Asia Pacific Food Processing And Food Material Handling Equipment Market

Market Size in USD Billion

CAGR :

%

USD

78.25 Billion

USD

141.65 Billion

2025

2033

USD

78.25 Billion

USD

141.65 Billion

2025

2033

| 2026 –2033 | |

| USD 78.25 Billion | |

| USD 141.65 Billion | |

|

|

|

|

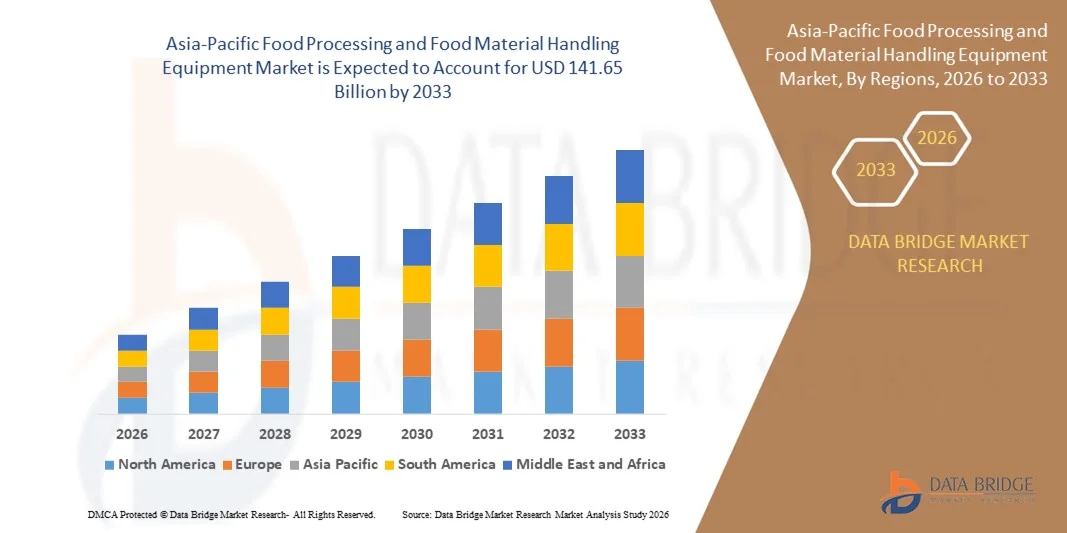

What is the Asia-Pacific Food Processing and Food Material Handling Equipment Market Size and Growth Rate?

- The Asia-Pacific food processing and food material handling equipment market size was valued at USD 78.25 billion in 2025 and is expected to reach USD 141.65 billion by 2033, at a CAGR of 7.70% during the forecast period

- The market growth is primarily driven by increasing demand for processed and packaged food products, advancements in automation technologies, and the growing need for efficient supply chains to meet rising global food consumption

- In addition, rising consumer preferences for convenience foods, coupled with stringent food safety regulations, are propelling the adoption of advanced food processing and handling equipment, significantly boosting industry growth

What are the Major Takeaways of Food Processing and Food Material Handling Equipment Market?

- Food processing and material handling equipment are critical components of the food and beverage industry, enabling efficient production, packaging, and distribution of food products while ensuring compliance with hygiene and safety standards

- The surge in demand is fueled by the growing global population, increasing urbanization, and a rising preference for ready-to-eat and packaged foods, particularly in emerging markets

- China dominated the Asia-Pacific food processing and food material handling equipment market with the largest revenue share of 36.8% in 2024, driven by strong industrial food processing capacity, rising packaged food consumption, and large-scale investments in automated processing and material handling systems across meat, dairy, and beverage industries

- The India food processing and food material handling equipment market is witnessing the fastest growth at a CAGR of 8.1%, driven by rapid expansion of food processing parks, rising demand for packaged and ready-to-eat foods, and government initiatives such as PLI schemes and Mega Food Parks

- The food processing equipment segment dominated the largest market revenue share of 68% in 2024, driven by its critical role in transforming raw materials into finished food products across various applications such as bakery, meat, dairy, and beverages

Report Scope and Food Processing and Food Material Handling Equipment Market Segmentation

|

Attributes |

Food Processing and Food Material Handling Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Food Processing and Food Material Handling Equipment Market?

Increasing Integration of IoT and Automation Technologies

- The global food processing and food material handling equipment market is experiencing a significant trend toward the integration of Internet of Things (IoT) and automation technologies

- These technologies enable real-time monitoring, data analytics, and process optimization, providing insights into equipment performance, production efficiency, and quality control

- IoT-powered solutions allow for predictive maintenance, identifying potential equipment failures before they cause production downtime, thus reducing costs and improving operational reliability

- For instance, companies are developing IoT-driven platforms that monitor production parameters to optimize bakery and confectionery processes or streamline meat and poultry processing lines based on real-time demand and supply chain data

- This trend enhances the efficiency and value proposition of food processing and handling systems, making them more appealing to manufacturers and food producers

- Automation systems can analyze a wide range of operational data, including processing speeds, temperature control, packaging accuracy, and hygiene compliance, to ensure consistent product quality

What are the Key Drivers of Food Processing and Food Material Handling Equipment Market?

- Increasing consumer demand for processed and convenience foods, such as ready-to-eat meals, bakery products, and packaged beverages, is a major driver for the global food processing and food material handling equipment market

- Food processing equipment enhances production efficiency by enabling high-volume processing of bakery and confectionery products, meat and poultry, dairy, and fish and seafood products with features such as automated cutting, mixing, and packaging

- Government initiatives in regions such as Asia-Pacific, particularly in China and India, to boost food processing industries are contributing to the widespread adoption of advanced equipment

- The proliferation of IoT and advancements in automation technologies are further enabling the expansion of food processing applications, offering faster production cycles and improved safety standards for food products

- Manufacturers are increasingly integrating advanced food processing and packaging equipment as standard solutions to meet consumer expectations for quality, hygiene, and convenience

Which Factor is Challenging the Growth of the Food Processing and Food Material Handling Equipment Market?

- The substantial initial investment required for acquiring, installing, and integrating advanced food processing and material handling equipment can be a significant barrier to adoption, particularly for small and medium-sized enterprises in emerging markets

- Retrofitting existing production facilities with modern equipment, such as automated packaging or IoT-enabled processing systems, can be complex and costly

- In addition, data security and privacy concerns pose a major challenge. IoT-enabled equipment collects and transmits large amounts of sensitive production and operational data, raising concerns about potential breaches, misuse of information, and compliance with stringent food safety and data protection regulations

- The fragmented regulatory landscape across different countries regarding food safety standards, data collection, and environmental compliance further complicates operations for global manufacturers and service providers

- These factors can deter potential adopters and limit market expansion, especially in regions with high cost sensitivity or stringent regulatory oversight

How is the Food Processing and Food Material Handling Equipment Market Segmented?

The market is segmented on the basis of equipment type, application, and form.

- By Equipment Type

On the basis of equipment type, the global food processing and food material handling equipment market is segmented into food processing equipment and food packaging equipment. The food processing equipment segment dominated the largest market revenue share of 68% in 2024, driven by its critical role in transforming raw materials into finished food products across various applications such as bakery, meat, dairy, and beverages. The demand for advanced processing technologies, such as non-thermal processing and automation, further supports its dominance.

The food packaging equipment segment is anticipated to witness the fastest growth rate of 6.8% from 2025 to 2032, fueled by increasing consumer demand for hygienic, convenient, and sustainable packaging solutions. Innovations such as IoT-enabled smart packaging and automation in form-fill-seal and labeling technologies are enhancing efficiency and traceability, driving adoption across the food industry.

- By Application

On the basis of application, the global food processing and food material handling equipment market is segmented into bakery & confectionery products, meat & poultry products, dairy products, alcoholic beverages, non-alcoholic beverages, fish & seafood products, and others. The bakery & confectionery products segment is expected to hold the largest market revenue share of 31% in 2024, driven by the high global demand for bread, pastries, and confectionery items, particularly in Europe and North America, where bread consumption averages 50 kg per person annually. The fragmented nature of this market and the need for equipment such as industrial ovens, mixers, and molders further bolster its dominance.

The non-alcoholic beverages segment is anticipated to experience the fastest growth rate from 2025 to 2032, driven by rising consumer preference for diverse flavors, sparkling waters, and ready-to-drink beverages. Advancements in beverage processing equipment, such as high-speed bottling and aseptic packaging, along with increasing social acceptance of non-alcoholic options in various settings, are key growth drivers.

- By Form

On the basis of form, the global food processing and food material handling equipment market is segmented into solid, liquid, and semi-solid. The solid segment is expected to hold the largest market revenue share of 45% in 2024, driven by the high consumption of solid food products such as processed meats, baked goods, and vegetables. The ease of handling, packaging, and longer shelf life of solid foods, coupled with consumer preference for ready-to-eat products, supports this segment's dominance.

The liquid segment is anticipated to witness the fastest growth rate of 7.1% from 2025 to 2032, fueled by increasing demand for packaged beverages such as juices, milk, and functional drinks. The adoption of advanced processing technologies, such as pasteurization and ultrafiltration, and the growing focus on sustainable liquid packaging solutions are key factors driving growth in this segment.

Which Region Holds the Largest Share of the Food Processing and Food Material Handling Equipment Market?

- China dominated the Asia-Pacific food processing and food material handling equipment market with the largest revenue share of 36.8% in 2024, driven by strong industrial food processing capacity, rising packaged food consumption, and large-scale investments in automated processing and material handling systems across meat, dairy, and beverage industries

- Widespread adoption of automation, robotics, conveyor systems, and smart packaging equipment across large food manufacturing hubs is strengthening regional market leadership

- Strong government support for food safety modernization, expanding domestic food processing industries, and integration of AI-, IoT-, and sensor-enabled equipment position Asia-Pacific as the most technology-driven regional market

India Food Processing and Food Material Handling Equipment Market Insight

The India food processing and food material handling equipment market is witnessing the fastest growth at a CAGR of 8.1%, driven by rapid expansion of food processing parks, rising demand for packaged and ready-to-eat foods, and government initiatives such as PLI schemes and Mega Food Parks. Increasing adoption of automated packaging, sorting, and material handling equipment is improving operational efficiency and reducing post-harvest losses. Continuous policy support, foreign investments, and partnerships between equipment manufacturers and food processors are reinforcing India’s role as a high-growth market in the Asia-Pacific landscape.

Australia Food Processing and Food Material Handling Equipment Market Insight

The Australia food processing and food material handling equipment market is expanding steadily, supported by a strong export-oriented food industry, high automation levels, and strict food quality standards. Growing adoption of robotic handling systems, cold-chain material handling equipment, and advanced processing technologies is driving market growth. Government focus on food safety, sustainability, and collaboration between research institutions and equipment manufacturers positions Australia as a key adopter of advanced food processing and material handling solutions in the Asia-Pacific market.

Which are the Top Companies in Food Processing and Food Material Handling Equipment Market?

The Food Processing and Food Material Handling Equipment industry is primarily led by well-established companies, including:

- ALFA LAVAL (Sweden)

- FENCO Food Machinery s.r.l. (Italy)

- JBT (U.S.)

- SPX FLOW (U.S.)

- TNA Australia Pty Limited (Australia)

- Krones AG (Germany)

- Schaaf Technologie GmbH (Germany)

- BAADER (Germany)

- Marel (Iceland)

- Bühler Group (Switzerland)

- The Middleby Corporation (U.S.)

- Lehui (China)

- GEA Group Aktiengesellschaft (Germany)

- Tetra Pak (Sweden)

What are the Recent Developments in Global Food Processing and Food Material Handling Equipment Market?

- In May 2024, Tetra Pak partnered with Outokumpu to introduce Circle Green, a revolutionary stainless steel with a carbon footprint up to 93% lower than the global industry average. This low-emission material is now used in Tetra Pak’s homogenizers, helping reduce Scope 3 emissions across its supply chain. Manufactured using recycled steel and 100% low-carbon electricity, Circle Green supports Tetra Pak’s commitment to achieving net-zero emissions by 2050. The collaboration also explores broader applications of Circle Green across food processing equipment, reinforcing sustainability in packaging and manufacturing

- In April 2024, JBT Corporation entered into a definitive agreement to acquire Marel hf., a global leader in advanced food processing solutions for poultry, meat, and seafood. The deal marks a strategic move to expand JBT’s global footprint and diversify its product portfolio across high-value segments of the food industry. Marel shareholders were offered a mix of cash and JBT common stock, with the combined entity to be named JBT Marel Corporation. The transaction is expected to close by the end of 2024, pending regulatory and shareholder approvals

- In March 2024, GEA Group unveiled GEA InsightPartner, a cloud-based web application designed to optimize food and beverage processing operations. Introduced at the Anuga FoodTec trade show in Cologne, InsightPartner enables real-time monitoring, predictive maintenance, and data-driven decision-making by providing 24/7 access to live and historical machine data. The platform helps manufacturers maximize equipment uptime, minimize unplanned shutdowns, and reduce operational costs, ultimately lowering the total cost of ownership. It can be retrofitted to existing GEA machines or integrated into new equipment, offering a user-friendly dashboard to track key performance indicators and identify efficiency improvements

- In February 2024, SPX FLOW, Inc. confirmed that its CU4 and CU4plus valve control units received ATEX and IECEx certifications for use in Zone 2 hazardous environments. These control units feature impact-resistant enclosures and advanced safety mechanisms, including manual override solenoids, high-precision position sensors, and LED indicators for valve status. Designed to operate in explosive atmospheres, they support fluid handling applications across industries such as food and beverage, chemicals, and personal care. The certification ensures compliance with stringent safety standards, boosting operational reliability and efficiency in high-risk settings

- In January 2024, Alfa Laval AB introduced the Free Rotating Retractor, a high-efficiency retractable Cleaning-in-Place (CIP) device engineered for hygienic processing environments. Designed to clean hard-to-reach areas inside tanks and ducts, it delivers 100% cleaning coverage using a dynamic 310° spray pattern. The device remains flush with the vessel wall during production and extends only during cleaning, minimizing contamination risks and boosting uptime. Compared to static spray ball systems, it offers up to 35% savings in water, chemicals, and time, supporting sustainability and operational efficiency across food, beverage, and personal care industries

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Asia Pacific Food Processing And Food Material Handling Equipment Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Asia Pacific Food Processing And Food Material Handling Equipment Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Asia Pacific Food Processing And Food Material Handling Equipment Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.