Asia Pacific Neem Oil Concentrates Market

Market Size in USD Thousand

CAGR :

%

USD

476,188.67 Thousand

USD

1,270,566.81 Thousand

2022

2030

USD

476,188.67 Thousand

USD

1,270,566.81 Thousand

2022

2030

| 2023 –2030 | |

| USD 476,188.67 Thousand | |

| USD 1,270,566.81 Thousand | |

|

|

|

|

Asia-Pacific Neem Oil and Concentrates Market Analysis and Size

Neem oil is a vegetable oil derived from the seeds of the neem tree (Azadirachta indica), which is native to the Indian subcontinent. It has been used for centuries in traditional Indian medicine, agriculture, and skincare. Neem oil contains a variety of biologically active compounds, including azadirachtin, nimbin, and nimbidin, which are responsible for its medicinal and pesticidal properties. It has antifungal, antibacterial, antiviral, and insecticidal properties, making it a popular natural remedy and pesticide.

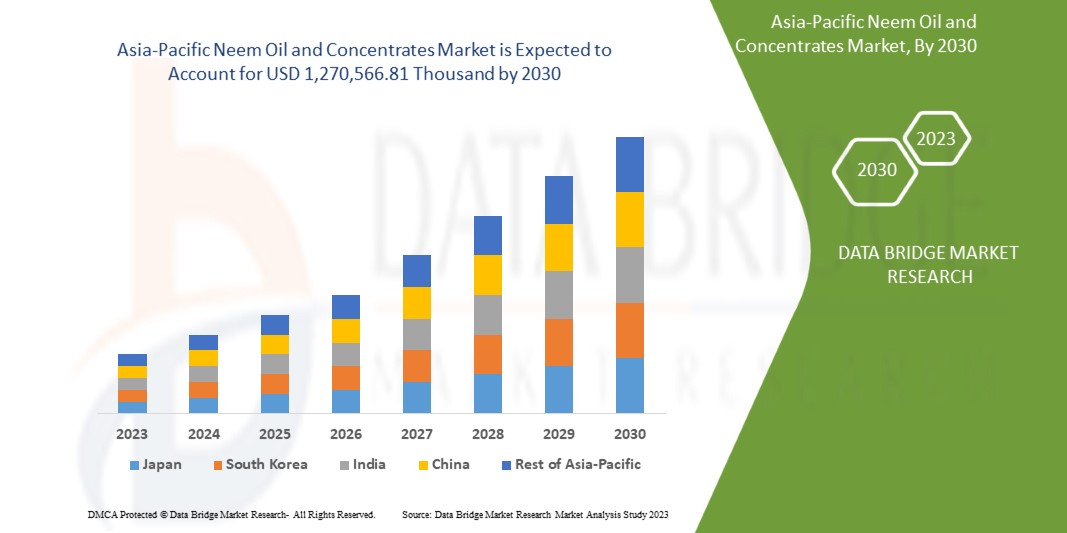

The Asia-Pacific neem oil and concentrates market is expected to reach USD 1,270,566.81 thousand by 2030 from USD 476,188.67 thousand in 2023, growing with a substantial CAGR of 13.3% in the forecast period of 2023 to 2030.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Thousand |

|

Segments Covered |

Type (Fruit and Seed Extract, Leaf Extract, and Bark Extract), Application (Agriculture and Farming, Pharmaceuticals and Nutraceuticals, Personal Care, Automotive, Food and Beverages, and Others) |

|

Countries Covered |

Japan, China, India, South Korea, Australia & New Zealand, Philippines, Malaysia, Thailand, Indonesia, Singapore, and Rest of Asia-Pacific |

|

Market Players Covered |

Murugappa Group, SUNSHIV BOTANICS, ConnOils LLC, VedaOils, Ozone Biotech, SPECTRUM BRANDS, INC., Woodstream Corporation, DYNA-GRO, INC, GreenWay Biotech, MYCSA AG, Manorama Industries Limited., SUN BIONATURALS, and NOW Foods among others |

Market Definition

Neem tree seeds contain neem oil, a naturally occurring insecticide. It is yellow to brown, gives garlic/sulfur smells, and has a bitter taste. It has been used to eradicate illnesses and pests for hundreds of years. Neem oil is still used today in many different products in various forms. These consist of pet shampoos, cosmetics, soaps, and toothpaste. Neem oil may also be used to make biodiesel or biofuels. Neem oil is made up of many ingredients. The most effective insect deterrent and killer is azadirachtin, derived from neem oil. It is known as clarified hydrophobic neem oil when there is any leftover.

Asia-Pacific Neem Oil and Concentrates Market Dynamics

This section deals with understanding the market drivers, advantages, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Growing Demand for Organic Products

The market for neem oil concentrates is seeing increased demand for organic goods. Neem oil derived from the neem tree has been increasingly popular recently. The demand for organic goods, such as neem oil concentrates, has increased as customers grow more concerned about their health and the environment. As customers become more aware of the potential health dangers linked to synthetic chemicals and pesticides, organic products have grown tremendously on the market. Neem oil concentrates are extracted from the seeds of the neem tree and are called organic because they are produced without toxic chemicals or genetically modified organisms (GMOs). This makes neem oil concentrates appealing to those seeking natural and sustainable solutions. Neem oil has insecticidal characteristics and can treat various pests, including insects, mites, and nematodes. Unlike synthetic pesticides, neem oil is non-toxic to humans and beneficial insects, making it an environmentally benign pest control approach.

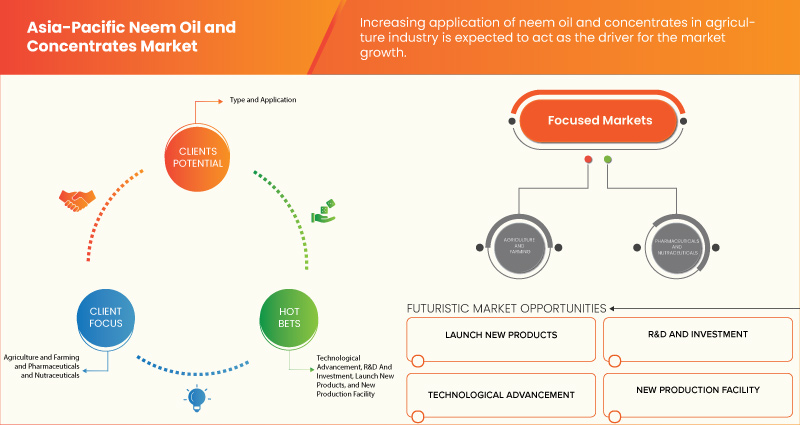

- Increasing Application of Neem Oil Concentrates in the Agriculture Industry

The Asia-Pacifc neem oil and concentrates market is witnessing an increase in the use of neem oil concentrates in agriculture. Neem oil, derived from the neem tree (Azadirachta indica), has grown in popularity in agriculture due to its wide variety of applications and multiple advantages. Demand for neem oil concentrates increases as agriculture seeks more sustainable and environmentally friendly alternatives. Neem oil has insecticidal characteristics and can treat various crop pests, such as aphids, whiteflies, mites, caterpillars, and beetles. Its active components prevent insect proliferation and development, resulting in less crop loss. Unlike synthetic pesticides, neem oil is deemed safe for humans, beneficial insects, and the environment.

Opportunities

- Potential Applications in Automotive Industry

The increased demand for environmentally friendly products, the automobile sector is continually looking for novel and long-lasting solutions. Natural neem oil has advantages for a variety of automobile applications. The automotive coatings and paints industry can use neem oil as an ingredient. Its antibacterial and insecticidal qualities can aid in defending the outside surfaces of cars from dangerous pathogens and pests. Car manufacturers can add neem oil to coating formulae to boost paint tenacity and longevity, as well as to add protection against environmental variables that could cause the paint to degrade. Because of its outstanding lubricating characteristics, neem oil can be used as a lubricant or as an addition to automobile lubricants. It can reduce friction and wear in various engine components, resulting in improved engine performance and prolonged engine part lifespan. Furthermore, the natural composition of neem oil can help to reduce the environmental impact of lubricant use in automotive industry products.

- New Product Development and Diversification

Neem oil is well-known for its many useful effects, including insecticidal, antibacterial, and antioxidant capabilities. These characteristics make it a flexible element for a variety of applications. Companies can explore new formulations and applications of neem oil by investing in research and development, creating unique products that cater to certain market segments.

Neem oil can be prepared in various concentrations or combined with other natural components to increase its efficiency and adaptability. This can lead to the creation of concentrated neem oil-based products that provide targeted pest control solutions for certain crops or uses. Furthermore, neem oil-based products can be improved to satisfy the specialized needs of industries such as cosmetics, medicines, personal care, and automotive.

Restraints/Challenges

- Availability of Substitutes

While neem oil is commonly used in agriculture as a biopesticide and insecticide, alternative products and synthetic chemicals on the market provide similar pest control qualities. These substitutes may be more readily available, less expensive, or have a more established market presence, posing a challenge to the broad adoption of neem oil. Similarly, some alternatives provide comparable performance in the automotive industry, where neem oil is utilized in lubricants and coatings. Alternatives to neem oil include synthetic lubricants, coatings, and other bio-based oils. The availability and competitiveness of these substitutes may limit neem oil usage in the automotive sector.

- Regulatory Hurdles and Quality Control

Neem oil, obtained from the seeds of the neem tree, has recently received a lot of interest because of its numerous applications in agricultural, healthcare, and personal care goods. However, the neem oil market has substantial challenges in negotiating the complicated regulatory landscape and achieving consistent quality control.

The registration and licensing requirements for neem oil products are one of the most significant regulatory barriers. Manufacturers must get regulatory permissions or certificates in several countries before lawfully advertising and selling neem oil products. The registration process can be time-consuming and expensive and involve extensive documentation and testing procedures. This can result in delays in bringing neem oil products to market and increase the cost of compliance for manufacturers, especially for small and medium-sized enterprises.

- Limited Awareness of Neem Oil and Concentrates

This lack of understanding presents various obstacles for market participants regarding market penetration, product adoption, and overall market growth. One of the major issues confronting the neem oil and concentrate business is a lack of consumer knowledge. Many consumers are unaware of neem oil's benefits, applications, and potential uses outside traditional agricultural applications. This lack of awareness limits the demand for neem oil-based products in various industries, including personal care, medicines, and household cleaning.

- Limited Availability and Supply Chain Challenges

The neem oil and concentrate market has major challenges due to limited availability and supply chain challenges. The cultivation and processing of neem trees, which can be affected by various factors such as climate, pests, and diseases, is required to manufacture neem oil. This can cause changes in neem oil availability and disrupt the supply chain. Furthermore, the demand for neem oil has steadily increased across various industries, including agriculture, cosmetics, and healthcare. Meeting this growing demand requires a well-established and efficient supply chain to ensure neem oil products' timely and consistent availability.

Recent Development

- In 2022, in Birkoni, Chhattisgarh, Manorama Industries Limited opened a brand-new facility to meet the surge in demand for customized custom-made fats and CBE. This aids businesses in developing and manufacturing new items and fortifying their local and global supply networks

Asia-Pacific Neem Oil and Concentrates Market Scope

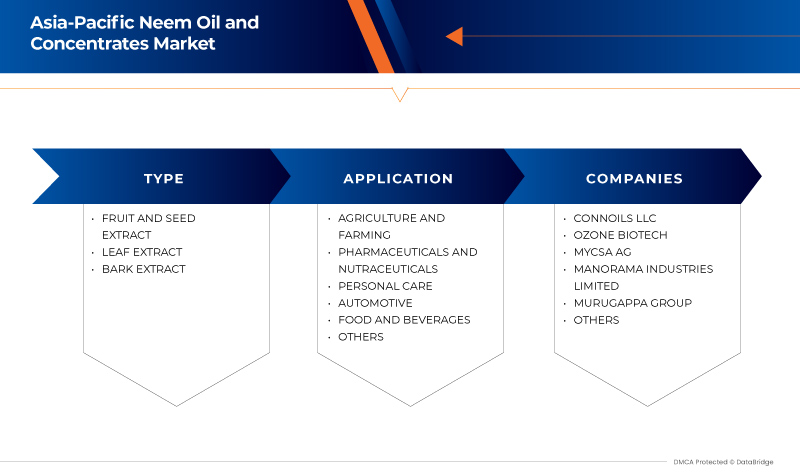

The Asia-Pacific neem oil and concentrates market is categorized based on type and application. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Type

- Fruit and Seed Extract

- Leaf Extract

- Bark Extract

On the basis of type, the market is segmented into fruit and seed extract, leaf extract, and bark extract.

Application

- Agriculture and Farming

- Pharmaceuticals and Nutraceuticals

- Personal Care

- Automotive

- Food and Beverages

- Others

On the basis of application, the market is segmented into agriculture and farming, pharmaceuticals and nutraceuticals, personal care, automotive, food and beverages, and others.

Asia-Pacific Neem Oil and Concentrates Market Regional Analysis/Insights

The Asia-Pacific neem oil and concentrates market is segmented on the basis of on type and application.

The countries in the Asia-Pacific neem oil and concentrates market are the Japan, China, India, South Korea, Australia & New Zealand, Philippines, Malaysia, Thailand, Indonesia, Singapore, and rest of Asia-Pacific.

China is dominating the Asia-Pacific neem oil and concentrates market due to growing awareness regarding the properties of the neem oil and concentrates products.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data point downstream and upstream value chain analysis, technical trends porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of regional brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Asia-Pacific Neem Oil and Concentrates Market Share Analysis

The Asia-Pacific neem oil and concentrates market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to the market.

Some of the major market players operating in the Asia-Pacific neem oil and concentrates market are Murugappa Group, SUNSHIV BOTANICS, ConnOils LLC, VedaOils, Ozone Biotech, SPECTRUM BRANDS, INC., Woodstream Corporation, DYNA-GRO, INC, GreenWay Biotech, MYCSA AG, Manorama Industries Limited., SUN BIONATURALS, and NOW Foods among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDYD

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING DEMAND FOR ORGANIC PRODUCTS

5.1.2 INCREASING APPLICATION OF NEEM OIL CONCENTRATES IN THE AGRICULTURE INDUSTRY

5.1.3 EXPANSION OF END-USE INDUSTRIES FOR NEEM OIL CONCENTRATES

5.2 RESTRAINTS

5.2.1 AVAILABILITY OF SUBSTITUTES

5.2.2 REGULATORY HURDLES AND QUALITY CONTROL

5.3 OPPORTUNITIES

5.3.1 POTENTIAL APPLICATIONS IN AUTOMOTIVE INDUSTRY

5.3.2 NEW PRODUCT DEVELOPMENT AND DIVERSIFICATION

5.4 CHALLENGES

5.4.1 LIMITED AWARENESS OF NEEM OIL AND CONCENTRATES

5.4.2 LIMITED AVAILABILITY AND SUPPLY CHAIN CHALLENGES

6 ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET, BY TYPE

6.1 OVERVIEW

6.2 FRUIT AND SEED EXTRACT

6.3 LEAF EXTRACT

6.4 BARK EXTRACT

7 ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 AGRICULTURE AND FARMING

7.2.1 BY TYPE

7.2.1.1 FRUIT AND SEED EXTRACT

7.2.1.2 LEAF EXTRACT

7.2.1.3 BARK EXTRACT

7.3 PHARMACEUTICALS AND NUTRACEUTICALS

7.3.1 BY TYPE

7.3.1.1 FRUIT AND SEED EXTRACT

7.3.1.2 LEAF EXTRACT

7.3.1.3 BARK EXTRACT

7.4 PERSONAL CARE

7.4.1 BY TYPE

7.4.1.1 FRUIT AND SEED EXTRACT

7.4.1.2 LEAF EXTRACT

7.4.1.3 BARK EXTRACT

7.5 AUTOMOTIVE

7.5.1 BY TYPE

7.5.1.1 FRUIT AND SEED EXTRACT

7.5.1.2 LEAF EXTRACT

7.5.1.3 BARK EXTRACT

7.6 FOOD AND BEVERAGES

7.6.1 BY TYPE

7.6.1.1 FRUIT AND SEED EXTRACT

7.6.1.2 LEAF EXTRACT

7.6.1.3 BARK EXTRACT

7.7 OTHERS

7.7.1 BY TYPE

7.7.1.1 FRUIT AND SEED EXTRACT

7.7.1.2 LEAF EXTRACT

7.7.1.3 BARK EXTRACT

8 ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET, BY REGION

8.1 ASIA-PACIFIC

8.1.1 CHINA

8.1.2 INDIA

8.1.3 AUSTRALIA & NEW ZEALAND

8.1.4 SOUTH KOREA

8.1.5 JAPAN

8.1.6 INDONESIA

8.1.7 THAILAND

8.1.8 PHILIPPINES

8.1.9 MALAYSIA

8.1.10 SINGAPORE

8.1.11 REST OF ASIA-PACIFIC

9 ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET: COMPANY LANDSCAPE

9.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

9.2 CERTIFICATION

9.3 ACQUISITION

9.4 NEW PLANT

10 SWOT ANALYSIS

11 COMPANY PROFILES

11.1 MURUGAPPA GROUP

11.1.1 COMPANY SNAPSHOT

11.1.2 REVENUE ANALYSIS

11.1.3 PRODUCT PORTFOLIO

11.1.4 RECENT DEVELOPMENT

11.2 CONNOILS LLC

11.2.1 COMPANY SNAPSHOT

11.2.2 PRODUCT PORTFOLIO

11.2.3 RECENT DEVELOPMENT

11.3 MANORAMA INDUSTRIES LIMITED

11.3.1 COMPANY SNAPSHOT

11.3.2 REVENUE ANALYSIS

11.3.3 PRODUCT PORTFOLIO

11.3.4 RECENT DEVELOPMENT

11.4 MYCSA AG

11.4.1 COMPANY SNAPSHOT

11.4.2 PRODUCT PORTFOLIO

11.4.3 RECENT DEVELOPMENT

11.5 OZONE BIOTECH

11.5.1 COMPANY SNAPSHOT

11.5.2 PRODUCT PORTFOLIO

11.5.3 RECENT DEVELOPMENT

11.6 DYNO-GRO, INC

11.6.1 COMPANY SNAPSHOT

11.6.2 PRODUCT PORTFOLIO

11.6.3 RECENT DEVELOPMENT

11.7 GREENWAY BIOTECH

11.7.1 COMPANY SNAPSHOT

11.7.2 PRODUCT PORTFOLIO

11.7.3 RECENT DEVELOPMENT

11.8 NOW FOODS

11.8.1 COMPANY SNAPSHOT

11.8.2 PRODUCT PORTFOLIO

11.8.3 RECENT DEVELOPMENT

11.9 SPECTRUM BRANDS, INC.

11.9.1 COMPANY SNAPSHOT

11.9.2 REVENUE ANALYSIS

11.9.3 PRODUCT PORTFOLIO

11.9.4 RECENT DEVELOPMENT

11.1 SUN BIONATURALS

11.10.1 COMPANY SNAPSHOT

11.10.2 PRODUCT PORTFOLIO

11.10.3 RECENT DEVELOPMENT

11.11 SUNSHIV BOTANICS

11.11.1 COMPANY SNAPSHOT

11.11.2 PRODUCT PORTFOLIO

11.11.3 RECENT DEVELOPMENT

11.12 VEDAOILS

11.12.1 COMPANY SNAPSHOT

11.12.2 PRODUCT PORTFOLIO

11.12.3 RECENT DEVELOPMENT

11.13 WOODSTREAM CORPORATION

11.13.1 COMPANY SNAPSHOT

11.13.2 PRODUCT PORTFOLIO

11.13.3 RECENT DEVELOPMENT

12 QUESTIONNAIRE

13 RELATED REPORTS

List of Table

TABLE 1 ASIA-PACIFC NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 2 ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 3 ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 4 ASIA-PACIFIC AGRICULTURE AND FARMING IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 5 ASIA-PACIFIC PHARMACEUTICALS AND NUTRACEUTICALS IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 6 ASIA-PACIFIC PERSONAL CARE IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 7 ASIA-PACIFIC AUTOMOTIVE IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 8 ASIA-PACIFIC FOOD AND BEVERAGES IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 9 ASIA-PACIFIC OTHERS IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 10 ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 11 ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET, BY COUNTRY, 2021-2030 (TONS)

TABLE 12 ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 13 ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 14 ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 15 ASIA-PACIFIC AGRICULTURE AND FARMING IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 16 ASIA-PACIFIC PHARMACEUTICALS AND NUTRACEUTICALS IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 17 ASIA-PACIFIC PERSONAL CARE IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 18 ASIA-PACIFIC AUTOMOTIVE IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 19 ASIA-PACIFIC FOOD AND BEVERAGES IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 20 ASIA-PACIFIC OTHERS IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 21 CHINA NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 22 CHINA NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 23 CHINA NEEM OIL AND CONCENTRATES MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 24 CHINA AGRICULTURE AND FARMING IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 25 CHINA PHARMACEUTICALS AND NUTRACEUTICALS IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 26 CHINA PERSONAL CARE IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 27 CHINA AUTOMOTIVE IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 28 CHINA FOOD AND BEVERAGES IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 29 CHINA OTHERS IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 30 INDIA NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 31 INDIA NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 32 INDIA NEEM OIL AND CONCENTRATES MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 33 INDIA AGRICULTURE AND FARMING IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 34 INDIA PHARMACEUTICALS AND NUTRACEUTICALS IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 35 INDIA PERSONAL CARE IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 36 INDIA AUTOMOTIVE IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 37 INDIA FOOD AND BEVERAGES IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 38 INDIA OTHERS IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 39 AUSTRALIA & NEW ZEALAND NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 40 AUSTRALIA & NEW ZEALAND NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 41 AUSTRALIA & NEW ZEALAND NEEM OIL AND CONCENTRATES MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 42 AUSTRALIA & NEW ZEALAND AGRICULTURE AND FARMING IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 43 AUSTRALIA & NEW ZEALAND PHARMACEUTICALS AND NUTRACEUTICALS IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 44 AUSTRALIA & NEW ZEALAND PERSONAL CARE IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 45 AUSTRALIA & NEW ZEALAND AUTOMOTIVE IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 46 AUSTRALIA & NEW ZEALAND FOOD AND BEVERAGES IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 47 AUSTRALIA & NEW ZEALAND OTHERS IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 48 SOUTH KOREA NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 49 SOUTH KOREA NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 50 SOUTH KOREA NEEM OIL AND CONCENTRATES MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 51 SOUTH KOREA AGRICULTURE AND FARMING IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 52 SOUTH KOREA PHARMACEUTICALS AND NUTRACEUTICALS IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 53 SOUTH KOREA PERSONAL CARE IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 54 SOUTH KOREA AUTOMOTIVE IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 55 SOUTH KOREA FOOD AND BEVERAGES IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 56 SOUTH KOREA OTHERS IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 57 JAPAN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 58 JAPAN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 59 JAPAN NEEM OIL AND CONCENTRATES MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 60 JAPAN AGRICULTURE AND FARMING IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 61 JAPAN PHARMACEUTICALS AND NUTRACEUTICALS IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 62 JAPAN PERSONAL CARE IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 63 JAPAN AUTOMOTIVE IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 64 JAPAN FOOD AND BEVERAGES IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 65 JAPAN OTHERS IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 66 INDONESIA NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 67 INDONESIA NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 68 INDONESIA NEEM OIL AND CONCENTRATES MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 69 INDONESIA AGRICULTURE AND FARMING IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 70 INDONESIA PHARMACEUTICALS AND NUTRACEUTICALS IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 71 INDONESIA PERSONAL CARE IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 72 INDONESIA AUTOMOTIVE IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 73 INDONESIA FOOD AND BEVERAGES IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 74 INDONESIA OTHERS IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 75 THAILAND NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 76 THAILAND NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 77 THAILAND NEEM OIL AND CONCENTRATES MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 78 THAILAND AGRICULTURE AND FARMING IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 79 THAILAND PHARMACEUTICALS AND NUTRACEUTICALS IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 80 THAILAND PERSONAL CARE IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 81 THAILAND AUTOMOTIVE IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 82 THAILAND FOOD AND BEVERAGES IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 83 THAILAND OTHERS IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 84 PHILIPPINES NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 85 PHILIPPINES NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 86 PHILIPPINES NEEM OIL AND CONCENTRATES MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 87 PHILIPPINES AGRICULTURE AND FARMING IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 88 PHILIPPINES PHARMACEUTICALS AND NUTRACEUTICALS IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 89 PHILIPPINES PERSONAL CARE IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 90 PHILIPPINES AUTOMOTIVE IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 91 PHILIPPINES FOOD AND BEVERAGES IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 92 PHILIPPINES OTHERS IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 93 MALAYSIA NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 94 MALAYSIA NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 95 MALAYSIA NEEM OIL AND CONCENTRATES MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 96 MALAYSIA AGRICULTURE AND FARMING IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 97 MALAYSIA PHARMACEUTICALS AND NUTRACEUTICALS IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 98 MALAYSIA PERSONAL CARE IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 99 MALAYSIA AUTOMOTIVE IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 100 MALAYSIA FOOD AND BEVERAGES IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 101 MALAYSIA OTHERS IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 102 SINGAPORE NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 103 SINGAPORE NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 104 SINGAPORE NEEM OIL AND CONCENTRATES MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 105 SINGAPORE AGRICULTURE AND FARMING IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 106 SINGAPORE PHARMACEUTICALS AND NUTRACEUTICALS IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 107 SINGAPORE PERSONAL CARE IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 108 SINGAPORE AUTOMOTIVE IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 109 SINGAPORE FOOD AND BEVERAGES IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 110 SINGAPORE OTHERS IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 111 REST OF ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 112 REST OF ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (TONS)

List of Figure

FIGURE 1 ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET: SEGMENTATION

FIGURE 2 ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET: DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET: REGIONAL VS COUNTRY ANALYSIS

FIGURE 5 ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET: TYPE LIFE LINE CURVE

FIGURE 7 ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET: MULTIVARIATE MODELLING

FIGURE 8 ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET: DBMR MARKET POSITION GRID

FIGURE 10 ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET: APPLICATION COVERAGE GRID

FIGURE 11 ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET: CHALLENGE MATRIX

FIGURE 12 ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET: SEGMENTATION

FIGURE 14 GROWING DEMAND FOR ORGANIC PRODUCTS IS DRIVING THE ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 15 FRUIT AND SEED EXTRACT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET IN 2023 & 2030

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET

FIGURE 17 ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET: BY TYPE, 2022

FIGURE 18 ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET: BY APPLICATION, 2022

FIGURE 19 ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET: SNAPSHOT (2022)

FIGURE 20 ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET: BY COUNTRY (2022)

FIGURE 21 ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET: BY COUNTRY (2023 & 2030)

FIGURE 22 ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET: BY COUNTRY (2022 & 2030)

FIGURE 23 ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET: BY TYPE (2023 - 2030)

FIGURE 24 ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET: COMPANY SHARE 2022 (%)

Asia Pacific Neem Oil Concentrates Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Asia Pacific Neem Oil Concentrates Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Asia Pacific Neem Oil Concentrates Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.