Asia-Pacific Printable Self-Adhesive Vinyl Films Market Analysis and Insights

Printable self-adhesive vinyl films offer optical clarity as well as ease of removal. These films are used as promotional decals and window graphics. These films are placed on the windows of restaurants, shops, offices, and other commercial establishments to provide privacy or advertising. These films are versatile and flexible, and they are made from vinyl adhesives like acrylic. They are used to create logos, signs, and advertising campaigns to promote businesses and spread information to large audiences.

Printable self-adhesive vinyl films are mostly manufactured using numerous vinyl polymers that utilize monomers such as vinyl esters or vinyl acetate. Increasing demand for printable self-adhesive vinyl films in construction and architectural applications is expected to drive the Asia-Pacific printable self-adhesive vinyl films market. In addition, a wide range of self-adhesive vinyl films with different characteristics is available. However, new strategic developments and initiatives by manufacturers may serve as an opportunity for the Asia-Pacific market. Whereas, increasing environmental concerns and government regulations may possess a serious challenge in the growth of Asia-Pacific printable self-adhesive vinyl films market.

The demand for the printable self-adhesive vinyl films is increasing for which manufacturers are now more focused and they are involved in the new product launch, promotion, awards, certification, and event participation in the market. These decisions are ultimately enhancing the growth of the market.

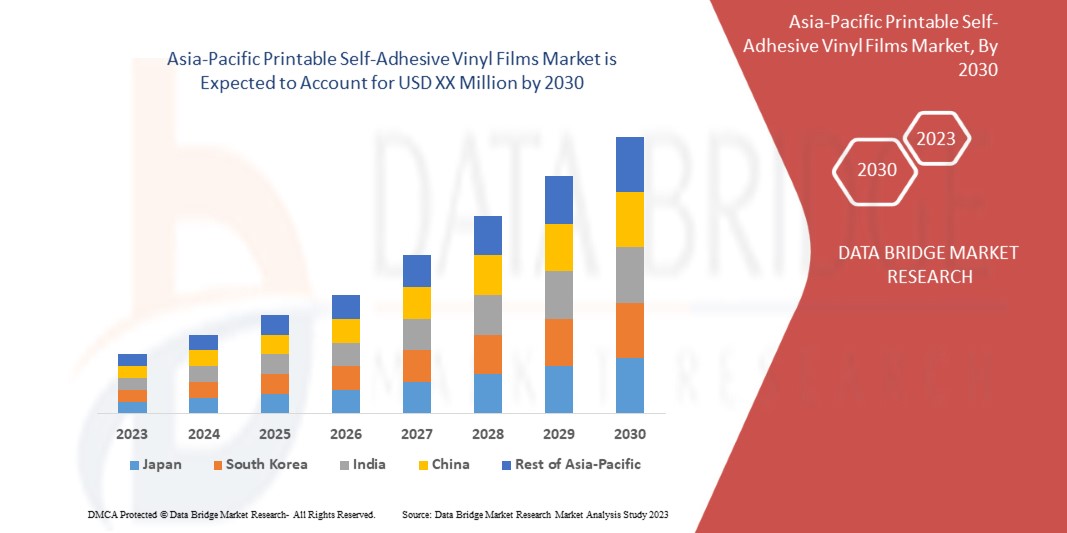

Data Bridge Market Research analyses that the Asia-Pacific printable self-adhesive vinyl films market will grow at a CAGR of 4.8% from 2023 to 2030.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2020 - 2016) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

By Manufacturing Process (Calendered Films and Cast Films), Thickness (Thin (2-3 Mils) and Thick (More than 3 Mils)), Type (Opaque, Transparent, and Translucent), Substrate (Floor, Plastics, Glass, and Others), Application (Fleet Graphics, Watercraft Graphics, Car Wrapping, Floor Graphics, Labels & Stickers, Window Graphics, Exhibition Panels, Outdoor Advertising, Furniture Decoration, Wallcovering, and Others) |

|

Countries Covered |

China, Japan, India, South Korea, Thailand, Indonesia, Malaysia, Taiwan, Vietnam, Philippines, Australia, New Zealand, Singapore, Rest of Asia-Pacific |

|

Market Players Covered |

Brite Coatings Private Limited, Item Plastic Corp., 3M, AVERY DENNISON CORPORATION, Arlon Graphics, LLC., HEXIS S.A.S., Metamark, DRYTAC, FLEXcon Company, Inc., TEKRA LLC, LX Hausys, LINTEC Corporation, Stahls’ International, POLI-TAPE Group, Innovia Films, Henkel Adhesives Technologies India Private Limited, Responsive Industries Ltd., ACHILLIES CORPORATION, ORAFOL Europe GmbH, Shubh Plastics |

Market Definition

Printable self-adhesive vinyl films offer optical clarity as well as ease of removal. These films are used as promotional decals and window graphics. These films are placed on the windows of restaurants, shops, offices, and other commercial establishments to provide privacy or advertising. These films are versatile, flexible, and made from vinyl adhesives like acrylic. They are used to create logos, signs, and advertising campaigns to promote businesses and spread information to large audiences.

Asia-Pacific Printable Self-Adhesive Vinyl Films Market Dynamics

Drivers

-

Increasing demand for printable self-adhesive vinyl films in construction and architectural applications

The increasing use of self-adhesive vinyl films in a variety of architectural applications such as floor coverings, wall coverings, decks, and platform coverings is positively influencing market demand for self-adhesive vinyl films. Self-adhesive film is a strong and long-lasting material that can be used to protect a variety of surfaces. These films are widely used to protect surfaces from scratches, abrasions, vandalism, shattering, UV damage, and fading. Moreover, the self-adhesive vinyl films have various designs which are used for wall covering.

The printable self-adhesive vinyl films are intended for use on smooth surfaces to improve the texture and colour of the proposed surface. Because of their updated designs and durability, the films are becoming popular as the best solution for commercial renovations and new construction projects. Furthermore, various key manufacturers are delivering self-adhesive vinyl films for architectural applications which is expected to boost the growth of Asia-Pacific self-adhesive vinyl films market.

For instance,

- DRYTAC provides a self-adhesive vinyl film roll named TimeTech Wall Protector. The film can be used for kitchen wallpaper, cupboards, wall covering as well as for furniture’s.

- The Avery Dennison Corporation provides interior design collection to its end users. The MPI 8000 series films are available in various designs. These films can be applied without the need for primer, and excellent opacity ensures that the underlying wall is completely concealed.

Hence, with the increasing demand of printable self-adhesive vinyl films for architectural as well as construction applications is expected to boost the growth of market. Moreover, the manufacturers providing new and innovative films for these applications is expected to boost the market growth globally.

-

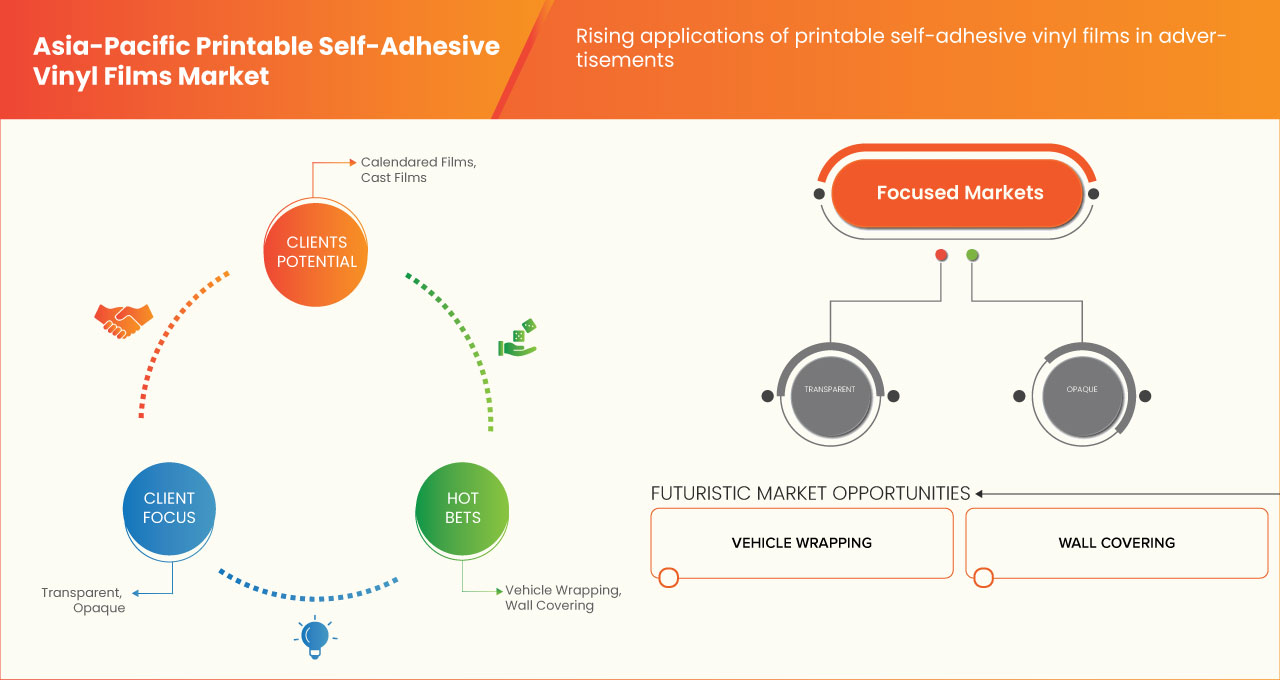

Rising applications of printable self-adhesive vinyl films in advertisements

Self-adhesive printable vinyl films are widely used in advertising, particularly outdoor advertising. These films have generally been used in outdoor commercials to increase brand awareness and visibility. Because of the capacity, this provides businesses with a creative canvas on which to convey their brand message, as well as the ease with which it can be modified.

The demand for these films for branding and advertising purposes is fueled by aesthetic features such as increased brightness, which attracts travellers and other notable customers. Furthermore, demand for these films has increased as a result of government initiatives to promote tourism, such as the use of printable self-adhesive vinyl for fleet graphics on commercial vehicles such as buses and lorries. Moreover, manufacturers are delivering especially designed products for advertisements which is fueling the market growth.

For Instance,

- Avery Dennison Corporation offers a wide range of pressure-sensitive graphics films in a variety of tints and finishes, as well as next-generation digital imaging films that can turn virtually any surface, from walls to windows, floors to furniture, into a functional canvas for eye-catching promotions.

Hence, owing to their high quality and resolution pictures and advertisements, printable self-adhesive vinyl films are highly used for advertisements. In addition, manufacturers providing films for advertising is also expected to boost the market growth.

Opportunities

-

New strategic developments and initiatives by key manufacturers

The wide applications of printable self-adhesive vinyl films in various industries has increased its demand significantly in the market. Therefore, the key manufacturers of self-adhesive vinyl films are launching new and innovative products in order to generate good revenues and fulfill the demand from end users. Moreover, they are indulged in new acquisitions and merges which is expected to create immense opportunity in the market.

For Instance,

- In December 2022, LX International has agreed to acquire a 100% stake in HanGlas. The primary goal of the acquisition was to expand the size of its affiliate LX Hausys' coated glass and window business.

Hence, the new strategic developments and initiatives by the key manufacturers is expected to crete opportunities in the Asia-Pacific printable self-adhesive vinyl films market.

Restraints/Challenges

- Availability of various substitutes

The printable self-adhesive vinyl films have number of applications such as labels, signs, floor graphics, wall coverings etc. and are used widely across the globe. However, there are plenty of substitutes available for printable self-adhesive vinyl films such as papers, fabrics, biodegradable films, and PVC –free films. Paper can be used for printing labels, stickers and decals. It is biodegradable and also present in range of finishes and textures. Moreover, biodegradable films are an ecofriendly alternative to traditional vinyl films. They are made of materials such as polylactic acid (PLA) or cellulose and are intended to degrade over time. There are various substitutes which are present in the market, which may hamper the growth of market.

For Instance,

Next Day Flyers offers paper labels such as white BOPP label and clear BOPP label which is gloss laminated, transparent as well as resistant to water, oil and refrigeration. The paper can be used instead of self-adhesive vinyl films.

Post COVID-19 Impact on Asia-Pacific Printable Self-Adhesive Vinyl Films Market

COVID-19 has affected the market to some extent. Due to the lockdown, the trade of raw materials and printable self-adhesive vinyl films across the world severely affected due to quarantine measures, influencing the market. Due to the change in many mandates and regulations, manufacturers can design and launch new products in the market, which will help the market's growth.

Recent Developments

- In February 2022, Stahls’ launched UltraColor Max direct-to-film (DTF) transfers as a new custom heat-transfer service option. The service offers unlimited colors, and extremely fine detail with no white or clear outline. It will expand the product portfolio of the company

- In October 2019, POLI-TAPE Group acquired Aslan, which is a leading developer, manufacturer and marketer of specialised self-adhesive films.

Asia-Pacific Printable Self-Adhesive Vinyl Films Market Scope

The Asia-Pacific printable self-adhesive vinyl films market is segmented into five notable segments based on manufacturing process, thickness, type, substrate and application. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Manufacturing Process

- Calendared Films

- Cast Films

On the basis of manufacturing process, the printable self-adhesive vinyl films market is segmented into calendared films and cast films.

Thickness

- Thick (2-3 mils)

- Thin (more than 3 mils)

On the basis of thickness, the printable self-adhesive vinyl films market is segmented into thin (2-3 mils and thick (more than 3 mils).

Type

- Transparent

- Translucent

- Opaque

On the basis of type, the printable self-adhesive vinyl films market is segmented into transparent, translucent and opaque.

Application

- Fleet Graphics

- Watercraft Graphics

- Car Wrapping

- Floor Graphics

- Labels & Stickers

- Window Graphics

- Exhibition Panels

- Outdoor Advertising

- Furniture Decoration

- Wallcovering

- Others

On the basis of application, the printable self-adhesive vinyl films market is segmented into fleet graphics, watercraft graphics, car wrapping, floor graphics, labels & stickers, window graphics, exhibition panels, outdoor advertising, furniture decoration, wallcovering and others.

Asia-Pacific Printable Self-Adhesive Vinyl Films Market Regional Analysis/Insights

The Asia-Pacific printable self-adhesive vinyl films market is analyzed, and market size insights and trends are provided based on as referenced above.

The countries covered in the Asia-Pacific printable self-adhesive vinyl films market report are China, Japan, India, South Korea, Thailand, Indonesia, Malaysia, Taiwan, Vietnam, Philippines, Australia, New Zealand, Singapore, Rest of Asia-Pacific.

China is expected to dominate the Asia-Pacific printable self-adhesive vinyl films market in terms of market share and revenue and is estimated to maintain its dominance during the forecast period due to the growing surge for printable self-adhesive vinyl films in various industries. In addition, availability of various types of printable self-adhesive vinyl films enables the manufacturers to choose the type of vinyl films required according to their needs.

The region section of the report also provides individual market-impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of Asia-Pacific brands and their challenges faced due to high competition from local and domestic brands, and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Asia-Pacific Printable Self-Adhesive Vinyl Films Market Share Analysis

The Asia-Pacific printable self-adhesive vinyl films market competitive landscape provides details about the competitors. Details include company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Asia-Pacific presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points are only related to the companies focus on the Asia-Pacific printable self-adhesive vinyl films market.

Some of the major players operating in the market are Brite Coatings Private Limited, Item Plastic Corp., 3M, AVERY DENNISON CORPORATION, Arlon Graphics, LLC., HEXIS S.A.S., Metamark, DRYTAC, FLEXcon Company, Inc., LX Hausys, LINTEC Corporation, and Shubh Plastics, among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE ASIA PACIFIC PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 MANUFACTURING PROCESS LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER'S FIVE ANALYSIS FOR THE ASIA PACIFIC PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET

4.2.1 BARGAINING POWER OF BUYERS/CONSUMERS:

4.2.2 BARGAINING POWER OF SUPPLIERS:

4.2.3 THE THREAT OF NEW ENTRANTS:

4.2.4 THREAT OF SUBSTITUTES:

4.2.5 RIVALRY AMONG EXISTING COMPETITORS:

4.3 LIST OF KEY BUYERS

4.3.1 ASIA-PACIFIC

4.4 ASIA PACIFIC PRINTABLE SELF-ADHESIVE VINYL FILM MARKET: PRODUCTION CONSUMPTION ANALYSIS

4.5 CLIMATE CHANGE SCENARIO

4.5.1 ENVIRONMENTAL CONCERNS

4.5.2 INDUSTRY RESPONSE

4.5.3 GOVERNMENT’S ROLE

4.5.4 ANALYST RECOMMENDATION

4.6 TRADE ANALYSIS

4.7 RAW MATERIAL PRODUCTION COVERAGE

4.8 SUPPLY CHAIN ANALYSIS

4.8.1 OVERVIEW

4.8.2 LOGISTIC COST SCENARIO

4.8.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.9 TECHNOLOGICAL ADVANCEMENTS IN THE ASIA PACIFIC PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET

4.1 VENDOR SELECTION CRITERIA

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING DEMAND FOR PRINTABLE SELF-ADHESIVE VINYL FILMS IN CONSTRUCTION AND ARCHITECTURAL APPLICATIONS

6.1.2 RISING APPLICATIONS OF PRINTABLE SELF-ADHESIVE VINYL FILMS IN ADVERTISEMENTS

6.1.3 AVAILABILITY OF A WIDE RANGE OF SELF-ADHESIVE VINYL FILMS WITH DIFFERENT CHARACTERISTICS

6.2 RESTRAINTS

6.2.1 FLUCTUATION IN RAW MATERIAL PRICES

6.2.2 AVAILABILITY OF VARIOUS SUBSTITUTES

6.3 OPPORTUNITIES

6.3.1 NEW STRATEGIC DEVELOPMENTS AND INITIATIVES BY KEY MANUFACTURERS

6.3.2 RISING DEMAND FOR VEHICLE WRAPS

6.3.3 COMPANIES OFFERING SUSTAINABLE PRINTABLE SELF-ADHESIVE VINYL FILMS

6.4 CHALLENGES

6.4.1 HIGH COMPETITION AMONG KEY MANUFACTURERS

6.4.2 INCREASING ENVIRONMENTAL CONCERNS AND GOVERNMENT REGULATIONS

7 ASIA PACIFIC PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY MANUFACTURING PROCESS

7.1 OVERVIEW

7.2 CALENDERED FILMS

7.3 CAST FILMS

8 ASIA PACIFIC PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY THICKNESS

8.1 OVERVIEW

8.2 THIN (2-3 MILS)

8.3 THICK (MORE THAN 3 MILS)

9 ASIA PACIFIC PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY TYPE

9.1 OVERVIEW

9.2 OPAQUE

9.3 TRANSPARENT

9.4 TRANSLUCENT

10 ASIA PACIFIC PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY SUBSTRATE

10.1 OVERVIEW

10.2 PLASTIC

10.3 FLOOR

10.4 GLASS

10.5 OTHERS

11 ASIA PACIFIC PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 CAR WRAPPING

11.3 FLEET GRAPHICS

11.4 WATERCRAFT GRAPHICS

11.5 FLOOR GRAPHICS

11.6 WINDOW GRPAHICS

11.7 OUTDOOR ADVERTISING

11.8 LABLES& STICKERS

11.9 FURNITURE DECORATION

11.1 WALLCOVERING

11.11 EXHIBITION PANELS

11.12 OTHERS

12 ASIA PACIFIC PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION

12.1 ASIA-PACIFIC

12.1.1 CHINA

12.1.2 JAPAN

12.1.3 INDIA

12.1.4 SOUTH KOREA

12.1.5 THAILAND

12.1.6 INDONESIA

12.1.7 MALAYSIA

12.1.8 TAIWAN

12.1.9 VIETNAM

12.1.10 PHILIPPINES

12.1.11 AUSTRALIA

12.1.12 NEW ZEALAND

12.1.13 SINGAPORE

12.1.14 REST OF ASIA-PACIFIC

13 ASIA PACIFIC PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

14 COMPANY PROFILE

14.1 3M

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 SWOT

14.1.5 PRODUCT PORTFOLIO

14.1.6 RECENT DEVELOPMENTS

14.2 AVERY DENNISON CORPORATION

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 SWOT

14.2.5 PRODUCT PORTFOLIO

14.2.6 RECENT DEVELOPMENTS

14.3 ORAFOL EUROPE GMBH

14.3.1 COMPANY SNAPSHOT

14.3.2 COMPANY SHARE ANALYSIS

14.3.3 SWOT

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 HENKEL ADHESIVES TECHNOLOGIES INDIA PRIVATE LIMITED

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 SWOT

14.4.5 PRODUCT PORTFOLIO

14.4.6 RECENT DEVELOPMENTS

14.5 LX HAUSYS

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 SWOT

14.5.5 PRODUCT PORTFOLIO

14.5.6 RECENT DEVELOPMENT

14.6 ACHILLIES CORPORATION

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 SWOT

14.6.4 PRODUCT PORTFOLIO

14.6.5 RECENT DEVELOPMENT

14.7 ARLON GRAPHICS, LLC.

14.7.1 COMPANY SNAPSHOT

14.7.2 SWOT

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENTS

14.8 BRITE COATINGS PRIVATE LIMITED

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 SWOT

14.8.4 RECENT DEVELOPMENT

14.9 DRYTAC

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 SWOT

14.9.4 RECENT DEVELOPMENT

14.1 FLEXCON COMPANY, INC.

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 SWOT

14.10.4 RECENT DEVELOPMENTS

14.11 HEXIS S.A.S.

14.11.1 COMPANY SNAPSHOT

14.11.2 SWOT

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT DEVELOPMENTS

14.12 INNOVIA FILMS

14.12.1 COMPANY SNAPSHOT

14.12.2 SWOT

14.12.3 PRODUCT PORTFOLIO

14.12.4 RECENT DEVELOPMENT

14.13 ITEM PLASTIC CORP.

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 SWOT

14.13.4 RECENT DEVELOPMENTS

14.14 LINTEC CORPORATION

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 SWOT

14.14.4 PRODUCT PORTFOLIO

14.14.5 RECENT DEVELOPMENTS

14.15 METAMARK

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 SWOT

14.15.4 RECENT DEVELOPMENTS

14.16 POLI-TAPE GROUP

14.16.1 COMPANY SNAPSHOT

14.16.2 SWOT

14.16.3 PRODUCT PORTFOLIO

14.16.4 RECENT DEVELOPMENT

14.17 RESPONSIVE INDUSTRIES LTD.

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 SWOT

14.17.4 PRODUCT PORTFOLIO

14.17.5 RECENT DEVELOPMENT

14.18 SHUBH PLASTICS

14.18.1 COMPANY SNAPSHOT

14.18.2 SWOT

14.18.3 PRODUCT PORTFOLIO

14.18.4 RECENT DEVELOPMENT

14.19 STAHLS’ INTERNATIONAL

14.19.1 COMPANY SNAPSHOT

14.19.2 SWOT

14.19.3 PRODUCT PORTFOLIO

14.19.4 RECENT DEVELOPMENTS

14.2 TEKRA, LLC.

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 SWOT

14.20.4 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 IMPORT DATA OF SELF-ADHESIVE PLATES, SHEETS, FILM, FOIL, TAPE, STRIP AND OTHER FLAT SHAPES, OF PLASTICS, WHETHER OR NOT IN ROLLS, HS CODE OF PRODUCT: 3919 (UNIT: US DOLLAR THOUSAND)

TABLE 2 EXPORT DATA OF SELF-ADHESIVE PLATES, SHEETS, FILM, FOIL, TAPE, STRIP AND OTHER FLAT SHAPES OF PLASTICS, WHETHER OR NOT IN ROLLS, HS CODE OF PRODUCT: 3919 (UNIT: US DOLLAR THOUSAND)

TABLE 3 LIST OF MAJOR RAW MATERIAL SUPPLIERS

TABLE 4 ASIA PACIFIC PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY MANUFACTURING PROCESS, 2021-2030 (USD MILLION)

TABLE 5 ASIA PACIFIC CALENDERED FILMS IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 ASIA PACIFIC CAST FILMS IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 7 ASIA PACIFIC PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY THICKNESS, 2021-2030 (USD MILLION)

TABLE 8 ASIA PACIFIC THIN (2-3 MILS) IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 9 ASIA PACIFIC THICK (MORE THAN 3 MILS) IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 ASIA PACIFIC PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 11 ASIA PACIFIC OPAQUE IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 ASIA PACIFIC TRANSPARENT IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 13 ASIA PACIFIC TRANSLUCENT IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 ASIA PACIFIC PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY SUBSTRATE, 2021-2030 (USD MILLION)

TABLE 15 ASIA PACIFIC PLASTIC IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 ASIA PACIFIC FLOOR IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 ASIA PACIFIC GLASS IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 ASIA PACIFIC OTHERS IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 ASIA PACIFIC PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 20 ASIA PACIFIC CAR WRAPPING IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 21 ASIA PACIFIC FLEET GRAPHICS IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 ASIA PACIFIC WATERCRAFT GRAPHICS IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 23 ASIA PACIFIC FLOOR GRAPHICS IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 ASIA PACIFIC WINDOW GRAPHICS IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 25 ASIA PACIFIC OUTDOOR ADVERTISING IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 26 ASIA PACIFIC LABELS & STICKERS IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 27 ASIA PACIFIC FURNITURE DECORATION IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 ASIA PACIFIC WALLCOVERING IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 29 ASIA PACIFIC EXHIBITION PANELS IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 30 ASIA PACIFIC OTHERS IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 31 ASIA-PACIFIC PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 32 ASIA-PACIFIC PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY MANUFACTURING PROCESS, 2021-2030 (USD MILLION)

TABLE 33 ASIA-PACIFIC PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY THICKNESS, 2021-2030 (USD MILLION)

TABLE 34 ASIA-PACIFIC PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 35 ASIA-PACIFIC PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY SUBSTRATE, 2021-2030 (USD MILLION)

TABLE 36 ASIA-PACIFIC PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 37 CHINA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY MANUFACTURING PROCESS, 2021-2030 (USD MILLION)

TABLE 38 CHINA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY THICKNESS, 2021-2030 (USD MILLION)

TABLE 39 CHINA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 40 CHINA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY SUBSTRATE, 2021-2030 (USD MILLION)

TABLE 41 CHINA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 42 JAPAN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY MANUFACTURING PROCESS, 2021-2030 (USD MILLION)

TABLE 43 JAPAN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY THICKNESS, 2021-2030 (USD MILLION)

TABLE 44 JAPAN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 45 JAPAN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY SUBSTRATE, 2021-2030 (USD MILLION)

TABLE 46 JAPAN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 47 INDIA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY MANUFACTURING PROCESS, 2021-2030 (USD MILLION)

TABLE 48 INDIA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY THICKNESS, 2021-2030 (USD MILLION)

TABLE 49 INDIA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 50 INDIA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY SUBSTRATE, 2021-2030 (USD MILLION)

TABLE 51 INDIA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 52 SOUTH KOREA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY MANUFACTURING PROCESS, 2021-2030 (USD MILLION)

TABLE 53 SOUTH KOREA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY THICKNESS, 2021-2030 (USD MILLION)

TABLE 54 SOUTH KOREA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 55 SOUTH KOREA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY SUBSTRATE, 2021-2030 (USD MILLION)

TABLE 56 SOUTH KOREA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 57 THAILAND PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY MANUFACTURING PROCESS, 2021-2030 (USD MILLION)

TABLE 58 THAILAND PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY THICKNESS, 2021-2030 (USD MILLION)

TABLE 59 THAILAND PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 60 THAILAND PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY SUBSTRATE, 2021-2030 (USD MILLION)

TABLE 61 THAILAND PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 62 INDONESIA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY MANUFACTURING PROCESS, 2021-2030 (USD MILLION)

TABLE 63 INDONESIA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY THICKNESS, 2021-2030 (USD MILLION)

TABLE 64 INDONESIA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 65 INDONESIA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY SUBSTRATE, 2021-2030 (USD MILLION)

TABLE 66 INDONESIA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 67 MALAYSIA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY MANUFACTURING PROCESS, 2021-2030 (USD MILLION)

TABLE 68 MALAYSIA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY THICKNESS, 2021-2030 (USD MILLION)

TABLE 69 MALAYSIA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 70 MALAYSIA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY SUBSTRATE, 2021-2030 (USD MILLION)

TABLE 71 MALAYSIA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 72 TAIWAN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY MANUFACTURING PROCESS, 2021-2030 (USD MILLION)

TABLE 73 TAIWAN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY THICKNESS, 2021-2030 (USD MILLION)

TABLE 74 TAIWAN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 75 TAIWAN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY SUBSTRATE, 2021-2030 (USD MILLION)

TABLE 76 TAIWAN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 77 VIETNAM PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY MANUFACTURING PROCESS, 2021-2030 (USD MILLION)

TABLE 78 VIETNAM PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY THICKNESS, 2021-2030 (USD MILLION)

TABLE 79 VIETNAM PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 80 VIETNAM PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY SUBSTRATE, 2021-2030 (USD MILLION)

TABLE 81 VIETNAM PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 82 PHILIPPINES PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY MANUFACTURING PROCESS, 2021-2030 (USD MILLION)

TABLE 83 PHILIPPINES PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY THICKNESS, 2021-2030 (USD MILLION)

TABLE 84 PHILIPPINES PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 85 PHILIPPINES PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY SUBSTRATE, 2021-2030 (USD MILLION)

TABLE 86 PHILIPPINES PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 87 AUSTRALIA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY MANUFACTURING PROCESS, 2021-2030 (USD MILLION)

TABLE 88 AUSTRALIA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY THICKNESS, 2021-2030 (USD MILLION)

TABLE 89 AUSTRALIA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 90 AUSTRALIA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY SUBSTRATE, 2021-2030 (USD MILLION)

TABLE 91 AUSTRALIA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 92 NEW ZEALAND PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY MANUFACTURING PROCESS, 2021-2030 (USD MILLION)

TABLE 93 NEW ZEALAND PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY THICKNESS, 2021-2030 (USD MILLION)

TABLE 94 NEW ZEALAND PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 95 NEW ZEALAND PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY SUBSTRATE, 2021-2030 (USD MILLION)

TABLE 96 NEW ZEALAND PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 97 SINGAPORE PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY MANUFACTURING PROCESS, 2021-2030 (USD MILLION)

TABLE 98 SINGAPORE PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY THICKNESS, 2021-2030 (USD MILLION)

TABLE 99 SINGAPORE PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 100 SINGAPORE PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY SUBSTRATE, 2021-2030 (USD MILLION)

TABLE 101 SINGAPORE PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 102 REST OF ASIA-PACIFIC PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY MANUFACTURING PROCESS, 2021-2030 (USD MILLION)

List of Figure

FIGURE 1 ASIA PACIFIC PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 ASIA PACIFIC PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: SEGMENTATION

FIGURE 10 INCREASING DEMAND FOR PRINTABLE SELF-ADHESIVE VINYL FILMS IN CONSTRUCTION AND ARCHITECTURAL APPLICATIONS IS EXPECTED TO DRIVE THE ASIA PACIFIC PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET IN THE FORECAST PERIOD FROM 2023 TO 2030

FIGURE 11 CALENDERED FILM SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET IN 2023 & 2030

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF ASIA PACIFIC PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET

FIGURE 13 ASIA PACIFIC PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: BY MANUFACTURING PROCESS, 2022

FIGURE 14 ASIA PACIFIC PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: BY THICKNESS, 2022

FIGURE 15 ASIA PACIFIC PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: BY TYPE, 2022

FIGURE 16 ASIA PACIFIC PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: BY SUBSTRATE, 2022

FIGURE 17 ASIA PACIFIC PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: BY APPLICATION, 2022

FIGURE 18 ASIA-PACIFIC PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: SNAPSHOT (2022)

FIGURE 19 ASIA-PACIFIC PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: BY COUNTRY (2022)

FIGURE 20 ASIA-PACIFIC PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 21 ASIA-PACIFIC PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 22 ASIA-PACIFIC PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: BY MANUFACTURING PROCESS (2023-2030)

FIGURE 23 ASIA PACIFIC PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: COMPANY SHARE 2022 (%)

Asia Pacific Printable Self Adhesive Vinyl Films Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Asia Pacific Printable Self Adhesive Vinyl Films Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Asia Pacific Printable Self Adhesive Vinyl Films Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.