Market Analysis and Insights

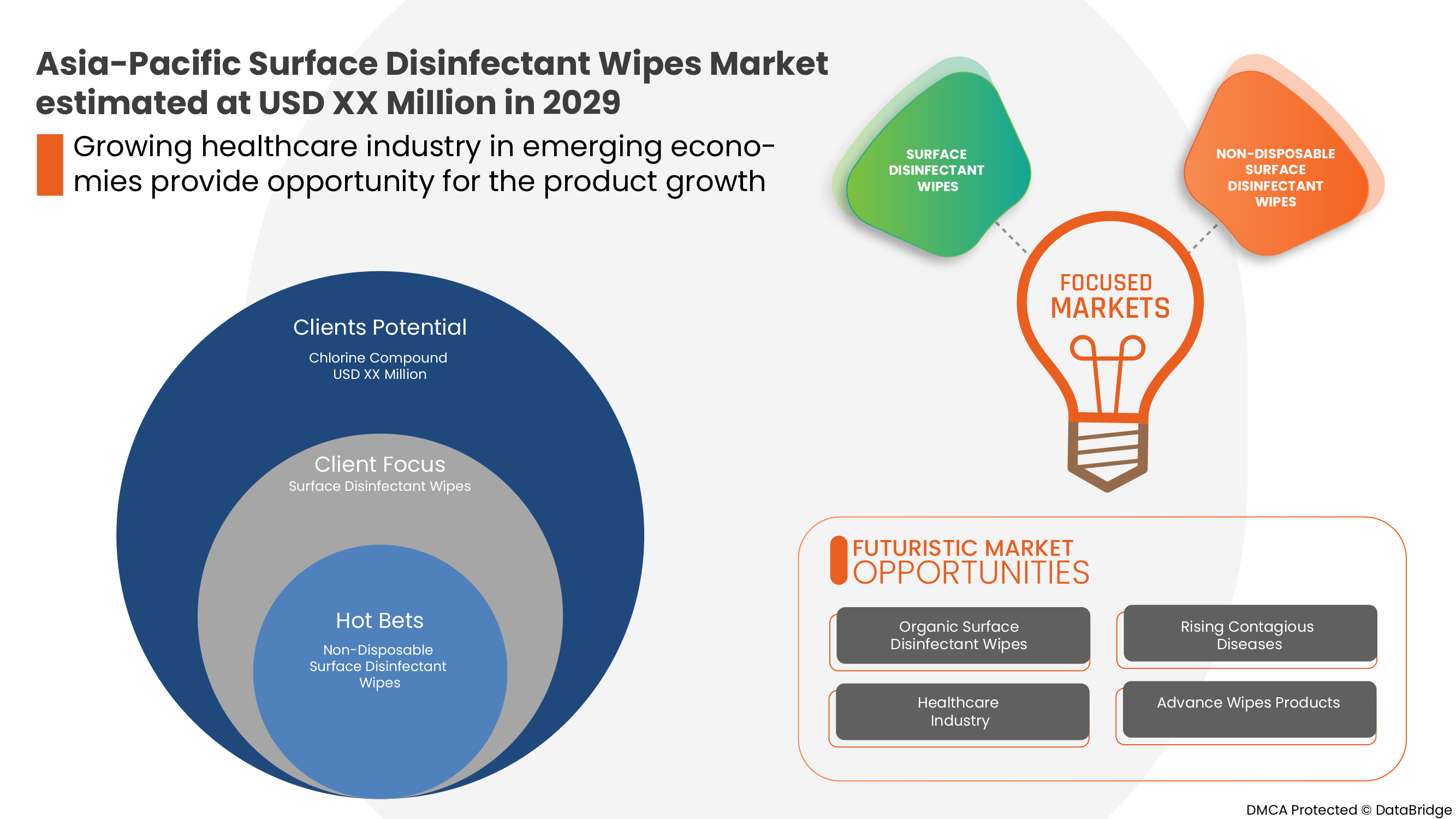

Asia-Pacific surface disinfectant wipes market is gaining significant growth due to the growing healthcare industry and the demand for flavored surface disinfectant wipes. The increase in demand for different types of surface disinfectant wipes owing to increasing infectious diseases is also boosting the growth of the Asia-Pacific surface disinfectant wipes market.

However, stringent government regulations associated with fluctuating raw materials prices are expected to restrain the market growth of surface disinfectant wipes during the forecast period.

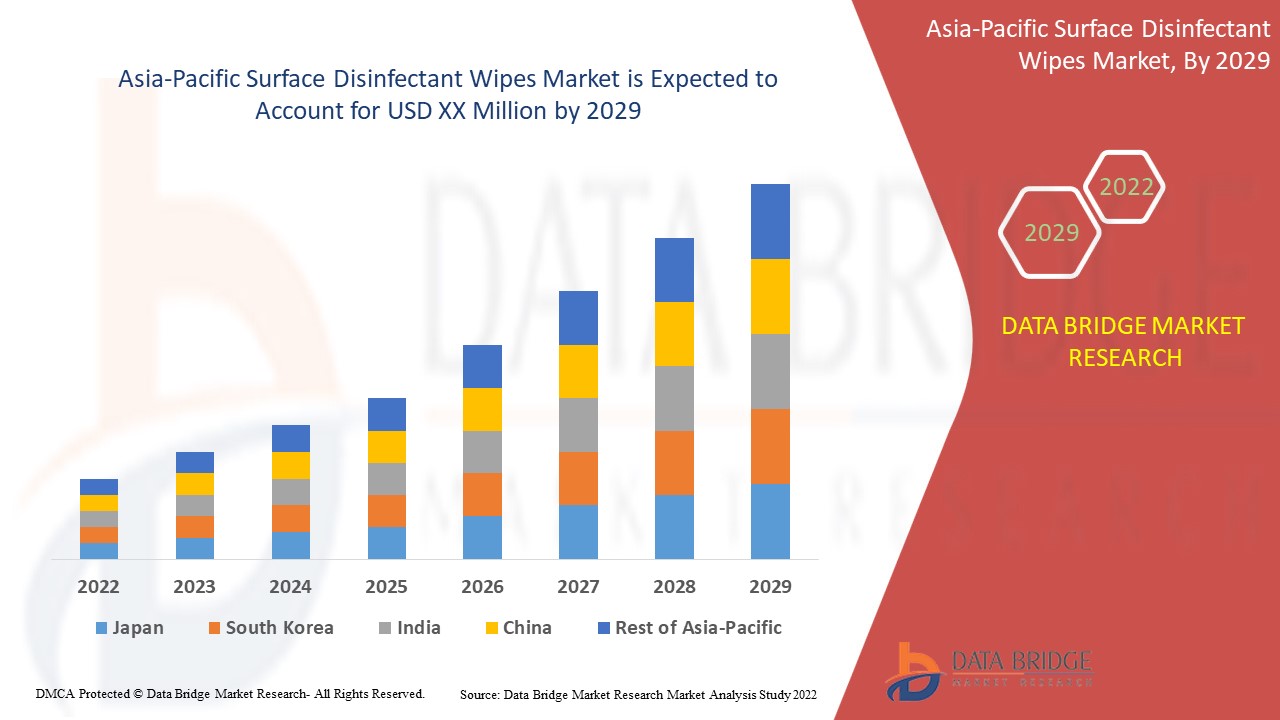

Data Bridge Market Research analyses that the Asia-Pacific surface disinfectant wipes market will grow at a CAGR of 7.4% during the forecast period of 2022 to 2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Year |

2020 (Customizable to 2019- 2015) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

By Composition (Quaternary Ammonium, Oxidizing Agents, Phenol, Alcohol, Chlorine Compounds, Iodine Compounds, Chlorhexidine Gluconate, Aldehydes, And Others), Usability (Disposable And Non-Disposable), Packaging (Flatpack, Canister And Others), Material Type (Textile Fiber Wipes, Virgin Fiber Wipes, Advanced Fiber Wipes And Others), Levels Of Disinfection (High, Intermediate And Low), Flavor (Lavender And Jasmine, Citrus, Lemon, Coconut And Others), Type (Sporicidal, Bactericidal, Tuberculocidal, Virucidal, Fungicidal And Germicidal), End-Use (Healthcare, Commercial, Industrial Kitchen, Transportation Industry, Optical Industry, Electronic And Computer Industry And Others), Distribution Channel (Direct Tenders And Retail Sales), Industry Trends and Forecast to 2029 |

|

Countries Covered |

China, Japan, India, South Korea, Australia, Singapore, Thailand, Malaysia, Indonesia, Philippines and the Rest of the Asia-Pacific |

|

Market Players Covered |

GOJO Industries, Inc., PDI, Inc., Metrex Research, LLC, Ecolab, 3M, Cantel Medical, Contec, Inc. KCWW, Reckitt Benckiser Group plc, Diversey Holdings LTD, Medline Industries, LP, Spartan Chemical Company, Inc., Procter & Gamble, STERIS, Johnson & Son Inc., Colgate-Palmolive Company, Zep Inc., Whiteley and PAUL HARTMANN Limited |

Market Definition

Small, pre-dampened towels or towelettes utilized to clean surfaces for the expulsion of earth and microbes, for instance, staph and salmonella hat may have been placed on the affected surface from foods, persons, or animals. Frequently scented with an agreeable smell, for instance, citrus or pine, are known as wipes.

Surface disinfecting wipes give a simple method to keep practically any kind of hard, non-permeable surface clean for use, sterilize, and wipe the thing or surface, permitting the territory scrubbed to stay soggy for around 30 seconds before drying. Ledges, apparatuses, sinks, installations (light and water), door handles, entryway handles, balustrades, tile, rock, earthenware production, phones, toys, and consoles are the average things or areas where surface disinfecting wipes can be utilized for cleaning and sterilizing.

Surface disinfecting wipes are accessible in various sizes and thicknesses. Slenderer wipes may need now and again in strength when presented to continue cleaning across surfaces or on harsh surfaces. Generally, the wipe is genuinely strong and gives the strength necessary to scrub the surface completely.

Asia-Pacific Surface Disinfectant Wipes Market Dynamics

Drivers

- Increasing use of surface disinfectant wipes for commercial applications

Surface disinfectants are chemical compounds used to destroy pathogens and other microorganisms via a process called disinfection. Surface disinfectant wipes aids in the inhibition of the growth of pathogens such as bacteria, viruses, and fungi, among others, which leads to various forms of contamination and infections. These surface disinfectants comprise different chemical compounds such as quaternary ammonium or quarts, chlorine compounds, phenolic compounds, oxidizing agents, alcohol, amphoteric compounds, and even their combinations. To prevent contamination, the surge in surface disinfectant wipes is seen in various commercial applications, namely house, kitchen, food and agriculture, and hospitality.

- Increasing consumer awareness about hygiene and preventive healthcare

Multiple health conditions could impact a person, but their prior knowledge and preventive measures help reduce the severity of the disease or its complete prevention. Hygiene is of utmost importance to people of all ages. Various unhygienic practices lead to communicable or nosocomial infections in people, and with the emergence of the COVID-19 pandemic, the importance of hygiene is equated with survival. Education plays a vital role in creating awareness among the general public of all age groups about health, hygiene, and preventive care. Such understanding plays a crucial role in preventing various health risks. The government and non-government organizations have launched multiple campaigns to bridge the knowledge gap about the same.

This awareness about health and hygiene has increased the demand for surface disinfectant wipes in various food & beverages, healthcare, pharmaceutical, and other applications. In addition, multiple companies and governments are also launching various campaigns and different awareness programs that are helping the market to grow in the coming years.

Opportunities

-

Strategies by major market players

The demand for surface disinfectant wipes has extensively boomed up worldwide owing to increasing consumer awareness about hygiene and preventive healthcare. Recently, the global market for surface disinfectant wipes has surged due to the pandemic outbreak of COVID-19. Moreover, many hospitals worldwide significantly elevate the need for surface disinfectant wipes. These affirmative factors enhance the demand for surface disinfectant wipes and accomplish the market demand. Minor as well as major market players are utilizing various strategies.

Strategic initiatives such as acquisition, partnership, contract agreement, and participation in conferences provide an opportunity to flourish their customer base geographically. Moreover, through such initiative strategies, both the companies can expand their reach through new geographic or industry markets, access to new products or services, or new types of customers. Both the market players open the door to additional or new resources such as technology and talent.

Restraints/Challenges

- Escalation in healthcare waste

Healthcare waste (HCW) is the waste generated by health care activities, including infectious and non-infectious waste such as sharps, non-sharps, blood, body parts, chemicals, disposable and non-disposable surface disinfectant wipes, pharmaceuticals, medical devices, and radioactive materials. 10-25% of healthcare waste is infectious and needs special treatment and is referred to as the healthcare risk waste. The pandemic outbreak of COVID-19 has escalated the usage of disposable surface disinfectant wipes, generating huge healthcare waste.

The significant sources of healthcare waste are hospitals and other health facilities, laboratories and research centers, animal research and testing laboratories, blood banks and collection services, and nursing homes for elderly citizens, where various types of disinfectant wipes are used enormously. High-income countries generate high waste per hospital bed per day compared to low-income countries.

Henceforth, growing healthcare waste may act as a major challenge in the growth of the global surface disinfectant wipes market.

- Fluctuation in the prices of raw material

The market players in the surface disinfectant wipes market have a hard time anticipating the risk of great fluctuation in the cost of raw materials. The increased cost of raw materials often significantly impacts the product's sales as the manufacturing is directly hampered due to the high cost of the raw material. Thus, the success of a product or company is highly endangered by the fluctuating raw material costs and their infective price management. The competitive companies adopt various strategies to cope with the fluctuation in the price of raw material, including replacing the ingredient with any other ingredient, among others.

Post COVID-19 Impact on Asia-Pacific Surface Disinfectant Wipes Market

Post- COVID-19, the demand for surface disinfectant wipes is increased in the Asia-Pacific region due to increased awareness about the health and hygiene of consumers and a gradual shift towards increasing the need for surface disinfectant wipes among various end-users such as food & beverages and automotive and others. The emergence of COVID-19 resulted in lockdown imposed by various countries, flight cancellation, supply chain disruption, and competition for raw materials among various industries. This has led to a fluctuation in the prices. However, manufacturers are now coping with the situation and the demand for surface disinfectant wipes has increased, which is helping the market grow.

Recent Developments

- In March, CleanWell, LLC. announced that it had been acquired by Pinstripe Capital, LLC, a real estate advisory boutique. This acquisition of the company leads to the expansion of distribution channels, including a broader portfolio of natural channels, and the development of a supportive ingredient business. Thus, this has increased the growth of the company in the market.

- In May, GOJO Industries, Inc. announced that it had launched its new products of the brand PURELL for surface sanitizing and disinfection in Canada. These new products found by the company have increased its sales and demand in the market, leading to increased revenue in the future.

- In February 2020, GAMA Healthcare Ltd. announced the efficacy of its Clinell Universal Wipes against coronavirus causing COVID-19 in 30 seconds of contact time. The company also announced the validation of its wipes for effectiveness by Microbac Laboratory, a third-party Biosafety Level 3 Laboratory. This announcement done by the company has increased its demand and credibility in the market.

Asia-Pacific Surface Disinfectant Wipes Market Scope

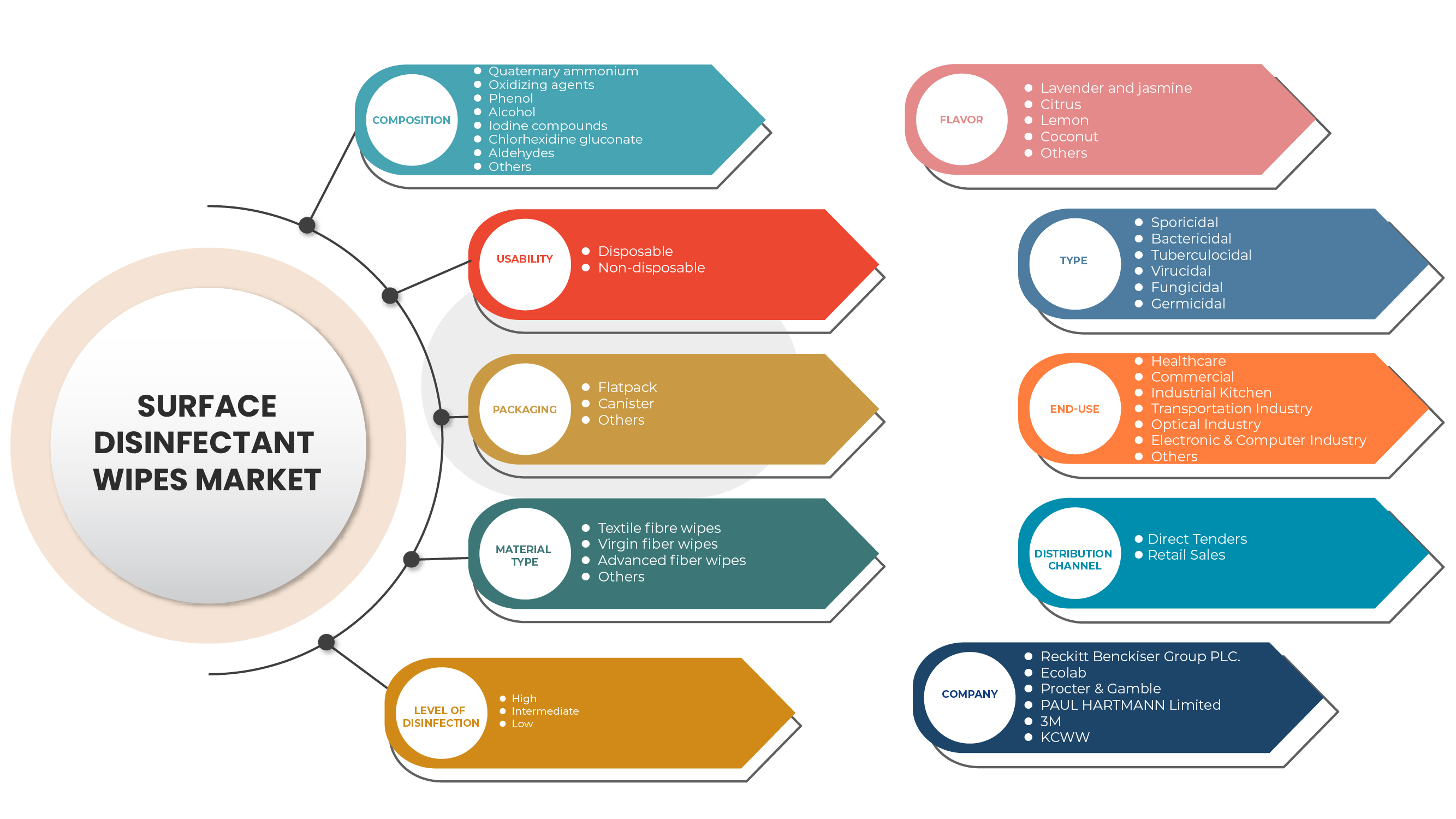

Asia-Pacific surface disinfectant wipes market is segmented into nine segments based on composition, usability, packaging, material type, level of disinfection, flavor, type, end-use, & distribution channel. The growth amongst these segments will help you analyze major industry growth segments and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Composition

- Chlorine compounds

- Quaternary ammonium

- Oxidizing agents

- Phenol

- Alcohol

- Iodine compounds

- Chlorhexidine gluconate

- Aldehydes

- Others

Based on composition, the Asia-Pacific surface disinfectant wipes market is segmented into quaternary ammonium, oxidizing agents, phenol, alcohol, chlorine compounds, iodine compounds, chlorhexidine gluconate, aldehydes, and others.

Usability

- Disposable

- Non-disposable

Based on usability, the Asia-Pacific surface disinfectant wipes market is segmented into disposable and Non-disposable.

Packaging

- Flatpack

- Canister

- Others

Based on packaging, the Asia-Pacific surface disinfectant wipes market is segmented into flatpack, canisters and others.

Material Type

- Textile fiber wipes

- Virgin fiber wipes

- Advanced fiber wipes

- Others

Based on material type, the Asia-Pacific surface disinfectant wipes market is segmented into textile fiber wipes, virgin fiber wipes, advanced fiber wipes and others

Level of Disinfection

- High

- Intermediate

- Low

Based on the level of disinfection, the Asia-Pacific surface disinfectant wipes market is segmented into high, intermediate and low.

Flavor

- Lavender and jasmine

- Citrus

- Lemon

- Coconut

- Others

Based on flavor, the Asia-Pacific surface disinfectant wipes market is segmented into lavender and jasmine, citrus, lemon, coconut and others.

Type

- Sporicidal

- Bactericidal

- Tuberculocidal

- Virucidal

- Fungicidal

- Germicidal

Based on type, the Asia-Pacific surface disinfectant wipes market is segmented into sporicidal, bactericidal, tuberculocidal, virucidal, fungicidal and germicidal.

End-Use

- Healthcare

- Commercial

- Industrial kitchen

- Transportation industry

- Optical industry

- Electronic and computer industry

- Others

Based on end-use, the Asia-Pacific surface disinfectant wipes market is segmented into healthcare, commercial, industrial kitchen, transportation industry, optical industry, electronic and computer industry, and others.

Distribution Channel

- Direct tenders

- Retail sales

Based on the distribution channel, the Asia-Pacific surface disinfectant wipes market is segmented into direct tenders and retail sales.

Asia-Pacific Surface Disinfectant Wipes Market Regional Analysis/Insights

Asia-Pacific surface disinfectant wipes market is analyzed, and market size insights and trends are provided by composition, usability, packaging, material type, levels of disinfection, flavor, type, end-use, and distribution channel.

The countries covered in the Asia-Pacific surface disinfectant wipes market report are China, Japan, India, South Korea, Australia, Singapore, Thailand, Malaysia, Indonesia, Philippines and the Rest of the Asia-Pacific

China dominates the Asia-Pacific surface disinfectant wipes market in terms of market share and revenue and will continue to flourish its dominance during the forecast period. This is due to the growing demand for surface disinfectant wipes from various industries owing to increased health awareness and hygiene to avoid the infectious diseases.

The country section of the report also provides individual market impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of Europe brands and their challenges faced due to high competition from local and domestic brands and the impact of sales channels are considered while providing a forecast analysis of the country data.

Competitive Landscape and Asia-Pacific Surface Disinfectant Wipes Market Share Analysis

The Asia-Pacific surface disinfectant wipes market competitive landscape provides details about the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Asia-Pacific presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points are only related to the companies' focus on the Asia-Pacific surface disinfectant wipes market.

Some of the major players operating in the Asia-Pacific surface disinfectant wipes market are GOJO Industries, Inc., PDI, Inc., Metrex Research, LLC, Ecolab, 3M, Cantel Medical, Contec, Inc. KCWW, Reckitt Benckiser Group plc, Diversey Holdings LTD, Medline Industries, LP, Spartan Chemical Company, Inc., Procter & Gamble, STERIS, Johnson & Son Inc., Colgate-Palmolive Company, Zep Inc., Whiteley and PAUL HARTMANN Limited.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning grids, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, Asia-Pacific Vs Regional and Vendor Share Analysis. Please request an analyst call in case of further inquiry.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE ASIA PACIFIC SURFACE DISINFECTANT WIPES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 COMPOSITION LIFELINE CURVE

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 MARKET PRODUCT TYPE COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PESTEL ANALYSIS

4.1.1 POLITICS:

4.1.2 ECONOMIC:

4.1.3 SOCIAL:

4.1.4 TECHNOLOGY:

4.1.5 ENVIRONMENTAL:

4.1.6 LEGAL:

4.2 PORTER ANALYSIS

4.2.1 THREATS OF NEW ENTRANTS

4.2.2 BARGAINING POWER OF SUPPLIERS

4.2.3 BARGAINING POWER OF BUYERS

4.2.4 THREATS OF SUBSTITUTE PRODUCTS

4.2.5 RIVALRY AMONG THE EXISTING COMPETITORS

4.3 INDUSTRIAL INSIGHTS:

4.3.1 KEY PRICING STRATEGIES:

4.3.2 PRICES OF RAW MATERIALS:

4.3.3 FLUCTUATION IN DEMAND AND SUPPLY

4.3.4 LEVELS OF DISINFECTION

4.3.5 QUALITY:

4.3.6 CONCLUSION:

4.4 SURFACE DISINFECTANT WIPES ANALYSIS: BY USABILITY

5 ASIA PACIFIC SURFACE DISINFECTANT WIPES MARKET: REGULATIONS

6 EPIDERMIOLOGY

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASING USE OF SURFACE DISINFECTANT WIPES FOR COMMERCIAL APPLICATIONS

7.1.2 INCREASING CONSUMER AWARENESS ABOUT HYGIENE AND PREVENTIVE HEALTHCARE

7.1.3 EMERGENCE OF COVID-19

7.1.4 HIGH PREVALENCE OF HOSPITAL-ACQUIRED INFECTIONS (HAIS)

7.1.5 HIGH DEMAND FOR QUICK AND CONVENIENT DISINFECTION OPTIONS

7.2 RESTRAINTS

7.2.1 SIDE EFFECTS OF USING SURFACE DISINFECTANT WIPES

7.2.2 FLUCTUATION IN THE PRICES OF RAW MATERIAL

7.2.3 EMERGING ALTERNATIVE TECHNOLOGIES

7.3 OPPORTUNITIES

7.3.1 STRATEGIES BY MAJOR MARKET PLAYERS

7.3.2 INCREASING NUMBER OF PRODUCT APPROVAL AND LAUNCHES

7.3.3 GROWING HEALTHCARE EXPENDITURE

7.3.4 INCREASING CHRONIC AND CONTAGIOUS DISEASES

7.4 CHALLENGES

7.4.1 LACK OF ACCESSIBILITY

7.4.2 ESCALATION IN HEALTHCARE WASTE

8 ASIA PACIFIC SURFACE DISINFECTANT WIPES MARKET, BY COMPOSITION

8.1 OVERVIEW

8.2 CHLORINE COMPOUNDS

8.3 QUATERNARY AMMONIUM

8.4 OXIDIZING AGENTS

8.5 PHENOL

8.6 ALCOHOL

8.7 IODINE COMPOUNDS

8.8 CHLORHEXIDINE GLUCONATE

8.9 ALDEHYDES

8.1 OTHERS

9 ASIA PACIFIC SURFACE DISINFECTANT WIPES MARKET, BY USABILITY

9.1 OVERVIEW

9.2 DISPOSABLE

9.3 NON-DISPOSABLE

10 ASIA PACIFIC SURFACE DISINFECTANT WIPES MARKET, BY PACKAGING

10.1 OVERVIEW

10.2 FLATPACK

10.3 CANISTER

10.4 OTHERS

11 ASIA PACIFIC SURFACE DISINFECTANT WIPES MARKET, BY MATERIAL TYPE

11.1 OVERVIEW

11.2 TEXTILE FIBER WIPES

11.3 VIRGIN FIBER WIPES

11.4 ADVANCED FIBER WIPES

11.5 OTHERS

12 ASIA PACIFIC SURFACE DISINFECTANT WIPES MARKET, BY LEVEL OF DISINFECTION

12.1 OVERVIEW

12.2 HIGH

12.3 INTERMEDIATE

12.4 LOW

13 ASIA PACIFIC SURFACE DISINFECTANT WIPES MARKET, BY FLAVOR

13.1 OVERVIEW

13.2 LAVENDER & JASMINE

13.3 LEMON

13.4 CITRUS

13.5 COCONUT

13.6 OTHERS

14 ASIA PACIFIC SURFACE DISINFECTANT WIPES MARKET, BY TYPE

14.1 OVERVIEW

14.2 BACTERICIDAL

14.3 VIRUCIDAL

14.4 SPORICIDAL

14.5 TUBERCULOCIDAL

14.6 FUNGICIDAL

14.7 GERMICIDAL

15 ASIA PACIFIC SURFACE DISINFECTANT WIPES MARKET, BY END USE

15.1 OVERVIEW

15.2 HEALTHCARE

15.3 COMMERCIAL

15.4 INDUSTRIAL KITCHEN

15.5 TRANSPORTATION INDUSTRY

15.6 OPTICAL INDUSTRY

15.7 ELECTRONIC & COMPUTER INDUSTRY

15.8 OTHERS

16 ASIA PACIFIC SURFACE DISINFECTANT WIPES MARKET, BY DISTRIBUTION CHANNEL

16.1 OVERVIEW

16.2 DIRECT TENDERS

16.3 RETAIL SALES

17 ASIA PACIFIC SURFACE DISINFECTANT WIPES MARKET, BY REGION

17.1 ASIA-PACIFIC

17.1.1 CHINA

17.1.2 JAPAN

17.1.3 INDIA

17.1.4 SOUTH KOREA

17.1.5 AUSTRALIA

17.1.6 SINGAPORE

17.1.7 THAILAND

17.1.8 MALAYSIA

17.1.9 INDONESIA

17.1.10 PHILIPPINES

17.1.11 REST OF ASIA-PACIFIC

18 ASIA PACIFIC SURFACE DISINFECTANT WIPES MARKET: COMPANY LANDSCAPE

18.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

19 SWOT ANALYSIS

20 COMPANY PROFILE

20.1 RECKITT BENCKISER GROUP PLC

20.1.1 COMPANY SNAPSHOT

20.1.2 REVENUE ANALYSIS

20.1.3 COMPANY SHARE ANALYSIS

20.1.4 PRODUCT PORTFOLIO

20.1.5 RECENT DEVELOPMENTS

20.2 ECOLAB

20.2.1 COMPANY SNAPSHOT

20.2.2 REVENUE ANALYSIS

20.2.3 COMPANY SHARE ANALYSIS

20.2.4 PRODUCT PORTFOLIO

20.2.5 RECENT DEVELOPMENT

20.3 PROCTER & GAMBLE

20.3.1 COMPANY SNAPSHOT

20.3.2 REVENUE ANALYSIS

20.3.3 COMPANY SHARE ANALYSIS

20.3.4 PRODUCT PORTFOLIO

20.3.5 RECENT DEVELOPMENT

20.4 PAUL HARTMANN LIMITED

20.4.1 COMPANY SNAPSHOT

20.4.2 COMPANY SHARE ANALYSIS

20.4.3 PRODUCT PORTFOLIO

20.4.4 RECENT DEVELOPMENT

20.5 3M

20.5.1 COMPANY SNAPSHOT

20.5.2 REVENUE ANALYSIS

20.5.3 COMPANY SHARE ANALYSIS

20.5.4 PRODUCT PORTFOLIO

20.5.5 RECENT DEVELOPMENT

20.6 BETCO

20.6.1 COMPANY SNAPSHOT

20.6.2 PRODUCT PORTFOLIO

20.6.3 RECENT DEVELOPMENT

20.7 CANTEL MEDICAL

20.7.1 COMPANY SNAPSHOT

20.7.2 REVENUE ANALYSIS

20.7.3 PRODUCT PORTFOLIO

20.8 CLEANWELL, LLC.

20.8.1 COMPANY SNAPSHOT

20.8.2 PRODUCT PORTFOLIO

20.8.3 RECENT DEVELOPMENT

20.9 COLGATE-PALMOLIVE COMPANY

20.9.1 COMPANY SNAPSHOT

20.9.2 REVENUE ANALYSIS

20.9.3 PRODUCT PORTFOLIO

20.9.4 RECENT DEVELOPMENTS

20.1 CONTEC, INC.

20.10.1 COMPANY SNAPSHOT

20.10.2 PRODUCT PORTFOLIO

20.10.3 RECENT DEVELOPMENT

20.11 DIVERSEY HOLDINGS LTD (2021)

20.11.1 COMPANY SNAPSHOT

20.11.2 REVENUE ANALYSIS

20.11.3 PRODUCT PORTFOLIO

20.11.4 RECENT DEVELOPMENTS

20.12 DREUMEX

20.12.1 COMPANY SNAPSHOT

20.12.2 PRODUCT PORTFOLIO

20.12.3 RECENT DEVELOPMENTS

20.13 GOJO INDUSTRIES, INC.

20.13.1 COMPANY SNAPSHOT

20.13.2 PRODUCT PORTFOLIO

20.13.3 RECENT DEVELOPMENT

20.14 KCWW

20.14.1 COMPANY SNAPSHOT

20.14.2 REVENUE ANALYSIS

20.14.3 PRODUCT PORTFOLIO

20.14.4 RECENT DEVELOPMENTS

20.15 MEDLINE INDUSTRIES, LP

20.15.1 COMPANY SNAPSHOT

20.15.2 PRODUCT PORTFOLIO

20.15.3 RECENT DEVELOPMENTS

20.16 METREX RESEARCH, LLC.

20.16.1 COMPANY SNAPSHOT

20.16.2 PRODUCT PORTFOLIO

20.16.3 RECENT DEVELOPMENTS

20.17 PAL INTERNATIONAL

20.17.1 COMPANY SNAPSHOT

20.17.2 PRODUCT PORTFOLIO

20.17.3 RECENT DEVELOPMENTS

20.18 PARKER LABORATORIES, INC

20.18.1 COMPANY SNAPSHOT

20.18.2 PRODUCT PORTFOLIO

20.18.3 1.18.3 RECENT DEVELOPMENT

20.19 PDI, INC.

20.19.1 COMPANY SNAPSHOT

20.19.2 PRODUCT PORTFOLIO

20.19.3 RECENT DEVELOPMENTS

20.2 JOHNSON & SON INC.

20.20.1 COMPANY SNAPSHOT

20.20.2 PRODUCT PORTFOLIO

20.20.3 RECENT DEVELOPMENTS

20.21 SEVENTH GENERATION INC.

20.21.1 COMPANY SNAPSHOT

20.21.2 PRODUCT PORTFOLIO

20.21.3 RECENT DEVELOPMENTS

20.22 SPARTAN CHEMICAL COMPANY, INC.

20.22.1 COMPANY SNAPSHOT

20.22.2 PRODUCT PORTFOLIO

20.22.3 RECENT DEVELOPMENTS

20.23 STERIS

20.23.1 COMPANY SNAPSHOT

20.23.2 REVENUE ANALYSIS

20.23.3 PRODUCT PORTFOLIO

20.23.4 RECENT DEVELOPMENTS

20.24 THE CLAIRE MANUFACTURING COMPANY

20.24.1 COMPANY SNAPSHOT

20.24.2 PRODUCT PORTFOLIO

20.24.3 RECENT UPDATE

20.25 WHITELEY

20.25.1 COMPANY SNAPSHOT

20.25.2 PRODUCT PORTFOLIO

20.25.3 RECENT UPDATE

20.26 WIPESPLUS

20.26.1 COMPANY SNAPSHOT

20.26.2 PRODUCT PORTFOLIO

20.26.3 RECENT DEVELOPMENT

20.27 ZEP INC.

20.27.1 COMPANY SNAPSHOT

20.27.2 PRODUCT PORTFOLIO

20.27.3 RECENT DEVELOPMENT

21 QUESTIONNAIRE

22 RELATED REPORTS

List of Table

TABLE 1 COMPARATIVE TABLE OF THE IDENTIFIED KEY ASPECTS OF SURFACE DISINFECTANTS THROUGHOUT THE REGULATORY FRAMEWORK

TABLE 2 REGULATIONS SET BY THE U.K. GOVERNMENT FOR THE IMPROVEMENT OF DISINFECTANT WIPES

TABLE 3 TESTS ASSOCIATED WITH DISINFECTANT WIPES

TABLE 4 PREVALENCE OF DIABETES

TABLE 5 POVERTY RATES IN ENGLAND, WALES, SCOTLAND, AND NORTHERN IRELAND AFTER HOUSING COSTS (AHC)

TABLE 6 ASIA PACIFIC SURFACE DISINFECTANT WIPES MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC CHLORINE COMPOUNDS IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC QUATERNARY AMMONIUM IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC OXIDIZING AGENTS IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC PHENOL IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC ALCOHOL IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC IODINE COMPOUNDS IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC CHLORHEXIDINE GLUCONATE IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC ALDEHYDES IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC OTHERS IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC SURFACE DISINFECTANT WIPES MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC DISPOSABLE IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC NON-DISPOSABLE IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC SURFACE DISINFECTANT WIPES MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC FLATPACK IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC CANISTER IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC OTHERS IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC SURFACE DISINFECTANT WIPES MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC TEXTILE FIBER WIPES IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 ASIA PACIFIC VIRGIN FIBER WIPES IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 ASIA PACIFIC ADVANCED FIBER WIPES IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 ASIA PACIFIC OTHERS IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 ASIA PACIFIC SURFACE DISINFECTANT WIPES MARKET, BY LEVELS OF DISINFECTION, 2020-2029 (USD MILLION)

TABLE 29 ASIA PACIFIC HIGH IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 ASIA PACIFIC INTERMEDIATE IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 ASIA PACIFIC LOW IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 ASIA PACIFIC SURFACE DISINFECTANT WIPES MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 33 ASIA PACIFIC LAVENDER & JASMINE IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 ASIA PACIFIC LEMON IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 ASIA PACIFIC CITRUS IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 ASIA PACIFIC COCONUT IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 ASIA PACIFIC OTHERS IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 ASIA PACIFIC SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 ASIA PACIFIC BACTERICIDAL IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 ASIA PACIFIC VIRUCIDAL IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 ASIA PACIFIC SPORICIDAL IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 ASIA PACIFIC TUBERCULOCIDAL IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 ASIA PACIFIC FUNGICIDAL IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 ASIA PACIFIC GERMICIDAL IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 ASIA PACIFIC SURFACE DISINFECTANT WIPES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 46 ASIA PACIFIC HEALTHCARE IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 47 ASIA PACIFIC COMMERCIAL IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 ASIA PACIFIC INDUSTRIAL KITCHEN IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 49 ASIA PACIFIC TRANSPORTATION INDUSTRY IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 50 ASIA PACIFIC OPTICAL INDUSTRY IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 51 ASIA PACIFIC ELECTRONIC & COMPUTER INDUSTRY IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 52 ASIA PACIFIC OTHERS IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 53 ASIA PACIFIC SURFACE DISINFECTANT WIPES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 54 ASIA PACIFIC DIRECT TENDERS IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 55 ASIA PACIFIC RETAIL SALES IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 56 ASIA-PACIFIC SURFACE DISINFECTANT WIPES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 57 ASIA-PACIFIC SURFACE DISINFECTANT WIPES MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 58 ASIA-PACIFIC SURFACE DISINFECTANT WIPES MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 59 ASIA-PACIFIC SURFACE DISINFECTANT WIPES MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 60 ASIA-PACIFIC SURFACE DISINFECTANT WIPES MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 61 ASIA-PACIFIC SURFACE DISINFECTANT WIPES MARKET, BY LEVELS OF DISINFECTION, 2020-2029 (USD MILLION)

TABLE 62 ASIA-PACIFIC SURFACE DISINFECTANT WIPES MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 63 ASIA-PACIFIC SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 ASIA-PACIFIC SURFACE DISINFECTANT WIPES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 65 ASIA-PACIFIC SURFACE DISINFECTANT WIPES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 66 CHINA SURFACE DISINFECTANT WIPES MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 67 CHINA SURFACE DISINFECTANT WIPES MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 68 CHINA SURFACE DISINFECTANT WIPES MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 69 CHINA SURFACE DISINFECTANT WIPES MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 70 CHINA SURFACE DISINFECTANT WIPES MARKET, BY LEVELS OF DISINFECTION, 2020-2029 (USD MILLION)

TABLE 71 CHINA SURFACE DISINFECTANT WIPES MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 72 CHINA SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 CHINA SURFACE DISINFECTANT WIPES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 74 CHINA SURFACE DISINFECTANT WIPES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 75 JAPAN SURFACE DISINFECTANT WIPES MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 76 JAPAN SURFACE DISINFECTANT WIPES MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 77 JAPAN SURFACE DISINFECTANT WIPES MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 78 JAPAN SURFACE DISINFECTANT WIPES MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 79 JAPAN SURFACE DISINFECTANT WIPES MARKET, BY LEVELS OF DISINFECTION, 2020-2029 (USD MILLION)

TABLE 80 JAPAN SURFACE DISINFECTANT WIPES MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 81 JAPAN SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 JAPAN SURFACE DISINFECTANT WIPES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 83 JAPAN SURFACE DISINFECTANT WIPES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 84 INDIA SURFACE DISINFECTANT WIPES MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 85 INDIA SURFACE DISINFECTANT WIPES MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 86 INDIA SURFACE DISINFECTANT WIPES MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 87 INDIA SURFACE DISINFECTANT WIPES MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 88 INDIA SURFACE DISINFECTANT WIPES MARKET, BY LEVELS OF DISINFECTION, 2020-2029 (USD MILLION)

TABLE 89 INDIA SURFACE DISINFECTANT WIPES MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 90 INDIA SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 INDIA SURFACE DISINFECTANT WIPES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 92 INDIA SURFACE DISINFECTANT WIPES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 93 SOUTH KOREA SURFACE DISINFECTANT WIPES MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 94 SOUTH KOREA SURFACE DISINFECTANT WIPES MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 95 SOUTH KOREA SURFACE DISINFECTANT WIPES MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 96 SOUTH KOREA SURFACE DISINFECTANT WIPES MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 97 SOUTH KOREA SURFACE DISINFECTANT WIPES MARKET, BY LEVELS OF DISINFECTION, 2020-2029 (USD MILLION)

TABLE 98 SOUTH KOREA SURFACE DISINFECTANT WIPES MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 99 SOUTH KOREA SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 SOUTH KOREA SURFACE DISINFECTANT WIPES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 101 SOUTH KOREA SURFACE DISINFECTANT WIPES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 102 AUSTRALIA SURFACE DISINFECTANT WIPES MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 103 AUSTRALIA SURFACE DISINFECTANT WIPES MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 104 AUSTRALIA SURFACE DISINFECTANT WIPES MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 105 AUSTRALIA SURFACE DISINFECTANT WIPES MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 106 AUSTRALIA SURFACE DISINFECTANT WIPES MARKET, BY LEVELS OF DISINFECTION, 2020-2029 (USD MILLION)

TABLE 107 AUSTRALIA SURFACE DISINFECTANT WIPES MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 108 AUSTRALIA SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 109 AUSTRALIA SURFACE DISINFECTANT WIPES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 110 AUSTRALIA SURFACE DISINFECTANT WIPES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 111 SINGAPORE SURFACE DISINFECTANT WIPES MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 112 SINGAPORE SURFACE DISINFECTANT WIPES MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 113 SINGAPORE SURFACE DISINFECTANT WIPES MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 114 SINGAPORE SURFACE DISINFECTANT WIPES MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 115 SINGAPORE SURFACE DISINFECTANT WIPES MARKET, BY LEVELS OF DISINFECTION, 2020-2029 (USD MILLION)

TABLE 116 SINGAPORE SURFACE DISINFECTANT WIPES MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 117 SINGAPORE SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 118 SINGAPORE SURFACE DISINFECTANT WIPES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 119 SINGAPORE SURFACE DISINFECTANT WIPES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 120 THAILAND SURFACE DISINFECTANT WIPES MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 121 THAILAND SURFACE DISINFECTANT WIPES MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 122 THAILAND SURFACE DISINFECTANT WIPES MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 123 THAILAND SURFACE DISINFECTANT WIPES MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 124 THAILAND SURFACE DISINFECTANT WIPES MARKET, BY LEVELS OF DISINFECTION, 2020-2029 (USD MILLION)

TABLE 125 THAILAND SURFACE DISINFECTANT WIPES MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 126 THAILAND SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 127 THAILAND SURFACE DISINFECTANT WIPES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 128 THAILAND SURFACE DISINFECTANT WIPES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 129 MALAYSIA SURFACE DISINFECTANT WIPES MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 130 MALAYSIA SURFACE DISINFECTANT WIPES MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 131 MALAYSIA SURFACE DISINFECTANT WIPES MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 132 MALAYSIA SURFACE DISINFECTANT WIPES MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 133 MALAYSIA SURFACE DISINFECTANT WIPES MARKET, BY LEVELS OF DISINFECTION, 2020-2029 (USD MILLION)

TABLE 134 MALAYSIA SURFACE DISINFECTANT WIPES MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 135 MALAYSIA SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 136 MALAYSIA SURFACE DISINFECTANT WIPES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 137 MALAYSIA SURFACE DISINFECTANT WIPES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 138 INDONESIA SURFACE DISINFECTANT WIPES MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 139 INDONESIA SURFACE DISINFECTANT WIPES MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 140 INDONESIA SURFACE DISINFECTANT WIPES MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 141 INDONESIA SURFACE DISINFECTANT WIPES MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 142 INDONESIA SURFACE DISINFECTANT WIPES MARKET, BY LEVELS OF DISINFECTION, 2020-2029 (USD MILLION)

TABLE 143 INDONESIA SURFACE DISINFECTANT WIPES MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 144 INDONESIA SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 145 INDONESIA SURFACE DISINFECTANT WIPES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 146 INDONESIA SURFACE DISINFECTANT WIPES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 147 PHILIPPINES SURFACE DISINFECTANT WIPES MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 148 PHILIPPINES SURFACE DISINFECTANT WIPES MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 149 PHILIPPINES SURFACE DISINFECTANT WIPES MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 150 PHILIPPINES SURFACE DISINFECTANT WIPES MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 151 PHILIPPINES SURFACE DISINFECTANT WIPES MARKET, BY LEVELS OF DISINFECTION, 2020-2029 (USD MILLION)

TABLE 152 PHILIPPINES SURFACE DISINFECTANT WIPES MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 153 PHILIPPINES SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 154 PHILIPPINES SURFACE DISINFECTANT WIPES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 155 PHILIPPINES SURFACE DISINFECTANT WIPES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 156 REST OF ASIA-PACIFIC SURFACE DISINFECTANT WIPES MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 ASIA PACIFIC SURFACE DISINFECTANT WIPES MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC SURFACE DISINFECTANT WIPES MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC SURFACE DISINFECTANT WIPES MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC SURFACE DISINFECTANT WIPES MARKET: COUNTRY VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC SURFACE DISINFECTANT WIPES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC SURFACE DISINFECTANT WIPES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC SURFACE DISINFECTANT WIPES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC SURFACE DISINFECTANT WIPES MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ASIA PACIFIC SURFACE DISINFECTANT WIPES MARKET: MARKET END USE COVERAGE GRID

FIGURE 10 ASIA PACIFIC SURFACE DISINFECTANT WIPES MARKET: SEGMENTATION

FIGURE 11 NORTH AMERICA IS ANTICIPATED TO DOMINATE THE ASIA PACIFIC SURFACE DISINFECTANT WIPES MARKET, AND ASIA-PACIFIC IS ESTIMATED TO BE GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 AN INCREASE IN THE PREVALENCE OF HOSPITAL ACQUIRED INFECTIONS (HAIS) LEADS TO INCREASED ADOPTION OF DISINFECTANT WIPES TO DRIVE THE ASIA PACIFIC SURFACE DISINFECTANT WIPES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 CHLORINE COMPOUNDS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC SURFACE DISINFECTANT WIPES MARKET IN 2022 & 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC SURFACE DISINFECTANT WIPES MARKET

FIGURE 15 GOVERNMENT HEALTHCARE EXPENDITURE BY SHARE OF HEALTHCARE PROVIDERS IN THE U.K. IN 2018

FIGURE 16 GOVERNMENT HEALTHCARE EXPENDITURE BY SHARE OF HEALTHCARE FUNCTIONS IN THE U.K. IN 2018

FIGURE 17 ASIA PACIFIC SURFACE DISINFECTANT WIPES MARKET: BY COMPOSITION, 2021

FIGURE 18 ASIA PACIFIC SURFACE DISINFECTANT WIPES MARKET: BY USABILITY, 2021

FIGURE 19 ASIA PACIFIC SURFACE DISINFECTANT WIPES MARKET: BY PACKAGING, 2021

FIGURE 20 ASIA PACIFIC SURFACE DISINFECTANT WIPES MARKET: BY MATERIAL TYPE, 2021

FIGURE 21 ASIA PACIFIC SURFACE DISINFECTANT WIPES MARKET: BY LEVEL OF INDISFECTION, 2021

FIGURE 22 ASIA PACIFIC SURFACE DISINFECTANT WIPES MARKET, BY FLAVOR, 2021

FIGURE 23 ASIA PACIFIC SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2021

FIGURE 24 ASIA PACIFIC SURFACE DISINFECTANT WIPES MARKET, BY END-USE, 2021

FIGURE 25 ASIA PACIFIC SURFACE DISINFECTANT WIPES MARKET, BY DISTRIBUTION CHANNEL, 2020

FIGURE 26 ASIA-PACIFIC SURFACE DISINFECTANT WIPES MARKET: SNAPSHOT (2021)

FIGURE 27 ASIA-PACIFIC SURFACE DISINFECTANT WIPES MARKET: BY COUNTRY (2021)

FIGURE 28 ASIA-PACIFIC SURFACE DISINFECTANT WIPES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 29 ASIA-PACIFIC SURFACE DISINFECTANT WIPES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 30 ASIA-PACIFIC SURFACE DISINFECTANT WIPES MARKET: BY COMPOSITION (2022 & 2029)

FIGURE 31 ASIA PACIFIC SURFACE DISINFECTANT WIPES MARKET: COMPANY SHARE 2021 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.