Asia Pacific Gene Synthesis Market

Market Size in USD Million

CAGR :

%

USD

429.59 Million

USD

2,557.01 Million

2021

2029

USD

429.59 Million

USD

2,557.01 Million

2021

2029

| 2022 –2029 | |

| USD 429.59 Million | |

| USD 2,557.01 Million | |

|

|

|

Asia-Pacific Gene Synthesis Market Analysis and Insights

Gene synthesis is the process of creating artificial genes in a lab setting using synthetic biology. The generation of recombinant proteins is one of the numerous applications of recombinant DNA technology, where gene synthesis is emerging as a key instrument. The traditional methods of cloning and mutagenesis are quickly being replaced by de novo gene synthesis, which also enables the production of nucleic acids for which there is no template.

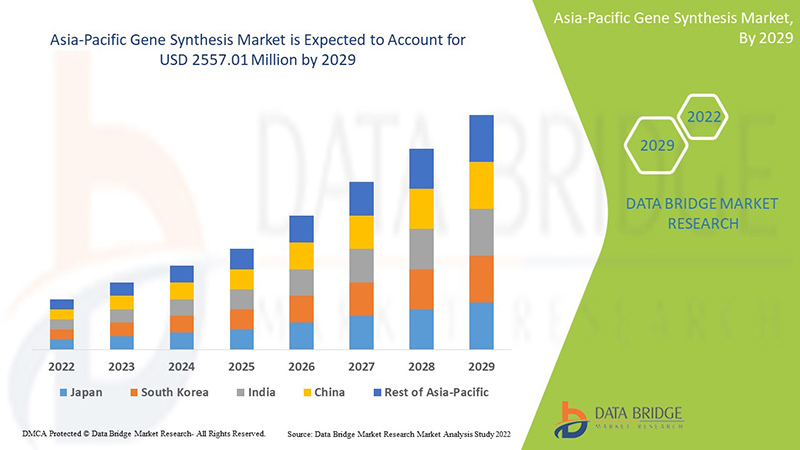

Asia-Pacific gene synthesis market is expected to grow in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 24.7% in the forecast period of 2022 to 2029 and is expected to reach USD 2557.01 million by 2029 from USD 429.59 million in 2021.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

By Component (Synthesizer, Consumables, and Software & Services), Gene Type (Standard Gene, Express Gene, Complex Gene and Others), Gene Synthesis Type (Gene Library Synthesis, and Custom Gene Synthesis), Application (Synthetic Biology, Genetic Engineering, Vaccine Design, Therapeutics Antibodies, and Others), Method (Solid Phase Synthesis, Chip-Based DNA Synthesis, and PCR-Based Enzyme Synthesis), End User (Academic & Research Institutes, Diagnostics Laboratories, Biotech & Pharmaceutical Companies, and Others), Distribution Channel (Direct Tender, Online Distribution, and Third Party Distributors) |

|

Countries Covered |

China, Japan, India, South Korea, Australia, Singapore, Thailand, Malaysia, Indonesia, Philippines, and the Rest of the Asia-Pacific. |

|

Market Players Covered |

MACROGEN CO., LTD., Bioneer Pacific, Kaneka Eurogentec S.A, Bbi-lifesciences, and GCC Biotech (INDIA) Pvt. Ltd., among others. |

Market Definition

Gene synthesis refers to the chemical synthesis of DNA strand base-by base. Unlike DNA replication that occurs in cells or by Polymerase Chain Reaction (PCR), gene synthesis does not require a template strand. Rather, gene synthesis involves the step-wise addition of nucleotides to a single-stranded molecule, which then serves as a template for creating a complementary strand. Gene synthesis is the fundamental technology upon which the field of synthetic biology has been built.

Gene Synthesis Market Dynamics

This section deals with understanding the market drivers, opportunities, restraints, and challenges. All of this is discussed in detail as below:

Drivers

- INCREASED PREVALENCE OF CHRONIC INFECTIOUS DISEASES

Bacterial and viral diseases are rapidly expanding due to the rising prevalence of infectious diseases worldwide. As a result, the demand for novel and effective therapies has increased to fight against such deadly diseases. These diseases can be cured using chemical drugs and biological therapies, including gene therapy. By applying genomics, the management of infectious and endemic diseases has been enhanced. It also allows us to understand emerging drug resistance and identify targets for new therapeutics and vaccines. For the treatment of infectious diseases, gene therapy has attracted many researchers as it can be treated by using recombinant DNA technology, DNA &RNA ribozyme, and single chain antibodies.

As the rising prevalence of the chronic infectious disease is increasing globally, the demand for vaccines and effective gene therapy has also risen, which has increased the demand for novel genes with a significant application for research activities and drug and vaccine manufacturing. Thus, the rising prevalence of infectious diseases is acting as the driver for the gene synthesis market growth.

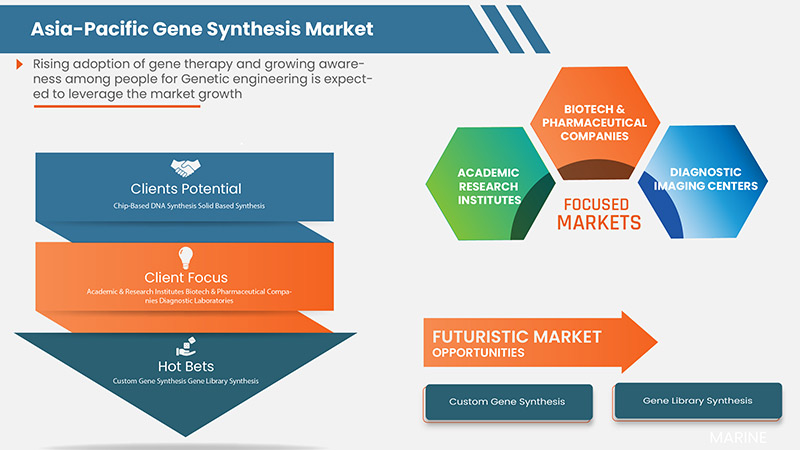

- RISING ADOPTION OF GENE THERAPY

Gene therapy is an advanced technique that includes the usage of several genes for the prevention of a particular disease type. The technique involves the insertion of genes into patient cells instead of drugs and surgery. Due to increased demand for novel and long-lasting therapy results, the adoption of gene therapy is rising. Gene therapies demand synthetic gene constructs, among other gene products, to accelerate gene therapy development. Due to the rise in genetic diseases, the demand for a proper cure is one major factor, and with the help of gene therapy, a particular disease type can be cured.

Due to the increased demand, leaders are constantly focused on producing gene therapy products, achieving approval, and marketing authorizations.

Lifesaving medicines and therapies are in huge demand to provide quality life to different patients. These rising numbers of patients largely depend on the gene therapies available to achieve a proper cure. To manufacture gene therapies, synthetic and novel genes are required, which can be achieved by the gene synthesis technique. Thus, the rising adoption of gene therapy is expected to act as a driver for the gene synthesis market.

- EXPANSION OF SYNTHETIC BIOLOGY

The incorporation of engineering principles into biology is termed synthetic biology. DNA genome can be reassembled with the help of synthetic biology as it involves the chemical synthesis of DNA by combining it with its genome. Oligonucleotides can be constructed in a short period by incorporating gene synthesis services, software, and consumables. As synthetic biology products' demand increases worldwide, gene synthesis products and services are also increasing.

Thus, due to its effective and innovative products, the demand for synthetic biology products is increasing globally, which is expected to act as a driving factor for the gene synthesis market.

Opportunities

-

RISING HEALTHCARE EXPENDITURE

Healthcare expenditure has increased worldwide as people's disposable income in various countries is increasing. Moreover, to accomplish the population requirements, government bodies and healthcare organizations are taking the initiative by virtue of accelerating healthcare expenditure.

Also, the strategic initiatives taken by key market players will provide structural integrity and future opportunities for the medical device testing market in the forecast period of 2022-2029.

Restraints/Challenges

- HIGH COST OF THE GENE SYNTHESIS PROCESS

However, the barriers to the gene synthesis techniques and the high cost of the gene synthesis process in some regions may impede the growth of the gene synthesis procedures hampering the growth of the market. Additionally, high competition in medical technology industries and long lead time for the overseas qualification can be challenging factors for the growth of the market

This gene synthesis market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the gene synthesis market, contact Data Bridge Market Research for an Analyst Brief. Our team will help you make an informed market decision to achieve market growth.

Recent Development

- In December 2020, Twist Bioscience launched clonal-ready gene fragments to complete the offering of genes. The fragments launched can be used with adapters or without adapters to build up the perfect clones. The clonal-ready gene fragments are compatible with the protein expression pathways, enzyme engineering, and gene expression, among others.

- In 2020, according to an article published in an ACS journal, a total estimated 19.3 million new cancer cases and almost 10.0 million cancer deaths were reported worldwide. This suggests that cancer coverage is suboptimal, and there is a great need to implement high cancer coverage all over the world.

Asia-Pacific Gene Synthesis Market Scope

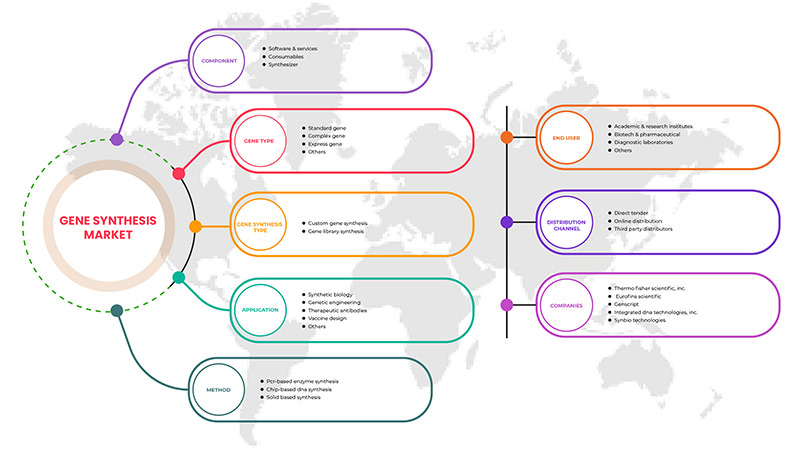

Asia-Pacific gene synthesis market is segmented into component, gene type, gene synthesis type, application, method, end user, and distribution channel. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Component

- Synthesizers

- Consumables

- Software & services

On the basis of component, the Asia-Pacific gene synthesis market is segmented into synthesizers, consumables, and software & services.

Gene Type

- Standard gene

- Express gene

- Complex gene

- Others

On the basis of gene type, the Asia-Pacific gene synthesis market is segmented into the standard gene, express gene, complex gene and others.

Gene Synthesis Type

- Gene library synthesis

- Custom gene synthesis

On the basis of gene synthesis type, the Asia-Pacific gene synthesis market is segmented into gene library synthesis, and custom gene synthesis.

Application

- Synthetic biology,

- Genetic engineering,

- Vaccine design,

- Therapeutics antibodies

- Others

On the basis of application, the Asia-Pacific gene synthesis market is segmented into synthetic biology, genetic engineering, vaccine design, therapeutics antibodies, and others.

Method

- Solid based synthesis,

- Chip-based DNA synthesis

- PCR-based enzyme synthesis

On the basis of the method, the Asia-Pacific gene synthesis market is segmented into solid based synthesis, chip-based DNA synthesis, and PCR-based enzyme synthesis.

End User

- Academic & research institutes,

- Diagnostics laboratories,

- Biotech & pharmaceutical companies

- Others

On the basis of end user, the Asia-Pacific gene synthesis market is segmented into academic & research institutes, diagnostics laboratories, biotech & pharmaceutical companies, and others.

Distribution Channel

- Direct tender

- Online distribution

- Third party distributors

On the basis of distribution channel, the Asia-Pacific gene synthesis market is segmented into direct tender, online distribution, and third party distributors.

Gene Synthesis Market Regional Analysis/Insights

The gene synthesis market is analyzed, and market size insights and trends are provided by the country, component, gene type, gene synthesis type, application, method, end user, and distribution channel, as referenced above.

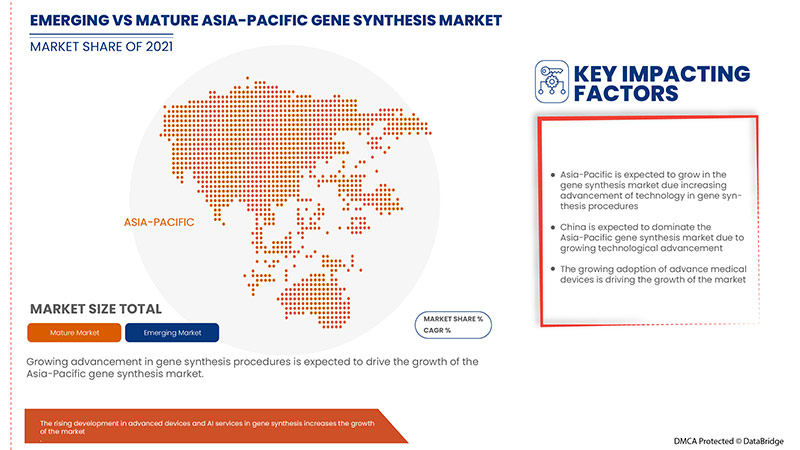

China dominates the Asia-Pacific gene synthesis market in terms of market share and market revenue and will continue to flourish its dominance during the forecast period. This is due to the rising need for the verification and validation of gene synthesis processes in the region, and rapid research development is boosting the market.

The country section of the report also provides individual market-impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of global brands and their challenges faced due to high competition from local and domestic brands, and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Gene Synthesis Market Share Analysis

The gene synthesis market competitive landscape provides details by the competitors. Details include company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies focus on the gene synthesis market.

Some of the major players operating in the gene synthesis market are ATDBio Ltd (Subsidiary of Biotage), General Biosystems, Inc., MACROGEN CO., LTD., Boster Biological Technology, Creative Biogene, Bioneer Pacific, exonbio, trenzyme GmbH, Twist Bioscience, BioCat GmbH (Subsidiary of AddLife AB), OriGene Technologies, Inc., Integrated DNA Technologies, Inc. 9Subsidiary of Danaher Corporation), Eurofins Scientific, NZYTech, Lda. - Genes and Enzymes, Ansa Biotechnologies, Inc., Thermo Fisher Scientific, Genescript, Synbio Technologies, Proteogenix, Bio Basic Inc., ATG:biosynthetics GmbH, Merck KGaA, Kaneka Eurogentec S.A, Ginkgo Bioworks, Bbi-lifesciences, Evonetix, ProMab Biotechnologies, Inc., GCC Biotech (INDIA) Pvt. Ltd., CSBio, Azenta US, Inc., and among others.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include the Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, Asia-Pacific vs. Regional, and Vendor Share Analysis. Please request an analyst call in case of further inquiry.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC GENE SYNTHESIS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHIC SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 RESEARCH METHODOLOGY

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 MULTIVARIATE MODELLING

2.8 COMPONENT SEGMENT LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 MARKET APPLICATION COVERAGE GRID

2.12 THE CATEGORY VS TIME GRID

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL

4.2 PORTER'S FIVE FORCES MODEL

5 ASIA PACIFIC GENE SYNTHESIS MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASED PREVALENCE OF CHRONIC INFECTIOUS DISEASES

6.1.2 RISING ADOPTION OF GENE THERAPY

6.1.3 EXPANSION OF SYNTHETIC BIOLOGY

6.1.4 RISING INTEREST OF GENE SYNTHESIS IN THE FIELD OF MOLECULAR BIOLOGY

6.2 RESTRAINTS

6.2.1 LACK OF TRAINED PROFESSIONALS

6.2.2 ETHICAL ISSUES

6.2.3 LONG APPROVAL PROCESS

6.3 OPPORTUNITIES

6.3.1 RISE IN HEALTHCARE EXPENDITURE

6.3.2 STRATEGIC INITIATIVES BY KEY PLAYERS

6.3.3 RISING DEMAND FOR CUSTOMIZED MEDICATIONS

6.4 CHALLENGES

6.4.1 TECHNICAL LIMITATIONS ACROSS PRODUCTION PROCESS

6.4.2 LACK OF WELL DEFINED PATENT SYSTEM

7 ASIA PACIFIC GENE SYNTHESIS MARKET, BY COMPONENT

7.1 OVERVIEW

7.2 SOFTWARE & SERVICES

7.3 CONSUMABLES

7.3.1 REAGENTS

7.3.2 ASSAYS

7.3.3 PROBES & DYES

7.3.4 OTHERS

7.4 SYNTHESIZER

7.4.1 COLUMN-BASED SYNTHESIZERS

7.4.2 MICROARRAY-BASED SYNTHESIZERS

8 ASIA PACIFIC GENE SYNTHESIS MARKET, BY GENE TYPE

8.1 OVERVIEW

8.2 STANDARD GENE

8.3 COMPLEX GENE

8.4 EXPRESS GENE

8.5 OTHERS

9 ASIA PACIFIC GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE

9.1 OVERVIEW

9.2 CUSTOM GENE SYNTHESIS

9.2.1 STANDARD GENE

9.2.2 COMPLEX GENE

9.2.3 EXPRESS GENE

9.2.4 OTHERS

9.3 GENE LIBRARY SYNTHESIS

9.3.1 STANDARD GENE

9.3.2 COMPLEX GENE

9.3.3 EXPRESS GENE

9.3.4 OTHERS

10 ASIA PACIFIC GENE SYNTHESIS MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 SYNTHETIC BIOLOGY

10.2.1 CUSTOM GENE SYNTHESIS

10.2.2 GENE LIBRARY SYNTHESIS

10.3 GENETIC ENGINEERING

10.3.1 CUSTOM GENE SYNTHESIS

10.3.2 GENE LIBRARY SYNTHESIS

10.4 THERAPEUTIC ANTIBODIES

10.4.1 CUSTOM GENE SYNTHESIS

10.4.2 GENE LIBRARY SYNTHESIS

10.5 VACCINE DESIGN

10.5.1 CUSTOM GENE SYNTHESIS

10.5.2 GENE LIBRARY SYNTHESIS

10.6 OTHERS

11 ASIA PACIFIC GENE SYNTHESIS MARKET, BY METHOD

11.1 OVERVIEW

11.2 PCR-BASED ENZYME SYNTHESIS

11.3 CHIP-BASED DNA SYNTHESIS

11.4 SOLID BASED SYNTHESIS

12 ASIA PACIFIC GENE SYNTHESIS MARKET, BY END USER

12.1 OVERVIEW

12.2 ACADEMIC & RESEARCH INSTITUTE

12.3 BIOTECH & PHARMACEUTICAL COMPANIES

12.4 DIAGNOSTIC LABORATORIES

12.5 OTHERS

13 ASIA PACIFIC GENE SYNTHESIS MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 DIRECT TENDER

13.3 ONLINE DISTRIBUTION

13.4 THIRD PARTY DISTRIBUTORS

14 ASIA PACIFIC GENE SYNTHESIS MARKET, BY REGION

14.1 ASIA-PACIFIC

14.1.1 CHINA

14.1.2 JAPAN

14.1.3 INDIA

14.1.4 SOUTH KOREA

14.1.5 AUSTRALIA

14.1.6 SINGAPORE

14.1.7 MALAYSIA

14.1.8 THAILAND

14.1.9 INDONESIA

14.1.10 PHILIPPINES

14.1.11 REST OF ASIA-PACIFIC

15 ASIA PACIFIC GENE SYNTHESIS MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 INTEGRATED DNA TECHNOLOGIES, INC. (A SUBSIDIARY OF DANAHER)

17.1.1 COMPANY SNAPSHOT

17.1.2 COMPANY SHARE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENTS

17.2 THERMO FISHER SCIENTIFIC INC.

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 EUROFINS SCIENTIFIC

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 SERVICE PORTFOLIO

17.3.5 RECENT DEVELOPMENT

17.4 MERCK KGAA

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENT

17.5 KANEKA EUROGENTEC S.A.

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENTS

17.6 ANSA BIOTECHNOLOGIES, INC

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENTS

17.7 ATD BIO LTD

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENTS

17.8 ATG:BIOSYNTHETICS GMBH

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENTS

17.9 AZENTUS US, INC (2021)

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT DEVELOPMENT

17.1 BBI LIFESCIENCES CORPORATION

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENTS

17.11 BIO BASIC INC.

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENTS

17.12 BIOCAT GMBH

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENTS

17.13 BIONEER PACIFIC

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 BOSTER BIOLOGICAL TECHNOLOGY

17.14.1 COMPANY SNAPSHOT

17.14.2 SERVICE PORTFOLIO

17.14.3 RECENT DEVELOPMENT

17.15 CSBIO

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENTS

17.16 CREATIVE BIOGENE

17.16.1 COMPANY SNAPSHOT

17.16.2 RODUCTPORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.17 EVONETIX

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENTS

17.18 EXONBIO

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENT

17.19 GCC BIOTECH (INDIA) PVT. LTD.

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENT

17.2 GINKGO BIOWORKS (2021)

17.20.1 COMPANY SNAPSHOT

17.20.2 REVENUE ANALYSIS

17.20.3 PRODUCT PORTFOLIO

17.20.4 RECENT DEVELOPMENTS

17.21 GENERAL BIOSYSTEMS INC

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENTS

17.22 GENSCRIPT

17.22.1 COMPANY SNAPSHOT

17.22.2 REVENUE ANALYSIS

17.22.3 PRODUCT PORTFOLIO

17.22.4 RECENT DEVELOPMENTS

17.23 MACROGEN CO., LTD. (A SUBSIDIARY OF MACROGEN, INC)

17.23.1 COMPANY SNAPSHOT

17.23.2 REVENUE ANALYSIS

17.23.3 PRODUCT PORTFOLIO

17.23.4 RECENT DEVELOPMENTS

17.24 NZYTECH, LDA. - GENES AND ENZYMES.

17.24.1 COMPANY SNAPSHOT

17.24.2 PRODUCT PORTFOLIO

17.24.3 RECENT DEVELOPMENT

17.25 ORIGENE TECHNOLOGIES, INC

17.25.1 COMPANY SNAPSHOT

17.25.2 PRODUCT PORTFOLIO

17.25.3 RECENT DEVELOPMENTS

17.26 PROMAB BIOTECHNOLOGIES

17.26.1 COMPANY SNAPSHOT

17.26.2 PRODUCT PORTFOLIO

17.26.3 RECENT DEVELOPMENTS

17.27 PROTEOGENIX

17.27.1 COMPANY SNAPSHOT

17.27.2 PRODUCT PORTFOLIO

17.27.3 RECENT DEVELOPMENTS

17.28 SYNBIO TECHNOLOGIES

17.28.1 COMPANY SNAPSHOT

17.28.2 PRODUCT PORTFOLIO

17.28.3 RECENT DEVELOPMENTS

17.29 TRENZYME GMBH

17.29.1 COMPANY SNAPSHOT

17.29.2 PRODUCT PORTFOLIO

17.29.3 RECENT DEVELOPMENTS

17.3 TWIST BIOSCIENCE

17.30.1 COMPANY SNAPSHOT

17.30.2 REVENUE ANALYSIS

17.30.3 PRODUCT PORTFOLIO

17.30.4 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

List of Table

TABLE 1 ASIA PACIFIC GENE SYNTHESIS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 2 ASIA PACIFIC SOFTWARE & SERVICES IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 ASIA PACIFIC CONSUMABLES IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC CONSUMABLES IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC SYNTHESIZER IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC SYNTHESIZER IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC STANDARD GENE IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC COMPLEX GENE IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC EXPRESS GENE IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC OTHERS IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC CUSTOM GENE SYNTHESIS IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC CUSTOM GENE SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC GENE LIBRARY SYNTHESIS IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC GENE LIBRARY SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC GENE SYNTHESIS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC SYNTHETIC BIOLOGY IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC SYNTHETIC BIOLOGY IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC GENETIC ENGINEERING IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC GENETIC ENGINEERING IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC THERAPEUTIC ANTIBODIES IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC THERAPEUTIC ANTIBODIES IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC VACCINE DESIGN IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 ASIA PACIFIC VACCINE DESIGN IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 26 ASIA PACIFIC OTHERS IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 ASIA PACIFIC GENE SYNTHESIS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 28 ASIA PACIFIC PCR-BASED ENZYME SYNTHESIS IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 ASIA PACIFIC CHIP-BASED DNA SYNTHESIS IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 ASIA PACIFIC SOLID BASED SYNTHESIS IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 ASIA PACIFIC GENE SYNTHESIS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 32 ASIA PACIFIC ACADEMIC & RESEARCH INSTITUTES IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 ASIA PACIFIC BIOTECH & PHARMACEUTICAL COMPANIES IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 ASIA PACIFIC DIAGNOSTIC LABORATORIES IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 ASIA PACIFIC OTHERS IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 ASIA PACIFIC GENE SYNTHESIS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 37 ASIA PACIFIC DIRECT TENDER IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 ASIA PACIFIC ONLINE DISTRIBUTION IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 ASIA PACIFIC THIRD PARTY DISTRIBUTORS IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 ASIA-PACIFIC GENE SYNTHESIS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 41 ASIA-PACIFIC GENE SYNTHESIS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 42 ASIA-PACIFIC CONSUMABLES IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 ASIA-PACIFIC SYNTHESIZER IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 ASIA-PACIFIC GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 45 ASIA-PACIFIC GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 46 ASIA-PACIFIC CUSTOM GENE SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 47 ASIA-PACIFIC GENE LIBRARY SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 48 ASIA-PACIFIC GENE SYNTHESIS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 49 ASIA-PACIFIC SYNTHETIC BIOLOGY IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 50 ASIA-PACIFIC GENETIC ENGINEERING IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 51 ASIA-PACIFIC THERAPEUTIC ANTIBODIES IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 52 ASIA-PACIFIC VACCINE DESIGN IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 53 ASIA-PACIFIC GENE SYNTHESIS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 54 ASIA-PACIFIC GENE SYNTHESIS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 55 ASIA-PACIFIC GENE SYNTHESIS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 56 CHINA GENE SYNTHESIS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 57 CHINA CONSUMABLES IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 CHINA SYNTHESIZER IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 CHINA GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 60 CHINA GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 61 CHINA CUSTOM GENE SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 62 CHINA GENE LIBRARY SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 63 CHINA GENE SYNTHESIS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 64 CHINA SYNTHETIC BIOLOGY IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 65 CHINA GENETIC ENGINEERING IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 66 CHINA THERAPEUTIC ANTIBODIES IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 67 CHINA VACCINE DESIGN IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 68 CHINA GENE SYNTHESIS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 69 CHINA GENE SYNTHESIS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 70 CHINA GENE SYNTHESIS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 71 JAPAN GENE SYNTHESIS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 72 JAPAN CONSUMABLES IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 JAPAN SYNTHESIZER IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 74 JAPAN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 75 JAPAN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 76 JAPAN CUSTOM GENE SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 77 JAPAN GENE LIBRARY SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 78 JAPAN GENE SYNTHESIS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 79 JAPAN SYNTHETIC BIOLOGY IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 80 JAPAN GENETIC ENGINEERING IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 81 JAPAN THERAPEUTIC ANTIBODIES IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 82 JAPAN VACCINE DESIGN IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 83 JAPAN GENE SYNTHESIS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 84 JAPAN GENE SYNTHESIS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 85 JAPAN GENE SYNTHESIS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 86 INDIA GENE SYNTHESIS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 87 INDIA CONSUMABLES IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 NDIA SYNTHESIZER IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 INDIA GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 90 INDIA GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 91 INDIA CUSTOM GENE SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 92 INDIA GENE LIBRARY SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 93 INDIA GENE SYNTHESIS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 94 INDIA SYNTHETIC BIOLOGY IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 95 INDIA GENETIC ENGINEERING IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 96 INDIA THERAPEUTIC ANTIBODIES IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 97 INDIA VACCINE DESIGN IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 98 INDIA GENE SYNTHESIS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 99 INDIA GENE SYNTHESIS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 100 INDIA GENE SYNTHESIS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 101 SOUTH KOREA GENE SYNTHESIS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 102 SOUTH KOREA CONSUMABLES IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 SOUTH KOREA SYNTHESIZER IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 104 SOUTH KOREA GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 105 SOUTH KOREA GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 106 SOUTH KOREA CUSTOM GENE SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 107 SOUTH KOREA GENE LIBRARY SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 108 SOUTH KOREA GENE SYNTHESIS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 109 SOUTH KOREA SYNTHETIC BIOLOGY IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 110 SOUTH KOREA GENETIC ENGINEERING IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 111 SOUTH KOREA THERAPEUTIC ANTIBODIES IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 112 SOUTH KOREA VACCINE DESIGN IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 113 SOUTH KOREA GENE SYNTHESIS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 114 SOUTH KOREA GENE SYNTHESIS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 115 SOUTH KOREA GENE SYNTHESIS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 116 AUSTRALIA GENE SYNTHESIS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 117 AUSTRALIA CONSUMABLES IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 118 AUSTRALIA SYNTHESIZER IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 119 AUSTRALIA GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 120 AUSTRALIA GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 121 AUSTRALIA CUSTOM GENE SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 122 AUSTRALIA GENE LIBRARY SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 123 AUSTRALIA GENE SYNTHESIS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 124 AUSTRALIA SYNTHETIC BIOLOGY IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 125 AUSTRALIA GENETIC ENGINEERING IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 126 AUSTRALIA THERAPEUTIC ANTIBODIES IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 127 AUSTRALIA VACCINE DESIGN IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 128 AUSTRALIA GENE SYNTHESIS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 129 AUSTRALIA GENE SYNTHESIS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 130 AUSTRALIA GENE SYNTHESIS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 131 SINGAPORE GENE SYNTHESIS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 132 SINGAPORE CONSUMABLES IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 133 SINGAPORE SYNTHESIZER IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 134 SINGAPORE GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 135 SINGAPORE GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 136 SINGAPORE CUSTOM GENE SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 137 SINGAPORE GENE LIBRARY SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 138 SINGAPORE GENE SYNTHESIS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 139 SINGAPORE SYNTHETIC BIOLOGY IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 140 SINGAPORE GENETIC ENGINEERING IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 141 SINGAPORE THERAPEUTIC ANTIBODIES IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 142 SINGAPORE VACCINE DESIGN IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 143 SINGAPORE GENE SYNTHESIS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 144 SINGAPORE GENE SYNTHESIS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 145 SINGAPORE GENE SYNTHESIS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 146 MALAYSIA GENE SYNTHESIS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 147 MALAYSIA CONSUMABLES IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 148 MALAYSIA SYNTHESIZER IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 149 MALAYSIA GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 150 MALAYSIA GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 151 MALAYSIA CUSTOM GENE SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 152 MALAYSIA GENE LIBRARY SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 153 MALAYSIA GENE SYNTHESIS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 154 MALAYSIA SYNTHETIC BIOLOGY IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 155 MALAYSIA GENETIC ENGINEERING IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 156 MALAYSIA THERAPEUTIC ANTIBODIES IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 157 MALAYSIA VACCINE DESIGN IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 158 MALAYSIA GENE SYNTHESIS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 159 MALAYSIA GENE SYNTHESIS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 160 MALAYSIA GENE SYNTHESIS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 161 THAILAND GENE SYNTHESIS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 162 THAILAND CONSUMABLES IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 163 THAILAND SYNTHESIZER IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 164 THAILAND GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 165 THAILAND GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 166 THAILAND CUSTOM GENE SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 167 THAILAND GENE LIBRARY SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 168 THAILAND GENE SYNTHESIS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 169 THAILAND SYNTHETIC BIOLOGY IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 170 THAILAND GENETIC ENGINEERING IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 171 THAILAND THERAPEUTIC ANTIBODIES IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 172 THAILAND VACCINE DESIGN IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 173 THAILAND GENE SYNTHESIS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 174 THAILAND GENE SYNTHESIS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 175 THAILAND GENE SYNTHESIS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 176 INDONESIA GENE SYNTHESIS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 177 INDONESIA CONSUMABLES IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 178 INDONESIA SYNTHESIZER IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 179 INDONESIA GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 180 INDONESIA GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 181 INDONESIA CUSTOM GENE SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 182 INDONESIA GENE LIBRARY SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 183 INDONESIA GENE SYNTHESIS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 184 INDONESIA SYNTHETIC BIOLOGY IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 185 INDONESIA GENETIC ENGINEERING IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 186 INDONESIA THERAPEUTIC ANTIBODIES IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 187 INDONESIA VACCINE DESIGN IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 188 INDONESIA GENE SYNTHESIS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 189 INDONESIA GENE SYNTHESIS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 190 INDONESIA GENE SYNTHESIS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 191 PHILIPPINES GENE SYNTHESIS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 192 PHILIPPINES CONSUMABLES IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 193 PHILIPPINES SYNTHESIZER IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 194 PHILIPPINES GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 195 PHILIPPINES GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 196 PHILIPPINES CUSTOM GENE SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 197 PHILIPPINES GENE LIBRARY SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 198 PHILIPPINES GENE SYNTHESIS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 199 PHILIPPINES SYNTHETIC BIOLOGY IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 200 PHILIPPINES GENETIC ENGINEERING IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 201 PHILIPPINES THERAPEUTIC ANTIBODIES IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 202 PHILIPPINES VACCINE DESIGN IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 203 PHILIPPINES GENE SYNTHESIS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 204 PHILIPPINES GENE SYNTHESIS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 205 PHILIPPINES GENE SYNTHESIS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 206 REST OF ASIA-PACIFIC GENE SYNTHESIS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 ASIA PACIFIC GENE SYNTHESIS MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC GENE SYNTHESIS MARKET: GEOGRAPHIC SCOPE

FIGURE 3 ASIA PACIFIC GENE SYNTHESIS MARKET: DATA TRIANGULATION

FIGURE 4 ASIA PACIFIC GENE SYNTHESIS MARKET: SNAPSHOT

FIGURE 5 ASIA PACIFIC GENE SYNTHESIS MARKET: BOTTOM UP APPROACH

FIGURE 6 ASIA PACIFIC GENE SYNTHESIS MARKET: TOP DOWN APPROACH

FIGURE 7 ASIA PACIFIC GENE SYNTHESIS MARKET: INTERVIEWS BY REGION AND DESIGNATION

FIGURE 8 ASIA PACIFIC GENE SYNTHESIS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 ASIA PACIFIC GENE SYNTHESIS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 ASIA PACIFIC GENE SYNTHESIS MARKET: END USER COVERAGE GRID

FIGURE 11 ASIA PACIFIC GENE SYNTHESIS MARKET: THE CATEGORY VS TIME GRID

FIGURE 12 ASIA PACIFIC GENE SYNTHESIS MARKET SEGMENTATION

FIGURE 13 GROWING PREVALENCE OF CHRONIC INFECTIOUS DISEASES , EXPANSION OF SYNTHETIC BIOLOGY AND RISING ADOPTION OF GENE THERAPY ARE EXPECTED TO DRIVE THE MARKET FOR ASIA PACIFIC GENE SYNTHESIS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 SYNTHESIZER SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC GENE SYNTHESIS MARKET IN 2022 & 2029

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC GENE SYNTHESIS MARKET

FIGURE 16 ASIA PACIFIC GENE SYNTHESIS MARKET: BY COMPONENT, 2021

FIGURE 17 ASIA PACIFIC GENE SYNTHESIS MARKET: BY COMPONENT, 2022-2029 (USD MILLION)

FIGURE 18 ASIA PACIFIC GENE SYNTHESIS MARKET: BY COMPONENT, CAGR (2022-2029)

FIGURE 19 ASIA PACIFIC GENE SYNTHESIS MARKET: BY COMPONENT, LIFELINE CURVE

FIGURE 20 ASIA PACIFIC GENE SYNTHESIS MARKET: BY GENE TYPE, 2021

FIGURE 21 ASIA PACIFIC GENE SYNTHESIS MARKET: BY GENE TYPE, 2022-2029 (USD MILLION)

FIGURE 22 ASIA PACIFIC GENE SYNTHESIS MARKET: BY GENE TYPE, CAGR (2022-2029)

FIGURE 23 ASIA PACIFIC GENE SYNTHESIS MARKET: BY GENE TYPE, LIFELINE CURVE

FIGURE 24 ASIA PACIFIC GENE SYNTHESIS MARKET: BY GENE SYNTHESIS TYPE, 2021

FIGURE 25 ASIA PACIFIC GENE SYNTHESIS MARKET: BY GENE SYNTHESIS TYPE, 2022-2029 (USD MILLION)

FIGURE 26 ASIA PACIFIC GENE SYNTHESIS MARKET: BY GENE SYNTHESIS TYPE, CAGR (2022-2029)

FIGURE 27 ASIA PACIFIC GENE SYNTHESIS MARKET: BY GENE SYNTHESIS TYPE, LIFELINE CURVE

FIGURE 28 ASIA PACIFIC GENE SYNTHESIS MARKET: BY APPLICATION, 2021

FIGURE 29 ASIA PACIFIC GENE SYNTHESIS MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 30 ASIA PACIFIC GENE SYNTHESIS MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 31 ASIA PACIFIC GENE SYNTHESIS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 32 ASIA PACIFIC GENE SYNTHESIS MARKET: BY METHOD, 2021

FIGURE 33 ASIA PACIFIC GENE SYNTHESIS MARKET: BY METHOD, 2022-2029 (USD MILLION)

FIGURE 34 ASIA PACIFIC GENE SYNTHESIS MARKET: BY METHOD, CAGR (2022-2029)

FIGURE 35 ASIA PACIFIC GENE SYNTHESIS MARKET: BY METHOD, LIFELINE CURVE

FIGURE 36 ASIA PACIFIC GENE SYNTHESIS MARKET: BY END USER, 2021

FIGURE 37 ASIA PACIFIC GENE SYNTHESIS MARKET: BY END USER, 2021-2029 (USD MILLION)

FIGURE 38 ASIA PACIFIC GENE SYNTHESIS MARKET: BY END USER, CAGR (2022-2029)

FIGURE 39 ASIA PACIFIC GENE SYNTHESIS MARKET: BY END USER, LIFELINE CURVE

FIGURE 40 ASIA PACIFIC GENE SYNTHESIS MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 41 ASIA PACIFIC GENE SYNTHESIS MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 42 ASIA PACIFIC GENE SYNTHESIS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 43 ASIA PACIFIC GENE SYNTHESIS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 44 ASIA-PACIFIC GENE SYNTHESIS MARKET: SNAPSHOT (2021)

FIGURE 45 ASIA-PACIFIC GENE SYNTHESIS MARKET: BY COUNTRY (2021)

FIGURE 46 ASIA-PACIFIC GENE SYNTHESIS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 47 ASIA-PACIFIC GENE SYNTHESIS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 48 ASIA-PACIFIC GENE SYNTHESIS MARKET: BY COMPONENT (2022-2029)

FIGURE 49 ASIA PACIFIC GENE SYNTHESIS MARKET: COMPANY SHARE 2021 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.