Asia Pacific Small Molecule Sterile Injectable Drugs Market

Market Size in USD Billion

CAGR :

%

USD

46.25 Billion

USD

85.60 Billion

2025

2033

USD

46.25 Billion

USD

85.60 Billion

2025

2033

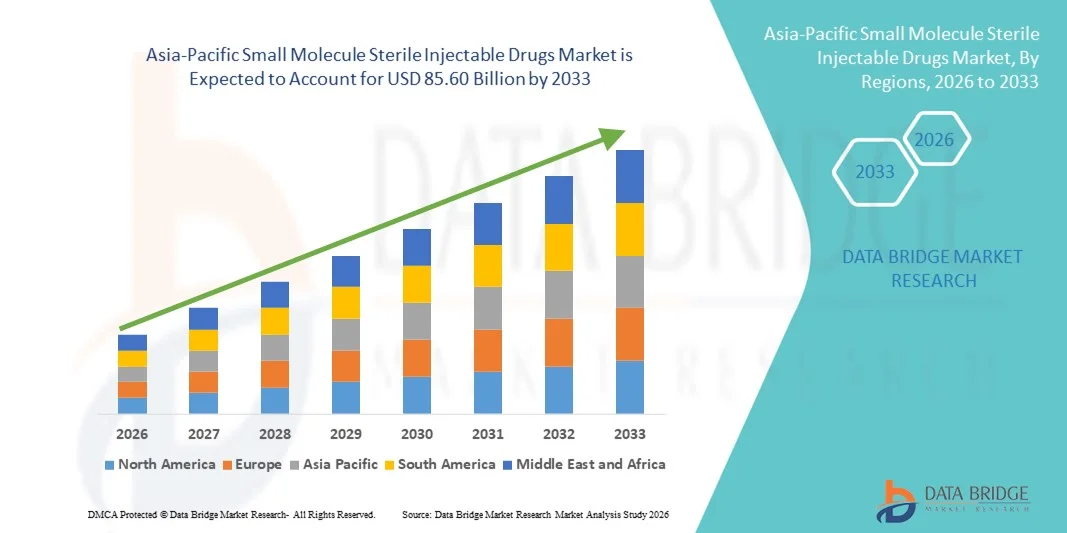

| 2026 –2033 | |

| USD 46.25 Billion | |

| USD 85.60 Billion | |

|

|

|

|

Asia-Pacific Small Molecule Sterile Injectable Drugs Market Size

- The Asia-Pacific small molecule sterile injectable drugs market size was valued at USD 46.25 billion in 2025 and is expected to reach USD 85.60 billion by 2033, at a CAGR of 8.0% during the forecast period

- The market growth is largely fueled by increasing prevalence of chronic and specialty diseases expansion of healthcare infrastructure, and growing adoption of advanced drug delivery systems that support small molecule sterile injectable formats across hospitals, clinics and other care settings

- Furthermore, rising healthcare expenditure, expanding geriatric population, and demand for efficient, reliable injectable therapies are driving stakeholders to invest in scalable sterile manufacturing and distribution networks. These converging factors are significantly boosting market uptake and positioning small molecule sterile injectables as essential components of modern therapeutic regimens across the Asia‑Pacific region

Asia-Pacific Small Molecule Sterile Injectable Drugs Market Analysis

- Small molecule sterile injectable drugs, offering precise and rapid systemic drug delivery, are increasingly vital components of modern therapeutic regimens in both hospitals and specialty care centers due to their efficacy, stability, and compatibility with advanced drug delivery technologies

- The escalating demand for these drugs is primarily fueled by the rising prevalence of chronic and specialty diseases such as oncology, metabolic disorders, and infectious conditions, alongside growing healthcare infrastructure and expanding adoption of advanced sterile manufacturing techniques

- Japan dominated the Asia-Pacific small molecule sterile injectable drugs market with the largest revenue share of 25.7% in 2025, characterized by well-established healthcare infrastructure, strong pharmaceutical R&D, high adoption of injectable therapies, and an aging population driving demand for specialty injectables

- China is expected to be the fastest growing country in the Asia-Pacific market during the forecast period driven by increasing healthcare spending, rising geriatric population, urbanization, and expanding access to specialty treatments across hospitals and clinics

- Vial Filling segment dominated the Asia-Pacific market with a market share of 41.2% in 2025, driven by its widespread use in hospitals, ease of handling, standardization in manufacturing processes, and growing demand for injectable therapies in oncology, infectious diseases, and critical care

Report Scope and Asia-Pacific Small Molecule Sterile Injectable Drugs Market Segmentation

|

Attributes |

Asia-Pacific Small Molecule Sterile Injectable Drugs Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Asia-Pacific Small Molecule Sterile Injectable Drugs Market Trends

Advanced Drug Delivery and Prefilled Systems

- A significant and accelerating trend in the Asia-Pacific sterile injectable market is the increasing adoption of advanced drug delivery systems such as prefilled syringes, dual-chamber vials, and auto-injectors, which improve dosing accuracy, patient safety, and convenience

- For instance, BD’s prefilled syringe systems allow hospitals and clinics to reduce medication errors while streamlining injectable therapy administration, improving overall operational efficiency

- Prefilled systems also facilitate better inventory management and reduce contamination risks, supporting more reliable and safe drug delivery in hospitals and specialty care centers

- The integration of advanced packaging technologies with temperature-sensitive formulations enables broader distribution of injectable drugs across remote and urban healthcare settings, ensuring drug stability and efficacy

- The trend of combining biologics and small molecule therapies in sterile formulations is gaining traction to address multi-targeted treatment regimens, especially in oncology and autoimmune diseases

- Digital monitoring technologies, such as smart sensors and IoT-enabled injectables, are increasingly being used to track dosage administration and cold chain conditions, enhancing treatment safety and compliance

- This trend towards more efficient, precise, and patient-friendly sterile injectable formats is reshaping expectations for drug administration in oncology, infectious diseases, and metabolic disorder therapies

- The demand for prefilled and advanced injectable systems is growing rapidly across hospitals and specialty clinics, as healthcare providers prioritize safety, operational efficiency, and patient compliance

Asia-Pacific Small Molecule Sterile Injectable Drugs Market Dynamics

Driver

Rising Chronic Diseases and Expanding Healthcare Infrastructure

- The increasing prevalence of chronic diseases such as cancer, diabetes, and infectious disorders, coupled with the expansion of hospital infrastructure, is a significant driver of demand for sterile injectable drugs

- For instance, in 2025, WuXi AppTec expanded its sterile manufacturing capabilities in China to support growing oncology injectable demand across hospitals and specialty clinics

- As patient populations requiring targeted injectable therapies rise, demand for reliable, safe, and scalable drug delivery systems is intensifying across Asia-Pacific markets

- Furthermore, government investments in healthcare modernization and increased private sector participation are enabling hospitals to adopt advanced sterile injectable therapies more broadly

- The rising preference for hospital-administered therapies, coupled with the need for precise dosing and rapid systemic drug action, is propelling market growth in both developed and emerging Asia-Pacific countries

- Increasing collaborations between pharmaceutical companies and contract manufacturing organizations (CMOs) are accelerating production capacities for sterile injectables, ensuring timely supply for high-demand therapies

- Expanding awareness and adoption of immunization programs and injectable biologics are further driving demand for small molecule sterile injectables across pediatric and adult population

Restraint/Challenge

Regulatory Compliance and Manufacturing Complexity

- Stringent regulatory standards for sterile injectable drugs, including GMP compliance, aseptic manufacturing, and documentation requirements, pose a significant challenge to market expansion

- For instance, delays in approval or compliance audits in countries such as India and Japan can restrict the introduction of new sterile injectable therapies despite high demand

- Addressing these regulatory hurdles requires continuous quality monitoring, process validation, and adherence to evolving pharmacopoeia standards, which can increase production costs

- Moreover, high capital investment for sterile manufacturing facilities and complex supply chain requirements can limit participation of smaller pharmaceutical manufacturers in the Asia-Pacific market

- Overcoming these challenges through technology adoption, regulatory harmonization, and enhanced training for production staff will be critical to sustaining long-term growth in the sterile injectable drugs segment

- Supply chain disruptions, particularly for raw materials and excipients critical to sterile formulations, can delay production and limit market availability

- Stringent environmental and waste management regulations for sterile manufacturing processes increase operational costs and require specialized infrastructure, presenting barriers for new entrants

Asia-Pacific Small Molecule Sterile Injectable Drugs Market Scope

The market is segmented on the basis of product, application, end-users, and distribution channels.

- By Product

On the basis of product, the Asia-Pacific market is segmented into vial filling, syringe filling, cartridge filling, and others. The Vial Filling segment dominated the market with the largest revenue share of 41.2% in 2025, driven by its widespread adoption in hospitals and specialty clinics. Vials offer a standardized, cost-effective solution for the bulk administration of injectable therapies across oncology, infectious diseases, and metabolic disorder treatments. Their compatibility with automated filling lines and established aseptic manufacturing processes enhances efficiency and reduces contamination risk. Vial filling also supports multi-dose administration, making it highly suitable for high-volume hospital settings. Hospitals and specialty care providers often prefer vials for their proven safety, ease of storage, and flexibility in dosing. The segment benefits from consistent regulatory approvals and robust supply chains in countries such as Japan and China.

The Syringe Filling segment is anticipated to witness the fastest growth rate of 14.8% from 2026 to 2033, fueled by increasing demand for prefilled syringes in oncology, autoimmune, and infectious disease therapies. Prefilled syringes enhance patient safety by reducing handling errors and contamination risks while improving operational efficiency in hospitals and clinics. Growing adoption of self-administered injectables in home care settings is further driving this trend. The convenience of ready-to-use syringes also appeals to specialty clinics focused on outpatient care. The combination of digital labeling, barcoding, and automated filling technologies adds reliability and traceability, contributing to the rapid expansion of this segment.

- By Application

On the basis of application, the market is segmented into oncology, infectious diseases, cardiovascular diseases, metabolic diseases, neurology, dermatology, urology, autoimmune diseases, respiratory disorders, and others. The Oncology segment dominated the market with a revenue share of 32.4% in 2025, owing to the high prevalence of cancer and the strong adoption of injectable chemotherapy and targeted therapies. Oncology treatments often require precise dosing and multi-drug regimens, which sterile injectable formats can reliably deliver. Hospitals and specialty oncology clinics prefer vials and prefilled syringes for their safety, efficacy, and ability to integrate with automated dispensing systems. Growth is supported by increasing government and private investments in cancer care infrastructure across Japan, China, and South Korea. Patient-centric initiatives, including outpatient chemotherapy and home-administered biologics, are also contributing to the dominance of this segment. Regulatory approvals for new oncology injectables continue to stimulate market expansion.

The Infectious Diseases segment is expected to witness the fastest CAGR of 15.2% from 2026 to 2033, driven by rising prevalence of bacterial, viral, and emerging infections, and the need for injectable antibiotics, antivirals, and vaccines. Prefilled syringes and auto-injectors are increasingly preferred to enhance patient compliance and reduce administration errors. Hospitals and clinics are investing in faster, more reliable injectable delivery systems to manage seasonal outbreaks and pandemic preparedness. The growing demand for immunization programs and injectable biologics in China and India is accelerating segment growth. Technological innovations, such as combination therapies and cold chain optimization, further support the rapid adoption of injectable solutions in this segment.

- By End-Users

On the basis of end-users, the market is segmented into hospitals, specialty clinics, home care settings, and others. The Hospitals segment dominated the market with a share of 55.1% in 2025, driven by high patient throughput, complex multi-drug regimens, and preference for standardized, bulk injectable administration. Hospitals utilize vial and syringe-based sterile injectables across oncology, infectious diseases, and metabolic disorder therapies. The established infrastructure, trained medical staff, and regulatory adherence in hospitals make them the largest consumers of sterile injectables. Investment in automated drug dispensing systems and cold chain logistics further supports vial and syringe usage in these settings. Hospitals in Japan, China, and South Korea are major contributors to revenue due to their strong healthcare infrastructure and large patient populations.

The Home Care Settings segment is expected to witness the fastest growth at a CAGR of 13.9% from 2026 to 2033, driven by increasing preference for self-administered injectables, patient-centric care models, and prefilled syringes. Home care enables patients with chronic conditions, autoimmune disorders, and oncology therapies to receive treatment outside hospital settings. Growth is accelerated by digital monitoring technologies and telemedicine initiatives, which ensure safety and compliance for home-administered therapies. Patients in China and India are increasingly opting for home-based injection therapies for convenience and reduced hospital visits. The convenience of prefilled syringes and auto-injectors makes home care a rapidly growing end-user segment.

- By Distribution Channels

On the basis of distribution channels, the market is segmented into direct tender, retail pharmacy, online pharmacy, and others. The Direct Tender segment dominated the market with a share of 46.8% in 2025, as hospitals, specialty clinics, and government healthcare programs procure large volumes of sterile injectables directly from manufacturers. Direct tenders ensure reliability, cost-effectiveness, and compliance with stringent quality standards. The segment benefits from long-term contracts, centralized procurement systems, and strong relationships between hospitals and manufacturers. Japan and China lead in the adoption of direct tender procurement for oncology and infectious disease injectables. Bulk purchasing through direct tenders also facilitates inventory management, secure cold chain maintenance, and traceability of high-value injectable drugs.

The Online Pharmacy segment is expected to witness the fastest growth with a CAGR of 16.1% from 2026 to 2033, driven by rising e-commerce adoption, telemedicine initiatives, and growing home care therapy demand. Online pharmacies offer convenient access to prefilled syringes, auto-injectors, and other sterile injectables for chronic disease management. Growth is further fueled by urbanization, increasing smartphone penetration, and digital payment adoption in India, China, and Southeast Asian countries. Online platforms also provide patient education, automated reminders, and doorstep delivery, ensuring compliance with therapy regimens. The COVID-19 pandemic accelerated online sales of injectable therapies, and this trend continues to expand rapidly.

Asia-Pacific Small Molecule Sterile Injectable Drugs Market Regional Analysis

- Japan dominated the Asia-Pacific small molecule sterile injectable drugs market with the largest revenue share of 25.7% in 2025, characterized by well-established healthcare infrastructure, strong pharmaceutical R&D, high adoption of injectable therapies, and an aging population driving demand for specialty injectables

- Hospitals and specialty clinics in Japan prioritize the use of vial and prefilled syringe formats due to their proven safety, precise dosing, and compatibility with automated dispensing systems, supporting widespread adoption of sterile injectables across oncology, infectious diseases, and metabolic disorder treatments

- This widespread adoption is further supported by an aging population, high healthcare expenditure, and increasing demand for specialty therapies, establishing sterile injectables as the preferred drug delivery format for hospitals, specialty clinics, and home care settings in the country

The Japan Small Molecule Sterile Injectable Drugs Market Insight

The Japan market is witnessing strong growth due to its well-established healthcare infrastructure, high pharmaceutical R&D capabilities, and preference for advanced sterile injectable therapies. Hospitals and specialty clinics in Japan prioritize vial and prefilled syringe formats for their reliability, precise dosing, and integration with automated dispensing systems. The aging population is further driving demand for oncology, autoimmune, and infectious disease injectables. The growing adoption of home care therapies and outpatient administration programs is also contributing to market expansion. Moreover, Japan’s emphasis on safety, quality, and innovation is fueling the adoption of novel sterile formulations and prefilled drug delivery systems.

China Small Molecule Sterile Injectable Drugs Market Insight

The China market is expected to grow at the fastest rate in the Asia-Pacific region, driven by increasing healthcare spending, urbanization, and rising patient population requiring injectable therapies. Expansion of hospitals, specialty clinics, and home care services is accelerating the adoption of vial, syringe, and prefilled injectable formats. Government initiatives for chronic disease management, immunization programs, and oncology care are boosting market demand. The increasing prevalence of diabetes, cardiovascular disorders, and infectious diseases is also driving sterile injectable adoption. Technological advancements in aseptic manufacturing and digital labeling for traceability further support growth. Moreover, cost efficiencies from local manufacturing hubs are enhancing the affordability and accessibility of injectable therapies.

India Small Molecule Sterile Injectable Drugs Market Insight

The India market accounted for the largest share of the Asia-Pacific sterile injectable drugs market in 2025, attributed to rapid urbanization, rising middle-class population, and growing healthcare infrastructure. Hospitals and specialty clinics are increasingly adopting vial, syringe, and prefilled injectable formats for oncology, infectious disease, and metabolic disorder treatments. Government initiatives supporting immunization programs and chronic disease management are accelerating adoption. The availability of affordable sterile injectables from domestic manufacturers is also a key growth driver. Furthermore, the increasing penetration of home care therapy programs and outpatient injectable administration is expanding market reach. Rising patient awareness about treatment efficacy and safety is propelling the demand for advanced injectable drug delivery solutions.

South Korea Small Molecule Sterile Injectable Drugs Market Insight

The South Korea market is witnessing steady growth due to the country’s advanced healthcare system, high adoption of hospital-administered therapies, and strong pharmaceutical R&D capabilities. Hospitals and specialty clinics prioritize vial and prefilled syringe formats for precise dosing and operational efficiency. The rising prevalence of oncology, cardiovascular, and metabolic disorders is fueling demand for sterile injectables. Government initiatives to improve access to specialty therapies and outpatient care programs are further supporting market expansion. Technological innovations in aseptic manufacturing and automated filling systems are enhancing safety and reliability. Moreover, South Korea’s urbanized population and high healthcare awareness are driving adoption in both hospitals and home care settings.

Asia-Pacific Small Molecule Sterile Injectable Drugs Market Share

The Asia-Pacific Small Molecule Sterile Injectable Drugs industry is primarily led by well-established companies, including:

- Dr. Reddy’s Laboratories Ltd. (India)

- Biocon Ltd. (India)

- Cipla (India)

- Aurobindo Pharma Limited (India)

- Hetero (India)

- Alembic Pharmaceuticals Limited (India)

- Intas Pharmaceuticals Ltd (India)

- Lupin Limited (India)

- Zydus Lifesciences Ltd (India)

- Gland Pharma Limited (India)

- Laurus Labs Ltd (India)

- WuXi AppTec Co., Ltd (China)

- Samsung Biologics Co., Ltd (South Korea)

- Strides Pharma Science Limited (India)

- Panacea Biotec Ltd (India)

- Ajanta Pharma Ltd (India)

- Emcure Pharmaceuticals Ltd (India)

- IPCA Laboratories Ltd (India)

- Cadila Pharmaceuticals Ltd (India)

What are the Recent Developments in Asia-Pacific Small Molecule Sterile Injectable Drugs Market?

- In December 2025, Thermo Fisher Scientific announced the expansion of its Bioprocess Design Centers in Asia, including new facilities in Hyderabad (India) and enhancements in Incheon (South Korea) and Singapore, strengthening local expertise and advanced technologies for biopharmaceutical manufacturing in the region. This expansion supports scientists with process design, simulation, and optimization capabilities, enabling faster development and commercialization of biologics and sterile injectable therapies across APAC

- In September 2025, the Corning and SGD Pharma joint venture inaugurated a high‑tech glass tubing facility near Hyderabad, India, with an annual capacity to support ~2.2 billion injectable vials by the end of 2025 or early 2026. This strategic investment strengthens local supply chains for sterile injectable packaging critical to parenteral drug formulation and delivery

- In July 2025, Akums’ sterile manufacturing plant received ANVISA GMP certification, enabling it to export sterile injectable and lyophilized products to Brazil and other regulated markets. This certification underscores the plant’s compliance with stringent global manufacturing standards and supports Akums’ global CDMO ambitions in sterile dosage manufacturing

- In January 2025, Akums Drugs & Pharmaceuticals Ltd. opened a new state‑of‑the‑art sterile manufacturing facility in India dedicated to producing lyophilized products and sterile injectables including vials and ampoules. This expansion enhances regional aseptic fill‑finish capacity and positions the company to meet rising healthcare demand across therapeutic categories requiring sterile dosage forms

- In May 2023, Thermo Fisher Scientific opened a new sterile drug manufacturing facility in Singapore, aimed at enhancing research, development, and manufacturing capabilities for critical medicines and vaccines. The site features a high-speed fully automated aseptic fill-finish line for both small and large molecules, increasing regional sterile injectable production capacity and contributing to supply chain resilience in Southeast Asia

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.