Asia Pacific Herpes Market

Market Size in USD Million

CAGR :

%

USD

238.62 Million

USD

368.99 Million

2025

2033

USD

238.62 Million

USD

368.99 Million

2025

2033

| 2026 –2033 | |

| USD 238.62 Million | |

| USD 368.99 Million | |

|

|

|

|

Asia-Pacific Herpes Market Size

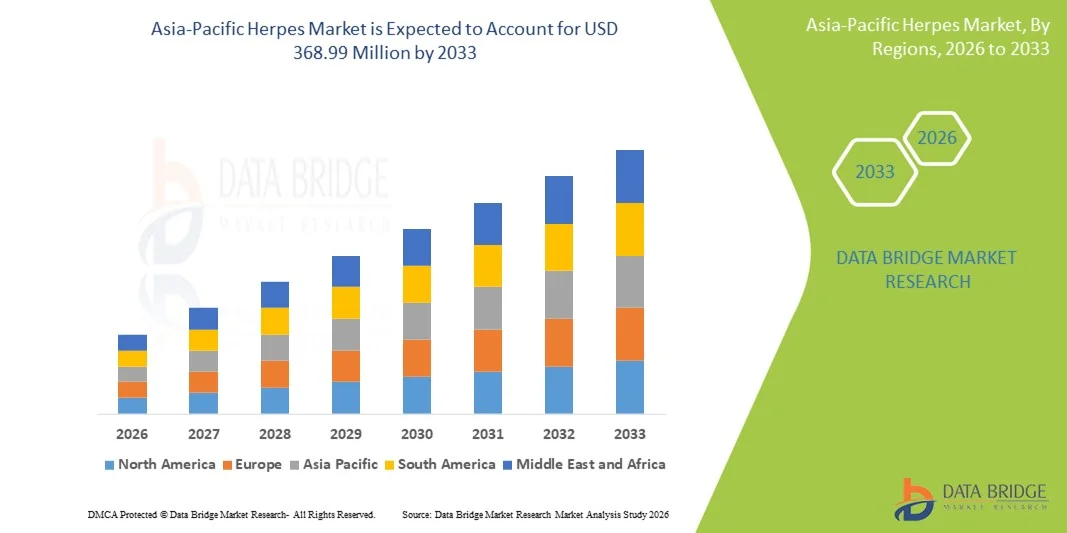

- The Asia-Pacific herpes market size was valued at USD 238.62 million in 2025 and is expected to reach USD 368.99 million by 2033, at a CAGR of 5.6% during the forecast period

- The market growth is largely fueled by the rising prevalence of herpes virus infections, increasing healthcare expenditure, expanding access to antiviral therapies, and growing awareness of sexual health and treatment options, leading to greater adoption of advanced treatment solutions across key regional countries such as China, India, and Japan

- Furthermore, rising demand for effective management and advanced therapeutic products for herpes simplex and herpes zoster infections coupled with supportive healthcare infrastructure development in both urban and rural settings is establishing robust demand for herpes care products and services across the region. These converging factors are accelerating the uptake of herpes treatment and management solutions, thereby significantly boosting the industry’s growth

Asia-Pacific Herpes Market Analysis

- Herpes treatments, encompassing antiviral therapies for herpes simplex virus (HSV) and herpes zoster infections, are increasingly vital components of healthcare systems in both outpatient and hospital settings due to their effectiveness in reducing viral replication, managing outbreaks, and preventing complications

- The escalating demand for herpes treatments is primarily fueled by the rising prevalence of herpes infections, growing awareness of sexual health, increasing healthcare expenditure, and expanded access to antiviral medications across Asia-Pacific countries

- China dominated the Asia-Pacific herpes market with the largest revenue share of 38.6% in 2025, characterized by a large patient population, improving healthcare infrastructure, and increasing adoption of prescription antivirals, with urban centers experiencing substantial growth in treatment uptake, particularly through hospitals, clinics, and telemedicine platforms, driven by innovations in therapy formulations and patient management programs

- Japan is expected to be the fastest-growing country in the Asia-Pacific herpes market during the forecast period due to rising healthcare accessibility, government initiatives for viral infection management, and increasing consumer awareness of treatment options

- Oral segment dominated the Asia-Pacific herpes market with a market share of 46.5% in 2025, driven by its established efficacy, convenience of administration, and widespread availability in both generic and branded formulations

Report Scope and Asia-Pacific Herpes Market Segmentation

|

Attributes |

Asia-Pacific Herpes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Asia-Pacific Herpes Market Trends

Advancements in Long-Acting Antivirals and Vaccine Development

- A significant and accelerating trend in the Asia-Pacific herpes market is the development of long-acting antiviral formulations and prophylactic vaccines, which are improving treatment adherence and preventive care for herpes simplex and herpes zoster infections

- For instance, new long-acting acyclovir and valacyclovir formulations are being trialed in Japan to reduce dosing frequency, enhancing patient compliance and reducing recurrence rates

- Vaccine research in countries such as China and South Korea focuses on both therapeutic and preventive approaches, aiming to reduce viral outbreaks and limit disease transmission, thereby shaping treatment protocols across the region

- These advancements allow healthcare providers to offer more convenient and effective management options for patients, reducing the burden of frequent doctor visits and continuous antiviral therapy

- This trend towards innovative, patient-friendly, and preventive solutions is reshaping patient expectations and treatment standards, prompting pharmaceutical companies such as Gilead Sciences and Fosun Pharma to invest in long-acting antivirals and vaccine development

- The demand for advanced therapeutics and preventive vaccines is growing rapidly across both hospital and outpatient sectors, as patients increasingly prioritize convenience, efficacy, and long-term herpes management

- Pharmaceutical collaborations and public-private partnerships in the region are accelerating research on novel antiviral agents and next-generation vaccines, offering opportunities for faster market expansion

Asia-Pacific Herpes Market Dynamics

Driver

Rising Prevalence and Growing Awareness of Herpes Infections

- The increasing prevalence of herpes virus infections, coupled with growing awareness of sexual health and preventive care, is a significant driver for heightened demand for antiviral therapies and vaccines

- For instance, in April 2025, China launched a nationwide awareness campaign to educate citizens about herpes prevention, early diagnosis, and access to antiviral treatments, expected to accelerate treatment adoption

- As patients become more aware of infection risks and recurrence potential, antiviral therapies offer effective viral suppression, outbreak management, and reduced transmission, providing a compelling alternative to untreated cases

- Furthermore, government initiatives and public health programs promoting sexually transmitted infection management are encouraging wider adoption of treatment protocols and preventive strategies

- The availability of oral antivirals, telemedicine consultations, and clinic-based therapy programs enhances accessibility and convenience, driving uptake among both urban and rural populations in Asia-Pacific

- Rising investments by pharmaceutical companies in R&D for new antivirals and vaccines are expanding the treatment portfolio and improving patient outcomes, reinforcing market growth

- Increased media coverage and educational campaigns in countries such as Japan and India are improving public understanding of herpes, reducing stigma, and driving demand for early treatment interventions

Restraint/Challenge

High Treatment Costs and Limited Healthcare Access

- Concerns surrounding the relatively high cost of advanced antiviral medications and vaccines pose a significant challenge to broader market penetration in lower-income populations across Asia-Pacific

- For instance, premium long-acting antivirals or vaccine regimens may remain inaccessible to patients in rural India or Southeast Asia, limiting overall market adoption despite clinical efficacy

- Addressing these affordability and access challenges through generic drug availability, government subsidies, and expanded insurance coverage is crucial for increasing patient uptake and ensuring equitable treatment access

- In addition, cultural stigma and lack of awareness around herpes infections can hinder patients from seeking timely medical care, delaying diagnosis and treatment initiation

- Overcoming these challenges through patient education programs, affordable therapeutic options, and improved healthcare infrastructure will be vital for sustained growth in the Asia-Pacific herpes market

- Regulatory hurdles in approving new antiviral drugs and vaccines can slow market entry, particularly for international pharmaceutical companies seeking to launch innovative therapies in multiple Asia-Pacific countries

- Logistical challenges, including cold-chain requirements for vaccines and distribution limitations in remote areas, further constrain accessibility and adoption of advanced herpes treatments

Asia-Pacific Herpes Market Scope

The market is segmented on the basis of virus type, product, drug type, age, route of administration, distribution channel, and end users.

- By Virus Type

On the basis of virus type, the Asia-Pacific herpes market is segmented into herpes simplex virus (HSV) and herpes zoster virus (HZV). The Herpes Simplex Virus segment dominated the market with the largest revenue share in 2025, driven by the higher prevalence of HSV-1 and HSV-2 infections across China, India, and Southeast Asian countries. HSV infections often require continuous management with oral antivirals, contributing to recurring demand. Awareness programs and public health campaigns are increasing early diagnosis, further boosting antiviral consumption. Hospitals and specialty clinics prioritize HSV treatments due to frequent outbreaks and higher patient load. The availability of generic antivirals enhances affordability, supporting the dominance of this segment. Continuous R&D into more effective HSV therapies is also strengthening its market position.

The Herpes Zoster Virus segment is expected to witness the fastest growth during the forecast period, primarily due to the increasing aging population in Japan, South Korea, and Australia. Vaccination campaigns targeting older adults and immunocompromised patients are driving demand for HZV vaccines. Therapeutic antiviral use for shingles treatment is rising as awareness of complications such as postherpetic neuralgia grows. Governments and healthcare providers are emphasizing preventive measures, boosting market penetration. Technological advancements in vaccine formulations are improving efficacy and patient adherence. The segment benefits from higher pricing per treatment, further supporting rapid growth.

- By Product

On the basis of product, the market is segmented into acyclovir, valacyclovir, famciclovir, docosanol, and others. The Acyclovir segment dominated the market with the largest revenue share in 2025, attributed to its established efficacy, affordability, and wide availability as both generic and branded forms. Acyclovir remains the first-line therapy for HSV and HZV infections in hospitals and clinics. Its use spans topical, oral, and parenteral administration, enhancing versatility across patient needs. The large base of long-term HSV patients ensures recurring demand. Physicians frequently prescribe Acyclovir due to its proven safety profile, contributing to strong market dominance. Ongoing clinical studies for improved formulations reinforce its leading position.

The Valacyclovir segment is expected to witness the fastest growth during the forecast period, driven by its superior bioavailability and convenience of less frequent dosing compared to Acyclovir. Valacyclovir is increasingly prescribed in both outpatient and hospital settings for HSV suppression and shingles management. Patient preference for easy-to-administer oral antivirals supports rising adoption. Awareness campaigns highlighting treatment adherence benefits encourage healthcare providers to recommend Valacyclovir. Its higher pricing and inclusion in insurance schemes accelerate uptake in urban populations. Pharmaceutical companies are expanding distribution and marketing to capture growth in fast-growing markets such as Japan and China.

- By Drug Type

On the basis of drug type, the market is segmented into prescription drugs and over-the-counter (OTC) drugs. The Prescription Drug segment dominated the market with the largest revenue share in 2025, owing to the clinical requirement for doctor-supervised therapy for HSV and HZV infections. Prescription antivirals ensure correct dosing, reduce resistance risks, and enable management of complicated cases. Hospitals and specialty clinics prefer prescription formulations to monitor patient adherence and outcomes. The segment also includes parenteral and high-potency oral drugs, contributing to recurring revenue. Government regulations favor prescription-based antivirals for safety reasons. Physician trust and established treatment protocols further strengthen this segment’s dominance.

The OTC Drug segment is expected to witness the fastest growth during the forecast period, driven by increasing consumer awareness of mild herpes outbreaks and self-care options. Topical creams, low-dose antivirals, and symptom relief formulations are accessible without prescriptions in countries such as India and Australia. Growing digital health platforms allow OTC products to reach remote areas efficiently. Convenience and privacy associated with OTC usage attract younger adults. Marketing initiatives targeting preventive care and symptom management encourage adoption. Rising disposable incomes and e-pharmacy penetration support rapid segment growth.

- By Age

On the basis of age, the market is segmented into adult and pediatrics. The Adult segment dominated the market with the largest revenue share in 2025, driven by the high prevalence of HSV infections among sexually active adults and increasing cases of shingles in the aging population. Adults are more likely to seek treatment for recurrent outbreaks, boosting antiviral sales. Hospitals and clinics focus on adult care due to higher patient volumes. Awareness campaigns and routine screenings in urban centers contribute to early diagnosis. Insurance coverage and government programs facilitate treatment affordability. Ongoing R&D for adult-specific formulations strengthens market dominance.

The Pediatrics segment is expected to witness the fastest growth during the forecast period, fueled by rising awareness of neonatal HSV infections and pediatric herpes zoster cases. Vaccination initiatives and early intervention strategies in countries such as Japan and China are expanding pediatric treatment adoption. Telemedicine and hospital outreach programs improve diagnosis and timely treatment. Pediatric-friendly oral and topical formulations enhance adherence. Increasing parental awareness of infection risks supports market growth. Collaboration with pediatric associations promotes safe and effective therapy use.

- By Route of Administration

On the basis of route of administration, the market is segmented into topical, oral, and parenteral. The Oral segment dominated the market with the largest revenue share of 46.5% in 2025, driven by patient preference for convenient administration and systemic effectiveness against HSV and HZV infections. Oral antivirals such as Acyclovir and Valacyclovir are widely prescribed for both adults and pediatrics. Hospital pharmacies and clinics stock oral medications due to their ease of dosing and lower monitoring requirements. Oral therapy allows home-based management, reducing hospital visits. Insurance coverage and generic availability support recurring use. Continuous R&D for bioavailability and taste-masked formulations reinforces dominance.

The Parenteral segment is expected to witness the fastest growth during the forecast period, driven by severe herpes cases requiring intravenous administration in hospitals and specialty clinics. Immunocompromised patients and severe shingles cases often receive parenteral antivirals. Growth in hospital infrastructure in China, Japan, and India supports adoption. Parenteral formulations offer rapid viral suppression, improving patient outcomes. Rising availability of hospital-grade antivirals enhances treatment access. Technological improvements in infusion devices and monitoring increase safety and efficiency.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into hospital pharmacies, retail pharmacies, drug stores, online pharmacies, and others. The Hospital Pharmacies segment dominated the market with the largest revenue share in 2025, owing to the high reliance on hospitals and specialty clinics for herpes diagnosis and prescription antiviral distribution. Hospitals ensure accurate dosing, adherence, and patient counseling. Urban and semi-urban hospitals act as primary procurement points for high-volume prescriptions. Physician trust in hospital pharmacy supply chains drives preference. Specialized storage facilities in hospitals maintain drug efficacy. Integrated patient care programs further strengthen this segment.

The Online Pharmacies segment is expected to witness the fastest growth during the forecast period, driven by the rise of digital health platforms and e-pharmacies in China, India, and Japan. Online channels provide convenient access to antivirals, especially for younger adults and remote populations. Telemedicine consultations paired with home delivery improve adherence. Price transparency and discreet delivery encourage adoption. Marketing initiatives by online pharmacies increase awareness and access. Government approvals for online prescriptions accelerate market penetration.

- By End Users

On the basis of end users, the market is segmented into hospitals, specialty clinics, and others. The Hospitals segment dominated the market with the largest revenue share in 2025, owing to high patient footfall, established treatment protocols, and availability of prescription antivirals for HSV and HZV infections. Hospitals provide integrated care with diagnostics, therapy, and follow-up, supporting recurring antiviral consumption. Urban hospitals in China and India serve large populations, driving volume sales. Strong procurement systems and clinical guidelines favor hospital dominance. Hospitals also invest in patient education and adherence programs. Government contracts and insurance coverage reinforce this segment’s market position.

The Specialty Clinics segment is expected to witness the fastest growth during the forecast period, driven by increasing outpatient clinics focused on dermatology, infectious diseases, and sexual health in Japan, South Korea, and Southeast Asia. Clinics offer convenient, targeted care for herpes patients, reducing hospital dependency. Preventive counseling and routine follow-ups improve adherence. Modern clinic infrastructure supports prescription of long-acting antivirals and vaccines. Telemedicine integration allows remote monitoring. Growing awareness and rising healthcare spending accelerate adoption in specialty clinics.

Asia-Pacific Herpes Market Regional Analysis

- China dominated the Asia-Pacific herpes market with the largest revenue share of 38.6% in 2025, characterized by a large patient population, improving healthcare infrastructure, and increasing adoption of prescription antivirals

- Patients and healthcare providers in the country highly value the availability of effective oral antivirals, preventive vaccines, and integrated treatment protocols that help manage recurrent outbreaks and reduce complications

- This widespread adoption is further supported by government awareness programs, improving healthcare infrastructure, and increasing accessibility through hospitals, specialty clinics, and online pharmacies, establishing China as the key market for herpes treatment solutions in the Asia-Pacific region

The China Asia-Pacific Herpes Market Insight

The China herpes market captured the largest revenue share of 38.6% in 2025, fueled by the high prevalence of herpes simplex virus infections and increasing healthcare expenditure. Patients are increasingly prioritizing early diagnosis and continuous antiviral therapy for recurrent outbreaks. The growing adoption of hospital-based and telemedicine treatment options, along with the availability of generic antivirals, further propels market growth. Government awareness campaigns and public health initiatives supporting preventive care are significantly contributing to the market’s expansion. In addition, urban hospitals and specialty clinics are driving adoption through prescription antivirals and vaccination programs.

Japan Asia-Pacific Herpes Market Insight

The Japan herpes market is poised to grow at the fastest CAGR of 9.8% during the forecast period, driven by rising healthcare accessibility and proactive vaccination campaigns against herpes zoster. The increasing aging population susceptible to shingles is elevating demand for preventive vaccines and long-acting antivirals. Telemedicine services, routine screenings, and patient education programs are accelerating treatment adoption. Hospitals and specialty clinics are integrating preventive care with antiviral therapy for better outcomes. Japan’s focus on early diagnosis and comprehensive care is significantly supporting market growth. Furthermore, awareness campaigns and technology-enabled healthcare delivery enhance accessibility and adherence.

India Asia-Pacific Herpes Market Insight

The India herpes market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to the country’s high population base, rising awareness of sexual health, and expanding healthcare infrastructure. Increasing urbanization and the growing middle-class population are driving demand for prescription antivirals and preventive vaccines. Hospitals, clinics, and online pharmacies are improving accessibility, while telemedicine platforms are supporting remote consultations and treatment monitoring. Public health campaigns and NGO-led education programs are raising awareness about herpes prevention and management. The availability of affordable generic antivirals is also a key factor propelling market growth.

South Korea Asia-Pacific Herpes Market Insight

The South Korea herpes market is expected to expand at a considerable CAGR during the forecast period, fueled by rising healthcare spending and government initiatives for viral infection management. Increasing patient awareness and screening programs for herpes simplex and zoster infections are promoting early treatment. Hospitals and specialty clinics are emphasizing preventive care through vaccines and long-acting antivirals. Advanced healthcare infrastructure and widespread adoption of telemedicine support rapid access to treatment. Patients are increasingly seeking effective and convenient therapies. The strong focus on digital health solutions is further facilitating market growth.

Asia-Pacific Herpes Market Share

The Asia-Pacific Herpes industry is primarily led by well-established companies, including:

- GSK plc (U.K.)

- Sanofi (France)

- Pfizer Inc. (U.S.)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Sun Pharmaceutical Industries Ltd. (India)

- Cipla Limited (India)

- Emcure Pharmaceuticals Limited (India)

- Aurobindo Pharma Limited (India)

- Viatris (U.S.)

- Zydus Lifesciences Ltd. (India)

- Fresenius SE & Co. KGaA (Germany)

- AbbVie Inc. (U.S.)

- Eli Lilly and Company (U.S.)

- Gilead Sciences, Inc. (U.S.)

- CENTURION REMEDIES Pvt. Ltd. (India)

- Zeelab Laboratories Ltd. (India)

- Novartis AG (Switzerland)

- Merck & Co., Inc. (U.S.)

What are the Recent Developments in Asia-Pacific Herpes Market?

- In October 2025, Maruho also signed an exclusive out‑licensing agreement with Hyphens for a rapid in‑vitro diagnostic kit for varicella‑zoster virus (VZV antigen), aiming to improve quick detection of herpes zoster infections in 10 ASEAN markets with a 5–10 minute test

- In February 2025, China’s National Medical Products Administration accepted the Biologics License Application (BLA) for Luzhu Biotech’s recombinant herpes zoster vaccine, which, if approved, would be the first locally developed recombinant shingles vaccine and a key preventive option in the region

- In June 2024, Maruho Co., Ltd. and Singapore‑based Hyphens Pharma entered an exclusive licensing agreement to develop and commercialize the anti‑herpes virus agent amenamevir (Amenalief®) across 10 ASEAN countries, expanding treatment availability beyond Japan into Southeast Asia

- In June 2023, GSK’s Shingrix (herpes zoster vaccine) received renewed approval/expanded indication in Japan, reinforcing availability of a globally recognized shingles vaccine and supporting regional immunization efforts for older adults

- In May 2023, Beijing Luzhu Biotechnology completed Phase II clinical trials for its LZ901 recombinant herpes zoster vaccine, demonstrating strong immune responses and safety, and setting the stage for Phase III trials and eventual commercial use in China and potentially beyond

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.