Asia Pacific Fraud Detection Transaction Monitoring Market

Market Size in USD Billion

CAGR :

%

USD

4.16 Billion

USD

19.26 Billion

2024

2032

USD

4.16 Billion

USD

19.26 Billion

2024

2032

| 2025 –2032 | |

| USD 4.16 Billion | |

| USD 19.26 Billion | |

|

|

|

|

Asia-Pacific Fraud Detection Transaction Monitoring Market Size

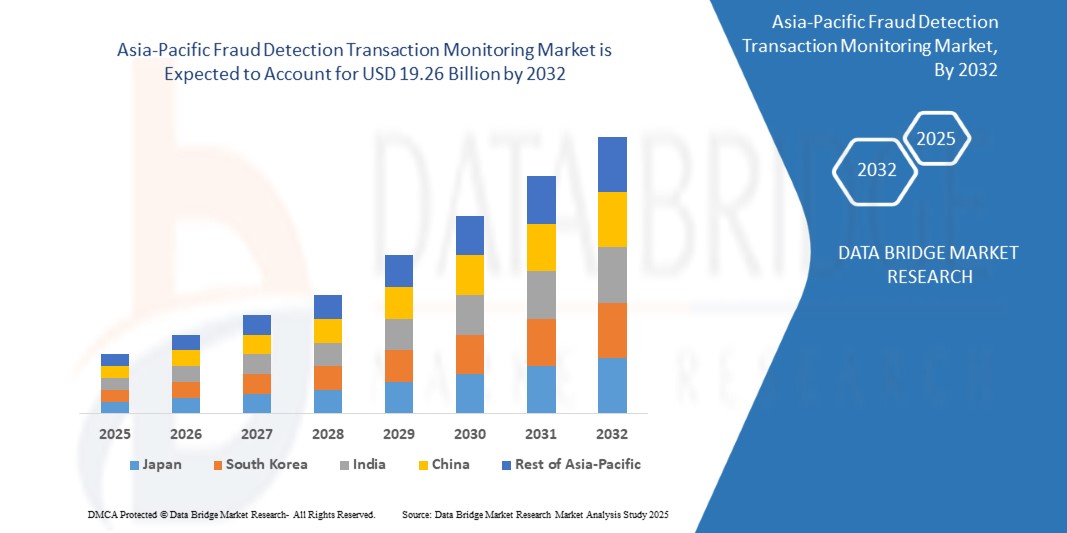

- The Asia-Pacific fraud detection transaction monitoring market size was valued at USD 4.16 billion in 2024 and is expected to reach USD 19.26 billion by 2032, at a CAGR of 21.1% during the forecast period

- The market growth is largely fueled by the increasing digitization of financial transactions, rising adoption of online banking and digital payment platforms, and the integration of AI and machine learning technologies for real-time fraud detection across BFSI, retail, and e-commerce sectors

- Furthermore, growing regulatory compliance requirements, including KYC, AML, and anti-fraud mandates, along with the rising need for secure, efficient, and automated transaction monitoring systems, are driving organizations to adopt advanced fraud detection solutions. These converging factors are accelerating the deployment of comprehensive monitoring platforms, thereby significantly boosting the industry's growth

Asia-Pacific Fraud Detection Transaction Monitoring Market Analysis

- Fraud detection transaction monitoring solutions help organizations identify, prevent, and mitigate fraudulent activities by analyzing transactions in real time using AI, machine learning, and predictive analytics. These systems provide alerts, automated risk scoring, and compliance reporting to safeguard financial and operational assets

- The escalating demand for these solutions is primarily fueled by the surge in online transactions, increasing sophistication of cyber fraud schemes, and the critical need for organizations to ensure regulatory compliance while protecting customer data and maintaining trust

- China dominated the fraud detection transaction monitoring market in 2024, due to rapid digitalization of financial services, widespread adoption of online banking and e-commerce, and a strong regulatory framework enforcing KYC and AML compliance

- India is expected to be the fastest growing country in the fraud detection transaction monitoring market during the forecast period due to rapid digitization of banking and e-commerce sectors, rising adoption of mobile and online payments, and increasing regulatory focus on KYC and AML compliance

- Solution segment dominated the market with a market share of 62.9% in 2024, due to the rising need for advanced fraud detection software that integrates AI, machine learning, and real-time analytics. Organizations across BFSI, retail, and telecom sectors increasingly deploy fraud detection platforms to safeguard transactions, reduce financial losses, and ensure regulatory compliance. The scalability of solutions, their ability to provide predictive insights, and seamless integration with enterprise systems make them the preferred choice for enterprises prioritizing security and operational efficiency

Report Scope and Asia-Pacific Fraud Detection Transaction Monitoring Market Segmentation

|

Attributes |

Asia-Pacific Fraud Detection Transaction Monitoring Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Asia-Pacific Fraud Detection Transaction Monitoring Market Trends

Adopting AI for Real-Time Fraud Detection

- The increasing adoption of artificial intelligence for real-time fraud detection is reshaping the fraud detection transaction monitoring market. Financial institutions and enterprises are leveraging AI-powered systems to identify suspicious activities instantly, reduce false positives, and improve overall detection accuracy in increasingly complex transaction networks

- For instance, Mastercard employs AI-driven fraud detection tools that analyze transaction patterns in real time to intercept fraudulent activities before they are completed. Similarly, Featurespace uses adaptive behavioral analytics powered by machine learning to enable banks and payment companies to identify anomalies across large-scale financial transactions with greater precision

- The use of AI significantly enhances fraud detection capabilities by analyzing enormous volumes of structured and unstructured data in seconds, something that traditional rule-based systems struggle to achieve. This allows organizations to counter advanced fraud tactics such as synthetic identities, account takeover, and cross-border transaction fraud effectively

- AI technologies also help reduce the rate of false declines which can negatively impact customer experience in the financial sector. By improving detection accuracy, real-time AI systems protect institutions from monetary losses and also safeguard consumer trust and loyalty

- The expansion of digital payment ecosystems including mobile wallets, e-commerce platforms, and peer-to-peer transfers has heightened the need for instant fraud prevention. AI-based transaction monitoring systems provide adaptive, real-time capabilities that allow seamless integration with high-speed financial networks

- In conclusion, the adoption of AI for real-time fraud detection is driving rapid transformation in the industry. This trend underscores the growing necessity for agile, intelligent, and predictive monitoring frameworks that can adapt to evolving fraud tactics and deliver secure, seamless financial transactions worldwide

Asia-Pacific Fraud Detection Transaction Monitoring Market Dynamics

Driver

Increased Focus on Identity Verification and Authentication

- The rising emphasis on identity verification and authentication is a key driver accelerating the adoption of transaction monitoring systems. With the surge in digital transactions, financial institutions are prioritizing advanced identity authentication methods to protect users from identity theft, account takeover fraud, and unauthorized access

- For instance, Experian has integrated advanced identity verification tools within its fraud detection solutions, utilizing biometric authentication and multi-factor verification to strengthen transaction security. Similarly, companies such as LexisNexis Risk Solutions use AI and big data to enable financial organizations to validate customer identities in real time while reducing friction in user experience

- The integration of biometric factors such as facial recognition, fingerprint scanning, and behavioral analytics further enhances risk mitigation across banking, e-commerce, and telecommunication services. These measures provide strong verification capabilities to complement transaction monitoring and reduce vulnerabilities in user accounts

- The regulatory landscape, particularly with frameworks such as Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements, is also reinforcing the need for robust identity verification and authentication tools. Financial organizations must adopt advanced monitoring solutions to remain compliant and minimize regulatory fines

- Overall, increased emphasis on identity verification and authentication is reinforcing global trust in digital channels. This driver ensures that fraud detection transaction monitoring systems continue to evolve as indispensable tools for securing financial services and protecting customer relationships

Restraint/Challenge

High Initial Investment and Ongoing Maintenance Costs

- A significant challenge in the fraud detection transaction monitoring market is the high financial investment required for implementation and ongoing maintenance. Deploying advanced AI-powered monitoring systems demands substantial capital investment in software platforms, integration technologies, and skilled personnel, which creates barriers for smaller financial institutions and enterprises

- For instance, large banks such as JPMorgan Chase can afford to implement AI-driven, real-time fraud monitoring platforms with predictive capabilities. However, mid-sized and regional institutions often struggle with high implementation costs and find it difficult to justify expenses, particularly in markets with thin profit margins

- The complexity of managing and maintaining these systems further adds to long-term costs. Continuous updates are required to keep threat models current, while operational expenses such as system tuning, cloud storage capacity, and advanced analytics tools increase the financial burden on organizations

- In addition, scalability challenges arise when transaction volumes surge, requiring institutions to invest further in infrastructure and support systems. This impacts organizations with limited budgets that are already balancing compliance costs and profit pressures

- As a result, high initial costs combined with ongoing maintenance expenditures limit the widespread adoption of fraud detection transaction monitoring solutions. Overcoming this challenge will require the development of cost-efficient platforms, cloud-based subscription models, and shared service offerings to expand accessibility for institutions of all sizes

Asia-Pacific Fraud Detection Transaction Monitoring Market Scope

The market is segmented on the basis of offering, function, deployment, organization size, application, and vertical.

- By Offering

On the basis of offering, the market is segmented into solutions and services. The solutions segment dominated the largest market revenue share of 62.9% in 2024, driven by the rising need for advanced fraud detection software that integrates AI, machine learning, and real-time analytics. Organizations across BFSI, retail, and telecom sectors increasingly deploy fraud detection platforms to safeguard transactions, reduce financial losses, and ensure regulatory compliance. The scalability of solutions, their ability to provide predictive insights, and seamless integration with enterprise systems make them the preferred choice for enterprises prioritizing security and operational efficiency.

The services segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the rising demand for managed services, consulting, and technical support. Businesses are increasingly outsourcing fraud monitoring to service providers due to a lack of in-house expertise and the complexity of handling evolving cyber threats. The surge in subscription-based fraud detection offerings, training services, and 24/7 monitoring support is further accelerating adoption. Service providers offering tailored advisory and compliance-focused solutions are gaining traction, particularly among SMEs that seek cost-effective, scalable fraud prevention.

- By Function

On the basis of function, the market is segmented into KYC/Customer Onboarding, Case Management, Watch List Screening, Dashboard & Reporting, and Others. The KYC/Customer Onboarding segment held the largest market revenue share in 2024, owing to growing regulatory mandates and compliance requirements across the financial sector. Financial institutions, fintechs, and digital banks rely on robust KYC solutions to authenticate identities, prevent fraudulent account openings, and strengthen customer trust. The adoption of biometric verification, e-KYC, and digital onboarding platforms has driven its dominance, ensuring both operational efficiency and reduced financial risk exposure.

The watch list screening segment is projected to witness the fastest growth rate from 2025 to 2032, driven by increasing global pressure to comply with anti-money laundering (AML) and counter-terrorism financing (CTF) regulations. Institutions are deploying advanced screening tools to monitor transactions against global sanctions, politically exposed persons (PEP) databases, and adverse media. The rise in cross-border payments and international trade is pushing businesses to prioritize automated, real-time screening solutions that minimize compliance risk and regulatory penalties.

- By Deployment

On the basis of deployment, the market is segmented into on-premise and cloud. The on-premise segment dominated the largest market revenue share in 2024, as large enterprises and government organizations continue to prioritize maximum data control, system customization, and enhanced security. On-premise deployment remains popular in highly regulated sectors such as banking and defense, where strict data sovereignty and confidentiality requirements exist. The ability to tightly integrate on-premise fraud monitoring tools with legacy IT systems also contributes to its widespread use.

The cloud segment is anticipated to witness the fastest CAGR from 2025 to 2032, driven by its scalability, cost-effectiveness, and ability to support real-time monitoring across distributed networks. Cloud-based fraud detection solutions provide organizations with instant software updates, AI-driven analytics, and flexibility to adapt to evolving fraud patterns. The rapid adoption of digital payments, remote working, and online banking has accelerated cloud adoption, particularly among SMEs seeking secure, subscription-based fraud monitoring platforms with minimal upfront infrastructure costs.

- By Organization Size

On the basis of organization size, the market is segmented into large enterprises and small & medium-sized enterprises (SMEs). The large enterprises segment accounted for the largest market share in 2024, as global corporations face significant risks from large-scale fraud attempts, money laundering schemes, and cyberattacks. These organizations invest heavily in AI-driven fraud monitoring platforms, advanced analytics, and enterprise-wide risk management systems. The availability of higher budgets, compliance-driven priorities, and integration with multi-channel operations ensure that large enterprises remain the leading adopters of fraud detection solutions.

The SMEs segment is forecasted to grow at the fastest rate from 2025 to 2032, fueled by their increasing vulnerability to cyber fraud, phishing, and account takeovers. SMEs are embracing cost-effective, cloud-based fraud detection tools that offer automated protection without requiring extensive IT infrastructure. Rising adoption of digital payment solutions, coupled with growing awareness of compliance obligations, is driving SMEs to adopt fraud monitoring platforms. Subscription-based pricing models and managed fraud detection services are making these solutions highly attractive for smaller businesses.

- By Application

On the basis of application, the market is segmented into payment fraud detection, money laundering detection, account takeover protection, identity theft prevention, and others. The payment fraud detection segment dominated the market in 2024, owing to the rapid growth of digital payments, e-commerce transactions, and mobile banking. Rising cases of unauthorized transactions, card fraud, and phishing attacks have pushed banks and retailers to adopt AI-powered fraud detection systems. Real-time transaction analysis, predictive fraud scoring, and integration with payment gateways have made this segment the most widely adopted application across industries.

The account takeover protection segment is expected to register the fastest growth rate from 2025 to 2032, driven by the increasing sophistication of credential theft, phishing scams, and social engineering attacks. Fraudsters target user accounts across banking, retail, and telecom, making account takeover a significant concern. Businesses are adopting multi-factor authentication, behavioral biometrics, and AI-driven monitoring to detect anomalies in user access patterns. The surge in online accounts, digital wallets, and cloud-based services is further fueling adoption of account takeover protection solutions.

- By Vertical

On the basis of vertical, the market is segmented into banking, financial services & insurance (BFSI), retail, IT & telecommunication, government & defense, healthcare, manufacturing, energy & utilities, and others. The BFSI segment dominated the largest market revenue share in 2024, as banks and financial institutions remain the primary targets of fraudsters. The sector invests heavily in fraud detection platforms to secure digital transactions, combat money laundering, and comply with stringent regulatory frameworks such as AML and KYC. The rapid expansion of online banking and fintech innovations continues to drive the adoption of advanced fraud monitoring solutions within BFSI.

The healthcare segment is projected to witness the fastest CAGR from 2025 to 2032, fueled by the rising incidence of medical identity theft, insurance fraud, and data breaches. With increasing digitization of health records and patient billing systems, healthcare providers are deploying fraud detection platforms to safeguard sensitive data. AI-driven analytics and monitoring systems are being adopted to detect fraudulent claims and prevent unauthorized access to medical information. The growing regulatory push for securing patient data is also accelerating fraud monitoring adoption in this sector.

Asia-Pacific Fraud Detection Transaction Monitoring Market Regional Analysis

- China dominated the fraud detection transaction monitoring market with the largest revenue share in 2024, driven by rapid digitalization of financial services, widespread adoption of online banking and e-commerce, and a strong regulatory framework enforcing KYC and AML compliance

- Increasing investments in AI-driven monitoring systems, predictive analytics, and real-time transaction screening have accelerated the deployment of advanced fraud detection solutions. The presence of major fintech companies, strong technology infrastructure, and robust cybersecurity initiatives further strengthen China’s leadership in the regional market

- Rising incidences of online payment fraud, growing consumer awareness about secure digital transactions, and integration of automated fraud monitoring in both banking and retail sectors ensure continued dominance in the forecast period

Japan Fraud Detection Transaction Monitoring Market Insight

The Japan market is anticipated to grow steadily from 2025 to 2032, driven by high adoption of technologically advanced fraud detection solutions and strong regulatory compliance standards. Japanese financial institutions and enterprises prioritize automation, AI-based monitoring, and integration of multi-channel fraud detection platforms. A mature digital payments ecosystem, emphasis on cybersecurity, and preference for secure, efficient transaction monitoring systems boost demand. Continuous innovation by domestic technology providers and investment in machine learning and predictive analytics position Japan as a stable and innovation-driven market for fraud detection solutions.

India Fraud Detection Transaction Monitoring Market Insight

India is projected to register the fastest CAGR in the Asia Pacific fraud detection transaction monitoring market during 2025–2032. Growth is propelled by rapid digitization of banking and e-commerce sectors, rising adoption of mobile and online payments, and increasing regulatory focus on KYC and AML compliance. Government initiatives promoting digital financial inclusion, expansion of fintech services, and growing awareness about transaction security are fueling demand. Domestic technology providers, coupled with scalable cloud-based fraud monitoring solutions, strengthen India’s position as the fastest-growing market. Rising online transactions and the need for real-time fraud prevention further accelerate growth.

Asia-Pacific Fraud Detection Transaction Monitoring Market Share

The fraud detection transaction monitoring industry is primarily led by well-established companies, including:

- Amazon Web Services, Inc. (U.S.)

- LexisNexis (U.S.)

- Mastercard (U.S.)

- TATA Consultancy Services Limited (India)

- Fiserv, Inc. (U.S.)

- SAS Institute Inc. (U.S.)

- ACI Worldwide (U.S.)

- Oracle (U.S.)

- NICE (Israel)

- FICO (U.S.)

- SymphonyAI (U.S.)

- UBIQUITY (U.S)

- Verafin Solutions ULC (Canada)

- GB Group plc (‘GBG’) (U.K.)

- INFORM SOFTWARE (Germany)

- Quantexa (U.K.)

- Sum and Substance Ltd (U.K.)

- DataVisor, Inc. (U.S.)

- Hawk (Germany)

- Featurespace Limited (England)

- INETCO Systems Ltd. (Canada)

- Abra Innovations, Inc. (U.S.)

- Seon Technologies Ltd. (Hungary)

- Feedzai (Portugal)

- Sanction Scanner (U.K.)

Latest Developments in Asia-Pacific Fraud Detection Transaction Monitoring Market

- In June 2024, American Express accelerated fraud detection using AI-powered long short-term memory (LSTM) models. By leveraging parallel computing on GPUs, the company rapidly processed and analyzed vast amounts of transactional data, enabling real-time fraud detection. This approach helped American Express handle the complexities arising from their high transaction volume. The integration of accelerated computing and AI enhanced their ability to detect anomalies swiftly, improving operational efficiency and reducing potential losses due to fraud

- In June 2024, DataVisor, Inc. enhanced its multi-tenancy capabilities to provide scalable, secure, and flexible fraud prevention and AML solutions. The upgrade allowed organizations to customize fraud and AML strategies and deploy them across sub-tenants with features such as machine learning models and business rules. These enhancements supported sponsor banks with compliance and enabled large financial institutions to centralize data while offering sub-tenancy decision-making. This development benefited DataVisor by strengthening its market position and increasing adoption of its solutions among banking and financial institutions, boosting customer satisfaction and retention

- In June 2024, ACI Worldwide and RS2 launched a comprehensive payment solution in Brazil, combining their acquiring and issuing technologies. This cloud-enabled platform allowed financial institutions and payment service providers to efficiently introduce new products and services, enhancing security and reducing costs. The integration of advanced fraud management and real-time analytics benefited the companies by expanding their market reach and increasing revenue opportunities

- In October 2023, ACI Worldwide partnered with Nymcard to enhance its fraud and anti-money laundering capabilities. This partnership allowed Nymcard to quickly and efficiently detect and prevent financial fraud using advanced machine learning and analytics. The deployment via ACI’s public cloud improved scalability, security, and operational efficiency, significantly strengthening Nymcard’s market position in MENA

- In July 2023, according to the blog published by BluEnt, companies faced increased challenges in fraud detection due to the high volume of transactions. Advanced technology and automated systems were adopted to analyze large datasets and spot high-risk trends and anomalies. Despite difficulties managing unstructured data where most fraud occurs, financial crime data analytics enabled the effective review of both structured and unstructured data. This approach helped in preventing fraudulent activities and integrating various data sources for improved detection

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.