Asia-Pacific Polyvinylpyrrolidone (PVP) Market Analysis and Size

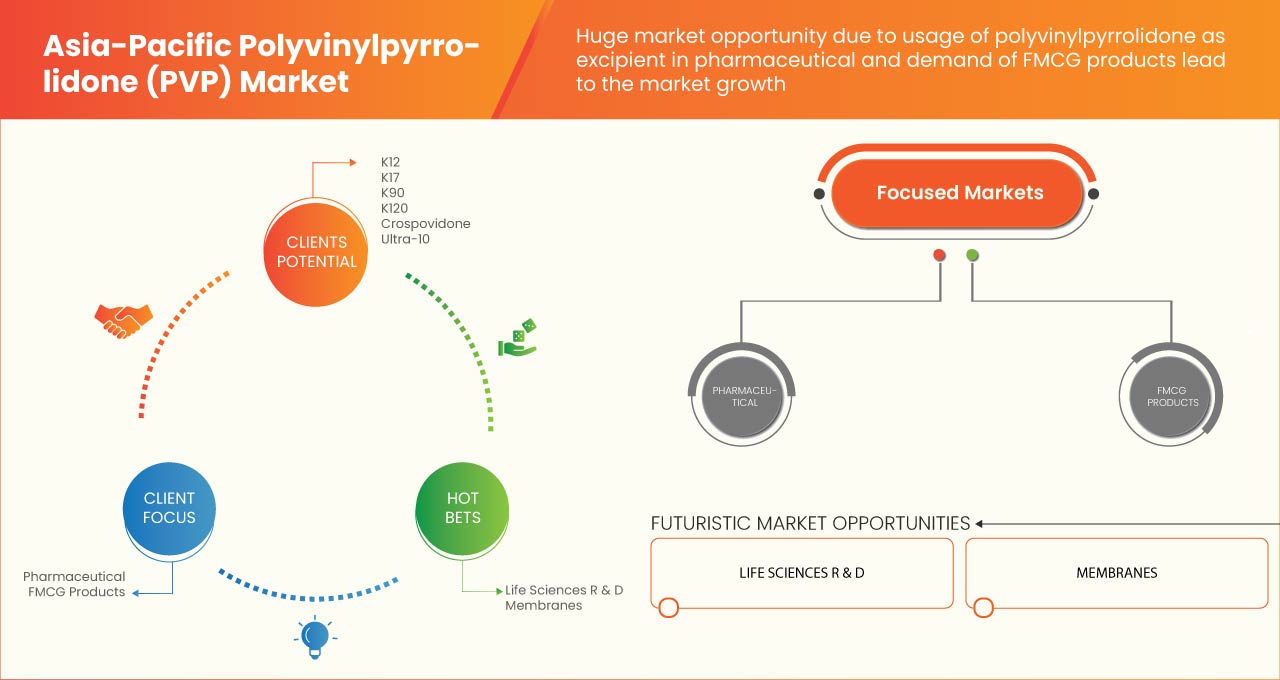

Asia-Pacific polyvinylpyrrolidone (PVP) market is expected to gain market growth in the forecast period of 2023 to 2030. Data Bridge Market Research analyses that the market is growing at a CAGR of 7.2% in the forecast period of 2023 to 2030 and is expected to reach USD 958,782.83 thousand by 2030. Application as an excipient in pharmaceutical products is an important factor for the Asia-Pacific polyvinylpyrrolidone (PVP) market, expected to drive the market growth.

Polyvinylpyrrolidone (PVP) market report provides details of market share, new developments and product pipeline analysis, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions and technological innovations in the market. To understand the analysis and the market scenario, contact us for an Analyst Brief. Our team will help you create a revenue-impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customisable to 2020-2015) |

|

Quantitative Units |

Revenue in USD Thousand |

|

Segments Covered |

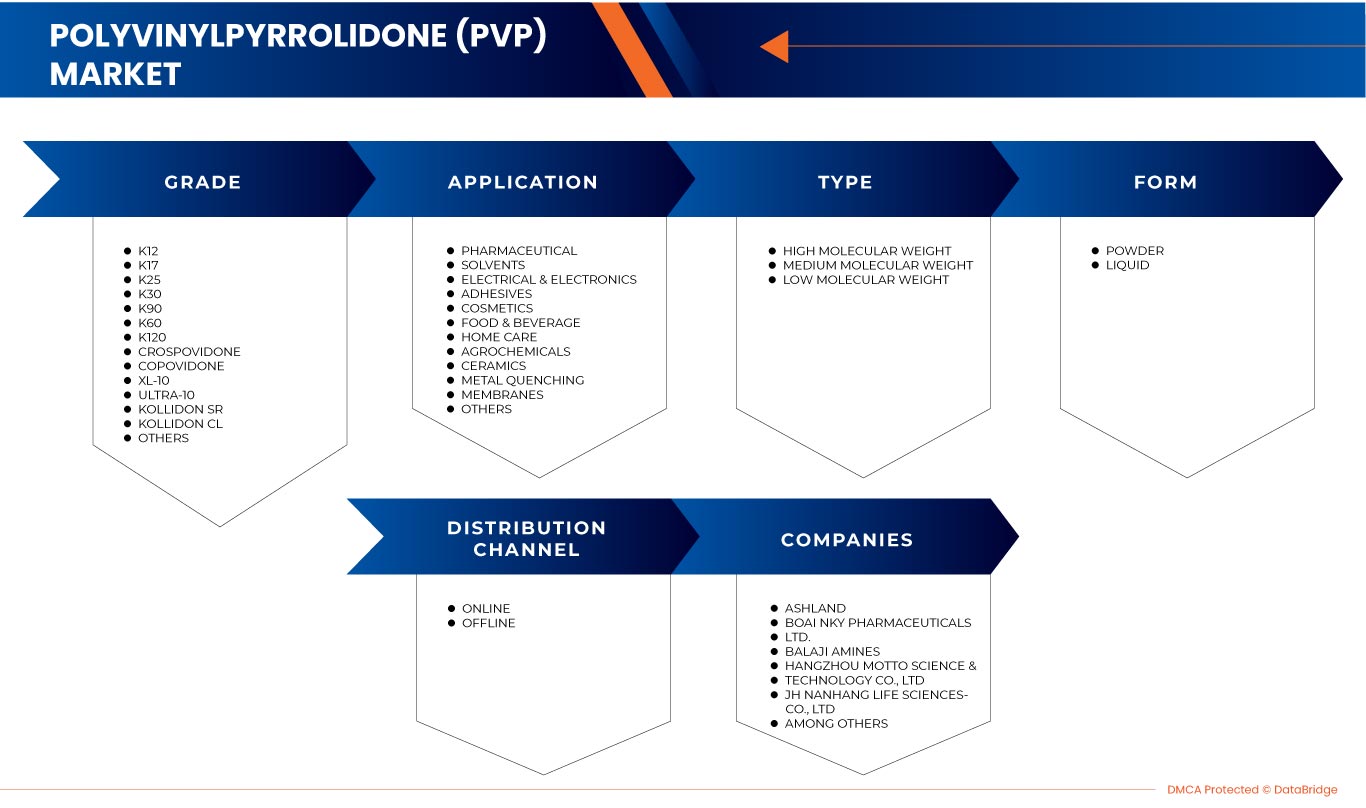

By Grade (K30, K90, K12, K25, K17, K60, K120, Kollidon SR, Kollidon CL, Crospovidone, Copovidone, XL-10, Ultra-10 and Others), Type (Medium Molecular Weight, High Molecular Weight and Low Molecular Weight), Form (Powder and Liquid), Application (Pharmaceutical, Cosmetics, solvents, Electrical & Electronics, Adhesives, Agrochemicals, Food & Beverage, Membranes, Ceramics, Home Care, Metal Quenching and Others), Distribution Channel (Offline and Online) |

|

Countries Covered |

Japan, China, South Korea, India, Singapore, Thailand, Indonesia, Malaysia, Philippines, Australia & New Zealand and the Rest of Asia-Pacific |

|

Market Players Covered |

Ashland, Boai NKY Pharmaceuticals Ltd., BALAJI AMINES, Hangzhou Motto Science & Technology Co., Ltd., JH Nanhang Life Sciences Co., Ltd. NIPPON SHOKUBAI CO., LTD., BASF SE, Merck KGaA, Alfa Aesar, Thermo Fisher Scientific, Huangshan Bonsun Pharmaceuticals Co., Ltd. and others |

Market Definition

Polyvinylpyrrolidone is also known as povidone or PVP. It is popularly used in the pharmaceutical industry as a synthetic polymer vehicle for dispersing and suspending drugs. The PVP is used in various pharmaceutical operations, including binder for tablets and capsules, film former for ophthalmic solutions, flavoring liquids and chewable tablets and as an adhesive for transdermal systems. The PVP appears as a white to slightly off-white powder and can dissolve in both water and oil solvents. The PVP is increasingly being used for biocompatibility, absence of toxicity and high capacity to form interpolymer complexes. Thus, the PVP market is expected to grow due to the demand for PVP in designing materials for different applications as biomaterials for medical and nonmedical uses.

Asia-Pacific Polyvinylpyrrolidone (PVP) Market Dynamics

Drivers

-

Application as an excipient in pharmaceutical products

Excipients are inert medicinal components utilized in the development of pharmaceutical products. Every excipient has its unique function, such as disintegrant, pH adjustment, binder or solvent. They are widely employed in the drug formulation process to enhance long-term stabilization, provide solid formulations with more strength and improve therapeutic drug bioavailability. The rise in chronic diseases, the growing demand for generic drugs and the development of new active pharmaceutical ingredients and vaccines are a few of the factors which are driving the demand and usage in pharmaceutical industries. The recent COVID-19 pandemic too influenced the growth of the worldwide excipient market due to increased demand for pharmaceutical drugs.

-

Growth in the fast-moving consumer goods industry

The term "fast-moving consumer goods" (FMCG) refers to packaged goods that are bought or sold often and in small quantities. The FMCG consists of various industries that are engaged in the production of cosmetics, personal care products, food and beverages, home care products and others. Such products are bought on a small scale from consumers from supermarkets and groceries. Increasing disposable incomes, new technology to manufacture products, increasing foreign direct investment, favorable frameworks of government, unique marketing strategies, rapid urbanization and the boom of e-commerce platforms are the factors that have caused the growth of the fast-moving consumer goods industry.

-

Increase in demand from end-user industries

Polyvinylpyrrolidone has applications in different end-user industries, such as adhesives, paints, electronics, ceramics, and membranes. The polymer has significant properties such as high solubility, cross-linkability, high polarity and hydrophilicity which enables it as an efficient option to use in the production of adhesives. Such adhesives have high viscosity, which is further applied in the binding of materials like wood and paper and in the construction industry. Due to its binding property, it is used as a binding agent in the production of ceramics such as tiles and bricks. Likewise, polyvinylpyrrolidone is used on a large scale in the electronics industry, such as in the manufacturing of batteries, inorganic solar cells, cathode ray tubes and printed circuit boards.

Opportunities

-

Growth in research and development activities

The polymer has exceptional properties as excipients in pharmaceutical products and has also been approved by U.S. FDA as generally recognized as a safe chemical. The research on new therapeutic drugs to cure diseases offers a huge opportunity for the growth of the Asia-Pacific polyvinylpyrrolidone market.

Polyvinylpyrrolidone also has applications in molecular biology. It is used as an ingredient in the preparation of Denhardt's Solution, which is employed in nucleic acid hybridization techniques like southern blot analysis. The polymer can also be used in the isolation of nucleic acids experiments. It has the exceptional property of absorbing polyphenols when the purification of nucleic acids is performed

-

Supportive chemical industry outlook in emerging economies

Diverse industrial applications, high consumption, increased income and urbanization, increased foreign direct investment and promising export potential are some of the factors which are encouraging chemical industry growth in developing economies such as India and China. Upcoming opportunities to manufacture specialty chemicals and polymers will create a huge domestic demand and the country will be self-efficient in producing chemicals. Also, investment from developed countries or setting up a chemical plant in emerging economies, which can offer a wide opportunity for the growth of the Asia-Pacific polyvinylpyrrolidone market.

Restraint

- Volatility in raw material prices

Made from the N-vinylpyrrolidone monomer, polyvinylpyrrolidone is an aromatic hydrocarbon polymer. By reacting acetylene and 2-pyrrolidone, polyvinylpyrrolidone is produced. Along with it, initiator like 2,2’-Azobisisobutyronitrile is involved in the production of polyvinylpyrrolidone. It is reasonable to anticipate that since acetylene is the product of the processing of petroleum and natural gas, its prices will follow the price of crude oil. In addition, the facilities required to produce such polyvinylpyrrolidone require high capital and extensive infrastructure.

- Usage of harmful chemicals in polyvinylpyrrolidone production

2-pyrrolidone chemical, when exposed to the eyes, can cause severe irritation and damage. The chemical could cause skin inflammation and respiratory when one is exposed for a long duration. Acetylene is a gas that gets ignited easily and has serious health effects. If inhaled, acetylene can cause nausea, dizziness, headache and vomiting, abnormal heart rhythms, high blood pressure and difficulty in breathing. Long-term exposure to chemicals like 2,2’-Azobisisobutyronitrile and hydrogen peroxide causes serious health issues, such as respiratory and skin problems.

CHALLENGE

- Credible threat of other substitutes

Polyvinylpyrrolidone is one of the most used polymers because of its wide range of applications. It has the important role of excipients like a binder in the production of pharmaceutical products due to its unique properties. However, polyvinylpyrrolidone production requires harmful chemicals which have a negative side effects on health. The polymer is also non-biodegradable. Thus, it stays for a long time in the environment. Owing to such drawbacks, consumers are looking for other substitutes which are also sustainable in nature.

Hyaluronate is one of the naturally available alternatives for artificial polyvinylpyrrolidone, which has been replaced in intracytoplasmic sperm injection applications.

Recent Development

October 6 2022, According to the Times of India, the Asia-Pacific FMCG sector is well positioned to grow by USD 310.5 billion between 2022 and 2026, mostly due to an increase in the consumption of ready-to-eat food goods.

Asia-Pacific Polyvinylpyrrolidone (PVP) Market Scope

Asia-Pacific polyvinylpyrrolidone (PVP) market is categorized into grade, type, form, application and distribution channel. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

Grade

- K30

- K90

- K12

- K25

- K17

- K60

- K120

- Crospovidone

- Copovidone

- XL-10

- Ultra-10

- Kollidon SR

- Kollidon CL

- Others

On the basis of grade, the market is segmented into K30, K90, K12, K25, K17, K60, K120, Crosopovidone, Copovidone, XL-10, Ultra-10, Kollidon SR, Kollidon CL and others.

Type

- Medium molecular weight

- High molecular weight

- Low molecular weight

On the basis of type, the market is segmented into medium molecular weight, high molecular weight, low molecular weight and others.

Form

- Powder

- Liquid

On the basis of form, the market is segmented into powder, liquid and others.

Application

- Pharmaceutical

- cosmetics

- Solvents

- Electrical & electronics

- Adhesives

- Agrochemicals

- Food & beverage

- Membranes

- Ceramics

- Home care

- Metal quenching

- Others

On the basis of application, the market is segmented into pharmaceuticals, cosmetics, solvents, electrical & electronics, adhesives, agrochemicals, food & beverage, membranes, ceramics, home care, metal quenching and others.

Distribution Channel

- Offline

- Online

On the basis of distribution channels, the market is segmented offline and online.

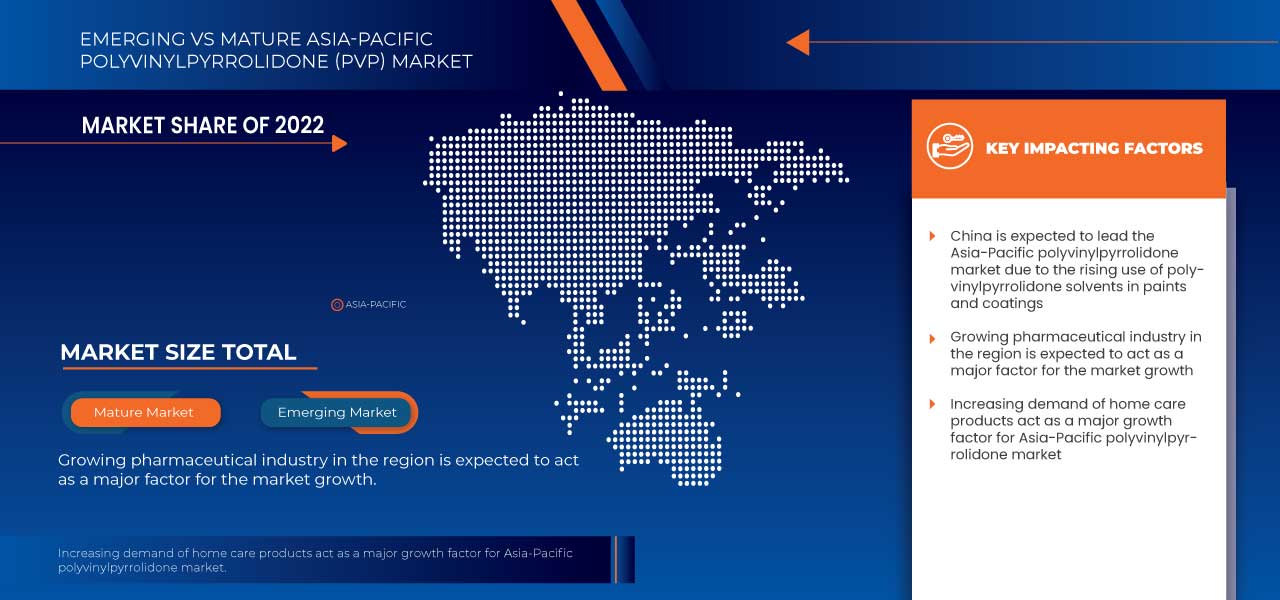

Asia-Pacific Polyvinylpyrrolidone (PVP) Market Regional Analysis / Insights

Asia-Pacific polyvinylpyrrolidone (PVP) market is analyzed and market size information is provided by country, grade, type, form, application and distribution channel, as referenced above.

The countries covered are Japan, China, South Korea, India, Singapore, Thailand, Indonesia, Malaysia, Philippines, Australia & New Zealand and the Rest of Asia-Pacific.

China is dominating the market due to growth in the fast-moving consumer good industry, and an increase in demand from end-user industries are expected to provide opportunities.

The country section of the report also provides individual market-impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of brands and their challenges faced due to large or scarce competition from local and domestic brands and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Polyvinylpyrrolidone (PVP) Market Share Analysis

Asia-Pacific polyvinylpyrrolidone (PVP) market competitive landscape provides details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Asia-Pacific presence, production sites and facilities, company strengths and weaknesses, product launch, clinical trials pipelines, brand analysis, product approvals, patents, product width and breath, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus related to Asia-Pacific Polyvinylpyrrolidone (PVP) market.

Some of the major players covered in the report are Ashland, Boai NKY Pharmaceuticals Ltd., BALAJI AMINES, Hangzhou Motto Science & Technology Co., Ltd., JH Nanhang Life Sciences Co., Ltd. NIPPON SHOKUBAI CO., LTD., BASF SE, Merck KGaA, Alfa Aesar, Thermo Fisher Scientific, and Huangshan Bonsun Pharmaceuticals Co., Ltd., among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE ASIA PACIFIC POLYVINYLPYRROLIDONE (PVP) MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 GRADE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END-USER COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER’S FIVE FORCES:

4.2.1 THREAT OF NEW ENTRANTS:

4.2.2 THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 CLIMATE CHANGE SCENARIO

4.3.1 ENVIRONMENTAL CONCERNS

4.3.2 INDUSTRY RESPONSE

4.3.3 GOVERNMENT’S ROLE

4.3.4 ANALYST RECOMMENDATION

4.4 LIST OF KEY PATENTS LAUNCHED

4.5 SUPPLY CHAIN ANALYSIS

4.6 VENDOR SELECTION CRITERIA

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 APPLICATION AS EXCIPIENT IN PHARMACEUTICAL PRODUCTS

5.1.2 GROWTH IN THE FAST-MOVING CONSUMER GOODS INDUSTRY

5.1.3 INCREASE IN DEMAND FROM END-USER INDUSTRIES

5.2 RESTRAINTS

5.2.1 VOLATILITY IN RAW MATERIAL PRICES

5.2.2 USAGE OF HARMFUL CHEMICALS IN POLYVINYLPYRROLIDONE PRODUCTION

5.3 OPPORTUNITIES

5.3.1 GROWTH IN RESEARCH AND DEVELOPMENT ACTIVITIES

5.3.2 SUPPORTIVE CHEMICAL INDUSTRY OUTLOOK IN EMERGING ECONOMIES

5.4 CHALLENGES

5.4.1 CREDIBLE THREAT OF OTHER SUBSTITUTES

6 ASIA PACIFIC POLYVINYLPYRROLIDONE (PVP) MARKET, BY GRADE

6.1 OVERVIEW

6.2 K30

6.3 K90

6.4 K12

6.5 K25

6.6 K17

6.7 K60

6.8 K120

6.9 CROSPOVIDONE

6.1 COPOVIDONE

6.11 XL-10

6.12 ULTRA-10

6.13 KOLLIDON SR

6.14 KOLLIDON CL

6.15 OTHERS

7 ASIA PACIFIC POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE

7.1 OVERVIEW

7.2 MEDIUM MOLECULAR WEIGHT

7.3 HIGH MOLECULAR WEIGHT

7.4 LOW MOLECULAR WEIGHT

8 ASIA PACIFIC POLYVINYLPYRROLIDONE (PVP) MARKET, BY FORM

8.1 OVERVIEW

8.2 POWDER

8.3 LIQUID

9 ASIA PACIFIC POLYVINYLPYRROLIDONE (PVP) MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 PHARMACEUTICAL

9.2.1 TABLETS

9.2.2 LIQUID SUSPENSIONS/OINTMENT

9.2.3 INJECTIONS

9.2.4 OTHERS

9.3 COSMETICS

9.3.1 HAIR FIXATIVE POLYMERS

9.3.2 SKIN CARE

9.3.3 ORAL CARE

9.3.4 PERFUMES

9.4 SOLVENTS

9.4.1 INKS

9.4.2 PAINTS & COATINGS

9.4.3 POLISHING AGENTS

9.5 ELECTRICAL & ELECTRONICS

9.5.1 BATTERIES

9.5.2 PCBS

9.5.3 OTHERS

9.5.3.1 SCREENS

9.5.3.2 CMP

9.6 ADHESIVES

9.6.1 HOT MELT ADHESIVES

9.6.2 SKIN ADHESIVES

9.6.3 THICKENERS

9.7 AGROCHEMICALS

9.8 FOOD & BEVERAGE

9.8.1 ALCOHOLIC

9.8.2 NON-ALCOHOLIC

9.9 MEMBRANES

9.9.1 WATER

9.9.2 HEMODIALYSIS

9.1 CERAMICS

9.11 HOME CARE

9.12 METAL QUENCHING

9.13 OTHERS

10 ASIA PACIFIC POLYVINYLPYRROLIDONE (PVP) MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 OFFLINE

10.3 ONLINE

11 ASIA PACIFIC POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION

11.1 ASIA-PACIFIC

11.1.1 CHINA

11.1.2 INDIA

11.1.3 JAPAN

11.1.4 SOUTH KOREA

11.1.5 AUSTRALIA & NEW ZEALAND

11.1.6 SINGAPORE

11.1.7 THAILAND

11.1.8 INDONESIA

11.1.9 MALAYSIA

11.1.10 PHILIPPINES

11.1.11 REST OF ASIA-PACIFIC

12 ASIA PACIFIC POLYVINYLPYRROLIDONE (PVP) MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

12.2 RECOGNITION

12.3 EVENT

12.4 JOINT VENTURE

12.5 CERTIFICATION

12.6 INVESTMENT

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 BASF SE

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 ASHLAND

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DVELOPMENT

14.3 NIPPON SHOKUBAI CO., LTD.

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENT

14.4 BOAI NKY PHARMACEUTICALS LTD.

14.4.1 COMPANY SNAPSHOT

14.4.2 COMPANY SHARE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENT

14.5 BALAJI AMINES

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENT

14.6 ALFA AESAR, THERMO FISHER SCIENTIFIC

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENT

14.7 HANGZHOU MOTTO SCIENCE & TECHNOLOGY CO., LTD.

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 HUANGSHAN BONSUN PHARMACEUTICALS CO., LTD.

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 JH NANHANG LIFE SCIENCES CO., LTD.

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 MERCK KGAA

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 IMPORT DATA OF POLYMERS OF VINYL ESTERS AND OTHER VINYL POLYMERS, IN PRIMARY FORMS; HS CODE - 390599 (USD THOUSAND)

TABLE 2 EXPORT DATA OF POLYMERS OF VINYL ESTERS AND OTHER VINYL POLYMERS, IN PRIMARY FORMS; HS CODE - 390599 (USD THOUSAND)

TABLE 3 ASIA PACIFIC POLYVINYLPYRROLIDONE (PVP) MARKET, BY GRADE, 2017-2030 (USD THOUSAND)

TABLE 4 ASIA PACIFIC POLYVINYLPYRROLIDONE (PVP) MARKET, BY GRADE, 2017-2030 (TONS)

TABLE 5 ASIA PACIFIC K30 IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 6 ASIA PACIFIC K30 IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (TONS)

TABLE 7 ASIA PACIFIC K90 IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 8 ASIA PACIFIC K90 IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (TONS)

TABLE 9 ASIA PACIFIC K12 IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 10 ASIA PACIFIC K12 IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (TONS)

TABLE 11 ASIA PACIFIC K25 IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 12 ASIA PACIFIC K25 IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (TONS)

TABLE 13 ASIA PACIFIC K17 IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 14 ASIA PACIFIC K17 IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (TONS)

TABLE 15 ASIA PACIFIC K60 IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 16 ASIA PACIFIC K60 IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (TONS)

TABLE 17 ASIA PACIFIC K120 IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 18 ASIA PACIFIC K120 IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (TONS)

TABLE 19 ASIA PACIFIC CROSPOVIDONE IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 20 ASIA PACIFIC CROSPOVIDONE IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (TONS)

TABLE 21 ASIA PACIFIC COPOVIDONE IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 22 ASIA PACIFIC COPOVIDONE IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (TONS)

TABLE 23 ASIA PACIFIC XL-10 IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 24 ASIA PACIFIC XL-10 IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (TONS)

TABLE 25 ASIA PACIFIC ULTRA-10 IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 26 ASIA PACIFIC ULTRA-10 IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (TONS)

TABLE 27 ASIA PACIFIC KOLLIDON SR IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 28 ASIA PACIFIC KOLLIDON SR IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (TONS)

TABLE 29 ASIA PACIFIC KOLLIDON CL IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 30 ASIA PACIFIC KOLLIDON CL IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (TONS)

TABLE 31 ASIA PACIFIC OTHERS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 32 ASIA PACIFIC OTHERS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (TONS)

TABLE 33 ASIA PACIFIC POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 34 ASIA PACIFIC MEDIUM MOLECULAR WEIGHT IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 35 ASIA PACIFIC HIGH MOLECULAR WEIGHT IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 36 ASIA PACIFIC LOW MOLECULAR WEIGHT IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 37 ASIA PACIFIC POLYVINYLPYRROLIDONE (PVP) MARKET, BY FORM, 2017-2030 (USD THOUSAND)

TABLE 38 ASIA PACIFIC POWDER IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 39 ASIA PACIFIC LIQUID IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 40 ASIA PACIFIC POLYVINYLPYRROLIDONE (PVP) MARKET, BY APPLICATION, 2017-2030 (USD THOUSAND)

TABLE 41 ASIA PACIFIC PHARMACEUTICAL IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 42 ASIA PACIFIC PHARMACEUTICAL IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 43 ASIA PACIFIC COSMETICS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 44 ASIA PACIFIC COSMETICS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 45 ASIA PACIFIC SOLVENTS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 46 ASIA PACIFIC SOLVENTS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 47 ASIA PACIFIC ELECTRICAL & ELECTRONICS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 48 ASIA PACIFIC ELECTRICAL & ELECTRONICS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 49 ASIA PACIFIC OTHERS IN ELECTRICAL & ELECTRONICS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 50 ASIA PACIFIC ADHESIVES IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 51 ASIA PACIFIC ADHESIVES IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 52 ASIA PACIFIC AGROCHEMICALS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 53 ASIA PACIFIC FOOD & BEVERAGE IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 54 ASIA PACIFIC FOOD & BEVERAGE IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 55 ASIA PACIFIC MEMBRANES IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 56 ASIA PACIFIC MEMBRANES IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 57 ASIA PACIFIC CERAMICS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 58 ASIA PACIFIC HOME CARE IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 59 ASIA PACIFIC METAL QUENCHING IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 60 ASIA PACIFIC OTHERS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 61 ASIA PACIFIC POLYVINYLPYRROLIDONE (PVP) MARKET, BY DISTRIBUTION CHANNEL, 2017-2030 (USD THOUSAND)

TABLE 62 ASIA PACIFIC OFFLINE IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 63 ASIA PACIFIC ONLINE IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 64 ASIA-PACIFIC POLYVINYLPYRROLIDONE (PVP) MARKET, BY COUNTRY, 2017-2030 (USD THOUSAND)

TABLE 65 ASIA-PACIFIC POLYVINYLPYRROLIDONE (PVP) MARKET, BY COUNTRY, 2017-2030 (TONS)

TABLE 66 ASIA-PACIFIC POLYVINYLPYRROLIDONE (PVP) MARKET, BY GRADE, 2017-2030 (USD THOUSAND)

TABLE 67 ASIA-PACIFIC POLYVINYLPYRROLIDONE (PVP) MARKET, BY GRADE, 2017-2030 (TONS)

TABLE 68 ASIA-PACIFIC POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 69 ASIA-PACIFIC POLYVINYLPYRROLIDONE (PVP) MARKET, BY FORM, 2017-2030 (USD THOUSAND)

TABLE 70 ASIA-PACIFIC POLYVINYLPYRROLIDONE (PVP) MARKET, BY APPLICATION, 2017-2030 (USD THOUSAND)

TABLE 71 ASIA-PACIFIC PHARMACEUTICAL IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 72 ASIA-PACIFIC COSMETICS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 73 ASIA-PACIFIC SOLVENTS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 74 ASIA-PACIFIC ELECTRICAL & ELECTRONICS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 75 ASIA-PACIFIC OTHERS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 76 ASIA-PACIFIC ADHESIVES IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 77 ASIA-PACIFIC MEMBRANES IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 78 ASIA-PACIFIC POLYVINYLPYRROLIDONE (PVP) MARKET, BY DISTRIBUTION CHANNEL, 2017-2030 (USD THOUSAND)

TABLE 79 CHINA POLYVINYLPYRROLIDONE (PVP) MARKET, BY GRADE, 2017-2030 (USD THOUSAND)

TABLE 80 CHINA POLYVINYLPYRROLIDONE (PVP) MARKET, BY GRADE, 2017-2030 (TONS)

TABLE 81 CHINA POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 82 CHINA POLYVINYLPYRROLIDONE (PVP) MARKET, BY FORM, 2017-2030 (USD THOUSAND)

TABLE 83 CHINA POLYVINYLPYRROLIDONE (PVP) MARKET, BY APPLICATION, 2017-2030 (USD THOUSAND)

TABLE 84 CHINA PHARMACEUTICAL IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 85 CHINA COSMETICS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 86 CHINA SOLVENTS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 87 CHINA ELECTRICAL & ELECTRONICS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 88 CHINA OTHERS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 89 CHINA ADHESIVES IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 90 CHINA FOOD & BEVERAGE IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 91 CHINA MEMBRANES IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 92 CHINA POLYVINYLPYRROLIDONE (PVP) MARKET, BY DISTRIBUTION CHANNEL, 2017-2030 (USD THOUSAND)

TABLE 93 INDIA POLYVINYLPYRROLIDONE (PVP) MARKET, BY GRADE, 2017-2030 (USD THOUSAND)

TABLE 94 INDIA POLYVINYLPYRROLIDONE (PVP) MARKET, BY GRADE, 2017-2030 (TONS)

TABLE 95 INDIA POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 96 INDIA POLYVINYLPYRROLIDONE (PVP) MARKET, BY FORM, 2017-2030 (USD THOUSAND)

TABLE 97 INDIA POLYVINYLPYRROLIDONE (PVP) MARKET, BY APPLICATION, 2017-2030 (USD THOUSAND)

TABLE 98 INDIA PHARMACEUTICAL IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 99 INDIA COSMETICS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 100 INDIA SOLVENTS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 101 INDIA ELECTRICAL & ELECTRONICS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 102 INDIA OTHERS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 103 INDIA ADHESIVES IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 104 INDIA FOOD & BEVERAGE IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 105 INDIA MEMBRANES IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 106 INDIA POLYVINYLPYRROLIDONE (PVP) MARKET, BY DISTRIBUTION CHANNEL, 2017-2030 (USD THOUSAND)

TABLE 107 JAPAN POLYVINYLPYRROLIDONE (PVP) MARKET, BY GRADE, 2017-2030 (USD THOUSAND)

TABLE 108 JAPAN POLYVINYLPYRROLIDONE (PVP) MARKET, BY GRADE, 2017-2030 (TONS)

TABLE 109 JAPAN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 110 JAPAN POLYVINYLPYRROLIDONE (PVP) MARKET, BY FORM, 2017-2030 (USD THOUSAND)

TABLE 111 JAPAN POLYVINYLPYRROLIDONE (PVP) MARKET, BY APPLICATION, 2017-2030 (USD THOUSAND)

TABLE 112 JAPAN PHARMACEUTICAL IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 113 JAPAN COSMETICS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 114 JAPAN SOLVENTS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 115 JAPAN ELECTRICAL & ELECTRONICS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 116 JAPAN OTHERS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 117 JAPAN ADHESIVES IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 118 JAPAN FOOD & BEVERAGE IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 119 JAPAN MEMBRANES IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 120 JAPAN POLYVINYLPYRROLIDONE (PVP) MARKET, BY DISTRIBUTION CHANNEL, 2017-2030 (USD THOUSAND)

TABLE 121 SOUTH KOREA POLYVINYLPYRROLIDONE (PVP) MARKET, BY GRADE, 2017-2030 (USD THOUSAND)

TABLE 122 SOUTH KOREA POLYVINYLPYRROLIDONE (PVP) MARKET, BY GRADE, 2017-2030 (TONS)

TABLE 123 SOUTH KOREA POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 124 SOUTH KOREA POLYVINYLPYRROLIDONE (PVP) MARKET, BY FORM, 2017-2030 (USD THOUSAND)

TABLE 125 SOUTH KOREA POLYVINYLPYRROLIDONE (PVP) MARKET, BY APPLICATION, 2017-2030 (USD THOUSAND)

TABLE 126 SOUTH KOREA PHARMACEUTICAL IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 127 SOUTH KOREA COSMETICS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 128 SOUTH KOREA SOLVENTS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 129 SOUTH KOREA ELECTRICAL & ELECTRONICS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 130 SOUTH KOREA OTHERS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 131 SOUTH KOREA ADHESIVES IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 132 SOUTH KOREA FOOD & BEVERAGE IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 133 SOUTH KOREA MEMBRANES IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 134 SOUTH KOREA POLYVINYLPYRROLIDONE (PVP) MARKET, BY DISTRIBUTION CHANNEL, 2017-2030 (USD THOUSAND)

TABLE 135 AUSTRALIA & NEW ZEALAND POLYVINYLPYRROLIDONE (PVP) MARKET, BY GRADE, 2017-2030 (USD THOUSAND)

TABLE 136 AUSTRALIA & NEW ZEALAND POLYVINYLPYRROLIDONE (PVP) MARKET, BY GRADE, 2017-2030 (TONS)

TABLE 137 AUSTRALIA & NEW ZEALAND POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 138 AUSTRALIA & NEW ZEALAND POLYVINYLPYRROLIDONE (PVP) MARKET, BY FORM, 2017-2030 (USD THOUSAND)

TABLE 139 AUSTRALIA & NEW ZEALAND POLYVINYLPYRROLIDONE (PVP) MARKET, BY APPLICATION, 2017-2030 (USD THOUSAND)

TABLE 140 AUSTRALIA & NEW ZEALAND PHARMACEUTICAL IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 141 AUSTRALIA & NEW ZEALAND COSMETICS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 142 AUSTRALIA & NEW ZEALAND SOLVENTS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 143 AUSTRALIA & NEW ZEALAND ELECTRICAL & ELECTRONICS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 144 AUSTRALIA & NEW ZEALAND OTHERS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 145 AUSTRALIA & NEW ZEALAND ADHESIVES IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 146 AUSTRALIA & NEW ZEALAND FOOD & BEVERAGE IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 147 AUSTRALIA & NEW ZEALAND MEMBRANES IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 148 AUSTRALIA & NEW ZEALAND POLYVINYLPYRROLIDONE (PVP) MARKET, BY DISTRIBUTION CHANNEL, 2017-2030 (USD THOUSAND)

TABLE 149 SINGAPORE POLYVINYLPYRROLIDONE (PVP) MARKET, BY GRADE, 2017-2030 (USD THOUSAND)

TABLE 150 SINGAPORE POLYVINYLPYRROLIDONE (PVP) MARKET, BY GRADE, 2017-2030 (TONS)

TABLE 151 SINGAPORE POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 152 SINGAPORE POLYVINYLPYRROLIDONE (PVP) MARKET, BY FORM, 2017-2030 (USD THOUSAND)

TABLE 153 SINGAPORE POLYVINYLPYRROLIDONE (PVP) MARKET, BY APPLICATION, 2017-2030 (USD THOUSAND)

TABLE 154 SINGAPORE PHARMACEUTICAL IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 155 SINGAPORE COSMETICS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 156 SINGAPORE SOLVENTS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 157 SINGAPORE ELECTRICAL & ELECTRONICS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 158 SINGAPORE OTHERS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 159 SINGAPORE ADHESIVES IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 160 SINGAPORE FOOD & BEVERAGE IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 161 SINGAPORE MEMBRANES IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 162 SINGAPORE POLYVINYLPYRROLIDONE (PVP) MARKET, BY DISTRIBUTION CHANNEL, 2017-2030 (USD THOUSAND)

TABLE 163 THAILAND POLYVINYLPYRROLIDONE (PVP) MARKET, BY GRADE, 2017-2030 (USD THOUSAND)

TABLE 164 THAILAND POLYVINYLPYRROLIDONE (PVP) MARKET, BY GRADE, 2017-2030 (TONS)

TABLE 165 THAILAND POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 166 THAILAND POLYVINYLPYRROLIDONE (PVP) MARKET, BY FORM, 2017-2030 (USD THOUSAND)

TABLE 167 THAILAND POLYVINYLPYRROLIDONE (PVP) MARKET, BY APPLICATION, 2017-2030 (USD THOUSAND)

TABLE 168 THAILAND PHARMACEUTICAL IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 169 THAILAND COSMETICS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 170 THAILAND SOLVENTS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 171 THAILAND ELECTRICAL & ELECTRONICS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 172 THAILAND OTHERS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 173 THAILAND ADHESIVES IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 174 THAILAND FOOD & BEVERAGE IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 175 THAILAND MEMBRANES IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 176 THAILAND POLYVINYLPYRROLIDONE (PVP) MARKET, BY DISTRIBUTION CHANNEL, 2017-2030 (USD THOUSAND)

TABLE 177 INDONESIA POLYVINYLPYRROLIDONE (PVP) MARKET, BY GRADE, 2017-2030 (USD THOUSAND)

TABLE 178 INDONESIA POLYVINYLPYRROLIDONE (PVP) MARKET, BY GRADE, 2017-2030 (TONS)

TABLE 179 INDONESIA POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 180 INDONESIA POLYVINYLPYRROLIDONE (PVP) MARKET, BY FORM, 2017-2030 (USD THOUSAND)

TABLE 181 INDONESIA POLYVINYLPYRROLIDONE (PVP) MARKET, BY APPLICATION, 2017-2030 (USD THOUSAND)

TABLE 182 INDONESIA PHARMACEUTICAL IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 183 INDONESIA COSMETICS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 184 INDONESIA SOLVENTS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 185 INDONESIA ELECTRICAL & ELECTRONICS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 186 INDONESIA OTHERS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 187 INDONESIA ADHESIVES IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 188 INDONESIA FOOD & BEVERAGE IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 189 INDONESIA MEMBRANES IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 190 INDONESIA POLYVINYLPYRROLIDONE (PVP) MARKET, BY DISTRIBUTION CHANNEL, 2017-2030 (USD THOUSAND)

TABLE 191 MALAYSIA POLYVINYLPYRROLIDONE (PVP) MARKET, BY GRADE, 2017-2030 (USD THOUSAND)

TABLE 192 MALAYSIA POLYVINYLPYRROLIDONE (PVP) MARKET, BY GRADE, 2017-2030 (TONS)

TABLE 193 MALAYSIA POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 194 MALAYSIA POLYVINYLPYRROLIDONE (PVP) MARKET, BY FORM, 2017-2030 (USD THOUSAND)

TABLE 195 MALAYSIA POLYVINYLPYRROLIDONE (PVP) MARKET, BY APPLICATION, 2017-2030 (USD THOUSAND)

TABLE 196 MALAYSIA PHARMACEUTICAL IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 197 MALAYSIA COSMETICS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 198 MALAYSIA SOLVENTS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 199 MALAYSIA ELECTRICAL & ELECTRONICS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 200 MALAYSIA OTHERS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 201 MALAYSIA ADHESIVES IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 202 MALAYSIA FOOD & BEVERAGE IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 203 MALAYSIA MEMBRANES IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 204 MALAYSIA POLYVINYLPYRROLIDONE (PVP) MARKET, BY DISTRIBUTION CHANNEL, 2017-2030 (USD THOUSAND)

TABLE 205 PHILIPPINES POLYVINYLPYRROLIDONE (PVP) MARKET, BY GRADE, 2017-2030 (USD THOUSAND)

TABLE 206 PHILIPPINES POLYVINYLPYRROLIDONE (PVP) MARKET, BY GRADE, 2017-2030 (TONS)

TABLE 207 PHILIPPINES POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 208 PHILIPPINES POLYVINYLPYRROLIDONE (PVP) MARKET, BY FORM, 2017-2030 (USD THOUSAND)

TABLE 209 PHILIPPINES POLYVINYLPYRROLIDONE (PVP) MARKET, BY APPLICATION, 2017-2030 (USD THOUSAND)

TABLE 210 PHILIPPINES PHARMACEUTICAL IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 211 PHILIPPINES COSMETICS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 212 PHILIPPINES SOLVENTS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 213 PHILIPPINES ELECTRICAL & ELECTRONICS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 214 PHILIPPINES OTHERS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 215 PHILIPPINES ADHESIVES IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 216 PHILIPPINES FOOD & BEVERAGE IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 217 PHILIPPINES MEMBRANES IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 218 PHILIPPINES POLYVINYLPYRROLIDONE (PVP) MARKET, BY DISTRIBUTION CHANNEL, 2017-2030 (USD THOUSAND)

TABLE 219 REST OF ASIA-PACIFIC POLYVINYLPYRROLIDONE (PVP) MARKET, BY GRADE, 2017-2030 (USD THOUSAND)

TABLE 220 REST OF ASIA-PACIFIC POLYVINYLPYRROLIDONE (PVP) MARKET, BY GRADE, 2017-2030 (TONS)

List of Figure

FIGURE 1 ASIA PACIFIC POLYVINYLPYRROLIDONE (PVP) MARKET

FIGURE 2 ASIA PACIFIC POLYVINYLPYRROLIDONE (PVP) MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC POLYVINYLPYRROLIDONE (PVP) MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC POLYVINYLPYRROLIDONE (PVP) MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC POLYVINYLPYRROLIDONE (PVP) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC POLYVINYLPYRROLIDONE (PVP) MARKET: THE GRADE LIFE LINE CURVE

FIGURE 7 ASIA PACIFIC POLYVINYLPYRROLIDONE (PVP) MARKET: MULTIVARIATE MODELLING

FIGURE 8 ASIA PACIFIC POLYVINYLPYRROLIDONE (PVP) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 ASIA PACIFIC POLYVINYLPYRROLIDONE (PVP) MARKET: DBMR MARKET POSITION GRID

FIGURE 10 ASIA PACIFIC POLYVINYLPYRROLIDONE (PVP) MARKET: MARKET END-USER COVERAGE GRID

FIGURE 11 ASIA PACIFIC POLYVINYLPYRROLIDONE (PVP) MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 ASIA PACIFIC POLYVINYLPYRROLIDONE (PVP) MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 ASIA PACIFIC POLYVINYLPYRROLIDONE (PVP) MARKET: SEGMENTATION

FIGURE 14 APPLICATION AS AN EXCIPIENT IN PHARMACEUTICAL PRODUCTS IS EXPECTED TO DRIVE THE ASIA PACIFIC POLYVINYLPYRROLIDONE (PVP) MARKET IN THE FORECAST PERIOD

FIGURE 15 K30 SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC POLYVINYLPYRROLIDONE (PVP) MARKET IN 2023 & 2030

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE ASIA PACIFIC POLYVINYLPYRROLIDONE (PVP) MARKET

FIGURE 17 ASIA PACIFIC POLYVINYLPYRROLIDONE (PVP) MARKET: BY GRADE, 2022

FIGURE 18 ASIA PACIFIC POLYVINYLPYRROLIDONE (PVP) MARKET: BY TYPE, 2022

FIGURE 19 ASIA PACIFIC POLYVINYLPYRROLIDONE (PVP) MARKET: BY FORM, 2022

FIGURE 20 ASIA PACIFIC POLYVINYLPYRROLIDONE (PVP) MARKET: BY APPLICATION, 2022

FIGURE 21 ASIA PACIFIC POLYVINYLPYRROLIDONE (PVP) MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 22 ASIA-PACIFIC POLYVINYLPYRROLIDONE (PVP) MARKET: SNAPSHOT (2022)

FIGURE 23 ASIA-PACIFIC POLYVINYLPYRROLIDONE (PVP) MARKET: BY COUNTRY (2022)

FIGURE 24 ASIA-PACIFIC POLYVINYLPYRROLIDONE (PVP) MARKET: BY COUNTRY (2023 & 2030)

FIGURE 25 ASIA-PACIFIC POLYVINYLPYRROLIDONE (PVP) MARKET: BY COUNTRY (2022 & 2030)

FIGURE 26 ASIA-PACIFIC POLYVINYLPYRROLIDONE (PVP) MARKET: BY GRADE (2023 - 2030)

FIGURE 27 ASIA PACIFIC POLYVINYLPYRROLIDONE (PVP) MARKET: COMPANY SHARE 2022 (%)

Asia Pacific Polyvinylpyrrolidone Pvp Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Asia Pacific Polyvinylpyrrolidone Pvp Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Asia Pacific Polyvinylpyrrolidone Pvp Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.