Market Analysis and Insights: Asia-Pacific Smoke Detector Market

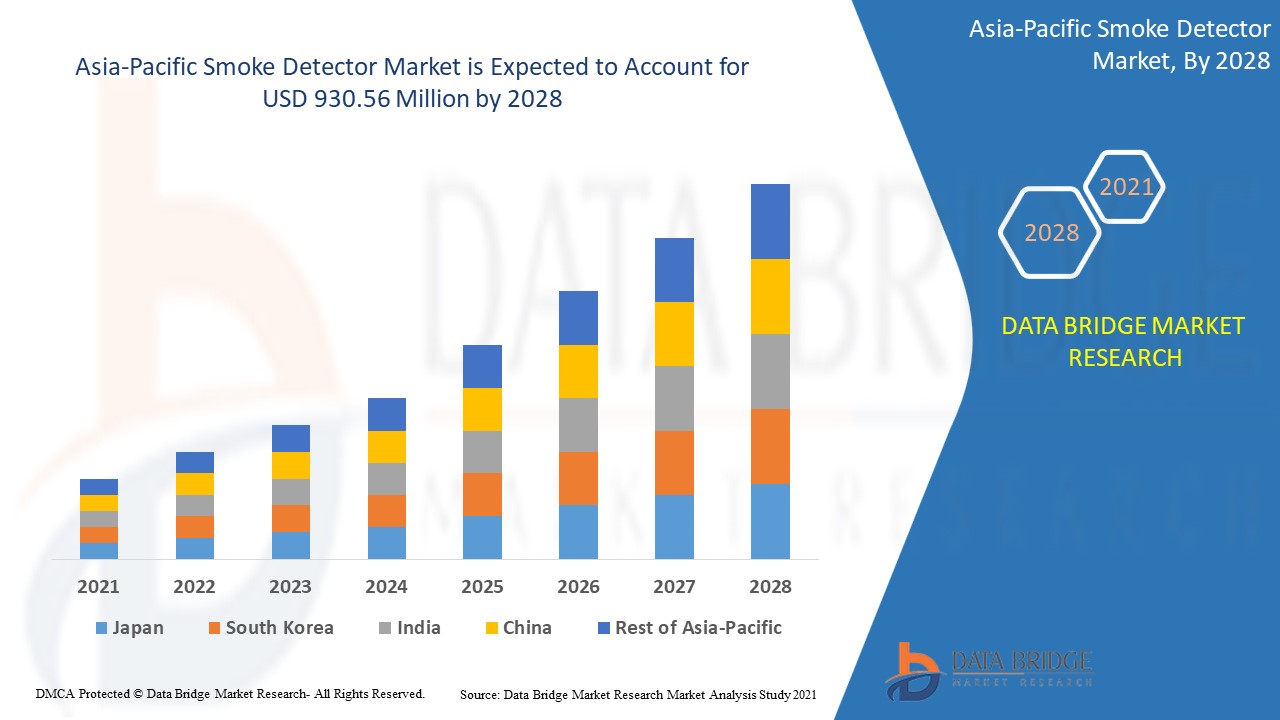

Asia-Pacific smoke detector market is expected to gain market growth in the forecast period of 2021 to 2028. Data Bridge Market Research analyses that the market is growing with a CAGR of 9.7% in the forecast period of 2021 to 2028 and expected to reach USD 930.56 million by 2028. Increase in consumption of internet services is acting as major factor for the growth of the market.

Smoke detectors are the electronic fire protection devices that automatically senses the presence of smoke for key indication of fire and alerts a warning sign to building occupants. Fires can occur in a variety of ways and in any property. Smoke detectors is the first key step towards safety of lives and properties. There are two basic types of smoke detectors namely photoelectric (optical) and ionization. A photoelectric smoke detector is a type of smoke detector which consists of a source of infrared, visible, or ultraviolet light that’s is a light emitting diode and a light sensitive sensor arranged inside a chamber. Ionization smoke detector is a type of smoke detector which uses a small amount of radioactive material to ionize air in an internal sensing chamber.

Some of the factors which are driving the market are rising safety concerns due to fire accidents, and emerging trend of smart homes and buildings. High cost for installation and upgradability of smoke detectors to connected system or IoT is restraining the Asia-Pacific smoke detector market growth. Growing adoption of IoT Technology in smoke detectors and rising investment in the construction industry are some of the factors which are opening lucrative opportunity for the market. Complexities involved in designing to reduce false alarms is acting as a major challenge for the market growth.

This smoke detector market report provides details of market share, new developments, and product pipeline analysis, impact of domestic and localised market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario contact us for an Analyst Brief, our team will help you create a revenue impact solution to achieve your desired goal.

Asia-Pacific Smoke Detector Market Scope and Market Size

Asia-Pacific smoke detector market is segmented on the basis of power source, product type, service and end use. The growth among segments helps you analyse niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

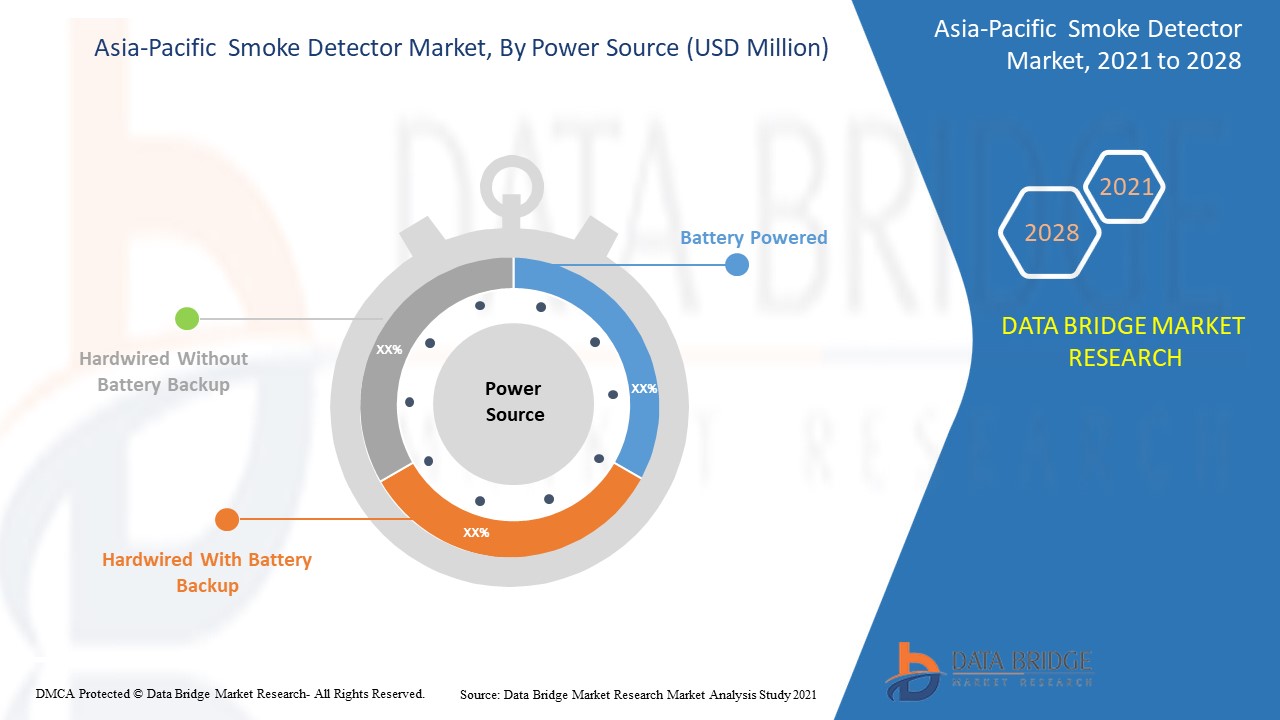

- On the basis of power source, the Asia-Pacific smoke detector market is segmented into battery powered, hardwired with battery backup and hardwired without battery backup. In 2021, hardwired with battery backup is expected to dominate the market as hardwired with battery backup smoke detector does not need to be replaced frequently because of exhausted battery or disposition of battery chemicals in the enclosure of the smoke detector. Therefore, the demand for hardwired with battery backup smoke detector is gaining popularity among the customers of regions such as China, Japan and others.

- On the basis of product type, the Asia-Pacific smoke detector market has been segmented into photoelectric smoke detector, ionization smoke detector, dual sensor smoke detector and others. In 2021, photoelectric smoke detector is expected to dominate the market, as photoelectric smoke detector were capable of detecting cause of fire deaths from smouldering fires and Photoelectric detection is better for extreme harsh environment due to which there is huge adoption of photoelectric smoke detector amongst the Asian customers.

- On the basis of service, Asia-Pacific smoke detector market has been segmented into engineering services, installation and design services, maintenance services, managed services and other services. In 2021, maintenance services is expected to dominate the market, due to factors such increasing demand for routine servicing and maintenance of smoke detector from the various sectors across the Asia-Pacific region.

- On the basis of end use, Asia-Pacific smoke detector market has been segmented into commercial, residential, oil & gas and mining, transportation and logistics, telecommunication, manufacturing and others. In 2021, commercial is expected to dominate the market as rapid development in the commercial construction and rise in number of fire accidents in production sites across the countries such as China, Japan and others is attributing to the high growth of market in the residential sector.

Asia-Pacific Smoke Detector Market Country Level Analysis

Asia-Pacific smoke detector market is analysed and market size information is provided by country, power source, product type, service and end use.

The countries covered in Asia-Pacific smoke detector market report are, China, Japan, South Korea, Australia, Malaysia, Singapore, India, Thailand, Indonesia, Philippines, and Rest of Asia-Pacific

China is expected to dominate the Asia-Pacific smoke detector market due to the presence of large number of smoke detectors suppliers and providers and increasing adoption of smart smoke detection technologies.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of sales channels are considered while providing forecast analysis of the country data.

Expanding demand for High Bandwidth Communication

Asia-Pacific smoke detector market also provides you with detailed market analysis for every country growth in industry with sales, components sales, impact of technological development in smoke detector and changes in regulatory scenarios with their support for the Asia-Pacific smoke detector market. The data is available for historic period of 2010-2019.

Competitive Landscape and Asia-Pacific Smoke Detector Market Share Analysis

Asia-Pacific smoke detector market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Asia-Pacific presence, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to Asia-Pacific smoke detector market.

The major players covered in the report Honeywell International, Inc., Siemens, ABB, Schneider Electric, Carrier, Analog Devices, Inc., Emerson Electric Co., Robert Bosch GmbH, Mircom Group of Companies, BRK Brands, Inc., Johnson Controls, HOCHIKI Corporation., SECOM CO., LTD,Protec Fire & Security Group Ltd, ADT INC, Securiton AG, Universal Security Instruments, Inc., GENTEX CORPORATION among others. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

Many product developments are also initiated by the companies worldwide which are also accelerating the growth of Asia-Pacific smoke detector market.

For instance,

- In November 2020, Johnson Controls launched a Smart Fire Sprinkler Monitoring Solution. This new solution will monitor and detect breakout of fire using smart sensors distributed across the building and control the fire outbreak using water sprinklers. This was first of its kind as this solution provides all round early detection and security. This product can help in gaining trust of the customers with the early detection feature which will help in expansion of market for the company.

- In July 2020, Carrier through its brand Kidde announced launch of New Multi-Criteria Smoke Detector, Achieves Early Compliance to 2021 UL Safety Standard. This UL standard incorporates three new tests, including a cooking nuisance alarm test and two polyurethane foam tests. These new tests better represent the smoke profiles and behaviour of modern building fires and are designed to give building occupants enough time to abandon safely. This has helped the company to enhance their offerings in the market.

Partnership, joint ventures and other strategies enhances the company market share with increased coverage and presence. It also provides the benefit for organisation to improve their offering for smoke detector through expanded range of size.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA-PACIFIC SMOKE DETECTOR MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 PRODUCT TYPE TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING ADOPTION OF SMART SMOKE DETECTORS

5.1.2 RISING SAFETY CONCERNS DUE TO FIRE ACCIDENTS

5.1.3 STRINGENT GOVERNMENT REGULATIONS FOR FIRE PREVENTION

5.1.4 TECHNOLOGICAL INNOVATIONS IN SMOKE DETECTION SYSTEM

5.1.5 EMERGING TREND OF SMART HOMES AND BUILDINGS.

5.2 RESTRAINTS

5.2.1 HIGH COST FOR INSTALLATION AND UPGRADABILITY OF SMOKE DETECTORS TO CONNECTED SYSTEM OR IOT

5.2.2 LIMITED TECHNICAL EXPERTISE WHEN INTEGRATED WITH SMART CONNECTED NETWORK

5.3 OPPORTUNITIES

5.3.1 INCREASED AWARENESS OF THE FIRE PROTECTION SYSTEM.

5.3.2 INCREASING ADOPTION OF SMOKE DETECTORS IN THE OIL & GAS INDUSTRY

5.3.3 RISING INVESTMENT IN THE CONSTRUCTION INDUSTRY TO INSTALL SMOKE DETECTORS FOR SAFETY

5.3.4 RAPID ADOPTION OF IOT TECHNOLOGY IN SMOKE DETECTORS

5.3.5 GROWTH IN DISPOSABLE INCOME HELP TO INVEST IN SAFETY SYSTEM

5.4 CHALLENGES

5.4.1 COMPLEXITIES IN DESIGNS TO REDUCE FALSE ALARMS

5.4.2 COMPLEXITIES IN PROPER DISPOSAL OF SMOKE DETECTORS.

5.4.3 LIMITATIONS IN DETECTING RANGE

6 IMPACT OF COVID-19 ON THE ASIA-PACIFIC SMOKE DETECTOR MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

6.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

6.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.4 IMPACT ON PRICE

6.5 IMPACT ON DEMAND AND SUPPLY CHAIN

6.6 CONCLUSION

7 ASIA-PACIFIC SMOKE DETECTOR MARKET, BY POWER SOURCE

7.1 OVERVIEW

7.2 BATTERY POWERED

7.3 HARDWIRED WITH BATTERY BACKUP

7.3.1 HARDWIRE INTER-CONNECTABLE SMOKE DETECTOR WITH BATTERY BACK-UP

7.3.2 HARDWIRE NON INTER-CONNECTABLE SMOKE DETECTOR WITH BATTERY BACK-UP

7.4 HARDWIRED WITHOUT BATTERY BACKUP

8 ASIA-PACIFIC SMOKE DETECTOR MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 PHOTOELECTRIC SMOKE DETECTOR

8.3 IONIZATION SMOKE DETECTOR

8.4 DUAL SENSOR SMOKE DETECTOR

8.5 OTHERS

9 ASIA-PACIFIC SMOKE DETECTOR MARKET, BY SERVICE

9.1 OVERVIEW

9.2 ENGINEERING SERVICES

9.3 INSTALLATION AND DESIGN SERVICES

9.4 MAINTENANCE SERVICES

9.5 MANAGED SERVICES

9.6 OTHER SERVICES

10 ASIA-PACIFIC SMOKE DETECTOR MARKET, BY END USE

10.1 OVERVIEW

10.2 COMMERCIAL

10.2.1 RETAIL

10.2.2 HEALTHCARE

10.2.3 HOSPITALITY

10.2.4 BANKING, FINANCIAL SERVICES, & INSURANCE (BFSI)

10.2.5 ACADEMIA & INSTITUTIONAL

10.3 RESIDENTIAL

10.4 OIL & GAS AND MINING

10.5 TRANSPORTATION AND LOGISTICS

10.6 TELECOMMUNICATION

10.7 MANUFACTURING

10.8 OTHERS

11 ASIA-PACIFIC SMOKE DETECTOR MARKET, BY REGION

11.1 ASIA-PACIFIC

11.1.1 CHINA

11.1.2 JAPAN

11.1.3 SOUTH KOREA

11.1.4 AUSTRALIA

11.1.5 SINGAPORE

11.1.6 INDIA

11.1.7 MALAYSIA

11.1.8 THAILAND

11.1.9 INDONESIA

11.1.10 PHILIPPINES

11.1.11 REST OF ASIA-PACIFIC

12 ASIA-PACIFIC SMOKE DETECTOR MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 JOHNSON CONTROLS

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT AND SERVICE PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 CARRIER

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT & SERVICE PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.3 EMERSON ELECTRIC CO.

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENT

14.4 ROBERT BOSCH GMBH

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT & SERVICE PORTFOLIO

14.4.5 RECENT DEVELOPMENTS

14.5 SCHNEIDER ELECTRIC

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENT

14.6 ABB

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENT

14.7 ADT

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 SERVICE & SOLUTION PORTFOLIO

14.7.4 RECENT DEVELOPMENT

14.8 ANALOG DEVICES, INC.

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 APPLICATION PORTFOLIO

14.8.4 RECENT DEVELOPMENTS

14.9 APOLLO FIRE DETECTORS (A SUBSIDIARY OF HALMA PLC)

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENT

14.1 ARGUS SPECTRUM INTERNATIONAL

14.10.1 COMPANY SNAPSHOT

14.10.2 SOLUTION PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 BRK BRANDS, INC.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 GENTEX CORPORATION

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 SERVICE PORTFOLIO

14.12.4 RECENT DEVELOPMENTS

14.13 HOCHIKI CORPORATION

14.13.1 COMPANY SNAPSHOT

14.13.2 REVENUE ANALYSIS

14.13.3 PRODUCT PORTFOLIO

14.13.4 RECENT DEVELOPMENTS

14.14 HONEYWELL INTERNATIONAL INC.

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 RECENT DEVELOPMENTS

14.15 MIRCOM GROUP OF COMPANIES

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENTS

14.16 PROTEC FIRE AND SECURITY GROUP LTD

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENT

14.17 SECOM CO., LTD.

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 SERVICE PORTFOLIO

14.17.4 RECENT DEVELOPMENT

14.18 SECURITON AG

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENT

14.19 SIEMENS

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 PRODUCT PORTFOLIO

14.19.4 RECENT DEVELOPMENTS

14.2 UNIVERSAL SECURITY INSTRUMENTS, INC.

14.20.1 COMPANY SNAPSHOT

14.20.2 REVENUE ANALYSIS

14.20.3 PRODUCT PORTFOLIO

14.20.4 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 SMOKE DETECTOR INSTALLATION COST

TABLE 2 SMOKE DETECTOR PRICE BY FEATURE

TABLE 3 SMOKE DETECTOR COST BY TYPE

TABLE 4 ASIA-PACIFIC SMOKE DETECTOR MARKET, BY POWER SOURCE, 2019-2028 (USD MILLION)

TABLE 5 ASIA-PACIFIC BATTERY POWERED IN SMOKE DETECTOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 6 ASIA-PACIFIC HARDWIRED WITH BATTERY BACKUP IN SMOKE DETECTOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 7 ASIA-PACIFIC HARDWIRED WITH BATTERY BACKUP IN SMOKE DETECTOR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 8 ASIA-PACIFIC HARDWIRED WITHOUT BATTERY BACKUP IN SMOKE DETECTOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 9 ASIA-PACIFIC SMOKE DETECTOR MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 10 ASIA-PACIFIC PHOTOELECTRIC SMOKE DETECTOR IN SMOKE DETECTOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 11 ASIA-PACIFIC IONIZATION SMOKE DETECTOR IN SMOKE DETECTOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 12 ASIA-PACIFIC DUAL SENSOR SMOKE DETECTOR IN SMOKE DETECTOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 13 ASIA-PACIFIC OTHERS IN SMOKE DETECTOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 14 ASIA-PACIFIC SMOKE DETECTOR MARKET, BY SERVICE, 2019-2028 (USD MILLION)

TABLE 15 ASIA-PACIFIC ENGINEERING SERVICES IN SMOKE DETECTOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 16 ASIA-PACIFIC INSTALLATION AND DESIGN SERVICES IN SMOKE DETECTOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 17 ASIA-PACIFIC MAINTENANCE SERVICES IN SMOKE DETECTOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 18 ASIA-PACIFIC MANAGED SERVICES DETECTOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 19 ASIA-PACIFIC OTHER SERVICES IN SMOKE DETECTOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 20 ASIA-PACIFIC SMOKE DETECTOR MARKET, BY END USE, 2019-2028 (USD MILLION)

TABLE 21 ASIA-PACIFIC COMMERCIAL IN SMOKE DETECTOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 22 ASIA-PACIFIC COMMERCIAL SEGMENT IN SMOKE DETECTOR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 23 ASIA-PACIFIC RESIDENTIAL IN SMOKE DETECTOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 24 ASIA-PACIFIC OIL & GAS AND MINING IN SMOKE DETECTOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 25 ASIA-PACIFIC TRANSPORTATION AND LOGISTICS IN SMOKE DETECTOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 26 ASIA-PACIFIC TELECOMMUNICATION IN SMOKE DETECTOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 27 ASIA-PACIFIC MANUFACTURING IN SMOKE DETECTOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 28 ASIA-PACIFIC OTHERS IN SMOKE DETECTOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 29 ASIA-PACIFIC SMOKE DETECTOR MARKET, BY COUNTRY, 2019-2028 (USD MILLION)

TABLE 30 ASIA-PACIFIC SMOKE DETECTOR MARKET, BY POWER SOURCE, 2019-2028 (USD MILLION)

TABLE 31 ASIA-PACIFIC HARDWIRED WITH BATTERY BACKUP IN SMOKE DETECTOR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 32 ASIA-PACIFIC SMOKE DETECTOR MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 33 ASIA-PACIFIC SMOKE DETECTOR MARKET, BY SERVICE, 2019-2028 (USD MILLION)

TABLE 34 ASIA-PACIFIC SMOKE DETECTOR MARKET, BY END USE, 2019-2028 (USD MILLION)

TABLE 35 ASIA-PACIFIC COMMERCIAL IN SMOKE DETECTOR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 36 CHINA SMOKE DETECTOR MARKET, BY POWER SOURCE, 2019-2028 (USD MILLION)

TABLE 37 CHINA HARDWIRED WITH BATTERY BACKUP IN SMOKE DETECTOR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 38 CHINA SMOKE DETECTOR MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 39 CHINA SMOKE DETECTOR MARKET, BY SERVICE, 2019-2028 (USD MILLION)

TABLE 40 CHINA SMOKE DETECTOR MARKET, BY END USE, 2019-2028 (USD MILLION)

TABLE 41 CHINA COMMERCIAL IN SMOKE DETECTOR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 42 JAPAN SMOKE DETECTOR MARKET, BY POWER SOURCE, 2019-2028 (USD MILLION)

TABLE 43 JAPAN HARDWIRED WITH BATTERY BACKUP IN SMOKE DETECTOR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 44 JAPAN SMOKE DETECTOR MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 45 JAPAN SMOKE DETECTOR MARKET, BY SERVICE, 2019-2028 (USD MILLION)

TABLE 46 JAPAN SMOKE DETECTOR MARKET, BY END USE, 2019-2028 (USD MILLION)

TABLE 47 JAPAN COMMERCIAL IN SMOKE DETECTOR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 48 SOUTH KOREA SMOKE DETECTOR MARKET, BY POWER SOURCE, 2019-2028 (USD MILLION)

TABLE 49 SOUTH KOREA HARDWIRED WITH BATTERY BACKUP IN SMOKE DETECTOR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 50 SOUTH KOREA SMOKE DETECTOR MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 51 SOUTH KOREA SMOKE DETECTOR MARKET, BY SERVICE, 2019-2028 (USD MILLION)

TABLE 52 SOUTH KOREA SMOKE DETECTOR MARKET, BY END USE, 2019-2028 (USD MILLION)

TABLE 53 SOUTH KOREA COMMERCIAL IN SMOKE DETECTOR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 54 AUSTRALIA SMOKE DETECTOR MARKET, BY POWER SOURCE, 2019-2028 (USD MILLION)

TABLE 55 AUSTRALIA HARDWIRED WITH BATTERY BACKUP IN SMOKE DETECTOR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 56 AUSTRALIA SMOKE DETECTOR MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 57 AUSTRALIA SMOKE DETECTOR MARKET, BY SERVICE, 2019-2028 (USD MILLION)

TABLE 58 AUSTRALIA SMOKE DETECTOR MARKET, BY END USE, 2019-2028 (USD MILLION)

TABLE 59 AUSTRALIA COMMERCIAL IN SMOKE DETECTOR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 60 SINGAPORE SMOKE DETECTOR MARKET, BY POWER SOURCE, 2019-2028 (USD MILLION)

TABLE 61 SINGAPORE HARDWIRED WITH BATTERY BACKUP IN SMOKE DETECTOR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 62 SINGAPORE SMOKE DETECTOR MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 63 SINGAPORE SMOKE DETECTOR MARKET, BY SERVICE, 2019-2028 (USD MILLION)

TABLE 64 SINGAPORE SMOKE DETECTOR MARKET, BY END USE, 2019-2028 (USD MILLION)

TABLE 65 SINGAPORE COMMERCIAL IN SMOKE DETECTOR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 66 INDIA SMOKE DETECTOR MARKET, BY POWER SOURCE, 2019-2028 (USD MILLION)

TABLE 67 INDIA HARDWIRED WITH BATTERY BACKUP IN SMOKE DETECTOR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 68 INDIA SMOKE DETECTOR MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 69 INDIA SMOKE DETECTOR MARKET, BY SERVICE, 2019-2028 (USD MILLION)

TABLE 70 INDIA SMOKE DETECTOR MARKET, BY END USE, 2019-2028 (USD MILLION)

TABLE 71 INDIA COMMERCIAL IN SMOKE DETECTOR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 72 MALAYSIA SMOKE DETECTOR MARKET, BY POWER SOURCE, 2019-2028 (USD MILLION)

TABLE 73 MALAYSIA HARDWIRED WITH BATTERY BACKUP IN SMOKE DETECTOR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 74 MALAYSIA SMOKE DETECTOR MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 75 MALAYSIA SMOKE DETECTOR MARKET, BY SERVICE, 2019-2028 (USD MILLION)

TABLE 76 MALAYSIA SMOKE DETECTOR MARKET, BY END USE, 2019-2028 (USD MILLION)

TABLE 77 MALAYSIA COMMERCIAL IN SMOKE DETECTOR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 78 THAILAND SMOKE DETECTOR MARKET, BY POWER SOURCE, 2019-2028 (USD MILLION)

TABLE 79 THAILAND HARDWIRED WITH BATTERY BACKUP IN SMOKE DETECTOR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 80 THAILAND SMOKE DETECTOR MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 81 THAILAND SMOKE DETECTOR MARKET, BY SERVICE, 2019-2028 (USD MILLION)

TABLE 82 THAILAND SMOKE DETECTOR MARKET, BY END USE, 2019-2028 (USD MILLION)

TABLE 83 THAILAND COMMERCIAL IN SMOKE DETECTOR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 84 INDONESIA SMOKE DETECTOR MARKET, BY POWER SOURCE, 2019-2028 (USD MILLION)

TABLE 85 INDONESIA HARDWIRED WITH BATTERY BACKUP IN SMOKE DETECTOR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 86 INDONESIA SMOKE DETECTOR MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 87 INDONESIA SMOKE DETECTOR MARKET, BY SERVICE, 2019-2028 (USD MILLION)

TABLE 88 INDONESIA SMOKE DETECTOR MARKET, BY END USE, 2019-2028 (USD MILLION)

TABLE 89 INDONESIA COMMERCIAL IN SMOKE DETECTOR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 90 PHILIPPINES SMOKE DETECTOR MARKET, BY POWER SOURCE, 2019-2028 (USD MILLION)

TABLE 91 PHILIPPINES HARDWIRED WITH BATTERY BACKUP IN SMOKE DETECTOR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 92 PHILIPPINES SMOKE DETECTOR MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 93 PHILIPPINES SMOKE DETECTOR MARKET, BY SERVICE, 2019-2028 (USD MILLION)

TABLE 94 PHILIPPINES SMOKE DETECTOR MARKET, BY END USE, 2019-2028 (USD MILLION)

TABLE 95 PHILIPPINES COMMERCIAL IN SMOKE DETECTOR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 96 REST OF ASIA-PACIFIC SMOKE DETECTOR MARKET, BY POWER SOURCE, 2019-2028 (USD MILLION)

List of Figure

FIGURE 1 ASIA-PACIFIC SMOKE DETECTOR MARKET: SEGMENTATION

FIGURE 2 ASIA-PACIFIC SMOKE DETECTOR MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC SMOKE DETECTOR MARKET: DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC SMOKE DETECTOR MARKET: ASIA-PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA-PACIFIC SMOKE DETECTOR MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC SMOKE DETECTOR MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA-PACIFIC SMOKE DETECTOR MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA-PACIFIC SMOKE DETECTOR MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ASIA-PACIFIC SMOKE DETECTOR MARKET: SEGMENTATION

FIGURE 10 GROWING ADOPTION OF SMART SMOKE DETECTORS ACROSS THE GLOBE IS EXPECTED TO DRIVE THE ASIA-PACIFIC SMOKE DETECTOR MARKET IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 11 HARDWIRED WITH BATTERY BACKUP SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF ASIA-PACIFIC SMOKE DETECTOR MARKET IN 2021 & 2028

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF ASIA-PACIFIC SMOKE DETECTOR MARKET

FIGURE 13 SIZE OF THE IOT MARKET WORLDWIDE FROM 2017 TO 2019, FORECAST FOR 2020-2025

FIGURE 14 HOUSEHOLD SPENDING OF COUNTRIES IN USD MILLION

FIGURE 15 ASIA-PACIFIC SMOKE DETECTOR MARKET, BY POWER SOURCE, 2020

FIGURE 16 ASIA-PACIFIC SMOKE DETECTOR MARKET: BY PRODUCT TYPE, 2020

FIGURE 17 ASIA-PACIFIC SMOKE DETECTOR MARKET: BY SERVICE, 2020

FIGURE 18 ASIA-PACIFIC SMOKE DETECTOR MARKET: BY END USE, 2020

FIGURE 19 ASIA-PACIFIC SMOKE DETECTOR MARKET: SNAPSHOT (2020)

FIGURE 20 ASIA-PACIFIC SMOKE DETECTOR MARKET: BY COUNTRY (2020)

FIGURE 21 ASIA-PACIFIC SMOKE DETECTOR MARKET: BY COUNTRY (2021 & 2028)

FIGURE 22 ASIA-PACIFIC SMOKE DETECTOR MARKET: BY COUNTRY (2020 & 2028)

FIGURE 23 ASIA-PACIFIC SMOKE DETECTOR MARKET: BY POWER SOURCE (2021-2028)

FIGURE 24 ASIA-PACIFIC SMOKE DETECTOR MARKET: COMPANY SHARE 2020 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.