Asia Pacific Hepatitis B Infection Market

Market Size in USD Billion

CAGR :

%

USD

4.27 Billion

USD

6.92 Billion

2024

2032

USD

4.27 Billion

USD

6.92 Billion

2024

2032

| 2025 –2032 | |

| USD 4.27 Billion | |

| USD 6.92 Billion | |

|

|

|

|

Asia-Pacific Hepatitis B Infection Market Size

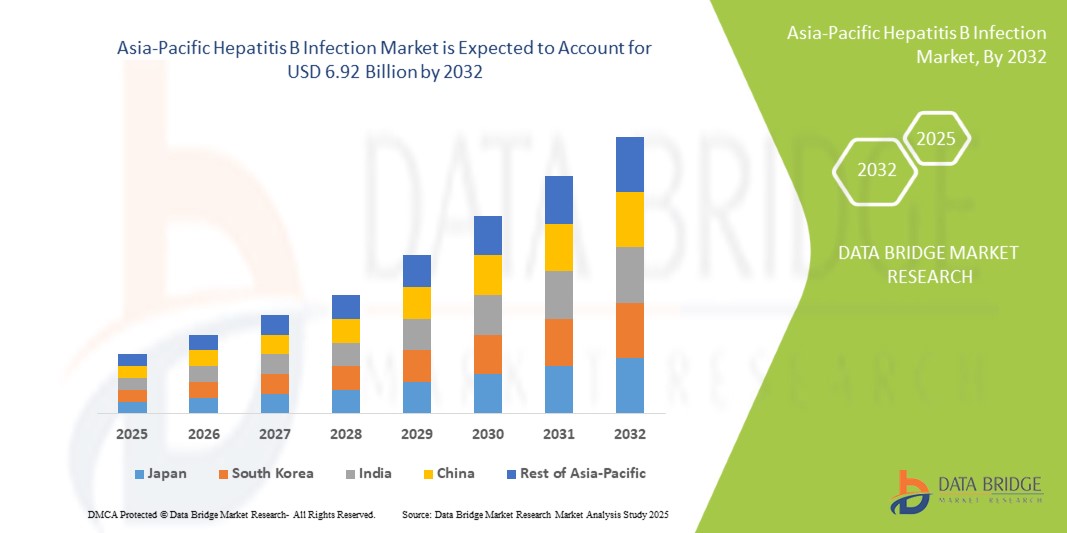

- The Asia-Pacific hepatitis B infection market size was valued at USD 4.27 billion in 2024 and is expected to reach USD 6.92 billion by 2032, at a CAGR of 6.20% during the forecast period

- The market growth is largely fueled by the growing adoption of advanced diagnostic technologies and therapeutic innovations for Hepatitis B, coupled with increasing digitalization and integration of electronic health systems across Europe

- Furthermore, rising consumer and public health demand for accurate, accessible, and preventive solutions is establishing Hepatitis B management protocols as a central focus of healthcare policy. These converging factors are accelerating the adoption of vaccination, screening, and antiviral therapies, thereby significantly boosting the Hepatitis B Infection market growth across the region

Asia-Pacific Hepatitis B Infection Market Analysis

- Hepatitis B treatments and diagnostics are increasingly vital components of Asia-Pacific’s public health infrastructure, particularly across both urban and rural healthcare settings, due to rising infection awareness, expansion of diagnostic capabilities, and advancements in antiviral therapy accessibility

- The escalating demand for effective Hepatitis B management in the region is primarily fueled by national immunization programs, increasing HBV-HDV co-infection screening efforts, and the growing burden of chronic liver diseases, especially among aging populations in countries such as China and Japan

- China dominated the Asia-Pacific Hepatitis B Infection market with the largest revenue share of 34.7% in 2024, characterized by large-scale public health initiatives, robust vaccination coverage, and widespread access to diagnostic testing. The country has seen rapid improvements in treatment availability, especially for rural and high-risk populations, driven by government-backed health insurance schemes and liver disease awareness campaigns

- India is expected to be the fastest growing region in the Asia-Pacific Hepatitis B Infection Market The market benefits from government initiatives such as the Universal Immunization Programme, rising public awareness, and enhanced access to affordable diagnostics and generics, particularly in underserved regions. These factors collectively contribute to India’s growing role in driving regional market expansion

- The chronic hepatitis B segment dominated the Asia-Pacific Hepatitis B Infection market with a market share of 62.4% in 2024, driven by its long-term health implications, the growing number of diagnosed cases, and the need for extended antiviral therapy and liver monitoring programs

Report Scope and Asia-Pacific Hepatitis B Infection Market Segmentation

|

Attributes |

Asia-Pacific Hepatitis B Infection Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Hepatitis B Infection Market Trends

“Enhanced Convenience Through Integrated Care and Advanced Treatment Access”

- A significant and accelerating trend in the Asia-Pacific hepatitis B infection market is the growing integration of multidisciplinary care models and advanced treatment access through centralized healthcare systems. This trend is significantly improving patient outcomes and adherence by enabling seamless communication between general practitioners, hepatologists, and public health institutions

- For instance, several Western European countries have implemented national hepatitis action plans that allow patients to receive early diagnosis, antiviral treatment, and regular follow-up care under one coordinated framework. Germany’s integrated care model, for instance, enables efficient linkage from diagnosis to treatment, reducing disease progression rates

- Efforts such as centralized patient registries, digital health record systems, and streamlined referral pathways are optimizing hepatitis B infection management by enabling timely intervention and monitoring. These systems allow healthcare providers to track liver function, treatment response, and co-infections such as hepatitis D in real-time

- The integration of advanced diagnostics with routine primary care services facilitates early detection of both acute and chronic cases. This centralized approach, combined with affordable access to newer antiviral therapies, enhances both individual patient care and broader public health surveillance

- This trend toward more streamlined, coordinated, and technology-supported hepatitis B care is fundamentally reshaping expectations within national healthcare systems. As a result, many European governments are expanding access to viral hepatitis screening, particularly among vulnerable and high-risk populations such as migrants, intravenous drug users, and the elderly

- The demand for accessible, efficient, and integrated hepatitis B treatment models is rapidly growing across both public and private healthcare sectors, as stakeholders increasingly focus on long-term disease control and alignment with the World Health Organization’s 2030 hepatitis elimination goals

Asia-Pacific Hepatitis B Infection Market Dynamics

Driver

“Growing Need Due to Rising Disease Burden and Preventive Healthcare Adoption”

- The increasing prevalence of hepatitis B infections across Europe, along with heightened awareness about liver diseases, is significantly driving the demand for early diagnosis, vaccination, and treatment solutions

- For instance, in April 2024, GlaxoSmithKline plc (GSK) expanded its European hepatitis B vaccine supply through a strategic partnership with regional healthcare systems, aiming to improve immunization rates across high-risk populations. Such initiatives by key market players are expected to fuel growth in the Asia-Pacific Hepatitis B Infection market over the forecast period

- As public health authorities and consumers become more aware of the long-term complications associated with chronic hepatitis B—such as cirrhosis and liver cancer—the adoption of preventive strategies such as vaccination and early screening continues to rise

- Furthermore, the integration of hepatitis B testing into routine health check-ups and the growing popularity of point-of-care diagnostic technologies are making hepatitis B management more accessible and efficient across Europe

- The availability of effective vaccines, oral antiviral drugs, and the development of advanced immune modulators are enabling better disease control. Government funding, reimbursement policies, and WHO-led hepatitis elimination goals are also boosting adoption rates in both public and private healthcare settings

Restraint/Challenge

“Concerns Regarding Treatment Accessibility and High Cost of Advanced Therapies”

- Despite medical advancements, limited access to advanced antiviral therapies and immune modulators in certain parts of Asia-Pacific remains a challenge, particularly in Eastern and Southern Asia-Pacific where healthcare disparities persist

- For instance, studies published in early 2024 indicated that some EU member states still face shortages in hepatitis B vaccines and limited access to novel treatment regimens due to procurement and reimbursement issues

- Bridging this gap requires policy-level efforts to harmonize hepatitis B care standards across all European nations, particularly through EU-level funding support, price negotiations, and streamlined regulatory approvals

- Moreover, while first-line antiviral drugs are becoming more affordable, newer generation therapies with improved efficacy often come at a higher cost, potentially limiting their uptake among uninsured or low-income populations

- Public mistrust or vaccine hesitancy, especially in post-pandemic Europe, is another barrier that must be addressed through awareness campaigns and healthcare provider engagement

- Overcoming these challenges through expanded insurance coverage, public-private partnerships, and increased investment in regional healthcare infrastructure will be crucial to sustaining long-term growth in the Asia-Pacific Hepatitis B Infection market

Asia-Pacific Hepatitis B Infection Market Scope

The market is segmented on the basis of type, and treatment.

• By Type

On the basis of type, the Asia-Pacific Hepatitis B Infection market is segmented into chronic and acute. The chronic segment dominated the largest market revenue share of 62.4% in 2024, primarily due to the high prevalence of chronic HBV cases and the need for lifelong disease management through antiviral therapies and monitoring.

The acute segment is anticipated to witness the fastest growth rate with a CAGR of 6.4% from 2025 to 2032, fueled by enhanced early screening efforts, public health initiatives, and growing awareness leading to timely diagnosis and treatment.

• By Treatment

On the basis of treatment, the Asia-Pacific Hepatitis B Infection market is segmented into vaccine, antiviral drugs, immune modulator drugs, and surgery. The vaccine segment held the largest revenue share of 41.2% in 2024, supported by national vaccination drives, increased birth-dose immunization, and strong uptake among high-risk adult populations.

The antiviral drugs segment is projected to witness the fastest CAGR of 7.1% from 2025 to 2032, driven by the expanding chronic HBV patient pool, advancements in oral therapies, and favorable reimbursement policies.

Asia-Pacific Hepatitis B Infection Market Regional Analysis

- Asia-Pacific dominated the hepatitis B infection market with the largest revenue share of 33.27% in 2024, driven by strong public health infrastructure, high vaccination coverage, and increasing awareness about hepatitis B transmission and prevention

- The region is characterized by advanced diagnostic capabilities, well-established immunization programs, and active government-led hepatitis surveillance initiatives

- This widespread adoption of preventive and therapeutic measures is further supported by universal healthcare access, continuous R&D investments, and the growing focus on early screening and disease control, positioning Asia-Pacific as a key contributor to the global Hepatitis B Infection market

China Hepatitis B Infection Market Insight

The China hepatitis B infection market dominated the Asia-Pacific market with the largest revenue share of 34.7% in 2024, driven by extensive vaccination programs, strong government policies, and widespread diagnostic availability. The country’s high disease burden has prompted comprehensive national strategies for HBV control, including early screening, affordable antiviral therapies, and public health campaigns, particularly in rural and high-risk populations.

Japan Hepatitis B Infection Market Insight

The Japan hepatitis B infection market accounted for 14.2% of the regional revenue share in 2024. The market is supported by a robust healthcare system, routine antenatal and infant screening, and government-supported vaccination programs. Continued R&D funding and access to advanced antivirals contribute to sustained market growth and improved patient outcomes.

India Asia-Pacific Hepatitis B Infection Market Insight

The India hepatitis B infection market held a 13.5% revenue share in the Asia-Pacific Hepatitis B infection market in 2024 and is projected to grow at a CAGR of 7.1% during the forecast period. The market benefits from government initiatives such as the Universal Immunization Programme, rising public awareness, and enhanced access to affordable diagnostics and generics, especially in underserved regions.

South Korea Asia-Pacific Hepatitis B Infection Market Insight

The South Korea hepatitis B infection market contributed 8.6% to the regional market in 2024. Growth is supported by high public health expenditure, comprehensive HBV vaccination policies, and integration of hepatitis services into primary care. Government-backed screening and early treatment programs are further enhancing disease management.

Asia-Pacific Hepatitis B Infection Market Share

The Asia-Pacific Hepatitis B Infection industry is primarily led by well-established companies, including:

- Gilead Sciences, Inc. (U.S.)

- GSK plc (U.K.)

- Dynavax Technologies (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Bristol-Myers Squibb Company (U.S.)

- Merck & Co., Inc. (U.S.)

- Novartis AG (Switzerland)

- Arrowhead Pharmaceuticals Inc. (U.S.)

- Arbutus Biopharma (Canada)

- Teva Pharmaceuticals, Inc. (Israel)

- Zydus Pharmaceuticals (India)

- Aurobindo Pharma (India)

- Lupin Pharmaceuticals, Inc. (India)

Latest Developments in Asia-Pacific Hepatitis B Infection Market

- In September 2024, Gilead Sciences and Genesis Therapeutics announced a strategic collaboration to discover and develop novel small molecule therapies using Genesis’ GEMS AI platform. Gilead gained exclusive rights to develop and commercialize products from this partnership

- In July 2024, Gilead Sciences, Inc. presented research data, showcasing long-term efficacy and safety of Biktarvy in diverse HIV populations, including Hispanic/Latine individuals and older adults with comorbidities. Investigational once-daily and weekly dosing regimens were also highlighted

- In February 2024, GSK completed its acquisition of Aiolos Bio, including the promising AIO-001 monoclonal antibody for severe asthma. GSK paid USD 1000 million upfront and up to USD 400 million in milestone payments, expanding its respiratory biologics portfolio

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.