Asia Pacific Flow Cytometry Market

Market Size in USD Billion

CAGR :

%

USD

1.29 Billion

USD

3.25 Billion

2024

2032

USD

1.29 Billion

USD

3.25 Billion

2024

2032

| 2025 –2032 | |

| USD 1.29 Billion | |

| USD 3.25 Billion | |

|

|

|

|

Asia-Pacific Flow Cytometry Market Analysis

Flow cytometry is a technique for detecting and quantifying the physical and chemical properties of a population of cells or particles. A sample containing cells or particles is suspended in a fluid and injected into the flow cytometer equipment in this process. Flow cytometry is a well-established technology for identifying cells in a solution that is most typically used to assess peripheral blood, bone marrow, and other bodily fluids. Immune cells are identified and quantified using flow cytometry, which is also used to describe hematological malignancies. The evaluation of cells through this technique has a key role in diagnosing many chronic diseases. It analyzes biological activities inside cells, apoptosis, necrosis, cell cycle, cell membrane, cell proliferation, and measurement of DNA per cell.

The major diagnostic applications include benign hematologic process, cancer, AIDS, immune deficiency, benign hematologic, and these diseases' detection using fluorescence. In this process, cells are dyed with fluorophores to detect the light emitted to produce the intensity by labeling specific proteins (immunophenotyping) for diagnosing leukemia and lymphomas.

Asia-Pacific Flow Cytometry Market Size

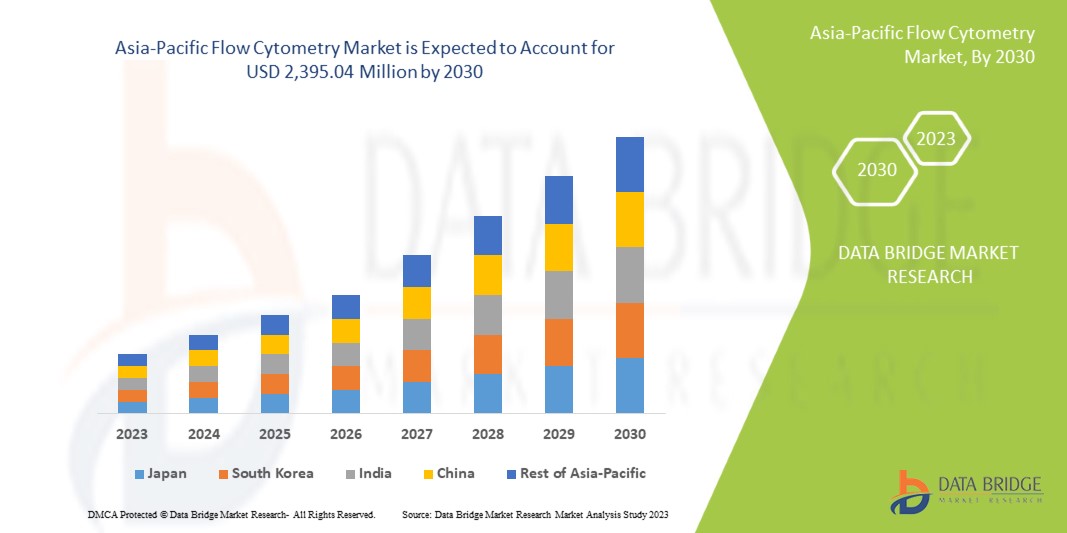

Asia-Pacific flow cytometry market size was valued at USD 1.29 billion in 2024 and is projected to reach USD 3.25 billion by 2032, with a CAGR of 12.2% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Asia-Pacific Flow Cytometry Market Trends

“Increasing Adoption of Multi-Parameter Analysis Capabilities”

One significant trend in the Asia-Pacific flow cytometry market is the increasing adoption of multi-parameter analysis capabilities, driven by advancements in technology that allow for the simultaneous measurement of numerous cellular markers. This trend is largely fueled by the rising demand for detailed cellular characterization in areas such as cancer research, immunology, and personalized medicine, where complex cellular interactions need to be understood. Innovations in laser systems, detectors, and software are making it possible to analyze more parameters with greater sensitivity and resolution, enabling researchers and clinicians to gain deeper insights into biological processes and improve diagnostic accuracy. This shift towards more sophisticated flow cytometry systems is transforming research methodologies and expanding the applicability of flow cytometry across various fields.

Report Scope and Asia-Pacific Flow Cytometry Market Segmentation

|

Attributes |

Asia-Pacific Flow Cytometry Market Insights |

|

Segments Covered |

|

|

Region Covered |

U.S., Canada , Mexico, Germany, France, U.K., Italy, Spain, Russia, Netherlands, Switzerland, Turkey, Belgium, Austria, Ireland, Norway, Poland, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Thailand, Malaysia, Indonesia, Vietnam, Philippines, Rest of Asia-Pacific, Brazil, Argentina, Peru, Rest of South America, South Africa, Saudi Arabia, U.A.E., Egypt, Kuwait, Israel, and Rest of Middle East & Africa |

|

Key Market Players |

BD (U.S.), Agilent Technologies, Inc.(U.S.), Thermo Fisher Scientific Inc.(U.S.), Bio-Rad Laboratories, Inc.(U.S.), Sartorius AG (Germany), Bennubio Inc. (U.S.), Enzo Biochem Inc. (U.S.), Apogee Flow Systems Ltd. (U.K.), Beckman Coulter, Inc. (U.S.), Coherent Corp. (U.S.), Cell Signaling Technology, Inc. (U.S.), Cytek Biosciences (U.S.), Biomérieux. (France), and Cytonome/ST LLC (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Flow Cytometry Market Definition

The Asia-Pacific flow cytometry market refers to the industry that encompasses the development, production, and distribution of flow cytometry equipment, reagents, software, and services used for analyzing and sorting cells and other particles suspended in a fluid stream. Flow cytometry is a powerful technique that allows for the simultaneous measurement of multiple physical and chemical characteristics of individual cells, such as size, complexity, and protein expression. This technology is widely employed in various applications, including immunology, oncology, microbiology, and drug development, making it an essential tool in both clinical diagnostics and research settings.

Asia-Pacific Flow Cytometry Market Dynamics

Drivers

- Rising Prevalence of Chronic Diseases

Flow cytometry is a technique for detecting and quantifying the physical and chemical properties of a population of cells or particles. A sample containing cells or particles is suspended in a fluid and injected into the flow cytometer equipment in this process. Flow cytometry is a well-established technology for identifying cells in a solution that is most typically used to assess peripheral blood, bone marrow, and other bodily fluids. Immune cells are identified and quantified using flow cytometry, which is also used to describe hematological malignancies. The evaluation of cells through this technique has a key role in diagnosing many chronic diseases. It analyzes biological activities inside cells, apoptosis, necrosis, cell cycle, cell membrane, cell proliferation, and measurement of DNA per cell.

The major diagnostic applications include benign hematologic process, cancer, AIDS, immune deficiency, benign hematologic, and these diseases' detection using fluorescence. In this process, cells are dyed with fluorophores to detect the light emitted to produce the intensity by labeling specific proteins (immunophenotyping) for diagnosing leukemia and lymphomas.

The increasing prevalence of chronic diseases has created a growing demand for flow cytometric techniques that can help researchers and clinicians better understand the underlying mechanisms of these diseases and develop more effective treatments.

- Increasing Application of Cytometry Instruments

Flow cytometry is a powerful analytical tool used to analyze and quantify single cells or particles in a heterogeneous mixture. It uses lasers and optics to detect and measure cells or particles such as size, shape and fluorescence intensity. This technique involves labeling cells or particles with fluorescent dyes or antibodies that bind to specific cell surface markers or intracellular molecules. The labeled cells or particles are then passed through a flow cytometer, which detects and measures the fluorescence emitted by each cell or particle. Flow cytometry is widely used in many research fields, including immunology, microbiology, stem cell research, cancer research, drug discovery and development, and clinical diagnostics. The technique is constantly evolving with new applications and hardware and software improvements, making it an important tool in the study of biological systems.

For instance,

- In July 2023, according to the article published by NCBI, the increasing application of flow cytometry in diverse fields, including immunophenotyping, viability assays, cell cycle analysis, and rare cell identification, drives the Asia-Pacific flow cytometry market. Its ability to analyze individual cells at a single-cell level and sort specific populations for advanced research fuels demand. This versatility accelerates growth in both academic and clinical research, propelling market expansion.

- In June 2020, according to the article published by the Wiley online library, flow cytometry can be used to identify and characterize different subsets of immune cells in patients with autoimmune diseases such as Systemic Lupus Erythematosus (SLE). The study concluded that flow cytometry could provide valuable insights into the pathogenesis of these diseases and help develop more targeted therapies. This accelerates growth in both academic and clinical research, propelling market expansion.

Growing Use of Flow Cytometry in Drug Discovery

- The expanding research activities are projected to drive the growth of flow cytometry. It has emerged as the major key to exploring drug discovery and development processes. Due to its outstanding ability to analyze heterogeneous populations of cells, flow cytometry presents an appealing promise for drug discovery and development paths. It delivers higher-resolution insights into the multiparameter functional and biological information of a single cell. Moreover, continuing progress in flow cytometry approaches such as high-throughput multifactorial analysis, cell sorting improvements, and quick event detection and resolution ensures increased efficiency in finding and characterizing novel bioactive medicines.

- For instance;-

- In March 2024, according to the article published by NCBI, the increasing use of flow cytometry in drug discovery, particularly for biomarker modulation in early clinical trials, drives the Asia-Pacific flow cytometry market. Its ability to provide valuable insights into molecule progression and reverse translation of patient data accelerates discoveries in therapeutic development. This growing application in drug discovery propels the demand for advanced flow cytometry technologies in the healthcare and pharmaceutical sectors.

- In November 2021, according to the article published by News Medical Life Sciences, the increased use of flow cytometry in drug discovery, from target identification to lead development, is driving the Asia-Pacific market. It enables the analysis of various biomolecular structures, including cell membranes, proteins, DNA, and mRNA, allowing for precise targeting in drug development. This broad applicability in understanding complex biological processes accelerates the demand for flow cytometry technologies in pharmaceutical research.

Opportunities

- Increase In Adoption of Flow Cytometry Techniques in Research and Academia

Flow cytometry is a sophisticated technique for measuring individual cells and other particles in suspension at a rate of thousands of cells per second. Flow cytometry has been extended to environmental investigations, extracellular vesicle analysis, and the capacity to use upwards of 30 different parameters for more extensive analysis. It is most typically used in the setting of immunology. Flow cytometers provide exceptional capabilities, high-quality data, and an easy-to-use platform that saves time for researchers while collecting and evaluating data.

The rise in chronic diseases and infectious diseases prevalence and incidence has opened wide opportunities for enormous research and development for novel diagnostic and therapeutic applications.

For instances,

In February 2021, according to a study published in PLOS ONE, researchers used flow cytometry to analyze the immune response of patients with COVID-19. The study found that flow cytometry was a reliable and effective tool for characterizing the immune response to the virus, which could help guide treatment strategies

In April 2021, according to a study published in Frontiers in Immunology, researchers used flow cytometry to study the immune response to HIV infection. The study found that flow cytometry was an effective tool for characterizing the immune response to the virus, which could lead to the development of new treatments and vaccines

- Rising Development of Pharmaceutical and Biotechnology Industries

Flow cytometry instruments have become an integral part of drug discovery and development in the pharmaceutical and biotechnology industries. The development of new flow cytometry equipment has helped researchers analyze and sort cells faster, more accurately and more efficiently, which has helped speed up the drug development timeline. For instance, Beckman Coulter, a leading manufacturer of flow cytometry equipment, has developed the CytoFLEX LX flow cytometer with rapid detection, enhanced sensitivity and a small footprint. CytoFLEX LX is designed to help researchers analyze rare cell populations faster and more efficiently.

Overall, the development of new flow cytometry devices is helping pharmaceutical and biotechnology companies accelerate drug development timelines by enabling faster and more accurate analysis of complex cell populations. With the rising geriatric population and chronic disease cases, the growth of biotechnology and pharmaceutical firms is also expanding. Across the globe, research and development activities are escalating due to public health expenditure with economic performance.

For instance,

- In October 2024, Ardena announced a substantial expansion of its Bioanalytical in the Netherlands. Moreover, it focused on expanding its capabilities in immunochemistry, flow cytometry, and qPCR platforms, increasing its LC-MS/MS capacity, and adding new Hamilton automated systems to enhance efficiency and address evolving bioanalytical challenges

- In April 2021, according to data provided by the CBO (Congressional Budget Office), the pharmaceutical sector spent USD 83 Billion on research and development. These costs were incurred for a number of operations, including the discovery and testing of novel medications, the development of incremental advancements such as product expansions, and clinical testing for safety monitoring and marketing

Restraints/Challenges

- High Cost of Flow Cytometry Instruments

The substantial initial investment required for flow cytometry instruments, coupled with the ongoing costs of reagents, dyes, and maintenance, creates financial barriers, particularly for smaller laboratories or those in resource-constrained environments. Additionally, the technical complexity of flow cytometry demands skilled personnel for operation, with specialized training required to properly utilize the technology. This limits its accessibility in regions where expertise is lacking, reducing its adoption rate. Moreover, flow cytometry systems require regular maintenance, calibration, and troubleshooting, which increases operational costs and can result in downtime, further impacting laboratory efficiency. Stringent regulatory requirements for approval of these medical devices also create delays in market entry and additional compliance costs. These factors collectively hinder the widespread adoption of flow cytometry, especially in emerging markets where financial constraints, lack of trained professionals, and slow regulatory processes act as significant barriers to growth, ultimately restraining the market’s potential expansion.

For Instance –

- In January 2024, according to the article published by Excedr, the high cost of flow cytometry instruments, ranging from USDUSD100,000 to USDUSD1.5 million, acts as a significant restraint for the Asia-Pacific market. These expenses limit access to smaller labs and institutions, making it challenging for them to adopt advanced technology. As a result, the high initial investment and maintenance costs hinder widespread use and slow market growth, especially in resource-limited settings.

- In November 2023, according to the article published by NCBI, the high cost of flow cytometry instruments, ranging from USD50,000 to USD750,000 or more, acts as a significant restraint on the Asia-Pacific market. This substantial financial investment required for advanced features and specifications limits accessibility, especially for smaller research labs and institutions with constrained budgets. Consequently, the high cost slows adoption and hampers market growth, particularly in resource-limited settings.

The initial investment in instruments and the ongoing expenses for reagents and maintenance create financial challenges for smaller labs and those in resource-limited areas. The technology’s complexity also requires trained personnel, limiting its use in regions lacking expertise. Additionally, the need for regular maintenance and calibration increases operational costs and causes potential downtime. Strict regulatory requirements further delay product approval and market entry. These factors limit the adoption of flow cytometry, especially in emerging markets, restraining the overall growth of the market.

- Limitations of Flow Cytometry

Flow cytometry has inherent limitations, such as its inability to analyze formalin-fixed tissues, which restricts its use in certain research and clinical applications. The method is designed for fresh or frozen samples, and formalin fixation can alter cell structure and marker expression, rendering them unsuitable for analysis. Additionally, flow cytometry struggles to fully capture complex cellular interactions or multi-layered signaling pathways. These restrictions limit the scope of its use in various fields and act as a restraint on the Asia-Pacific flow cytometry market by narrowing its applicability, particularly in clinical and pathology settings.

For instance

- In June 2021, according to the article published by LearnHaem, Flow cytometry requires fresh samples to be processed immediately after collection, as improper storage or prolonged storage leads to natural apoptosis, which diminishes the accuracy of results. Additionally, flow cytometry cannot be used on formalin-fixed tissues, limiting its application in certain clinical and research environments. These constraints act as a restraint on the Asia-Pacific flow cytometry market by reducing its versatility and applicability in some areas.

- In March 2020, according to the article published by NCBI, Flow cytometry faced limitations due to optical blur caused by high cell movement, which affects image clarity. Additionally, the detection of rare and atypical objects, such as Circulating Tumor Cells (CTCs), poses a challenge despite their prognostic importance. These issues limit the ability to accurately capture and analyze critical biomarkers, restraining the growth and application of flow cytometry in certain diagnostic and research areas.

Flow cytometry faces limitations, such as its inability to analyze formalin-fixed tissues, which are commonly used in pathology and clinical diagnostics. The process requires fresh or frozen samples, and the chemical fixation process alters cell markers, rendering them incompatible with flow cytometric analysis. Furthermore, the technique struggles to fully capture intricate cellular interactions or complex signaling pathways. These limitations restrict the technology’s broader application, acting as a restraint on the Asia-Pacific flow cytometry market by reducing its versatility in clinical and research settings.

Asia-Pacific Flow Cytometry Market Scope

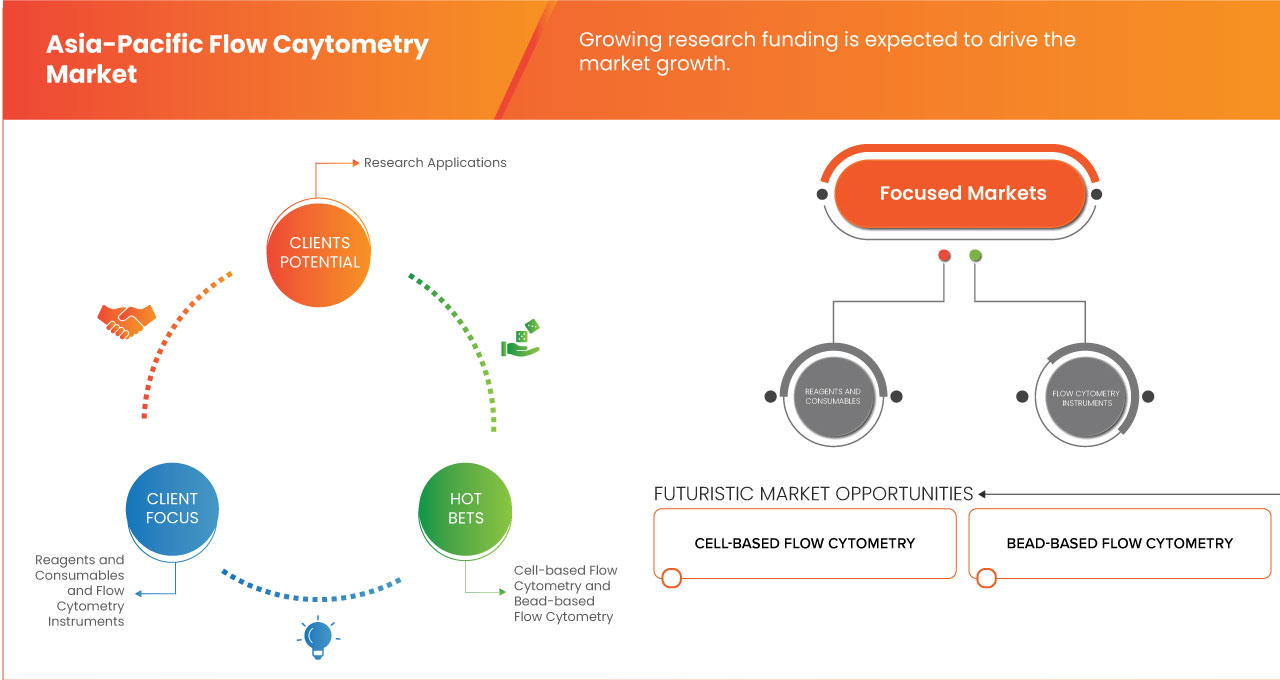

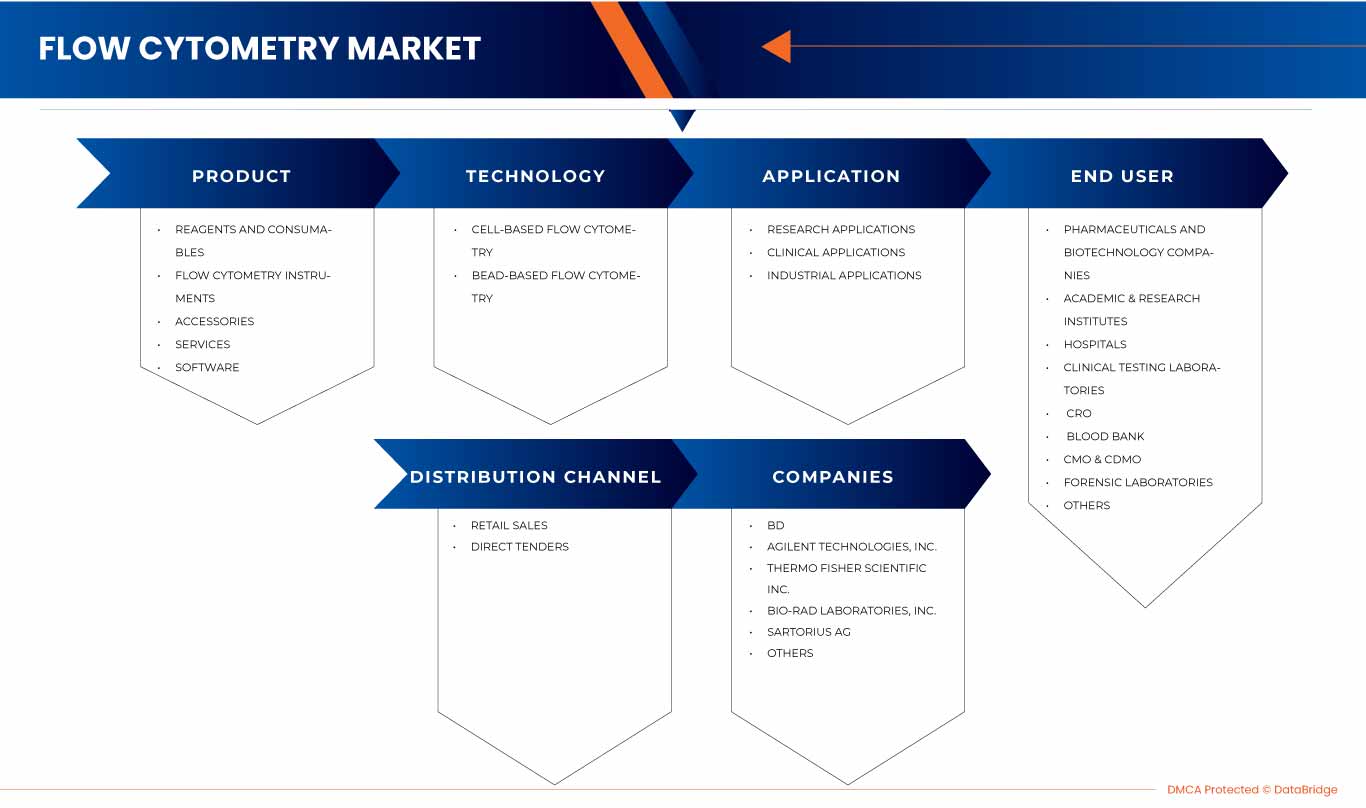

The market is segmented on the basis of product, application, technology, distribution channel, and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Reagents And Consumables

- Dye

- Antibodies

- Beads

- Others

- Flow Cytometry Instruments

- Cell Analyzers

- By Type

- Imaging Flow Cytometers

- Non-Imaging Flow Cytometers

- By Range

- High-Range Cell Analyzers

- Mid-Range Cell Analyzers

- Low-Range Cell Analyzers

- By Modality

- Benchtop

- Standalone

- By Type

- Cell Sorters

- By Modality

- Benchtop

- Standalone

- By Range

- High-Range Cell Analyzers

- Mid-Range Cell Analyzers

- Low-Range Cell Analyzers

- By Modality

- Cell Analyzers

- Accessories

- Filters

- Detectors

- Others

- Services

- Software

Technology

- Cell-Based Flow Cytometry

- Flow Cytometry Instruments

- Reagnets & Consumables

- Accessories

- Bead-Based Flow Cytometry

- Flow Cytometry Instruments

- Reagnets & Consumables

- Accessories

Application

- Research Applications

- Cell Cycle Analysis

- Cell Sorting/Screening

- Cell Transfection/Viability

- Pharmaceutical And Biotechnology

- Drug Discovery

- Stem Cell Research

- In Vitro Toxicity Testing

- Immunology

- Apoptosis

- Cell Counting

- Others

- Clinical Applications

- Hematology

- Cancer

- Immunodeficiency Diseases

- Organ Transplantation

- Other Clinical Application

- Industrial Applications

End User

- Pharmaceuticals And Biotechnology Companies

- Academic & Research Institutes

- Hospitals

- Clinical Testing Laboratories

- Cro

- Blood Bank

- Cmo & Cdmo

- Forensic Laboratoreis

- Others

Distribution Channel

- Retail Sales

- Offline

- Online

- Direct Tenders

Asia-Pacific Flow Cytometry Market Regional Analysis

The market is analyzed and market size insights and trends are provided by country, product, application, technology, distribution channel, and end user as referenced above.

The countries covered in the market are China, Japan, India, South Korea, Australia, Singapore, Thailand, Malaysia, Indonesia, Philippines and Rest of Asia-Pacific

Japan holds the largest share of the market, due to advanced healthcare infrastructure, strong biotech and pharma industries, high technology adoption, significant R&D investment, and government support. Its aging population and well-established market players further drive demand for flow cytometry.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Asia-Pacific Flow Cytometry Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Asia-Pacific presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Asia-Pacific Flow Cytometry Market Leaders Operating in the Market Are:

- BD(U.S.)

- Agilent Technologies, Inc.(U.S.)

- Thermo Fisher Scientific Inc.(U.S.)

- Bio-Rad Laboratories, Inc.(U.S.)

- Sartorius AG (Germany)

- Bennubio Inc. (U.S.)

- Enzo Biochem Inc. (U.S.)

- Apogee Flow Systems Ltd. (U.K.)

- Beckman Coulter, Inc. (U.S.)

- Coherent Corp. (U.S.)

- Cell Signaling Technology, Inc. (U.S.)

- Cytek Biosciences (U.S.)

- Biomérieux. (France)

- Cytonome/ST LLC (U.S.)

Latest Developments Asia-Pacific Flow Cytometry Market

- In July 2024, Agilent Technologies has announced the acquisition of Canadian drug services firm BioVectra for USD 925 million. This move expands Agilent's capabilities in gene editing, specifically in manufacturing oligonucleotides and peptides, enhancing its role in RNA-based therapies and gene editing technologies like CRISPR-Cas

- In June 2024, Thermo Fisher celebrated the ribbon-cutting of a 72,500-square-foot expansion at its Middleton campus, which will serve as a laboratory for pharmaceutical testing. The project will create 350 jobs over the next two years, with state tax credits supporting the initiative

- In November 2024, Sartorius Stedim Biotech has opened a new Center for Bioprocess Innovation in Marlborough, Massachusetts, aimed at advancing the development of next-generation therapeutics. The 63,000-square-foot facility will provide process optimization, training, and GMP suites for clinical production starting in 2025

- In March 2024, Beckman Coulter Life Sciences has launched the CytoFLEX nano Flow Cytometer, a breakthrough in nanoparticle analysis that enables detection as small as 40 nm. This system enhances sensitivity, offering up to 50% more data for research into extracellular vesicles and lower-abundance targets

- In March 2024, Beckman Coulter Life Sciences has received FDA 510(k) clearance to distribute its DxFLEX Clinical Flow Cytometer in the U.S. This simplifies high-complexity testing with enhanced sensitivity and automated compensation, making multicolor flow cytometry more accessible and efficient for labs

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE ASIA-PACIFIC FLOW CYTOMETRY MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 DBMR MARKET POSITION GRID

2.8 VENDOR SHARE ANALYSIS

2.9 SECONDARY SOURCES

2.1 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTAL ANALYSIS

4.2 PORTERS FIVE FORCES ANALYSIS

5 ASIA-PACIFIC FLOW CYTOMETRY MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING PREVALENCE OF CHRONIC DISEASES

6.1.2 INCREASING APPLICATION OF CYTOMETRY INSTRUMENTS

6.1.3 GROWING USE OF FLOW CYTOMETRY IN DRUG DISCOVERY

6.1.4 GROWING RESEARCH FUNDING

6.2 RESTRAINTS

6.2.1 HIGH COST OF FLOW CYTOMETRY INSTRUMENTS

6.2.2 LIMITATIONS OF FLOW CYTOMETRY

6.3 OPPORTUNITIES

6.3.1 INCREASE IN ADOPTION OF FLOW CYTOMETRY TECHNIQUES IN RESEARCH AND ACADEMIA

6.3.2 RISING DEVELOPMENT OF PHARMACEUTICAL AND BIOTECHNOLOGY INDUSTRIES

6.3.3 STRATEGIC INITIATIVES BY KEY MARKET PLAYERS

6.4 CHALLENGES

6.4.1 DIFFICULTY IN THE DEVELOPMENT AND VALIDATION OF FLOW CYTOMETRY ASSAYS

6.4.2 COMPLEXITIES RELATED TO REAGENT DEVELOPMENT

7 ASIA-PACIFIC FLOW CYTOMETRY MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 REAGENTS AND CONSUMABLES

7.2.1 DYE

7.2.2 ANTIBODIES

7.2.3 BEADS

7.2.4 OTHERS

7.3 FLOW CYTOMETRY INSTRUMENTS

7.3.1 CELL ANALYZERS

7.3.1.1 CELL ANALYZERS, BY TYPE

7.3.1.1.1 IMAGING FLOW CYTOMETERS

7.3.1.1.2 NON-IMAGING FLOW CYTOMETERS

7.3.1.2 CELL ANALYZERS, BY RANGE

7.3.1.2.1 HIGH-RANGE CELL ANALYZERS

7.3.1.2.2 MID-RANGE CELL ANALYZERS

7.3.1.2.3 LOW-RANGE CELL ANALYZERS

7.3.1.3 CELL ANALYZERS, BY MODALITY

7.3.1.3.1 BENCHTOP

7.3.1.3.2 STANDALONE

7.3.2 CELL SORTERS

7.3.2.1 BENCHTOP

7.3.2.2 STANDALONE

7.3.3 CELL SORTERS

7.3.3.1 HIGH-RANGE CELL ANALYZERS

7.3.3.2 MID-RANGE CELL ANALYZERS

7.3.3.3 LOW-RANGE CELL ANALYZERS

7.4 ACCESSORIES

7.4.1 FILTERS

7.4.2 DETECTORS

7.4.3 OTHERS

7.5 SERVICES

7.6 SOFTWARE

8 ASIA-PACIFIC FLOW CYTOMETRY MARKET, BY TECHNOLOGY

8.1 OVERVIEW

8.2 CELL-BASED FLOW CYTOMETRY

8.2.1 FLOW CYTOMETRY INSTRUMENTS

8.2.2 REAGENTS & CONSUMABLES

8.2.3 ACCESSORIES

8.3 BEAD-BASED FLOW CYTOMETRY

8.3.1 FLOW CYTOMETRY INSTRUMENTS

8.3.2 REAGENTS & CONSUMABLES

8.3.3 ACCESSORIES

9 ASIA-PACIFIC FLOW CYTOMETRY MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 RESEARCH APPLICATIONS

9.2.1 CELL CYCLE ANALYSIS

9.2.2 CELL SORTING/SCREENING

9.2.3 CELL TRANSFECTION/VIABILITY

9.2.4 PHARMACEUTICAL AND BIOTECHNOLOGY

9.2.4.1 DRUG DISCOVERY

9.2.4.2 STEM CELL RESEARCH

9.2.4.3 IN VITRO TOXICITY TESTING

9.2.5 IMMUNOLOGY

9.2.6 APOPTOSIS

9.2.7 CELL COUNTING

9.2.8 OTHERS

9.3 CLINICAL APPLICATIONS

9.3.1 HAEMATOLOGY

9.3.2 CANCER

9.3.3 IMMUNODEFICIENCY DISEASES

9.3.4 ORGAN TRANSPLANTATION

9.3.5 OTHER CLINICAL APPLICATION

9.4 INDUSTRIAL APPLICATIONS

10 ASIA-PACIFIC FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 RETAIL SALES

10.2.1 OFFLINE

10.2.2 ONLINE

10.3 DIRECT TENDERS

11 ASIA-PACIFIC FLOW CYTOMETRY MARKET, BY END USER

11.1 OVERVIEW

11.2 PHARMACEUTICALS AND BIOTECHNOLOGY COMPANIES

11.3 ACADEMIC & RESEARCH INSTITUTES

11.4 HOSPITALS

11.5 CLINICAL TESTING LABORATORIES

11.6 CRO

11.7 BLOOD BANK

11.8 CMO & CDMO

11.9 FORENSIC LABORATORIES

11.1 OTHERS

12 ASIA-PACIFIC FLOW CYTOMETRY MARKET, BY REGION

12.1 ASIA-PACIFIC

12.1.1 JAPAN

12.1.2 CHINA

12.1.3 INDIA

12.1.4 SOUTH KOREA

12.1.5 AUSTRALIA

12.1.6 SINGAPORE

12.1.7 THAILAND

12.1.8 MALAYSIA

12.1.9 INDONESIA

12.1.10 PHILIPPINES

12.1.11 REST OF ASIA-PACIFIC

13 ASIA-PACIFIC FLOW CYTOMETRY MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 BD

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 AGILENT TECHNOLOGIES, INC.

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 THERMO FISHER SCIENTIFIC INC

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT

15.4 BIO-RAD LABORATORIES, INC.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.5 SARTORIUS AG

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENT

15.6 APOGEE FLOW SYSTEMS LTD.

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 BECKMAN COULTER, INC. (A SUBSIDIARY OF DANAHER CORPORATION)

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENT

15.8 BIOMÉRIEUX

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 BIOLEGEND, INC.

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 BENNUBIO INC

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 COHERENT CORP.

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENT

15.12 CYTONOME/ST, LLC

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 CYTOBUOY

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 CELL SIGNALING TECHNOLOGY, INC

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 CYTEK BIOSCIENCES

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 DIASORIN S.P.A.

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENT

15.17 ELABSCIENCE BIONOVATION INC.

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 ENZO BIOCHEM, INC

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENT

15.19 MILTENYI BIOTEC AND/OR ITS AFFILIATES

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

15.2 MERCK KGAA

15.20.1 COMPANY SNAPSHOT

15.20.2 REVENUE ANALYSIS

15.20.3 PRODUCT PORTFOLIO

15.20.4 RECENT DEVELOPMENT

15.21 NANOCELLECT BIOMEDICAL

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENTS

15.22 NEOGENOMICS LABORATORIES

15.22.1 COMPANY SNAPSHOT

15.22.2 REVENUE ANALYSIS

15.22.3 PRODUCT PORTFOLIO

15.22.4 RECENT DEVELOPMENT

15.23 ON-CHIP BIOTECHNOLOGIES CO., LTD. CORPORATION

15.23.1 COMPANY SNAPSHOT

15.23.2 PRODUCT PORTFOLIO

15.23.3 RECENT DEVELOPMENTS

15.24 ORLFO TECHNOLOGIES

15.24.1 COMPANY SNAPSHOT

15.24.2 PRODUCT PORTFOLIO

15.24.3 RECENT DEVELOPMENT

15.25 STRATEDIGM, INC

15.25.1 COMPANY SNAPSHOT

15.25.2 PRODUCT PORTFOLIO

15.25.3 RECENT DEVELOPMENTS

15.26 SONY BIOTECHNOLOGY INC

15.26.1 COMPANY SNAPSHOT

15.26.2 PRODUCT PORTFOLIO

15.26.3 RECENT DEVELOPMENT

15.27 SYSMEX ASIA PACIFIC PTE LTD (PART OF SYSMEX CORPORATION)

15.27.1 COMPANY SNAPSHOT

15.27.2 REVENUE ANALYSIS

15.27.3 PRODUCT PORTFOLIO

15.27.4 RECENT DEVELOPMENT

15.28 TAKARA BIO INC.

15.28.1 COMPANY SNAPSHOT

15.28.2 PRODUCT PORTFOLIO

15.28.3 RECENT DEVELOPMENT

15.29 UNION BIOMETRICA, INC.

15.29.1 COMPANY SNAPSHOT

15.29.2 PRODUCT PORTFOLIO

15.29.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 ASIA-PACIFIC FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 2 ASIA-PACIFIC REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 3 ASIA-PACIFIC REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 4 ASIA-PACIFIC REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 5 ASIA-PACIFIC FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 6 ASIA-PACIFIC FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 7 ASIA-PACIFIC CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 8 ASIA-PACIFIC CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (VOLUME)

TABLE 9 ASIA-PACIFIC CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 10 ASIA-PACIFIC CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 11 ASIA-PACIFIC CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 12 ASIA-PACIFIC CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 13 ASIA-PACIFIC CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 14 ASIA-PACIFIC CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 15 ASIA-PACIFIC CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 16 ASIA-PACIFIC ACCESSORIES IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 17 ASIA-PACIFIC ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 18 ASIA-PACIFIC ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 19 ASIA-PACIFIC SERVICES IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 20 ASIA-PACIFIC SOFTWARE IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 21 ASIA-PACIFIC FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 22 ASIA-PACIFIC CELL-BASED FLOW CYTOMETRY IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 23 ASIA-PACIFIC CELL-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 24 ASIA-PACIFIC BEAD-BASED FLOW CYTOMETRY IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 25 ASIA-PACIFIC BEAD-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 26 ASIA-PACIFIC FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 27 ASIA-PACIFIC RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 28 ASIA-PACIFIC RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 29 ASIA-PACIFIC PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 30 ASIA-PACIFIC CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 31 ASIA-PACIFIC CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 32 ASIA-PACIFIC INDUSTRIAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 33 ASIA-PACIFIC FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 34 ASIA-PACIFIC RETAIL SALES IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 35 ASIA-PACIFIC RETAIL SALES IN FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 36 ASIA-PACIFIC RETAIL SALES IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 37 ASIA-PACIFIC FLOW CYTOMETRY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 38 ASIA-PACIFIC PHARMACEUTICALS & BIOTECHNOLOGY COMPANIES IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 39 ASIA-PACIFIC ACADEMIC & RESEARCH INSTITUTES COMPANIES IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 40 ASIA-PACIFIC HOSPITALS IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 41 ASIA-PACIFIC CLINICAL TESTING LABORATORIES IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 42 ASIA-PACIFIC CRO IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 43 ASIA-PACIFIC BLOOD BANK IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 44 ASIA-PACIFIC CMO&CDMO IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 45 ASIA-PACIFIC FORENSIC LABORATORIES IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 46 ASIA-PACIFIC OTHERS IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 47 ASIA-PACIFIC FLOW CYTOMETRY MARKET, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 48 ASIA-PACIFIC FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 49 ASIA-PACIFIC REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 50 ASIA-PACIFIC REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 51 ASIA-PACIFIC REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 52 ASIA-PACIFIC FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 53 ASIA-PACIFIC CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 54 ASIA-PACIFIC CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (VOLUME)

TABLE 55 ASIA-PACIFIC CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 56 ASIA-PACIFIC CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 57 ASIA-PACIFIC CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 58 ASIA-PACIFIC CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 59 ASIA-PACIFIC CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 60 ASIA-PACIFIC CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 61 ASIA-PACIFIC CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 62 ASIA-PACIFIC CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 63 ASIA-PACIFIC CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 64 ASIA-PACIFIC CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (VOLUME)

TABLE 65 ASIA-PACIFIC CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (ASP)

TABLE 66 ASIA-PACIFIC ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 67 ASIA-PACIFIC ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 68 ASIA-PACIFIC ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 69 ASIA-PACIFIC FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 70 ASIA-PACIFIC CELL-BASED FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 71 ASIA-PACIFIC BEAD-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 72 ASIA-PACIFIC FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 73 ASIA-PACIFIC RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 74 ASIA-PACIFIC PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 75 ASIA-PACIFIC CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 76 ASIA-PACIFIC FLOW CYTOMETRY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 77 ASIA-PACIFIC FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 78 ASIA-PACIFIC RETAIL SALES IN FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 79 JAPAN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 80 JAPAN REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 81 JAPAN REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 82 JAPAN REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 83 JAPAN FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 84 JAPAN CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 85 JAPAN CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (VOLUME)

TABLE 86 JAPAN CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 87 JAPAN CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 88 JAPAN CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 89 JAPAN CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 90 JAPAN CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 91 JAPAN CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 92 JAPAN CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 93 JAPAN CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 94 JAPAN CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 95 JAPAN CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (VOLUME)

TABLE 96 JAPAN CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (ASP)

TABLE 97 JAPAN ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 98 JAPAN ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 99 JAPAN ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 100 JAPAN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 101 JAPAN CELL-BASED FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 102 JAPAN BEAD-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 103 JAPAN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 104 JAPAN RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 105 JAPAN PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 106 JAPAN CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 107 JAPAN FLOW CYTOMETRY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 108 JAPAN FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 109 JAPAN RETAIL SALES IN FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 110 CHINA FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 111 CHINA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 112 CHINA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 113 CHINA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 114 CHINA FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 115 CHINA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 116 CHINA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (VOLUME)

TABLE 117 CHINA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 118 CHINA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 119 CHINA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 120 CHINA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 121 CHINA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 122 CHINA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 123 CHINA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 124 CHINA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 125 CHINA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 126 CHINA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (VOLUME)

TABLE 127 CHINA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (ASP)

TABLE 128 CHINA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 129 CHINA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 130 CHINA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 131 CHINA FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 132 CHINA CELL-BASED FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 133 CHINA BEAD-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 134 CHINA FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 135 CHINA RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 136 CHINA PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 137 CHINA CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 138 CHINA FLOW CYTOMETRY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 139 CHINA FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 140 CHINA RETAIL SALES IN FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 141 INDIA FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 142 INDIA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 143 INDIA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 144 INDIA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 145 INDIA FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 146 INDIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 147 INDIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (VOLUME)

TABLE 148 INDIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 149 INDIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 150 INDIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 151 INDIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 152 INDIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 153 INDIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 154 INDIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 155 INDIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 156 INDIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 157 INDIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (VOLUME)

TABLE 158 INDIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (ASP)

TABLE 159 INDIA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 160 INDIA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 161 INDIA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 162 INDIA FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 163 INDIA CELL-BASED FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 164 INDIA BEAD-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 165 INDIA FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 166 INDIA RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 167 INDIA PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 168 INDIA CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 169 INDIA FLOW CYTOMETRY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 170 INDIA FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 171 INDIA RETAIL SALES IN FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 172 SOUTH KOREA FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 173 SOUTH KOREA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 174 SOUTH KOREA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 175 SOUTH KOREA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 176 SOUTH KOREA FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 177 SOUTH KOREA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 178 SOUTH KOREA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (VOLUME)

TABLE 179 SOUTH KOREA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 180 SOUTH KOREA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 181 SOUTH KOREA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 182 SOUTH KOREA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 183 SOUTH KOREA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 184 SOUTH KOREA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 185 SOUTH KOREA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 186 SOUTH KOREA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 187 SOUTH KOREA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 188 SOUTH KOREA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (VOLUME)

TABLE 189 SOUTH KOREA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (ASP)

TABLE 190 SOUTH KOREA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 191 SOUTH KOREA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 192 SOUTH KOREA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 193 SOUTH KOREA FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 194 SOUTH KOREA CELL-BASED FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 195 SOUTH KOREA BEAD-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 196 SOUTH KOREA FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 197 SOUTH KOREA RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 198 SOUTH KOREA PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 199 SOUTH KOREA CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 200 SOUTH KOREA FLOW CYTOMETRY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 201 SOUTH KOREA FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 202 SOUTH KOREA RETAIL SALES IN FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 203 AUSTRALIA FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 204 AUSTRALIA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 205 AUSTRALIA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 206 AUSTRALIA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 207 AUSTRALIA FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 208 AUSTRALIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 209 AUSTRALIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (VOLUME)

TABLE 210 AUSTRALIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 211 AUSTRALIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 212 AUSTRALIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 213 AUSTRALIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 214 AUSTRALIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 215 AUSTRALIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 216 AUSTRALIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 217 AUSTRALIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 218 AUSTRALIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 219 AUSTRALIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (VOLUME)

TABLE 220 AUSTRALIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (ASP)

TABLE 221 AUSTRALIA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 222 AUSTRALIA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 223 AUSTRALIA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 224 AUSTRALIA FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 225 AUSTRALIA CELL-BASED FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 226 AUSTRALIA BEAD-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 227 AUSTRALIA FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 228 AUSTRALIA RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 229 AUSTRALIA PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 230 AUSTRALIA CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 231 AUSTRALIA FLOW CYTOMETRY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 232 AUSTRALIA FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 233 AUSTRALIA RETAIL SALES IN FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 234 SINGAPORE FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 235 SINGAPORE REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 236 SINGAPORE REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 237 SINGAPORE REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 238 SINGAPORE FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 239 SINGAPORE CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 240 SINGAPORE CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (VOLUME)

TABLE 241 SINGAPORE CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 242 SINGAPORE CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 243 SINGAPORE CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 244 SINGAPORE CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 245 SINGAPORE CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 246 SINGAPORE CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 247 SINGAPORE CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 248 SINGAPORE CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 249 SINGAPORE CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 250 SINGAPORE CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (VOLUME)

TABLE 251 SINGAPORE CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (ASP)

TABLE 252 SINGAPORE ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 253 SINGAPORE ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 254 SINGAPORE ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 255 SINGAPORE FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 256 SINGAPORE CELL-BASED FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 257 SINGAPORE BEAD-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 258 SINGAPORE FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 259 SINGAPORE RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 260 SINGAPORE PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 261 SINGAPORE CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 262 SINGAPORE FLOW CYTOMETRY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 263 SINGAPORE FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 264 SINGAPORE RETAIL SALES IN FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 265 THAILAND FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 266 THAILAND REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 267 THAILAND REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 268 THAILAND REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 269 THAILAND FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 270 THAILAND CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 271 THAILAND CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (VOLUME)

TABLE 272 THAILAND CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 273 THAILAND CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 274 THAILAND CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 275 THAILAND CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 276 THAILAND CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 277 THAILAND CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 278 THAILAND CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 279 THAILAND CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 280 THAILAND CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 281 THAILAND CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (VOLUME)

TABLE 282 THAILAND CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (ASP)

TABLE 283 THAILAND ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 284 THAILAND ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 285 THAILAND ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 286 THAILAND FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 287 THAILAND CELL-BASED FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 288 THAILAND BEAD-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 289 THAILAND FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 290 THAILAND RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 291 THAILAND PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 292 THAILAND CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 293 THAILAND FLOW CYTOMETRY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 294 THAILAND FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 295 THAILAND RETAIL SALES IN FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 296 MALAYSIA FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 297 MALAYSIA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 298 MALAYSIA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 299 MALAYSIA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 300 MALAYSIA FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 301 MALAYSIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 302 MALAYSIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (VOLUME)

TABLE 303 MALAYSIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 304 MALAYSIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 305 MALAYSIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 306 MALAYSIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 307 MALAYSIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 308 MALAYSIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 309 MALAYSIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 310 MALAYSIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 311 MALAYSIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 312 MALAYSIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (VOLUME)

TABLE 313 MALAYSIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (ASP)

TABLE 314 MALAYSIA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 315 MALAYSIA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 316 MALAYSIA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 317 MALAYSIA FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 318 MALAYSIA CELL-BASED FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 319 MALAYSIA BEAD-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 320 MALAYSIA FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 321 MALAYSIA RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 322 MALAYSIA PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 323 MALAYSIA CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 324 MALAYSIA FLOW CYTOMETRY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 325 MALAYSIA FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 326 MALAYSIA RETAIL SALES IN FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 327 INDONESIA FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 328 INDONESIA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 329 INDONESIA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 330 INDONESIA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 331 INDONESIA FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 332 INDONESIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 333 INDONESIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (VOLUME)

TABLE 334 INDONESIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 335 INDONESIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 336 INDONESIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 337 INDONESIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 338 INDONESIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 339 INDONESIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 340 INDONESIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 341 INDONESIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 342 INDONESIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 343 INDONESIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (VOLUME)

TABLE 344 INDONESIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (ASP)

TABLE 345 INDONESIA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 346 INDONESIA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 347 INDONESIA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 348 INDONESIA FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 349 INDONESIA CELL-BASED FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 350 INDONESIA BEAD-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 351 INDONESIA FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 352 INDONESIA RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 353 INDONESIA PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 354 INDONESIA CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 355 INDONESIA FLOW CYTOMETRY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 356 INDONESIA FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 357 INDONESIA RETAIL SALES IN FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 358 PHILIPPINES FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 359 PHILIPPINES REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 360 PHILIPPINES REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 361 PHILIPPINES REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 362 PHILIPPINES FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 363 PHILIPPINES CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 364 PHILIPPINES CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (VOLUME)

TABLE 365 PHILIPPINES CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 366 PHILIPPINES CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 367 PHILIPPINES CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 368 PHILIPPINES CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 369 PHILIPPINES CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 370 PHILIPPINES CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 371 PHILIPPINES CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 372 PHILIPPINES CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 373 PHILIPPINES CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 374 PHILIPPINES CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (VOLUME)

TABLE 375 PHILIPPINES CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (ASP)

TABLE 376 PHILIPPINES ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 377 PHILIPPINES ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 378 PHILIPPINES ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 379 PHILIPPINES FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 380 PHILIPPINES CELL-BASED FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 381 PHILIPPINES BEAD-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 382 PHILIPPINES FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 383 PHILIPPINES RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 384 PHILIPPINES PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 385 PHILIPPINES CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 386 PHILIPPINES FLOW CYTOMETRY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 387 PHILIPPINES FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 388 PHILIPPINES RETAIL SALES IN FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 389 REST OF ASIA-PACIFIC FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

List of Figure

FIGURE 1 ASIA-PACIFIC FLOW CYTOMETRY MARKET: SEGMENTATION

FIGURE 2 ASIA-PACIFIC FLOW CYTOMETRY MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC FLOW CYTOMETRY MARKET: DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC FLOW CYTOMETRY MARKET: ASIA-PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA-PACIFIC FLOW CYTOMETRY MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC FLOW CYTOMETRY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA-PACIFIC FLOW CYTOMETRY MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA-PACIFIC FLOW CYTOMETRY MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ASIA-PACIFIC FLOW CYTOMETRY MARKET: SEGMENTATION

FIGURE 10 FIVE SEGMENTS COMPRISE THE ASIA-PACIFIC FLOW CYTOMETRY MARKET, BY PRODUCT

FIGURE 11 EXECUTIVE SUMMARY

FIGURE 12 STRATEGIC DECISIONS

FIGURE 13 RISING PREVALENCE OF CHRONIC DISEASES IS DRIVING THE GROWTH OF THE ASIA-PACIFIC FLOW CYTOMETRY MARKET FROM 2025 TO 2032

FIGURE 14 THE REAGENTS AND CONSUMABLES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA-PACIFIC FLOW CYTOMETRY MARKET IN 2025 AND 2032

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA-PACIFIC FLOW CYTOMETRY MARKET

FIGURE 16 ASIA-PACIFIC FLOW CYTOMETRY MARKET: BY PRODUCT, 2024

FIGURE 17 ASIA-PACIFIC FLOW CYTOMETRY MARKET: BY PRODUCT, 2025-2032 (USD MILLION)

FIGURE 18 ASIA-PACIFIC FLOW CYTOMETRY MARKET: BY PRODUCT, CAGR (2025-2032)

FIGURE 19 ASIA-PACIFIC FLOW CYTOMETRY MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 20 ASIA-PACIFIC FLOW CYTOMETRY MARKET: BY TECHNOLOGY, 2024

FIGURE 21 ASIA-PACIFIC FLOW CYTOMETRY MARKET: BY TECHNOLOGY, 2025-2032 (USD MILLION)

FIGURE 22 ASIA-PACIFIC FLOW CYTOMETRY MARKET: BY TECHNOLOGY, CAGR (2025-2032)

FIGURE 23 ASIA-PACIFIC FLOW CYTOMETRY MARKET: BY TECHNOLOGY, LIFELINE CURVE

FIGURE 24 ASIA-PACIFIC FLOW CYTOMETRY MARKET: BY APPLICATION, 2024

FIGURE 25 ASIA-PACIFIC FLOW CYTOMETRY MARKET: BY APPLICATION, 2025-2032 (USD MILLION)

FIGURE 26 ASIA-PACIFIC FLOW CYTOMETRY MARKET: BY APPLICATION, CAGR (2025-2032)

FIGURE 27 ASIA-PACIFIC FLOW CYTOMETRY MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 28 ASIA-PACIFIC FLOW CYTOMETRY MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 29 ASIA-PACIFIC FLOW CYTOMETRY MARKET: BY DISTRIBUTION CHANNEL, 2025-2032 (USD MILLION)

FIGURE 30 ASIA-PACIFIC FLOW CYTOMETRY MARKET: BY DISTRIBUTION CHANNEL, CAGR (2025-2032)

FIGURE 31 ASIA-PACIFIC FLOW CYTOMETRY MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 32 ASIA-PACIFIC FLOW CYTOMETRY MARKET: BY END USER, 2024

FIGURE 33 ASIA-PACIFIC FLOW CYTOMETRY MARKET: BY END USER, 2025-2032 (USD MILLION)

FIGURE 34 ASIA-PACIFIC FLOW CYTOMETRY MARKET: BY END USER, CAGR (2025-2032)

FIGURE 35 ASIA-PACIFIC FLOW CYTOMETRY MARKET: BY END USER, LIFELINE CURVE

FIGURE 36 ASIA-PACIFIC FLOW CYTOMETRY MARKET: SNAPSHOT (2024)

FIGURE 37 ASIA-PACIFIC FLOW CYTOMETRY MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available