Asia Pacific Gloves Market

Market Size in USD Million

CAGR :

%

USD

4,207.42 Million

USD

9,817.60 Million

2021

2029

USD

4,207.42 Million

USD

9,817.60 Million

2021

2029

| 2022 –2029 | |

| USD 4,207.42 Million | |

| USD 9,817.60 Million | |

|

|

|

|

Asia-Pacific Gloves Market Analysis and Insights

Gloves give comfort and protection for hands from extremes of temperature, sickness, and harm from chemicals, abrasion, and friction. They can also act as a guard against objects that bare hands should not touch. Healthcare workers frequently wear latex, nitrile rubber, or vinyl disposable gloves as a precaution against contamination and for hygiene reasons. To avoid destroying evidence at crime scenes, police personnel frequently wear them while on the job. They also help avoid burns while working on electricals as well as professionals handling harmful chemicals.

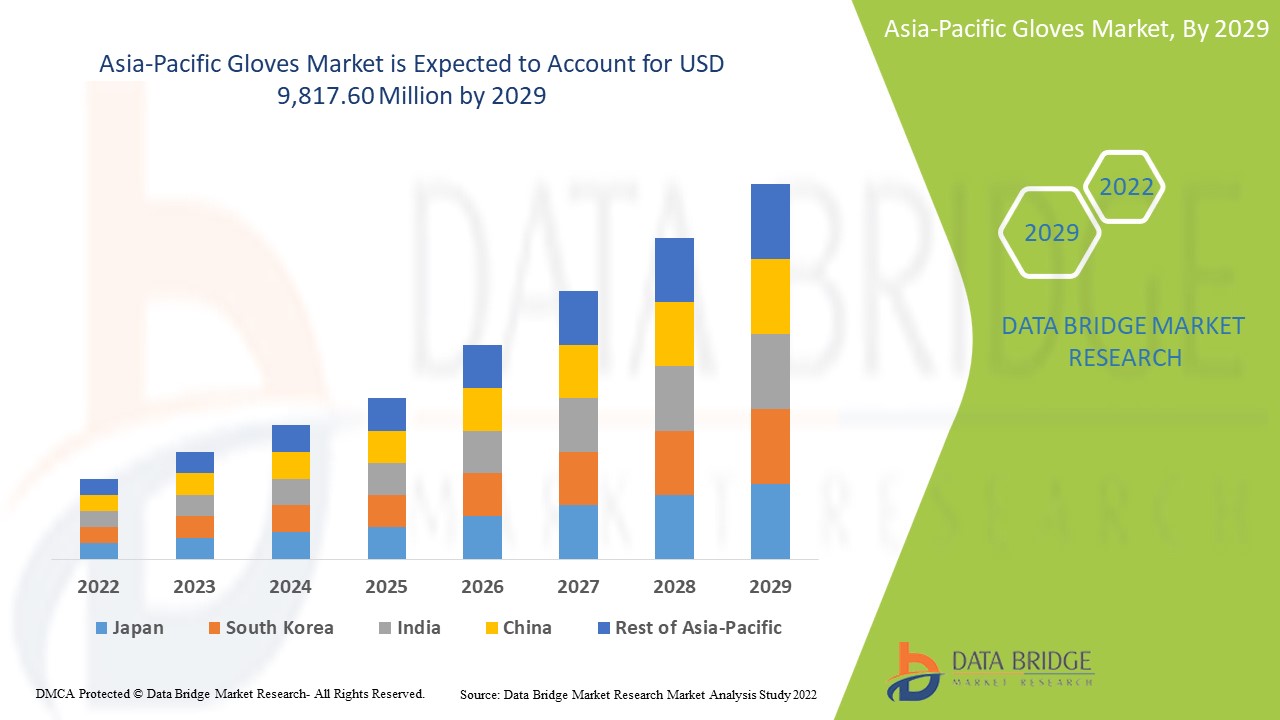

Asia-Pacific gloves market is expected to gain market growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyzes that the market is growing with a CAGR of 11.1% in the forecast period of 2022 to 2029 and is expected to reach USD 9,817.60 million by 2029 from USD 4,207.42 million in 2021.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Year |

2020 |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

By Product Type (Nitrile Gloves, Latex Gloves, Vinyl Gloves, Puncture Resistant Gloves, Polyethylene Gloves, Cotton Fabric Gloves, Butyl Gloves, Aluminized Gloves, Neoprene Gloves, Kevlar Gloves, Leather Gloves, and Others), Type (Disposable and Reusable), Application (Biological, Chemical, Mechanical, Thermal, Anti-Static, and Others), End User (Medical & Healthcare, Food & Beverage, Fire Protection, Construction, Manufacturing Industries, Metal Fabrication, Electronics, and Others), Distribution Channel (Online, Offline, and Others) |

|

Countries Covered |

China, Japan, India, South Korea, Australia, Singapore, Thailand, Malaysia, Indonesia, Philippines, Vietnam, and rest of Asia-Pacific |

|

Market Players Covered |

Tenacious Holdings, Inc., MCR Safety, Cardinal Health, Lakeland Inc., Shamrock Manufacturing Co. Inc, VIP GLOVE SDN BHD (Malaysia), Midas Safety, Superior Glove, Hartalega Holdings, Rubberex Corporation (M) Berhad, 3M, Kimberly-Clark Worldwide, Inc, ANSELL LTD., Honeywell International Inc, DuPont de Nemours Inc., Top Glove Corporation Bhd, Kossan Rubber Industries Bhd, Comfort Rubber Gloves Industries Sdn Bhd, and DELTA PLUS among others |

Market Definition

A glove is a hand-covering item of clothing. The thumb and each finger typically have their openings or sheaths on gloves. Cloth, knitted or felted wool, leather, rubber, latex, neoprene, silk, and metal are among the materials used to make gloves (as in mail). Kevlar gloves shield the wearer from cuts. In pressure suits and spacesuits like the Apollo/Skylab A7L that traveled to the moon, gloves and gauntlets are essential parts. Gloves for spacesuits combine a certain amount of sensitivity and flexibility with hardness and environmental protection.

Asia-Pacific Gloves Market Dynamics

The drivers, opportunities, and restraints/challenges for the Asia-Pacific gloves market are:

Drivers

- INCREASING CONSUMER AWARENESS ON USAGE OF GLOVES

For healthcare workers trying to protect themselves and their patients from exposure to infection, the prudent use of gloves as well as ample provisioning remains crucial. These gloves create a barrier between microbes and hands. They act as a shield protecting healthcare workers against contagious infections. During surgeries, surgeons and other professionals along with patients have a potential risk of infection. Medical gloves aid in protecting physicians and healthcare workers from cross-contamination. Additionally, it was recommended that wearing gloves in the hospital helps to prevent the spread of microbes in the environment. Moreover, in recent decades the demand for high-quality food has increased due to greater awareness of the food quality issue in response to market pressure and reaction to other factors such as health and environmental concerns which have been seen in the increasing number of foodborne illnesses. The increasing incidences of food-related disorders have prompted consumers to bring about vital changes in their diet and lifestyle, making them more health-conscious than ever. Food safety is important not only for consumers’ health but also for the entire food industry and regulatory authorities.

For instance,

- According to United Nations Food and Agriculture Organization (UNFAO), the Italian Development Cooperation has made an additional contribution of Euro 14 million to the FAO trust fund for food safety and food security.

The rising number of initiatives taken by the governmental authorities to promote food safety coupled with rising awareness about that among consumers will propel the market growth. Thus, food safety modernization in countries such as Europe, U.S. and some low and middle-income countries, such as China, India and Vietnam has been driven by a combination of high overall consumer expectations for food safety and significant illness outbreaks that further intensified consumer demands for improvement which is expected to increase the demand for the market.

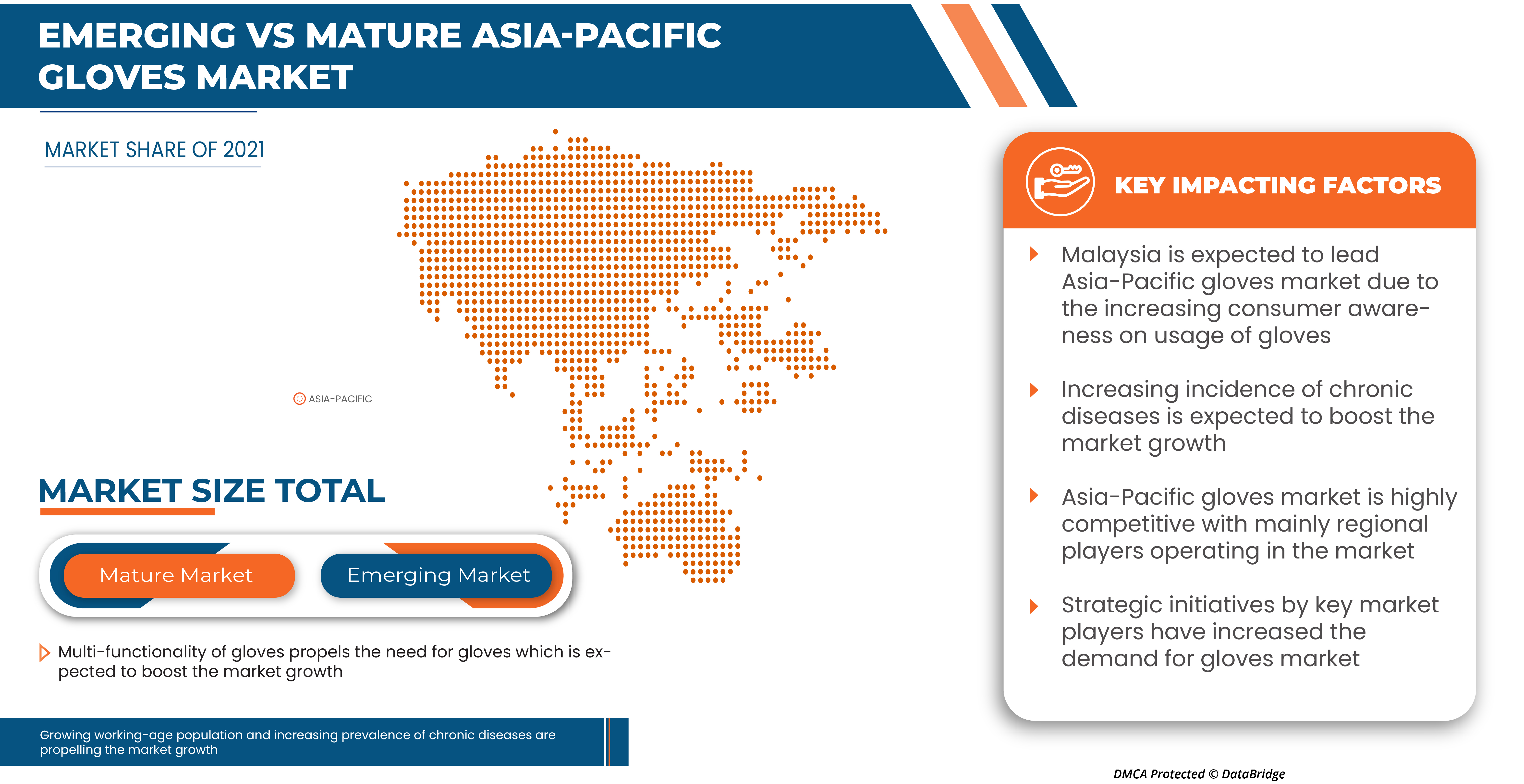

- INCREASING INCIDENCE OF CHRONIC DISEASES

The high prevalence of chronic diseases is due to the rapidly increasing population and infections can be seen globally. Thus, increase in the prevalence of chronic and acute diseases in the older population is resulting in rise in hospitalization. This, in turn, is boosting the demand for gloves in the market. Achieving disinfection and sterilization through the use of disinfectants and sterilization practices is essential for ensuring that medical and surgical instruments do not transmit infectious pathogens to patients. The evaluation of disorders will further lead to high demand for medical gloves used in operation theaters.

Chronic diseases include cardiovascular diseases, stroke, cancer, chronic respiratory diseases and diabetes, wherein the cardiovascular disease is the major cause of death globally. Sterile surgical gloves are required for surgical interventions. Some non-surgical care procedures, such as central vascular catheter insertion, also require surgical glove use. The healthcare sector is one of the prominent end users of natural rubber latex gloves. Powder-free nitrile gloves are best for medical environments. The powdered material is not advised even when non-latex hand protection is used. The nitrile goes through a special process that allows it to have the same benefits as if they were powdered, such as easy removal. The product is being used in operation theaters, owing to their ability to decrease the possibility of transfer of infection for healthcare professionals as well as patients has led to an increase in demand for gloves.

Gloves are designed to serve for care purposes as well as for housekeeping activities in healthcare facilities. The increased risks of these infectious conditions directly enhance the demand for gloves required to reduce such conditions. Thus, the increasing number of chronic diseases is expected to act as a driver for market growth.

- GOVERNMENT INITIATIVES AND IMPROVED REGULATIONS

The government by association with different organizations and manufacturing companies have provided the healthcare sectors with PPE supplies that include gloves and masks in it. Thus, the government initiatives undertaken would result in more supplies of gloves for the safety of healthcare and industrial workers. It would also ensure collaboration with health organizations and PPE-based companies to conduct seminars, symposiums and display the product portfolio to create consciousness among individuals which is expected to act as a driving factor for market growth.

Moreover, within the food industry gloves are used not only to prevent hand contact with food or food contact surfaces but, also used to protect workers from injury and contamination and to provide comfort and protection from heat, cold and moisture. According to the Centers for Disease Control and Prevention, each year roughly one in six Americans (or 48 million people) falls sick, 3,000 die and 128,000 are hospitalized because of foodborne diseases. Consumers can trust in the safety and quality of products they purchase when the companies meet the standards. Also, importers can trust the food that they ordered will meet their specifications. So, nowadays, food safety is a major concern. Many governments are taking initiatives for food safety, quality and fair trade.

- In the U.S., the Coordinated Outbreak Response and Evaluation (CORE) Network of the FDA was developed to coordinate foodborne disease outbreak monitoring, response and post-response activities related to incidents involving multiple diseases associated with FDA-regulated human dietary supplements and food. Thus, governments are taking various initiatives for safety to prevent the spread of foodborne diseases which is expected to contribute to market growth.

Opportunity

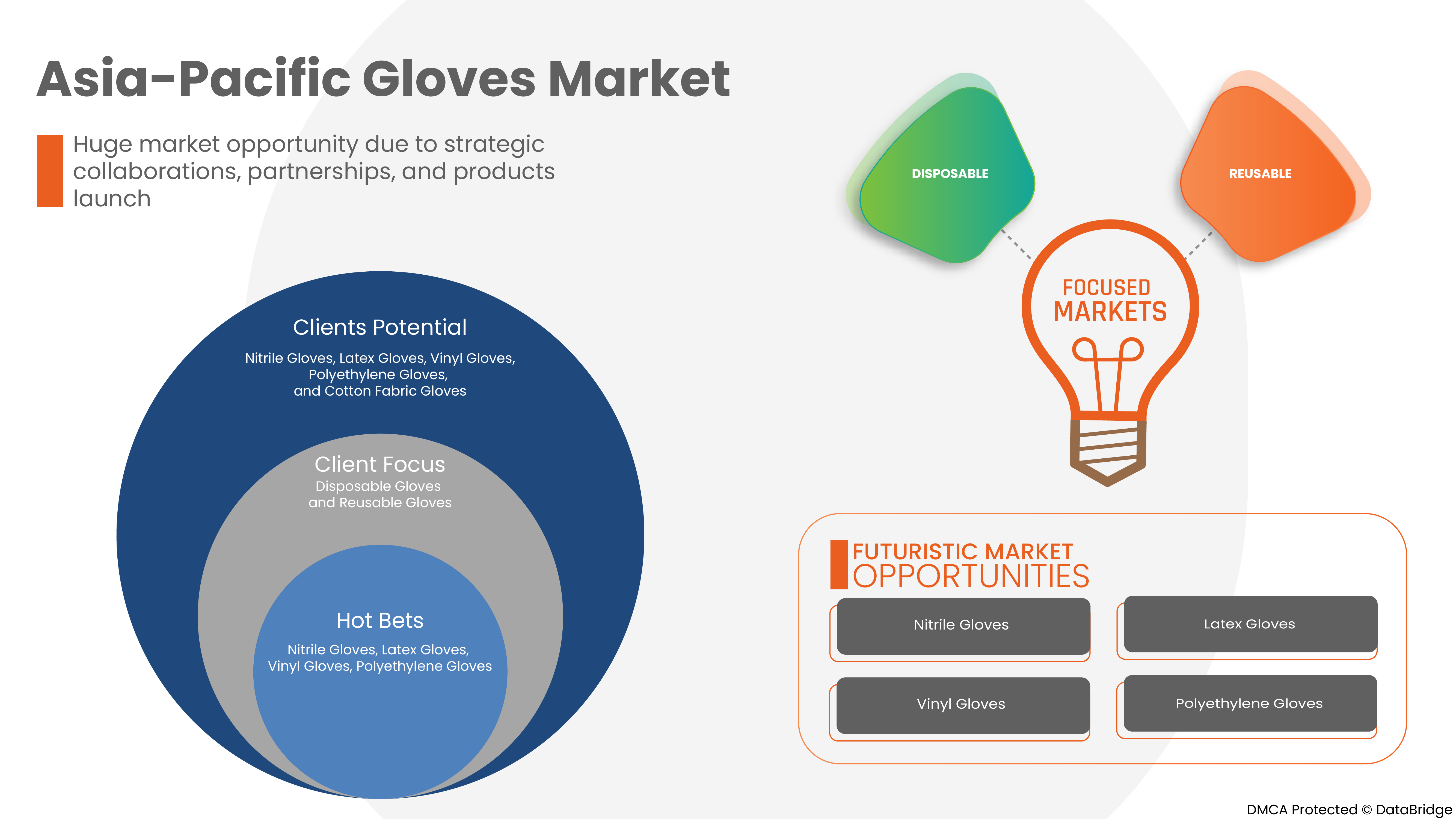

MULTI-FUNCTIONALITY OF GLOVES

There are many types of gloves available today to protect against a wide variety of hazards. The multi-functionality of the gloves is contributing to a large number of applications.

In general, gloves fall into four groups:

Leather, Canvas, or Metal Mesh Gloves

- Sturdy gloves made from metal mesh, leather, or canvas provide protection against cuts and burns. Leather or canvass gloves also protect against sustained heat.

- Leather gloves protect against sparks, moderate heat, blows, chips and rough objects.

Fabric and Coated Fabric Gloves

- Fabric and coated fabric gloves are made of cotton or other fabric to provide varying degrees of protection.

- Fabric gloves protect against dirt, slivers, chafing and abrasions. They do not provide sufficient protection for use with rough, sharp, or heavy materials. Adding a plastic coating will strengthen some fabric gloves.

Chemical and Liquid-Resistant Gloves

- Chemical-resistant gloves are made with different kinds of rubber: natural, butyl, neoprene, nitrile and fluorocarbon (Viton); or various kinds of plastic: Polyvinyl Chloride (PVC), polyvinyl alcohol and polyethylene. These materials can be blended or laminated for better performance. As a general rule, the thicker the glove material, the greater the chemical resistance but thick gloves may impair grip and dexterity, having a negative impact on safety.

- Butyl gloves are made of synthetic rubber and protect against a wide variety of chemicals, such as peroxide, rocket fuels, highly corrosive acids (nitric acid, sulfuric acid, hydrofluoric acid and red-fuming nitric acid), strong bases, alcohols, aldehydes, ketones, esters and nitro compounds. Butyl gloves also resist oxidation, ozone corrosion and abrasion and remain flexible at low temperatures.

Insulating Rubber Gloves

- Natural (latex) rubber gloves are comfortable to wear, which makes them popular general-purpose gloves. They feature outstanding tensile strength, elasticity and temperature resistance. In addition to resisting abrasions caused by grinding and polishing, these gloves protect employees’ hands from most water solutions of acids, alkalis, salts and ketones.

- Neoprene gloves are made of synthetic rubber and offer good pliability, finger dexterity, high density and tear resistance. They protect against hydraulic fluids, gasoline, alcohol, organic acids and alkalis. They generally have chemical and wear resistance properties superior to those made of natural rubber.

This wide range of varieties and multi-functionality of the gloves act as a great opportunity for market growth.

Restraint/Challenge

However, the barriers to the gloves market are health hazards caused by gloves and in some regions may impede the growth of the gloves hampering the market growth. Additionally, high competition in industries and long lead time for overseas qualification can be challenging factors for market growth.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, the impact of domestic and localized market players, analyzes opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions and technological innovations in the market. To gain more info on the Asia-Pacific gloves market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Development

- In March 2020, as much of the nation began shutting down businesses as a result of COVID-19, Luginbill and Matt Hayes, founder and owner of Unmanned Propulsion Development, recognized that as Tech Port entrepreneurs, they were in an ideal position to help. They initially created gloves, masks, shields, and gowns, but quickly realized the materials would run out long before the end of the pandemic. So for help, eight companies were approached to help and two local companies based in Southern Maryland, Burch Oil, and Triton Defense, where the box was built which is capable of disinfecting 24,000 N95 masks per day, or other PPE equipment, the “hot box” could provide healthcare personnel the ability to reuse their gear at least 20 times.

Asia-Pacific Gloves Market Scope

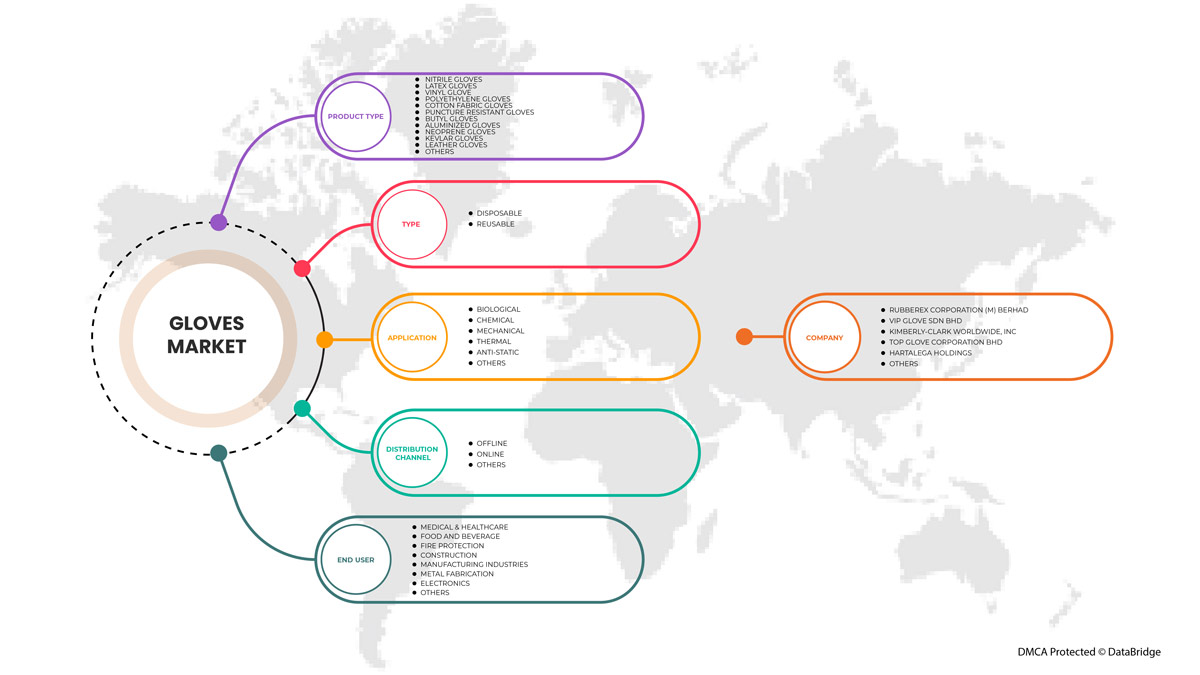

The Asia-Pacific gloves market is segmented into product type, type, application, end user and distribution channel. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

BY PRODUCT TYPE

- Nitrile Gloves

- Latex Gloves

- Vinyl Glove

- Polyethylene Gloves

- Cotton Fabric Gloves

- Puncture Resistant Gloves

- Butyl Gloves

- Aluminized Gloves

- Neoprene Gloves

- Kevlar Gloves

- Leather Gloves

- Others

Based on product type, the market is segmented into nitrile gloves, latex gloves, vinyl glove, polyethylene gloves, cotton fabric gloves, puncture resistant gloves, butyl gloves, aluminized gloves, neoprene gloves, kevlar gloves, leather gloves and others.

BY TYPE

- Disposable

- Reusable

Based on type, the market is segmented into disposable and reusable.

BY APPLICATION

- Biological

- Chemical

- Mechanical

- Thermal

- Anti-Static

- Others

Based on application, the market is segmented into biological, chemical, mechanical, thermal, anti-static and others.

BY END USER

- Medical & Healthcare

- Food & Beverage

- Fire Protection

- Construction

- Manufacturing Industries

- Metal Fabrication

- Electronics

- Others

Based on end user, the market is segmented into medical & healthcare, food & beverage, fire protection, construction, manufacturing industries, metal fabrication, electronics and others.

BY DISTRIBUTION CHANNEL

- Online

- Offline

- Others

Based on distribution channel, the market is segmented into online, offline and others.

Asia-Pacific Gloves Market Regional Analysis/Insights

The Asia-Pacific gloves market is analyzed and market size insights and trends are provided by country, product type, type, application, end user, and distribution channel as referenced above.

Asia-Pacific gloves market comprises of the countries Malaysia, Thailand, China, Japan, India, Indonesia, Australia, Singapore, Philippines, South Korea and Rest of Asia-Pacific.

Malaysia dominates the Asia-Pacific gloves market in terms of market share and market revenue and will continue to flourish its dominance during the forecast period. This is due to the rising need for gloves in the region and the rapid boosting of the market.

The country section of the report also provides individual market impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of Asia-Pacific brands and their challenges faced due to high competition from local and domestic brands, and impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Asia-Pacific Gloves Market Share Analysis

The Asia-Pacific gloves market competitive landscape provides details by the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, Asia-Pacific presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus on the market.

Some of the major players operating in the market are Tenacious Holdings, Inc., MCR Safety, Cardinal Health, Lakeland Inc., Shamrock Manufacturing Co. Inc, VIP GLOVE SDN BHD (Malaysia), Midas Safety, Superior Glove, Hartalega Holdings, Rubberex Corporation (M) Berhad, 3M, Kimberly-Clark Worldwide, Inc, ANSELL LTD., Honeywell International Inc, DuPont de Nemours Inc., Top Glove Corporation Bhd, Kossan Rubber Industries Bhd, Comfort Rubber Gloves Industries Sdn Bhd, and DELTA PLUS among others.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, Asia-Pacific vs. Regional, and Vendor Share Analysis. Please request an analyst call in case of further inquiry.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market, and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors as you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC GLOVES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 PREMIUM INSIGHTS

3.1 PORTER'S FIVE FORCES MODEL

3.2 BRAND COMPETITIVE ANALYSIS: ASIA PACIFIC GLOVES MARKET

3.3 ASIA PACIFIC GLOVES MARKET: BUYING BEHAVIOUR

3.3.1 RESEARCH

3.3.2 OCCUPATIONAL HEALTH AND ALLERGY CONCERNS

3.3.3 TYPE OF MATERIAL

3.3.4 APPLICATION IN VARIOUS INDUSTRIES

3.3.5 ENVIRONMENTAL ISSUES

3.4 FACTORS INFLUENCING BUYING DECISION

3.5 ASIA PACIFIC GLOVES MARKET: PRODUCT ADOPTION SCENARIO

3.5.1 TYPE OF MATERIAL

3.5.2 SAFETY CONCERNS

3.6 IMPACT OF ECONOMIC SLOWDOWN

3.6.1 IMPACT ON PRICES

3.6.2 IMPACT ON SUPPLY CHAIN

3.6.3 IMPACT ON SHIPMENT

3.6.4 IMPACT ON DEMAND

3.6.5 IMPACT ON STRATEGIC DECISIONS

3.7 SUPPLY CHAIN: ASIA PACIFIC GLOVES MARKET

3.7.1 RAW MATERIAL PROCUREMENT

3.7.2 MANUFACTURING

3.7.3 MARKETING & DISTRIBUTION

3.7.4 END USERS

3.7.5 LOGISTIC COST SCENARIO

3.7.6 IMPORTANCE OF LOGISTIC SERVICE PROVIDER

4 ASIA PACIFIC GLOVES MARKET: REGULATIONS

4.1 CANADA REGULATION

4.1.1 MEDICAL GLOVES

4.1.2 NON-MEDICAL GLOVES

4.2 WORLD HEALTH ORGANIZATION STANDARDS

4.2.1 GLOVES EXAMINATION (NON-STERILE)-

4.2.2 GLOVES EXAMINATION (NON-STERILE)-

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING CONSUMER AWARENESS ON USAGE OF GLOVES

5.1.2 INCREASING INCIDENCE OF CHRONIC DISEASES

5.1.3 GOVERNMENT INITIATIVES AND IMPROVED REGULATIONS

5.1.4 RISE IN NUMBER OF MANUFACTURING UNIT

5.2 RESTRAINTS

5.2.1 UNREGULATED DISPOSAL AND WASTAGE OF PERSONAL PROTECTIVE EQUIPMENT (PPE)

5.2.2 HEALTH HAZARDS ASSOCIATED WITH GLOVES

5.3 OPPORTUNITIES

5.3.1 GROWING WORKING-AGE POPULATION

5.3.2 WORK PLACE SAFETY REGULATIONS

5.3.3 MULTI-FUNCTIONALITY OF GLOVES

5.4 CHALLENGES

5.4.1 MANUFACTURING OF POOR QUALITY GLOVES

5.4.2 SHIPMENT DELAYS

6 ASIA PACIFIC GLOVES MARKET, BY PRODUCT TYPE

6.1 OVERVIEW

6.2 NITRILE GLOVES

6.2.1 DISPOSABLE

6.2.2 REUSABLE

6.3 LATEX GLOVES

6.3.1 DISPOSABLE

6.3.2 REUSABLE

6.4 VINYL GLOVES

6.4.1 DISPOSABLE

6.4.2 REUSABLE

6.5 POLYETHYLENE GLOVES

6.5.1 DISPOSABLE

6.5.2 REUSABLE

6.6 COTTON FABRIC GLOVES

6.6.1 DISPOSABLE

6.6.2 REUSABLE

6.7 PUNCTURE RESISTANT GLOVES

6.7.1 DISPOSABLE

6.7.2 REUSABLE

6.8 BUTYL GLOVES

6.8.1 DISPOSABLE

6.8.2 REUSABLE

6.9 ALUMINIZED GLOVES

6.9.1 DISPOSABLE

6.9.2 REUSABLE

6.1 NEOPRENE GLOVES

6.10.1 DISPOSABLE

6.10.2 REUSABLE

6.11 KEVLAR GLOVES

6.11.1 DISPOSABLE

6.11.2 REUSABLE

6.12 LEATHER GLOVES

6.12.1 DISPOSABLE

6.12.2 REUSABLE

6.13 OTHERS

6.13.1 DISPOSABLE

6.13.2 REUSABLE

7 ASIA PACIFIC GLOVES MARKET, BY TYPE

7.1 OVERVIEW

7.2 DISPOSABLE

7.3 REUSABLE

8 ASIA PACIFIC GLOVES MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 BIOLOGICAL

8.3 CHEMICAL

8.4 MECHANICAL

8.4.1 AUTOMOTIVE

8.4.2 CHEMICAL

8.4.3 OIL & GAS

8.4.4 OTHERS

8.5 THERMAL

8.6 ANTI-STATIC

8.7 OTHERS

9 ASIA PACIFIC GLOVES MARKET , BY END USER

9.1 OVERVIEW

9.2 MEDICAL & HEALTHCARE

9.2.1 BY END USE

9.2.1.1 HOSPITALS

9.2.1.2 AMBULATORY SURGERY

9.2.1.3 DIAGNOSTIC CENTERS

9.2.1.4 CLINICS

9.2.1.5 REHABILITATION CENTERS

9.2.1.6 OTHERS

9.2.2 BY PRODUCT TYPE

9.2.2.1 NITRILE GLOVES

9.2.2.2 LATEX GLOVES

9.2.2.3 VINYL GLOVES

9.2.2.4 POLYETHYLENE GLOVES

9.2.2.5 COTTON FABRIC GLOVES

9.2.2.6 PUNCTURE RESISTANT GLOVES

9.2.2.7 BUTYL GLOVES

9.2.2.8 ALUMINIZED GLOVES

9.2.2.9 NEOPRENE GLOVES

9.2.2.10 KEVLAR GLOVES

9.2.2.11 LEATHER GLOVES

9.2.2.12 OTHERS

9.3 FOOD AND BEVERAGE

9.3.1 NITRILE GLOVES

9.3.2 LATEX GLOVES

9.3.3 VINYL GLOVES

9.3.4 POLYETHYLENE GLOVES

9.3.5 COTTON FABRIC GLOVES

9.3.6 PUNCTURE RESISTANT GLOVES

9.3.7 BUTYL GLOVES

9.3.8 ALUMINIZED GLOVES

9.3.9 NEOPRENE GLOVES

9.3.10 KEVLAR GLOVES

9.3.11 LEATHER GLOVES

9.3.12 OTHERS

9.4 FIRE PROTECTION

9.4.1 NITRILE GLOVES

9.4.2 LATEX GLOVES

9.4.3 VINYL GLOVES

9.4.4 POLYETHYLENE GLOVES

9.4.5 COTTON FABRIC GLOVES

9.4.6 PUNCTURE RESISTANT GLOVES

9.4.7 BUTYL GLOVES

9.4.8 ALUMINIZED GLOVES

9.4.9 NEOPRENE GLOVES

9.4.10 KEVLAR GLOVES

9.4.11 LEATHER GLOVES

9.4.12 OTHERS

9.5 CONSTRUCTION

9.5.1 NITRILE GLOVES

9.5.2 LATEX GLOVES

9.5.3 VINYL GLOVES

9.5.4 POLYETHYLENE GLOVES

9.5.5 COTTON FABRIC GLOVES

9.5.6 PUNCTURE RESISTANT GLOVES

9.5.7 BUTYL GLOVES

9.5.8 ALUMINIZED GLOVES

9.5.9 NEOPRENE GLOVES

9.5.10 KEVLAR GLOVES

9.5.11 LEATHER GLOVES

9.5.12 OTHERS

9.6 MANUFACTURING INDUSTRIES

9.6.1 NITRILE GLOVES

9.6.2 LATEX GLOVES

9.6.3 VINYL GLOVES

9.6.4 POLYETHYLENE GLOVES

9.6.5 COTTON FABRIC GLOVES

9.6.6 PUNCTURE RESISTANT GLOVES

9.6.7 BUTYL GLOVES

9.6.8 ALUMINIZED GLOVES

9.6.9 NEOPRENE GLOVES

9.6.10 KEVLAR GLOVES

9.6.11 LEATHER GLOVES

9.6.12 OTHERS

9.7 METAL FABRICATION

9.7.1 NITRILE GLOVES

9.7.2 LATEX GLOVES

9.7.3 VINYL GLOVES

9.7.4 POLYETHYLENE GLOVES

9.7.5 COTTON FABRIC GLOVES

9.7.6 PUNCTURE RESISTANT GLOVES

9.7.7 BUTYL GLOVES

9.7.8 ALUMINIZED GLOVES

9.7.9 NEOPRENE GLOVES

9.7.10 KEVLAR GLOVES

9.7.11 LEATHER GLOVES

9.7.12 OTHERS

9.8 ELECTRONICS

9.8.1 NITRILE GLOVES

9.8.2 LATEX GLOVES

9.8.3 VINYL GLOVES

9.8.4 POLYETHYLENE GLOVES

9.8.5 COTTON FABRIC GLOVES

9.8.6 PUNCTURE RESISTANT GLOVES

9.8.7 BUTYL GLOVES

9.8.8 ALUMINIZED GLOVES

9.8.9 NEOPRENE GLOVES

9.8.10 KEVLAR GLOVES

9.8.11 LEATHER GLOVES

9.8.12 OTHERS

9.9 OTHERS

9.9.1 NITRILE GLOVES

9.9.2 LATEX GLOVES

9.9.3 VINYL GLOVES

9.9.4 POLYETHYLENE GLOVES

9.9.5 COTTON FABRIC GLOVES

9.9.6 PUNCTURE RESISTANT GLOVES

9.9.7 BUTYL GLOVES

9.9.8 ALUMINIZED GLOVES

9.9.9 NEOPRENE GLOVES

9.9.10 KEVLAR GLOVES

9.9.11 LEATHER GLOVES

9.9.12 OTHERS

10 ASIA PACIFIC GLOVES MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 OFFLINE

10.2.1 DIRECT SALES

10.2.2 SUPERMARKETS/HYPERMARKETS

10.2.3 MEDICAL STORES

10.2.4 OTHERS

10.3 ONLINE

10.3.1 E-COMMERCE

10.3.2 BRAND WEBSITES

10.3.3 OTHERS

10.4 OTHERS

11 ASIA PACIFIC GLOVES MARKET, BY GEOGRAPHY

11.1 ASIA-PACIFIC

11.1.1 MALAYSIA

11.1.2 THAILAND

11.1.3 CHINA

11.1.4 JAPAN

11.1.5 INDIA

11.1.6 INDONESIA

11.1.7 AUSTRALIA

11.1.8 SINGAPORE

11.1.9 PHILIPPINES

11.1.10 SOUTH KOREA

11.1.11 REST OF ASIA-PACIFIC

12 ASIA PACIFIC GLOVES MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 RUBBEREX CORPORATION (M) BERHAD (2021)

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENTS

14.2 VIP GLOVE SDN BHD (MALAYSIA) (2021)

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.3 KIMBERLY-CLARK WORLDWIDE, INC.

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 TOP GLOVE CORPORATION BHD

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENT

14.5 HARTALEGA HOLDINGS BERHAD

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENT

14.6 DUPONT DE NEMOURS INC.

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENT

14.7 HONEYWELL INTERNATIONAL INC.

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENT

14.8 KOSSAN RUBBER INDUSTRIES BHD

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENT

14.9 ANSELL LTD

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENT

14.1 CARDINAL HEALTH

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENT

14.11 3M

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE ANALYSIS

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT DEVELOPMENT

14.12 COMFORT RUBBER GLOVES INDUSTRIES SDN BHD

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 PRODUCT PORTFOLIO

14.12.4 RECENT DEVELOPMENT

14.13 DELTA PLUS

14.13.1 COMPANY SNAPSHOT

14.13.2 REVENUE ANALYSIS

14.13.3 PRODUCT PORTFOLIO

14.13.4 RECENT DEVELOPMENT

14.14 SUPERIOR GLOVE.

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 MCR SAFETY

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENTS

14.16 TENACIOUS HOLDINGS, INC. (DBA ERGODYNE)

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENT

14.17 MIDAS SAFETY

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENTS

14.18 LAKELAND INC.

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 PRODUCT PORTFOLIO

14.18.4 RECENT DEVELOPMENT

14.19 SHAMROCK MANUFACTURING CO. INC.,

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 ASIA PACIFIC GLOVES MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 2 ASIA PACIFIC GLOVES MARKET, BY PRODUCT TYPE, VOLUME, 2015-2029 (UNITS,KILO TONNES)

TABLE 3 ASIA PACIFIC NITRILE GLOVES IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC NITRILE GLOVES IN GLOVES MARKET, BY TYPE, 2015-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC LATEX GLOVES IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC LATEX GLOVES IN GLOVES MARKET, BY TYPE, 2015-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC VINYL GLOVE IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC VINYL GLOVES IN GLOVES MARKET, BY TYPE, 2015-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC POLYETHYLENE GLOVES IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC POLYETHYLENE GLOVES IN GLOVES MARKET, BY TYPE, 2015-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC COTTON FABRIC GLOVES IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC COTTON FABRIC GLOVES IN GLOVES MARKET, BY TYPE, 2015-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC PUNCTURE RESISTANT GLOVES IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC PUNCTURE RESISTANT GLOVES IN GLOVES MARKET, BY TYPE, 2015-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC BUTYL GLOVES IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC BUTYL GLOVES IN GLOVES MARKET, BY TYPE, 2015-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC ALUMINIZED GLOVES IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC ALUMINIZED GLOVES IN GLOVES MARKET, BY TYPE, 2015-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC NEOPRENE GLOVES IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC NEOPRENE GLOVES IN GLOVES MARKET, BY TYPE, 2015-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC KEVLAR GLOVES IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC KEVLAR GLOVES IN GLOVES MARKET, BY TYPE, 2015-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC LEATHER GLOVES IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC LEATHER GLOVES IN GLOVES MARKET, BY TYPE, 2015-2029 (USD MILLION)

TABLE 25 ASIA PACIFIC OTHERS IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 26 ASIA PACIFIC OTHERS GLOVES IN GLOVES MARKET, BY TYPE, 2015-2029 (USD MILLION)

TABLE 27 ASIA PACIFIC GLOVES MARKET, BY TYPE, 2015-2029 (USD MILLION)

TABLE 28 ASIA PACIFIC GLOVES MARKET, BY TYPE, VOLUME, 2015-2029 (UNITS,KILO TONNES)

TABLE 29 ASIA PACIFIC DISPOSABLE IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 30 ASIA PACIFIC REUSABLE IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 31 ASIA PACIFIC GLOVES MARKET, BY APPLICATION, 2015-2029 (USD MILLION)

TABLE 32 ASIA PACIFIC GLOVES MARKET, BY APPLICATION, VOLUME, 2015-2029 (UNITS,KILO TONNES)

TABLE 33 ASIA PACIFIC BIOLOGICAL IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 34 ASIA PACIFIC CHEMICAL IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 35 ASIA PACIFIC MECHANICAL IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 36 ASIA PACIFIC MECHANICAL IN GLOVES MARKET, BY APPLICATION, 2015-2029 (USD MILLION)

TABLE 37 ASIA PACIFIC THERMAL IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 38 ASIA PACIFIC ANTI-STATIC IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 39 ASIA PACIFIC OTHERS IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 40 ASIA PACIFIC GLOVES MARKET , BY END USER, 2015-2029 (USD MILLION)

TABLE 41 ASIA PACIFIC GLOVES MARKET , BY END USER, VOLUME,2015-2029 (UNITS,KILO TONNES)

TABLE 42 ASIA PACIFIC MEDICAL & HEALTHCARE IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 43 ASIA PACIFIC MEDICAL & HEALTHCARE IN GLOVES MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 44 ASIA PACIFIC MEDICAL & HEALTHCARE IN GLOVES MARKET, BY PRODUCT TYPE, 2015-2029 (USD MILLION)

TABLE 45 ASIA PACIFIC FOOD AND BEVERAGE IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 46 ASIA PACIFIC FOOD AND BEVERAGE IN GLOVES MARKET, BY PRODUCT TYPE, 2015-2029 (USD MILLION)

TABLE 47 ASIA PACIFIC FIRE PROTECTION IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 48 ASIA PACIFIC FIRE PROTECTION IN GLOVES MARKET, BY PRODUCT TYPE, 2015-2029 (USD MILLION)

TABLE 49 ASIA PACIFIC CONSTRUCTION IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 50 ASIA PACIFIC CONSTRUCTION IN GLOVES MARKET, BY PRODUCT TYPE, 2015-2029 (USD MILLION)

TABLE 51 ASIA PACIFIC MANUFACTURING INDUSTRIES IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 52 ASIA PACIFIC MANUFACTURING INDUSTRIES IN GLOVES MARKET, BY PRODUCT TYPE, 2015-2029 (USD MILLION)

TABLE 53 ASIA PACIFIC METAL FABRICATION IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 54 ASIA PACIFIC METAL FABRICATION IN GLOVES MARKET, BY PRODUCT TYPE, 2015-2029 (USD MILLION)

TABLE 55 ASIA PACIFIC ELECTRONICS IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 56 ASIA PACIFIC ELECTRONICS IN GLOVES MARKET, BY PRODUCT TYPE, 2015-2029 (USD MILLION)

TABLE 57 ASIA PACIFIC OTHERS IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 58 ASIA PACIFIC OTHERS IN GLOVES MARKET, BY PRODUCT TYPE, 2015-2029 (USD MILLION)

TABLE 59 ASIA PACIFIC GLOVES MARKET, BY DISTRIBUTION CHANNEL, 2015-2029 (USD MILLION)

TABLE 60 ASIA PACIFIC GLOVES MARKET, BY PRODUCT TYPE, VOLUME, 2015-2029 (UNITS,KILO TONNES)

TABLE 61 ASIA PACIFIC OFFLINE IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 62 ASIA PACIFIC OFFLINE IN GLOVES MARKET, BY DISTRIBUTION CHANNEL, 2015-2029 (USD MILLION)

TABLE 63 ASIA PACIFIC ONLINE IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 64 ASIA PACIFIC ONLINE IN GLOVES MARKET, BY DISTRIBUTION CHANNEL, 2015-2029 (USD MILLION)

TABLE 65 ASIA PACIFIC OTHERS IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

List of Figure

FIGURE 1 ASIA PACIFIC GLOVES MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC GLOVES MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC GLOVES MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC GLOVES MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC GLOVES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC GLOVES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC GLOVES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC GLOVES MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 ASIA PACIFIC GLOVES MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 ASIA PACIFIC GLOVES MARKET: SEGMENTATION

FIGURE 11 RISING MANUFACTURING UNITS AND INCREASING CHRONIC DISEASES IS EXPECTED TO DRIVE THE ASIA PACIFIC GLOVES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 NITRILE GLOVES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC GLOVES MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC GLOVES MARKET

FIGURE 14 ASIA PACIFIC GLOVES MARKET: BY PRODUCT TYPE, 2021

FIGURE 15 ASIA PACIFIC GLOVES MARKET: BY PRODUCT TYPE, 2022-2029 (USD MILLION)

FIGURE 16 ASIA PACIFIC GLOVES MARKET: BY PRODUCT TYPE, CAGR (2022-2029)

FIGURE 17 ASIA PACIFIC GLOVES MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 18 ASIA PACIFIC GLOVES MARKET: BY TYPE, 2021

FIGURE 19 ASIA PACIFIC GLOVES MARKET: BY TYPE, 2022-2029 (USD MILLION)

FIGURE 20 ASIA PACIFIC GLOVES MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 21 ASIA PACIFIC GLOVES MARKET: BY TYPE, LIFELINE CURVE

FIGURE 22 ASIA PACIFIC GLOVES MARKET: BY APPLICATION, 2021

FIGURE 23 ASIA PACIFIC GLOVES MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 24 ASIA PACIFIC GLOVES MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 25 ASIA PACIFIC GLOVES MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 30 ASIA PACIFIC GLOVES MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 31 ASIA PACIFIC GLOVES MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 32 ASIA PACIFIC GLOVES MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 33 ASIA PACIFIC GLOVES MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 34 ASIA-PACIFIC GLOVES MARKET: SNAPSHOT (2021)

FIGURE 35 ASIA-PACIFIC GLOVES MARKET: BY COUNTRY (2021)

FIGURE 36 ASIA-PACIFIC GLOVES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 37 ASIA-PACIFIC GLOVES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 38 ASIA-PACIFIC GLOVES MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 39 ASIA PACIFIC GLOVES MARKET: COMPANY SHARE 2021 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.