Asia Pacific Rubber Testing Equipment Market

Market Size in USD Million

CAGR :

%

USD

116.54 Million

USD

192.87 Million

2024

2032

USD

116.54 Million

USD

192.87 Million

2024

2032

| 2025 –2032 | |

| USD 116.54 Million | |

| USD 192.87 Million | |

|

|

|

|

Asia-Pacific Rubber Testing Equipment Market Size

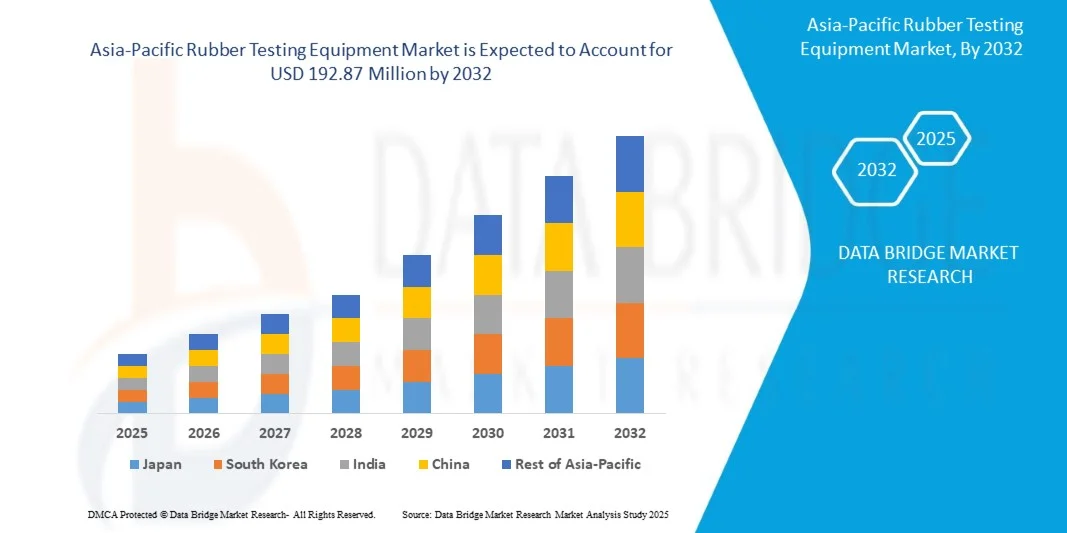

- The Asia-Pacific rubber testing equipment market size was valued at USD 116.54 million in 2024 and is expected to reach USD 192.87 million by 2032, at a CAGR of 6.5% during the forecast period

- The market growth is largely fuelled by the increasing demand for high-performance rubber components across automotive, aerospace, and industrial sectors, along with stringent quality and safety regulations driving the adoption of advanced testing solutions

- In addition, technological advancements in testing equipment, such as automation, real-time data analytics, and integration with digital platforms, are enhancing testing accuracy and efficiency, further supporting market expansion

Asia-Pacific Rubber Testing Equipment Market Analysis

- The rubber testing equipment market is experiencing steady growth as manufacturers increasingly focus on quality assurance to meet performance standards across industrial applications

- Growing emphasis on product consistency and safety in sectors such as automotive and manufacturing is encouraging the use of precise and automated rubber testing solutions

- China dominated the rubber testing equipment market with the largest revenue share of 38.5% in 2024, driven by rapid industrialization, rising automotive production, and stringent quality regulations

- Japan is expected to witness the highest compound annual growth rate (CAGR) in the Asia-Pacific rubber testing equipment market due to increasing investment in advanced testing technologies, rising demand for precision and durability in automotive and industrial rubber products, and continuous innovation in automation and modular testing systems

- The viscosity testing segment accounted for the largest market revenue share in 2024, driven by its critical role in evaluating the processability and flow characteristics of rubber compounds. Manufacturers rely heavily on viscosity testing to ensure consistency in production and to meet the performance requirements of end-use applications

Report Scope and Asia-Pacific Rubber Testing Equipment Market Segmentation

|

Attributes |

Asia-Pacific Rubber Testing Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Asia-Pacific Rubber Testing Equipment Market Trends

“Increasing Adoption of Advanced Rubber Testing Solutions”

- The growing use of advanced rubber testing equipment is transforming the quality control landscape by enabling precise and reliable evaluation of rubber properties such as tensile strength, hardness, and elasticity. These systems allow manufacturers to ensure consistent product performance and compliance with industry standards, reducing defects and improving overall product quality. Furthermore, integration with digital reporting and data analytics helps manufacturers track production trends and make informed decisions for product improvement

- Rising demand for rubber products in automotive, industrial, and consumer applications is accelerating the adoption of automated and portable testing devices. These solutions are particularly effective in identifying material inconsistencies and ensuring that rubber components meet safety and durability requirements. The trend is further strengthened by increasing global quality regulations and the need for certifications in export markets

- The ease of use, accuracy, and versatility of modern rubber testing instruments make them attractive for routine quality inspections, helping manufacturers maintain production efficiency and reduce material wastage. In addition, these systems often feature modular designs and remote monitoring capabilities, enabling flexible deployment across multiple production lines and facilities. The adoption also supports sustainability goals by minimizing defective output and resource wastage

- For instance, in 2023, several tire and industrial rubber manufacturers in region reported improved product consistency and reduced production defects after implementing automated tensile and hardness testing machines. These improvements enhanced brand reputation and customer satisfaction, while also lowering recall rates and warranty claims. The integration of smart sensors and real-time feedback further allowed manufacturers to fine-tune their processes and maintain uniform product quality

- While advanced rubber testing equipment is gaining traction, its impact depends on continuous technological innovation, operator training, and affordability. Manufacturers must focus on developing modular, scalable, and reliable systems to fully capitalize on market growth. Ongoing software upgrades and compatibility with emerging IoT solutions are also critical for sustaining operational efficiency and meeting evolving industry standards

Asia-Pacific Rubber Testing Equipment Market Dynamics

Driver

“Rising Emphasis on Product Quality, Safety, and Standardization”

- The growing focus on product safety and compliance with international standards is driving the adoption of rubber testing equipment. Companies are increasingly prioritizing testing solutions that ensure durability, performance, and regulatory adherence across automotive, industrial, and consumer segments. Increasing awareness of end-user safety and brand liability also compels manufacturers to adopt high-precision testing systems

- Manufacturers are increasingly seeking automated, precise, and reliable testing systems to optimize production processes, reduce waste, and maintain consistent quality across batches. Advanced testing equipment enables detailed material characterization, helping improve product design and performance. The use of connected devices and analytics ensures process traceability, supporting regulatory audits and internal quality assurance initiatives

- The expansion of the rubber industry, particularly in automotive tires, industrial seals, and consumer goods, is further fueling market demand. Testing solutions provide critical insights into material properties, ensuring end products meet performance expectations and customer requirements. In addition, rising exports to regions with stringent safety standards are encouraging companies to adopt advanced testing protocols to maintain market access

- For instance, in 2022, several rubber component manufacturers in region integrated automated hardness and tensile testing systems into production lines, leading to enhanced product uniformity and reduced failure rates. The adoption also improved operational efficiency by reducing manual intervention and minimizing human error, resulting in higher throughput and lower costs

- While product quality and standardization are key growth drivers, adoption depends on cost-effectiveness, ease of use, and the availability of trained personnel to operate sophisticated testing equipment. Continuous training programs and technical support services are becoming essential to ensure optimal utilization and prevent downtime, ultimately supporting long-term market expansion

Restraint/Challenge

“High Cost of Advanced Testing Equipment and Limited Accessibility in Small-Scale Operations”

- The high cost of advanced rubber testing instruments, including universal testing machines, hardness testers, and rheometers, limits adoption among small and medium-sized manufacturers. Price constraints restrict access to cutting-edge technologies that enhance quality control. Moreover, expensive maintenance contracts and calibration requirements add to operational expenses, deterring smaller players from investing

- In many regions, there is a shortage of skilled personnel capable of operating and maintaining complex testing equipment. Lack of training and technical expertise hampers effective utilization, reducing the benefits of advanced systems. This challenge is particularly pronounced in emerging markets where vocational training for advanced laboratory equipment is limited

- Supply chain challenges and the limited availability of specialized testing instruments in developing regions further restrict market penetration. Small manufacturers often rely on manual or outdated testing methods, which may result in inconsistent quality. Delays in importing high-end equipment and spare parts can disrupt production schedules, affecting overall operational efficiency

- For instance, in 2023, several rubber component producers in Southeast Asia reported delays in upgrading to automated testing equipment due to budgetary and logistical constraints, affecting production efficiency and product reliability. These setbacks led to missed deadlines and limited their ability to meet export quality standards, impacting revenue and market competitiveness

- While testing technologies continue to evolve, addressing cost, accessibility, and skill gaps is essential for broader adoption and sustainable growth in the rubber testing equipment market. Industry collaborations, government support, and flexible financing options could further enable smaller players to adopt advanced testing systems and improve overall market standards

Asia-Pacific Rubber Testing Equipment Market Scope

The Asia-Pacific rubber testing equipment market is segmented on the basis of type of testing, technology, rubber type, frequency range, and application.

- By Type of Testing

On the basis of type of testing, the market is segmented into viscosity testing, density testing, hardness testing, flex testing, thickness tester, mechanical stability tester, impact tester, and aging oven testing. The viscosity testing segment accounted for the largest market revenue share in 2024, driven by its critical role in evaluating the processability and flow characteristics of rubber compounds. Manufacturers rely heavily on viscosity testing to ensure consistency in production and to meet the performance requirements of end-use applications.

The hardness testing segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the rising demand for high-performance rubber components in sectors such as automotive, construction, and aerospace. Hardness testing provides accurate assessments of material resistance under pressure, ensuring the durability and reliability of rubber parts used in extreme conditions.

- By Technology

On the basis of technology, the market is segmented into Mooney viscometer, moving die rheometer, automated density tester, automated hardness tester, and process analyzer. The Mooney viscometer segment held the largest share in 2024, as it remains a widely accepted standard for measuring the viscosity of raw rubber and rubber compounds. Its simple operation and broad applicability make it a fundamental tool in rubber quality control processes.

The process analyzer segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing demand for real-time monitoring of production parameters. Process analyzers enhance operational efficiency by reducing downtime and enabling data-driven decision-making, which is becoming vital in automated and large-scale manufacturing environments.

- By Rubber Type

On the basis of rubber type, the market is segmented into styrene butadiene rubber, EPDM rubber, butyl rubber, natural rubber, silicone rubber, neoprene rubber, nitrile rubber, and others. Natural rubber dominated the market in 2024, owing to its extensive use across automotive, industrial, and consumer applications due to its elasticity and mechanical strength. Its compatibility with diverse testing methods and availability across global markets further supports segment dominance.

The silicone rubber segment is expected to witness the fastest growth rate from 2025 to 2032, attributed to its excellent thermal stability, electrical insulation properties, and rising use in the electronics and healthcare sectors. This material requires rigorous testing to meet stringent quality standards, fueling demand for specialized rubber testing equipment.

- By Frequency Range

On the basis of frequency range, the market is segmented into more than 4 Hz, 1 to 4 Hz, and less than 1 Hz. The 1 to 4 Hz segment held the largest market revenue share in 2024 due to its broad application across standard dynamic mechanical analysis and fatigue testing. This range is optimal for assessing performance under repetitive stress conditions in sectors such as automotive and footwear.

The more than 4 Hz segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its increasing use in advanced fatigue and impact testing applications. Equipment operating in this range enables faster testing cycles and higher precision, which is crucial for high-throughput industrial environments.

- By Application

On the basis of application, the market is segmented into tyres & automotive parts, industrial rubber products, rubber seals & O rings, shoe soles, conveyor belts, belts, rubber mats & carpets, and sports & fitness. The tyres & automotive parts segment accounted for the largest share in 2024, driven by the strict quality requirements and safety regulations in the automotive sector. Testing ensures components such as tires and bushings meet performance criteria for wear, pressure, and temperature resistance.

The conveyor belts segment is expected to witness the fastest growth rate from 2025 to 2032, supported by expanding industrialization and the need for durable materials in logistics and mining. Robust testing of mechanical properties and aging resistance is crucial to ensure long-lasting performance under continuous operation and abrasive environments.

Asia-Pacific Rubber Testing Equipment Market Regional Analysis

- China dominated the rubber testing equipment market with the largest revenue share of 38.5% in 2024, driven by rapid industrialization, rising automotive production, and stringent quality regulations

- Manufacturers are adopting automated and precision testing systems to ensure consistent product performance and compliance with international standards

- Widespread adoption is further supported by increasing demand for tires, industrial seals, and consumer rubber products, boosting investments in advanced testing equipment

Japan Rubber Testing Equipment Market Insight

The Japan market is expected to witness the fastest growth rate from 2025 to 2032, driven by technological advancements, high adoption of automated testing systems, and demand for high-performance industrial rubber products. Manufacturers focus on quality improvement, process optimization, and integration of IoT-enabled testing solutions, supported by government regulations emphasizing safety and standardization.

Asia-Pacific Rubber Testing Equipment Market Share

The Asia-Pacific rubber testing equipment industry is primarily led by well-established companies, including:

- Taiwan Semiconductor Manufacturing Company (TSMC) (Taiwan)

- Samsung Electronics (South Korea)

- Toyota Motor Corporation (Japan)

- Reliance Industries Limited (India)

- Commonwealth Bank of Australia (CBA) (Australia)

- Singapore Airlines (Singapore)

- PetroChina (China)

- BHP Group (Australia)

- LG Electronics (South Korea)

- China State Construction Engineering Corporation (CSCEC) (China)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Asia Pacific Rubber Testing Equipment Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Asia Pacific Rubber Testing Equipment Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Asia Pacific Rubber Testing Equipment Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.