synthes and Stryker emphasize modular designs and service packages to reduce operational hurdles

- While prices for some entry-level surgical power tools are decreasing, premium features such as advanced motorized controls, torque feedback, or smart integration still command a higher price, limiting access in cost-sensitive markets

- Overcoming these challenges through affordable solutions, bundled service offerings, and surgeon training initiatives will be vital for sustained market growth and wider adoption in emerging Asia-Pacific healthcare markets

- Limited availability of skilled technicians for maintenance and repair of advanced surgical power tools can delay surgeries and reduce operational efficiency, restricting adoption in smaller hospitals or rural healthcare centers

- Regulatory compliance and varying certification standards across Asia-Pacific countries can create entry barriers for manufacturers, increasing the cost and complexity of market expansion

Asia-Pacific Surgical Power Tools Market Scope

The market is segmented on the basis of product, technology, device type, application, end user, and distribution channel.

- By Product

On the basis of product, the Asia-Pacific surgical power tools market is segmented into handpieces, disposables and accessories. The handpiece segment dominated the market with the largest market revenue share of 52% in 2025, driven by its critical role in performing precise cuts, drills, and bone shaping during orthopedic, neurosurgical, and dental procedures. Hospitals and surgical centers often prioritize high-quality handpieces for their reliability, durability, and compatibility with various surgical power systems. The segment sees strong demand due to continuous technological upgrades, such as ergonomic designs and integration with smart sensors for torque and speed feedback. Moreover, handpieces are reusable, reducing per-procedure costs in high-volume hospitals and supporting sustainable surgical operations. Leading manufacturers continuously focus on handpiece innovation, offering lightweight, motorized, and battery-powered options to meet surgeon expectations.

The disposables and accessories segment is anticipated to witness the fastest growth rate of 19.5% CAGR from 2026 to 2033, fueled by increasing adoption of single-use surgical components to prevent cross-contamination and maintain hygiene standards. Accessories such as drill bits, saw blades, and sterile attachments are in high demand across orthopedic and dental surgeries. The growth is further supported by regulatory emphasis on infection control and hospital policies favoring disposables for critical procedures. Surgeons also prefer accessories that are compatible with multiple tool systems, offering flexibility in diverse surgical setups. Rising surgical volumes and minimally invasive procedures contribute to consistent demand for this segment.

- By Technology

On the basis of technology, the market is segmented into electric-operated power tools, battery-driven power tools, pneumatic power tools, and others. The electric-operated power tools segment dominated the market with the largest market revenue share of 41% in 2025, owing to their high torque output, consistent performance, and suitability for complex orthopedic and spinal surgeries. Hospitals prefer electric tools for their precision and reliability, particularly in high-volume surgical settings. Electric tools also allow better integration with digital monitoring systems and surgical planning software, enabling data tracking and improved outcomes. Surgeons often choose electric tools for procedures requiring continuous, stable power for drilling, cutting, and reaming. The segment benefits from frequent technological enhancements, including noise reduction and ergonomic designs. Leading players are investing in digital feedback features for electric tools to enhance performance and safety.

Battery-driven power tools are expected to witness the fastest CAGR of 22.1% from 2026 to 2033, driven by their portability, ease of use in operating rooms with limited power outlets, and suitability for minimally invasive and outpatient surgeries. The cordless design allows flexibility across multiple operating theaters. Growing adoption in ambulatory surgical centers and small clinics further boosts the segment. Continuous battery technology improvements are increasing operational time, reducing interruptions during procedures. Surgeons prefer battery-driven tools for ergonomic advantages and reduced hand fatigue. The growing trend of hospital mobility solutions also supports the expansion of battery-powered surgical tools.

- By Device Type

On the basis of device type, the market is segmented into large bone power tools, medium bone power tools, small bone power tools, and others. Large bone power tools dominated the market with a share of 47% in 2025, driven by their extensive use in orthopedic surgeries such as joint replacements, fracture fixation, and spinal procedures. These tools offer high torque and robust performance for cutting, drilling, and shaping large bones. Hospitals and surgical centers prefer these tools for major surgeries due to their precision, efficiency, and compatibility with advanced surgical systems. Continuous innovation, including ergonomic handles, vibration reduction, and smart torque sensors, strengthens the demand for large bone tools. Leading manufacturers focus on durability and multi-functionality to cater to complex orthopedic procedures. High adoption in trauma centers and teaching hospitals further reinforces dominance.

Small bone power tools are expected to witness the fastest growth rate of 20.3% CAGR from 2026 to 2033, driven by rising demand in ENT, dental, and pediatric surgeries, where delicate bone structures require precision instruments. The growth is fueled by technological advancements, including miniaturized handpieces, battery operation, and torque-controlled drills. Increasing prevalence of craniofacial disorders, sinus surgeries, and dental implants supports adoption. The segment is also gaining traction due to its compatibility with minimally invasive techniques. Surgeons prefer small bone tools for accuracy and reduced tissue damage. Rising hospital investment in specialized surgical departments boosts demand for small bone devices.

- By Application

On the basis of application, the market is segmented into orthopedic surgery, ENT surgery, neurology surgery, dental surgery, cardiothoracic surgery, and others. Orthopedic surgery dominated the market with the largest share of 50% in 2025, driven by the high incidence of musculoskeletal disorders, trauma cases, and joint replacement procedures across Asia-Pacific countries. Hospitals prioritize surgical power tools for orthopedic applications due to their efficiency in reducing surgery time and improving precision. The segment benefits from frequent technological advancements, including smart torque feedback, motorized drills, and battery-driven handpieces. Growing aging population and sports-related injuries support the demand for orthopedic tools. Leading manufacturers invest in product innovation to improve surgeon control, safety, and patient outcomes. The segment’s dominance is reinforced by the need for high-volume trauma and orthopedic surgery centers in countries such as Japan, China, and India.

ENT surgery is expected to witness the fastest CAGR of 21.4% from 2026 to 2033, driven by rising prevalence of sinus, nasal, and ear disorders requiring minimally invasive procedures. Advanced small bone tools and battery-powered devices enable precision and reduced operating times. Increasing investments in specialized ENT departments and adoption of outpatient procedures further boost demand. The segment is supported by rising awareness of early surgical intervention for ENT conditions. Surgeons prefer compact, ergonomic tools that minimize patient trauma. Growing medical tourism in Asia-Pacific for ENT procedures contributes to rapid adoption.

- By End User

On the basis of end user, the market is segmented into hospitals, ambulatory surgical centers (ASC), clinics, and others. Hospitals dominated the market with a share of 61% in 2025, driven by high surgical volumes, advanced infrastructure, and the need for multi-specialty surgical instruments. Hospitals prefer surgical power tools for efficiency, precision, and integration with operating room management systems. The segment benefits from investments in smart surgical equipment and adoption of minimally invasive procedures. Leading hospitals in Japan, China, and India are major consumers due to high orthopedic and neurosurgical case loads. The availability of trained surgeons and technical staff supports consistent demand. Hospitals also prefer durable, high-performance tools to handle complex surgeries.

Ambulatory surgical centers (ASC) are expected to witness the fastest CAGR of 19.8% from 2026 to 2033, driven by the growing trend of outpatient surgeries and minimally invasive procedures. ASCs prefer battery-driven, portable, and lightweight surgical power tools to support multiple procedures in compact operating rooms. Rising patient preference for outpatient treatment due to cost-effectiveness and convenience supports adoption. ASCs increasingly invest in specialized surgical equipment to attract patients. Compatibility with rapid sterilization protocols and disposables enhances growth. Expanding ASC networks in urban Asia-Pacific markets further accelerate the segment.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tenders and third-party distribution. Direct tenders dominated the market with a share of 56% in 2025, driven by large hospital procurement practices and government contracts. Direct tenders allow hospitals to source high-value surgical power tools directly from manufacturers, ensuring authenticity, service support, and bulk purchase benefits. Leading manufacturers such as Stryker, DePuy Synthes, and Zimmer Biomet actively engage in direct tendering for institutional sales. Hospitals prefer this model for multi-year maintenance contracts and warranty coverage. Government-funded hospitals often rely on tender-based procurement. The segment benefits from long-term partnerships with top manufacturers.

Third-party distribution is expected to witness the fastest CAGR of 20.5% from 2026 to 2033, driven by increasing sales through medical device distributors to small hospitals, clinics, and ASCs. Third-party channels improve reach in tier-2 and tier-3 cities where direct manufacturer presence is limited. Distributors provide flexibility in sourcing, local service support, and smaller purchase quantities. Rising healthcare infrastructure and hospital expansion projects boost demand through this channel. Growing presence of authorized dealers and e-commerce medical platforms supports distribution growth.

Asia-Pacific Surgical Power Tools Market Regional Analysis

- Japan dominated the Asia-Pacific surgical power tools market with the largest revenue share of 28.5% in 2025, characterized by advanced healthcare infrastructure, high adoption of robotic-assisted surgeries, and the presence of leading medical device manufacturers, with Japanese hospitals experiencing substantial growth in orthopedic and spinal procedures driven by innovations in motorized and automated surgical devices

- Hospitals and surgical centers in the country prioritize precision, reliability, and integration with smart surgical systems, resulting in high demand for motorized, battery-driven, and ergonomic surgical power tools

- This widespread adoption is further supported by a highly skilled surgeon workforce, technologically advanced operating rooms, and government initiatives to modernize hospital infrastructure, establishing surgical power tools as a preferred choice for both major hospitals and specialty surgical centers

The Japan Surgical Power Tools Market Insight

The Japan surgical power tools market captured the largest revenue share of 28.5% in 2025, fueled by advanced healthcare infrastructure, high adoption of orthopedic, spinal, and neurosurgical procedures, and the presence of leading medical device manufacturers. Hospitals and surgical centers prioritize precision, reliability, and integration with smart surgical systems, resulting in strong demand for motorized, battery-driven, and ergonomic surgical power tools. The increasing use of minimally invasive procedures and robotic-assisted surgeries is further driving growth. Surgeons benefit from tools offering torque feedback, ergonomic handling, and digital integration for real-time monitoring. Government initiatives to modernize hospitals and operating rooms are also supporting adoption. Japan’s focus on high-quality healthcare outcomes continues to propel market expansion.

China Surgical Power Tools Market Insight

The China surgical power tools market is poised to grow at the fastest CAGR during the forecast period, driven by rising healthcare investments, expanding hospital networks, and increasing surgical volumes across urban and semi-urban centers. The growing prevalence of musculoskeletal disorders, trauma cases, and minimally invasive surgeries is boosting demand for advanced handpieces, battery-powered tools, and disposables. Surgeons increasingly adopt smart surgical power tools for enhanced precision, reduced operating times, and improved patient outcomes. Government initiatives to upgrade healthcare infrastructure and promote hospital digitalization are further accelerating market growth. China’s emergence as a manufacturing hub for surgical power tools also enhances affordability and accessibility. The expanding medical tourism sector contributes additional demand for advanced surgical equipment.

India Surgical Power Tools Market Insight

The India surgical power tools market accounted for the largest revenue share in Asia-Pacific after Japan in 2025, attributed to the country’s expanding middle-class population, rapid urbanization, and increasing healthcare expenditure. Hospitals and surgical centers are investing in advanced surgical power tools for orthopedic, dental, and ENT procedures. The growing adoption of minimally invasive surgeries, rising awareness of quality healthcare, and push toward smart hospitals support market expansion. Domestic and international manufacturers are actively supplying battery-driven, motorized, and ergonomic surgical tools, improving accessibility. Government initiatives such as smart city programs and hospital modernization projects are also promoting adoption. Rising surgical volumes and medical tourism further contribute to market growth.

South Korea Surgical Power Tools Market Insight

The South Korea surgical power tools market is expected to grow at a significant CAGR during the forecast period, driven by technological advancements, high-quality healthcare infrastructure, and increasing adoption of minimally invasive and outpatient surgeries. Hospitals prioritize precision, efficiency, and ergonomically designed surgical tools, particularly in orthopedic and spinal procedures. The country’s strong focus on innovation, research, and development in medical devices supports the adoption of smart and battery-driven surgical power tools. Integration with surgical planning software and hospital IT systems enhances workflow efficiency. Rising patient demand for faster recovery and less invasive procedures fuels market expansion. Increasing government support for advanced surgical technologies further contributes to growth.

Asia-Pacific Surgical Power Tools Market Share

The Asia-Pacific Surgical Power Tools industry is primarily led by well-established companies, including:

- Stryker (U.S.)

- Zimmer Biomet (U.S.)

- Medtronic (Ireland)

- CONMED Corporation (U.S.)

- Smith & Nephew (U.K.)

- Arthrex, Inc. (U.S.)

- De Soutter Medical (U.K.)

- Nouvag AG (Switzerland)

- NSK Ltd. (Japan)

- Exactech, Inc. (U.S.)

- GPC Medical Ltd. (India)

- Aygun Co., Inc. (Turkey)

- Shanghai Bojin Medical Instrument Co., Ltd. (China)

- OsteoMed LLC (U.S.)

- KLS Martin Group (U.S.)

- AlloTech Co., Ltd. (U.S.)

- MatOrtho Limited (U.K.)

- iMEDICOM Co., Ltd. (India)

- B. Braun SE (Germany)

What are the Recent Developments in Asia-Pacific Surgical Power Tools Market?

- In July 2024, MMI further signed multiple distribution agreements and secured regulatory approvals for the Symani Surgical System in Asia Pacific, including steps toward commercialization in Japan and approval in Hong Kong, Malaysia, New Zealand and Taiwan, reflecting continued expansion of advanced surgical robotics in APAC

- In October 2023, Medical Microinstruments (MMI) expanded its global footprint by entering the Asia‑Pacific market through distribution agreements to introduce the Symani® Surgical System for robotic microsurgery across several APAC countries signaling growth of precision surgical technology in the region

- In September 2022, CARE Hospitals, Hyderabad, successfully performed the first gynecology procedure in Asia‑Pacific using the Medtronic Hugo™ robotic‑assisted surgery system, demonstrating broader clinical adoption of robotic‑assisted platforms that incorporate powered surgical instruments in real surgical settings

- In September 2021, Medtronic inaugurated its first Surgical Robotics Experience Center in Asia Pacific designed to train clinicians on robotic‑assisted surgery technology such as Hugo™, supporting broader adoption of advanced surgical systems in the region’s hospitals and enhancing surgical precision and training

- In September 2021, Medtronic and Apollo Hospitals Group performed the first clinical procedure in the Asia‑Pacific region using the Hugo™ robotic‑assisted surgery system a modular platform that supports minimally invasive surgery with advanced wristed instruments, 3D visualization, and cloud‑based surgical case management, marking a key milestone for surgical technology adoption in APAC

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.