Market Analysis and Size

Gluten-free breakfast cereals are highly processed, with many ingredients added to reduce the risk of developing diseases such as coronary heart disease, cancer, diabetes, and diverticular disease. Breakfast cereals may be puffed, flaked, shredded, or coated in chocolate or frosting before it is dried, and finally, they are shaped into forms, such as balls, stars, loops, or rectangles.

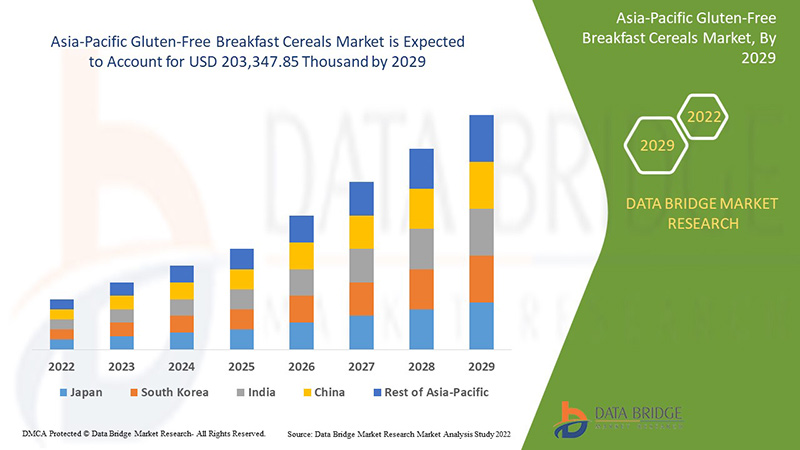

The increasing demand for ready-to-cook breakfast cereals and increased health awareness among the consumers are expected to drive the demand for the Asia-Pacific gluten-free breakfast cereals market. Data Bridge Market Research analyses that the gluten-free breakfast cereals market is expected to reach the value of USD 203,347.85 thousand by the year 2029, at a CAGR of 6.7% during the forecast period. "Adults" accounts for the most prominent consumer category segment in the respective market owing to rise in the demand for gluten-free breakfast cereals due to increased awareness for healthy lifestyle. The market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and climate chain scenario.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Thousand, Pricing in USD |

|

Segments Covered |

By Type (Hot Cereal, Ready To Eat Cereal), Breakfast Cereal Product Type (Porridge, Flakes, Loops, Crunchies, Crispies, Muesli, Others) , Breakfast Cereal Source (Corn, Rice, Wheat, Buckwheat, Granola, Bran, Millet, Multi-Grains, Others), Flavour (Plain, Flavoured), Sugar Content (With Added Sugar, Without Added Sugar), Product Category (Plain, With Nuts, With Fruits, Both Nuts And Fruits), Organic Category (Organic, Conventional), Nature (GMO, Non-GMO), Packaging Type (Plastic Wraps/Pouches, Cardboard Paper Boxes, Plastic Jars, Others), Packaging Size (Less Than 5 OZ, 5 - 7 OZ, 8 – 10 OZ, 11 – 13 OZ, More Than 13 OZ), Consumer Category (Adults, Kids), Distribution Channel (Store-Based Retailing, Online Retailing) |

|

Countries Covered |

China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Hong Kong, New Zealand, Taiwan and Rest of Asia-Pacific (APAC) |

|

Market Players Covered |

General Mills Inc. (Minnesota, U.S.), Kellogg's Company (Michigan, U.S.), Nestlé (Vevey, Switzerland), The Quaker Oats Company (a subsidiary of PepsiCo)( Illinois, U.S.), among others. |

Market Definition

Gluten-free breakfast cereal is made from processed grains and often fortified with vitamins and minerals, which is commonly eaten with milk, yogurt, fruit, or nuts. Gluten-free breakfast cereals are processed grains for human consumption and are usually packaged for sale as ready-to-eat (RTE) or hot cereals (HC) and must be cooked before consumption. The cereals are manufactured by continuous cooking, molding, and drying operations, after which flavors, sweeteners, vitamins, mineral fortifications, and particulate additive options are added before packaging. A cereal that has been derived from a gluten-containing grain can be labeled as “gluten-free” if it has been processed to remove gluten and consumption of that cereal results in the presence of less than 20 ppm of gluten in the food.

Regulatory Framework

Food and Drug Administration (FDA): The rule specifies, among other criteria, that any foods that carry the label “gluten-free,” “no gluten,” “free of gluten,” or “without gluten” must contain less than 20 parts per thousand (ppm) of gluten. This level is the lowest that can be reliably detected in foods using scientifically validated analytical methods. Other countries and international bodies use these same criteria, as most people with celiac disease can tolerate foods with very small amounts of gluten.

The Market Dynamics of the Gluten-Free Breakfast Cereals Market Include:

Drivers/Opportunities in the Gluten-Free Breakfast Cereals Market

- Increasing demand for ready-to-eat breakfast cereals

Ready-to-eat (RTE) foods include pre-washed, cooked, mostly packaged, ready-to-eat foods without prior preparation or cooking. Western culture strongly influences consumers for ready-to-eat breakfast cereals due to tight schedules, and everything is quick and easy with these ready-to-eat cereals. People are currently looking for faster, easier-to-prepare, and healthier options than other foods and quick snacks that are available in the market.

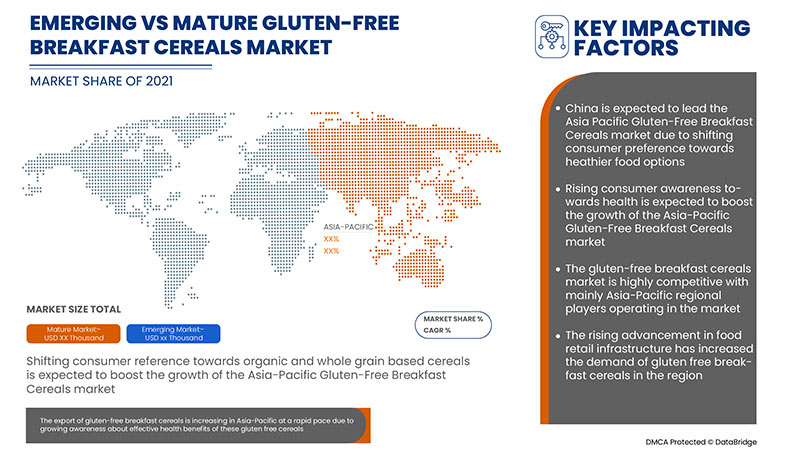

- Shifting consumer preference toward gluten-free, organic, and whole grain-based cereals

Increased awareness among end-users towards personal health and environmental concerns have increased the inclination of consumers toward the use of gluten-free organic products. In the current scenario, consumers mostly prefer organic food due to attributes such as nutrition value, taste, freshness, and appearance of organic food matters, which has eventually created opportunities for gluten-free organic-based products.

- Emerging number of food brands in the market

The impact of food fashion in the development of new brands cannot be denied. The latest food trends such as veganism, gluten-free, and anti-sugar are affecting almost every company in the food industry. Increasing health awareness and the quest for solutions to the obesity problem that led the industry's big hitters to revolutionize their products in response to the new brands emerging in the food industry.

- Increasing health awareness among consumers

Consumers are becoming more active, engaged in health care, using various digital tools to track their health, and using this data to make health decisions. Progressive health and wellness consumers are looking for alternatives to fear-based information, a phenomenon that has driven the view of wellness for decades. Consumer nutrition awareness encourages informed decisions regarding the purchase and consumption of cereals, grains, and many other healthy food items.

Restraints/Challenges faced by the Gluten-Free Breakfast Cereals Market

- Availability of alternative breakfast options

The healthiest breakfast choices include a combination of protein, fiber, healthy fats, and a modest amount of unrefined carbohydrates to provide rapid energy. The alternatives to cereals include mini frittatas, muffins, bread, and many others, often filled with all sorts of vitamins and minerals and rich in vegetables. Therefore, the alternative breakfast items are overall much healthier for both the short and long run.

- Huge commercialization of counterfeit products

The rise of digital channels that drive the buying and selling of consumer goods has led to a rapid increase in counterfeit trade worldwide. Some food brands are trying to stop selling counterfeit versions of their products. Counterfeit products are indeed similar to low-quality products. This may not seem like a serious threat, but the truth is that poor-quality items can have dire consequences in reality.

COVID-19 had a Minimal Impact on Gluten-Free Breakfast Cereals Market

COVID-19 impacted various manufacturing and service providing industries in the year 2020-2021 as it led to the closure of workplaces, disruption of supply chains, and restrictions on transportation. Though, the imbalance between demand and supply and its impact on pricing is considered short-term and is expected to recover as this pandemic comes to an end. Due to outbreak of covid19 throughout the globe, the demand for gluten-free breakfast cereals was decreased. Thus, food industries suffered a lot during covid19 outbreak, the gluten-free breakfast cereals industry will hopefully grow with the removed restrictions in varied countries.

Recent Developments

- In May 2022, General Mills Inc. agreed to acquire TNT Crust, a manufacturer of high-quality frozen pizza crusts for regional and national pizza chains, foodservice distributors, and retail outlets. This acquisition will help the company expand its operations in the market.

- In 2020, Kelloggs Co. was awarded America’s Most Trusted Brands (Morning Consult). This has enhanced company’s image in the Asia-Pacific market.

Asia-Pacific Gluten-Free Breakfast Cereals Market Scope

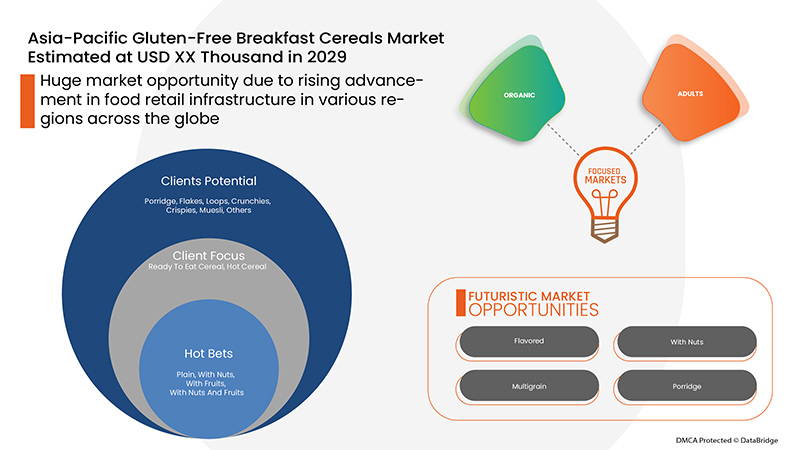

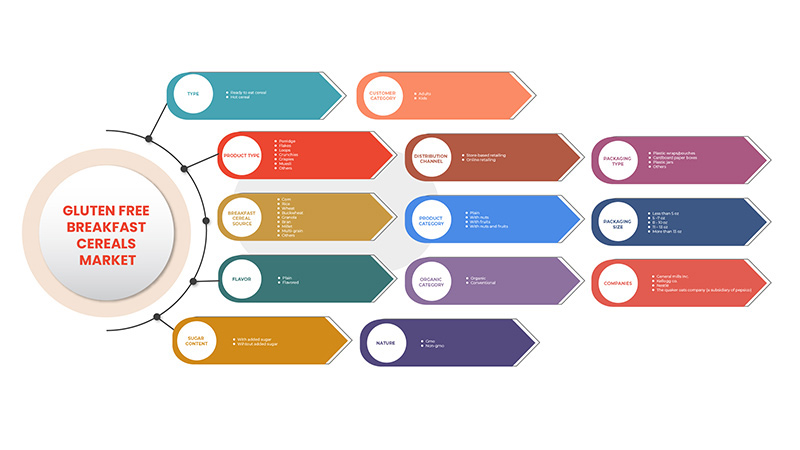

The gluten-free breakfast cereals market is segmented on the basis of type, breakfast cereal product type, breakfast cereal sources, flavour, sugar content, product category, organic category, nature, packaging size, packaging type, consumer category, distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Ready To Eat Cereal

- Hot Cereal

On the basis of type, the gluten-free breakfast cereals market is segmented into hot cereal and ready to eat cereal.

Breakfast Cereal Product Type

- Porridge

- Flakes

- Loops

- Crunchies

- Crispies

- Muesli

- Others

On the basis of breakfast cereal product type, the gluten-free breakfast cereals market is segmented into porridge, flakes, loops, crunchies, crispies, muesli and others.

Breakfast Cereal Source

- Corn

- Wheat

- Bran

- Multi-Grain

- Millet

- Rice

- Buckwheat

- Granola

- Others

On the basis of breakfast cereal source, the gluten-free breakfast cereals market is segmented into corn, rice, wheat, buckwheat, granola, bran, millet, multi-grains, and others.

Flavour

- Plain

- Flavoured

On the basis of flavour, the gluten-free breakfast cereals market is segmented into plain and flavoured.

Sugar Content

- With Added Sugar

- Without Added Sugar

On the basis of sugar content, the gluten-free breakfast cereals market is segmented into with added sugar, without added sugar.

Product Category

- Plain

- With Nuts

- With Fruits

- Both Nuts and Fruits

On the basis of product category, the gluten-free breakfast cereals market is segmented into plain, with nuts, with fruits, both nuts and fruits.

Organic Category

- Organic

- Conventional

On the basis of organic category, the gluten-free breakfast cereals market is segmented into organic and conventional.

Nature

- GMO

- NON-GMO

On the basis of nature, the gluten-free breakfast cereals market is segmented into GMO and non-GMO.

Packaging Type

- Plastic Wraps/Pouches

- Cardboard Paper Boxes

- Plastic Jars

- Others

On the basis of packaging type, the gluten-free breakfast cereals market is segmented into plastic wraps/pouches, cardboard paper boxes, plastic jars and others.

Packaging Size

- Less Than 5 Oz

- 5 –7 Oz

- 8 - 10 Oz

- 11 – 13 Oz

- More Than 13 Oz

On the basis of packaging size, the gluten-free breakfast cereals market is segmented into less than 5 OZ, 5-7 OZ, 8-10 OZ, 11-13 OZ and more than 13 OZ.

Consumer Category

- Adults

- Kids

On the basis of consumer category, the gluten-free breakfast cereals market is segmented into adults and kids.

Distribution Channel

- Store-Based Retailing

- Online Retailing

On the basis of distribution channel, the gluten-free breakfast cereals market is segmented into store-based retailing and online retailing.

Gluten-Free Breakfast Cereals Market Regional Analysis/Insights

The gluten-free breakfast cereals market is analyzed and market size insights and trends are provided by country, type, breakfast cereal product type, breakfast cereal sources, flavour, sugar content, product category, organic category, nature, packaging size, packaging type, consumer category, distribution channel as referenced above.

The countries covered in the gluten-free breakfast cereals market report are the China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Hong Kong, New Zealand, Taiwan and Rest of Asia-Pacific (APAC).

China dominates the gluten-free breakfast cereals market because of emerging number of food brands in the market. China is followed by India and is expected to witness significant growth during the forecast period of 2022 to 2029 due to growing demand for gluten-free breakfast cereals from almost every age group consumer in the region. India is followed by Japan and is expected to grow significantly owing to rising awareness for adoption of healthy lifestyle.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Gluten-Free Breakfast Cereals Market Share Analysis

The gluten-free breakfast cereals market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Asia-Pacific presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to gluten-free breakfast cereals market.

Some of the major market players engaged in the Asia-Pacific gluten-free breakfast cereals market are General Mills Inc., Kellogg's Company, Nestlé, The Quaker Oats Company (a subsidiary of PepsiCo), among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Asia Pacific Gluten Free Breakfast Cereals Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Asia Pacific Gluten Free Breakfast Cereals Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Asia Pacific Gluten Free Breakfast Cereals Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.