Asia Pacific Remote Patient Monitoring And Care Market

Market Size in USD Billion

CAGR :

%

USD

2.43 Billion

USD

5.53 Billion

2024

2032

USD

2.43 Billion

USD

5.53 Billion

2024

2032

| 2025 –2032 | |

| USD 2.43 Billion | |

| USD 5.53 Billion | |

|

|

|

|

Asia-Pacific Remote Patient Monitoring and Care Market Size

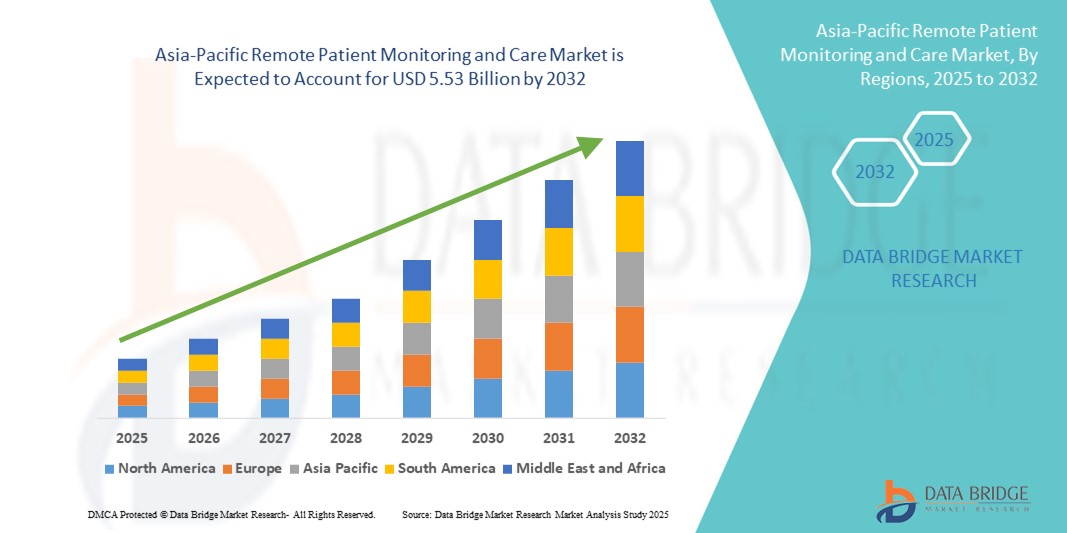

- The Asia-Pacific remote patient monitoring and care market size was valued at USD 2.43 billion in 2024 and is expected to reach USD 5.53 billion by 2032, at a CAGR of 10.8% during the forecast period

- The market growth is largely fueled by increasing awareness of chronic disease management, rising healthcare access, and advancements in digital health technologies across Asia-Pacific, enabling continuous patient monitoring and timely intervention. The region is experiencing a surge in adoption of remote monitoring solutions, particularly in rapidly urbanizing countries such as India, China, and Indonesia, contributing to the growing deployment of remote patient monitoring and care systems

- Furthermore, escalating investments in healthcare IT infrastructure, expansion of telehealth services in rural areas, and increasing public-private partnerships are driving innovation and availability of advanced RPM solutions. Government digital health initiatives, coupled with the growing presence of international healthcare technology companies and local software and device development capabilities, are significantly boosting the growth of the Asia-Pacific Remote Patient Monitoring and Care market

Asia-Pacific Remote Patient Monitoring and Care Market Analysis

- The Asia-Pacific remote patient monitoring and care market is witnessing strong growth, driven by increasing healthcare digitization, rising prevalence of chronic diseases, and growing adoption of telehealth solutions. Countries such as China, India, Japan, and South Korea are investing in advanced healthcare IT infrastructure, enabling real-time monitoring, early diagnosis, and continuous patient management across hospitals and homecare settings

- Rising awareness about remote patient monitoring (RPM) technologies, coupled with the expanding availability of wearable devices, mobile health applications, and cloud-based healthcare platforms, is further accelerating adoption. The increasing focus on patient-centric care and the need to reduce hospital readmissions are also key drivers for market growth across the region

- China dominated the Asia-Pacific remote patient monitoring and care market, accounting for the largest revenue share of 37.1% in 2024, driven by the country’s robust healthcare digitization programs, growing elderly population, and government support for telehealth initiatives. Investments in smart hospital networks and remote monitoring programs are further strengthening China’s leadership in the region

- India is projected to register the fastest CAGR of 13.8% in the Asia-Pacific remote patient monitoring and care market during the forecast period, fueled by increasing smartphone penetration, government initiatives such as Ayushman Bharat Digital Mission, and rising private investments in telehealth and digital healthcare services. The expansion of affordable RPM solutions across tier 2 and tier 3 cities is supporting rapid market adoption

- The Cardiovascular Diseases segment dominated the Asia-Pacific remote patient monitoring and care market with a share at 41.8% in 2024, fueled by the rising burden of heart-related disorders, increasing awareness of early detection and preventive care, and widespread adoption of cardiac monitoring in both inpatient and outpatient settings

Report Scope and Asia-Pacific Remote Patient Monitoring and Care Market Segmentation

|

Attributes |

Asia-Pacific Remote Patient Monitoring and Care Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Remote Patient Monitoring and Care Market Trends

Growing Adoption of Digital Health Solutions and Clinical Research

- A significant and accelerating trend in the Asia-Pacific remote patient monitoring and Care market is the increasing focus on digital health innovations and clinical research—particularly targeting chronic disease management, elderly care, and post-operative monitoring

- For instance, hospitals, telehealth providers, and research institutes across Asia-Pacific are investing in next-generation remote patient monitoring systems that integrate wearable sensors, IoT devices, and cloud-based analytics platforms. These technologies enable real-time monitoring of vital signs, early detection of complications, and personalized care interventions

- The increasing adoption of personalized healthcare models across specialty clinics, rehabilitation centers, and homecare services is improving patient outcomes. These models use advanced data analytics, AI-driven insights, and continuous patient feedback to optimize care plans and enhance adherence to treatment protocols

- Partnerships between medical technology firms, university hospitals, and government-backed programs are expanding access to RPM services by enhancing reimbursement frameworks, standardizing telehealth regulations, and providing training for healthcare providers on remote monitoring platforms

- As Asia-Pacific continues to prioritize patient-centered care, digital health integration, and value-based health outcomes, the remote patient monitoring and care market is poised for sustained growth—driven by innovation, improved clinical decision-making, and rising demand for accessible, real-time healthcare services among aging and chronic disease populations

Asia-Pacific Remote Patient Monitoring and Care Market Dynamics

Driver

Growing Need Due to Rising Chronic Disease Prevalence and Advancements in Digital Health Technologies

- The increasing prevalence of chronic diseases such as diabetes, cardiovascular conditions, and respiratory disorders across Asia-Pacific, supported by growing health awareness and improved diagnostic capabilities, is significantly driving market growth. Countries such as China, India, Japan, and South Korea are enhancing their healthcare infrastructure and telehealth programs, enabling earlier detection, continuous monitoring, and timely intervention

- For instance, in April 2024, Medtronic announced the launch of its new remote cardiac monitoring system integrating AI-powered predictive analytics for early detection of arrhythmias. Such innovations are expected to catalyze the adoption of advanced remote patient monitoring solutions, thereby accelerating the Asia-Pacific remote patient monitoring and care market over the forecast period

- Rising interest in personalized digital health solutions and the availability of next-generation wearable and implantable monitoring devices are prompting a market shift from conventional episodic care to continuous, data-driven patient management

- Regulatory bodies across Asia-Pacific, such as the Pharmaceuticals and Medical Devices Agency (PMDA) in Japan and the National Medical Products Administration (NMPA) in China, are increasingly supporting digital health innovation through fast-track approvals and clinical trial support, fostering rapid market access for new RPM technologies

- Collaborations among regional healthcare technology firms, academic research centers, and professional associations are strengthening the innovation ecosystem in Asia-Pacific. These partnerships are instrumental in expanding patient access to advanced monitoring solutions, scaling clinical research initiatives, and enhancing awareness of chronic disease management across diverse populations

Restraint/Challenge

Limited Infrastructure and Variability in Clinical Adoption

- The high cost associated with advanced RPM solutions—including wearable sensors, multi-parameter monitoring devices, and integrated telehealth platforms—poses a substantial barrier to widespread adoption, especially in rural areas and countries with limited healthcare funding

- Even when supported by government initiatives, these technologies typically involve complex integration, long development cycles, and sophisticated manufacturing or software requirements, making them less affordable for health systems with constrained budgets

- Moreover, specialized multidisciplinary care, which includes clinicians, nurses, telehealth coordinators, and data analysts, is often concentrated in urban centers. This geographic disparity forces patients to travel long distances or face delayed access to continuous monitoring services

- Another challenge is the lack of standardized protocols for device usage, data management, and remote patient care workflows. Due to limited clinical experience and variability in physician familiarity—especially in low-volume centers—the adoption of innovative RPM solutions remains inconsistent

- To overcome these challenges, policy reforms, enhanced government funding, cross-border research collaboration, and the establishment of dedicated digital health hubs across Asia-Pacific will be essential in expanding access and achieving sustainable growth in the Asia-Pacific Remote Patient Monitoring and Care Market

Asia-Pacific Remote Patient Monitoring and Care Market Scope

The market is segmented on the basis of device type, application, and end user.

- By Device Type

On the basis of device type, the remote patient monitoring and care market is segmented into cardiac monitoring devices, blood pressure monitoring devices, blood glucose monitoring devices, respiratory monitoring devices, neurological monitoring devices, multi-parameter monitoring devices, and others. The cardiac monitoring devices segment dominated the market in 2024, accounting for the largest revenue share of 37.4%. This dominance is attributed to the rising prevalence of cardiovascular diseases, increased demand for continuous and real-time heart monitoring, and the integration of wearable and implantable cardiac devices in both hospital and homecare settings.

The multi-parameter monitoring devices segment is projected to grow at the fastest CAGR of 11.2% from 2025 to 2032. Growth is driven by the increasing adoption of devices capable of simultaneously tracking multiple vital signs, integration with cloud-based analytics platforms, and growing emphasis on proactive, data-driven patient care in chronic and acute conditions.

- By Application

On the basis of application, the market is segmented into oncology, diabetes, cardiovascular diseases, and others. The cardiovascular diseases segment held the largest share at 41.8% in 2024, fueled by the rising burden of heart-related disorders, increasing awareness of early detection and preventive care, and widespread adoption of cardiac monitoring in both inpatient and outpatient settings.

The diabetes segment is expected to witness the fastest CAGR of 10.5% during 2025–2032, supported by the growing prevalence of diabetes across Asia-Pacific, the availability of innovative glucose monitoring solutions, and government-led initiatives promoting self-monitoring and remote disease management.

- By End User

On the basis of end user, the market is segmented into hospital-based patients, ambulatory patients, and home healthcare patients. The hospital-based patients segment dominated with a 43.6% share in 2024, driven by hospitals’ structured remote monitoring programs, strong clinical infrastructure, and the adoption of advanced monitoring technologies to enhance patient outcomes.

The Home Healthcare Patients segment is projected to grow at the fastest CAGR of 12.1% from 2025 to 2032, fueled by the rising demand for at-home chronic disease management, adoption of telehealth and remote monitoring solutions, and supportive government policies enabling decentralized care delivery.

Asia-Pacific Remote Patient Monitoring and Care Market Regional Analysis

- Asia-Pacific dominated the global remote patient monitoring and care market with the largest revenue share of 30.3% in 2024, driven by the region's expanding healthcare digitization, growing prevalence of chronic diseases, and rapid adoption of remote monitoring solutions

- Strong regulatory frameworks, widespread reimbursement policies, and high patient awareness are fostering growth across both public and private healthcare sectors. Increased government funding for telehealth infrastructure, along with public-private initiatives to expand digital health coverage post-COVID, is propelling the adoption of advanced remote patient monitoring technologies

- Furthermore, Asia-Pacific hosts several leading digital health solution providers and R&D centers, facilitating continuous innovation and clinical evaluation of RPM devices

China Asia-Pacific Remote Patient Monitoring and Care Market Insight

The China remote patient monitoring and care market dominated the Asia-Pacific Remote Patient Monitoring and Care market, accounting for the largest revenue share of 37.1% in 2024, driven by the country’s robust healthcare digitization programs, growing elderly population, and government support for telehealth initiatives. Investments in smart hospital networks, remote patient monitoring programs, and AI-driven predictive analytics are further strengthening China’s leadership in the region.

Japan Asia-Pacific Remote Patient Monitoring and Care Market Insight

The Japan remote patient monitoring and care market accounted for 20.3% of the Asia-Pacific market share in 2024, supported by its highly developed healthcare infrastructure, strong insurance coverage, and widespread integration of digital health technologies. Japan’s focus on quality-of-life improvements, combined with consistent clinical research output, is boosting the adoption of RPM solutions across hospitals and home healthcare settings.

India Asia-Pacific Remote Patient Monitoring and Care Market Insight

The India remote patient monitoring and care market is projected to register the fastest CAGR of 13.8% in the Asia-Pacific Remote Patient Monitoring and Care market during the forecast period, fueled by increasing smartphone penetration, government initiatives such as the Ayushman Bharat Digital Mission, and rising private investments in telehealth and digital healthcare services. The expansion of affordable RPM solutions across tier 2 and tier 3 cities is supporting rapid market adoption and strengthening India’s regional competitiveness.

Asia-Pacific Remote Patient Monitoring and Care Market Share

The Asia-Pacific remote patient monitoring and care industry is primarily led by well-established companies, including:

- Medtronic (Ireland)

- Boston Scientific Corporation (U.S.)

- VitalConnect (U.S.)

- Biobeat (Israel)

- General Electric Company (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- OMRON Corporation (Japan)

- Abbott (U.S.)

- Nihon Kohden Corporation (Japan)

- Vivify Health, Inc. (U.S.)

- Aerotel Medical Systems (Israel)

- BIOTRONIK SE & Co. KG (Germany)

- A&D Company, Limited (Japan)

- AliveCor, Inc. (U.S.)

- Masimo (U.S.)

- Dexcom, Inc. (U.S.)

- Senseonics, Inc. (U.S.)

- ResMed (U.S.)

- 100Plus (U.S.)

- ChroniSense Medical, Ltd. (Israel)

- Vitls (U.S.)

- cardiomo (U.S.)

- CoachCare (U.S.)

- neteera (Israel)

- Withings (France)

Latest Developments in Asia-Pacific Remote Patient Monitoring and Care market

- In January 2023, CoachCare, a leading provider of remote patient monitoring solutions, announced the acquisition of NVOLVE, a Winston-Salem-based RPM company specializing in pain, spine, and orthopedic care. This strategic acquisition aimed to enhance CoachCare's product portfolio and expand its business reach in the remote patient monitoring sector

- In September 2024, India launched a significant initiative to improve healthcare access in rural areas. The project involved establishing over 200 10-bed ICU units across the country, each equipped with tele-ICU systems connecting rural hospitals to specialists in major medical centers. This development aimed to provide timely and advanced care to rural patients, alleviating overcrowded city hospitals and enhancing local medical staff's expertise

- In May 2025, Australia's remote health innovations, particularly telehealth services, began transforming healthcare in rural areas. Observa Care, founded during the COVID-19 pandemic, utilized wearable devices and the national broadband network to enable real-time remote monitoring of patients' vital signs. This advancement aimed to reduce the need for hospital stays and travel for rural patients, allowing them to recover in the comfort of their own homes, thereby improving safety and addressing healthcare worker shortages in these regions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.