Asia-Pacific Modular Construction Market Analysis and Insights

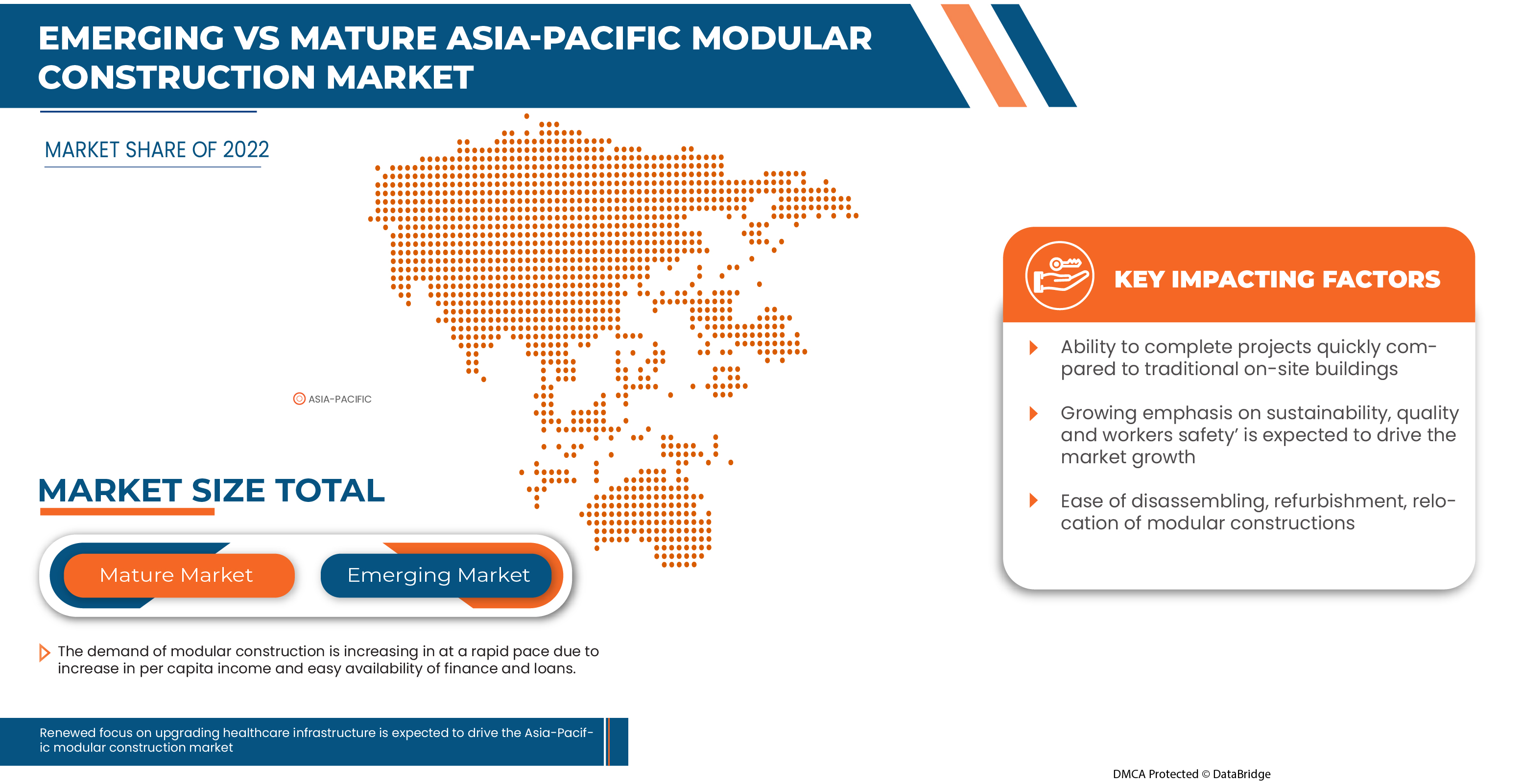

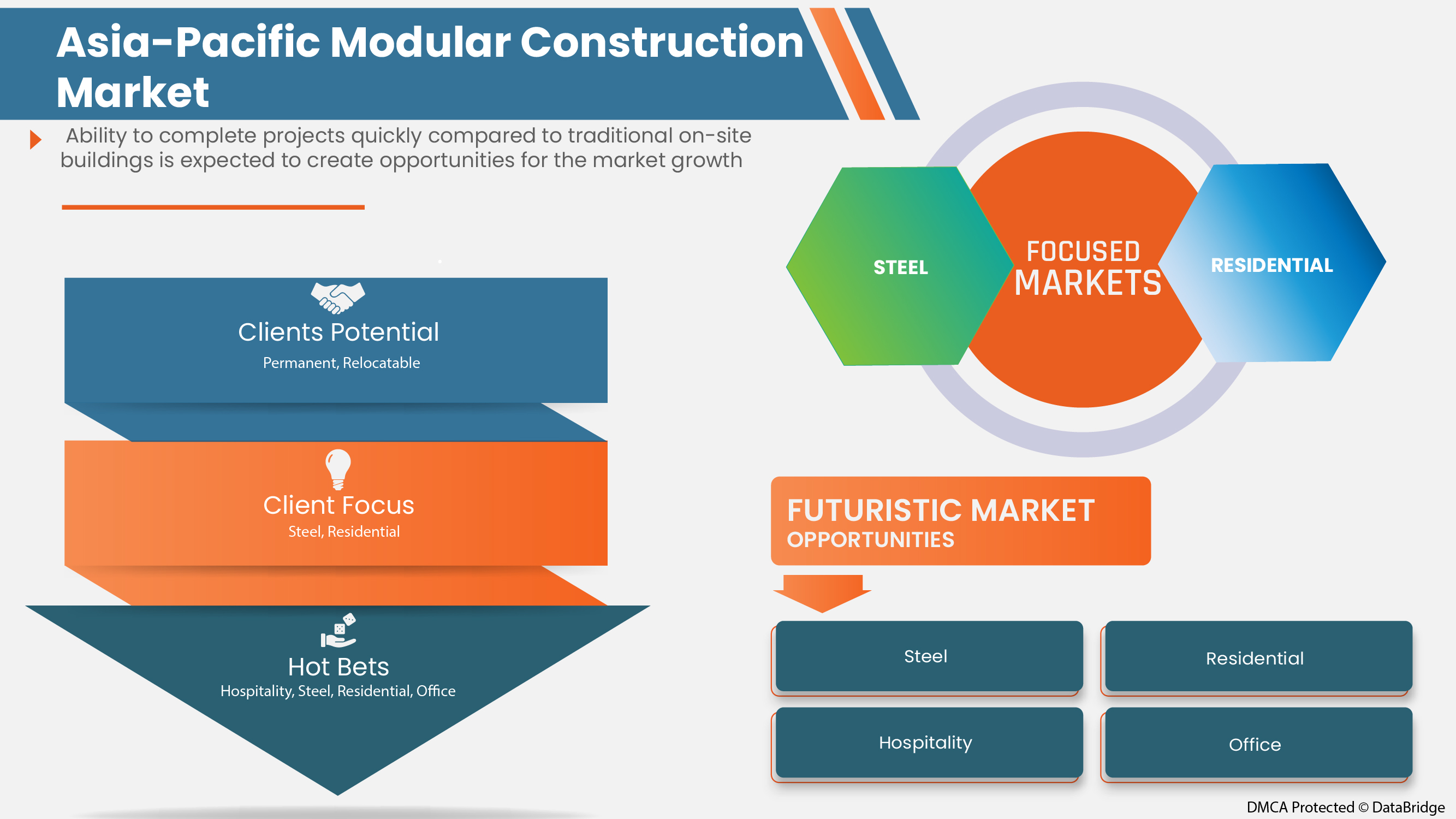

The major factor driving the growth of the Asia-Pacific modular construction market is the ability to complete projects quickly compared to traditional on-site buildings. Growing emphasis on sustainability, quality, worker safety, and ease of disassembling, refurbishment, and relocation of modular constructions are expected to propel the Asia-Pacific modular construction market growth. The major restraints that may negatively impact the Asia-Pacific modular construction market are the lack of reliability in modular construction in earthquake-prone regions and fluctuating transportation costs for prefabricated modules.

Increased support from government rules and policies and a renewed focus on upgrading healthcare infrastructure are expected to provide opportunities in the Asia-Pacific modular construction market. However, a lack of awareness regarding modular constructions is projected to challenge the market growth.

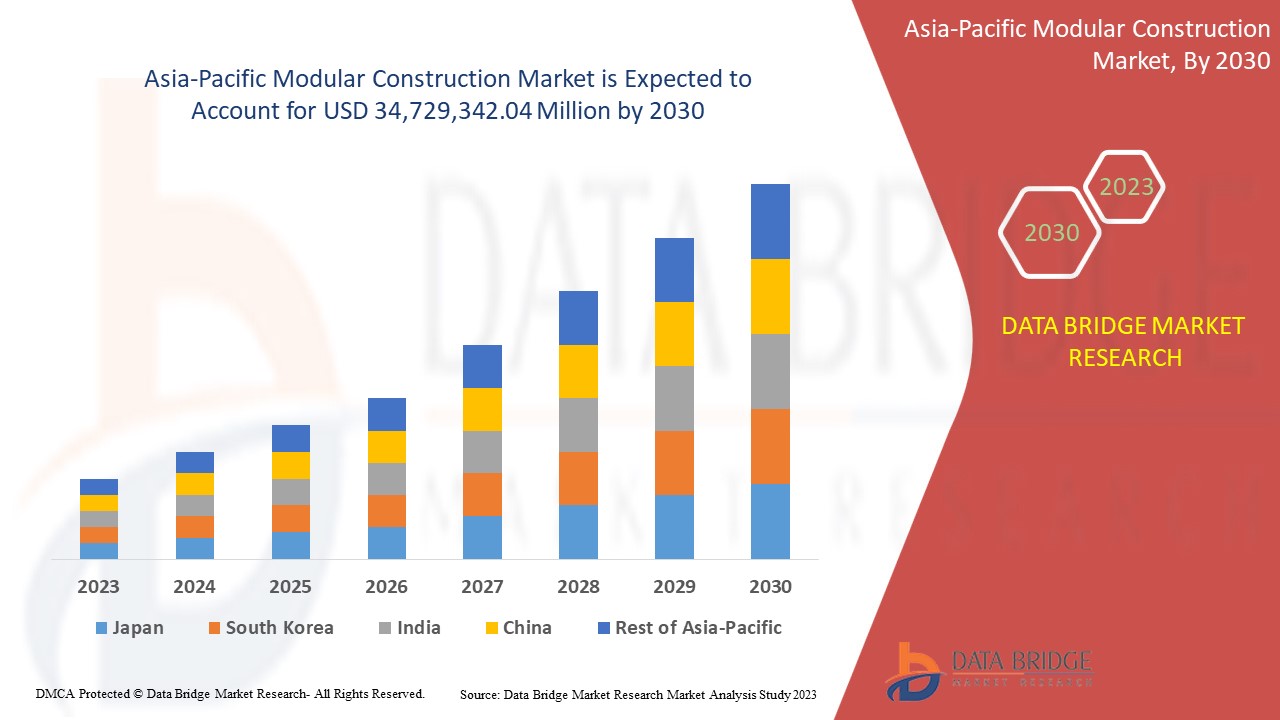

The Asia-Pacific modular construction market is expected to gain significant growth in the forecast period of 2023 to 2030. Data Bridge Market Research analyses that the market is growing with a CAGR of 7.0% in the forecast period of 2023 to 2030 and is expected to reach USD 34,729,342.04 million by 2030.

The Asia-Pacific modular construction market report provides details of market share, new developments, and the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an Analyst Brief; our team will help you create a revenue-impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Thousand, Volume in Average Square Feet |

|

Segments Covered |

By Type (Permanent, Relocatable), Material (Wood, Steel, Concrete, Others), End-User (Residential, Hospitality, Healthcare, Education, Retail and Commercial, Office, Others) |

|

Countries Covered |

Japan, China, South Korea, India, Singapore, Thailand, Indonesia, Malaysia, Philippines, Australia & New Zealand, Taiwan, Hong Kong and the Rest of Asia-Pacific |

|

Market Players Covered |

LAING O'ROURKE, RED SEA INTERNATIONAL, ATCO LTD., Skanska, Modulaire Group, KLEUSBERG, Bechtel Corporation, Fluor Corporation, DUBOX, Kwikspace, Guerdon, LLC., Westchester Modular Homes, Wernick Group, KOMA MODULAR, Elements Europe, FORM Homes, Northgate Industries Ltd., Modular Engineering, CUSTOM SHIPPING CONTAINERS AND MODULAR BUILDINGS, and HONOMOBO among others |

Market Definition

Modular construction is a process in which a building is constructed off-site. The building is constructed under controlled plant conditions using the same design and materials to the same codes and standards as usually built facilities but in around half the time. Buildings are manufactured in "modules" that, when put together on site, and specifications of the most sophisticated site-built facility reflect identical design intent without compromise. The factory-controlled process generates less waste, creates fewer site disturbances, and allows for tighter construction. Moreover, the construction of modular buildings occurs simultaneously with site work, allowing projects to be completed in half the time of traditional construction. Modular buildings are built with the same materials and to the same building codes and architectural specifications as traditional construction. Once assembled, they are virtually indistinguishable from their site-built counterparts.

Asia-Pacific Modular Construction Market Dynamics

Drivers

- Ease of disassembling, refurbishment, and relocation of modular constructions

Modular construction is a process that involves constructing prefabricated buildings in off-site factories and transporting them to a worksite for installation. With modular construction, there is an opportunity to include a "plug and play" flexibility that allows molecular buildings to be easily modified for different purposes. Ease of disassembling helps to deconstruct into parts and can be reconstructed or redistributed to incorporate into various other projects.

- Increase in per capita income and easy availability of finances and loans

Modular construction provides a solution to this shortage by enabling more automation. New technologies such as artificial intelligence can help to increase off-site prefabrication—modular construction cuts cost by 20 to 30 percent. Modular construction will help to meet the demands for affordable housing.

- Growing emphasis on sustainability, quality, and workers' safety

Modular construction uses precise measurement and management through which multiple modules are created so discarded materials can be reused for other projects. This effectively helps in minimizing the generation of waste. The amount of waste generated by traditional construction has always challenged the environment compared to modular construction. Modular construction generates less waste and is also easy to dispose of.

Opportunities

- Renewed focus on upgrading healthcare infrastructure

The healthcare sector is seeking ways to speed up construction and cut expenses while maintaining a high-quality medical building when it comes to building projects. More than ever, owners of hospitals and other healthcare facilities are turning to modular construction for their expansion needs

- Increased support from government rules and policies

Modular construction is one eco-conscious manufacturing technique that has recently gained popularity. There is a need for sustainable solutions and an understanding of the impact that construction alone can have on the environment.

Restraints/Challenges

- Lack of awareness regarding modular construction

One major challenge faced by modular construction is the lack of awareness among people for these prefabricated spaces. Many people have misconceptions about it, suggesting that modular buildings are temporary structures that are cheap and of limited use. One of the biggest criticism of modular construction is that modularization lacks freedom in designing and looks unattractive.

- Lack of reliability on modular construction in earthquake-prone regions

Modular construction is a revolutionary new method used to build homes and businesses. Modular homes can be found in the earthquake and seismic zones, but the precision assembly of modular houses is imperative. As assembling failure can lead to joint issues, leakages, or void spaces. Earthquake-resistant construction is the fabrication of a building or structure that can withstand sudden shock or shake by minimizing structural damage, human deaths, and injuries.

Recent Development

- In October 2022, The Australian Financial Review, a leading national business, and finance newspaper, recognized Laing O'Rourke on its annual innovation list. Laing O'Rourke was the only tier-one constructor to make the Financial Review BOSS Most Innovative Companies List, coming in at number seven amongst peers in the property, construction, and transport sectors

Asia-Pacific Modular Construction Market Scope

The Asia-Pacific modular construction market is categorized based on type, material, and end-user. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Type

- Permanent

- Relocatable

On the basis of type, the Asia-Pacific modular construction market is classified into permanent and relocatable.

Material

- Wood

- Steel

- Concrete

- Others

On the basis of material, the Asia-Pacific modular construction market is classified into wood, steel, concrete, and others.

End-User

- Residential

- Hospitality

- Healthcare

- Education

- Retail and Commercial

- Office

- Others

On the basis of end-user, the Asia-Pacific modular construction market is classified into residential, hospitality, healthcare, education, retail and commercial, office, and others.

Asia-Pacific Modular Construction Market Regional Analysis/Insights

The Asia-Pacific modular construction market is segmented on the basis of country, type, material, and end-user.

Countries covered in the Asia-Pacific modular construction market are Japan, China, South Korea, India, Singapore, Thailand, Indonesia, Malaysia, Philippines, Australia & New Zealand, Taiwan, Hong Kong and the Rest of Asia-Pacific. China is expected to dominate the Asia-Pacific modular construction market in terms of market share and revenue due to growing awareness of the excellent characteristics and properties of modular construction in the region.

The country section of the report also provides individual market-impacting factors and market regulation changes that impact the market's current and future trends. Data point downstream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Asia-Pacific Modular Construction Market Share Analysis

Asia-Pacific modular construction market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies' focus related to the Asia-Pacific modular construction market.

Some of the key players operating in the Asia-Pacific modular construction market are LAING O'ROURKE, RED SEA INTERNATIONAL, ATCO LTD., Modulaire Group, Bechtel Corporation, Fluor Corporation, KOMA MODULAR, and CUSTOM SHIPPING CONTAINERS AND MODULAR BUILDINGS among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 SUPPLY CHAIN ANALYSIS

4.1.1 RAW MATERIAL PROCUREMENT

4.1.2 MANUFACTURING AND PACKING

4.1.3 MARKETING AND DISTRIBUTION

4.1.4 END-USERS

4.2 VALUE CHAIN ANALYSIS

4.3 REGIONAL SUMMARY

4.3.1 ASIA PACIFIC

4.3.2 ASIA-PACIFIC

4.3.3 NORTH AMERICA

4.3.4 EUROPE

4.3.5 MIDDLE EAST AND AFRICA

4.3.6 SOUTH AMERICA

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 ABILITY TO COMPLETE PROJECTS QUICKLY COMPARED TO TRADITIONAL ON-SITE BUILDINGS

5.1.2 GROWING EMPHASIS ON SUSTAINABILITY, QUALITY, AND WORKERS' SAFETY

5.1.3 EASE OF DISASSEMBLING, REFURBISHMENT, AND RELOCATION OF MODULAR CONSTRUCTIONS

5.1.4 INCREASE IN PER CAPITA INCOME AND EASY AVAILABILITY OF FINANCES AND LOANS

5.2 RESTRAINTS

5.2.1 LACK OF RELIABILITY ON MODULAR CONSTRUCTION IN EARTHQUAKE-PRONE REGIONS

5.2.2 FLUCTUATING TRANSPORTATION COSTS FOR PREFABRICATED MODULES

5.3 OPPORTUNITIES

5.3.1 RISE IN INVESTMENTS AND GROWING DEMAND FOR NEW HOUSING, COMMERCIAL, AND INDUSTRIAL STRUCTURES

5.3.2 INCREASED SUPPORT FROM GOVERNMENT RULES AND POLICIES

5.3.3 RENEWED FOCUS ON UPGRADING HEALTHCARE INFRASTRUCTURE

5.4 CHALLENGES

5.4.1 LACK OF AWARENESS REGARDING MODULAR CONSTRUCTION

5.4.2 SHORTAGE OF SKILLED LABOR IN THE MODULAR CONSTRUCTION INDUSTRY

6 ASIA PACIFIC MODULAR CONSTRUCTION MARKET, BY TYPE

6.1 OVERVIEW

6.2 PERMANENT

6.3 RELOCATABLE

7 ASIA PACIFIC MODULAR CONSTRUCTION MARKET, BY MATERIAL

7.1 OVERVIEW

7.2 WOOD

7.3 STEEL

7.4 CONCRETE

7.5 OTHERS

8 ASIA PACIFIC MODULAR CONSTRUCTION MARKET, BY END-USER

8.1 OVERVIEW

8.2 RESIDENTIAL

8.3 HOSPITALITY

8.4 HEALTHCARE

8.5 EDUCATION

8.6 RETAIL AND COMMERCIAL

8.6.1 RETAIL AND COMMERCIAL, BY END-USER

8.6.1.1 RELOCATABLE BUILDING

8.6.1.2 PERMANENT MODULAR

8.7 OFFICE

8.8 OTHERS

9 ASIA PACIFIC MODULAR CONSTRUCTION MARKET, BY REGION

9.1 ASIA-PACIFIC

9.1.1 CHINA

9.1.2 INDIA

9.1.3 JAPAN

9.1.4 SOUTH KOREA

9.1.5 AUSTRALIA & NEW ZEALAND

9.1.6 SINGAPORE

9.1.7 THAILAND

9.1.8 HONG KONG

9.1.9 TAIWAN

9.1.10 INDONESIA

9.1.11 MALAYSIA

9.1.12 PHILIPPINES

9.1.13 REST OF ASIA-PACIFIC

10 ASIA PACIFIC MODULAR CONSTRUCTION MARKET: COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

10.2 CONTRACTS

10.3 DIVESTMENT

10.4 ACQUISITION

10.5 AWARDS

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 SKANSKA

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 PRODUCT PORTFOLIO

12.1.5 RECENT UPDATES

12.2 BECHTEL CORPORATION

12.2.1 COMPANY SNAPSHOT

12.2.2 COMPANY SHARE ANALYSIS

12.2.3 PRODUCT PORTFOLIO

12.2.4 RECENT UPDATE

12.3 LAING O’ ROURKE

12.3.1 COMPANY SNAPSHOT

12.3.2 COMPANY SHARE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 RECENT UPDATE

12.4 FLUOR CORPORATION

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 COMPANY SHARE ANALYSIS

12.4.4 PRODUCT PORTFOLIO

12.4.5 RECENT UPDATES

12.5 MODULAIRE GROUP

12.5.1 COMPANY SNAPSHOT

12.5.2 COMPANY SHARE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 RECENT UPDATE

12.6 ATCO LTD.

12.6.1 COMPANY SNAPSHOT

12.6.2 REVENUE ANALYSIS

12.6.3 PRODUCT PORTFOLIO

12.6.4 RECENT UPDATES

12.7 CUSTOM SHIPPING CONTAINERS AND MODULAR BUILDINGS

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 RECENT UPDATES

12.8 DUBOX

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT UPDATE

12.9 ELEMENTS EUROPE

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT UPDATE

12.1 FORM HOMES

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 RECENT UPDATES

12.11 GUERDON, LLC

12.11.1 COMPANY SNAPSHOT

12.11.2 PRODUCT PORTFOLIO

12.11.3 RECENT UPDATE

12.12 HONOMOBO

12.12.1 COMPANY SNAPSHOT

12.12.2 PRODUCT PORTFOLIO

12.12.3 RECENT UPDATES

12.13 KLEUSBERG

12.13.1 COMPANY SNAPSHOT

12.13.2 PRODUCT PORTFOLIO

12.13.3 RECENT UPDATES

12.14 KOMA MODULAR

12.14.1 COMPANY SNAPSHOT

12.14.2 PRODUCT PORTFOLIO

12.14.3 RECENT UPDATE

12.15 KWIKSPACE

12.15.1 COMPANY SNAPSHOT

12.15.2 PRODUCT PORTFOLIO

12.15.3 RECENT UPDATES

12.16 MODULAR ENGINEERING

12.16.1 COMPANY SNAPSHOT

12.16.2 PRODUCT PORTFOLIO

12.16.3 RECENT UPDATES

12.17 NORTHGATE INDUSTRIES LTD.

12.17.1 COMPANY SNAPSHOT

12.17.2 PRODUCT PORTFOLIO

12.17.3 RECENT UPDATE

12.18 RED SEA INTERNATIONAL

12.18.1 COMPANY SNAPSHOT

12.18.2 REVENUE ANALYSIS

12.18.3 PRODUCT PORTFOLIO

12.18.4 RECENT UPDATE

12.19 WERNICK GROUP

12.19.1 COMPANY SNAPSHOT

12.19.2 PRODUCT PORTFOLIO

12.19.3 RECENT UPDATES

12.2 WESTCHESTER MODULAR HOMES

12.20.1 COMPANY SNAPSHOT

12.20.2 PRODUCT PORTFOLIO

12.20.3 RECENT UPDATES

13 QUESTIONNAIRE

14 RELATED REPORTS

List of Table

TABLE 1 IMPORT DATA OF PREFABRICATED BUILDINGS, WHETHER OR NOT COMPLETE OR ALREADY ASSEMBLED; HS CODE – 9406 (USD THOUSAND)

TABLE 2 EXPORT DATA OF PREFABRICATED BUILDINGS, WHETHER OR NOT COMPLETE OR ALREADY ASSEMBLED; HS CODE – 9406 (USD THOUSAND)

TABLE 3 ASIA PACIFIC MODULAR CONSTRUCTION MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 4 ASIA PACIFIC MODULAR CONSTRUCTION MARKET, BY TYPE, 2021-2030 (AVERAGE SQUARE FEET)

TABLE 5 ASIA PACIFIC PERMANENT IN MODULAR CONSTRUCTION MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 6 ASIA PACIFIC PERMANENT IN MODULAR CONSTRUCTION MARKET, BY REGION, 2021-2030 (AVERAGE SQUARE FEET)

TABLE 7 ASIA PACIFIC RELOCATABLE IN MODULAR CONSTRUCTION MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 8 ASIA PACIFIC RELOCATABLE IN MODULAR CONSTRUCTION MARKET, BY REGION, 2021-2030 (AVERAGE SQUARE FEET)

TABLE 9 ASIA PACIFIC MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 10 ASIA PACIFIC WOOD IN MODULAR CONSTRUCTION MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 11 ASIA PACIFIC STEEL IN MODULAR CONSTRUCTION MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 12 ASIA PACIFIC CONCRETE IN MODULAR CONSTRUCTION MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 13 ASIA PACIFIC OTHERS IN MODULAR CONSTRUCTION MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 14 ASIA PACIFIC MODULAR CONSTRUCTION MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 15 ASIA PACIFIC RESIDENTIAL IN MODULAR CONSTRUCTION MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 16 ASIA PACIFIC HOSPITALITY IN MODULAR CONSTRUCTION MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 17 ASIA PACIFIC HEALTHCARE IN MODULAR CONSTRUCTION MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 18 ASIA PACIFIC EDUCATION IN MODULAR CONSTRUCTION MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 19 ASIA PACIFIC RETAIL AND COMMERCIAL IN MODULAR CONSTRUCTION MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 20 ASIA PACIFIC RETAIL AND COMMERCIAL IN MODULAR CONSTRUCTION MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 21 ASIA PACIFIC OFFICE IN MODULAR CONSTRUCTION MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 22 ASIA PACIFIC OTHERS IN MODULAR CONSTRUCTION MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 23 ASIA-PACIFIC MODULAR CONSTRUCTION MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 24 ASIA-PACIFIC MODULAR CONSTRUCTION MARKET, BY COUNTRY, 2021-2030 (AVERAGE SQUARE FEET)

TABLE 25 ASIA-PACIFIC MODULAR CONSTRUCTION MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 26 ASIA-PACIFIC MODULAR CONSTRUCTION MARKET, BY TYPE, 2021-2030 (AVERAGE SQUARE FEET)

TABLE 27 ASIA-PACIFIC MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 28 ASIA-PACIFIC MODULAR CONSTRUCTION MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 29 ASIA-PACIFIC RETAIL AND COMMERCIAL IN MODULAR CONSTRUCTION MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 30 CHINA MODULAR CONSTRUCTION MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 31 CHINA MODULAR CONSTRUCTION MARKET, BY TYPE, 2021-2030 (AVERAGE SQUARE FEET)

TABLE 32 CHINA MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 33 CHINA MODULAR CONSTRUCTION MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 34 CHINA RETAIL AND COMMERCIAL IN MODULAR CONSTRUCTION MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 35 INDIA MODULAR CONSTRUCTION MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 36 INDIA MODULAR CONSTRUCTION MARKET, BY TYPE, 2021-2030 (AVERAGE SQUARE FEET)

TABLE 37 INDIA MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 38 INDIA MODULAR CONSTRUCTION MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 39 INDIA RETAIL AND COMMERCIAL IN MODULAR CONSTRUCTION MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 40 JAPAN MODULAR CONSTRUCTION MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 41 JAPAN MODULAR CONSTRUCTION MARKET, BY TYPE, 2021-2030 (AVERAGE SQUARE FEET)

TABLE 42 JAPAN MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 43 JAPAN MODULAR CONSTRUCTION MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 44 JAPAN RETAIL AND COMMERCIAL IN MODULAR CONSTRUCTION MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 45 SOUTH KOREA MODULAR CONSTRUCTION MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 46 SOUTH KOREA MODULAR CONSTRUCTION MARKET, BY TYPE, 2021-2030 (AVERAGE SQUARE FEET)

TABLE 47 SOUTH KOREA MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 48 SOUTH KOREA MODULAR CONSTRUCTION MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 49 SOUTH KOREA RETAIL AND COMMERCIAL IN MODULAR CONSTRUCTION MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 50 AUSTRALIA & NEW ZEALAND MODULAR CONSTRUCTION MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 51 AUSTRALIA & NEW ZEALAND MODULAR CONSTRUCTION MARKET, BY TYPE, 2021-2030 (AVERAGE SQUARE FEET)

TABLE 52 AUSTRALIA & NEW ZEALAND MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 53 AUSTRALIA & NEW ZEALAND MODULAR CONSTRUCTION MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 54 AUSTRALIA & NEW ZEALAND RETAIL AND COMMERCIAL IN MODULAR CONSTRUCTION MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 55 SINGAPORE MODULAR CONSTRUCTION MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 56 SINGAPORE MODULAR CONSTRUCTION MARKET, BY TYPE, 2021-2030 (AVERAGE SQUARE FEET)

TABLE 57 SINGAPORE MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 58 SINGAPORE MODULAR CONSTRUCTION MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 59 SINGAPORE RETAIL AND COMMERCIAL IN MODULAR CONSTRUCTION MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 60 THAILAND MODULAR CONSTRUCTION MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 61 THAILAND MODULAR CONSTRUCTION MARKET, BY TYPE, 2021-2030 (AVERAGE SQUARE FEET)

TABLE 62 THAILAND MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 63 THAILAND MODULAR CONSTRUCTION MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 64 THAILAND RETAIL AND COMMERCIAL IN MODULAR CONSTRUCTION MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 65 HONG KONG MODULAR CONSTRUCTION MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 66 HONG KONG MODULAR CONSTRUCTION MARKET, BY TYPE, 2021-2030 (AVERAGE SQUARE FEET)

TABLE 67 HONG KONG MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 68 HONG KONG MODULAR CONSTRUCTION MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 69 HONG KONG RETAIL AND COMMERCIAL IN MODULAR CONSTRUCTION MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 70 TAIWAN MODULAR CONSTRUCTION MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 71 TAIWAN MODULAR CONSTRUCTION MARKET, BY TYPE, 2021-2030 (AVERAGE SQUARE FEET)

TABLE 72 TAIWAN MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 73 TAIWAN MODULAR CONSTRUCTION MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 74 TAIWAN RETAIL AND COMMERCIAL IN MODULAR CONSTRUCTION MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 75 INDONESIA MODULAR CONSTRUCTION MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 76 INDONESIA MODULAR CONSTRUCTION MARKET, BY TYPE, 2021-2030 (AVERAGE SQUARE FEET)

TABLE 77 INDONESIA MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 78 INDONESIA MODULAR CONSTRUCTION MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 79 INDONESIA RETAIL AND COMMERCIAL IN MODULAR CONSTRUCTION MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 80 MALAYSIA MODULAR CONSTRUCTION MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 81 MALAYSIA MODULAR CONSTRUCTION MARKET, BY TYPE, 2021-2030 (AVERAGE SQUARE FEET)

TABLE 82 MALAYSIA MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 83 MALAYSIA MODULAR CONSTRUCTION MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 84 MALAYSIA RETAIL AND COMMERCIAL IN MODULAR CONSTRUCTION MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 85 PHILIPPINES MODULAR CONSTRUCTION MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 86 PHILIPPINES MODULAR CONSTRUCTION MARKET, BY TYPE, 2021-2030 (AVERAGE SQUARE FEET)

TABLE 87 PHILIPPINES MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 88 PHILIPPINES MODULAR CONSTRUCTION MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 89 PHILIPPINES RETAIL AND COMMERCIAL IN MODULAR CONSTRUCTION MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 90 REST OF ASIA-PACIFIC MODULAR CONSTRUCTION MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 91 REST OF ASIA-PACIFIC MODULAR CONSTRUCTION MARKET, BY TYPE, 2021-2030 (AVERAGE SQUARE FEET)

List of Figure

FIGURE 1 ASIA PACIFIC MODULAR CONSTRUCTION MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC MODULAR CONSTRUCTION MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC MODULAR CONSTRUCTION MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC MODULAR CONSTRUCTION MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC MODULAR CONSTRUCTION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC MODULAR CONSTRUCTION MARKET: THE TYPE LIFE LINE CURVE

FIGURE 7 ASIA PACIFIC MODULAR CONSTRUCTION MARKET: MULTIVARIATE MODELLING

FIGURE 8 ASIA PACIFIC MODULAR CONSTRUCTION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 ASIA PACIFIC MODULAR CONSTRUCTION MARKET: DBMR MARKET POSITION GRID

FIGURE 10 ASIA PACIFIC MODULAR CONSTRUCTION MARKET: MARKET END-USER COVERAGE GRID

FIGURE 11 ASIA PACIFIC MODULAR CONSTRUCTION MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 ASIA PACIFIC MODULAR CONSTRUCTION MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 ASIA PACIFIC MODULAR CONSTRUCTION MARKET: SEGMENTATION

FIGURE 14 GROWING EMPHASIS ON SUSTAINABILITY, QUALITY, AND WORKERS' SAFETY IS EXPECTED TO DRIVE THE ASIA PACIFIC MODULAR CONSTRUCTION MARKET IN THE FORECAST PERIOD

FIGURE 15 PERMANENT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC MODULAR CONSTRUCTION MARKET IN 2023 & 2030

FIGURE 16 SUPPLY CHAIN ANALYSIS

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC MODULAR CONSTRUCTION MARKET

FIGURE 18 ASIA PACIFIC MODULAR CONSTRUCTION MARKET: BY TYPE, 2022

FIGURE 19 ASIA PACIFIC MODULAR CONSTRUCTION MARKET: BY MATERIAL, 2022

FIGURE 20 ASIA PACIFIC MODULAR CONSTRUCTION MARKET: BY END-USER, 2022

FIGURE 21 ASIA-PACIFIC MODULAR CONSTRUCTION MARKET: SNAPSHOT (2022)

FIGURE 22 ASIA-PACIFIC MODULAR CONSTRUCTION MARKET: BY COUNTRY (2022)

FIGURE 23 ASIA-PACIFIC MODULAR CONSTRUCTION MARKET: BY COUNTRY (2023 & 2030)

FIGURE 24 ASIA-PACIFIC MODULAR CONSTRUCTION MARKET: BY COUNTRY (2022 & 2030)

FIGURE 25 ASIA-PACIFIC MODULAR CONSTRUCTION MARKET: BY TYPE (2022 - 2030)

FIGURE 26 ASIA PACIFIC MODULAR CONSTRUCTION MARKET: COMPANY SHARE 2022 (%)

Asia Pacific Modular Construction Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Asia Pacific Modular Construction Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Asia Pacific Modular Construction Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.