Market Analysis and Insights

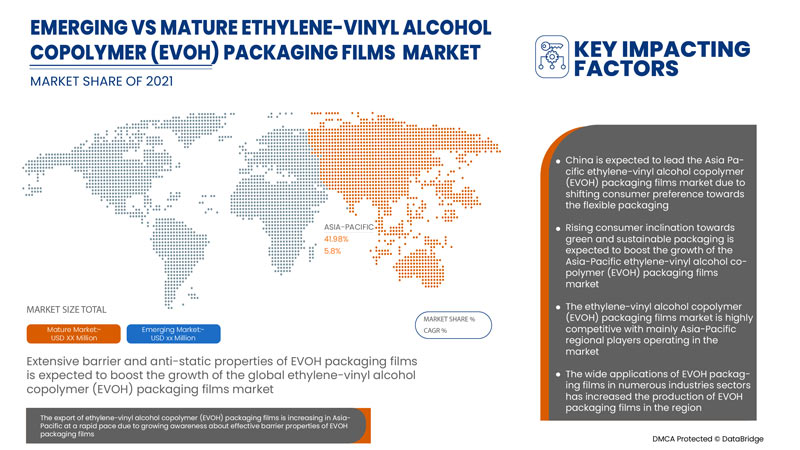

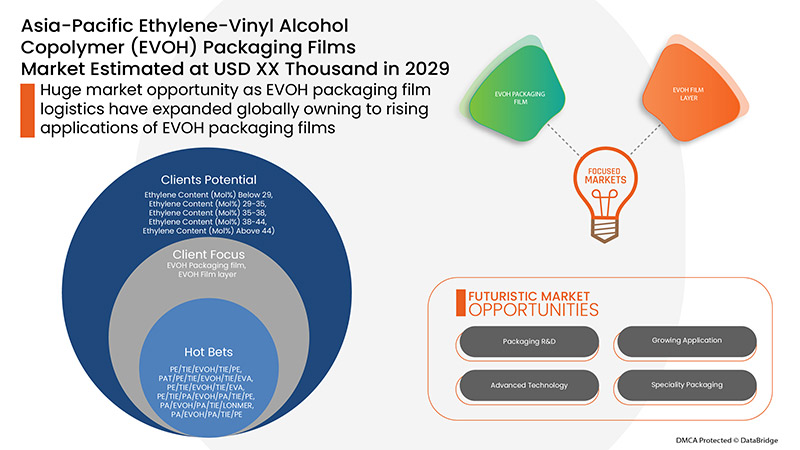

Asia-Pacific ethylene-vinyl alcohol copolymer (EVOH) packaging films market is expected to gain significant growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 5.8% in the forecast period of 2022 to 2029 and is expected to reach USD 3,125,584.15 thousand by 2029. The major factor driving the growth of the ethylene-vinyl alcohol copolymer (EVOH) packaging films are shifting consumer preference towards the flexible packaging, customer friendly and sustainable nature of EVOH packaging films.

Ethylene-vinyl alcohol copolymer or EVOH is a flexible, crystal clear, and glossy thermoplastic copolymer with excellent flex-crack resistance, and very high resistance to hydrocarbons, oils and organic solvents. It also has some of the best barrier properties to gases such as oxygen, nitrogen, and carbon dioxide making it especially suited for packaging of food, drugs, cosmetics, and other perishable or delicate products to extend shelf life. In comparison with many other common films, EVOH has superior barrier properties. However, EVOH loses its good gas barrier properties when exposed to moisture. For this reason and to optimize both cost and performance, it is frequently used in multilayer, co-extruded films like HDPE, PP, and PET, which have superior moisture barrier properties.

EVOH film for packaging has antistatic properties which ensures that dust particles in the atmosphere do not settle down on the packaging to prevent fungal growth that spoils the natural aroma and taste of products in the container. Due to heightened awareness regarding cleanliness to limit the spread of virus the demand for packaging that maintain hygiene of products placed in the container are expected to rise. This in turn is expected to surge the demand for EVOH film in the packaging market.

Asia-Pacific ethylene-vinyl alcohol copolymer (EVOH) packaging films market report provides details of market share, new developments, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario contact us for an Analyst Brief, our team will help you create a revenue impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in Thousand, Pricing in USD |

|

Segments Covered |

By Ethylene Content (Ethylene Content (Mol%) Below 29, Ethylene Content (Mol%) 29-35, Ethylene Content (Mol%) 35-38, Ethylene Content (Mol%) 38-44, Ethylene Content (Mol%), Application (PE/TIE/EVOH/TIE/PE, PAT/PE/TIE/EVOH/TIE/EVA, PE/TIE/EVOH/TIE/EVA, PE/TIE/PA/EVOH/PA/TIE/PE, PA/EVOH/PA/TIE/LONMER, and PA/EVOH/PA/TIE/PE), End-Use (Food, Personal Care & Cosmetics, Household, Pharmaceutical, Industrial, Others) |

|

Countries Covered |

Japan, China, South Korea, India, Singapore, Thailand, Indonesia, Malaysia, Philippines, Australia & New Zealand, and the rest of Asia-Pacific. |

|

Market Players Covered |

Schur Flexibles Holding GesmbH, Coveris, Mitsubishi Chemical Holdings Corporation, KURARAY CO., LTD., KUREHA CORPORATION, Arkema, Chang Chun Group., ProAmpac, MULTIFLEX FOLIEN GMBH & CO. KG, Vishakha Polyfab Pvt Ltd, International Plastic Engineering Co.,Ltd, Verpackungen GmbH, Shpusite Packaging Materials (Shanghai) Co., Ltd, Plastissimo Film Co., Ltd, and Zhongsu New Materials Technology (Hangzhou) Co., Ltd. |

Asia-Pacific Ethylene-Vinyl Alcohol Copolymer (EVOH) Packaging Films Market Dynamics

This Section Deals With Drivers, Restraints, Opportunities, and Challenges of the Market:

Drivers

- Shifting consumer preference towards the flexible packaging

The packaging industry across the globe has been witnessing rising demand from food and beverages, pharmaceuticals & healthcare products and cosmetics & personal care among other for their products to be packed in flexible packaging. EVOH packaging films offer various other properties as well in addition to their flexible nature such as cost-effectiveness, high seal strength, displaying and easy transportation. Moreover, these films offer excellent benefits for packaging, such as extending shelf life and limiting product losses, which makes the adoption of EVOH films widespread across the packaging industry. These will boost its demand in the market and will lead to the growth of the EVOH packaging films market

- Customer friendly and sustainable nature of EVOH packaging films

The rising demand for organic products that do not make use of any synthetic elements and are perishable in nature is expected to drive the demand for EVOH films for packaging. Additionally, EVOH is resistant to oil and organic solvents which makes it a right choice to store edibles and food items for longer duration. In addition, unlike PVDC, EVOH films do not contain any harmful elements such as chlorine, metals and dioxins, which may cause endocrinological disorders in humans and also harm the surroundings. Therefore, EVOH films are environment-friendly and a recyclable product which causes very little harm to the environment. These nature friendly properties of Ethylene-Vinyl Alcohol Copolymer (EVOH) packaging films will drive the demand for the material and will boost the Asia-Pacific Ethylene-Vinyl Alcohol Copolymer (EVOH) packaging films market.

- Extensive barrier and antistatic properties of EVOH packaging films

Rising industrial applications of barrier packaging materials is triggering demand for raw materials with highly specialized properties among market players in the EVOH packaging films market. This has led many companies to focus on undertaking strategic decisions to gain competitive market share in the market. These properties in turn is expected to increase the demand for durable EVOH packaging films that preserves quality of products for extensive durations, by acting as a barrier to different gases and dust particles present in the atmosphere

Opportunities

- Rising consumer inclination towards green and sustainable packaging

Due to the low odor, high chemical resistance, and inertness, many EVOH grades are suitable for food, medical, and pharmaceutical packaging applications under FDA regulations. Thus, the growing demand for green and sustainable high barrier packaging films such as Ethylene-Vinyl Alcohol Copolymer (EVOH) packaging films is expected to create lucrative opportunities for film manufacturers in this Asia-Pacific Ethylene-Vinyl Alcohol Copolymer (EVOH) packaging films market.

- Rising demand of innovative packaging solutions in the food and beverage industry

High use of EVOH in the food and beverage industry, especially to avoid food contamination, is expected to be an important opportunity to fuel the demand in the Asia-Pacific ethylene-vinyl alcohol copolymer (EVOH) packaging films market. Moreover, these EVOH films can be easily molded into sheets, tubes, or bottles for their excellent barrier effect against gases and organic liquids. The need for innovative packaging solutions in the food and beverage along with other industries to attract environmentally-conscious consumers is foreseen to further augment the demand for EVOH packaging films worldwide

Restraints/Challenges

- Availability of alternative which induced the consumers

The rising number of environmentally-conscious consumers and manufacturers making a shift towards paper packaging solutions may hinder in the demand for EVOH packaging films market in the near future. Increasing availability of numerous alternative products to EVOH films, such as PE lamination, paper products and met-PET films for customers may limit the growth in this market

- Poor adhesion characteristics of EVOH resins

EVOH resins have very poor adhesion so use of modified polyolefin adhesive resins is done to bond the EVOH layer to the adjacent layer in coextrusion. Therefore, there is a need for EVOH resins to be processed on commercially available equipment using various processes such as coextrusion coating for film and paper, coextrusion film laminating, coinjection stretch blow molding, monolayer blown and cast film extrusion, powder coating and many more. This also affects the properties of EVOH films as similar to other extrusion polymers, EVOH resins can easily degrade by prolonged exposure to thermal energy, both drying and extrusion processing

- Susceptibility to degradation of high barrier films

As EVOH packaging films are created by combining two or even more co-extruded or laminate films to create a single homogeneous film with unique individual layers. These offer a number of qualities that monolayer films cannot match. However, because these multilayer films are made from a range of materials, their recyclability is a serious issue. As a result, recycling of various materials requires separate processing, which is not a viable option. Mechanical recycling also becomes a problem with multilayer structures containing more than one type of plastic, as they cannot easily be recycled.

- EVOH loses its good gas barrier properties when exposed to humidity

EVOH copolymers provide an excellent barrier to oxygen, gases and organic compounds permeation under dry conditions, but at high humidity, the oxygen permeation of the EVOH increases considerably, which further affects to quality of products packed. The effect of temperature and humidity reduces the protection of the inner and outer layers of the structures and the EVOH absorbs large amounts of water, which strongly reduces the barrier characteristics. Therefore, EVOH copolymers are not ideal polymers when it comes to resistance to humidity. The high sensitivity to humidity, can be a problem with high barrier properties of the EVOH films therefore, acting as a challenge to the Asia-Pacific ethylene-vinyl alcohol copolymer (EVOH) packaging films market.

Recent Developments

- In February 2022, Arkema acquired Ashland’s Performance Adhesives business, which is a first-class leader in high performance adhesives in the U.S. This operation is a major step in Arkema’s strengthening its Adhesive Solutions segment. This acquisition will bring more opportunity for the company and increases its market growth

- In April 2022, Kuraray Co., Ltd has been included in the ESG (environmental, social and governance) investment indexes: FTSE Blossom Japan Sector Relative Index designed by the Asia-Pacific index provider FTSE Russell.This makes the company a constituent of all of the ESG investment indexes for Japanese stocks adopted by Japan’s Government Pension Investment Fund (GPIF). This sustainability initiative will increase company reputation in the market

- In December 2021, Mitsubishi Chemical Holdings Corportion is recognized as a Asia-Pacific leader in sustainable water management and has been awarded a position on the year’s Water A List, which is the highest rating in the CDP Water Security 2021.The Water A List is comprised of 118 companies out of a total of 12,000 surveyed around the world. This enhances the company’s image in the Asia-Pacific market

Asia-Pacific Ethylene-Vinyl Alcohol Copolymer (EVOH) Packaging Films Market Scope

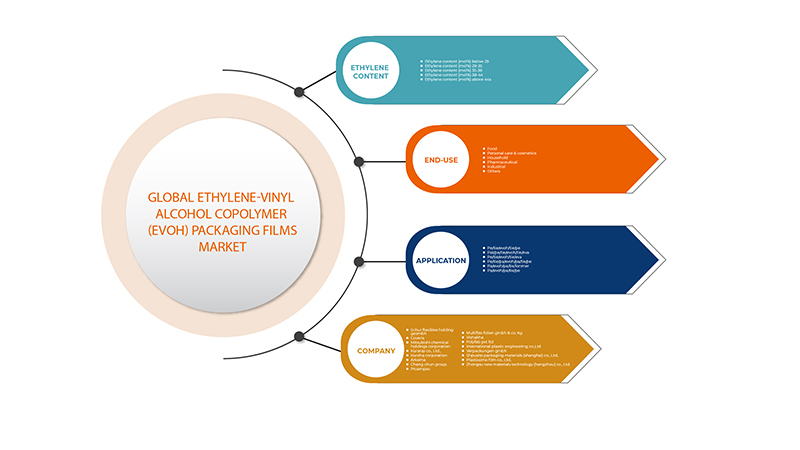

Asia-Pacific ethylene-vinyl alcohol copolymer (EVOH) packaging films market is categorized based on ethylene content, application and end-use. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Ethylene Content

- Ethylene Content (Mol%) Below 29

- Ethylene Content (Mol%) 29-35

- Ethylene Content (Mol%) 35-38

- Ethylene Content (Mol%) 38-44

- Ethylene Content (Mol%) Above 44

On the basis of ethylene content, the Asia-Pacific ethylene-vinyl alcohol copolymer (EVOH) packaging films market is segmented into ethylene content (mol%) below 29, ethylene content (mol%) 29-35, ethylene content (mol%) 35-38, ethylene content (mol%) 38-44, ethylene content (mol%) above 44.

Application

- PE/TIE/EVOH/TIE/PE

- PAT/PE/TIE/EVOH/TIE/EVA

- PE/TIE/EVOH/TIE/EVA

- PE/TIE/PA/EVOH/PA/TIE/PE

- PA/EVOH/PA/TIE/LONMER

- PA/EVOH/PA/TIE/PE

On the basis of application, the Asia-Pacific ethylene-vinyl alcohol copolymer (EVOH) packaging films market is segmented into PE/TIE/EVOH/TIE/PE, PAT/PE/TIE/EVOH/TIE/EVA, PE/TIE/EVOH/TIE/EVA, PE/TIE/PA/EVOH/PA/TIE/PE, PA/EVOH/PA/TIE/LONMER and PA/EVOH/PA/TIE/PE

End-Use

- Food

- Personal Care & Cosmetics

- Household

- Pharmaceutical

- Industrial

- Others

On the basis of end-use, the Asia-Pacific ethylene-vinyl alcohol copolymer (EVOH) packaging films market is segmented into food, personal care & cosmetics, household, pharmaceutical, industrial, others.

Asia-Pacific Ethylene-Vinyl Alcohol Copolymer (EVOH) Packaging Films Regional Analysis/Insights

Asia-Pacific ethylene-vinyl alcohol copolymer (EVOH) packaging films market is further segmented into Japan, China, South Korea, India, Singapore, Thailand, Indonesia, Malaysia, Philippines, Australia & New Zealand, and the rest of Asia-Pacific.

China dominates the Asia-Pacific ethylene-vinyl alcohol copolymer (EVOH) packaging films in terms of market share and market revenue and will continue to flourish its dominance during the forecast period. This is due to wide applications of EVOH packaging films in numerous industries sectors in the region.

The country section of the report also provides individual market impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of Asia-Pacific brands and their challenges faced due to high competition from local and domestic brands, and impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Asia-Pacific Ethylene-Vinyl Alcohol Copolymer (EVOH) Packaging Films Market Share Analysis

Asia-Pacific ethylene-vinyl alcohol copolymer (EVOH) packaging films market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to the ethylene-vinyl alcohol copolymer (EVOH) packaging films market.

Some of the prominent participants operating in the Asia-Pacific ethylene-vinyl alcohol copolymer (EVOH) packaging films market are Schur Flexibles Holding GesmbH, Coveris, Mitsubishi Chemical Holdings Corporation, KURARAY CO., LTD., KUREHA CORPORATION, Arkema, Chang Chun Group., ProAmpac, MULTIFLEX FOLIEN GMBH & CO. KG, Vishakha Polyfab Pvt Ltd, International Plastic Engineering Co.,Ltd, Verpackungen GmbH, Shpusite Packaging Materials (Shanghai) Co., Ltd, Plastissimo Film Co., Ltd, and Zhongsu New Materials Technology (Hangzhou) Co., Ltd.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, Asia-Pacific Vs Regional and Vendor Share Analysis. Please request analyst call in case of further inquiry.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END-USE COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 CLIMATE CHANGE SCENARIO

4.2 KEY BUYER LIST

4.3 KEY PATENT LAUNCHED

4.4 PESTLE ANALYSIS

4.4.1 POLITICAL FACTORS:

4.4.2 ECONOMIC FACTORS:

4.4.3 SOCIAL FACTORS:

4.4.4 TECHNOLOGICAL FACTORS:

4.5 LEGAL FACTORS:

4.5.1 ENVIRONMENTAL FACTORS:

4.6 PORTER’S FIVE FORCES:

4.7 RAW MATERIAL PRODUCTION COVERAGE

4.8 REGULATORY COVERAGE

4.9 SUPPLY CHAIN ANALYSIS

4.9.1 RAW MATERIAL PROCUREMENT

4.9.2 MANUFACTURING AND PACKING

4.9.3 MARKETING AND DISTRIBUTION

4.9.4 END USERS

4.1 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.11 VENDOR SELECTION CRITERIA

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 SHIFT IN CONSUMER PREFERENCE TOWARD THE FLEXIBLE PACKAGING

5.1.2 CUSTOMER-FRIENDLY AND SUSTAINABLE NATURE OF EVOH PACKAGING FILMS

5.1.3 EXTENSIVE BARRIER AND ANTISTATIC PROPERTIES OF EVOG PACKAGING FILMS

5.1.4 WIDE APPLICATIONS OF EVOH PACKAGING FILMS IN NUMEROUS INDUSTRIES SECTORS

5.2 RESTRAINTS

5.2.1 AVAILABILITY OF ALTERNATIVES THAT INDUCED THE CONSUMERS

5.2.2 POOR ADHESION CHARACTERISTICS OF EVOH RESINS

5.3 OPPORTUNITIES

5.3.1 RISING CONSUMER INCLINATION TOWARDS GREEN AND SUSTAINABLE PACKAGING

5.3.2 EASE OF PRINTING ON EVOH PACKAGING FILMS

5.3.3 GROWING USAGES OF LONGER SHELF-LIFE PRODUCTS

5.3.4 RISE IN DEMAND FOR INNOVATIVE PACKAGING SOLUTIONS IN THE FOOD AND BEVERAGE INDUSTRY

5.4 CHALLENGES

5.4.1 SUSCEPTIBILITY TO DEGRADATION OF HIGH BARRIER FILMS

5.4.2 EVOH LOSES ITS GOOD GAS BARRIER PROPERTIES WHEN EXPOSED TO HUMIDITY

6 ASIA PACIFIC ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY ETHYLENE CONTENT

6.1 OVERVIEW

6.2 ETHYLENE CONTENT (MOL%) BELOW 29

6.3 ETHYLENE CONTENT (MOL%) 29-35

6.4 ETHYLENE CONTENT (MOL%) 35-38

6.5 ETHYLENE CONTENT (MOL%) 38-44

6.6 ETHYLENE CONTENT (MOL%) ABOVE 44

7 ASIA PACIFIC ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 PE/TIE/EVOH/TIE/PE

7.3 PAT/PE/TIE/EVOH/TIE/EVA

7.4 PE/TIE/EVOH/TIE/EVA

7.5 PE/TIE/PA/EVOH/PA/TIE/PE

7.6 PA/EVOH/PA/TIE/LONMER

7.7 PA/EVOH/PA/TIE/PE

7.7.1 CO-EXTRUTION CAST FILMS

7.7.2 CO-EXTRUTION BLOWN FILMS

8 ASIA PACIFIC ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY END-USE

8.1 OVERVIEW

8.2 FOOD

8.2.1 MEAT, POULTRY & SEAFOOD

8.2.2 PET FOOD

8.2.3 BABY FOOD

8.2.4 OTHERS

8.3 PERSONAL CARE & COSMETICS

8.4 HOUSEHOLD

8.5 PHARMACEUTICAL

8.6 INDUSTRIAL

8.7 OTHERS

9 ASIA PACIFIC ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY REGION

9.1 ASIA-PACIFIC

9.1.1 CHINA

9.1.2 INDIA

9.1.3 JAPAN

9.1.4 SOUTH KOREA

9.1.5 THAILAND

9.1.6 SINGAPORE

9.1.7 INDONESIA

9.1.8 AUSTRALIA & NEW ZEALAND

9.1.9 PHILIPPINES

9.1.10 MALAYSIA

9.1.11 REST OF ASIA-PACIFIC

10 ASIA PACIFIC ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET: COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

10.1.1 SUSTAINABILITY

10.1.2 AWARDS

10.1.3 FACILITY EXPANSIONS

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 ARKEMA

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 PRODUCT PORTFOLIO

12.1.5 RECENT UPDATES

12.2 MITSUBISHI CHEMICAL HOLDINGS CORPORATION

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 PRODUCT PORTFOLIO

12.2.5 RECENT UPDATES

12.3 KURARAY CO., LTD.

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 COMPANY SHARE ANALYSIS

12.3.4 PRODUCT PORTFOLIO

12.3.5 RECENT UPDATE

12.4 COVERIS

12.4.1 COMPANY SNAPSHOT

12.4.2 COMPANY SHARE ANALYSIS

12.4.3 PRODUCT PORTFOLIO

12.4.4 RECENT UPDATES

12.5 CHANG CHUN GROUP

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUE ANALYSIS

12.5.3 COMPANY SHARE ANALYSIS

12.5.4 PRODUCT PORTFOLIO

12.5.5 RECENT UPDATES

12.6 INTERNATIONAL PLASTIC ENGINEERING CO., LTD

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCT PORTFOLIO

12.6.3 RECENT UPDATES

12.7 KUREHA CORPORATION

12.7.1 COMPANY SNAPSHOT

12.7.2 REVENUE ANALYSIS

12.7.3 PRODUCT PORTFOLIO

12.7.4 RECENT UPDATES

12.8 MULTIFLEX FOLIEN GMBH & CO. KG

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT UPDATE

12.9 PLASTISSIMO FILM CO., LTD.

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT UPDATES

12.1 PROAMPAC

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 RECENT UPDATES

12.11 SCHUR FLEXIBLES HOLDINGS GESMBH

12.11.1 COMPANY SNAPSHOT

12.11.2 PRODUCT PORTFOLIO

12.11.3 RECENT UPDATE

12.12 SHPUSITE PACKAGING MATERIALS (SHANGHAI) CO., LTD.

12.12.1 COMPANY SNAPSHOT

12.12.2 PRODUCT PORTFOLIO

12.12.3 RECENT UPDATES

12.13 VERPACKUNGEN GMBH

12.13.1 COMPANY SNAPSHOT

12.13.2 PRODUCT PORTFOLIO

12.13.3 RECENT UPDATE

12.14 VISHAKHA POLYFAB PVT LTD

12.14.1 COMPANY SNAPSHOT

12.14.2 PRODUCT PORTFOLIO

12.14.3 RECENT UPDATE

12.15 ZHONGSU NEW MATERIALS TECHNOLOGY (HANGZHOU) CO., LTD.

12.15.1 COMPANY SNAPSHOT

12.15.2 PRODUCT PORTFOLIO

12.15.3 RECENT UPDATES

13 QUESTIONNAIRE

14 RELATED REPORTS

List of Table

TABLE 1 IMPORT DATA OF PLATES, SHEETS, FILM, FOIL AND STRIP, OF NON-CELLULAR POLYMERS OF ETHYLENE, NOT REINFORCED; HS CODE – 392010 (USD THOUSAND)

TABLE 2 EXPORT DATA OF PLATES, SHEETS, FILM, FOIL AND STRIP, OF NON-CELLULAR POLYMERS OF ETHYLENE, NOT REINFORCED; HS CODE – 392010 (USD THOUSAND)

TABLE 3 ASIA PACIFIC ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY ETHYLENE CONTENT, 2020-2029 (USD THOUSAND)

TABLE 4 ASIA PACIFIC ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY ETHYLENE CONTENT, 2020-2029 (TONS)

TABLE 5 ASIA PACIFIC ETHYLENE CONTENT (MOL%) BELOW 29 IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 6 ASIA PACIFIC ETHYLENE CONTENT (MOL%) BELOW 29 IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY REGION, 2020-2029 (TONS)

TABLE 7 ASIA PACIFIC ETHYLENE CONTENT (MOL%) 29-35 IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 8 ASIA PACIFIC ETHYLENE CONTENT (MOL%) 29-35 IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY REGION, 2020-2029 (TONS)

TABLE 9 ASIA PACIFIC ETHYLENE CONTENT (MOL%) 35-38 IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 10 ASIA PACIFIC ETHYLENE CONTENT (MOL%) 35-38 IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY REGION, 2020-2029 (TONS)

TABLE 11 ASIA PACIFIC ETHYLENE CONTENT (MOL%) 38-44 IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 12 ASIA PACIFIC ETHYLENE CONTENT (MOL%) 38-44 IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY REGION, 2020-2029 (TONS)

TABLE 13 ASIA PACIFIC ETHYLENE CONTENT (MOL%) ABOVE 44 IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 14 ASIA PACIFIC ETHYLENE CONTENT (MOL%) ABOVE 44 IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY REGION, 2020-2029 (TONS)

TABLE 15 ASIA PACIFIC ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 16 ASIA PACIFIC PE/TIE/EVOH/TIE/PE IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 17 ASIA PACIFIC PAT/PE/TIE/EVOH/TIE/EVA IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 18 ASIA PACIFIC PE/TIE/EVOH/TIE/EVA IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 19 ASIA PACIFIC PE/TIE/PA/EVOH/PA/TIE/PE IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 20 ASIA PACIFIC PA/EVOH/PA/TIE/LONMER IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 21 ASIA PACIFIC PA/EVOH/PA/TIE/PE IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 22 ASIA PACIFIC PA/EVOH/PA/TIE/PE IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 23 ASIA PACIFIC ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 24 ASIA PACIFIC FOOD IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 25 ASIA PACIFIC FOOD IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 26 ASIA PACIFIC PERSONAL CARE & COSMETICS ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 27 ASIA PACIFIC HOUSEHOLD IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 28 ASIA PACIFIC PHARMACEUTICAL IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 29 ASIA PACIFIC INDUSTRIAL IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 30 ASIA PACIFIC OTHERS IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 31 ASIA-PACIFIC ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 32 ASIA-PACIFIC ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY COUNTRY, 2020-2029 (TONS)

TABLE 33 ASIA-PACIFIC ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY ETHYLENE CONTENT, 2020-2029 (USD THOUSAND)

TABLE 34 ASIA-PACIFIC ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY ETHYLENE CONTENT, 2020-2029 (TONS)

TABLE 35 ASIA-PACIFIC ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 36 ASIA-PACIFIC PA/EVOH/PA/TIE/PE IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 37 ASIA-PACIFIC ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 38 ASIA-PACIFIC FOOD IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 39 CHINA ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY ETHYLENE CONTENT, 2020-2029 (USD THOUSAND)

TABLE 40 CHINA ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY ETHYLENE CONTENT, 2020-2029 (TONS)

TABLE 41 CHINA ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 42 CHINA PA/EVOH/PA/TIE/PE IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 43 CHINA ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 44 CHINA FOOD IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 45 INDIA ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY ETHYLENE CONTENT, 2020-2029 (USD THOUSAND)

TABLE 46 INDIA ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY ETHYLENE CONTENT, 2020-2029 (TONS)

TABLE 47 INDIA ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 48 INDIA PA/EVOH/PA/TIE/PE IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 49 INDIA ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 50 INDIA FOOD IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 51 JAPAN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY ETHYLENE CONTENT, 2020-2029 (USD THOUSAND)

TABLE 52 JAPAN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY ETHYLENE CONTENT, 2020-2029 (TONS)

TABLE 53 JAPAN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 54 JAPAN PA/EVOH/PA/TIE/PE IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 55 JAPAN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 56 JAPAN FOOD IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 57 SOUTH KOREA ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY ETHYLENE CONTENT, 2020-2029 (USD THOUSAND)

TABLE 58 SOUTH KOREA ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY ETHYLENE CONTENT, 2020-2029 (TONS)

TABLE 59 SOUTH KOREA ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 60 SOUTH KOREA PA/EVOH/PA/TIE/PE IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 61 SOUTH KOREA ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 62 SOUTH KOREA FOOD IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 63 THAILAND ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY ETHYLENE CONTENT, 2020-2029 (USD THOUSAND)

TABLE 64 THAILAND ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY ETHYLENE CONTENT, 2020-2029 (TONS)

TABLE 65 THAILAND ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 66 THAILAND PA/EVOH/PA/TIE/PE IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 67 THAILAND ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 68 THAILAND FOOD IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 69 SINGAPORE ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY ETHYLENE CONTENT, 2020-2029 (USD THOUSAND)

TABLE 70 SINGAPORE ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY ETHYLENE CONTENT, 2020-2029 (TONS)

TABLE 71 SINGAPORE ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 72 SINGAPORE PA/EVOH/PA/TIE/PE IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 73 SINGAPORE ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 74 SINGAPORE FOOD IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 75 INDONESIA ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY ETHYLENE CONTENT, 2020-2029 (USD THOUSAND)

TABLE 76 INDONESIA ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY ETHYLENE CONTENT, 2020-2029 (TONS)

TABLE 77 INDONESIA ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 78 INDONESIA PA/EVOH/PA/TIE/PE IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 79 INDONESIA ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 80 INDONESIA FOOD IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 81 AUSTRALIA & NEW ZEALAND ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY ETHYLENE CONTENT, 2020-2029 (USD THOUSAND)

TABLE 82 AUSTRALIA & NEW ZEALAND ETHYLENE -VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY ETHYLENE CONTENT, 2020-2029 (TONS)

TABLE 83 AUSTRALIA & NEW ZEALAND ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 84 AUSTRALIA & NEW ZEALAND PA/EVOH/PA/TIE/PE IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 85 AUSTRALIA & NEW ZEALAND ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 86 AUSTRALIA & NEW ZEALAND FOOD IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 87 PHILIPPINES ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY ETHYLENE CONTENT, 2020-2029 (USD THOUSAND)

TABLE 88 PHILIPPINES ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY ETHYLENE CONTENT, 2020-2029 (TONS)

TABLE 89 PHILIPPINES ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 90 PHILIPPINES PA/EVOH/PA/TIE/PE IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 91 PHILIPPINES ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 92 PHILIPPINES FOOD IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 93 MALAYSIA ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY ETHYLENE CONTENT, 2020-2029 (USD THOUSAND)

TABLE 94 MALAYSIA ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY ETHYLENE CONTENT, 2020-2029 (TONS)

TABLE 95 MALAYSIA ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 96 MALAYSIA PA/EVOH/PA/TIE/PE IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 97 MALAYSIA ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 98 MALAYSIA FOOD IN ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 99 REST OF ASIA-PACIFIC ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY ETHYLENE CONTENT, 2020-2029 (USD THOUSAND)

TABLE 100 REST OF ASIA-PACIFIC ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, BY ETHYLENE CONTENT, 2020-2029 (TONS)

List of Figure

FIGURE 1 ASIA PACIFIC ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET

FIGURE 2 ASIA PACIFIC ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET: THE TYPE LIFE LINE CURVE

FIGURE 7 ASIA PACIFIC ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET: MULTIVARIATE MODELLING

FIGURE 8 ASIA PACIFIC ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 ASIA PACIFIC ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 ASIA PACIFIC ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET: MARKET END-USE COVERAGE GRID

FIGURE 11 ASIA PACIFIC ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 ASIA PACIFIC ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 ASIA PACIFIC ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET: SEGMENTATION

FIGURE 14 ASIA-PACIFIC IS EXPECTED TO DOMINATE THE ASIA PACIFIC ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET, WHILE NORTH AMERICA IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 15 EXTENSIVE BARRIER AND ANTISTATIC PROPERTIES OF EVOH PACKAGING FILMS IS EXPECTED TO DRIVE ASIA PACIFIC ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET IN THE FORECAST PERIOD

FIGURE 16 ETHYLENE CONTENT (MOL%) BELOW 29 SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET IN 2022 & 2029

FIGURE 17 SUPPLY CHAIN ANALYSIS- ASIA PACIFIC ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET

FIGURE 18 VENDOR SELECTION CRITERIA

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET

FIGURE 20 ASIA PACIFIC ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET: BY ETHYLENE CONTENT, 2021

FIGURE 21 ASIA PACIFIC ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET: BY APPLICATION, 2021

FIGURE 22 ASIA PACIFIC ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET: BY END-USE, 2021

FIGURE 23 ASIA-PACIFIC ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET: SNAPSHOT (2021)

FIGURE 24 ASIA-PACIFIC ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET: BY COUNTRY (2021)

FIGURE 25 ASIA-PACIFIC ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 26 ASIA-PACIFIC ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 27 ASIA-PACIFIC ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET: BY ETHYLENE CONTENT (2022 & 2029)

FIGURE 28 ASIA PACIFIC ETHYLENE-VINYL ALCOHOL COPOLYMER (EVOH) PACKAGING FILMS MARKET: COMPANY SHARE 2021 (%)

Asia Pacific Ethylene Vinyl Alcohol Copolymer Evoh Packaging Films Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Asia Pacific Ethylene Vinyl Alcohol Copolymer Evoh Packaging Films Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Asia Pacific Ethylene Vinyl Alcohol Copolymer Evoh Packaging Films Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.