Asia-Pacific Passive Fire Protection Coatings Market Analysis and Size

PFP systems are designed to "prevent" the spread of fire and smoke, or heating of structural members, for an intended limited period as determined by the local building code and fire codes. Passive fire protection measures such as firestops, fire walls, and fire doors, are tested to determine the fire-resistance rating of the final assembly, which is usually expressed in terms of hours of fire resistance (e.g., ?, ¾, 1, 1½, 2, 3, 4 hour).

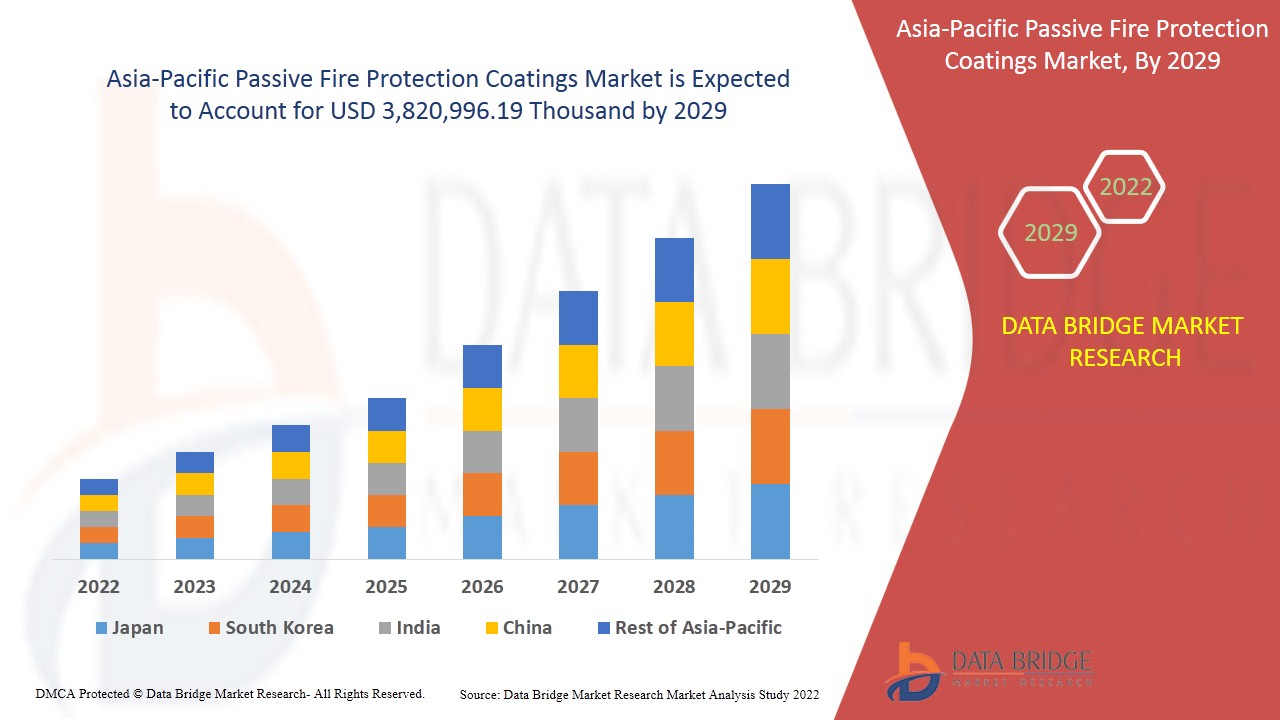

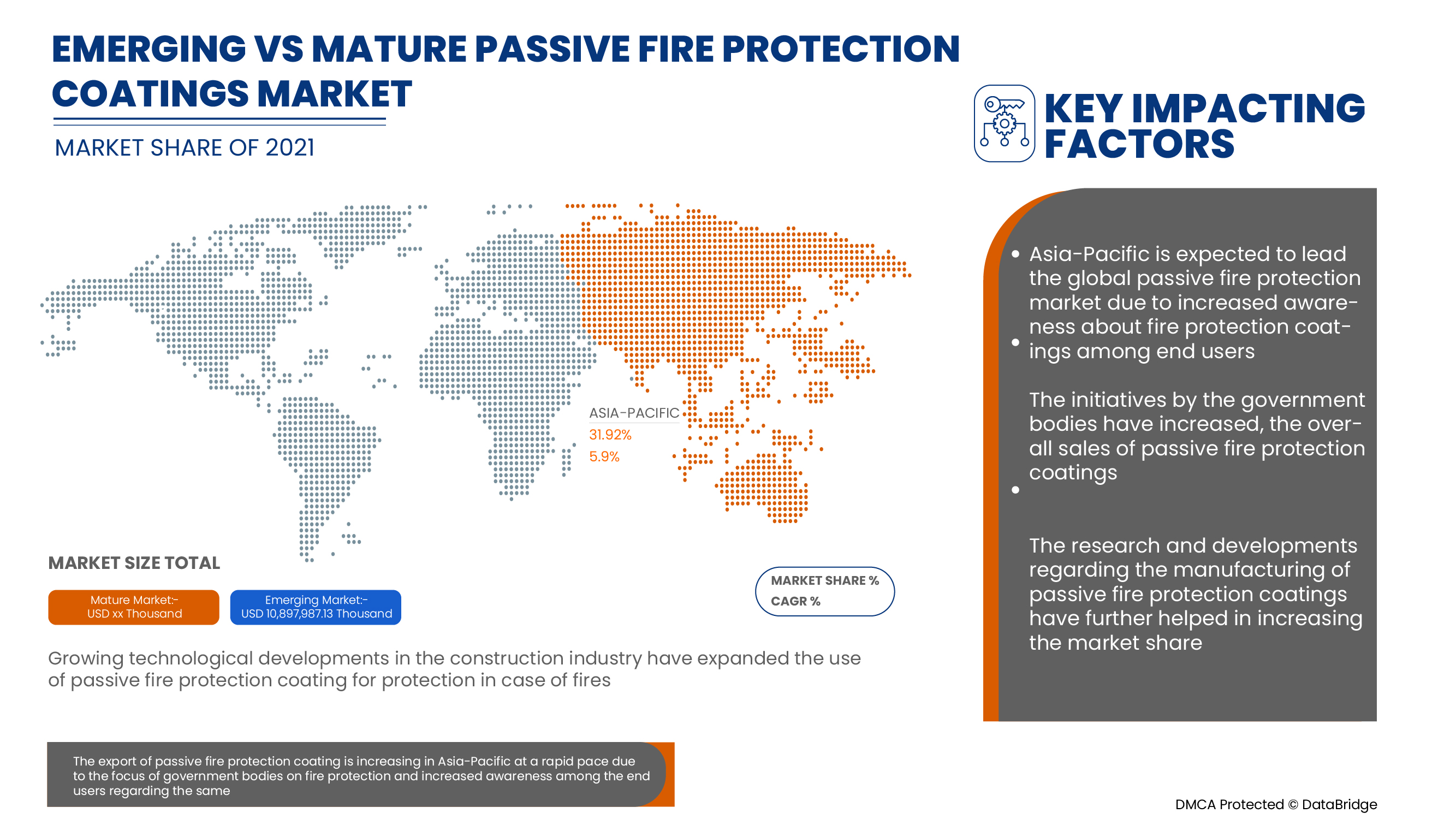

Increasing demand for passive fire protection coatings by the construction industry and the growing demand for passive fire protection coatings in various industries are some of the drivers boosting sulfuric acid demand in the market. Data Bridge Market Research analyses that the passive fire protection coatings market is expected to reach the value of USD 3,820,996.19 thousand by the year 2029, at a CAGR of 5.9% during the forecast period. Intumescent coatings accounts for the most prominent application segment in the respective market owing to rise in the demand from the construction industry. The market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and climate chain scenario.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Thousand, Volumes in Thousand kg, Pricing in USD |

|

Segments Covered |

By Product Type (Cementitious Material, Intumescent Coating, Fireproofing Cladding, Others), Technology (Water-Based Protection Coating, Solvent-Based Protection Coating), Application (Oil & Gas, Construction, Aerospace, Electrical And Electronics, Automotive, Textile, Furniture, Warehousing, Others), End User (Building & Construction, Oil & Gas, Transportation, Others) |

|

Countries Covered |

Japan, China, South Korea, India, Singapore, Thailand, Indonesia, Malaysia, Philippines, Australia & New Zealand and Rest of Asia-Pacific in Asia -Pacific. |

|

Market Players Covered |

3M, Hempel A/S, The Sherwin-Williams Company, Hilti Group, AkzoNobel N.V, PPG, Kansai Paint Co.,Ltd, Jotun, Etex Group, GCP Applied Technologies Inc, Sharpfibre Limited, svt Holding GmbH, Rudolf Hensel Gmbh, Isolatek International Corporation, Contego International Inc., Isolatek International, envirograf passive fire products, no-burn inc., TEKNOS GROUP, CARBOLINE, Vijay Systems Engineers Pvt Ltd. among others. |

Market Definition

Passive fire protection (PFP) are components of a building or structure that slows or impedes the fire or smoke without system activation, and usually without movement. The instances of passive systems include floor-ceilings and roofs, fire doors, windows, and wall assemblies, fire-resistant coatings, and other fire and smoke control assemblies. Passive fire protection systems can include active components such as fire dampers. The Asia-Pacific is the largest consumer of passive fire protection coatings due to the increased awareness about the same in the region.

COVID-19 had a Minimal Impact on Passive Fire Protection Coatings Market

COVID-19 has impacted various manufacturing industries due to the halt in production operations in various industries throughout the globe, the demand for passive fire protection coating has gone down tremendously. Also, with the continuously dropping requirements of automotive petroleum refining and many other industries, the manufacturers’ margins are declining, which they earn from the supply of sulfuric acid. However, the governments are taking steps to relax tax, fiscal deficit, and others to minimize the impact.

The Market Dynamics of the Passive Fire Protection Coatings Market Include:

- Growing Construction Industry

Growing construction industry in the Asia Pacific region has eventually helped in increasing the overall demand of passive fire protection coating in the market.

- Escalating Application Scope of Passive Fire Protection Coatings in Various Industries

Passive fire protection system limits the fire propagation for a certain period of time. Passive fire protection is a term that includes a wide range of items and practices. In the most shortsighted sense, Passive fire protection alludes to materials incorporated with the structures that encompass us which are expected to slow or forestall the spread of fire.

- Rising Demand of Water Based Fire Protection Coatings

Water based items are accessible with the exceptional properties to individual products. Along with this, water based items will in general get marked as one nonexclusive gathering, various definitions exist. Every item should, along these lines, be considered independently as far as its specialized capacity. Many have come to fruition through broad obliviousness and deception, once in a while advanced by the makers of dissolvable based items.

- Imposition of Favourable Government Guidelines and Fire Safety Standards

Construction laws would now be able to offer improved insurance against the dangers of cataclysmic events and psychological oppression to make our networks stronger, reasonable and bearable for a long time into the future, which brings down the cost of alleviation for building proprietors. Model codes give direction on the best way to configuration, manufacture and work structures to accomplish these objectives.

Restraints/Challenges Faced by the Fire Protection Coatings Market

- Availability of Cheaper Alternatives

Fire protective coatings are comparatively costlier than other fire extinguisher products as these coatings are applied or sprayed which requires human resources as well as time thus making the coatings costlier. Consumers tend to use alternative materials such as heat resistant foams and other materials to cut down the cost which will be incurred for coating the whole area.

- Volatility in the Raw Material Costs

The raw materials which is generally are chemicals are in huge demand thus making it difficult for the manufacturers to procure as well as maintain the availability of the raw materials. The preparing of fire protection materials is the complex process as the greater part of the buyer request the slight differentiation depending on the structure it is used on for ideal outcomes market in the forecast period of 2022-2029.

Recent Developments

- In March 2021, Dyneon LLC, a 3M company, announced the acquisition of the business of Hitech Polymers Inc., a manufacturer of specialty thermoplastic polymers and provider of toll thermoplastic compounding services based in Hebron. The addition of Hitech Polymers increases Dyneon’s ability to bring new solutions to existing customer’s faster

- In July 2020, The Sherwin-Williams Company has introduced a revolutionary practical onshore passive fire safety coating. Firetex M90/03 complies with UL 1709 fire protection certification specifications. The launch of a new product has opened new business opportunities for the company.

Asia-Pacific Passive Fire Protection Coatings Market Scope

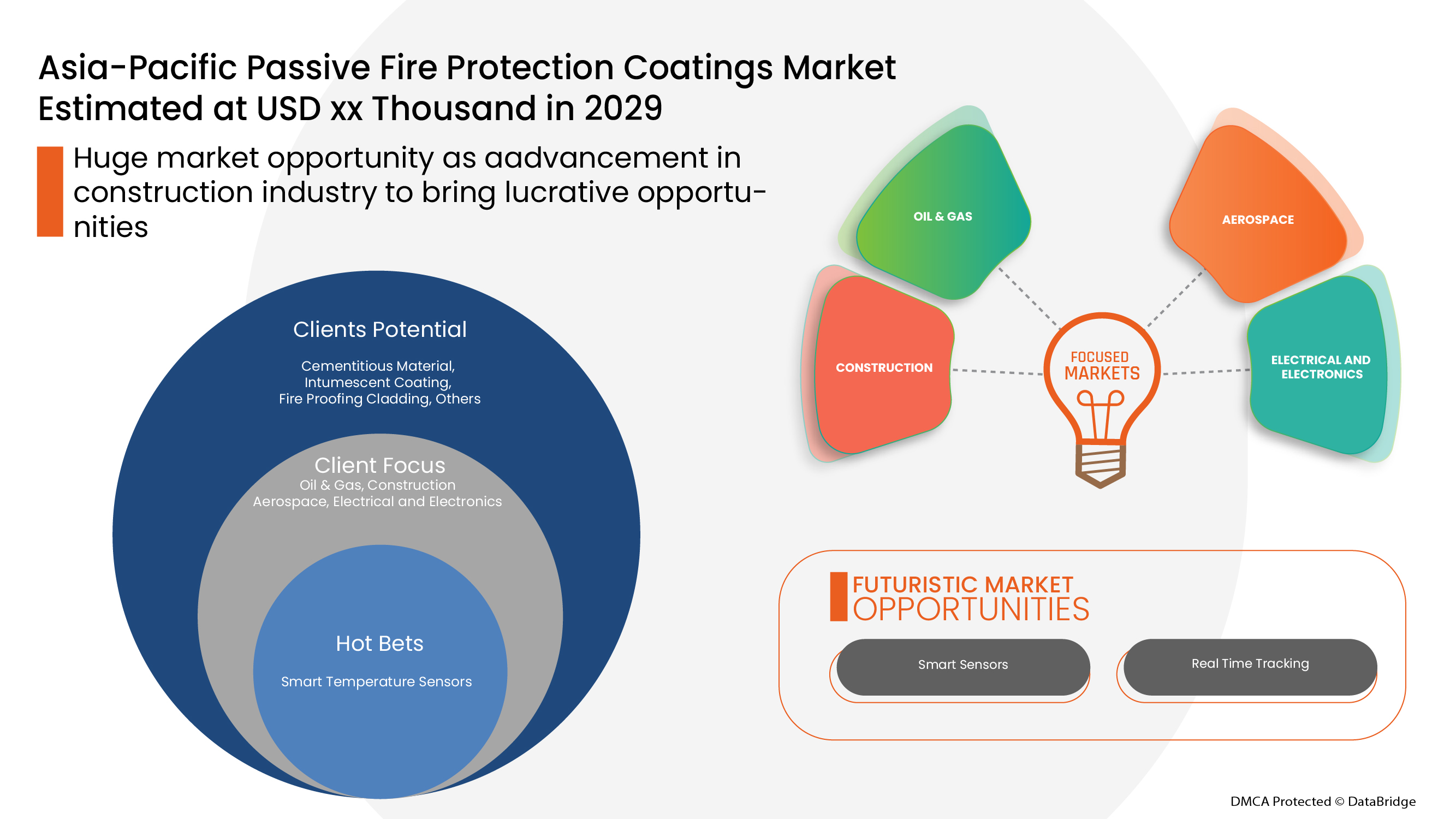

Asia-Pacific passive fire protection coatings market is segmented into four notable segments, based on product type, technology, application and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product Type

- Cementitious Material

- Intumescent Coating

- Fireproofing Cladding

- Others

On the basis of product type, the Asia-Pacific passive fire protection coatings market is segmented into cementitious material, intumescent coating, fireproofing cladding, and others. The intumescent coating segment is expected to dominate the Asia-Pacific region, intumescent coating is expected to dominate the market due to wider consumer preference in construction and building industries

Technology

- Water-Based Protection Coating

- Solvent-Based Protection Coating

On the basis of technology, the Asia-Pacific passive fire protection coatings market is segmented into water-based protection coating and solvent-based protection coating.

Application

- Oil & Gas

- Construction

- Aerospace

- Electrical and Electronics

- Automotive

- Textile

- Furniture

- Warehousing

- Others

On the basis of application the Asia-Pacific passive fire protection coatings market is segmented into oil & gas, construction, aerospace, electrical and electronics, automotive, textile, furniture, warehousing and others. In Asia-Pacific, automotive is projected to dominate the market as it reduces potentially vulnerable people that may be at risk on the premises.

End User

- Building & Construction

- Oil & Gas

- Transportation

- Others

On the basis of end user, the Asia-Pacific passive fire protection coatings market is segmented into building and construction, oil and gas, transportation and others. In Asia-Pacific, building and construction segment is expected to dominate the market because largest construction projects were initiated in the regions.

Passive Fire Protection Coatings Market Regional Analysis/Insights

The passive fire protection coatings market is analyzed and market size insights and trends are provided by country, product type, technology, application and end user as referenced above.

The countries covered in the sulfuric acid market report are the Japan, China, South Korea, India, Singapore, Thailand, Indonesia, Malaysia, Philippines, Australia & New Zealand and Rest of Asia-Pacific.

China is expected to dominate the Asia-Pacific passive fire protection coatings market due to high demand from the construction and building industry. Asia-Pacific is expected to witness significant growth during the forecast period of 2022 to 2029 due to growing demand for batteries in the automotive industry in the region.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Passive Fire Protection Coatings Share Analysis

The passive fire protection coatings market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to sulfuric acid market.

Some of the major players operating in the Asia-Pacific passive fire protection coatings market are 3M, Hempel A/S, The Sherwin-Williams Company, Hilti Group, AkzoNobel N.V, PPG, Kansai Paint Co.,Ltd, Jotun, Etex Group, GCP Applied Technologies Inc, Sharpfibre Limited, svt Holding GmbH, Rudolf Hensel Gmbh, Isolatek International Corporation, Contego International Inc., Isolatek International, envirograf passive fire products, no-burn inc., TEKNOS GROUP, CARBOLINE, Vijay Systems Engineers Pvt Ltd. among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC PASSIVE FIRE PROTECTION COATING MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PRODUCTION PROCESS

4.1.1 INTRODUCTION

4.1.2 FUNCTION

4.1.3 KEYS ELEMENTS

4.1.4 PROCESS

4.2 POTENTIAL COLLABORATION OPPORTUNITIES

4.3 COMPARATIVE ANALYSIS WITH POTENTIAL SUBSTITUTES

4.4 REGIONAL SUMMARY

4.4.1 ASIA PACIFIC

4.4.2 ASIA-PACIFIC

4.4.3 EUROPE

4.4.4 NORTH AMERICA

4.4.5 MIDDLE-EAST & AFRICA

4.4.6 SOUTH AMERICA

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING CONSTRUCTION INDUSTRY

5.1.2 ESCALATING APPLICATION SCOPE OF PASSIVE FIRE PROTECTION COATING IN VARIOUS INDUSTRIES

5.1.3 RISING DEMAND FOR WATER-BASED FIRE PROTECTION COATINGS

5.1.4 IMPOSITION OF FAVORABLE GOVERNMENT GUIDELINES AND FIRE SAFETY STANDARDS

5.2 RESTRAINTS

5.2.1 AVAILABILITY OF CHEAPER ALTERNATIVES

5.2.2 VOLATILITY IN THE RAW MATERIAL COSTS

5.3 OPPORTUNITIES

5.3.1 INCREASING INDIVIDUALS DISPOSABLE INCOME

5.3.2 RISING OIL AND GAS EXPLORATION ACTIVITIES

5.3.3 ADVANCEMENT IN THE CONSTRUCTION INDUSTRY TO BRING LUCRATIVE OPPORTUNITIES

5.3.4 RISING USAGES OF FIRE PROTECTION COATINGS IN RENOVATION PROJECTS

5.4 CHALLENGES

5.4.1 LACK OF AWARENESS AMONG POTENTIAL END-USERS

5.4.2 HIGH INSTALLATION AND MAINTENANCE COST

6 ASIA PACIFIC PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE

6.1 OVERVIEW

6.2 INTUMESCENT COATING

6.2.1 CELLULOSIC FIRE PROTECTION

6.2.2 HYDROCARBON FIRE PROTECTION

6.3 CEMENTITIOUS MATERIAL

6.3.1 HYDRAULIC CEMENT

6.3.2 SUPPLEMENTARY CEMENTITIOUS MATERIALS (SCMS)

6.4 FIREPROOFING CLADDING

6.5 OTHERS

7 ASIA PACIFIC PASSIVE FIRE PROTECTION COATING MARKET, BY TECHNOLOGY

7.1 OVERVIEW

7.2 WATER-BASED PROTECTION COATING

7.3 SOLVENT-BASED PROTECTION COATING

8 ASIA PACIFIC PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 AUTOMOTIVE

8.3 OIL & GAS

8.4 CONSTRUCTION

8.4.1 HOSPITALS

8.4.2 SKYSCRAPERS

8.4.3 COLLEGES

8.4.4 RESTAURANTS

8.4.5 RESIDENTIAL BUILDINGS

8.4.6 COMMERCIAL BUILDINGS

8.4.7 OFFICES

8.4.8 OTHERS

8.5 AEROSPACE

8.6 ELECTRICAL AND ELECTRONICS

8.7 TEXTILE

8.8 FURNITURE

8.9 WAREHOUSING

8.1 OTHERS

9 ASIA PACIFIC PASSIVE FIRE PROTECTION COATING MARKET, END USER

9.1 OVERVIEW

9.2 BUILDING & CONSTRUCTION

9.2.1 INTUMESCENT COATING

9.2.2 CEMENTITIOUS MATERIAL

9.2.3 FIREPROOFING CLADDING

9.2.4 OTHERS

9.3 OIL & GAS

9.3.1 INTUMESCENT COATING

9.3.2 CEMENTITIOUS MATERIAL

9.3.3 FIREPROOFING CLADDING

9.3.4 OTHERS

9.4 TRANSPORTATION

9.4.1 INTUMESCENT COATING

9.4.2 CEMENTITIOUS MATERIAL

9.4.3 FIREPROOFING CLADDING

9.4.4 OTHERS

9.5 OTHERS

9.5.1 INTUMESCENT COATING

9.5.2 CEMENTITIOUS MATERIAL

9.5.3 FIREPROOFING CLADDING

9.5.4 OTHERS

10 ASIA PACIFIC PASSIVE FIRE PROTECTION COATING MARKET, BY REGION

10.1 ASIA-PACIFIC

10.1.1 CHINA

10.1.2 SOUTH KOREA

10.1.3 JAPAN

10.1.4 INDIA

10.1.5 SINGAPORE

10.1.6 THAILAND

10.1.7 INDONESIA

10.1.8 AUSTRALIA & NEW ZEALAND

10.1.9 PHILIPPINES

10.1.10 NETHERLANDS

10.1.11 REST OF ASIA-PACIFIC

11 ASIA PACIFIC PASSIVE FIRE PROTECTION COATING MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

11.2 MERGER & ACQUISITION

11.3 RECENT UPDATE

11.4 PRODUCT LAUNCH

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 3M

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT UPDATE

13.2 GCP APPLIED TECHNOLOGIES INC.

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT UPDATE

13.3 AKZO NOBEL N.V.

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT UPDATE

13.4 THE SHERWIN-WILLIAMS COMPANY

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 COMPANY SHARE ANALYSIS

13.4.4 PRODUCT PORTFOLIO

13.4.5 RECENT UPDATE

13.5 HILTI

13.5.1 COMPANY SNAPSHOT

13.5.2 COMPANY SHARE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT UPDATE

13.6 ETEX GROUP

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT UPDATE

13.7 KANSAI PAINT CO.,LTD.

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 PRODUCT PORTFOLIO

13.7.4 RECENT UPDATE

13.8 JOTUN

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT UPDATE

13.9 CARBOLINE

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT UPDATE

13.1 CONTEGO INTERNATIONAL INC.

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT UPDATE

13.11 EASTMAN CHEMICAL COMPANY

13.11.1 COMPANY SNAPSHOT

13.11.2 REVENUE ANALYSIS

13.11.3 PRODUCT PORTFOLIO

13.11.4 RECENT UPDATE

13.12 ENVIROGRAF PASSIVE FIRE PRODUCTS

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT UPDATE

13.13 HEMPEL A/S

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT UPDATE

13.14 ISOLATEK INTERNATIONAL

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT UPDATE

13.15 NO BURN, INC

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT UPDATE

13.16 PPG INDUSTRIES, INC.

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENUE ANALYSIS

13.16.3 PRODUCT PORTFOLIO

13.16.4 RECENT UPDATE

13.17 RUDOLF HENSEL GMBH

13.17.1 COMPANY SNAPSHOT

13.17.2 PRODUCT PORTFOLIO

13.17.3 RECENT UPDATE

13.18 SHARPFIBRE LIMITED

13.18.1 COMPANY SNAPSHOT

13.18.2 PRODUCT PORTFOLIO

13.18.3 RECENT UPDATE

13.19 SVT GROUP OF COMPANIES

13.19.1 COMPANY SNAPSHOT

13.19.2 PRODUCT PORTFOLIO

13.19.3 RECENT UPDATE

13.2 TEKNOS GROUP

13.20.1 COMPANY SNAPSHOT

13.20.2 PRODUCT PORTFOLIO

13.20.3 RECENT UPDATE

13.21 VIJAY SYSTEMS ENGINEERS PVT LTD

13.21.1 COMPANY SNAPSHOT

13.21.2 PRODUCT PORTFOLIO

13.21.3 RECENT UPDATE

14 QUESTIONNAIRE

15 RELATED REPORT

List of Table

TABLE 1 IMPORT DATA OF PRODUCT: 842410 FIRE EXTINGUISHERS WHEATHER OR NOT CHANGE… (USD THOUSAND)

TABLE 2 EXPORT DATA OF PRODUCT: 842410 FIRE EXTINGUISHERS WHEATHER OR NOT CHANGE… (USD THOUSAND)

TABLE 3 POTENTIAL COLLABORATION OPPORTUNITIES

TABLE 4 POTENTIAL SUBSTITUTES

TABLE 5 ASIA PACIFIC PASSIVE FIRE PROTECTION COATING MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 6 ASIA PACIFIC PASSIVE FIRE PROTECTION COATING MARKET, BY PRODUCT TYPE, 2020-2029 (THOUSAND KG)

TABLE 7 ASIA PACIFIC INTUMESCENT COATING IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 8 ASIA PACIFIC INTUMESCENT COATING IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (THOUSAND KG)

TABLE 9 ASIA PACIFIC INTUMESCENT COATING IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 10 ASIA PACIFIC CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 11 ASIA PACIFIC CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (THOUSAND KG)

TABLE 12 ASIA PACIFIC CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 13 ASIA PACIFIC FIREPROOFING CLADDING IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 14 ASIA PACIFIC FIREPROOFING CLADDING IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (THOUSAND KG)

TABLE 15 ASIA PACIFIC OTHERS IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 16 ASIA PACIFIC OTHERS IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (THOUSAND KG)

TABLE 17 ASIA PACIFIC PASSIVE FIRE PROTECTION COATING MARKET, BY TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 18 ASIA PACIFIC WATER-BASED PROTECTION COATING IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 19 ASIA PACIFIC SOLVENT-BASED PROTECTION COATING IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 20 ASIA PACIFIC PASSIVE FIRE PROTECTION COATING MARKET, APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 21 ASIA PACIFIC AUTOMOTIVE IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 22 ASIA PACIFIC OIL & GAS IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 23 ASIA PACIFIC CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 24 ASIA PACIFIC CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 25 ASIA PACIFIC AEROSPACE IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 26 ASIA PACIFIC ELECTRICAL AND ELECTRONICS IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 27 ASIA PACIFIC TEXTILE IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 28 ASIA PACIFIC FURNITURE IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 29 ASIA PACIFIC WAREHOUSING IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 30 ASIA PACIFIC OTHERS IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 31 ASIA PACIFIC PASSIVE FIRE PROTECTION COATING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 32 ASIA PACIFIC BUILDING & CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 33 ASIA PACIFIC BUILDING & CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 34 ASIA PACIFIC OIL & GAS IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 35 ASIA PACIFIC OIL & GAS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 36 ASIA PACIFIC TRANSPORTATION IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 37 ASIA PACIFIC TRANSPORTATION IN PASSIVE FIRE PROTECTION COATING MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 38 ASIA PACIFIC OTHERS IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 39 ASIA PACIFIC OTHERS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 40 ASIA-PACIFIC PASSIVE FIRE PROTECTION COATING MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 41 ASIA-PACIFIC PASSIVE FIRE PROTECTION COATING MARKET, BY COUNTRY, 2020-2029 (THOUSAND KG)

TABLE 42 ASIA-PACIFIC PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 43 ASIA-PACIFIC PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (THOUSAND KG)

TABLE 44 ASIA-PACIFIC INTUMESCENT COATING IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 45 ASIA-PACIFIC CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 46 ASIA-PACIFIC PASSIVE FIRE PROTECTION COATING MARKET, BY TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 47 ASIA-PACIFIC PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 48 ASIA-PACIFIC CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 49 ASIA-PACIFIC PASSIVE FIRE PROTECTION COATING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 50 ASIA-PACIFIC BUILDING & CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 51 ASIA-PACIFIC OIL & GAS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 52 ASIA-PACIFIC TRANSPORTATION IN PASSIVE FIRE PROTECTION COATING MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 53 ASIA-PACIFIC OTHERS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 54 CHINA PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 55 CHINA PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (THOUSAND KG)

TABLE 56 CHINA INTUMESCENT COATING IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 57 CHINA CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 58 CHINA PASSIVE FIRE PROTECTION COATING MARKET, BY TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 59 CHINA PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 60 CHINA CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 61 CHINA PASSIVE FIRE PROTECTION COATING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 62 CHINA BUILDING & CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 63 CHINA OIL & GAS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 64 CHINA TRANSPORTATION IN PASSIVE FIRE PROTECTION COATING MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 65 CHINA OTHERS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 66 SOUTH KOREA PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 67 SOUTH KOREA PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (THOUSAND KG)

TABLE 68 SOUTH KOREA INTUMESCENT COATING IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 69 SOUTH KOREA CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 70 SOUTH KOREA PASSIVE FIRE PROTECTION COATING MARKET, BY TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 71 SOUTH KOREA PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 72 SOUTH KOREA CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 73 SOUTH KOREA PASSIVE FIRE PROTECTION COATING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 74 SOUTH KOREA BUILDING & CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 75 SOUTH KOREA OIL & GAS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 76 SOUTH KOREA TRANSPORTATION IN PASSIVE FIRE PROTECTION COATING MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 77 SOUTH KOREA OTHERS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 78 JAPAN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 79 JAPAN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (THOUSAND KG)

TABLE 80 JAPAN INTUMESCENT COATING IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 81 JAPAN CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 82 JAPAN PASSIVE FIRE PROTECTION COATING MARKET, BY TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 83 JAPAN PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 84 JAPAN CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 85 JAPAN PASSIVE FIRE PROTECTION COATING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 86 JAPAN BUILDING & CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 87 JAPAN OIL & GAS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 88 JAPAN TRANSPORTATION IN PASSIVE FIRE PROTECTION COATING MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 89 JAPAN OTHERS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 90 INDIA PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 91 INDIA PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (THOUSAND KG)

TABLE 92 INDIA INTUMESCENT COATING IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 93 INDIA CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 94 INDIA PASSIVE FIRE PROTECTION COATING MARKET, BY TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 95 INDIA PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 96 INDIA CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 97 INDIA PASSIVE FIRE PROTECTION COATING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 98 INDIA BUILDING & CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 99 INDIA OIL & GAS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 100 INDIA TRANSPORTATION IN PASSIVE FIRE PROTECTION COATING MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 101 INDIA OTHERS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 102 SINGAPORE PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 103 SINGAPORE PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (THOUSAND KG)

TABLE 104 SINGAPORE INTUMESCENT COATING IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 105 SINGAPORE CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 106 SINGAPORE PASSIVE FIRE PROTECTION COATING MARKET, BY TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 107 SINGAPORE PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 108 SINGAPORE CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 109 SINGAPORE PASSIVE FIRE PROTECTION COATING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 110 SINGAPORE BUILDING & CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 111 SINGAPORE OIL & GAS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 112 SINGAPORE TRANSPORTATION IN PASSIVE FIRE PROTECTION COATING MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 113 SINGAPORE OTHERS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 114 THAILAND PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 115 THAILAND PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (THOUSAND KG)

TABLE 116 THAILAND INTUMESCENT COATING IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 117 THAILAND CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 118 THAILAND PASSIVE FIRE PROTECTION COATING MARKET, BY TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 119 THAILAND PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 120 THAILAND CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 121 THAILAND PASSIVE FIRE PROTECTION COATING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 122 THAILAND BUILDING & CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 123 THAILAND OIL & GAS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 124 THAILAND TRANSPORTATION IN PASSIVE FIRE PROTECTION COATING MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 125 THAILAND OTHERS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 126 INDONESIA PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 127 INDONESIA PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (THOUSAND KG)

TABLE 128 INDONESIA INTUMESCENT COATING IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 129 INDONESIA CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 130 INDONESIA PASSIVE FIRE PROTECTION COATING MARKET, BY TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 131 INDONESIA PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 132 INDONESIA CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 133 INDONESIA PASSIVE FIRE PROTECTION COATING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 134 INDONESIA BUILDING & CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 135 INDONESIA OIL & GAS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 136 INDONESIA TRANSPORTATION IN PASSIVE FIRE PROTECTION COATING MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 137 INDONESIA OTHERS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 138 AUSTRALIA & NEW ZEALAND PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 139 AUSTRALIA & NEW ZEALAND PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (THOUSAND KG)

TABLE 140 AUSTRALIA & NEW ZEALAND INTUMESCENT COATING IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 141 AUSTRALIA & NEW ZEALAND CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 142 AUSTRALIA & NEW ZEALAND PASSIVE FIRE PROTECTION COATING MARKET, BY TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 143 AUSTRALIA & NEW ZEALAND PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 144 AUSTRALIA & NEW ZEALAND CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 145 AUSTRALIA & NEW ZEALAND PASSIVE FIRE PROTECTION COATING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 146 AUSTRALIA & NEW ZEALAND BUILDING & CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 147 AUSTRALIA & NEW ZEALAND OIL & GAS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 148 AUSTRALIA & NEW ZEALAND TRANSPORTATION IN PASSIVE FIRE PROTECTION COATING MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 149 AUSTRALIA & NEW ZEALAND OTHERS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 150 PHILIPPINES PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 151 PHILIPPINES PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (THOUSAND KG)

TABLE 152 PHILIPPINES INTUMESCENT COATING IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 153 PHILIPPINES CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 154 PHILIPPINES PASSIVE FIRE PROTECTION COATING MARKET, BY TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 155 PHILIPPINES PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 156 PHILIPPINES CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 157 PHILIPPINES PASSIVE FIRE PROTECTION COATING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 158 PHILIPPINES BUILDING & CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 159 PHILIPPINES OIL & GAS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 160 PHILIPPINES TRANSPORTATION IN PASSIVE FIRE PROTECTION COATING MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 161 PHILIPPINES OTHERS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 162 MALAYSIA PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 163 MALAYSIA PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (THOUSAND KG)

TABLE 164 MALAYSIA INTUMESCENT COATING IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 165 MALAYSIA CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 166 MALAYSIA PASSIVE FIRE PROTECTION COATING MARKET, BY TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 167 MALAYSIA PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 168 MALAYSIA CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 169 MALAYSIA PASSIVE FIRE PROTECTION COATING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 170 MALAYSIA BUILDING & CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 171 MALAYSIA OIL & GAS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 172 MALAYSIA TRANSPORTATION IN PASSIVE FIRE PROTECTION COATING MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 173 MALAYSIA OTHERS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 174 REST OF ASIA-PACIFIC PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 175 REST OF ASIA-PACIFIC PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (THOUSAND KG)

List of Figure

FIGURE 1 ASIA PACIFIC PASSIVE FIRE PROTECTION COATING MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC PASSIVE FIRE PROTECTION COATING MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC PASSIVE FIRE PROTECTION COATING MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC PASSIVE FIRE PROTECTION COATING MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC PASSIVE FIRE PROTECTION COATING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC PASSIVE FIRE PROTECTION COATING MARKET: PRODUCT LIFE LINE CURVE

FIGURE 7 ASIA PACIFIC PASSIVE FIRE PROTECTION COATING MARKET: MULTIVARIATE MODELLING

FIGURE 8 ASIA PACIFIC PASSIVE FIRE PROTECTION COATING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 ASIA PACIFIC PASSIVE FIRE PROTECTION COATING MARKET: DBMR MARKET POSITION GRID

FIGURE 10 ASIA PACIFIC PASSIVE FIRE PROTECTION COATING MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 ASIA PACIFIC PASSIVE FIRE PROTECTION COATING MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 ASIA PACIFIC PASSIVE FIRE PROTECTION COATING MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 ASIA PACIFIC PASSIVE FIRE PROTECTION COATING MARKET: SEGMENTATION

FIGURE 14 ASIA-PACIFIC IS EXPECTED TO DOMINATE THE ASIA PACIFIC PASSIVE FIRE PROTECTION COATING MARKET AND IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 GROWING CONSTRUCTION INDUSTRY IS DRIVING THE ASIA PACIFIC PASSIVE FIRE PROTECTION COATING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 16 INTUMESCENT COATING SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC PASSIVE FIRE PROTECTION COATING MARKET IN 2022 & 2029

FIGURE 17 DRIVERS, RESTRAINT, OPPORTUNITY, AND CHALLENGES OF ASIA PACIFIC PASSIVE FIRE PROTECTION COATING MARKET

FIGURE 18 ASIA PACIFIC PASSIVE FIRE PROTECTION COATING MARKET, BY PRODUCT TYPE, 2021

FIGURE 19 ASIA PACIFIC PASSIVE FIRE PROTECTION COATING MARKET, BY TECHNOLOGY, 2021

FIGURE 20 ASIA PACIFIC PASSIVE FIRE PROTECTION COATING MARKET, APPLICATION, 2021

FIGURE 21 ASIA PACIFIC PASSIVE FIRE PROTECTION COATING MARKET, END USER, 2021

FIGURE 22 ASIA-PACIFIC PASSIVE FIRE PROTECTION COATING MARKET : SNAPSHOT (2021)

FIGURE 23 ASIA-PACIFIC PASSIVE FIRE PROTECTION COATING MARKET: BY COUNTRY (2021)

FIGURE 24 ASIA-PACIFIC PASSIVE FIRE PROTECTION COATING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 25 ASIA-PACIFIC PASSIVE FIRE PROTECTION COATING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 26 ASIA-PACIFIC PASSIVE FIRE PROTECTION COATING MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 27 ASIA PACIFIC PASSIVE FIRE PROTECTION COATING MARKET: COMPANY SHARE 2021 (%)

Asia Pacific Passive Fire Protection Coating Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Asia Pacific Passive Fire Protection Coating Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Asia Pacific Passive Fire Protection Coating Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.