Market Analysis and Insights : Asia-Pacific Meat Extract Market

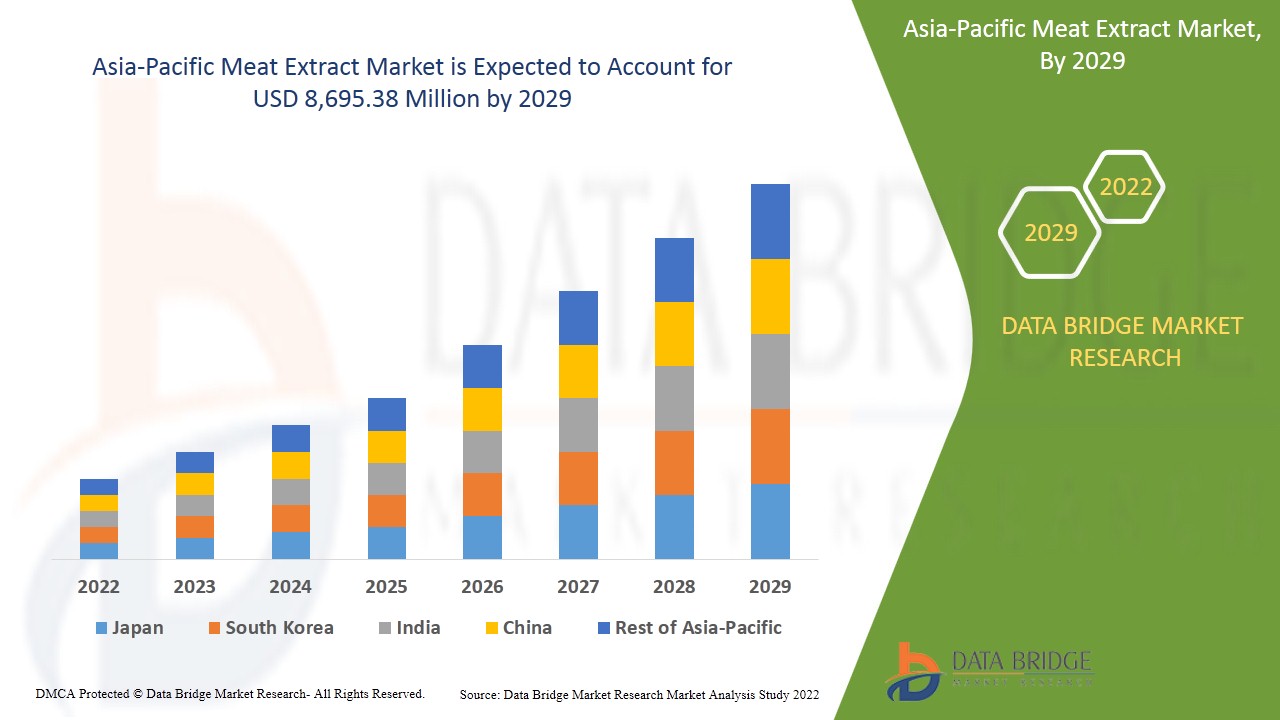

Asia-Pacific meat extract market is expected to gain market growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 5.6% in the forecast period of 2022 to 2029 and is expected to reach USD 8,695.38 million by 2029. Growing demand for protein-rich food products and beverages among consumers is expected to drive the Asia-Pacific meat extract market growth.

Meat extract contains the concentrated essence of meat. It is a rich form of meat stock obtained from animal sources such as beef, chicken, pork, seafood, and others. Meat extract is enriched with protein content and offers various health benefits such as boosting immune health, building and repairing healthy muscle, bones, skin and blood cells, and others. It is widely used for both industrial and commercial purposes. It acts as a flavoring agent for making processed food and beverages by improving the taste and flavor of the food. It is also used in biological research for culture media preparation and other purposes like industrial fermentation, analytical microbiology, and others.

Meat extracts are of two types, stock and extract, used as a flavoring agent, prepare culture media, and other purposes. The growing demand for the high nutritional value of meat extracts coupled with extensive use of meat extract in microbiology to grow culture media is anticipated to propel the growth of the Asia-Pacific meat extract market. However, stringent regulations laid by governmental bodies may hamper the market's growth.

Growing demand for protein-rich products is projected to create immense opportunities for meat extract manufacturers, whereas high competition among market players may challenge the market's growth.

The Asia-Pacific meat extract market report provides details of market share, new developments, and product pipeline analysis, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the Asia-Pacific meat extract market scenario, contact Data Bridge Market Research for an Analyst Brief; our team will help you create a revenue impact solution to achieve your desired goal.

Asia-Pacific Meat Extract Market Scope and Market Size

The Asia-Pacific meat extract market is segmented based on product, type, form, function, category, and application. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

- On the basis of product, the Asia-Pacific meat extract market is segmented into beef extract, pork extract, chicken extract, fish extract, lamb extract, and other meat extracts. In 2022, the beef extract segment is expected to dominate the Asia-Pacific meat extract market due to the increased consumption and production of beef and beef products.

- On the basis of type, the Asia-Pacific meat extract market is segmented into stock and extract. In 2022, the stock segment is expected to dominate the Asia-Pacific meat extract market due to the growing demand for stock in the food & beverages industry to enhance the flavor of processed products.

- On the basis of form, the Asia-Pacific meat extract market is segmented into powder, paste, and liquid. In 2022, the powder segment is expected to dominate the Asia-Pacific meat extract market due to the growing demand for easily soluble meat extract to prepare various dishes such as soups, sauces, noodles, and others.

- On the basis of function, the Asia-Pacific meat extract market is segmented into flavoring agent, preparation of culture media, and others. In 2022, the flavoring agent segment is expected to dominate the Asia-Pacific meat extract market due to the increasing demand for meat extract in the food & beverages industry to enhance the taste of products.

- On the basis of category, the Asia-Pacific meat extract market is segmented into organic and conventional. In 2022, the conventional segment is expected to dominate the Asia-Pacific meat extract market due to rising demand for conventional and low-priced meat extract products for functions, including preparation of culture media, flavoring agents, and others.

- On the basis of application, the Asia-Pacific meat extract market is segmented into food & beverage and pharmaceutical/laboratory research. In 2022, the food & beverage segment is expected to dominate the Asia-Pacific meat extract market due to surging demand for meat extract as a flavoring agent among food manufacturers, commercial consumers, and others.

Asia-Pacific Meat Extract Market Country Level Analysis

Asia-Pacific meat extract market is analyzed, and market size information is provided by the country, product, type, form, function, category, and application as referenced above.

Some of the countries covered in the Asia-Pacific meat extract market report are China, Australia, Japan, South Korea, Singapore, Malaysia, Indonesia, Philippines, India, Thailand, New Zealand, Vietnam, Rest of Asia-Pacific. China is expected to dominate the market due to the increased consumption of meat and meat products. Japan may dominate the market due to the surging demand for meat extract among food & beverages, cosmetic manufacturers, and others.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of sales channels are considered while providing forecast analysis of the country data.

Growing Strategic Activities by Major Market Players to Boost the Market Growth of Asia-Pacific Meat Extract Market

Asia-Pacific meat extract market also provides you with a detailed market analysis for every country's growth in the particular market. Additionally, it provides detailed information regarding the market players’ strategy and geographical presence. The data is available for the historical period 2011 to 2020.

Competitive Landscape and Asia-Pacific Meat Extract Market Share Analysis

Asia-Pacific meat extract market competitive landscape provides details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width, and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus related to the Asia-Pacific meat extract market.

Some of the major companies in the Asia-Pacific meat extract market are Kerry, PT. Foodex Indonesia, Maverick Biosciences, MP BIOMEDICALS, NH Foods Australia., Nikken Foods Co.,Ltd., Essentia Protein Solutions, HiMedia Laboratories., Thermo Fisher Scientific Inc., BD, NEOGEN Corporation, International Dehydrated Foods, Inc., ARIAKE JAPAN Co.,Ltd., Meioh Bussan Co., Ltd., among other domestic players. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

Many expansion and funding are also initiated by the companies worldwide, which also accelerates the Asia-Pacific meat extract market.

For instance,

- In June 2021, according to Industry Dive, Kerry acquired Niacet, a clean-label, low-sodium preservatives specialist, for around USD one billion. This acquisition aims to use their preservation technologies for meat-based products and their drying and granulation process for meat, and other applications

- In June 2021, Essentia Protein Solutions launched a new product named Essentia C3307 Chicken Flavor to enhance the multi-species ProFlavor line. The new flavor is high in protein, low in carbs, and has no added salt

Product launches, business expansion, award and recognition, and other strategies by the market player are enhancing the company footprints in the Asia-Pacific meat extract market, which also benefits the organization’s profit growth.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC MEAT EXTRACT MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 BRAND ANALYSIS

4.2 COMPARATIVE ANALYSIS WITH PARENT MARKET

4.3 LIST OF SUBSTITUTES IN THE ASIA PACIFIC MEAT EXTRACT MARKET

4.4 ASIA PACIFIC MEAT EXTRACT MARKET: MARKETING STRATEGIES

4.4.1 LAUNCHING INNOVATIVE MEAT EXTRACT PRODUCTS

4.4.2 THOUGHTFUL PACKAGING

4.4.3 A VAST NETWORK OF DISTRIBUTION

4.5 RAW MATERIAL PRICING ANALYSIS

4.6 SUPPLY CHAIN OF ASIA PACIFIC MEAT EXTRACT MARKET

4.6.1 RAW MATERIAL PROCUREMENT

4.6.2 MEAT EXTRACT PRODUCTION/PROCESSING

4.6.3 MARKETING & DISTRIBUTION

4.6.4 END USERS

4.7 VALUE CHAIN OF ASIA PACIFIC MEAT EXTRACT MARKET

5 ASIA PACIFIC MEAT EXTRACT MARKET- REGULATORY FRAMEWORKS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 HIGH NUTRITIONAL VALUE OF MEAT EXTRACT

6.1.2 SURGE IN THE DEMAND FOR CLEAN LABEL FOOD

6.1.3 EXTENSIVE USE OF MEAT EXTRACT IN MICROBIOLOGY TO GROW CULTURE MEDIA

6.1.4 INCREASING AWARENESS REGARDING DIET CLAIMS

6.2 RESTRAINTS

6.2.1 STRINGENT REGULATIONS LAID BY THE GOVERNMENT BODIES

6.2.2 HIGH IMPACT OF RELIGIOUS SENTIMENTS ON THE MARKET

6.3 OPPORTUNITIES

6.3.1 GROWING DEMAND FOR PROTEIN-RICH PRODUCTS

6.3.2 RISE IN CHANGING ASIA PACIFIC DIET TRENDS AND INCREASING HEALTH-CONSCIOUS CONSUMERS

6.4 CHALLENGES

6.4.1 HIGH COMPETITION AMONG MARKET PLAYERS

6.4.2 SUPPLY CHAIN DISRUPTION DUE TO COVID-19

7 ASIA PACIFIC MEAT EXTRACT MARKET, BY TYPE

7.1 OVERVIEW

7.2 STOCK

7.3 EXTRACT

8 ASIA PACIFIC MEAT EXTRACT MARKET, BY FUNCTION

8.1 OVERVIEW

8.2 FLAVORING AGENT

8.3 PREPARATION OF CULTURE MEDIA

8.4 OTHERS

9 ASIA PACIFIC MEAT EXTRACT MARKET, BY CATEGORY

9.1 OVERVIEW

9.2 CONVENTIONAL

9.3 ORGANIC

10 ASIA PACIFIC MEAT EXTRACT MARKET, BY PRODUCT

10.1 OVERVIEW

10.2 BEEF EXTRACT

10.2.1 BEEF EXTRACT, BY TYPE

10.2.2 STOCK

10.2.3 EXTRACT

10.3 PORK EXTRACT

10.3.1 PORK EXTRACT, BY TYPE

10.3.2 STOCK

10.3.3 EXTRACT

10.4 CHICKEN EXTRACT

10.4.1 CHICKEN EXTRACT, BY TYPE

10.4.2 STOCK

10.4.3 EXTRACT

10.5 FISH EXTRACT

10.5.1 FISH EXTRACT, BY TYPE

10.5.2 STOCK

10.5.3 EXTRACT

10.6 LAMB EXTRACT

10.6.1 LAMB EXTRACT, BY TYPE

10.6.2 STOCK

10.6.3 EXTRACT

10.7 OTHER MEAT EXTRACTS

11 ASIA PACIFIC MEAT EXTRACT MARKET, BY FORM

11.1 OVERVIEW

11.2 POWDER

11.3 PASTE

11.4 LIQUID

12 ASIA PACIFIC MEAT EXTRACT MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 FOOD & BEVERAGE

12.2.1 FOOD & BEVERAGE, BY TYPE

12.2.1.1 SOUP BROTHS

12.2.1.2 READY-TO-EAT MEALS

12.2.1.3 SEASONING & SAUCES

12.2.1.4 PROCESSED FOODS

12.2.1.4.1 INSTANT NOODLES

12.2.1.4.2 INSTANT SOUP POWDER

12.2.1.4.3 OTHERS

12.2.1.5 MEAT BASED SNACKS

12.2.1.5.1 SAUSAGES

12.2.1.5.2 MEATBALLS

12.2.1.5.3 MEAT BURGERS

12.2.1.5.4 NUGGETS

12.2.1.5.5 OTHERS

12.2.1.6 BAKERY & CONFECTIONERY PRODUCTS

12.2.1.7 BEVERAGES

12.2.1.8 SPORTS NUTRITION

12.2.1.9 OTHERS

12.2.2 FOOD & BEVERAGE, BY FORM

12.2.2.1 POWDER

12.2.2.2 PASTE

12.2.2.3 LIQUID

12.3 PHARMACEUTICAL/LABORATORY RESEARCH

12.3.1 PHARMACEUTICAL/LABORATORY RESEARCH, BY TYPE

12.3.1.1 MICROBIOLOGICAL ANALYSIS

12.3.1.2 ANIMAL HEALTH VACCINES

12.3.1.3 OTHERS

12.3.2 PHARMACEUTICAL/LABORATORY RESEARCH, BY FORM

12.3.2.1 POWDER

12.3.2.2 PASTE

12.3.2.3 LIQUID

13 ASIA PACIFIC MEAT EXTRACT MARKET, BY REGION

13.1 ASIA-PACIFIC

13.1.1 CHINA

13.1.2 JAPAN

13.1.3 INDIA

13.1.4 SOUTH KOREA

13.1.5 AUSTRALIA

13.1.6 NEW ZEALAND

13.1.7 MALAYSIA

13.1.8 SINGAPORE

13.1.9 INDONESIA

13.1.10 PHILIPPINES

13.1.11 THAILAND

13.1.12 VIETNAM

13.1.13 REST OF ASIA-PACIFIC

14 ASIA PACIFIC MEAT EXTRACT MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 KERRY

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 THERMO FISHER SCIENTIFIC INC.

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENT

16.3 BD

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENT

16.4 NH FOODS AUSTRALIA

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 PACIFIC FOODS OF OREGON, LLC.

16.5.1 COMPANY SNAPSHOT

16.5.2 PRODUCT PORTFOLIO

16.5.3 RECENT DEVELOPMENTS

16.6 ARIAKE JAPAN CO.LTD.

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 ESSENTIA PROTEIN SOLUTIONS

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 A. COSTANTINO & C.SPA

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 ABBEXA

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 ALPHA BIOSCIENCES

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 BARE BONES

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 BIO BASIC INC.

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 BONAFIDE PROVISIONS

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 CARNAD

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 COLIN INGRÉDIENTS

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 HARDY DIAGNOSTICS

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENT

16.17 HIMEDIA LABORATORIES

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENT

16.18 INTERNATIONAL DEHYDRATED FOODS, INC.

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENTS

16.19 JBS ASIA PACIFIC

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENT

16.2 MAVERICK BIOSCIENCES

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENT

16.21 MEIOH BUSSAN CO., LTD.

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENT

16.22 MP BIOMEDICALS

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENT

16.23 NEOGEN CORPORATION.

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 RECENT DEVELOPMENTS

16.24 NIKKEN FOODS CO., LTD.

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 RECENT DEVELOPMENT

16.25 PROLIANT BIOLOGICALS LLC.

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT DEVELOPMENT

16.26 PT. FOODEX INDONESIA

16.26.1 COMPANY SNAPSHOT

16.26.2 PRODUCT PORTFOLIO

16.26.3 RECENT DEVELOPMENT

17 QUESTIONARE:

18 RELATED REPORTS

List of Table

TABLE 1 COMPARISON OF MEAT EXTRACT WITH MEAT (PER 100G)

TABLE 2 LIST OF MEAT EXTRACT SUBSTITUTES

TABLE 3 BEEF MEAT PRICES

TABLE 4 CHICKEN MEAT PRICES

TABLE 5 TURKEY MEAT PRICES

TABLE 6 OTHER POULTRY MEAT PRICES

TABLE 7 PORK MEAT PRICES

TABLE 8 SEAFOOD MEAT PRICES

TABLE 9 BEEF MEAT PRICE AS PER COUNTRY

TABLE 10 CHICKEN MEAT PRICES AS PER COUNTRY

TABLE 11 NUTRITIONAL INFORMATION OF BEEF MEAT EXTRACT (PER 100 GRAMS)

List of Figure

FIGURE 1 ASIA PACIFIC MEAT EXTRACT MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC MEAT EXTRACT MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC MEAT EXTRACT MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC MEAT EXTRACT MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC MEAT EXTRACT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC MEAT EXTRACT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC MEAT EXTRACT MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC MEAT EXTRACT MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ASIA PACIFIC MEAT EXTRACT MARKET: SEGMENTATION

FIGURE 10 EUROPE IS EXPECTED TO DOMINATE THE ASIA PACIFIC MEAT EXTRACT MARKET AND GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 11 HIGH NUTRITIONAL VALUE OF MEAT EXTRACT IS EXPECTED TO DRIVE THE ASIA PACIFIC MEAT EXTRACT MARKET IN THE FORECAST PERIOD

FIGURE 12 BEEF EXTRACT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC MEAT EXTRACT MARKET IN 2022 & 2029

FIGURE 13 SUPPLY CHAIN OF ASIA PACIFIC MEAT EXTRACT MARKET

FIGURE 14 VALUE CHAIN OF ASIA PACIFIC MEAT EXTRACT MARKET

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC MEAT EXTRACT MARKET

FIGURE 16 ASIA PACIFIC MEAT EXTRACT MARKET, BY TYPE, 2021

FIGURE 17 ASIA PACIFIC MEAT EXTRACT MARKET, BY FUNCTION, 2021

FIGURE 18 ASIA PACIFIC MEAT EXTRACT MARKET, BY CATEGORY, 2021

FIGURE 19 ASIA PACIFIC MEAT EXTRACT MARKET, BY PRODUCT, 2021

FIGURE 20 ASIA PACIFIC MEAT EXTRACT MARKET, BY FORM, 2021

FIGURE 21 ASIA PACIFIC MEAT EXTRACT MARKET, BY APPLICATION, 2021

FIGURE 22 ASIA-PACIFIC MEAT EXTRACT MARKET: SNAPSHOT (2021)

FIGURE 23 ASIA-PACIFIC MEAT EXTRACT MARKET: BY COUNTRY (2021)

FIGURE 24 ASIA-PACIFIC MEAT EXTRACT MARKET: BY COUNTRY (2022 & 2029)

FIGURE 25 ASIA-PACIFIC MEAT EXTRACT MARKET: BY COUNTRY (2021 & 2029)

FIGURE 26 ASIA-PACIFIC MEAT EXTRACT MARKET: BY PRODUCT (2022 & 2029)

FIGURE 27 ASIA PACIFIC MEAT EXTRACT MARKET: COMPANY SHARE 2021 (%)

Asia Pacific Meat Extract Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Asia Pacific Meat Extract Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Asia Pacific Meat Extract Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.