Asia Pacific Oil Refining Catalyst Market

Market Size in USD Billion

CAGR :

%

USD

3.37 Billion

USD

4.95 Billion

2024

2032

USD

3.37 Billion

USD

4.95 Billion

2024

2032

| 2025 –2032 | |

| USD 3.37 Billion | |

| USD 4.95 Billion | |

|

|

|

|

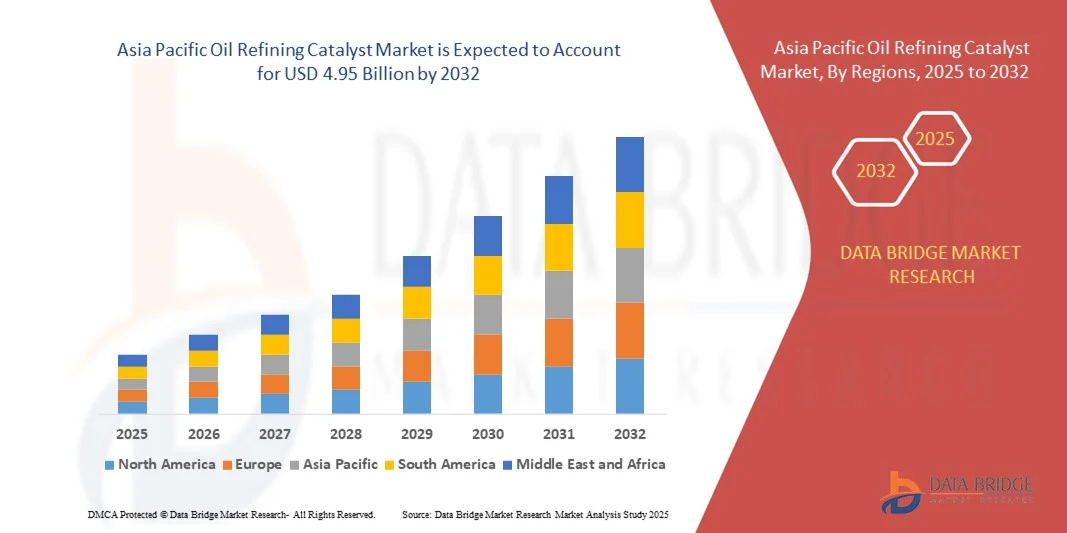

What is the Asia Pacific Oil Refining Catalyst Market Size and Growth Rate?

- The Asia Pacific oil refining catalyst market size was valued at USD 3.37 billion in 2024 and is expected to reach USD 4.95 billion by 2032, at a CAGR of4.9% during the forecast period

- The growth is primarily driven by rising urbanization, changing dietary habits, and growing health consciousness across emerging economies such as China, Japan, and India

- Increasing use of low-calorie sweeteners in food and beverages, along with expanding applications in pharmaceuticals and personal care, is further propelling market demand.

What are the Major Takeaways of Oil Refining Catalyst Market?

- Rising demand for sugar-free products, increasing prevalence of lifestyle diseases such as diabetes and obesity, and expanding research and development efforts for advanced artificial sweeteners are key growth determinants of the market

- However, health concerns regarding artificial sweeteners, stringent regulatory standards, and availability of natural substitutes such as stevia are expected to pose challenges to market expansion during the forecast period

- China dominated the Asia-Pacific oil refining catalyst market in 2024, holding the largest revenue share of 46.3%, driven by strong domestic demand for beverages, food, and pharmaceutical packaging

- The India oil refining catalyst market is projected to grow at the fastest CAGR of 8.58%, fueled by rising consumption of beverages, food, and pharmaceutical products in urban and rural areas. Government incentives for manufacturing, recycling, and sustainable production are accelerating market adoption

- The Fluidized Catalytic Cracking (FCC) segment dominated the market in 2024, accounting for a market share of 42.6%, driven by its widespread use in converting heavy crude fractions into lighter, high-value products such as gasoline and olefins

Report Scope and Oil Refining Catalyst Market Segmentation

|

Attributes |

Oil Refining Catalyst Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Oil Refining Catalyst Market?

Shift Toward Sustainable and High-Performance Catalysts

- A key trend shaping the oil refining catalyst market is the transition toward sustainable, energy-efficient, and high-performance catalyst technologies aimed at improving refining efficiency while minimizing carbon emissions. This shift is largely driven by stringent environmental regulations and the global movement toward cleaner fuels

- Manufacturers are investing in next-generation catalysts with improved activity, selectivity, and regeneration capacity to reduce waste and optimize fuel yields

- In addition, bio-based and nanostructured catalysts are gaining prominence, offering enhanced stability and reduced reliance on non-renewable raw materials

- A notable instance is BASF SE (Germany), which launched its FortiForm catalyst platform in 2024, designed to increase refinery throughput and reduce CO₂ emissions

- This ongoing shift toward sustainability and operational efficiency is transforming the refining landscape, prompting companies to invest in R&D for catalysts that meet both economic and environmental goals

What are the Key Drivers of Oil Refining Catalyst Market?

- The rising demand for cleaner fuels, combined with stringent emission norms imposed by governments, serves as a major driver for the oil refining catalyst market. Catalysts are essential for producing low-sulfur fuels and enhancing overall refinery performance

- For instance, in February 2024, Exxon Mobil Corporation (U.S.) expanded its refining catalyst R&D facilities to accelerate the development of more efficient hydroprocessing catalysts

- The growing consumption of gasoline, diesel, and jet fuel in emerging economies such as India and China are further boosting demand

- Moreover, refineries are modernizing to align with International Maritime Organization (IMO) 2020 sulfur standards, which has driven significant catalyst upgrades globally

- These developments collectively foster technological innovation, refinery optimization, and sustainable fuel production, thereby propelling the global oil refining catalyst market forward

Which Factor is Challenging the Growth of the Oil Refining Catalyst Market?

- The high cost of catalyst development and regeneration remains a key challenge for market expansion. Complex manufacturing processes, fluctuating raw material prices, and the need for specialized handling of rare metals such as platinum and palladium contribute to high operational costs

- For instance, in 2024, volatility in metal prices significantly affected the profitability of Clariant (Switzerland) and other major catalyst producers

- In addition, stringent disposal regulations regarding spent catalysts increase operational challenges and waste management costs for refineries

- Companies such as Albemarle Corporation (U.S.) and Johnson Matthey (U.K.) are addressing these constraints by developing recyclable and reactivable catalyst solutions to reduce lifecycle costs

- However, achieving an optimal balance between catalyst performance, cost-efficiency, and environmental compliance continues to be a major barrier, requiring sustained investment and innovation in catalyst technology

How is the Oil Refining Catalyst Market Segmented?

The Oil Refining Catalyst market is segmented on the basis of type, catalyst, distribution channel, and application.

- By Type

On the basis of type, the oil refining catalyst market is segmented into Hydrotreating, Fluidized Catalytic Cracking (FCC), Residue Fluidized Catalytic Cracking (RFCC), Hydrocracking, and Others. The Fluidized Catalytic Cracking (FCC) segment dominated the market in 2024, accounting for a market share of 42.6%, driven by its widespread use in converting heavy crude fractions into lighter, high-value products such as gasoline and olefins. FCC catalysts enhance refinery flexibility and fuel yield while reducing operational costs, making them indispensable for large-scale refineries.

The Hydrocracking segment is expected to register the fastest CAGR from 2025 to 2032, fueled by the global shift toward cleaner fuels and the need to produce ultra-low-sulfur diesel. Increasing investments in hydrocracking units across Asia Pacific and the Middle East are further accelerating this segment’s growth trajectory.

- By Catalyst

Based on catalyst type, the market is categorized into Zeolites, Metals, and Chemicals. The Zeolites segment held the largest market share of 48.3% in 2024, primarily due to its high selectivity, thermal stability, and efficiency in catalytic cracking and hydrocracking reactions. Zeolites are widely used in refineries to increase fuel yield and remove impurities, making them the most preferred catalyst type globally.

The Metals segment is anticipated to grow at the fastest CAGR during 2025–2032, driven by the rising demand for hydroprocessing and hydrogenation catalysts that use active metals such as nickel, cobalt, and platinum. The increasing focus on energy-efficient refining and high-performance catalyst regeneration technologies is further strengthening metal catalyst adoption.

- By Distribution Channel

On the basis of distribution channel, the oil refining catalyst market is segmented into Direct Sales/B2B, Distributors/Third-Party Distributors/Traders, E-Commerce, and Others. The Direct Sales/B2B segment dominated the market in 2024, capturing a market share of 56.4%, owing to the preference of refineries and petrochemical companies for long-term supply contracts and customized catalyst solutions directly from manufacturers. Direct partnerships also ensure technical support, performance monitoring, and product optimization.

The E-Commerce segment is projected to witness the fastest CAGR between 2025 and 2032, propelled by digital transformation across industrial supply chains. Online platforms are increasingly offering refined catalyst procurement options, reducing lead times and expanding access to smaller refineries and independent operators.

- By Application

Based on application, the market is segmented into Diesel, Kerosene, Distillate Dewax, and Others. The Diesel segment led the market in 2024 with a market share of 45.7%, attributed to the rising global demand for clean diesel and strict emission regulations requiring advanced catalytic refining processes. The use of catalysts in diesel production enhances desulfurization and improves fuel quality, making them essential for compliance with environmental norms.

The Distillate Dewax segment is expected to record the fastest CAGR from 2025 to 2032, driven by increasing demand for high-performance lubricants and low-temperature fuels. Growing consumption of premium-grade lubricants in the automotive and industrial sectors is fueling the adoption of specialized dewaxing catalysts across refineries worldwide.

Which Region Holds the Largest Share of the Oil Refining Catalyst Market?

- China dominated the Asia-Pacific oil refining catalyst market in 2024, holding the largest revenue share of 46.3%, driven by strong domestic demand for beverages, food, and pharmaceutical packaging

- The country’s well-established manufacturing infrastructure, cost-effective production capabilities, and abundant raw materials such as silica and cullet support large-scale catalyst and glass container production. Government policies promoting eco-friendly manufacturing, recycling initiatives, and investment in advanced glass-forming and refining technologies further strengthen market dominance

- China’s growing export orientation in alcoholic beverages, personal care, and processed foods, combined with rising domestic consumption of premium products, reinforces its leadership position in the regional market. Overall, China’s strategic manufacturing hub status and R&D capabilities solidify its leading role in the Asia-Pacific Oil Refining Catalyst industry.

India Oil Refining Catalyst Market Insight

The India oil refining catalyst market is projected to grow at the fastest CAGR of 8.58%, fueled by rising consumption of beverages, food, and pharmaceutical products in urban and rural areas. Government incentives for manufacturing, recycling, and sustainable production are accelerating market adoption. Increasing preference for premium and eco-friendly catalysts by beverage, cosmetic, and food processing companies drives demand across sectors. Rising exports of processed foods, alcoholic and non-alcoholic beverages, and personal care products strengthen India’s position in the regional market. Investments in modern production facilities and improved catalyst technologies are enhancing India’s competitiveness, making it a key growth contributor in the Asia-Pacific Oil Refining Catalyst landscape.

Vietnam Oil Refining Catalyst Market Insight

The Vietnam oil refining catalyst market is expanding due to growing industrialization and increasing consumption of bottled beverages, sauces, and cosmetics. The country benefits from government support for sustainable production, trade agreements promoting exports, and collaborations with global packaging and catalyst companies. Urban population growth and rising premium beverage and food consumption drive demand for high-quality, aesthetically appealing products. Advancements in production, refining, and recycling technologies are enhancing operational efficiency. Collectively, these factors position Vietnam as a growing contributor to the Asia-Pacific Oil Refining Catalyst market.

Indonesia Oil Refining Catalyst Market Insight

The Indonesia oil refining catalyst market is witnessing steady growth, supported by increasing domestic consumption of beverages, food, and pharmaceutical products. The country’s abundant raw materials, including silica sand and cullet, facilitate localized production. Government initiatives promoting eco-friendly and sustainable manufacturing encourage investments in modern refining and glass production technologies. Export-oriented beverage and food processing industries further boost demand for durable and premium catalysts and containers. Rising consumer awareness regarding product quality, safety, and sustainability is also fueling market adoption. Investments in R&D for functional catalyst products and innovative designs are enhancing competitiveness, making Indonesia a vital contributor to the Asia-Pacific market.

Which are the Top Companies in Oil Refining Catalyst Market?

The oil refining catalyst industry is primarily led by well-established companies, including:

- Royal Dutch Shell plc (U.K.)

- 3M (U.S.)

- Dow (U.S.)

- Exxon Mobil Corporation (U.S.)

- BASF SE (Germany)

- W. R. Grace & Co.-Conn (U.S.)

- Anten Chemical Co., Ltd (China)

- Johnson Matthey (U.K.)

- Clariant (Switzerland)

- China Petrochemical Corporation (China)

- Albemarle Corporation (U.S.)

- Honeywell International Inc (U.S.)

- Haldor Topsoe A/S (Denmark)

- Arkema (France)

- Kuwait Catalyst Company (Kuwait)

- JGC C&C (Japan)

- Axens (France)

- Gazpromneft-Catalytic Systems (Russia)

- UNICAT Catalyst Technologies, LLC (U.S.)

- TAIYO KOKO Co., Ltd (Japan)

What are the Recent Developments in Asia Pacific Oil Refining Catalyst Market?

- In January 2023, Albemarle Corporation announced the launch of Ketjen, a wholly-owned subsidiary offering customized, sophisticated catalyst solutions for the specialty chemical, refining, and petrochemical industries, strengthening its portfolio and market presence globally

- In February 2021, Bharat Petroleum Corporation Limited’s subsidiary, Numaligarh Refinery Limited (NRL), designated Axens to supply advanced technologies for the gasoline block of its Numaligarh Refinery Expansion Project (NREP), aiming to increase refinery capacity by 9000 KT per annum and enhance operational efficiency.

- In September 2020, Clariant announced the construction of a new catalyst production facility in China, investing significantly to strengthen its local presence and better support regional customers, while producing CATOFIN catalysts for propane dehydrogenation, boosting production capabilities and market competitiveness

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Asia Pacific Oil Refining Catalyst Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Asia Pacific Oil Refining Catalyst Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Asia Pacific Oil Refining Catalyst Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.