Asia-Pacific Hangers Market Analysis and Insights

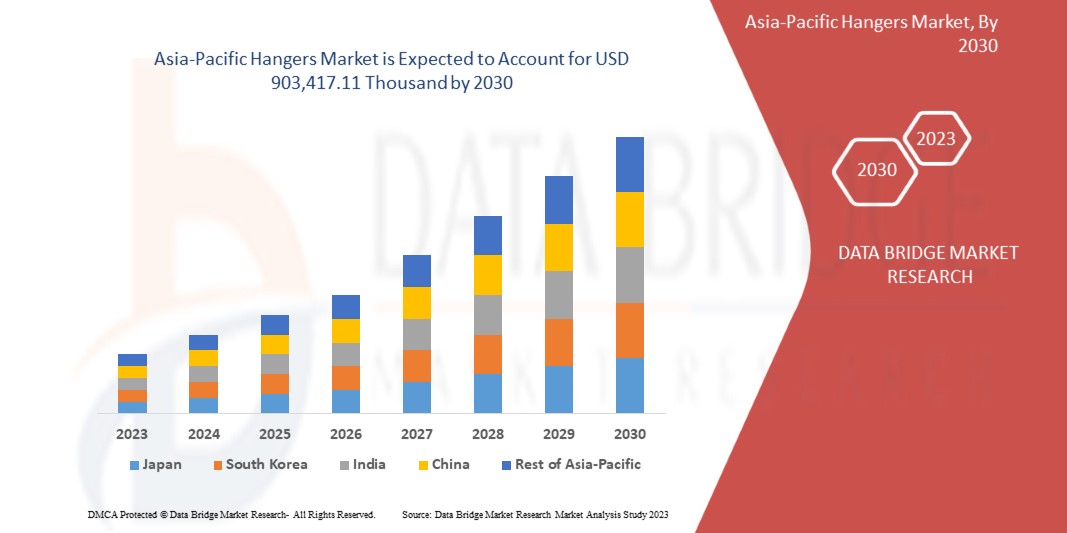

The Asia-Pacific hangers market is expected to gain significant growth in the forecast period of 2023 to 2030. Data Bridge Market Research analyses that the market is growing with a CAGR of 4.9% in the forecast period of 2023 to 2030 and is expected to reach USD 903,417.11 thousand by 2030. The major factor driving the growth of the Asia-Pacific hangers market is a thriving retail and hospitality sector leading to continuous growth.

A clothing hanger, coat hanger, or coat hanger is a hanging device constructed in the shape/contour of human shoulders to enable the hanging of a coat, jacket, sweater, shirt, blouse, or dress in a wrinkle-free way with a lower bar for the hanging of pants or skirts.

Asia-Pacific hangers market report provides details of market share, new developments, and the impact of domestic and localized market players, analysis opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an Analyst Brief; our team will help you create a revenue-impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2020 - 2015) |

|

Quantitative Units |

Revenue in USD Thousand |

|

Segments Covered |

Product (Plastic Hanger, Wooden Hanger, Stainless Steel, Aluminum Alloy, and Others), Application (Commercial, and Household), Mode of Sale (Retail, and Online). |

|

Countries Covered |

Japan, China, South Korea, India, Singapore, Thailand, Indonesia, Malaysia, Philippines, Australia & New Zealand, and the Rest of Asia-Pacific. |

|

Market Players Covered |

MAINETTI, EISHO CO., LTD., and Concept Mannequins among others. |

Market Definition

A general hanger is a type of hanger that can be used to hang clothes in a variety of different ways. It can be made from metal, wood, or plastic. There are many uses for general hangers. They can be used for personal use, such as hanging clothes to dry, or for commercial use, such as displaying products. They can also be used in different applications, such as hanging curtains or drapes.

Asia-Pacific Hangers Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

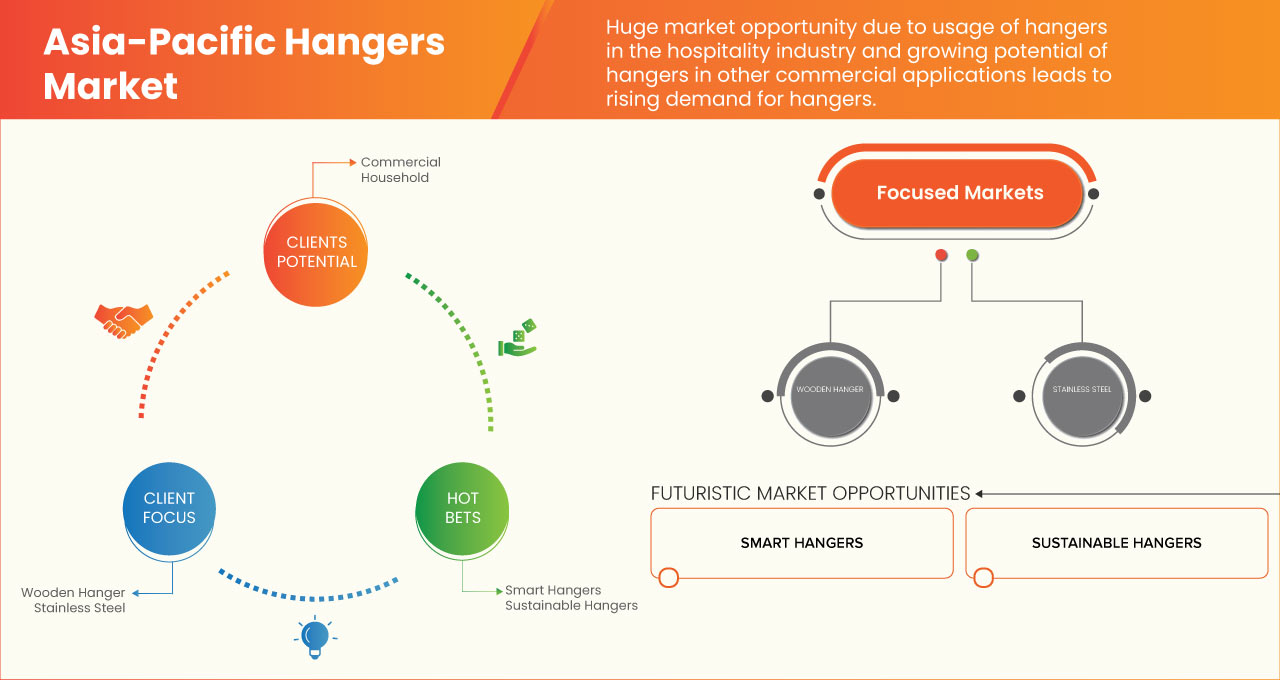

- A THRIVING RETAIL AND HOSPITALITY SECTOR LEADS TO CONTINUOUS GROWTH

Today, retail is one of the fastest developing channels, and it plays a vital part in the country's increasing economic growth. Customers are becoming increasingly drawn to retail markets in recent years. Changes in income structure, changing lifestyles, and organized retail, bolstered in particular by rising incomes and growing purchasing power among consumers in rapidly growing sectors of the economy, such as information technology and business process outsourcing, are just a few of the key factors driving growth in the retail industry. Large format retail firms dominate the retail environment in terms of retail space, categories, range, brands, and volumes. Their operational sizes are massive, their profit margins are significantly larger, and they operate in a variety of formats, such as discount shops, warehouses, supermarkets, department stores, hypermarkets, convenience stores, and specialty stores. The branded clothes market is the most rapidly growing.

The hospitality sector is a broad subset of the service industry, with two primary categories being travel and tourism and housing ranging from hotel resorts to hostels. The worldwide hotel business, like the entire economy, has experienced significant expansion over the previous decade. This exceptional growth has benefitted the hotel and tourism industries by increasing Asia-Pacific travel activity and adding countless room nights for leisure and business travel.

- THE PREFERENCE FOR WOODEN HANGERS IS TRENDING IN THE HANGERS MARKET

People use clothes hangers every day and stand to gain from properly keeping their clothing. That is why it is very odd that they don't pay much attention to the type of hangers in their wardrobes. The major reason clothing hangers don't receive the attention they deserve is that they're often fairly inexpensive and simple to get by, such as plastic, metal, and others. Buying and utilizing inexpensive hangers instead of higher quality hangers, such as wood clothing hangers, is a disadvantage.

Although wire hangers are convenient, they are not the ideal long-term choice for clothes storage. Wire hangers aren't very long-lasting. These hangers bend quickly, resulting in deformed hangers that create unsightly indentations in clothing. Even more, wire hangers can't handle bigger items and will simply bend under the increased weight. As a result, consumers who pick wire hangers will have to replace them more frequently. Similarly, plastic hangers, while easy and affordable, have the same issues as wire hangers. Furthermore, plastic hangers lack traction and might cause items to fall off the hanger. It can reduce the garment's lifespan and have an environmental impact if discarded.

Wood hangers are the best alternative for closet organizing and are the favored choice for various reasons. First, they provide unrivaled durability, holding up well regardless of the weight or size of your clothing. Wood hangers, for example, perform well as coat hangers or luxury suit hangers since they can hold the increased weight of these items. Furthermore, these hangers offer a fashionable touch to the closet. These elegant hangers help consumers design a premium wardrobe by creating a unified aesthetic.

- THE USE OF VARIOUS TYPES OF HANGERS IN HOUSEHOLDS IS INCREASING

A hanger is a piece of equipment used to hang garments. They were popular because they held a large amount of clothing. Hangers are now a must-have item in every home; it is impossible to imagine life without them. Several sorts of hangers are quite useful to people as the size of their households grows dramatically.

According to the material, the different types of hangers are wire, metallic, wooden, plastic, fabric/satin/velvet, bamboo, flocked, petite, and huggable hangers. According to their usability, the different types of hangers are shirt, pants, suit, skirts and lingerie, scarf, tie, shoe, sweater, and travel hangers. According to design/features are clips, swivel, thin, tubular, strap/notches, single bar, engraved, custom, combination, wide shoulder, non-slip, and dry/wet hangers. The manufacturers also produce recycled eco-friendly hangers. These are the various types of hangers that are increasingly used in households.

Opportunities

- INNOVATIONS OF INTELLIGENCE HANGERS ARE THE NEW CHOICE FOR DRYING CLOTHES

Intelligence Hangers innovations are a new alternative for drying clothes developed using innovative and beautiful approaches. The electrical product embraces the unusual traits of low-cost power expenses, a practical workstation, and efficient clothes drying. Traditional hangers are usually used for hanging and drying clothes, but intelligent clothing hangers function in rain and sunlight. Intelligent clothing hangers use light and raindrop sensors to distinguish between sunny and rainy days. These sensors can protect the garments from rain and keep the clothes aerated while the sun shines.

The intelligent clothes hanger is scientific and innovative in arranging the mechanical motor and electronic circuit. However, with the rapid growth of high-tech, intelligent hanger will be widely employed in the next years. Individuals are migrating toward luxury habits, lifestyles, and levels of consumption, according to the present market environment. Furthermore, individuals are accepting artificial inventions that are truly helpful and are within budgets.

- INCREASE IN THE COMMERCIAL SEGMENT AND PRODUCT ACCESSIBILITY

The commercial category has continued to thrive during the previous few years. The business sector is booming as a result of the high demand for retail and wholesale premises. The section makes it an appealing gamble, and this scenario is expected to continue in the next years. When a city's residential population begins to grow, the commercial sector begins to migrate. Social infrastructures such as malls, retail centers, restaurants, and workplaces are being built to assist people. It will occur in all areas of the world that develop in accordance with the rise of area civilization. This infrastructure creates a potential for branded and non-branded clothing retailers, wholesalers, and all other items. This will provide prospects for the hangers industry to thrive.

Restraints/Challenges

- ONLINE SALES WILL HAVE AN EFFECT ON CONVENTIONAL WHOLESALERS AND RETAILERS' SALES

The fashion business is a continuously changing, ever-evolving beast that is fuelled by the newest trends, technology, and ideas. However, there is no disputing that technology has harmed the fashion business. One of the primary reasons is online shopping; the arrival of the Internet as a marketing medium has altered the commercial connection between suppliers and customers.

People are increasingly purchasing online for a variety of reasons. It's easy, frequent sales or discounts exist, and anyone can locate everything they want with only a few clicks. However, this convenience has come at the price of conventional retail outlets. With the growth of internet shopping and social media and the resulting surge in sales, many brick-and-mortar companies have struggled to stay up. Indeed, numerous well-known stores have had to declare bankruptcy in recent years. This is due to the fact that consumers are just not shopping at physical stores as frequently as they used to. Small and independent fashion firms have been devastated by online shopping and rapid fashion development.

- FLUCTUATING RAW MATERIAL PRICES AND PROHIBITION ON PLASTIC USAGE

In recent days, it has been impossible to predict where raw material costs would go. They rise and fall in an erratic fashion with no discernable pattern. The prices of various raw materials might change, growing or decreasing, which can affect the prices of the goods that utilize them. There are five primary considerations: decreased supply, higher demand, sustainability difficulties, excessive price inflation in transportation and commerce, and more tax duties.

Wood, wire, metal, and plastics may all be used to make hangers. Raw material costs that fluctuate dramatically and inadequate pricing management might jeopardize a company's success. Plastic hangers are inexpensive and widely available. However, the price of plastics is variable, not only because the price of oil highly influences it but also because other market factors influence it.

Plastics are also prohibited in several nations owing to their negative impact on health and the environment. Every year, millions of plastic hangers are delivered to other nations. Plastic manufacturing has a significant environmental impact and generates much plastic trash once clothing is purchased.

RECENT DEVELOPMENTS

- In July 2021, MAINETTI introduced the Paperform Hanger line, which provides merchants with a sustainable and renewable complement to its hanger inventory. The hanger is 100% plastic-free, recyclable, and made from recycled paper and steel upon request. The revolutionary collection is available in a variety of hanger designs designed by the supply chain solutions provider. This assists the firm in gaining greater awareness and increasing product output.

- In November 2021, MAINETTI, a Asia-Pacific retail solutions provider, announced a collaboration with UBQ Materials Ltd. to establish a new benchmark for product innovation and sustainability in the fashion sector. The cooperation will use UBQ's proprietary thermoplastic to manufacture sustainable items for retailers Asia-Pacific utilizing climate-positive raw materials. This collaboration allows the firm to expand its product line, innovate, and develop.

Asia-Pacific Hangers Market Scope

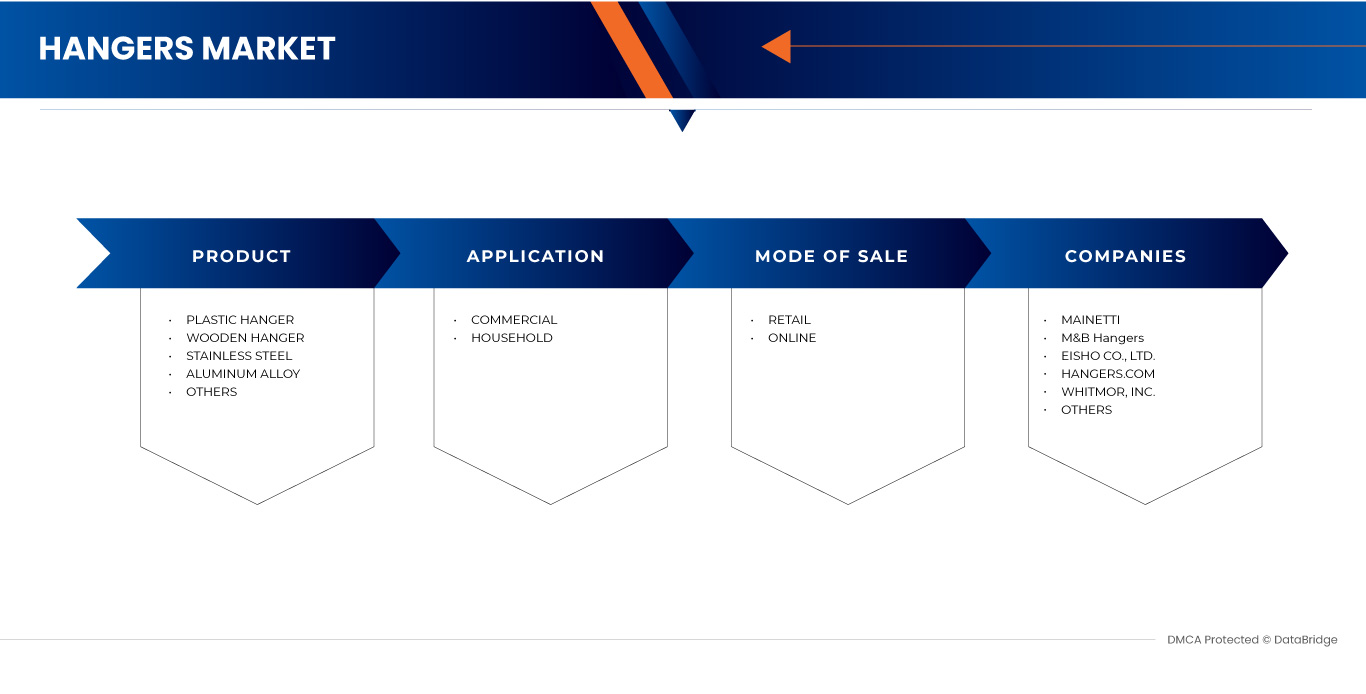

The Asia-Pacific hangers market is categorized based on product, application and mode of sale. The growth amongst these segments will help you analyze major industry growth segments and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Product

- Plastic Hanger

- Wooden Hanger

- Stainless Steel

- Aluminum Alloy

- Others

Based on product, the Asia-Pacific hangers market is segmented into plastic hanger, wooden hanger, stainless steel, aluminum alloy, and others.

Application

- Commercial

- Household

Based on application, the Asia-Pacific hangers market is segmented into commercial and household.

Mode of Sale

- Retail

- Online

Based on the mode of sale, the Asia-Pacific hangers market is segmented into retail and online.

Asia-Pacific Hangers Market Regional Analysis/Insights

The Asia-Pacific hangers market is segmented on the basis of product, application, and mode of sale.

Some countries in the Asia-Pacific hangers market is segmented into Japan, China, South Korea, India, Singapore, Thailand, Indonesia, Malaysia, Philippines, Australia & New Zealand, and the Rest of Asia-Pacific. China is expected to dominate the Asia-Pacific hangers market in terms of market share and market revenue due to the increasing usage of various types of hangers in households.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data points downstream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of new brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Asia-Pacific Hangers Market Share Analysis

Asia-Pacific hangers market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product approvals, patents, product width and breadth, application dominance, product lifeline curve. The above data points provided are only related to the companies' focus related to the Asia-Pacific hangers market.

Some of the prominent participants operating in the Asia-Pacific hangers market are MAINETTI, EISHO CO., LTD., and Concept Mannequins among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE ASIA PACIFIC HANGERS MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER'S FIVE FORCES:

4.1.1 THREAT OF NEW ENTRANTS:

4.1.2 THREAT OF SUBSTITUTES:

4.1.3 CUSTOMER BARGAINING POWER:

4.1.4 SUPPLIER BARGAINING POWER:

4.1.5 INTERNAL COMPETITION (RIVALRY):

4.2 BRAND SHARE ANALYSIS

4.3 CONSUMER BUYING BEHAVIOR

4.3.1 OVERVIEW

4.3.2 COMPLEX BUYING BEHAVIOR

4.3.3 DISSONANCE-REDUCING BUYING BEHAVIOR

4.3.4 HABITUAL BUYING BEHAVIOR

4.3.5 VARIETY SEEKING BEHAVIOR

4.3.6 CONCLUSION

4.4 FACTORS AFFECTING BUYING DECISION

4.4.1 ECONOMIC FACTOR

4.4.2 FUNCTIONAL FACTOR

4.5 CONSUMER PRODUCT ADSORPTION

4.5.1 OVERVIEW

4.5.2 PRODUCT AWARENESS

4.5.3 PRODUCT INTEREST

4.5.4 PRODUCT EVALUATION

4.5.5 PRODUCT TRIAL

4.5.6 PRODUCT ADOPTION

4.5.7 CONCLUSION

4.6 IMPACT OF ECONOMIC SLOWDOWN

4.6.1 IMPACT ON PRICE

4.6.2 IMPACT ON SUPPLY CHAIN

4.6.3 IMPACT ON SHIPMENT

4.6.4 IMPACT ON COMPANY'S STRATEGIC DECISIONS

4.7 IMPORT EXPORT SCENARIO

4.8 PRODUCTION CAPACITY OUTLOOK

4.9 SUPPLY CHAIN ANALYSIS

4.9.1 OVERVIEW

4.9.2 LOGISTIC COST SCENARIO

4.9.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.1 RAW MATERIAL SOURCING ANALYSIS

4.10.1 METAL

4.10.2 PLASTICS

4.10.3 WOOD

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 A THRIVING RETAIL AND HOSPITALITY SECTOR LEADS TO CONTINUOUS GROWTH

6.1.2 THE PREFERENCE FOR WOODEN HANGERS IS TRENDING IN THE HANGERS MARKET

6.1.3 THE USE OF VARIOUS TYPES OF HANGERS IN HOUSEHOLDS IS INCREASING

6.2 RESTRAINTS

6.2.1 ONLINE SALES HAVE AN EFFECT ON CONVENTIONAL WHOLESALERS AND RETAILERS' SALES

6.2.2 A CHEAP AND EASY ALTERNATIVE FOR HANGERS

6.3 OPPORTUNITIES

6.3.1 INNOVATIONS OF INTELLIGENCE HANGERS ARE THE NEW CHOICE FOR DRYING CLOTHES

6.3.2 INCREASE IN THE COMMERCIAL SEGMENT AND PRODUCT ACCESSIBILITY

6.4 CHALLENGES

6.4.1 FLUCTUATING RAW MATERIAL PRICES AND PROHIBITION ON PLASTIC USAGE

6.4.2 PROBLEMS ASSOCIATED WITH THE DIFFERENT TYPES OF HANGERS

7 ASIA PACIFIC HANGERS MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 PLASTIC HANGERS

7.3 WOODEN HANGER

7.4 STAINLESS STEEL

7.5 ALUMINUM ALLOY

7.6 OTHERS

8 ASIA PACIFIC HANGERS MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 COMMERCIAL

8.2.1 COMMERCIAL, BY PRODUCT

8.2.1.1 PLASTIC HANGER

8.2.1.2 WOODEN HANGER

8.2.1.3 STAINLESS STEEL

8.2.1.4 ALUMINUM ALLOY

8.2.1.5 OTHERS

8.3 HOUSEHOLD

8.3.1 HOUSEHOLD, BY PRODUCT

8.3.1.1 PLASTIC HANGER

8.3.1.2 WOODEN HANGER

8.3.1.3 STAINLESS STEEL

8.3.1.4 ALUMINUM ALLOY

8.3.1.5 OTHERS

9 ASIA PACIFIC HANGERS MARKET, BY MODE OF SALE

9.1 OVERVIEW

9.2 RETAIL

9.3 ONLINE

10 ASIA PACIFIC HANGERS MARKET, BY REGION

10.1 ASIA-PACIFIC

10.1.1 CHINA

10.1.2 INDIA

10.1.3 JAPAN

10.1.4 SOUTH KOREA

10.1.5 THAILAND

10.1.6 SINGAPORE

10.1.7 INDONESIA

10.1.8 AUSTRALIA & NEW ZEALAND

10.1.9 PHILIPPINES

10.1.10 MALAYSIA

10.1.11 REST OF ASIA-PACIFIC

11 ASIA PACIFIC HANGERS MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

11.2 PRODUCT LAUNCH

11.3 PARTNERSHIP

12 SWOT ANALYSIS

13 COMPANY PROFILES

13.1 MAINETTI

13.1.1 COMPANY SNAPSHOT

13.1.2 COMPANY SHARE ANALYSIS

13.1.3 PRODUCT PORTFOLIO

13.1.4 RECENT UPDATES

13.2 M&B HANGERS

13.2.1 COMPANY SNAPSHOT

13.2.2 COMPANY SHARE ANALYSIS

13.2.3 PRODUCT PORTFOLIO

13.2.4 RECENT UPDATES

13.3 EISHO CO., LTD.

13.3.1 COMPANY SNAPSHOT

13.3.2 COMPANY SHARE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT UPDATES

13.4 HANGERS.COM

13.4.1 COMPANY SNAPSHOT

13.4.2 COMPANY SHARE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT UPDATE

13.5 WHITMOR, INC.

13.5.1 COMPANY SNAPSHOT

13.5.2 COMPANY SHARE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT UPDATES

13.6 BEND & HOOK

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT UPDATES

13.7 CONCEPT MANNEQUINS

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT UPDATE

13.8 GUILIN IANGO HOME COLLECTION CO., LTD.

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT UPDATES

13.9 MAWA-HANGERS.COM.

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT UPDATES

13.1 NAHANC0

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT UPDATE

14 QUESTIONNAIRE

15 RELATED REPORT

List of Table

TABLE 1 IMPORT DATA OF CLOTHES HANGERS OF WOOD; HS CODE – 442110 (USD THOUSAND)

TABLE 2 EXPORT DATA OF CLOTHES HANGERS OF WOOD; HS CODE – 442110 (USD THOUSAND)

TABLE 3 REGULATORY FRAMEWORK

TABLE 4 ASIA PACIFIC HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 5 ASIA PACIFIC HANGERS MARKET, BY PRODUCT, 2021-2030 (THOUSAND UNITS)

TABLE 6 ASIA PACIFIC PLASTIC HANGERS IN HANGERS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 7 ASIA PACIFIC WOODEN HANGERS IN HANGERS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 8 ASIA PACIFIC STAINLESS STEEL IN HANGERS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 9 ASIA PACIFIC ALUMINIUM ALLOY IN HANGERS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 10 ASIA PACIFIC OTHERS IN HANGERS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 11 ASIA PACIFIC HANGERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 12 ASIA PACIFIC HANGERS MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 13 ASIA PACIFIC COMMERCIAL IN HANGERS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 14 ASIA PACIFIC COMMERCIAL IN HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 15 ASIA PACIFIC HOUSEHOLD IN HANGERS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 16 ASIA PACIFIC HOUSEHOLD IN HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 17 ASIA PACIFIC HANGERS MARKET, BY MODE OF SALE, 2021-2030 (USD THOUSAND)

TABLE 18 ASIA PACIFIC RETAIL IN HANGERS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 19 ASIA PACIFIC ONLINE IN HANGERS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 20 ASIA-PACIFIC HANGERS MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 21 ASIA-PACIFIC HANGERS MARKET, BY COUNTRY, 2021-2030 (THOUSAND UNITS)

TABLE 22 ASIA-PACIFIC HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 23 ASIA-PACIFIC HANGERS MARKET, BY PRODUCT, 2021-2030 (THOUSAND UNITS)

TABLE 24 ASIA-PACIFIC HANGERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 25 ASIA-PACIFIC HANGERS MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 26 ASIA-PACIFIC COMMERCIAL IN HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 27 ASIA-PACIFIC HOUSEHOLD IN HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 28 ASIA-PACIFIC HANGERS MARKET, BY MODE OF SALE, 2021-2030 (USD THOUSAND)

TABLE 29 CHINA HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 30 CHINA HANGERS MARKET, BY PRODUCT, 2021-2030 (THOUSAND UNITS)

TABLE 31 CHINA HANGERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 32 CHINA HANGERS MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 33 CHINA COMMERCIAL IN HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 34 CHINA HOUSEHOLD IN HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 35 CHINA HANGERS MARKET, BY MODE OF SALE, 2021-2030 (USD THOUSAND)

TABLE 36 INDIA HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 37 INDIA HANGERS MARKET, BY PRODUCT, 2021-2030 (THOUSAND UNITS)

TABLE 38 INDIA HANGERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 39 INDIA HANGERS MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 40 INDIA COMMERCIAL IN HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 41 INDIA HOUSEHOLD IN HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 42 INDIA HANGERS MARKET, BY MODE OF SALE, 2021-2030 (USD THOUSAND)

TABLE 43 JAPAN HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 44 JAPAN HANGERS MARKET, BY PRODUCT, 2021-2030 (THOUSAND UNITS)

TABLE 45 JAPAN HANGERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 46 JAPAN HANGERS MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 47 JAPAN COMMERCIAL IN HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 48 JAPAN HOUSEHOLD IN HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 49 JAPAN HANGERS MARKET, BY MODE OF SALE, 2021-2030 (USD THOUSAND)

TABLE 50 SOUTH KOREA HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 51 SOUTH KOREA HANGERS MARKET, BY PRODUCT, 2021-2030 (THOUSAND UNITS)

TABLE 52 SOUTH KOREA HANGERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 53 SOUTH KOREA HANGERS MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 54 SOUTH KOREA COMMERCIAL IN HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 55 SOUTH KOREA HOUSEHOLD IN HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 56 SOUTH KOREA HANGERS MARKET, BY MODE OF SALE, 2021-2030 (USD THOUSAND)

TABLE 57 THAILAND HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 58 THAILAND HANGERS MARKET, BY PRODUCT, 2021-2030 (THOUSAND UNITS)

TABLE 59 THAILAND HANGERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 60 THAILAND HANGERS MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 61 THAILAND COMMERCIAL IN HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 62 THAILAND HOUSEHOLD IN HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 63 THAILAND HANGERS MARKET, BY MODE OF SALE, 2021-2030 (USD THOUSAND)

TABLE 64 SINGAPORE HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 65 SINGAPORE HANGERS MARKET, BY PRODUCT, 2021-2030 (THOUSAND UNITS)

TABLE 66 SINGAPORE HANGERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 67 SINGAPORE HANGERS MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 68 SINGAPORE COMMERCIAL IN HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 69 SINGAPORE HOUSEHOLD IN HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 70 SINGAPORE HANGERS MARKET, BY MODE OF SALE, 2021-2030 (USD THOUSAND)

TABLE 71 INDONESIA HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 72 INDONESIA HANGERS MARKET, BY PRODUCT, 2021-2030 (THOUSAND UNITS)

TABLE 73 INDONESIA HANGERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 74 INDONESIA HANGERS MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 75 INDONESIA COMMERCIAL IN HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 76 INDONESIA HOUSEHOLD IN HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 77 INDONESIA HANGERS MARKET, BY MODE OF SALE, 2021-2030 (USD THOUSAND)

TABLE 78 AUSTRALIA & NEW ZEALAND HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 79 AUSTRALIA & NEW ZEALAND HANGERS MARKET, BY PRODUCT, 2021-2030 (THOUSAND UNITS)

TABLE 80 AUSTRALIA & NEW ZEALAND HANGERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 81 AUSTRALIA & NEW ZEALAND HANGERS MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 82 AUSTRALIA & NEW ZEALAND COMMERCIAL IN HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 83 AUSTRALIA & NEW ZEALAND HOUSEHOLD IN HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 84 AUSTRALIA & NEW ZEALAND HANGERS MARKET, BY MODE OF SALE, 2021-2030 (USD THOUSAND)

TABLE 85 PHILIPPINES HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 86 PHILIPPINES HANGERS MARKET, BY PRODUCT, 2021-2030 (THOUSAND UNITS)

TABLE 87 PHILIPPINES HANGERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 88 PHILIPPINES HANGERS MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 89 PHILIPPINES COMMERCIAL IN HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 90 PHILIPPINES HOUSEHOLD IN HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 91 PHILIPPINES HANGERS MARKET, BY MODE OF SALE, 2021-2030 (USD THOUSAND)

TABLE 92 MALAYSIA HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 93 MALAYSIA HANGERS MARKET, BY PRODUCT, 2021-2030 (THOUSAND UNITS)

TABLE 94 MALAYSIA HANGERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 95 MALAYSIA HANGERS MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 96 MALAYSIA COMMERCIAL IN HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 97 MALAYSIA HOUSEHOLD IN HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 98 MALAYSIA HANGERS MARKET, BY MODE OF SALE, 2021-2030 (USD THOUSAND)

TABLE 99 REST OF ASIA-PACIFIC HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 100 REST OF ASIA-PACIFIC HANGERS MARKET, BY PRODUCT, 2021-2030 (THOUSAND UNITS)

List of Figure

FIGURE 1 ASIA PACIFIC HANGERS MARKET

FIGURE 2 ASIA PACIFIC HANGERS MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC HANGERS MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC HANGERS MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC HANGERS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC HANGERS MARKET: THE PRODUCT LIFE LINE CURVE

FIGURE 7 ASIA PACIFIC HANGERS MARKET: MULTIVARIATE MODELLING

FIGURE 8 ASIA PACIFIC HANGERS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 ASIA PACIFIC HANGERS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 ASIA PACIFIC HANGERS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 ASIA PACIFIC HANGERS MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 ASIA PACIFIC HANGERS MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 ASIA PACIFIC HANGERS MARKET: SEGMENTATION

FIGURE 14 THRIVING RETAIL AND HOSPITALITY SECTOR LEAD TO CONTINUOUS IS EXPECTED TO DRIVE THE ASIA PACIFIC HANGERS MARKET IN THE FORECAST PERIOD

FIGURE 15 PLASTIC HANGER SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC HANGERS MARKET IN 2023 & 2030

FIGURE 16 ASIA PACIFIC HANGERS MARKET: TYPES OF CONSUMER BUYING BEHAVIOUR

FIGURE 17 ASIA PACIFIC HANGERS MARKET: PRODUCT ADOPTION SCENARIO

FIGURE 18 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE ASIA PACIFIC HANGERS MARKET

FIGURE 20 ASIA PACIFIC HANGERS MARKET, BY PRODUCT, 2022

FIGURE 21 ASIA PACIFIC HANGERS MARKET, BY APPLICATION, 2022

FIGURE 22 ASIA PACIFIC HANGERS MARKET, BY MODE OF SALE, 2022

FIGURE 23 ASIA-PACIFIC HANGERS MARKET: BY SNAPSHOT (2022)

FIGURE 24 ASIA-PACIFIC HANGERS MARKET: BY COUNTRY (2022)

FIGURE 25 ASIA-PACIFIC HANGERS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 26 ASIA-PACIFIC HANGERS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 27 ASIA-PACIFIC HANGERS MARKET: BY PRODUCT (2023 - 2030)

FIGURE 28 ASIA PACIFIC HANGERS MARKET: COMPANY SHARE 2022 (%)

Asia Pacific Hanger Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Asia Pacific Hanger Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Asia Pacific Hanger Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.