Asia-Pacific Polyvinyl Chloride (PVC) Paste Resin Market, By Grade (High K-Value Grade, Mid K-Value Grade, Low K-Value Grade, Suspension Copolymer Grade, and Suspension Blending Grade), Manufacturing Process (Micro-Suspension Process and Emulsion Process), Application (Artificial Leather, Wall Papers, Plastisol Inks, Hand Gloves, Artificial Flowers, Transparent Balls, and Others), End-Use (Construction, Automotive, Consumer Goods, Electrical & Electronics, Packaging, Healthcare, and Others)- Industry Trends and Forecast to 2030.

Asia-Pacific Polyvinyl Chloride (PVC) Paste Resin Market Analysis and Size

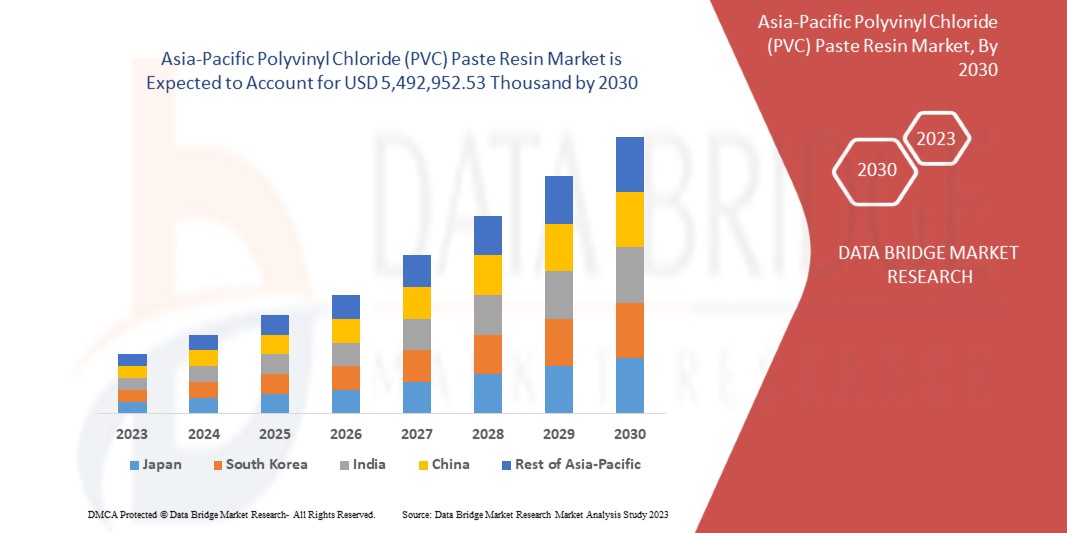

The Asia-Pacific polyvinyl chloride (PVC) paste resin market is expected to grow significantly from 2023 to 2030. Data Bridge Market Research analyses that the market is growing with a CAGR of 3.8% from 2023 to 2030 and is expected to reach USD 5,492,952.53 thousand by 2030. The increase in Asia-Pacific PVC-based construction materials demand is the key factor fueling the expansion of the polyvinyl chloride (PVC) paste resin market.

The construction sector is witnessing a rise in infrastructure investment by the government, construction companies, and private builders to meet the rising demand for residential and commercial properties. The demand for low-cost and low-weight alternatives for replacing conventional materials such as metal and wood is increasing, making room for PVC based such as vinyl siding, window profiles, magnetic stripe cards, pipe, and plumbing, as well as conduit fixtures. Therefore, increasing. PVC-based construction materials are gaining importance in the construction sector. Also, PVC paste resin can withstand moisture and has good tensile strength, making them a preferred choice for manufacturing industrial gloves.

The Asia-Pacific polyvinyl chloride (PVC) paste resin market report provides details of market share, new developments, and the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. Contact us for an analyst brief to understand the analysis and the market scenario. Our team will help you create a revenue-impact solution to achieve your desired goal.

|

Report Metric

|

Details

|

|

Forecast Period

|

2023 to 2030

|

|

Base Year

|

2022

|

|

Historic Years

|

2021 (Customizable to 2015 - 2020)

|

|

Quantitative Units

|

Revenue in USD Thousand

|

|

Segments Covered

|

By Grade (High K-Value Grade, Mid K-Value Grade, Low K-Value Grade, Suspension Copolymer Grade, and Suspension Blending Grade), Manufacturing Process (Micro-Suspension Process and Emulsion Process), Application (Artificial Leather, Wall Papers, Plastisol Inks, Hand Gloves, Artificial Flowers, Transparent Balls, and Others), End-Use (Construction, Automotive, Consumer Goods, Electrical & Electronics, Packaging, Healthcare, and Others)

|

|

Countries Covered

|

Japan, China, South Korea, India, Singapore, Thailand, Indonesia, Malaysia, Philippines, Australia & New Zealand, Rest of Asia-Pacific.

|

|

Market Players Covered

|

Formosa Plastics Corporation, U.S.A., KANEKA CORPORATION, Orbia, INEOS, Shin-Etsu Chemical Co., Ltd., PT. Standard Toyo Polymer (A subsidiary of TOSOH CORPORATION), LG Chem, Solvay, Westlake Vinnolit GmbH & Co. KG, Occidental Petroleum Corporation, Braskem, KEM ONE, SCG Chemicals Public Company Limited, CIRES, Lda, Chemplast Sanmar Ltd, Redox, CHEMDO, Gogara International, THE CHEMICAL COMPANY, and SHANGHAI KEAN TECHNOLOGY CO., LTD., among others.

|

Market Definition

Polyvinyl chloride PVC paste resin is a type of resin used to produce rubber and plastic. PVC paste resin grade is made by emulsion and micro-suspending and is widely used in processing such as dipping, roto forming, coating, and foaming. This is also used as a main raw material for artificial leather, wallpaper, disposable PVC latex examination gloves, and tarp, among others.

Asia-Pacific Polyvinyl Chloride (PVC) Paste Resin Market Dynamics

This section deals with understanding the market drivers, opportunities, restraints, and challenges. All of this is discussed in detail below:

Driver

- Growing applications of PVC paste in construction and healthcare industry

The construction sector is witnessing a rise in infrastructure investment by the government, construction companies, and private builders to meet the rising demand for residential and commercial properties. The demand for low-cost and low-weight alternatives for replacing conventional materials such as metal and wood is increasing, making room for PVC based such as vinyl siding, window profiles, magnetic stripe cards, pipe, and plumbing, as well as conduit fixtures. Therefore, increasing. PVC-based construction materials are gaining importance in the construction sector.

Moreover, the rapid shift towards modernizing households using various flooring options is expected to drive market growth soon. In the construction industry, PVC resins are also used to manufacture consumer goods and home materials such as pipes and fittings, cable isolation, doors and springs, office furniture, and many more. PVC paste resin is used for coating, dipping, foaming, spray coating, and rotational forming.

Thus, with an increase in construction production and investment activities across the globe, demand and production for PVC resins are growing, which, in turn, is anticipated to boost the growth scope for the polyvinyl chloride (PVC) paste resin market in the forecast period.

Opportunity

- The flourishing growth of the electrical & electronics industry

Polyvinyl chloride (PVC) resin is widely used in the electrical and electronics sector for applicability in wires and cables, computers, lighting, and others, owing to superior insulation and durability. With the constant research and development in the sector, innovation paves the way to improved products and upliftment. The electrical and electronics market constantly expands as traditional products give way to smart products.

Moreover, various governments are continuously making efforts to boost the Indian electronics industry and are attracting foreign and local players to invest in the country's electronics sector.

Restraint/Challenge

- Ban on phthalates

Various countries have banned phthalates due to their toxicity, which is projected to obstruct trade growth in the Asia-Pacific polyvinyl chloride (PVC) paste resin market. Phthalates are mainly used as plasticizers, substances added to plastics to increase their flexibility, transparency, durability, and longevity. They are used primarily to soften polyvinyl chloride (PVC).

Phthalates were initially considered harmless because they do not have an acutely toxic effect. However, risk assessments within the EU have shown that some phthalates must be classified as toxic to reproduction. Of the most frequently used phthalates, the four phthalates DEHP, DBP, DIBP, and BBP are classified within the EU as toxic to reproduction. Consumption of these phthalates has fallen since they were classified.

Therefore, the increase in instances of harm from phthalate and its ban is expected to pose a challenge to the growth of the Asia-Pacific polyvinyl chloride (PVC) paste resin market

Recent Developments

- In February 2023, INEOS acquired a portion of Chesapeake Energy's oil and gas assets in the Eagle Ford shale, south Texas, U.S., for USD 1.4 billion. The addition of Chesapeake's assets and operations in south Texas is part of INEOS' strategy to build an Asia-Pacific integrated portfolio fit for the energy transition, offering high-quality energy solutions to its customers.

- In September 2022, Orbia was listed on the DJSI MILA Pacific Alliance Index, with a year-over-year score increase of 6%. Orbia was awarded a score of 68, marking a 6% increase from 2021 and reflecting the company's progress across economic, governance, environmental, and social dimensions.

Asia-Pacific Polyvinyl Chloride (PVC) Paste Resin Market Scope

Asia-Pacific polyvinyl chloride (PVC) paste resin market is segmented into four notable segments: grade, manufacturing process, application, and end-use. The growth amongst these segments will help you analyze major industry growth segments and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

By Grade

- High K-Value Grade

- Mid K-Value Grade

- Low K-Value Grade

- Suspension Copolymer Grade

- Suspension Blending Grade

On the basis of grade, the Asia-Pacific polyvinyl chloride (PVC) paste resin market is classified into five segments, namely high k-value grade, mid k-value grade, low k-value grade, suspension copolymer grade, and suspension blending grade.

By Manufacturing Process

- Micro-Suspension Process

- Emulsion Process

On the basis of manufacturing process, the Asia-Pacific polyvinyl chloride (PVC) paste resin market is classified into two segments, namely micro-suspension process and emulsion process.

By Application

- Artificial Leather

- Wall Papers

- Plastisol Inks

- Hand Gloves

- Artificial Flowers

- Transparent Balls

- Others

On the basis of application, the Asia-Pacific polyvinyl chloride (PVC) paste resin market is classified into seven segments, artificial leather, wall papers, plastisol inks, hand gloves, artificial flowers, transparent balls, and others.

By End-Use

- Construction

- Automotive

- Consumer Goods

- Electrical & Electronics

- Packaging

- Healthcare

- Others

On the basis of end-use, the Asia-Pacific polyvinyl chloride (PVC) paste resin market is classified into seven segments, construction, automotive, consumer goods, electrical & electronics, packaging, healthcare, and others.

Asia-Pacific Polyvinyl Chloride (PVC) Paste Resin Market Regional Analysis/Insights

Asia-Pacific polyvinyl chloride (PVC) paste resin market is segmented into four notable segments that are grade, manufacturing process, application, and end-use.

The countries covered in this report are Japan, China, South Korea, India, Singapore, Thailand, Indonesia, Malaysia, Philippines, Australia & New Zealand, and Rest of Asia-Pacific.

China is expected to dominate the Asia-Pacific polyvinyl chloride (PVC) paste resin market. China dominates in the Asia-Pacific region due to the increasing use of polyvinyl chloride (PVC) paste resin, and growing applications of PVC paste in the construction and healthcare industry are boosting the demand for polyvinyl chloride (PVC) paste resin products.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data point downstream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Asia-Pacific Polyvinyl chloride (PVC) paste resin market Share Analysis

The Asia-Pacific polyvinyl chloride (PVC) paste resin market competitive landscape provides details of competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points are only related to the companies focusing on the Asia-Pacific polyvinyl chloride (PVC) paste resin market.

Some prominent participants operating in the Asia-Pacific polyvinyl chloride (PVC) paste resin market are Formosa Plastics Corporation, U.S.A., KANEKA CORPORATION, Orbia, INEOS, Shin-Etsu Chemical Co., Ltd., PT. Standard Toyo Polymer (A subsidiary of TOSOH CORPORATION), LG Chem, Solvay, Westlake Vinnolit GmbH & Co. KG, Occidental Petroleum Corporation, Braskem, KEM ONE, SCG Chemicals Public Company Limited, CIRES, Lda, Chemplast Sanmar Ltd, Redox, CHEMDO, Gogara International, THE CHEMICAL COMPANY, and SHANGHAI KEAN TECHNOLOGY CO., LTD., among others.

SKU-