Asia-Pacific Phosphorus and Derivatives Market Analysis and Insights

Phosphorous and phosphoric acid refers to crystalline acid that is generally weak, colorless, and odorless. These inorganic materials are corrosive to the ferrous metal & alloys and possess good solubility in water. These tend to decompose in high temperatures. These may form toxic fumes when combined with alcohol. It gives soft drinks a tangy flavor and prevents the growth of mold and bacteria, which can multiply easily in a sugary solution. Most of the soda's acidity also comes from phosphoric acid.

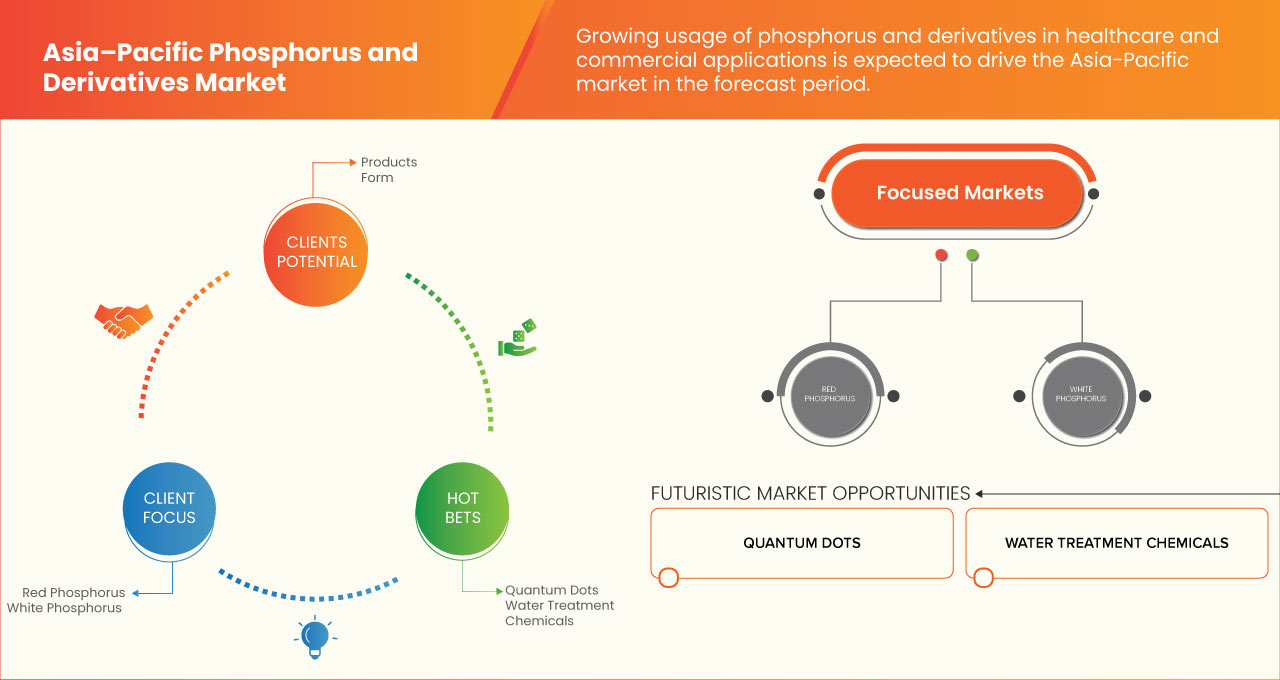

The driving factors that may be responsible for the growth of the Asia-Pacific phosphorus and derivatives market are the rapid growth in the agriculture, food, and food and beverages sector. However, the stringent government regulations on phosphorus and derivatives usage are expected to restrain the market.

On the other hand, strategic initiatives by market players and the rise in the agriculture field and the food and beverages industries may act as an opportunity to grow the Asia-Pacific phosphorus and derivatives market. The risks associated with overusing phosphate-based products may create challenges for the Asia-Pacific phosphorus and derivatives market. There are some recent developments related to the Asia-Pacific phosphorus and derivatives market.

However, the harmful effects of phosphorus and derivatives on the environment are expected to hamper the growth of the Asia-Pacific phosphorus and derivatives market in the forecast period.

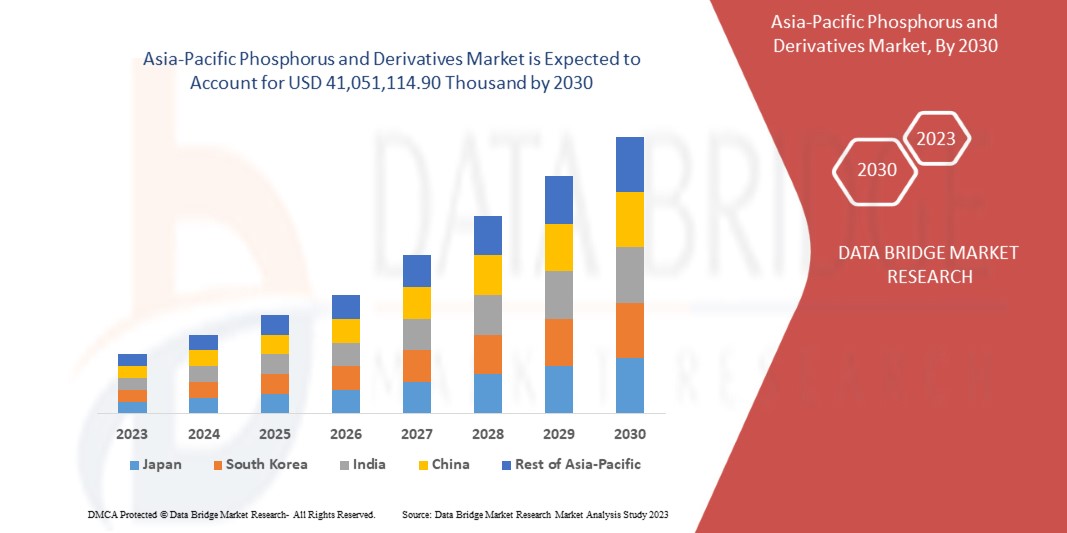

Data Bridge Market Research analyzes that the Asia-Pacific phosphorus and derivatives market is expected to reach the value of USD 41,051,114.90 thousand by 2030, at a CAGR of 4.34% during the forecast period. Phosphoric acid is the largest product segment in the market due to the growing use of phosphorus in Asia-Pacific phosphorus and derivatives.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (2015 -2020) |

|

Quantitative Units |

Revenue in USD Thousands |

|

Segments Covered |

Product (Phosphoric Acid, Ammonium Phosphate, Phosphorus Pentoxide, Phosphorus Chloride, Phosphorus Sulfide, Industrial Phosphate, Hypophosphorus Acid, Tricalcium Phosphate, Triethyl Phosphate, Phosphorus Tribromide, Trichlorophosphate, Adenosine Triphosphate, and Others), Form (Dry and Liquid), Application (Fertilizers, Food and Drink Additives, Detergents, Metal Finishing, Water Treatment Chemicals, Quantum Dots, Flame Retardant Material, and Others), End User (Agriculture, Food & Beverage, Pharmaceuticals/Healthcare, Chemical Processing, Automotive, Home Care, and Others), Allotropes (Red Phosphorous and White Phosphorous) |

|

Countries Covered |

Japan, China, South Korea, India, Australia, Singapore, Thailand Taiwan, Hong Kong, New Zealand, Malaysia, Indonesia, Philippines, Rest of Asia-Pacific |

|

Market Players Covered |

ANEXIB Chemicals, Nippon Chemical Industrial CO., LTD., Mosaic Company, LANXESS, Solvay, Ma'aden, ICL, Xuzhou JianPing Chemical Co., Ltd., and Sekisui Diagnostics among others |

Asia-Pacific Phosphorus and Derivatives Market Definition

Phosphorous is a combustible nonmetallic element generally found in two allotropic forms: white phosphorous and red phosphorous. Phosphoric acid, phosphorous acid, phosphorus oxychloride, phosphorus pentachloride, phosphorus tribromide, sodium hypophosphite, tributyl phosphate, and triethyl phosphate are such derivatives of phosphorous. Phosphorus derivative phosphoric acid is a crystalline acid generally weak, colorless, and odorless. These inorganic materials are corrosive to the ferrous metal & alloys and possess good solubility in water. These tend to decompose in high temperatures. These may form toxic fumes when combined with alcohol. It gives soft drinks a tangy flavor and prevents the growth of mold and bacteria, which can multiply easily in a sugary solution. Most of the soda's acidity also comes from phosphoric acid.

Phosphorus is first turned into phosphorus pentoxide through a chemical manufacturing process. It's then treated again to become phosphoric acid.

Asia-Pacific Phosphorus and Derivatives Market Dynamics

This section deals with understanding the market drivers, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Increasing demand for fertilizers in agriculture industry

Phosphoric acid produces several fertilizers, including DAP, MAP, NPKs, and SSP.

Diammonium phosphate (DAP) is the most popular phosphatic fertilizer because of its physical properties. The composition of DAP is N-18% and P2O5 -46%. DAP fertilizers are perfect for any agriculture crop to provide full phosphorus nutrition throughout crop growth and development and a starter dose of nitrogen and low Sulphur. It can be applied in autumn for tilling and spring during sowing and pre-sowing cultivation. Dissolving in soil provides temporary alkalization of the pH of the soil solution around the fertilizer granule, thus stimulating better phosphorus uptake from the fertilizers on acid soils. Fertilizer sulfur also contributes to plants' better intake of nitrogen and phosphorus.

Thus, multiple uses of phosphoric acid to produce phosphate fertilizers are expected to drive the growth of the Asia-Pacific phosphoric acid market.

- Increasing demand in the pharmaceutical sector

Phosphoric acid is mainly used in many medical applications, such as dental cement, for preparing albumin derivatives, acidifying the urine, removing necrotic (dead cells or tissue) debris, anti-nausea medicines, teeth whiteners, and mouth washing liquid.

Phosphoric acid used in teeth whitening phosphoric acid can alter the tooth surface. Using 37% phosphoric acid following bleaching can significantly increase the decalcifying effect of the acid on the enamel surface, creating an uneven etched surface. Moreover, it can create sensitivity in the teeth.

Thus, the growing usage of phosphoric acid in medical applications is expected to drive the growth of the Asia-Pacific phosphoric acid market.

Restraint

- Stringent government regulations on phosphorus and derivatives usage

There are many regulations by different government regulatory bodies for the use and production of phosphoric acid.

The FDA protects the public health by ensuring the safety, efficacy, and security of human and veterinary drugs, biological products, chemicals, and others. USFDA has given some regulations for using phosphoric acid in food and regulations for handling phosphoric acid. Below are some of the parameters by FDA for protection purposes

Thus, due to the stringent government regulations on phosphoric acid, there are limitations on the use of phosphoric acid, which may impede the market growth in the forecast period.

Opportunity

Increasing innovation and new product launches

Leading market players have launched new products that exhibit improved capabilities. Manufacturers have taken the necessary steps to improve the accuracy of new products and overall functionality.

Market players are further focusing on producing phosphoric acid domestically and operating by exporting to other regions to expand their business.

Thus, growing innovations and new product launches are expected to offer an opportunity for the Asia-Pacific phosphoric acid market.

Challenge

Risks associated with over usage of phosphate based products

At state, provisional, and national levels, the phosphoric acid supply is regulated by various government rules as several risks could impact the usage of fertilizers, and there are several environmental impacts during the production of phosphoric acid.

The production of phosphate fertilizers usually uses as raw material sedimentary phosphate rock, which contains enhanced concentrations from U‐series radionuclides about 10–100 times higher than unperturbed soils.

Thus, due to the harmful impacts of phosphoric acid on air, water, soil, and human health, many government bodies have led the implementation of several regulations, high-standard certification schemes, and company registrations for the use of phosphoric acid, which may pose a challenge to the Asia-Pacific phosphoric acid market.

Recent Developments

- In March 2023, Solvay announced that it had been recognized as one of the 60 top suppliers for 2022 in Northrop Grumman Corporation's Asia-Pacific network of more than 10,000 suppliers. This will increase the company's brand image, among others.

- In March 2023, Airedale group announced that the company would continue growing by acquiring McCann chemicals. This will help in increasing the growth and diversification of the company's product portfolio.

Asia-Pacific Phosphorus and Derivatives Market Scope

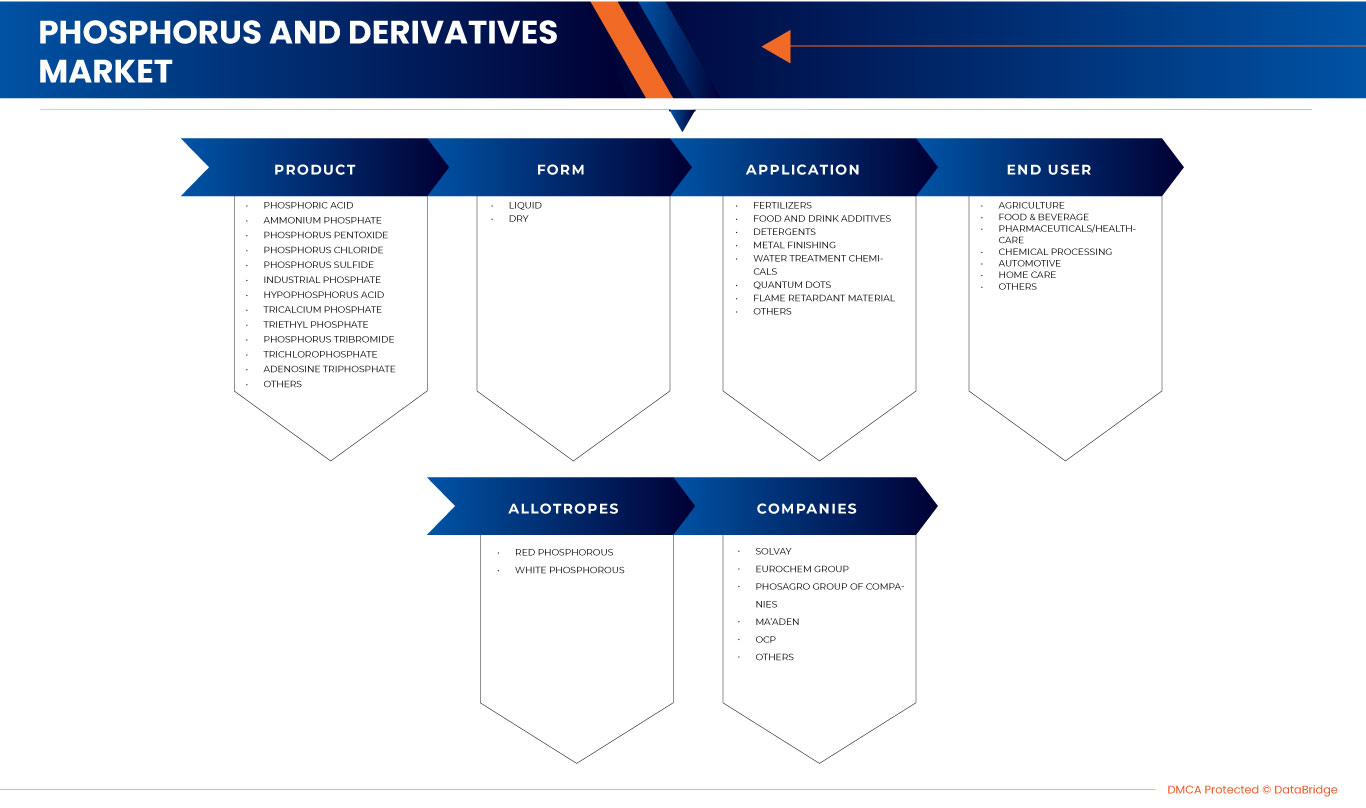

Asia-Pacific phosphorus and derivatives market is segmented into five notable segments such as, product, form, application, end user, and allotropes. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

Product

- Phosphoric Acid

- Ammonium Phosphate

- Phosphorus Pentoxide

- Phosphorus Chloride

- Phosphorus Sulfide

- Industrial Phosphate

- Hypophosphorus Acid

- Tricalcium Phosphate

- Triethyl Phosphate

- Phosphorus Tribromide

- Trichlorophosphate

- Adenosine Triphosphate

- Others

On the basis of product, Asia-Pacific phosphorus and derivatives market is segmented into phosphoric acid, ammonium phosphate, phosphorus pentoxide, phosphorus chloride, phosphorus sulfide, industrial phosphate, hypophosphorus acid, tricalcium phosphate, triethyl phosphate, phosphorus tribromide, trichlorophosphate, adenosine triphosphate, and others.

Form

- Dry

- Liquid

On the basis of form, the Asia-Pacific phosphorus and derivatives market is segmented into dry and liquid.

Application

- Fertilizers

- Food and Drink Additives

- Detergents

- Metal Finishing

- Water Treatment Chemicals

- Quantum Dots

- Flame Retardant Material

- Others

On the basis of application, the Asia-Pacific phosphorus and derivatives market is segmented into fertilizers, food and drink additives, detergents, metal finishing, water treatment chemicals, quantum dots, flame retardant material, and others.

End User

- Agriculture

- Food & Beverage

- Pharmaceuticals/HealthCare

- Chemical Processing

- Automotive

- Home Care

- Others

On the basis of end user, the Asia-Pacific phosphorus and derivatives market is segmented into agriculture, food & beverage, pharmaceuticals/healthcare, chemical processing, automotive, home care, and others.

Allotropes

- Red Phosphorous

- White Phosphorous

On the basis of allotropes, the Asia-Pacific phosphorus and derivatives market is segmented into red phosphorous and white phosphorous.

Asia-Pacific Phosphorus and Derivatives Market Regional Analysis/Insights

The Asia-Pacific phosphorus and derivatives market is segmented into five notable segments such as product, form, application, end user, and allotropes.

The countries covered in this market report Asia-Pacific phosphorus and derivatives market are Japan, China, South Korea, India, Australia, Singapore, New Zealand, Malaysia, Indonesia, Philippines, and the rest of Asia-Pacific.

The country section of the report also provides individual market-impacting factors and domestic regulation changes that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of phosphorus and its derivatives and the challenges due to stringent regulations are considered while providing forecast analysis of the country data.

Competitive Landscape and Asia-Pacific Phosphorus and Derivatives Market Share Analysis

Asia-Pacific phosphorus and derivatives market competitive landscape provides details of a competitor. Details include company overview, financials, revenue generated, market potential, business expansion, service facilities, partnership, strategic development, application dominance, and technology lifeline curve. The above data points only relate to the company's focus on the Asia-Pacific phosphorus and derivatives market.

Some of the major players operating in the Asia-Pacific phosphorus and derivatives market are ANEXIB Chemicals, Nippon Chemical Industrial CO., LTD., Mosaic Company, LANXESS, Solvay, Ma'aden, ICL, Xuzhou JianPing Chemical Co., Ltd., Sekisui Diagnostics and others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE EUROPE PHOSPHORUS AND DERIVATIVES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFELINE CURVE

2.7 MULTIVARIATE MODELLING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 MARKET APPLICATION COVERAGE GRID

2.12 DBMR MARKET CHALLENGE MATRIX

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ENVIRONMENTAL FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ECONOMICAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER'S FIVE FORCES

4.3 RAW MATERIAL COVERAGE

4.4 PRODUCTION CONSUMPTION ANALYSIS

4.5 IMPORT-EXPORT SCENARIO

4.6 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURES

4.7 VENDOR SELECTION CRITERIA

4.8 PRODUCTION CAPACITY OUTLOOK

5 REGULATION COVERAGE

6 CLIMATE CHANGE SCENARIO

6.1 ENVIRONMENTAL CONCERNS

6.2 INDUSTRY RESPONSE

6.3 GOVERNMENT'S ROLE

6.4 ANALYST RECOMMENDATION

7 PRICING ANALYSIS OF PHOSPHORUS

8 SUPPLY CHAIN ANALYSIS

9 REGIONAL SUMMARIES

10 MARKET OVERVIEW

10.1 DRIVERS

10.1.1 INCREASING DEMAND FOR FERTILIZERS IN THE AGRICULTURE INDUSTRY

10.1.2 GROWING AWARENESS ABOUT THE BENEFITS OF PHOSPHORUS AND DERIVATIVES AMONG CONSUMERS

10.1.3 INCREASING DEMAND IN THE PHARMACEUTICAL SECTOR

10.1.4 RISING APPLICATIONS OF PHOSPHORUS AND DERIVATIVES IN SEVERAL INDUSTRIES

10.2 RESTRAINTS

10.2.1 STRINGENT GOVERNMENT REGULATIONS ON PHOSPHORUS AND DERIVATIVES USAGE

10.2.2 HARMFUL EFFECTS OF PHOSPHORUS AND DERIVATIVES ON THE ENVIRONMENT

10.3 OPPORTUNITIES

10.3.1 INCREASING USE OF PHOSPHORUS AND DERIVATIVES IN THE FOOD & BEVERAGE INDUSTRY

10.3.2 INCREASING INNOVATION AND NEW PRODUCT LAUNCHES

10.3.3 GROWING USE OF PHOSPHORUS AND DERIVATIVES IN FUEL CELLS

10.4 CHALLENGES

10.4.1 RISKS ASSOCIATED WITH OVER USAGE OF PHOSPHATE-BASED PRODUCTS

10.4.2 INCREASING ADOPTION OF GENETICALLY MODIFIED SEEDS

11 EUROPE PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT

11.1 OVERVIEW:

11.2 PHOSPHORIC ACID

11.3 AMMONIUM PHOSPHATE

11.4 PHOSPHORUS PENTOXIDE

11.5 PHOSPHORUS CHLORIDE

11.6 PHOSPHORUS SULPHIDE

11.7 INDUSTRIAL PHOSPHATE

11.8 HYPHOSPHORUS ACID

11.9 TRICALCIUM PHOSPHATE

11.1 TRIETHYL PHOSPHATE

11.11 PHOSPHORUS TRIBROMIDE

11.12 TRICHLOROPHOSPHATE

11.13 ADENOSINE TRIPHOSPHATE

11.14 OTHERS

12 EUROPE PHOSPHORUS AND DERIVATIVES MARKET, BY FORM

12.1 OVERVIEW

12.2 DRY

12.3 LIQUID

13 EUROPE PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION

13.1 OVERVIEW:

13.2 FERTILIZERS

13.3 FOOD AND DRINK ADDITIVES

13.4 DETERGENTS

13.5 METAL FINISHING

13.6 WATER TREATMENT CHEMICALS

13.7 QUANTUM DOTS

13.8 FLAME RETARDANT MATERIAL

13.9 OTHERS

14 EUROPE PHOSPHORUS AND DERIVATIVES MARKET, BY END USER

14.1 OVERVIEW:

14.2 AGRICULTURE

14.3 FOOD AND BEVERAGES

14.4 PHARMACEUTICALS/HEALTHCARE

14.5 CHEMICAL PROCESSING

14.6 AUTOMOTIVE

14.7 HOMECARE

14.8 OTHERS

15 EUROPE PHOSPHOROUS AND DERIVATIVES MARKET, BY ALLOTROPES

15.1 OVERVIEW

15.2 RED PHOSPHOROUS

15.3 WHITE PHOSPHOROUS

16 EUROPE PHOSPHORUS AND DERIVATIVES MARKET, BY REGION

16.1 EUROPE

16.1.1 RUSSIA

16.1.2 U.K.

16.1.3 GERMANY

16.1.4 FRANCE

16.1.5 ITALY

16.1.6 SPAIN

16.1.7 NETHERLANDS

16.1.8 POLAND

16.1.9 SWEDEN

16.1.10 BELGIUM

16.1.11 IRELAND

16.1.12 AUSTRIA

16.1.13 DENMARK

16.1.14 FINLAND

16.1.15 ROMANIA

16.1.16 CZECH REPUBLIC

16.1.17 PORTUGAL

16.1.18 GREECE

16.1.19 HUNGARY

16.1.20 SLOVAKIA

16.1.21 LUXEMBOURG

16.1.22 BULGARIA

16.1.23 CROATIA

16.1.24 LITHUANIA

16.1.25 SLOVENIA

16.1.26 LATVIA

16.1.27 ESTONIA

16.1.28 REPUBLIC OF CYPRUS

16.1.29 MALTA

17 EUROPE PHOSPHORUS AND DERIVATIVES MARKET: COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: EUROPE

17.2 EXPANSIONS

17.3 AGREEMENTS

17.4 RECOGNITIONS

17.5 COLLABORATION

17.6 NEW LAUNCHES/PRODUCTS

17.7 ACQUISITIONS

17.8 PRESENTATION

17.9 NEW PRODUCTION BUILDING

17.1 INVESTMENT

18 COMPANY PROFILE

18.1 SOLVAY

18.1.1 COMPANY SNAPSHOT

18.1.2 PRODUCTION CAPACITY

18.1.3 SWOT

18.1.4 REVENUE ANALYSIS

18.1.5 COMPANY SHARE ANALYSIS

18.1.6 PRODUCT PORTFOLIO

18.1.7 RECENT DEVELOPMENT

18.2 EUROCHEM GROUP

18.2.1 COMPANY SNAPSHOT

18.2.2 PRODUCTION CAPACITY

18.2.3 SWOT

18.2.4 COMPANY SHARE ANALYSIS

18.2.5 PRODUCT PORTFOLIO

18.2.6 RECENT DEVELOPMENT

18.3 PHOSAGRO GROUP OF COMPANIES

18.3.1 COMPANY SNAPSHOT

18.3.2 PRODUCTION CAPACITY

18.3.3 SWOT

18.3.4 REVENUE ANALYSIS

18.3.5 COMPANY SHARE ANALYSIS

18.3.6 PRODUCT PORTFOLIO

18.3.7 RECENT DEVELOPMENT

18.4 MA'ADEN

18.4.1 COMPANY SNAPSHOT

18.4.2 PRODUCTION CAPACITY

18.4.3 SWOT

18.4.4 REVENUE ANALYSIS

18.4.5 COMPANY SHARE ANALYSIS

18.4.6 PRODUCT PORTFOLIO

18.4.7 RECENT DEVELOPMENTS

18.5 OCP

18.5.1 COMPANY SNAPSHOT

18.5.2 PRODUCTION CAPACITY

18.5.3 SWOT

18.5.4 COMPANY SHARE ANALYSIS

18.5.5 PRODUCT PORTFOLIO

18.5.6 RECENT DEVELOPMENT

18.6 ADITYA BIRLA MANAGEMENT CORPORATION PVT. LTD.

18.6.1 COMPANY SNAPSHOT

18.6.2 SWOT

18.6.3 REVENUE ANALYSIS

18.6.4 PRODUCT PORTFOLIO

18.6.5 RECENT DEVELOPMENT

18.7 AIREDALE CHEMICAL COMPANY LIMITED

18.7.1 COMPANY SNAPSHOT

18.7.2 SWOT

18.7.3 PRODUCT PORTFOLIO

18.7.4 RECENT DEVELOPMENT

18.8 ANEXIB CHEMICALS

18.8.1 COMPANY SNAPSHOT

18.8.2 SWOT

18.8.3 PRODUCT PORTFOLIO

18.8.4 RECENT DEVELOPMENT

18.9 ANHUI GUANGXIN AGROCHEMICAL CO., LTD.

18.9.1 COMPANY SNAPSHOT

18.9.2 SWOT

18.9.3 PRODUCT PORTFOLIO

18.9.4 RECENT DEVELOPMENTS

18.1 EXCEL INDUSTRIES LTD. (2022)

18.10.1 COMPANY SNAPSHOT

18.10.2 SWOT

18.10.3 REVENUE ANALYSIS

18.10.4 PRODUCT PORTFOLIO

18.10.5 RECENT DEVELOPMENT

18.11 FUTONG CHEMICAL CO., LTD

18.11.1 COMPANY SNAPSHOT

18.11.2 SWOT

18.11.3 PRODUCT PORTFOLIO

18.11.4 RECENT DEVELOPMENT

18.12 ICL

18.12.1 COMPANY SNAPSHOT

18.12.2 SWOT

18.12.3 REVENUE ANALYSIS

18.12.4 PRODUCT PORTFOLIO

18.12.5 RECENT DEVELOPMENTS

18.13 INNOPHOS

18.13.1 COMPANY SNAPSHOT

18.13.2 SWOT

18.13.3 PRODUCT PORTFOLIO

18.13.4 RECENT DEVELOPMENT

18.14 JORDAN PHOSPHATE MINES COMPANY (PLC)

18.14.1 COMPANY SNAPSHOT

18.14.2 SWOT

18.14.3 REVENUE ANALYSIS

18.14.4 PRODUCT PORTFOLIO

18.14.5 RECENT DEVELOPMENT

18.15 KAZPHOSPHATE LLC

18.15.1 COMPANY SNAPSHOT

18.15.2 SWOT

18.15.3 PRODUCT PORTFOLIO

18.15.4 RECENT DEVELOPMENT

18.16 LANXESS

18.16.1 COMPANY SNAPSHOT

18.16.2 SWOT

18.16.3 REVENUE ANALYSIS

18.16.4 PRODUCT PORTFOLIO

18.16.5 RECENT DEVELOPMENTS

18.17 MOSAIC

18.17.1 COMPANY SNAPSHOT

18.17.2 SWOT

18.17.3 REVENUE ANALYSIS

18.17.4 PRODUCT PORTFOLIO

18.17.5 RECENT DEVELOPMENT

18.18 NIPPON CHEMICAL INDUSTRIAL CO., LTD.

18.18.1 COMPANY SNAPSHOT

18.18.2 SWOT

18.18.3 REVENUE ANALYSIS

18.18.4 PRODUCT PORTFOLIO

18.18.5 RECENT DEVELOPMENTS

18.19 NUTRIEN LTD. (2022)

18.19.1 COMPANY SNAPSHOT

18.19.2 SWOT

18.19.3 REVENUE ANALYSIS

18.19.4 PRODUCT PORTFOLIO

18.19.5 RECENT DEVELOPMENT

18.2 PCC ROKITA SPÓŁKA AKCYJNA. (A SUBSIDIARY OF PCC GROUP)

18.20.1 COMPANY SNAPSHOT

18.20.2 SWOT

18.20.3 REVENUE ANALYSIS

18.20.4 PRODUCT PORTFOLIO

18.20.5 RECENT DEVELOPMENT

18.21 SANDHYA GROUP

18.21.1 COMPANY SNAPSHOT

18.21.2 SWOT

18.21.3 PRODUCT PORTFOLIO

18.21.4 RECENT DEVELOPMENT

18.22 SEKISUI DIAGNOSTICS

18.22.1 COMPANY SNAPSHOT

18.22.2 SWOT

18.22.3 PRODUCT PORTFOLIO

18.22.4 RECENT DEVELOPMENT

18.23 SMC EUROPE

18.23.1 COMPANY SNAPSHOT

18.23.2 SWOT

18.23.3 PRODUCT PORTFOLIO

18.23.4 RECENT DEVELOPMENT

18.24 STREM (A SUBSIDIARY OF ASCENSUS)

18.24.1 COMPANY SNAPSHOT

18.24.2 SWOT

18.24.3 PRODUCT PORTFOLIO

18.24.4 RECENT DEVELOPMENTS

18.25 XUZHOU JIANPING CHEMICAL CO., LTD.

18.25.1 COMPANY SNAPSHOT

18.25.2 SWOT

18.25.3 PRODUCT PORTFOLIO

18.25.4 RECENT DEVELOPMENTS

19 QUESTIONNAIRE

20 RELATED REPORTS

List of Table

TABLE 1 ASIA PACIFIC PHOSPHORUS AND DERIVATIVES MARKET, BY REGION, 2019-2022 (AVERAGE SELLING PRICE (USD) PER KG)

TABLE 2 THE RECOMMENDED DIETARY ALLOWANCE (RDA) FOR PHOSPHORUS IS THE FOLLOWING:

TABLE 3 ASIA-PACIFIC PHOSPHORUS AND DERIVATIVES MARKET, BY COUNTRY, 2016-2030 (USD THOUSAND)

TABLE 4 ASIA-PACIFIC PHOSPHORUS AND DERIVATIVES MARKET, BY COUNTRY, 2016-2030 (TONS)

TABLE 5 ASIA-PACIFIC PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (USD THOUSAND)

TABLE 6 ASIA-PACIFIC PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (TONS)

TABLE 7 ASIA-PACIFIC PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 8 ASIA-PACIFIC PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 9 ASIA-PACIFIC AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 10 ASIA-PACIFIC AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 11 ASIA-PACIFIC PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 12 ASIA-PACIFIC PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 13 ASIA-PACIFIC PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 14 ASIA-PACIFIC PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 15 ASIA-PACIFIC PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (USD THOUSAND)

TABLE 16 ASIA-PACIFIC PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (TONS)

TABLE 17 ASIA-PACIFIC PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (USD THOUSAND)

TABLE 18 ASIA-PACIFIC PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (TONS)

TABLE 19 ASIA-PACIFIC PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (USD THOUSAND)

TABLE 20 ASIA-PACIFIC PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (TONS)

TABLE 21 ASIA-PACIFIC PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (USD THOUSAND)

TABLE 22 ASIA-PACIFIC PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (TONS)

TABLE 23 CHINA PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (USD THOUSAND)

TABLE 24 CHINA PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (TONS)

TABLE 25 CHINA PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 26 CHINA PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 27 CHINA AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 28 CHINA AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 29 CHINA PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 30 CHINA PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 31 CHINA PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 32 CHINA PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 33 CHINA PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (USD THOUSAND)

TABLE 34 CHINA PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (TONS)

TABLE 35 CHINA PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (USD THOUSAND)

TABLE 36 CHINA PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (TONS)

TABLE 37 CHINA PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (USD THOUSAND)

TABLE 38 CHINA PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (TONS)

TABLE 39 CHINA PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (USD THOUSAND)

TABLE 40 CHINA PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (TONS)

TABLE 41 INDIA PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (USD THOUSAND)

TABLE 42 INDIA PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (TONS)

TABLE 43 INDIA PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 44 INDIA PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 45 INDIA AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 46 INDIA AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 47 INDIA PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 48 INDIA PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 49 INDIA PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 50 INDIA PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 51 INDIA PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (USD THOUSAND)

TABLE 52 INDIA PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (TONS)

TABLE 53 INDIA PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (USD THOUSAND)

TABLE 54 INDIA PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (TONS)

TABLE 55 INDIA PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (USD THOUSAND)

TABLE 56 INDIA PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (TONS)

TABLE 57 INDIA PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (USD THOUSAND)

TABLE 58 INDIA PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (TONS)

TABLE 59 JAPAN PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (USD THOUSAND)

TABLE 60 JAPAN PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (TONS)

TABLE 61 JAPAN PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 62 JAPAN PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 63 JAPAN AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 64 JAPAN AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 65 JAPAN PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 66 JAPAN PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 67 JAPAN PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 68 JAPAN PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 69 JAPAN PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (USD THOUSAND)

TABLE 70 JAPAN PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (TONS)

TABLE 71 JAPAN PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (USD THOUSAND)

TABLE 72 JAPAN PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (TONS)

TABLE 73 JAPAN PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (USD THOUSAND)

TABLE 74 JAPAN PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (TONS)

TABLE 75 JAPAN PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (USD THOUSAND)

TABLE 76 JAPAN PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (TONS)

TABLE 77 SOUTH KOREA PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (USD THOUSAND)

TABLE 78 SOUTH KOREA PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (TONS)

TABLE 79 SOUTH KOREA PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 80 SOUTH KOREA PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 81 SOUTH KOREA AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 82 SOUTH KOREA AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 83 SOUTH KOREA PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 84 SOUTH KOREA PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 85 SOUTH KOREA PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 86 SOUTH KOREA PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 87 SOUTH KOREA PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (USD THOUSAND)

TABLE 88 SOUTH KOREA PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (TONS)

TABLE 89 SOUTH KOREA PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (USD THOUSAND)

TABLE 90 SOUTH KOREA PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (TONS)

TABLE 91 SOUTH KOREA PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (USD THOUSAND)

TABLE 92 SOUTH KOREA PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (TONS)

TABLE 93 SOUTH KOREA PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (USD THOUSAND)

TABLE 94 SOUTH KOREA PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (TONS)

TABLE 95 INDONESIA PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (USD THOUSAND)

TABLE 96 INDONESIA PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (TONS)

TABLE 97 INDONESIA PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 98 INDONESIA PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 99 INDONESIA AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 100 INDONESIA AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 101 INDONESIA PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 102 INDONESIA PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 103 INDONESIA PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 104 INDONESIA PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 105 INDONESIA PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (USD THOUSAND)

TABLE 106 INDONESIA PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (TONS)

TABLE 107 INDONESIA PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (USD THOUSAND)

TABLE 108 INDONESIA PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (TONS)

TABLE 109 INDONESIA PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (USD THOUSAND)

TABLE 110 INDONESIA PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (TONS)

TABLE 111 INDONESIA PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (USD THOUSAND)

TABLE 112 INDONESIA PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (TONS)

TABLE 113 AUSTRALIA PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (USD THOUSAND)

TABLE 114 AUSTRALIA PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (TONS)

TABLE 115 AUSTRALIA PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 116 AUSTRALIA AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 117 AUSTRALIA AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 118 AUSTRALIA PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 119 AUSTRALIA PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 120 AUSTRALIA PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 121 AUSTRALIA PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 122 AUSTRALIA PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (USD THOUSAND)

TABLE 123 AUSTRALIA PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (TONS)

TABLE 124 AUSTRALIA PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (USD THOUSAND)

TABLE 125 AUSTRALIA PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (TONS)

TABLE 126 AUSTRALIA PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (USD THOUSAND)

TABLE 127 AUSTRALIA PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (TONS)

TABLE 128 AUSTRALIA PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (USD THOUSAND)

TABLE 129 AUSTRALIA PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (TONS)

TABLE 130 SINGAPORE PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (USD THOUSAND)

TABLE 131 SINGAPORE PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (TONS)

TABLE 132 SINGAPORE PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 133 SINGAPORE PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 134 SINGAPORE AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 135 SINGAPORE AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 136 SINGAPORE PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 137 SINGAPORE PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 138 SINGAPORE PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 139 SINGAPORE PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 140 SINGAPORE PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (USD THOUSAND)

TABLE 141 SINGAPORE PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (TONS)

TABLE 142 SINGAPORE PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (USD THOUSAND)

TABLE 143 SINGAPORE PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (TONS)

TABLE 144 SINGAPORE PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (USD THOUSAND)

TABLE 145 SINGAPORE PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (TONS)

TABLE 146 SINGAPORE PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (USD THOUSAND)

TABLE 147 SINGAPORE PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (TONS)

TABLE 148 PHILIPPINES PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (USD THOUSAND)

TABLE 149 PHILIPPINES PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (TONS)

TABLE 150 PHILIPPINES PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 151 PHILIPPINES PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 152 PHILIPPINES AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 153 PHILIPPINES AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 154 PHILIPPINES PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 155 PHILIPPINES PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 156 PHILIPPINES PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 157 PHILIPPINES PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 158 PHILIPPINES PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (USD THOUSAND)

TABLE 159 PHILIPPINES PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (TONS)

TABLE 160 PHILIPPINES PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (USD THOUSAND)

TABLE 161 PHILIPPINES PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (TONS)

TABLE 162 PHILIPPINES PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (USD THOUSAND)

TABLE 163 PHILIPPINES PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (TONS)

TABLE 164 PHILIPPINES PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (USD THOUSAND)

TABLE 165 PHILIPPINES PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (TONS)

TABLE 166 THAILAND PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (USD THOUSAND)

TABLE 167 THAILAND PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (TONS)

TABLE 168 THAILAND PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 169 THAILAND PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 170 THAILAND AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 171 THAILAND AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 172 THAILAND PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 173 THAILAND PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 174 THAILAND PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 175 THAILAND PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 176 THAILAND PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (USD THOUSAND)

TABLE 177 THAILAND PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (TONS)

TABLE 178 THAILAND PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (USD THOUSAND)

TABLE 179 THAILAND PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (TONS)

TABLE 180 THAILAND PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (USD THOUSAND)

TABLE 181 THAILAND PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (TONS)

TABLE 182 THAILAND PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (USD THOUSAND)

TABLE 183 THAILAND PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (TONS)

TABLE 184 MALAYSIA PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (USD THOUSAND)

TABLE 185 MALAYSIA PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (TONS)

TABLE 186 MALAYSIA PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 187 MALAYSIA PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 188 MALAYSIA AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 189 MALAYSIA AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 190 MALAYSIA PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 191 MALAYSIA PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 192 MALAYSIA PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 193 MALAYSIA PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 194 MALAYSIA PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (USD THOUSAND)

TABLE 195 MALAYSIA PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (TONS)

TABLE 196 MALAYSIA PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (USD THOUSAND)

TABLE 197 MALAYSIA PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (TONS)

TABLE 198 MALAYSIA PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (USD THOUSAND)

TABLE 199 MALAYSIA PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (TONS)

TABLE 200 MALAYSIA PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (USD THOUSAND)

TABLE 201 MALAYSIA PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (TONS)

TABLE 202 NEW ZEALAND PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (USD THOUSAND)

TABLE 203 NEW ZEALAND PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (TONS)

TABLE 204 NEW ZEALAND PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 205 NEW ZEALAND PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 206 NEW ZEALAND AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 207 NEW ZEALAND AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 208 NEW ZEALAND PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 209 NEW ZEALAND PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 210 NEW ZEALAND PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 211 NEW ZEALAND PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 212 NEW ZEALAND PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (USD THOUSAND)

TABLE 213 NEW ZEALAND PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (TONS)

TABLE 214 NEW ZEALAND PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (USD THOUSAND)

TABLE 215 NEW ZEALAND PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (TONS)

TABLE 216 NEW ZEALAND PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (USD THOUSAND)

TABLE 217 NEW ZEALAND PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (TONS)

TABLE 218 NEW ZEALAND PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (USD THOUSAND)

TABLE 219 NEW ZEALAND PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (TONS)

TABLE 220 HONG KONG PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (USD THOUSAND)

TABLE 221 HONG KONG PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (TONS)

TABLE 222 HONG KONG PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 223 HONG KONG PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 224 HONG KONG AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 225 HONG KONG AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 226 HONG KONG PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 227 HONG KONG PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 228 HONG KONG PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 229 HONG KONG PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 230 HONG KONG PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (USD THOUSAND)

TABLE 231 HONG KONG PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (TONS)

TABLE 232 HONG KONG PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (USD THOUSAND)

TABLE 233 HONG KONG PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (TONS)

TABLE 234 HONG KONG PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (USD THOUSAND)

TABLE 235 HONG KONG PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (TONS)

TABLE 236 HONG KONG PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (USD THOUSAND)

TABLE 237 HONG KONG PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (TONS)

TABLE 238 TAIWAN PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (USD THOUSAND)

TABLE 239 TAIWAN PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (TONS)

TABLE 240 TAIWAN PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 241 TAIWAN PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 242 TAIWAN AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 243 TAIWAN AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 244 TAIWAN PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 245 TAIWAN PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 246 TAIWAN PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 247 TAIWAN PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 248 TAIWAN PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (USD THOUSAND)

TABLE 249 TAIWAN PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (TONS)

TABLE 250 TAIWAN PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (USD THOUSAND)

TABLE 251 TAIWAN PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (TONS)

TABLE 252 TAIWAN PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (USD THOUSAND)

TABLE 253 TAIWAN PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (TONS)

TABLE 254 TAIWAN PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (USD THOUSAND)

TABLE 255 TAIWAN PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (TONS)

TABLE 256 REST OF ASIA-PACIFIC PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (USD THOUSAND)

TABLE 257 REST OF ASIA-PACIFIC PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (TONS)

List of Figure

FIGURE 1 ASIA PACIFIC PHOSPHORUS AND DERIVATIVES MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC PHOSPHORUS AND DERIVATIVES MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC PHOSPHORUS AND DERIVATIVES MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC PHOSPHORUS AND DERIVATIVES MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC PHOSPHORUS AND DERIVATIVES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC PHOSPHORUS AND DERIVATIVES MARKET: PRODUCT LIFELINE CURVE

FIGURE 7 ASIA PACIFIC PHOSPHORUS AND DERIVATIVES MARKET: MULTIVARIATE MODELLING

FIGURE 8 ASIA PACIFIC PHOSPHORUS AND DERIVATIVES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 ASIA PACIFIC PHOSPHORUS AND DERIVATIVES MARKET: DBMR MARKET POSITION GRID

FIGURE 10 ASIA PACIFIC PHOSPHORUS AND DERIVATIVES MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 ASIA PACIFIC PHOSPHORUS AND DERIVATIVES MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 12 ASIA PACIFIC PHOSPHORUS AND DERIVATIVES: THE MARKET CHALLENGE MATRIX

FIGURE 13 ASIA PACIFIC PHOSPHORUS AND DERIVATIVES MARKET: SEGMENTATION

FIGURE 14 RISING APPLICATIONS OF PHOSPHORUS AND DERIVATIVES IN SEVERAL INDUSTRIES ARE DRIVING THE GROWTH OF THE ASIA PACIFIC PHOSPHORUS AND DERIVATIVES MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 15 THE PHOSPHORIC ACID SEGMENT IN THE PRODUCT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC PHOSPHORUS AND DERIVATIVES MARKET IN 2023 & 2030

FIGURE 16 PRODUCTION PROCESS OF PHOSPHORUS AND ITS DERIVATIVES

FIGURE 17 UNITED STATES CONSUMPTION OF PHOSPHATE ROCK (2019 – 2022)

FIGURE 18 IMPORT EXPORT SCENARIO OF PHOSPHORUS

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC PHOSPHORUS AND DERIVATIVES MARKET

FIGURE 20 FERTILIZER CONSUMPTION IN EUROPEAN COUNTRIES (2019) (KILOGRAMS PER HECTARE OF LAND)

FIGURE 21 ASIA PACIFIC PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2022

FIGURE 22 ASIA PACIFIC PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2022

FIGURE 23 ASIA PACIFIC PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2022

FIGURE 24 ASIA PACIFIC PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2022

FIGURE 25 ASIA PACIFIC PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2022

FIGURE 26 ASIA-PACIFIC PHOSPHORUS AND DERIVATIVES MARKET: SNAPSHOT (2022)

FIGURE 27 ASIA-PACIFIC PHOSPHORUS AND DERIVATIVES MARKET: BY COUNTRY (2022)

FIGURE 28 ASIA-PACIFIC PHOSPHORUS AND DERIVATIVES MARKET: BY COUNTRY (2023 & 2030)

FIGURE 29 ASIA-PACIFIC PHOSPHORUS AND DERIVATIVES MARKET: BY COUNTRY (2022 & 2030)

FIGURE 30 ASIA-PACIFIC PHOSPHORUS AND DERIVATIVES MARKET: BY PRODUCT (2022 - 2030)

FIGURE 31 ASIA PACIFIC PHOSPHORUS AND DERIVATIVES MARKET: COMPANY SHARE 2022 (%)

Asia Pacific Phosphorus And Derivatives Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Asia Pacific Phosphorus And Derivatives Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Asia Pacific Phosphorus And Derivatives Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.