Asia-Pacific Glyphosate Market Analysis and Insights

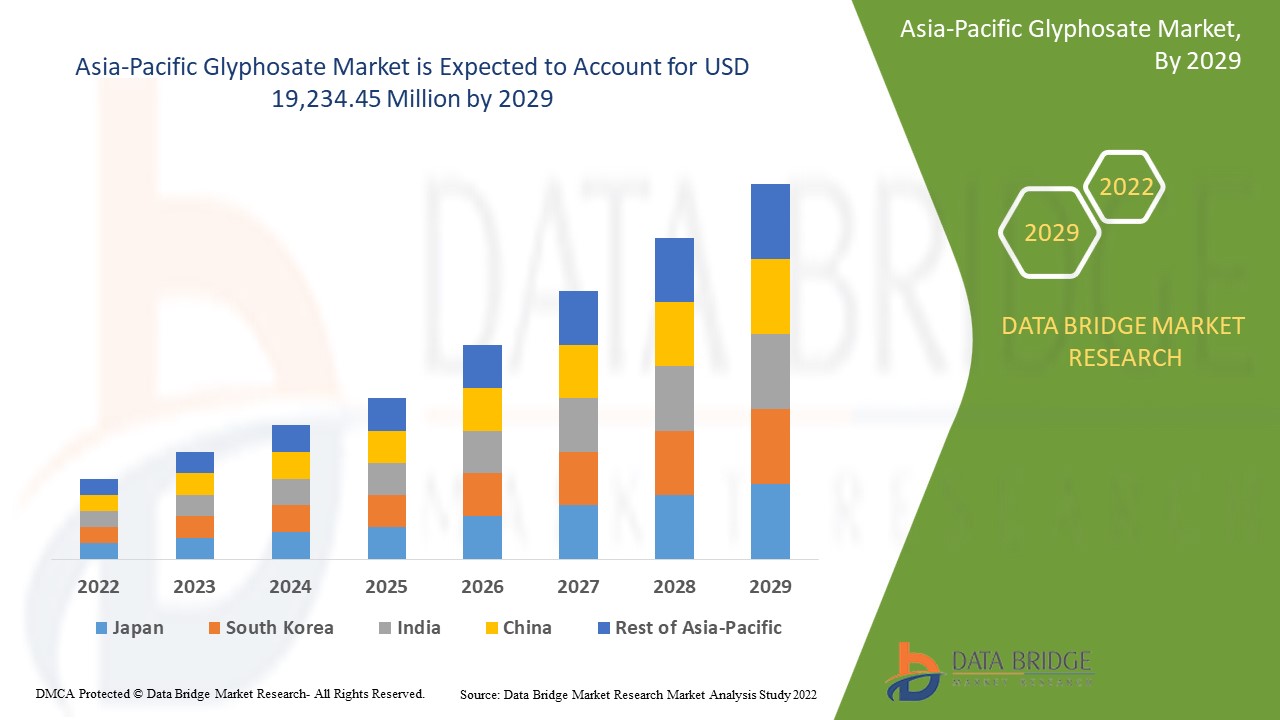

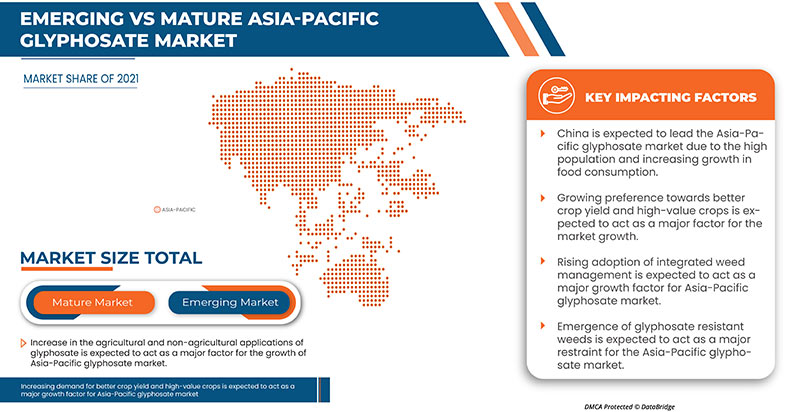

The Asia-Pacific glyphosate market is expected to grow significantly in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 6.1% in the forecast period of 2022 to 2029 and is expected to reach USD 19,234.45 million by 2029. The major factor driving the growth of the glyphosate market is the rise in the agricultural sector, rising adoption of integrated weed management, growing commercialization of high-value crops, and increase in the agricultural and non-agricultural applications of glyphosate.

The increase in the agricultural and non-agricultural applications of glyphosate across the globe is one of the major factors driving the growth of the glyphosate market. The use of glyphosate to kill weeds such as chickweed, barnyard grass, dandelion, and other weeds and the increase in the replacement of mechanical weed control in many crops accelerate the market growth. The rise in the approval of herbicide-tolerance technology for crops to grow inorganically with rapid farmer adoption, and product advantages over mechanical tillage systems, such as low cost, less soil, and environmental degradation, influence the market. Additionally, a rise in demand for enhanced quality crops and the expansion of the agriculture sector positively affect the glyphosate market.

The Asia-Pacific glyphosate market report provides details of market share, new developments, and the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an Analyst Brief. Our team will help you create a revenue-impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

By Type (Glyphosate Salts and Glyphosate Acids), Form (Dry and Liquid), Function (Weed Management Solution, Improve Soil Health, Improved Planting Efficiency, and Others), Color (White And Colorless), Shelf Life (Less Than 1 Years, 1 Year, 2 Years, 3 Years and More Than 3 Years), Crop Application (Oil Seeds, Pulses, Cereals & Grains, Fruits, Vegetables, Horticulture, and Turn & Ornaments), Distribution Channel (Direct and Indirect), |

|

Countries Covered |

Japan, China, South Korea, India, Singapore, Thailand, Indonesia, Malaysia, Philippines, Australia, Rest of Asia-Pacific. |

|

Market Players Covered |

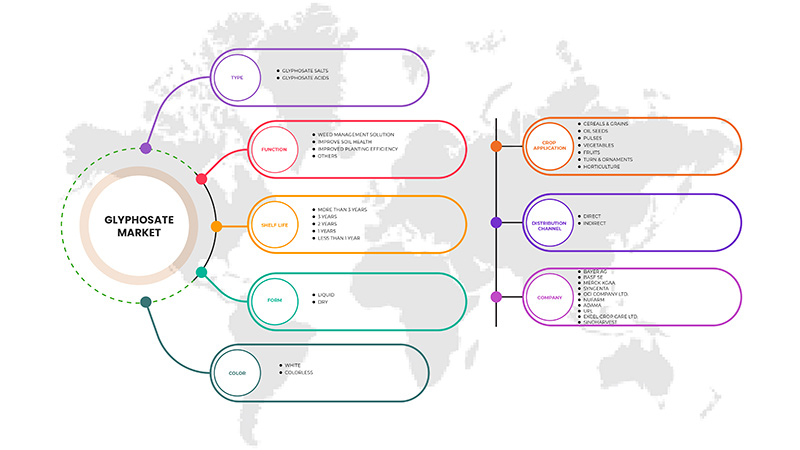

SinoHarvest, Syngenta, AgroStar, Novus Biologicals, Bayer AG, Nufarm, UPL, ADAMA, OCI COMPANY Ltd., Excel Crop Care Ltd., Merck KGaA, BASF SE |

Market Definition

Glyphosate is one of the most commonly used herbicides and is classified as a post-emergent, systemic herbicide, non-selective, capable of killing weeds with green foliage. These pesticides are used to prevent and control the growth of fungi and spore diseases. It is an herbicide applied to the leaves of plants to kill both broadleaf plants and grasses. It is used in agriculture and forestry, lawns and gardens, and for weeds in industrial areas. It is also used to control the growth of aquatic plants. 2 types of glyphosate are glyphosate salts and glyphosate acids. It is a weed management solution to improve soil health, planting efficiency, and others.

Asia-Pacific Glyphosate Market Dynamics

Drivers

- Rise in the agricultural sector

Agriculture plays a major role in the economic growth and development of countries. It helps development by ensuring food security and improving nutrition. Economic transformation means a country's shift in the relative contribution of its technology and sectors to its overall gross domestic product (GDP), where the agricultural sector plays a crucial role. It boosts labor productivity, increases agricultural surplus to accumulate capital, and increases foreign exchange via exports.

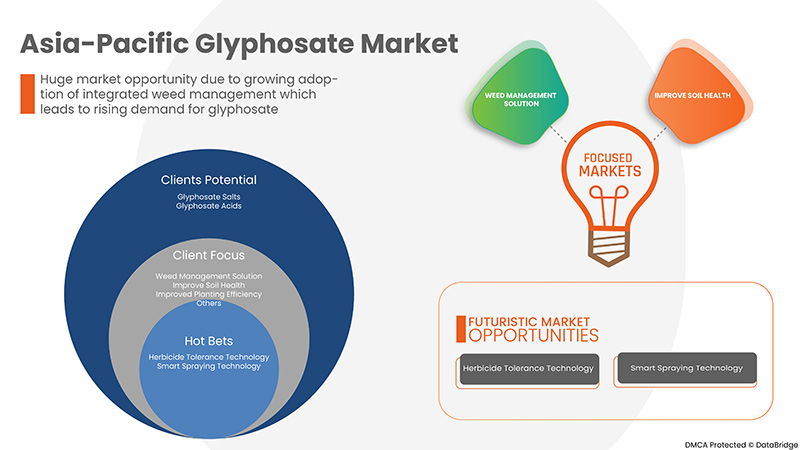

- Rising adoption of integrated weed management

The increasing adoption of effective and integrated weed control systems and solutions is the major factor expected to accelerate the growth of the Asia-Pacific glyphosate market in the forecast period. Glyphosate is widely gaining popularity for weed management in various land and water bodies to control the unnecessary growth of unwanted weeds. Glyphosate is extensively used in agricultural waters, canals, irrigation waters, farms, nurseries, and more.

- Growing commercialization of high value crops

High-value crops are stapled crops such as vegetables, fruits, flowers, ornamentals, condiments, and spices. These provide higher net returns per hectare to the farmer than staples or other widely grown crops. Introducing innovative practices and solutions on the farm contributes to the commercialization of the high-value crop. These systems and technologies will help farmers benefit from the ongoing agricultural transformation. Agriculture production in Asia is shifting toward high-value crops such as vegetables and fruit supported by new practices and technologies. Contract farming has the potential to benefit both farmers and contractors by allowing product specialization but requires the capacity of local government agencies to monitor and enforce contracts. Similarly, digital technologies can promote inclusive development by helping farmers in remote areas access technical and market information, but this will require better access to mobile technology. To support the ongoing agricultural transformation, agriculture policy should facilitate greater market orientation through research and development.

- Increase in the agricultural and non-agricultural applications of glyphosate

Glyphosate is an herbicide widely used and applied/sprayed in agriculture and forestry, on lawns and gardens, and for weeds in industrial areas. It kills weeds, especially annual broadleaf weeds and grasses that compete with crops. The sodium salt form of glyphosate regulates plant growth and ripens specific crops. It prevents the plants from making certain proteins to stop plant growth. This non-selective herbicide moves from the treated foliage to other plant parts, including the roots. In this way, glyphosate kills annual and perennial weeds. It is used in various crop applications such as oil seeds, pulses, cereals & grains, fruits, vegetables, and horticulture.

Opportunity

- Rise in the approval of herbicide-tolerance technology

Glyphosates are pesticides that protect against and control fungi and spore diseases. Glyphosates can control specific fungal diseases as well as those from multiple sources. Herbicide-tolerant crop hybrids are genetically modified to withstand non-selective herbicides, such as glyphosate. In order to develop tolerance to glyphosate, many research and development efforts focus on evaluating glyphosate, the most effective herbicide that can control all plants despite species. Several companies continuously conduct extensive research and launch new products in the market.

Restraints/Challenges

- Emergence of glyphosate resistant weeds

Glyphosate resistance first appeared in Lolium rigidum in an apple orchard in Australia in 1996, and the same year, the first glyphosate-resistant crop (soybean) was introduced in the U.S. There are more than thirty weed species have now evolved resistance to glyphosate, which are distributed across 37 countries and in 34 different crops and six non-crop situations. Moreover, glyphosate-resistant weeds have been identified in orchards, vineyards, plantations, cereals, and fallow and non-crop situations. Glyphosate-resistant weeds present the greatest threat to sustained weed control in major agronomic crops because this herbicide is used to control weeds with resistance to herbicides with other sites of action, and no new herbicide sites of action have been introduced for a very long time. However, the industry is responding by developing herbicide-resistance traits in major crops that allow existing herbicides to be used in a new way. But, over-reliance on these traits results in multiple-resistance in weeds.

- Stringent government regulation regarding glyphosate

The enactment of stringent regulations, especially in the Asia-Pacific region, is expected to limit the expansion of the Asia-Pacific glyphosate market. Regulatory bodies in Asia-Pacific countries follow stringent regulations on growing genetically modified crops. Their eager adoption has led to extensive usage of herbicides, thus causing the evolution of glyphosate-resistant weeds. Therefore, one factor limiting the industry is the rigorous laws regulating the use of glyphosate due to several environmental and health concerns. Overexposure to glyphosate can result in cancer and related health problems.

- Harmful impact of glyphosates on the environment and human population

Concerns regarding the hazardous effects of glyphosate on the human population and environment are projected to challenge the glyphosate market. Several environmental effects of glyphosate have been documented and recorded within terrestrial and aquatic environments and against human health. Glyphosate herbicide leakage into water bodies negatively affects aquatic organisms such as tadpoles and fish, which are killed. Aside from killing plants in the areas where glyphosate is distributed, it also kills plants in their surroundings. Whether on land or in water, the deaths of these living organisms can have adverse effects. This type of environmental impact threatens the market and challenges its growth of the market.

Recent Development

In September 2022, Merck KGaA opened a viral clearance (VC) laboratory as part of the first building phase of its new € 29 million China Biologics Testing Center. This new 5,000 square meter center is the first of its kind for Merck KGaA in China. The VC laboratory allows customers to conduct viral clearance studies locally from pre-clinical development to commercialization and will meet the double-digit demand for VC testing services in China. This will help the company to enhance its operations in the Asia-Pacific region.

Asia-Pacific Glyphosate Market Scope

The Asia-Pacific glyphosate market is categorized based on type, form, function, color, shelf life, application, and distribution channel. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Type

- Glyphosate Salts

- Glyphosate Acids

Based on type, the Asia-Pacific glyphosate market is classified into two segments glyphosate salts and glyphosate acids.

Form

- Liquid

- Dry

Based on a form, the Asia-Pacific glyphosate market is classified into two segments dry and liquid.

Function

- Weed Management Solution

- Improve Soil Health

- Improved Planting Efficiency

- Others

Based on the function, the Asia-Pacific glyphosate market is classified into four segments weed management solutions, improved soil health, improved planting efficiency, and others.

Color

- White

- Colorless

Based on color, the Asia-Pacific glyphosate market is classified into three segments white and colorless.

Shelf Life

- More Than 3 Years

- 3 Years

- 2 Years

- 1 Year

- Less Than 1 Year

Based on shelf life, the Asia-Pacific glyphosate market is classified into five segments less than 1 year, 1 year, 2 years, 3 years, and more than 3 years.

Crop Application

- Cereals & Grains

- Oil Seeds

- Pulses

- Vegetables

- Fruits

- Turn & Ornaments

- Horticulture

Based on the crop application, the Asia-Pacific glyphosate market is classified into seven segments with oil seeds, pulses, cereals & grains, fruits, vegetables, horticulture, and turn & ornaments.

Distribution Channel

- Direct

- Indirect

Based on the distribution channel, the Asia-Pacific glyphosate market is classified into two segments with, direct and indirect.

Asia-Pacific Glyphosate Market Regional Analysis/Insights

The Asia-Pacific glyphosate market is segmented on the basis of type, form, function, color, shelf life, application, and distribution channel.

The countries in the Asia-Pacific glyphosate market are Japan, China, South Korea, India, Singapore, Thailand, Indonesia, Malaysia, Philippines, Australia, and the Rest of Asia-Pacific. China is dominating the Asia-Pacific glyphosate market in terms of market share and market revenue due to the strong presence of market players in the region.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data point downstream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Europe brands and the challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Asia-Pacific Glyphosate Market Share Analysis

Asia-Pacific glyphosate market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies focus on the Asia-Pacific glyphosate market.

Some of the prominent participants operating in the Asia-Pacific glyphosate market are SinoHarvest, Syngenta, AgroStar, Novus Biologicals, Bayer AG, Nufarm, UPL, ADAMA, OCI COMPANY Ltd., Excel Crop Care Ltd., Merck KGaA, BASF SE.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning grids, Market Time Line Analysis, Market Overview and Guide, Company Positioning grids, Company Market Share Analysis, Standards of Measurement, Europe Vs. Regional and Vendor Share Analysis. Please request an analyst call in case of further inquiry.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE ASIA-PACIFIC GLYPHOSATE MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 BRAND OUTLOOK

4.1.1 COMPARATIVE BRAND ANALYSIS

4.1.2 PRODUCT VS BRAND OVERVIEW

4.2 CONSUMER-LEVEL TRENDS

4.3 FACTORS INFLUENCING PURCHASING DECISION OF CUSTOMER

4.4 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.5 IMPORT EXPORT SCENERIO

4.6 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.7 MEETING CONSUMER REQUIREMENT

4.8 NEW PRODUCT LAUNCH STRATEGY

4.8.1 NUMBER OF PRODUCT LAUNCHES

4.8.1.1 LINE EXTENSION

4.8.1.2 NEW PACKAGING

4.8.1.3 RE-LAUNCHED

4.8.1.4 NEW FORMULATION

4.9 OVERVIEW OF TECHNOLOGICAL INNOVATIONS

4.1 CONSUMER DISPOSABLE INCOME DYNAMICS/SPEND DYNAMICS

4.10.1 OVERVIEW

4.10.2 SOCIAL FACTORS

4.10.3 CULTURAL FACTORS

4.10.4 PSYCHOLOGICAL FACTORS

4.10.5 PERSONAL FACTORS

4.10.6 ECONOMIC FACTORS

4.10.7 PRODUCT TRAITS

4.10.8 MARKET ATTRIBUTES

4.10.9 CONCLUSION

4.11 IMPACT OF ECONOMIC SLOWDOWN

4.12 PORTER’S FIVE FORCES:

4.12.1 THREAT OF NEW ENTRANTS:

4.12.2 THREAT OF SUBSTITUTES:

4.12.3 CUSTOMER BARGAINING POWER:

4.12.4 SUPPLIER BARGAINING POWER:

4.12.5 INTERNAL COMPETITION (RIVALRY):

4.13 PRICING INDEX

4.14 PROMOTIONAL ACTIVITIES

4.15 RAW MATERIAL SOURCING ANALYSIS

4.16 SHOPPING BEHAVIOUR AND DYNAMICS

4.17 SUPPLY CHAIN ANALYSIS

4.17.1 OVERVIEW

4.17.2 LOGISTIC COST SCENARIO

4.17.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.18 VALUE CHAIN ANALYSIS

5 PRODUCTION CAPACITY OF KEY MANUFACTURERS

6 REGULATORY FRAMEWORK AND GUIDELINES

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISE IN THE AGRICULTURAL SECTOR

7.1.2 RISING ADOPTION OF INTEGRATED WEED MANAGEMENT

7.1.3 GROWING COMMERCIALIZATION OF HIGH-VALUE CROPS

7.1.4 INCREASE IN THE AGRICULTURAL AND NON-AGRICULTURAL APPLICATIONS OF GLYPHOSATE

7.2 RESTRAINTS

7.2.1 EMERGENCE OF GLYPHOSATE-RESISTANT WEEDS

7.2.2 STRINGENT GOVERNMENT REGULATION REGARDING GLYPHOSATE

7.3 OPPORTUNITIES

7.3.1 RISE IN THE APPROVAL OF HERBICIDE-TOLERANCE TECHNOLOGY

7.4 CHALLENGES

7.4.1 HARMFUL IMPACT OF GLYPHOSATES ON THE ENVIRONMENT AND HUMAN POPULATION

8 ASIA-PACIFIC GLYPHOSATE MARKET, BY TYPE

8.1 OVERVIEW

8.2 GLYPHOSATE SALTS

8.2.1 ISOPROPYLAMINE SALT

8.2.2 MONOAMMONIUM SALT

8.2.3 POTASSIUM SALT

8.2.4 DIAMMONIUM SALT

8.2.5 OTHERS

8.3 GLYPHOSATE ACIDS

9 ASIA-PACIFIC GLYPHOSATE MARKET, BY FORM

9.1 OVERVIEW

9.2 LIQUID

9.3 DRY

9.3.1 GRANULAR

9.3.2 POWDER

9.3.3 OTHERS

10 ASIA-PACIFIC GLYPHOSATE MARKET, BY FUNCTION

10.1 OVERVIEW

10.2 WEED MANAGEMENT SOLUTION

10.3 IMPROVE SOIL HEALTH

10.4 IMPROVED PLANTING EFFICIENCY

10.5 OTHERS

11 ASIA-PACIFIC GLYPHOSATE MARKET, BY COLOR

11.1 OVERVIEW

11.2 WHITE

11.3 COLORLESS

12 ASIA-PACIFIC GLYPHOSATE MARKET, BY SHELF LIFE

12.1 OVERVIEW

12.2 MORE THAN 3 YEARS

12.3 3 YEARS

12.4 2 YEARS

12.5 1 YEAR

12.6 LESS THAN 1 YEAR

13 ASIA-PACIFIC GLYPHOSATE MARKET, BY CROP APPLICATION

13.1 OVERVIEW

13.2 CEREALS AND GRAINS

13.2.1 CEREALS AND GRAINS, BY TYPE

13.2.1.1 WHEAT

13.2.1.2 RICE

13.2.1.3 BARLEY

13.2.1.4 MILLET

13.2.1.5 OAT

13.2.1.6 SORGHUM

13.2.1.7 RYE

13.2.1.8 OTHERS

13.2.2 CEREALS AND GRAINS, BY GLYPHOSATE TYPE

13.2.2.1 GLYPHOSATE SALTS

13.2.2.2 GLYPHOSATE ACIDS

13.3 OIL SEEDS

13.3.1 OIL SEEDS, BY TYPE

13.3.1.1 SOYBEAN

13.3.1.2 COTTONSEED

13.3.1.3 SUNFLOWER

13.3.1.4 CORN

13.3.1.5 PEANUT

13.3.1.6 FLAXSEEDS

13.3.1.7 OTHERS

13.3.2 OIL SEEDS, BY GLYPHOSATE TYPE

13.3.2.1 GLYPHOSATE SALTS

13.3.2.2 GLYPHOSATE ACIDS

13.4 PULSES

13.4.1 PULSES, BY TYPE

13.4.1.1 CHICKPEAS

13.4.1.2 BLACK BEANS

13.4.1.3 PEAS

13.4.1.4 OTHERS

13.4.2 PULSES, BY GLYPHOSATE TYPE

13.4.2.1 GLYPHOSATE SALTS

13.4.2.2 GLYPHOSATE ACIDS

13.5 VEGETABLES

13.5.1 VEGETABLES, BY TYPE

13.5.1.1 LEAFY GREENS

13.5.1.2 CRUCIFEROUS VEGETABLES

13.5.1.3 MARROW VEGETABLES

13.5.1.4 ROOT VEGETABLES

13.5.1.5 ONION

13.5.1.6 GARLIC

13.5.1.7 OTHERS

13.5.2 VEGETABLES, BY GLYPHOSATE TYPE

13.5.2.1 GLYPHOSATE SALTS

13.5.2.2 GLYPHOSATE ACIDS

13.6 FRUITS

13.6.1 FRUITS, BY TYPE

13.6.1.1 APPLE & PEARS

13.6.1.2 CITRUS FRUITS

13.6.1.3 TROPICAL FRUITS

13.6.1.4 BERRIES

13.6.1.5 MELONS

13.6.1.6 OTHERS

13.6.2 FRUITS, BY GLYPHOSATE TYPE

13.6.2.1 GLYPHOSATE SALTS

13.6.2.2 GLYPHOSATE ACIDS

13.7 TURN AND ORNAMENTS

13.7.1 TURN AND ORNAMENTS, BY GLYPHOSATE TYPE

13.7.1.1 GLYPHOSATE SALTS

13.7.1.2 GLYPHOSATE ACIDS

13.8 HORTICULTURE

13.8.1 HORTICULTURE, BY GLYPHOSATE TYPE

13.8.1.1 GLYPHOSATE SALTS

13.8.1.2 GLYPHOSATE ACIDS

14 ASIA-PACIFIC GLYPHOSATE MARKET, BY DISTRIBUTION CHANNEL

14.1 OVERVIEW

14.2 DIRECT

14.3 INDIRECT

15 ASIA-PACIFIC GLYPHOSATE MARKET, BY COUNTRY

15.1 CHINA

15.2 INDIA

15.3 AUSTRALIA

15.4 JAPAN

15.5 SOUTH KOREA

15.6 INDONESIA

15.7 THAILAND

15.8 SINGAPORE

15.9 MALAYSIA

15.1 PHILIPPINES

15.11 REST OF ASIA-PACIFIC

16 ASIA-PACIFIC GLYPHOSATE MARKET, COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

16.1.1 COLLABORATION

16.1.2 FACILITY EXPANSIONS

16.1.3 EVENT

16.1.4 ACQUISITION

17 SWOT ANALYSIS

18 COMPANY PROFILES

18.1 BAYER AG

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 PRODUCT PORTFOLIO

18.1.4 RECENT UPDATES

18.2 BASF SE

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 PRODUCT PORTFOLIO

18.2.4 RECENT UPDATES

18.3 MERCK KGAA

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 PRODUCT PORTFOLIO

18.3.4 RECENT UPDATES

18.4 SYNGENTA

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 PRODUCT PORTFOLIO

18.4.4 RECENT UPDATES

18.5 OCI COMPANY LTD.

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 PRODUCT PORTFOLIO

18.5.4 RECENT UPDATES

18.6 ADAMA

18.6.1 COMPANY SNAPSHOT

18.6.2 REVENUE ANALYSIS

18.6.3 PRODUCT PORTFOLIO

18.6.4 RECENT UPDATES

18.7 AGROSTAR

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCT PORTFOLIO

18.7.3 RECENT UPDATES

18.8 EXCEL CROP CARE LTD.

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENTS

18.9 NOVUS BIOLOGICALS

18.9.1 COMPANY SNAPSHOT

18.9.2 PRODUCT PORTFOLIO

18.9.3 RECENT DEVELOPMENTS

18.1 NUFARM

18.10.1 COMPANY SNAPSHOT

18.10.2 REVENUE ANALYSIS

18.10.3 PRODUCT PORTFOLIO

18.10.4 RECENT UPDATES

18.11 SINOHARVEST

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT UPDATES

18.12 UPL

18.12.1 COMPANY SNAPSHOT

18.12.2 REVENUE ANALYSIS

18.12.3 PRODUCT PORTFOLIO

18.12.4 RECENT UPDATES

19 QUESTIONNAIRE

20 RELATED REPORTS

List of Table

TABLE 1 IMPORT DATA OF HERBICIDES, ANTI-SPROUTING PRODUCTS, AND PLANT-GROWTH REGULATORS, PUT UP IN FORMS OR PACKINGS FOR RETAIL SALE OR AS PREPARATIONS OR ARTICLES (EXCL. GOODS OF SUBHEADING 3808.59); HS CODE - 380893 (USD THOUSAND)

TABLE 2 EXPORT DATA OF HERBICIDES, ANTI-SPROUTING PRODUCTS, AND PLANT-GROWTH REGULATORS, PUT UP IN FORMS OR PACKINGS FOR RETAIL SALE OR AS PREPARATIONS OR ARTICLES (EXCL. GOODS OF SUBHEADING 3808.59); HS CODE - 380893 (USD THOUSAND)

TABLE 3 REGULATORY FRAMEWORK

TABLE 4 ASIA-PACIFIC GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 ASIA-PACIFIC GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 6 ASIA-PACIFIC GLYPHOSATE SALTS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 ASIA-PACIFIC GLYPHOSATE SALTS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 8 ASIA-PACIFIC GLYPHOSATE MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 9 ASIA-PACIFIC GLYPHOSATE MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 10 ASIA-PACIFIC DRY IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 11 ASIA-PACIFIC DRY IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 12 ASIA-PACIFIC GLYPHOSATE MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 13 ASIA-PACIFIC GLYPHOSATE MARKET, BY FUNCTION, 2020-2029 (KILO TONS)

TABLE 14 ASIA-PACIFIC GLYPHOSATE MARKET, BY COLOR, 2020-2029 (USD MILLION)

TABLE 15 ASIA-PACIFIC GLYPHOSATE MARKET, BY COLOR, 2020-2029 (KILO TONS)

TABLE 16 ASIA-PACIFIC GLYPHOSATE MARKET, BY SHELF LIFE, 2020-2029 (USD MILLION)

TABLE 17 ASIA-PACIFIC GLYPHOSATE MARKET, BY SHELF LIFE, 2020-2029 (KILO TONS)

TABLE 18 ASIA-PACIFIC GLYPHOSATE MARKET, BY CROP APPLICATION, 2020-2029 (USD MILLION)

TABLE 19 ASIA-PACIFIC GLYPHOSATE MARKET, BY CROP APPLICATION, 2020-2029 (KILO TONS)

TABLE 20 ASIA-PACIFIC CEREAL AND GRAINS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 21 ASIA-PACIFIC CEREALS AND GRAINS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 22 ASIA-PACIFIC CEREALS AND GRAINS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 23 ASIA-PACIFIC CEREALS AND GRAINS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 24 ASIA-PACIFIC OIL SEEDS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 25 ASIA-PACIFIC OIL SEEDS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 26 ASIA-PACIFIC OIL SEEDS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 27 ASIA-PACIFIC OIL SEEDS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 28 ASIA-PACIFIC PULSES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 29 ASIA-PACIFIC PULSES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 30 ASIA-PACIFIC PULSES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 31 ASIA-PACIFIC PULSES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 32 ASIA-PACIFIC VEGETABLE IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 33 ASIA-PACIFIC VEGETABLE IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 34 ASIA-PACIFIC VEGETABLE IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 35 ASIA-PACIFIC VEGETABLE GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 36 ASIA-PACIFIC FRUITS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 ASIA-PACIFIC FRUITS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 38 ASIA-PACIFIC FRUITS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 39 ASIA-PACIFIC FRUITS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 40 ASIA-PACIFIC TURN AND ORNAMENTS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 41 ASIA-PACIFIC TURN AND ORNAMENTS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 42 ASIA-PACIFIC HORTICULTURE IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 43 ASIA-PACIFIC HORTICULTURE IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 44 ASIA-PACIFIC GLYPHOSATE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 45 ASIA-PACIFIC GLYPHOSATE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (KILO TONS)

TABLE 46 ASIA-PACIFIC GLYPHOSATE MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 47 ASIA-PACIFIC GLYPHOSATE MARKET, BY COUNTRY, 2020-2029 (KILO TONS)

TABLE 48 CHINA GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 CHINA GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 50 CHINA GLYPHOSATE SALTS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 CHINA GLYPHOSATE SALTS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 52 CHINA GLYPHOSATE MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 53 CHINA GLYPHOSATE MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 54 CHINA DRY IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 CHINA DRY IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 56 CHINA GLYPHOSATE MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 57 CHINA GLYPHOSATE MARKET, BY FUNCTION, 2020-2029 (KILO TONS)

TABLE 58 CHINA GLYPHOSATE MARKET, BY COLOR, 2020-2029 (USD MILLION)

TABLE 59 CHINA GLYPHOSATE MARKET, BY COLOR, 2020-2029 (KILO TONS)

TABLE 60 CHINA GLYPHOSATE MARKET, BY SHELF LIFE, 2020-2029 (USD MILLION)

TABLE 61 CHINA GLYPHOSATE MARKET, BY SHELF LIFE, 2020-2029 (KILO TONS)

TABLE 62 CHINA GLYPHOSATE MARKET, BY CROP APPLICATION, 2020-2029 (USD MILLION)

TABLE 63 CHINA GLYPHOSATE MARKET, BY CROP APPLICATION, 2020-2029 (KILO TONS)

TABLE 64 CHINA OIL SEEDS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 CHINA OIL SEEDS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 66 CHINA OIL SEEDS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 67 CHINA OIL SEEDS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 68 CHINA PULSES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 CHINA PULSES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 70 CHINA PULSES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 71 CHINA PULSES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 72 CHINA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 CHINA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 74 CHINA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 75 CHINA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 76 CHINA FRUITS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 CHINA FRUITS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 78 CHINA FRUITS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 79 CHINA FRUITS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 80 CHINA VEGETABLES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 CHINA VEGETABLES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 82 CHINA VEGETABLES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 83 CHINA VEGETABLES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 84 CHINA HORTICULTURE IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 85 CHINA HORTICULTURE IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 86 CHINA TURN & ORNAMENTS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 87 CHINA TURN & ORNAMENTS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 88 CHINA GLYPHOSATE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 89 CHINA GLYPHOSATE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (KILO TONS)

TABLE 90 INDIA GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 INDIA GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 92 INDIA GLYPHOSATE SALTS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 93 INDIA GLYPHOSATE SALTS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 94 INDIA GLYPHOSATE MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 95 INDIA GLYPHOSATE MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 96 INDIA DRY IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 INDIA DRY IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 98 INDIA GLYPHOSATE MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 99 INDIA GLYPHOSATE MARKET, BY FUNCTION, 2020-2029 (KILO TONS)

TABLE 100 INDIA GLYPHOSATE MARKET, BY COLOR, 2020-2029 (USD MILLION)

TABLE 101 INDIA GLYPHOSATE MARKET, BY COLOR, 2020-2029 (KILO TONS)

TABLE 102 INDIA GLYPHOSATE MARKET, BY SHELF LIFE, 2020-2029 (USD MILLION)

TABLE 103 INDIA GLYPHOSATE MARKET, BY SHELF LIFE, 2020-2029 (KILO TONS)

TABLE 104 INDIA GLYPHOSATE MARKET, BY CROP APPLICATION, 2020-2029 (USD MILLION)

TABLE 105 INDIA GLYPHOSATE MARKET, BY CROP APPLICATION, 2020-2029 (KILO TONS)

TABLE 106 INDIA OIL SEEDS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 107 INDIA OIL SEEDS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 108 INDIA OIL SEEDS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 109 INDIA OIL SEEDS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 110 INDIA PULSES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 INDIA PULSES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 112 INDIA PULSES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 113 INDIA PULSES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 114 INDIA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 115 INDIA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 116 INDIA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 117 INDIA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 118 INDIA FRUITS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 119 INDIA FRUITS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 120 INDIA FRUITS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 121 INDIA FRUITS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 122 INDIA VEGETABLES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 123 INDIA VEGETABLES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 124 INDIA VEGETABLES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 125 INDIA VEGETABLES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 126 INDIA HORTICULTURE IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 127 INDIA HORTICULTURE IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 128 INDIA TURN & ORNAMENTS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 129 INDIA TURN & ORNAMENTS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 130 INDIA GLYPHOSATE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 131 INDIA GLYPHOSATE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (KILO TONS)

TABLE 132 AUSTRALIA GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 133 AUSTRALIA GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 134 AUSTRALIA GLYPHOSATE SALTS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 135 AUSTRALIA GLYPHOSATE SALTS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 136 AUSTRALIA GLYPHOSATE MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 137 AUSTRALIA GLYPHOSATE MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 138 AUSTRALIA DRY IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 139 AUSTRALIA DRY IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 140 AUSTRALIA GLYPHOSATE MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 141 AUSTRALIA GLYPHOSATE MARKET, BY FUNCTION, 2020-2029 (KILO TONS)

TABLE 142 AUSTRALIA GLYPHOSATE MARKET, BY COLOR, 2020-2029 (USD MILLION)

TABLE 143 AUSTRALIA GLYPHOSATE MARKET, BY COLOR, 2020-2029 (KILO TONS)

TABLE 144 AUSTRALIA GLYPHOSATE MARKET, BY SHELF LIFE, 2020-2029 (USD MILLION)

TABLE 145 AUSTRALIA GLYPHOSATE MARKET, BY SHELF LIFE, 2020-2029 (KILO TONS)

TABLE 146 AUSTRALIA GLYPHOSATE MARKET, BY CROP APPLICATION, 2020-2029 (USD MILLION)

TABLE 147 AUSTRALIA GLYPHOSATE MARKET, BY CROP APPLICATION, 2020-2029 (KILO TONS)

TABLE 148 AUSTRALIA OIL SEEDS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 149 AUSTRALIA OIL SEEDS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 150 AUSTRALIA OIL SEEDS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 151 AUSTRALIA OIL SEEDS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 152 AUSTRALIA PULSES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 153 AUSTRALIA PULSES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 154 AUSTRALIA PULSES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 155 AUSTRALIA PULSES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 156 AUSTRALIA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 157 AUSTRALIA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 158 AUSTRALIA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 159 AUSTRALIA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 160 AUSTRALIA FRUITS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 161 AUSTRALIA FRUITS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 162 AUSTRALIA FRUITS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 163 AUSTRALIA FRUITS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 164 AUSTRALIA VEGETABLES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 165 AUSTRALIA VEGETABLES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 166 AUSTRALIA VEGETABLES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 167 AUSTRALIA VEGETABLES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 168 AUSTRALIA HORTICULTURE IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 169 AUSTRALIA HORTICULTURE IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 170 AUSTRALIA TURN & ORNAMENTS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 171 AUSTRALIA TURN & ORNAMENTS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 172 AUSTRALIA GLYPHOSATE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 173 AUSTRALIA GLYPHOSATE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (KILO TONS)

TABLE 174 JAPAN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 175 JAPAN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 176 JAPAN GLYPHOSATE SALTS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 177 JAPAN GLYPHOSATE SALTS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 178 JAPAN GLYPHOSATE MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 179 JAPAN GLYPHOSATE MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 180 JAPAN DRY IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 181 JAPAN DRY IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 182 JAPAN GLYPHOSATE MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 183 JAPAN GLYPHOSATE MARKET, BY FUNCTION, 2020-2029 (KILO TONS)

TABLE 184 JAPAN GLYPHOSATE MARKET, BY COLOR, 2020-2029 (USD MILLION)

TABLE 185 JAPAN GLYPHOSATE MARKET, BY COLOR, 2020-2029 (KILO TONS)

TABLE 186 JAPAN GLYPHOSATE MARKET, BY SHELF LIFE, 2020-2029 (USD MILLION)

TABLE 187 JAPAN GLYPHOSATE MARKET, BY SHELF LIFE, 2020-2029 (KILO TONS)

TABLE 188 APAN GLYPHOSATE MARKET, BY CROP APPLICATION, 2020-2029 (USD MILLION)

TABLE 189 JAPAN GLYPHOSATE MARKET, BY CROP APPLICATION, 2020-2029 (KILO TONS)

TABLE 190 JAPAN OIL SEEDS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 191 JAPAN OIL SEEDS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 192 JAPAN OIL SEEDS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 193 JAPAN OIL SEEDS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 194 JAPAN PULSES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 195 JAPAN PULSES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 196 JAPAN PULSES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 197 JAPAN PULSES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 198 JAPAN CEREALS & GRAINS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 199 JAPAN CEREALS & GRAINS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 200 JAPAN CEREALS & GRAINS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 201 JAPAN CEREALS & GRAINS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 202 JAPAN FRUITS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 203 JAPAN FRUITS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 204 JAPAN FRUITS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 205 JAPAN FRUITS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 206 JAPAN VEGETABLES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 207 JAPAN VEGETABLES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 208 JAPAN VEGETABLES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 209 JAPAN VEGETABLES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 210 JAPAN HORTICULTURE IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 211 JAPAN HORTICULTURE IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 212 JAPAN TURN & ORNAMENTS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 213 JAPAN TURN & ORNAMENTS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 214 JAPAN GLYPHOSATE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 215 JAPAN GLYPHOSATE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (KILO TONS)

TABLE 216 SOUTH KOREA GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 217 SOUTH KOREA GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 218 SOUTH KOREA GLYPHOSATE SALTS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 219 SOUTH KOREA GLYPHOSATE SALTS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 220 SOUTH KOREA GLYPHOSATE MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 221 SOUTH KOREA GLYPHOSATE MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 222 SOUTH KOREA DRY IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 223 SOUTH KOREA DRY IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 224 SOUTH KOREA GLYPHOSATE MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 225 SOUTH KOREA GLYPHOSATE MARKET, BY FUNCTION, 2020-2029 (KILO TONS)

TABLE 226 SOUTH KOREA GLYPHOSATE MARKET, BY COLOR, 2020-2029 (USD MILLION)

TABLE 227 SOUTH KOREA GLYPHOSATE MARKET, BY COLOR, 2020-2029 (KILO TONS)

TABLE 228 SOUTH KOREA GLYPHOSATE MARKET, BY SHELF LIFE, 2020-2029 (USD MILLION)

TABLE 229 SOUTH KOREA GLYPHOSATE MARKET, BY SHELF LIFE, 2020-2029 (KILO TONS)

TABLE 230 SOUTH KOREA GLYPHOSATE MARKET, BY CROP APPLICATION, 2020-2029 (USD MILLION)

TABLE 231 SOUTH KOREA GLYPHOSATE MARKET, BY CROP APPLICATION, 2020-2029 (KILO TONS)

TABLE 232 SOUTH KOREA OIL SEEDS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 233 SOUTH KOREA OIL SEEDS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 234 SOUTH KOREA OIL SEEDS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 235 SOUTH KOREA OIL SEEDS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 236 SOUTH KOREA PULSES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 237 SOUTH KOREA PULSES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 238 SOUTH KOREA PULSES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 239 SOUTH KOREA PULSES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 240 SOUTH KOREA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 241 SOUTH KOREA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 242 SOUTH KOREA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 243 SOUTH KOREA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 244 SOUTH KOREA FRUITS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 245 SOUTH KOREA FRUITS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 246 SOUTH KOREA FRUITS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 247 SOUTH KOREA FRUITS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 248 SOUTH KOREA VEGETABLES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 249 SOUTH KOREA VEGETABLES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 250 SOUTH KOREA VEGETABLES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 251 SOUTH KOREA VEGETABLES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 252 SOUTH KOREA HORTICULTURE IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 253 SOUTH KOREA HORTICULTURE IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 254 SOUTH KOREA TURN & ORNAMENTS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 255 SOUTH KOREA TURN & ORNAMENTS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 256 SOUTH KOREA GLYPHOSATE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 257 SOUTH KOREA GLYPHOSATE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (KILO TONS)

TABLE 258 INDONESIA GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 259 INDONESIA GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 260 INDONESIA GLYPHOSATE SALTS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 261 INDONESIA GLYPHOSATE SALTS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 262 INDONESIA GLYPHOSATE MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 263 INDONESIA GLYPHOSATE MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 264 INDONESIA DRY IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 265 INDONESIA DRY IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 266 INDONESIA GLYPHOSATE MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 267 INDONESIA GLYPHOSATE MARKET, BY FUNCTION, 2020-2029 (KILO TONS)

TABLE 268 INDONESIA GLYPHOSATE MARKET, BY COLOR, 2020-2029 (USD MILLION)

TABLE 269 INDONESIA GLYPHOSATE MARKET, BY COLOR, 2020-2029 (KILO TONS)

TABLE 270 INDONESIA GLYPHOSATE MARKET, BY SHELF LIFE, 2020-2029 (USD MILLION)

TABLE 271 INDONESIA GLYPHOSATE MARKET, BY SHELF LIFE, 2020-2029 (KILO TONS)

TABLE 272 INDONESIA GLYPHOSATE MARKET, BY CROP APPLICATION, 2020-2029 (USD MILLION)

TABLE 273 INDONESIA GLYPHOSATE MARKET, BY CROP APPLICATION, 2020-2029 (KILO TONS)

TABLE 274 INDONESIA OIL SEEDS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 275 INDONESIA OIL SEEDS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 276 INDONESIA OIL SEEDS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 277 INDONESIA OIL SEEDS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 278 INDONESIA PULSES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 279 INDONESIA PULSES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 280 INDONESIA PULSES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 281 INDONESIA PULSES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 282 INDONESIA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 283 INDONESIA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 284 INDONESIA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 285 INDONESIA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 286 INDONESIA FRUITS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 287 INDONESIA FRUITS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 288 INDONESIA FRUITS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 289 INDONESIA FRUITS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 290 INDONESIA VEGETABLES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 291 INDONESIA VEGETABLES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 292 INDONESIA VEGETABLES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 293 INDONESIA VEGETABLES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 294 INDONESIA HORTICULTURE IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 295 INDONESIA HORTICULTURE IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 296 INDONESIA TURN & ORNAMENTS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 297 INDONESIA TURN & ORNAMENTS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 298 INDONESIA GLYPHOSATE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 299 INDONESIA GLYPHOSATE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (KILO TONS)

TABLE 300 THAILAND GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 301 THAILAND GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 302 THAILAND GLYPHOSATE SALTS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 303 THAILAND GLYPHOSATE SALTS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 304 THAILAND GLYPHOSATE MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 305 THAILAND GLYPHOSATE MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 306 THAILAND DRY IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 307 THAILAND DRY IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 308 THAILAND GLYPHOSATE MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 309 THAILAND GLYPHOSATE MARKET, BY FUNCTION, 2020-2029 (KILO TONS)

TABLE 310 THAILAND GLYPHOSATE MARKET, BY COLOR, 2020-2029 (USD MILLION)

TABLE 311 THAILAND GLYPHOSATE MARKET, BY COLOR, 2020-2029 (KILO TONS)

TABLE 312 THAILAND GLYPHOSATE MARKET, BY SHELF LIFE, 2020-2029 (USD MILLION)

TABLE 313 THAILAND GLYPHOSATE MARKET, BY SHELF LIFE, 2020-2029 (KILO TONS)

TABLE 314 THAILAND GLYPHOSATE MARKET, BY CROP APPLICATION, 2020-2029 (USD MILLION)

TABLE 315 THAILAND GLYPHOSATE MARKET, BY CROP APPLICATION, 2020-2029 (KILO TONS)

TABLE 316 THAILAND OIL SEEDS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 317 THAILAND OIL SEEDS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 318 THAILAND OIL SEEDS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 319 THAILAND OIL SEEDS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 320 THAILAND PULSES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 321 THAILAND PULSES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 322 THAILAND PULSES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 323 THAILAND PULSES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 324 THAILAND CEREALS & GRAINS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 325 THAILAND CEREALS & GRAINS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 326 THAILAND CEREALS & GRAINS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 327 THAILAND CEREALS & GRAINS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 328 THAILAND FRUITS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 329 THAILAND FRUITS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 330 THAILAND FRUITS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 331 THAILAND FRUITS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 332 THAILAND VEGETABLES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 333 THAILAND VEGETABLES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 334 THAILAND VEGETABLES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 335 THAILAND VEGETABLES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 336 THAILAND HORTICULTURE IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 337 THAILAND HORTICULTURE IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 338 THAILAND TURN & ORNAMENTS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 339 THAILAND TURN & ORNAMENTS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 340 THAILAND GLYPHOSATE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 341 THAILAND GLYPHOSATE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (KILO TONS)

TABLE 342 SINGAPORE GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 343 SINGAPORE GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 344 SINGAPORE GLYPHOSATE SALTS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 345 SINGAPORE GLYPHOSATE SALTS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 346 SINGAPORE GLYPHOSATE MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 347 SINGAPORE GLYPHOSATE MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 348 SINGAPORE DRY IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 349 SINGAPORE DRY IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 350 SINGAPORE GLYPHOSATE MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 351 SINGAPORE GLYPHOSATE MARKET, BY FUNCTION, 2020-2029 (KILO TONS)

TABLE 352 SINGAPORE GLYPHOSATE MARKET, BY COLOR, 2020-2029 (USD MILLION)

TABLE 353 SINGAPORE GLYPHOSATE MARKET, BY COLOR, 2020-2029 (KILO TONS)

TABLE 354 SINGAPORE GLYPHOSATE MARKET, BY SHELF LIFE, 2020-2029 (USD MILLION)

TABLE 355 SINGAPORE GLYPHOSATE MARKET, BY SHELF LIFE, 2020-2029 (KILO TONS)

TABLE 356 SINGAPORE GLYPHOSATE MARKET, BY CROP APPLICATION, 2020-2029 (USD MILLION)

TABLE 357 SINGAPORE GLYPHOSATE MARKET, BY CROP APPLICATION, 2020-2029 (KILO TONS)

TABLE 358 SINGAPORE OIL SEEDS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 359 SINGAPORE OIL SEEDS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 360 SINGAPORE OIL SEEDS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 361 SINGAPORE OIL SEEDS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 362 SINGAPORE PULSES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 363 SINGAPORE PULSES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 364 SINGAPORE PULSES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 365 SINGAPORE PULSES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 366 SINGAPORE CEREALS & GRAINS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 367 SINGAPORE CEREALS & GRAINS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 368 SINGAPORE CEREALS & GRAINS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 369 SINGAPORE CEREALS & GRAINS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 370 SINGAPORE FRUITS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 371 SINGAPORE FRUITS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 372 SINGAPORE FRUITS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 373 SINGAPORE FRUITS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 374 SINGAPORE VEGETABLES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 375 SINGAPORE VEGETABLES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 376 SINGAPORE VEGETABLES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 377 SINGAPORE VEGETABLES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 378 SINGAPORE HORTICULTURE IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 379 SINGAPORE HORTICULTURE IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 380 SINGAPORE TURN & ORNAMENTS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 381 SINGAPORE TURN & ORNAMENTS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 382 SINGAPORE GLYPHOSATE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 383 SINGAPORE GLYPHOSATE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (KILO TONS)

TABLE 384 MALAYSIA GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 385 MALAYSIA GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 386 MALAYSIA GLYPHOSATE SALTS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 387 MALAYSIA GLYPHOSATE SALTS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 388 MALAYSIA GLYPHOSATE MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 389 MALAYSIA GLYPHOSATE MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 390 MALAYSIA DRY IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 391 MALAYSIA DRY IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 392 MALAYSIA GLYPHOSATE MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 393 MALAYSIA GLYPHOSATE MARKET, BY FUNCTION, 2020-2029 (KILO TONS)

TABLE 394 MALAYSIA GLYPHOSATE MARKET, BY COLOR, 2020-2029 (USD MILLION)

TABLE 395 MALAYSIA GLYPHOSATE MARKET, BY COLOR, 2020-2029 (KILO TONS)

TABLE 396 MALAYSIA GLYPHOSATE MARKET, BY SHELF LIFE, 2020-2029 (USD MILLION)

TABLE 397 MALAYSIA GLYPHOSATE MARKET, BY SHELF LIFE, 2020-2029 (KILO TONS)

TABLE 398 MALAYSIA GLYPHOSATE MARKET, BY CROP APPLICATION, 2020-2029 (USD MILLION)

TABLE 399 MALAYSIA GLYPHOSATE MARKET, BY CROP APPLICATION, 2020-2029 (KILO TONS)

TABLE 400 MALAYSIA OIL SEEDS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 401 MALAYSIA OIL SEEDS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 402 MALAYSIA OIL SEEDS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 403 MALAYSIA OIL SEEDS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 404 MALAYSIA PULSES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 405 MALAYSIA PULSES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 406 MALAYSIA PULSES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 407 MALAYSIA PULSES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 408 MALAYSIA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 409 MALAYSIA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 410 MALAYSIA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 411 MALAYSIA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 412 MALAYSIA FRUITS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 413 MALAYSIA FRUITS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 414 MALAYSIA FRUITS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 415 MALAYSIA FRUITS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 416 MALAYSIA VEGETABLES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 417 MALAYSIA VEGETABLES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 418 MALAYSIA VEGETABLES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 419 MALAYSIA VEGETABLES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 420 MALAYSIA HORTICULTURE IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 421 MALAYSIA HORTICULTURE IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 422 MALAYSIA TURN & ORNAMENTS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 423 MALAYSIA TURN & ORNAMENTS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 424 MALAYSIA GLYPHOSATE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 425 MALAYSIA GLYPHOSATE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (KILO TONS)

TABLE 426 PHILIPPINES GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 427 PHILIPPINES GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 428 PHILIPPINES GLYPHOSATE SALTS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 429 PHILIPPINES GLYPHOSATE SALTS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 430 PHILIPPINES GLYPHOSATE MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 431 PHILIPPINES GLYPHOSATE MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 432 PHILIPPINES DRY IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 433 PHILIPPINES DRY IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 434 PHILIPPINES GLYPHOSATE MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 435 PHILIPPINES GLYPHOSATE MARKET, BY FUNCTION, 2020-2029 (KILO TONS)

TABLE 436 PHILIPPINES GLYPHOSATE MARKET, BY COLOR, 2020-2029 (USD MILLION)

TABLE 437 PHILIPPINES GLYPHOSATE MARKET, BY COLOR, 2020-2029 (KILO TONS)

TABLE 438 PHILIPPINES GLYPHOSATE MARKET, BY SHELF LIFE, 2020-2029 (USD MILLION)

TABLE 439 PHILIPPINES GLYPHOSATE MARKET, BY SHELF LIFE, 2020-2029 (KILO TONS)

TABLE 440 PHILIPPINES GLYPHOSATE MARKET, BY CROP APPLICATION, 2020-2029 (USD MILLION)

TABLE 441 PHILIPPINES GLYPHOSATE MARKET, BY CROP APPLICATION, 2020-2029 (KILO TONS)

TABLE 442 PHILIPPINES OIL SEEDS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 443 PHILIPPINES OIL SEEDS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 444 PHILIPPINES OIL SEEDS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 445 PHILIPPINES OIL SEEDS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 446 PHILIPPINES PULSES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 447 PHILIPPINES PULSES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 448 PHILIPPINES PULSES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 449 PHILIPPINES PULSES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 450 PHILIPPINES CEREALS & GRAINS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 451 PHILIPPINES CEREALS & GRAINS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 452 PHILIPPINES CEREALS & GRAINS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 453 PHILIPPINES CEREALS & GRAINS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 454 PHILIPPINES FRUITS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 455 PHILIPPINES FRUITS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 456 PHILIPPINES FRUITS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 457 PHILIPPINES FRUITS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 458 PHILIPPINES VEGETABLES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 459 PHILIPPINES VEGETABLES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 460 PHILIPPINES VEGETABLES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 461 PHILIPPINES VEGETABLES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 462 PHILIPPINES HORTICULTURE IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 463 PHILIPPINES HORTICULTURE IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 464 PHILIPPINES TURN & ORNAMENTS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 465 PHILIPPINES TURN & ORNAMENTS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 466 PHILIPPINES GLYPHOSATE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 467 PHILIPPINES GLYPHOSATE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (KILO TONS)

TABLE 468 REST OF ASIA-PACIFIC GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 469 REST OF ASIA-PACIFIC GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

List of Figure

FIGURE 1 ASIA-PACIFIC GLYPHOSATE MARKET: SEGMENTATION

FIGURE 2 ASIA-PACIFIC GLYPHOSATE MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC GLYPHOSATE MARKET: DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC GLYPHOSATE MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA-PACIFIC GLYPHOSATE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC GLYPHOSATE MARKET: THE DISTRIBUTION CHANNEL LIFE LINE CURVE

FIGURE 7 ASIA-PACIFIC GLYPHOSATE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 ASIA-PACIFIC GLYPHOSATE MARKET: DBMR MARKET POSITION GRID

FIGURE 9 ASIA-PACIFIC GLYPHOSATE MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 ASIA-PACIFIC GLYPHOSATE MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 11 ASIA-PACIFIC GLYPHOSATE MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 ASIA-PACIFIC GLYPHOSATE MARKET: SEGMENTATION

FIGURE 13 RISE IN THE AGRICULTURAL SECTOR EXPECTED TO DRIVE THE ASIA-PACIFIC GLYPHOSATE MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 THE GLYPHOSATE SALTS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA-PACIFIC GLYPHOSATE MARKET IN 2022 & 2029

FIGURE 15 ASIA-PACIFIC GLYPHOSATE MARKET: FACTORS AFFECTING DISPOSABLE INCOME OR SPEND DYNAMICS OF THE CONSUMERS

FIGURE 16 PRICE ANALYSIS FOR THE ASIA-PACIFIC GLYPHOSATE MARKET (USD/KG)

FIGURE 17 VALUE CHAIN OF THE ASIA-PACIFIC GLYPHOSATE MARKET

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA-PACIFIC GLYPHOSATE MARKET

FIGURE 19 ASIA-PACIFIC GLYPHOSATE MARKET: BY TYPE, 2021

FIGURE 20 ASIA-PACIFIC GLYPHOSATE MARKET: BY FORM, 2021

FIGURE 21 ASIA-PACIFIC GLYPHOSATE MARKET: BY FUNCTION, 2021

FIGURE 22 ASIA-PACIFIC GLYPHOSATE MARKET: BY COLOR, 2021

FIGURE 23 ASIA-PACIFIC GLYPHOSATE MARKET: BY SHELF LIFE 2021

FIGURE 24 ASIA-PACIFIC GLYPHOSATE MARKET: BY CROP APPLICATION, 2021

FIGURE 25 ASIA-PACIFIC GLYPHOSATE MARKET: BY DISTRIBUTION CHANNEL 2021

FIGURE 26 ASIA-PACIFIC GLYPHOSATE MARKET: SNAPSHOT (2021)

FIGURE 27 ASIA-PACIFIC GLYPHOSATE MARKET: BY COUNTRY (2021)

FIGURE 28 ASIA-PACIFIC GLYPHOSATE MARKET: BY COUNTRY (2022 & 2029)

FIGURE 29 ASIA-PACIFIC GLYPHOSATE MARKET: BY COUNTRY (2021 & 2029)

FIGURE 30 ASIA-PACIFIC GLYPHOSATE MARKET: BY TYPE (2022 - 2029)

FIGURE 31 ASIA-PACIFIC GLYPHOSATE MARKET: COMPANY SHARE 2021 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.