Market Analysis and Size

Lithium ion battery has been in high demand in the past few years as it delivers high open-circuit voltage and a good energy-to-weight ratio. These batteries do not require scheduled cycling to enhance its service life. Lithium ion battery is utilized in numerous industry verticals, such as automotive and consumer electronics, among others.

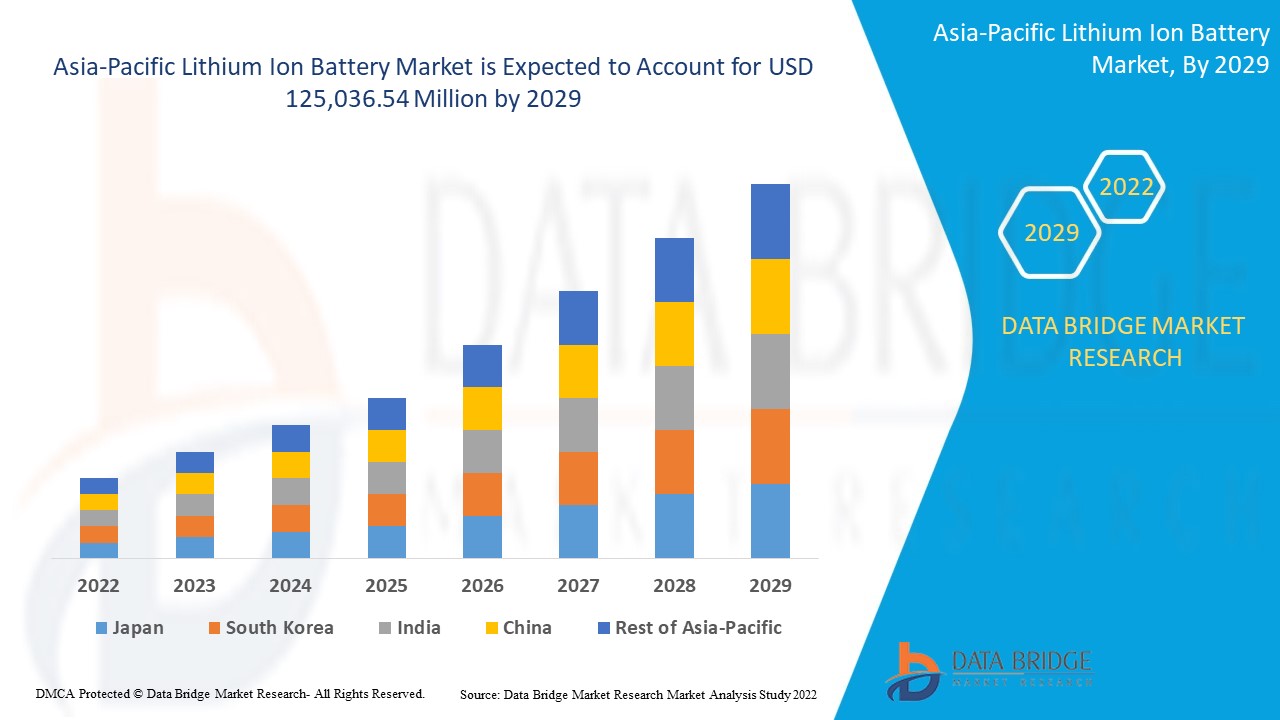

Asia-Pacific Lithium Ion Battery Market was valued at USD 25,293.82 million in 2021 and is expected to reach USD 125,036.54 million by 2029, registering a CAGR of 16.80% during the forecast period of 2022-2029. Consumer electronics accounts for the largest vertical segment in the respective market owing to the high usage of batteries in electronic gadgets. The market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Market Definition

Lithium ion battery comprises of lithium ions which moves from negative electrode to the positive electrode through the electrolyte during charging and moves backwards at the time of charging. These batteries are rechargeable and commonly used in consumer electronics and automobiles. It consists of four components cathode, anode, separator and electrolyte. Anode helps in storing and releasing of lithium ions from cathode, enabling the pass of current through an external circuit.

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Type (Medical Robots, Drones, Cleaning Robots, Entertainment Robots, Education Robots, Personal/Handicap Assistant Robots, Public Relation Robots, Security and Surveillance Robots), End User (Commercial, Residential, Industrial) |

|

Countries Covered |

Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific |

|

Market Players Covered |

Type (Lithium Cobalt Oxide (LCO), Lithium Manganese Oxide (LMO), Lithium Nickel Manganese Cobalt Oxide (LI-NMC), Lithium Iron Phosphate (LFP), Lithium Nickel Cobalt Aluminum Oxide (NCA) and Lithium Titanate Oxide (LTO)), Component (Anode, Cathode, Electrolytic and Separator), Power Capacity (Below 3000 mAh, 3000 mAh to 10000 mAh, 10000 mAh to 60000 mAh and Above 60000 mAh), Product (Cell, Module, Pack and Energy Storage System (ESS)), Vertical (Automotive, Consumer Electronics, Aerospace and Defense, Industrial, Construction, Power, Telecom, Marine and Others) |

|

Market Opportunities |

|

Asia-Pacific Lithium Ion Battery Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

- High Demand for Consumer Electronics

The rise in demand for consumer electronics across the globe acts as one of the major factors driving the growth of lithium ion battery market. The penetration of portable variants, such as laptops, gaming consoles, smartphones, torches, and digital cameras, along with high-speed internet connectivity has a positive impact on the market.

- Demand for High-Quality Rechargeable Batteries

The increase in the demand for high-quality rechargeable batteries accelerate the market growth. Also, the usage of these electronics and use of lithium ion battery as an indispensable component of electric vehicles (EVs) drives the market.

- Sustainable Development

The rise in focus on sustainable development along with increase in awareness regarding the adverse effects of using traditional automobiles further influence the market. Various governments of numerous countries are implementing favorable initiatives to promote the sales of EVs.

Additionally, rapid urbanization, change in lifestyle, surge in investments and increased consumer spending positively impact the lithium ion battery market.

Opportunities

Furthermore, use of LIB as a crucial component in grid energy storage extend profitable opportunities to the market players in the forecast period of 2022 to 2029. Also, increase in number of research and development initiatives by manufacturers for improvements in Li-ion batteries will further expand the market.

Restraints/Challenges

On the other hand, safety issues related to storage and transportation of spent batteries and high costs associated with battery-operated industrial vehicles are expected to obstruct market growth. Also, aging of lithium-ion batteries and issues with overheating of lithium-ion batteries are projected to challenge the lithium ion battery market in the forecast period of 2022-2029.

This lithium ion battery market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on lithium ion battery market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Asia-Pacific Lithium Ion Battery Market

COVID-19 had a negative impact on various industries including lithium ion battery market. Both public and government sectors suffered greatly due to the facing financial crises during the outbreak of COVID-19. Businesses were shut down in numerous countries because of the social distancing guidelines and the imposition of lockdown. The lithium ion battery industry faced huge problems due to the shortage of labourers declining the low production. A decline in the demand for lithium ion battery was witnessed owing to the limited production and shut down of industries, such as oil and gas sectors, among others. However, the lithium ion battery market is expected to witness growth in demand after the post-covid-19 situation.

Recent Developments

- CATL and Daimler Truck AG announced the intensification of their existing partnership in May’2021. These are based on their shared vision of CO2-neutral electrified trucking. CATL will act as a supplier of lithium-ion battery packs for the Mercedes-Benz eActros LongHaul battery-electric truck. These trucks will be ready for series production in 2024.

Global Asia-Pacific Lithium Ion Battery Market Scope and Market Size

The lithium ion battery market is segmented on the basis of type, component, power capacity, product and vertical. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Lithium Cobalt Oxide (LCO)

- Lithium Manganese Oxide (LMO)

- Lithium Nickel Manganese Cobalt Oxide (LI-NMC)

- Lithium Iron Phosphate (LFP)

- Lithium Nickel Cobalt Aluminum Oxide (NCA)

- Lithium Titanate Oxide (LTO)

Component

- Anode

- Cathode

- Separator

- Electrolytic

Power Capacity

- Below 3000 mAh

- 3000 mAh to 10000 mAh

- 10000 mAh to 60000 mAh

- Above 60000 mAh

Vertical

- Automotive

- Consumer Electronics

- Aerospace and Defense

- Industrial

- Construction

- Power

- Telecom

- Marine

- Others

Asia-Pacific Lithium Ion Battery Market Regional Analysis/Insights

The lithium ion battery market is analysed and market size insights and trends are provided by country, component, load carrying capacity, type, number of wheels, and verticals as referenced above.

The countries covered in the lithium ion battery market report are Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, and Rest of Asia-Pacific.

China is dominating the market in Asia-Pacific region due to presence of large number of lithium ion battery manufacturers in the region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Asia-Pacific Lithium Ion Battery Market

The lithium ion battery market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to lithium ion battery market.

Some of the major players operating in the lithium ion battery market are

- Saft (France)

- SAMSUNG SDI CO.,LTD. (South Korea)

- Lithium Energy Japan (Japan)

- Tianjin Lishen Battery Co., Ltd. (China)

- Shenzhen A&S Power Technology Co., Ltd. (China)

- LITHIUMWERKS (Europe)

- GlobTek, Inc. (US)

- BYD Company Ltd (Chiana)

- Panasonic Corporation (Japan)

- LG Chem (South Korea)

- VARTA Microbattery GmbH (Germany)

- Dalian CBAK Power Battery Co., Ltd (China)

- TOSHIBA CORPORATION (Japan)

- CALB USA Inc. (US)

- Shenzhen BAK Technology Co., Ltd. (China)

- Contemporary Amperex Technology Co., Limited (China)

- A123 Systems LLC (US)

- Amperex Technology Limited (China)

- XALT Energy (Switzerland)

- Leclanche (Switzerland)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA-PACIFIC LITHIUM ION BATTERY MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TYPE TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 STANDARDS

4.2 VALUE CHAIN ANALYSIS

4.3 PRICE ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING DEMAND FOR SMARTPHONES AND CONSUMER ELECTRONICS

5.1.2 GROWING ADOPTION OF CORDLESS POWER TOOLS

5.1.3 GROWING DEMAND FOR SMART DEVICES AND WEARABLE

5.1.4 INCREASING NUMBER OF AUTOMOTIVE VEHICLES

5.1.5 HIGH REQUIREMENT FOR LITHIUM-ION BATTERIES FOR VARIOUS INDUSTRIAL AND MEDICAL APPLICATIONS

5.2 RESTRAINTS

5.2.1 SAFETY ISSUES RELATED TO STORAGE, USAGE AND TRANSPORTATION OF LITHIUM ION BATTERIES

5.2.2 AVAILABILITY OF ALTERNATIVE SOLUTIONS

5.3 OPPORTUNITIES

5.3.1 INCREASE IN DEMAND FOR ELECTRIC VEHICLES

5.3.2 GROWING NUMBER OF R&D INITIATIVES AND MANUFACTURING FACILITIES

5.3.3 INCREASING USE OF LITHIUM ION BATTERIES IN DEFENSE AND AEROSPACE

5.3.4 INCREASING GROWTH IN RENEWABLE ENERGY

5.4 CHALLENGES

5.4.1 OVERHEATING OF LITHIUM-ION BATTERIES

5.4.2 AGING AND DEGRADATION OF LITHIUM ION BATTERIES

5.4.3 HIGH COST OF BATTERY OPERATED VEHICLES

6 COVID-19 IMPACT ON ASIA-PACIFIC LITHIUM ION BATTERY MARKET IN SEMICONDUCTOR AND ELECTRONICS INDUSTRY

6.1 ANALYSIS ON IMPACT OF COVID-19

6.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVES TO BOOST THE MARKET

6.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.4 IMPACT ON DEMAND

6.5 IMPACT ON SUPPLY CHAIN

6.6 CONCLUSION

7 ASIA-PACIFIC LITHIUM ION BATTERY MARKET, BY TYPE

7.1 OVERVIEW

7.2 LITHIUM COBALT OXIDE (LCO)

7.3 LITHIUM NICKEL MANGANESE COBALT OXIDE(LI-NMC)

7.4 LITHIUM NICKEL COBALT ALUMINUM OXIDE(NCA)

7.5 LITHIUM MANGANESE OXIDE (LMO)

7.6 LITHIUM TITANATE OXIDE (LTO)

7.7 LITHIUM IRON PHOSPHATE (LFP)

8 ASIA-PACIFIC LITHIUM ION BATTERY MARKET, BY COMPONENT

8.1 OVERVIEW

8.2 ANODE

8.3 CATHODE

8.4 ELECTROLYTIC

8.5 SEPARATOR

9 ASIA-PACIFIC LITHIUM ION BATTERY MARKET, BY POWER CAPACITY

9.1 OVERVIEW

9.20 MAH TO 10000 MAH

9.300 MAH TO 60000 MAH

9.4 BELOW 3000 MAH

9.5 ABOVE 60000 MAH

10 ASIA-PACIFIC LITHIUM ION BATTERY MARKET, BY PRODUCT

10.1 OVERVIEW

10.2 CELL

10.2.1 CYLINDRICAL CELL

10.2.2 PRISMATIC CELL

10.2.3 POUCH CELL

10.2.4 BUTTON CELL

10.3 PACK

10.4 ENERGY STORAGE SYSTEM (ESS)

10.5 MODULE

11 ASIA-PACIFIC LITHIUM ION BATTERY MARKET, BY VERTICAL

11.1 OVERVIEW

11.2 CONSUMER ELECTRONICS

11.2.1 SMARTPHONES

11.2.2 LAPTOPS & TABLETS

11.2.3 ELECTRONIC CAMERAS

11.2.4 UPS

11.2.5 OTHERS

11.3 AUTOMOTIVE

11.3.1 POWER TYPE

11.3.1.1 BATTERY ELECTRIC VEHICLES (BEV)

11.3.1.2 PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV)

11.3.1.3 HYBRID ELECTRIC VEHICLES (HEV)

11.3.2 VEHICLE TYPE

11.3.2.1 PASSENGER CARS

11.3.2.2 E-BIKES/ E-SCOOTER/MOPEDS

11.3.2.3 LIGHT COMMERCIAL VEHICLES

11.3.2.4 HEAVY COMMERCIAL VEHICLES

11.3.2.5 3-WHEELED ELECTRIC SCOOTER

11.3.2.6 OTHERS

11.4 INDUSTRIAL

11.5 POWER

11.6 CONSTRUCTION

11.7 TELECOM

11.8 AEROSPACE AND DEFENSE

11.9 MARINE

11.1 OTHERS

12 ASIA-PACIFIC LITHIUM ION BATTERY MARKET, BY GEOGRAPHY

12.1 ASIA-PACIFIC

12.1.1 CHINA

12.1.2 JAPAN

12.1.3 SOUTH KOREA

12.1.4 INDIA

12.1.5 AUSTRALIA

12.1.6 SINGAPORE

12.1.7 THAILAND

12.1.8 MALAYSIA

12.1.9 INDONESIA

12.1.10 PHILIPPINES

12.1.11 REST OF ASIA-PACIFIC

13 ASIA-PACIFIC LITHIUM ION BATTERY MARKET:COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

14 SWOT

15 COMPANY PROFILES

15.1 LG CHEM

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 SAMSUNG SDI CO.,LTD.

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 CONTEMPORARY AMPEREX TECHNOLOGY CO., LIMITED

15.3.1 COMPANY SNAPSHOT

15.3.2 COMPANY SHARE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENTS

15.4 PANASONIC CORPORATION

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.5 BYD COMPANY LTD

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENT

15.6 SAFT (A SUBSIDIARY OF TOTAL)

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 A123 SYSTEMS LLC

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 LITHIUM ENERGY JAPAN (A SUBSIDIARY OF GS YUASA INTERNATIONAL LTD.)

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 VARTA MICROBATTERY GMBH (A SUBSIDIARY OF VARTA AG)

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENTS

15.1 AMPEREX TECHNOLOGY LIMITED (A SUBSIDIARY OF TDK CORPORATION)

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENT

15.11 CALB USA INC.

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 DALIAN CBAK POWER BATTERY CO., LTD

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENT

15.13 GLOBTEK, INC.

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 LECLANCHE

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT DEVELOPMENTS

15.15 LITHIUMWERKS

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

15.16 SHENZHEN A&S POWER TECHNOLOGY CO., LTD.

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 SHENZHEN BAK TECHNOLOGY CO., LTD.

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 TIANJIN LISHEN BATTERY CO., LTD.

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 TOSHIBA CORPORATION

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 PRODUCT PORTFOLIO

15.19.4 RECENT DEVELOPMENTS

15.2 XALT ENERGY

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

LIST OF TABLES

TABLE 1 ASIA-PACIFIC LITHIUM ION BATTERY MARKET, BY TYPE, MARKET FORECAST 2020-2027 (USD MILLION)

TABLE 2 ASIA-PACIFIC LITHIUM COBALT OXIDE (LCO) IN LITHIUM ION BATTERY MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 3 ASIA-PACIFIC LITHIUM NICKEL MANGANESE COBALT OXIDE(LI-NMC) IN LITHIUM ION BATTERY MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 4 ASIA-PACIFIC LITHIUM NICKEL COBALT ALUMINUM OXIDE(NCA) IN LITHIUM ION BATTERY MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 5 ASIA-PACIFIC LITHIUM MANGANESE OXIDE (LMO) IN LITHIUM ION BATTERY MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 6 ASIA-PACIFIC LITHIUM TITANATE OXIDE (LTO) IN LITHIUM ION BATTERY MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 7 ASIA-PACIFIC LITHIUM IRON PHOSPHATE (LFP) IN LITHIUM ION BATTERY MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 8 ASIA-PACIFIC LITHIUM ION BATTERY MARKET, BY COMPONENT, MARKET FORECAST 2020-2027 (USD MILLION)

TABLE 9 ASIA-PACIFIC ANODE IN LITHIUM ION BATTERY MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 10 ASIA-PACIFIC CATHODE IN LITHIUM ION BATTERY MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 11 ASIA-PACIFIC ELECTROLYTIC IN LITHIUM ION BATTERY MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 12 ASIA-PACIFIC SEPARATOR IN LITHIUM ION BATTERY MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 13 ASIA-PACIFIC LITHIUM ION BATTERY MARKET, BY POWER CAPACITY, MARKET FORECAST 2020-2027 (USD MILLION)

TABLE 14 ASIA-PACIFIC 3000 MAH TO 10000 MAH IN LITHIUM ION BATTERY MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 15 ASIA-PACIFIC 10000 MAH TO 60000 MAH IN LITHIUM ION BATTERY MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 16 ASIA-PACIFIC BELOW 3000 MAH IN LITHIUM ION BATTERY MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 17 ASIA-PACIFIC ABOVE 60000 MAH IN LITHIUM ION BATTERY MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 18 ASIA-PACIFIC LITHIUM ION BATTERY MARKET, BY PRODUCT, MARKET FORECAST 2020-2027 (USD MILLION)

TABLE 19 ASIA-PACIFIC CELL IN LITHIUM ION BATTERY MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 20 ASIA-PACIFIC CELL IN LITHIUM ION BATTERY MARKET, BY PRODUCT,2018-2027, (USD MILLION)

TABLE 21 ASIA-PACIFIC PACK IN LITHIUM ION BATTERY MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 22 ASIA-PACIFIC ENERGY STORAGE SYSTEM (ESS) IN LITHIUM ION BATTERY MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 23 ASIA-PACIFIC ENERGY STORAGE SYSTEM (ESS) IN LITHIUM ION BATTERY MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 24 ASIA-PACIFIC LITHIUM ION BATTERY MARKET, BY VERTICAL, MARKET FORECAST 2020-2027 (USD MILLION)

TABLE 25 ASIA-PACIFIC CONSUMER ELECTRONICS IN LITHIUM ION BATTERY MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 26 ASIA-PACIFIC CONSUMER ELECTRONICS IN LITHIUM ION BATTERY MARKET, BY VERTICAL,2018-2027, (USD MILLION)

TABLE 27 ASIA-PACIFIC AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 28 ASIA-PACIFIC AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY POWER TYPE,2018-2027, (USD MILLION)

TABLE 29 ASIA-PACIFIC AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY VEHICLE TYPE,2018-2027, (USD MILLION)

TABLE 30 ASIA-PACIFIC INDUSTRIAL IN LITHIUM ION BATTERY MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 31 ASIA-PACIFIC POWER IN LITHIUM ION BATTERY MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 32 ASIA-PACIFIC CONSTRUCTION IN LITHIUM ION BATTERY MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 33 ASIA-PACIFIC TELECOM IN LITHIUM ION BATTERY MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 34 ASIA-PACIFIC AEROSPACE AND DEFENSE IN LITHIUM ION BATTERY MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 35 ASIA-PACIFIC MARINE IN LITHIUM ION BATTERY MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 36 ASIA-PACIFIC INDUSTRIAL IN LITHIUM ION BATTERY MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 37 ASIA-PACIFIC LITHIUM ION BATTERY MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 38 ASIA-PACIFIC LITHIUM ION BATTERY MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 39 ASIA-PACIFIC LITHIUM ION BATTERY MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 40 ASIA-PACIFIC LITHIUM ION BATTERY MARKET, BY POWER CAPACITY, 2018-2027 (USD MILLION)

TABLE 41 ASIA-PACIFIC LITHIUM ION BATTERY MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 42 ASIA-PACIFIC CELL IN LITHIUM ION BATTERY MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 43 ASIA-PACIFIC COMMERCIAL IN LITHIUM ION BATTERY MARKET, BY VERTICAL, 2018-2027 (USD MILLION)

TABLE 44 ASIA-PACIFIC CONSUMER ELECTRONICS IN LITHIUM ION BATTERY MARKET, BY VERTICAL, 2018-2027 (USD MILLION)

TABLE 45 ASIA-PACIFIC AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY POWER TYPE, 2018-2027 (USD MILLION)

TABLE 46 ASIA-PACIFIC AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY VEHICLE TYPE, 2018-2027 (USD MILLION)

TABLE 47 CHINA LITHIUM ION BATTERY MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 48 CHINA LITHIUM ION BATTERY MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 49 CHINA LITHIUM ION BATTERY MARKET, BY POWER CAPACITY, 2018-2027 (USD MILLION)

TABLE 50 CHINA LITHIUM ION BATTERY MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 51 CHINA CELL IN LITHIUM ION BATTERY MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 52 CHINA COMMERCIAL IN LITHIUM ION BATTERY MARKET, BY VERTICAL, 2018-2027 (USD MILLION)

TABLE 53 CHINA CONSUMER ELECTRONICS IN LITHIUM ION BATTERY MARKET, BY VERTICAL, 2018-2027 (USD MILLION)

TABLE 54 CHINA AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY POWER TYPE, 2018-2027 (USD MILLION)

TABLE 55 CHINA AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY VEHICLE TYPE, 2018-2027 (USD MILLION)

TABLE 56 JAPAN LITHIUM ION BATTERY MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 57 JAPAN LITHIUM ION BATTERY MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 58 JAPAN LITHIUM ION BATTERY MARKET, BY POWER CAPACITY, 2018-2027 (USD MILLION)

TABLE 59 JAPAN LITHIUM ION BATTERY MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 60 JAPAN CELL IN LITHIUM ION BATTERY MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 61 JAPAN COMMERCIAL IN LITHIUM ION BATTERY MARKET, BY VERTICAL, 2018-2027 (USD MILLION)

TABLE 62 JAPAN CONSUMER ELECTRONICS IN LITHIUM ION BATTERY MARKET, BY VERTICAL, 2018-2027 (USD MILLION)

TABLE 63 JAPAN AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY POWER TYPE, 2018-2027 (USD MILLION)

TABLE 64 JAPAN AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY VEHICLE TYPE, 2018-2027 (USD MILLION)

TABLE 65 SOUTH KOREALITHIUM ION BATTERY MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 66 SOUTH KOREALITHIUM ION BATTERY MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 67 SOUTH KOREALITHIUM ION BATTERY MARKET, BY POWER CAPACITY, 2018-2027 (USD MILLION)

TABLE 68 SOUTH KOREALITHIUM ION BATTERY MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 69 SOUTH KOREACELL IN LITHIUM ION BATTERY MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 70 SOUTH KOREACOMMERCIAL IN LITHIUM ION BATTERY MARKET, BY VERTICAL, 2018-2027 (USD MILLION)

TABLE 71 SOUTH KOREACONSUMER ELECTRONICS IN LITHIUM ION BATTERY MARKET, BY VERTICAL, 2018-2027 (USD MILLION)

TABLE 72 SOUTH KOREAAUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY POWER TYPE, 2018-2027 (USD MILLION)

TABLE 73 SOUTH KOREAAUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY VEHICLE TYPE, 2018-2027 (USD MILLION)

TABLE 74 INDIALITHIUM ION BATTERY MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 75 INDIALITHIUM ION BATTERY MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 76 INDIALITHIUM ION BATTERY MARKET, BY POWER CAPACITY, 2018-2027 (USD MILLION)

TABLE 77 INDIALITHIUM ION BATTERY MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 78 INDIACELL IN LITHIUM ION BATTERY MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 79 INDIACOMMERCIAL IN LITHIUM ION BATTERY MARKET, BY VERTICAL, 2018-2027 (USD MILLION)

TABLE 80 INDIACONSUMER ELECTRONICS IN LITHIUM ION BATTERY MARKET, BY VERTICAL, 2018-2027 (USD MILLION)

TABLE 81 INDIAAUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY POWER TYPE, 2018-2027 (USD MILLION)

TABLE 82 INDIAAUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY VEHICLE TYPE, 2018-2027 (USD MILLION)

TABLE 83 AUSTRALIALITHIUM ION BATTERY MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 84 AUSTRALIALITHIUM ION BATTERY MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 85 AUSTRALIALITHIUM ION BATTERY MARKET, BY POWER CAPACITY, 2018-2027 (USD MILLION)

TABLE 86 AUSTRALIALITHIUM ION BATTERY MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 87 AUSTRALIACELL IN LITHIUM ION BATTERY MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 88 AUSTRALIACOMMERCIAL IN LITHIUM ION BATTERY MARKET, BY VERTICAL, 2018-2027 (USD MILLION)

TABLE 89 AUSTRALIACONSUMER ELECTRONICS IN LITHIUM ION BATTERY MARKET, BY VERTICAL, 2018-2027 (USD MILLION)

TABLE 90 AUSTRALIAAUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY POWER TYPE, 2018-2027 (USD MILLION)

TABLE 91 AUSTRALIAAUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY VEHICLE TYPE, 2018-2027 (USD MILLION)

TABLE 92 SINGAPORELITHIUM ION BATTERY MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 93 SINGAPORELITHIUM ION BATTERY MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 94 SINGAPORELITHIUM ION BATTERY MARKET, BY POWER CAPACITY, 2018-2027 (USD MILLION)

TABLE 95 SINGAPORELITHIUM ION BATTERY MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 96 SINGAPORECELL IN LITHIUM ION BATTERY MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 97 SINGAPORECOMMERCIAL IN LITHIUM ION BATTERY MARKET, BY VERTICAL, 2018-2027 (USD MILLION)

TABLE 98 SINGAPORECONSUMER ELECTRONICS IN LITHIUM ION BATTERY MARKET, BY VERTICAL, 2018-2027 (USD MILLION)

TABLE 99 SINGAPOREAUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY POWER TYPE, 2018-2027 (USD MILLION)

TABLE 100 SINGAPOREAUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY VEHICLE TYPE, 2018-2027 (USD MILLION)

TABLE 101 THAILANDLITHIUM ION BATTERY MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 102 THAILANDLITHIUM ION BATTERY MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 103 THAILANDLITHIUM ION BATTERY MARKET, BY POWER CAPACITY, 2018-2027 (USD MILLION)

TABLE 104 THAILANDLITHIUM ION BATTERY MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 105 THAILANDCELL IN LITHIUM ION BATTERY MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 106 THAILANDCOMMERCIAL IN LITHIUM ION BATTERY MARKET, BY VERTICAL, 2018-2027 (USD MILLION)

TABLE 107 THAILANDCONSUMER ELECTRONICS IN LITHIUM ION BATTERY MARKET, BY VERTICAL, 2018-2027 (USD MILLION)

TABLE 108 THAILANDAUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY POWER TYPE, 2018-2027 (USD MILLION)

TABLE 109 THAILANDAUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY VEHICLE TYPE, 2018-2027 (USD MILLION)

TABLE 110 MALAYSIALITHIUM ION BATTERY MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 111 MALAYSIALITHIUM ION BATTERY MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 112 MALAYSIALITHIUM ION BATTERY MARKET, BY POWER CAPACITY, 2018-2027 (USD MILLION)

TABLE 113 MALAYSIALITHIUM ION BATTERY MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 114 MALAYSIACELL IN LITHIUM ION BATTERY MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 115 MALAYSIACOMMERCIAL IN LITHIUM ION BATTERY MARKET, BY VERTICAL, 2018-2027 (USD MILLION)

TABLE 116 MALAYSIACONSUMER ELECTRONICS IN LITHIUM ION BATTERY MARKET, BY VERTICAL, 2018-2027 (USD MILLION)

TABLE 117 MALAYSIAAUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY POWER TYPE, 2018-2027 (USD MILLION)

TABLE 118 MALAYSIAAUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY VEHICLE TYPE, 2018-2027 (USD MILLION)

TABLE 119 INDONESIALITHIUM ION BATTERY MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 120 INDONESIALITHIUM ION BATTERY MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 121 INDONESIALITHIUM ION BATTERY MARKET, BY POWER CAPACITY, 2018-2027 (USD MILLION)

TABLE 122 INDONESIALITHIUM ION BATTERY MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 123 INDONESIACELL IN LITHIUM ION BATTERY MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 124 INDONESIACOMMERCIAL IN LITHIUM ION BATTERY MARKET, BY VERTICAL, 2018-2027 (USD MILLION)

TABLE 125 INDONESIACONSUMER ELECTRONICS IN LITHIUM ION BATTERY MARKET, BY VERTICAL, 2018-2027 (USD MILLION)

TABLE 126 INDONESIAAUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY POWER TYPE, 2018-2027 (USD MILLION)

TABLE 127 INDONESIAAUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY VEHICLE TYPE, 2018-2027 (USD MILLION)

TABLE 128 PHILIPPINESLITHIUM ION BATTERY MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 129 PHILIPPINESLITHIUM ION BATTERY MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 130 PHILIPPINESLITHIUM ION BATTERY MARKET, BY POWER CAPACITY, 2018-2027 (USD MILLION)

TABLE 131 PHILIPPINESLITHIUM ION BATTERY MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 132 PHILIPPINESCELL IN LITHIUM ION BATTERY MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 133 PHILIPPINESCOMMERCIAL IN LITHIUM ION BATTERY MARKET, BY VERTICAL, 2018-2027 (USD MILLION)

TABLE 134 PHILIPPINESCONSUMER ELECTRONICS IN LITHIUM ION BATTERY MARKET, BY VERTICAL, 2018-2027 (USD MILLION)

TABLE 135 PHILIPPINESAUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY POWER TYPE, 2018-2027 (USD MILLION)

TABLE 136 PHILIPPINESAUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY VEHICLE TYPE, 2018-2027 (USD MILLION)

TABLE 137 REST OF ASIA-PACIFICLITHIUM ION BATTERY MARKET, BY TYPE, 2018-2027 (USD MILLION)

List of Figure

LIST OF FIGURES

FIGURE 1 ASIA-PACIFIC LITHIUM ION BATTERY MARKET: SEGMENTATION

FIGURE 2 ASIA-PACIFIC LITHIUM ION BATTERY MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC LITHIUM ION BATTERY MARKET: DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC LITHIUM ION BATTERY MARKET: ASIA-PACIFIC VS. REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA-PACIFIC LITHIUM ION BATTERY MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC LITHIUM ION BATTERY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA-PACIFIC LITHIUM ION BATTERY MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA-PACIFIC LITHIUM ION BATTERY MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ASIA-PACIFIC LITHIUM ION BATTERY MARKET: SEGMENTATION

FIGURE 10 INCREASING DEMAND FOR SMARTPHONES AND CONSUMER ELECTRONICS IS EXPECTED TO DRIVE THE ASIA-PACIFIC LITHIUM ION BATTERY MARKET IN THE FORECAST PERIOD OF 2020 TO 2027

FIGURE 11 TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF ASIA-PACIFIC LITHIUM ION BATTERY MARKET IN 2020 & 2027

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGE OF ASIA-PACIFIC LITHIUM ION BATTERY MARKET

FIGURE 13 ASIA-PACIFIC LITHIUM ION BATTERY MARKET: BY TYPE, 2019

FIGURE 14 ASIA-PACIFIC LITHIUM ION BATTERY MARKET: BY COMPONENT, 2019

FIGURE 15 ASIA-PACIFIC LITHIUM ION BATTERY MARKET: BY POWER CAPACITY, 2019

FIGURE 16 ASIA-PACIFIC LITHIUM ION BATTERY MARKET: BY PRODUCT, 2019

FIGURE 17 ASIA-PACIFIC LITHIUM ION BATTERY MARKET: BY VERTICAL, 2019

FIGURE 18 ASIA-PACIFIC LITHIUM ION BATTERY MARKET: SNAPSHOT (2019)

FIGURE 19 ASIA-PACIFIC LITHIUM ION BATTERY MARKET: BY COUNTRY (2019)

FIGURE 20 ASIA-PACIFIC LITHIUM ION BATTERY MARKET: BY COUNTRY (2020 & 2027)

FIGURE 21 ASIA-PACIFIC LITHIUM ION BATTERY MARKET: BY COUNTRY (2019 & 2027)

FIGURE 22 ASIA-PACIFIC LITHIUM ION BATTERY MARKET: BY TYPE (2020-2027)

FIGURE 23 ASIA-PACIFIC LITHIUM ION BATTERY MARKET: COMPANY SHARE 2019 (%)

Asia Pacific Lithium Ion Battery Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Asia Pacific Lithium Ion Battery Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Asia Pacific Lithium Ion Battery Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.