Market Analysis and Insights: Asia-Pacific Electric Vehicle Lithium-Ion Battery Recycling Market

Market Analysis and Insights: Asia-Pacific Electric Vehicle Lithium-Ion Battery Recycling Market

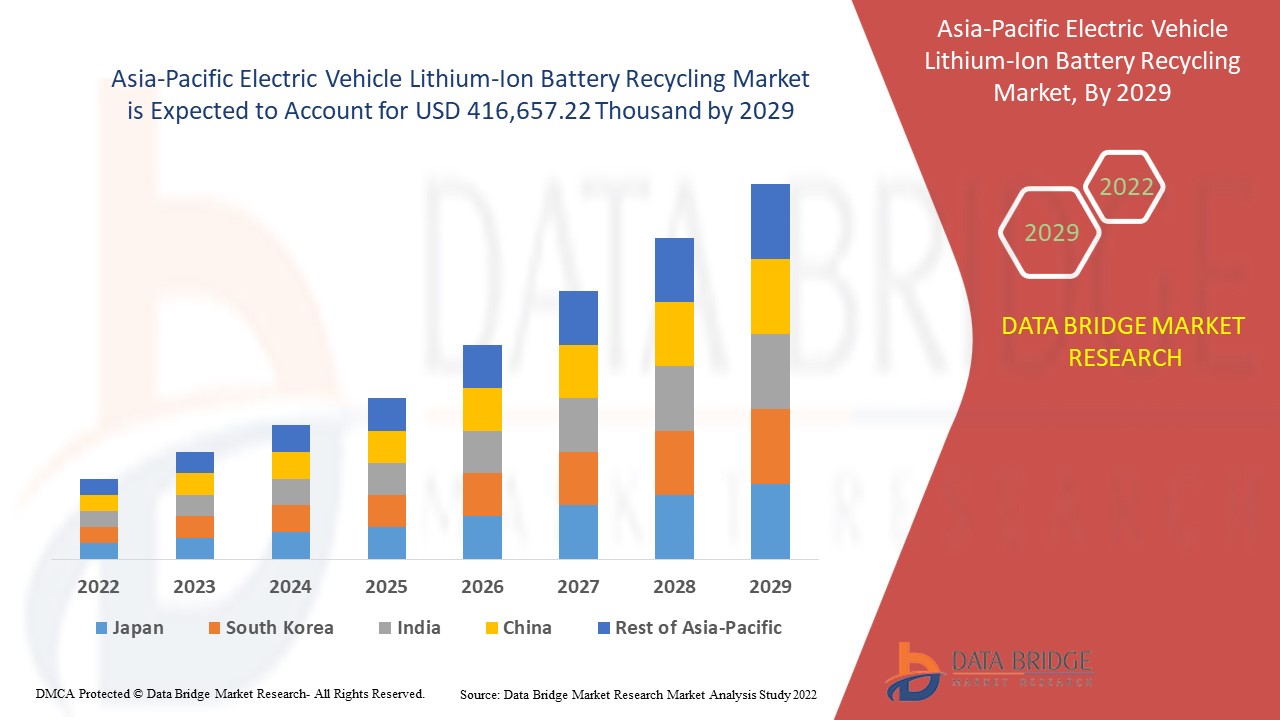

Asia-Pacific electric vehicle lithium-ion battery recycling market is expected to gain market growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing at a CAGR of 22.0% in the forecast period of 2022 to 2029 and is expected to reach USD 416,657.22 thousand by 2029.

Lithium-ion (Li-ion) batteries are rechargeable batteries used in electric vehicles. Methods used for the recycling of lithium-ion batteries are pyrometallurgical and hydrometallurgical.

The number of electric vehicles is increasing due to improved battery technologies and low maintenance requirements for these lithium-ion batteries. Moreover, the improvements in battery recycling techniques and government economic stimulus policies in battery recycling methods are expected to boost the electric vehicle lithium-ion battery recycling market. On the other hand, the lack of awareness among the people for electric vehicle battery recycling may restrain the growth of the Asia-Pacific electric vehicle lithium-ion battery recycling market.

Growing environmental awareness and conservation of natural resources is providing opportunities in the electric vehicle lithium-ion battery recycling market. However, accessible installation of batteries while utilizing minimum space may act as a challenge to the electric vehicle lithium-ion battery recycling market.

This Asia-Pacific electric vehicle lithium-ion battery recycling market report provides details of market share, new developments, and product pipeline analysis, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an Analyst Brief. Our team will help you create a revenue impact solution to achieve your desired goal.

Asia-Pacific Electric Vehicle Lithium-Ion Battery Recycling Market Scope And Market Size

Asia-Pacific Electric Vehicle Lithium-Ion Battery Recycling Market Scope And Market Size

Asia-Pacific electric vehicle lithium-ion battery recycling market is segmented on the basis of process and application. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

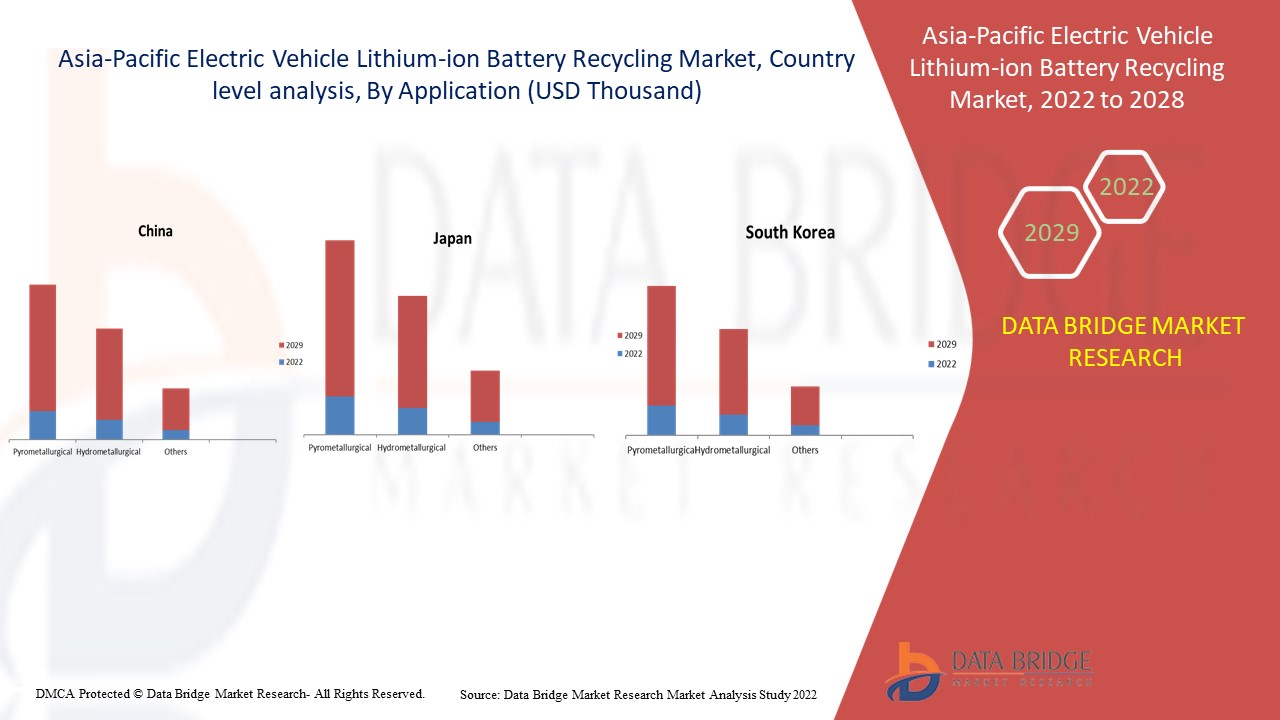

- On the basis of process, the Asia-Pacific electric vehicle lithium-ion battery recycling market is segmented into pyrometallurgical, hydrometallurgical, and others. In 2022, the pyrometallurgical segment is expected to dominate the electric vehicle lithium-ion battery recycling market globally as the pyrometallurgical process allows a short-process chain and less environmental impact, which increases its demand globally. In Asia-Pacific, the demand for the pyrometallurgical segment is more in China and India due to the increase in the production of electric vehicles and adoption of the recycling process, which makes pyrometallurgical dominate the region.

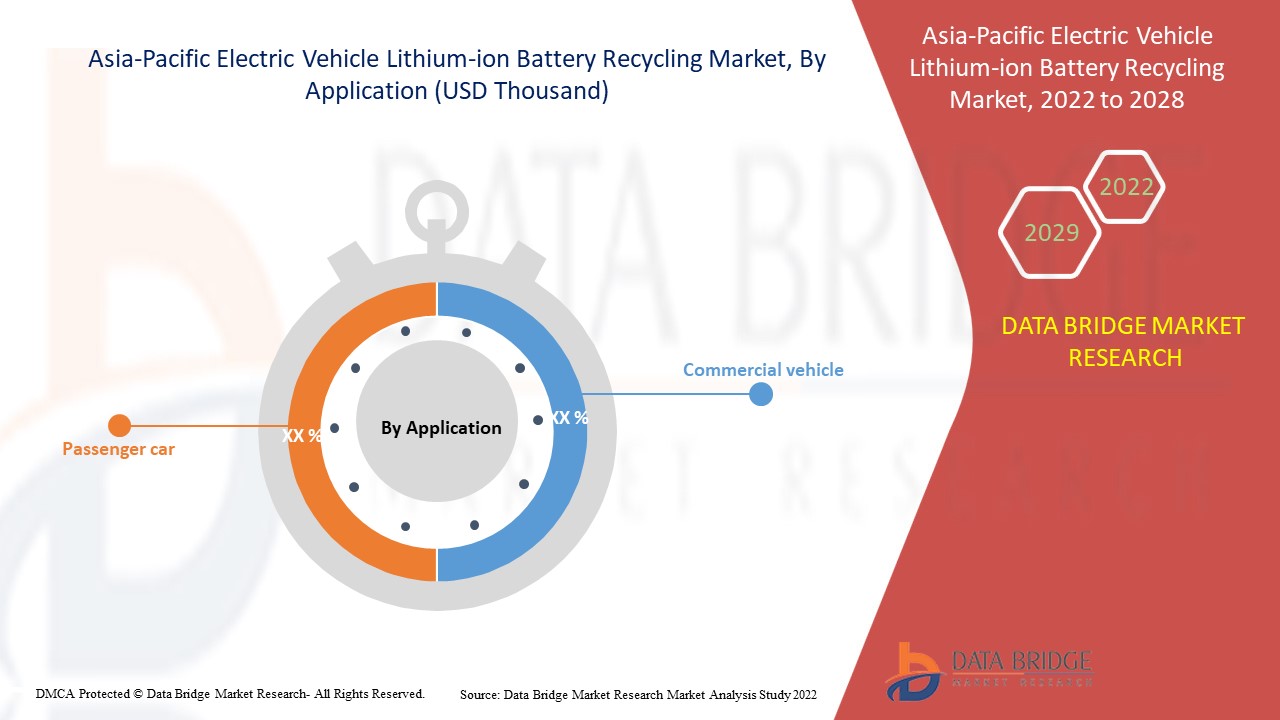

- On the basis of application, Asia-Pacific electric vehicle lithium-ion battery recycling market is segmented into passenger car and commercial vehicle. In 2022, the passenger car segment is expected to dominate the electric vehicle lithium-ion battery recycling market globally as passenger cars have lower fueling and maintenance costs that make the passenger car segment dominate in the region. In Asia-Pacific, the large numbers of electric passenger car manufacturers in the region make the passenger car segment to dominate in the region.

Asia-Pacific Electric Vehicle Lithium-Ion Battery Recycling Market Country Level Analysis

Asia-Pacific Electric Vehicle Lithium-Ion Battery Recycling Market Country Level Analysis

The Asia-Pacific market is analyzed, and market size information is provided by process and application.

The countries covered in the Asia-Pacific electric vehicle lithium-ion battery recycling market report are Japan, China, South Korea, Australia, India, Singapore, Thailand, Malaysia, Indonesia, Philippines, and the rest of Asia-Pacific. China is expected to dominate the Asia-Pacific electric vehicle lithium-ion battery recycling market due to an increase in the production of electric vehicles and the adoption of the recycling process. Japan is expected to dominate the Asia-Pacific electric vehicle lithium-ion battery recycling market due to government initiatives that all new passenger cars sold domestically should be electrified. South Korea is expected to dominate the Asia-Pacific electric vehicle lithium-ion battery recycling market due to supportive government regulations.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of sales channels are considered while providing forecast analysis of the country data.

Growth in the Asia-Pacific Electric Vehicle Lithium-Ion Battery Recycling Market

Asia-Pacific electric vehicle lithium-ion battery recycling market also provides you with detailed market analysis for every country's growth in the installed base of different kinds of products for the market, the impact of technology using lifeline curves and changes in infant formula regulatory scenarios, and their impact on the electric vehicle lithium-ion battery recycling market. The data is available for the historical period 2010 to 2020.

Competitive Landscape and Asia-Pacific Electric Vehicle Lithium-Ion Battery Recycling Market Share Analysis

Asia-Pacific electric vehicle lithium-ion battery recycling market competitive landscape provides details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, company strengths and weaknesses, product launch, clinical trials pipelines, brand analysis, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the company's focus related to the Asia-Pacific electric vehicle lithium-ion battery recycling market.

Some of the major players covered in the report are Neometals, Glencore, FORTUM, Gem Co. Ltd., Brunp Recycle Technology Co.Ltd. (A subsidiary of CATL), Tata Chemicals Ltd., GanfengLithium, Umicore, among others. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

For instance,

- In January, Paulson Prize for Sustainability Help GEM CO. Ltd. Build Partnership and Boost High-quality Development of Recycling Industry. This partnership will help the company to promote its extensive cooperation with global automobile and battery enterprises in the recycling of waste batteries

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC ELECTRIC VEHICLE LITHIUM-ION BATTERY RECYCLING MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

4.1 DRIVERS

4.1.1 DEVELOPING INFRASTRUCTURE FOR ELECTRIC VEHICLE PRODUCTION IN EMERGING ECONOMIES

4.1.2 GROWING DEMAND FOR ZERO-EMISSION VEHICLES

4.1.3 LENIENT LAWS AND TAXATION POLICIES SUPPORTING THE USE OF ELECTRIC VEHICLES

4.2 RESTRAINTS

4.2.1 HIGH ESTABLISHMENT COST OF ELECTRIC VEHICLE BATTERY RECYCLING PLANTS

4.2.2 LACK OF AWARENESS OF ELECTRIC VEHICLE BATTERY RECYCLING

4.3 OPPORTUNITIES

4.3.1 GROWING ENVIRONMENT AWARENESS AND CONSERVATION OF NATURAL RESOURCES

4.3.2 STRINGENT STANDARDS AND LAWS TO PROMOTE BATTERY RECYCLING

4.4 CHALLENGES

4.4.1 ACCESSIBLE INSTALLATION OF BATTERIES WHILE UTILIZING MINIMUM SPACE

4.4.2 ADOPTION OF EFFICIENT DISMANTLING TECHNIQUES

5 IMPACT OF COVID-19 IMPACT ON THE ASIA PACIFIC ELECTRIC VEHICLE LITHIUM-ION BATTERY RECYCLING MARKET

5.1 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE ASIA PACIFIC ELECTRIC VEHICLE LITHIUM-ION BATTERY RECYCLING MARKET

5.2 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

5.3 IMPACT ON PRICE

5.4 IMPACT ON DEMAND

5.5 IMPACT ON SUPPLY CHAIN

5.6 CONCLUSION

6 ASIA PACIFIC ELECTRIC VEHICLE LITHIUM-ION BATTERY RECYCLING MARKET, BY PROCESS

6.1 OVERVIEW

6.2 PYROMETALLURGICAL

6.3 HYDROMETALLURGICAL

6.4 OTHERS

7 ASIA PACIFIC ELECTRIC VEHICLE LITHIUM-ION BATTERY RECYCLING MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 PASSENGER CAR

7.3 COMMERCIAL VEHICLE

8 ASIA PACIFIC ELECTRIC VEHICLE LITHIUM-ION BATTERY RECYCLING MARKET, BY REGION

8.1 ASIA-PACIFIC

8.1.1 CHINA

8.1.2 JAPAN

8.1.3 SOUTH KOREA

8.1.4 INDIA

8.1.5 AUSTRALIA & NEW ZEALAND

8.1.6 SINGAPORE

8.1.7 INDONESIA

8.1.8 THAILAND

8.1.9 MALAYSIA

8.1.10 PHILIPPINES

8.1.11 REST OF ASIA-PACIFIC

9 ASIA PACIFIC ELECTRIC VEHICLE LITHIUM-ION BATTERY RECYCLING MARKET: COMPANY LANDSCAPE

9.1 COMPANY SHARE ANALYSIS: EUROPE, NORTH AMERICA, AND ASIA-PACIFIC

9.2 MERGER & ACQUISITION

9.3 EXPANSIONS

9.4 PARTNERSHIP

9.5 JOINT VENTURE

9.6 AGREEMENTS

9.7 COLLABORATION

10 SWOT ANALYSIS

11 COMPANY PROFILE

11.1 BRUNP RECYCLING TECHNOLOGY CO., LTD. (AS A SUBSIDIARY OF CATL)

11.1.1 COMPANY SNAPSHOT

11.1.2 REVENUE ANALYSIS

11.1.3 COMPANY SHARE ANALYSIS

11.1.4 PRODUCT PORTFOLIO

11.1.5 RECENT UPDATE

11.2 UMICORE

11.2.1 COMPANY SNAPSHOT

11.2.2 REVENUE ANALYSIS

11.2.3 COMPANY SHARE ANALYSIS

11.2.4 PRODUCT PORTFOLIO

11.2.5 RECENT UPDATES

11.3 GANFENGLITHIUM

11.3.1 COMPANY SNAPSHOT

11.3.2 REVENUE ANALYSIS

11.3.3 COMPANY SHARE ANALYSIS

11.3.4 PRODUCT PORTFOLIO

11.3.5 RECENT UPDATE

11.4 FORTUM

11.4.1 COMPANY SNAPSHOT

11.4.2 REVENUE ANALYSIS

11.4.3 COMPANY SHARE ANALYSIS

11.4.4 PRODUCT PORTFOLIO

11.4.5 RECENT UPDATES

11.5 AMERICAN MANGANESE INC.

11.5.1 COMPANY SNAPSHOT

11.5.2 COMPANY SHARE ANALYSIS

11.5.3 PRODUCT PORTFOLIO

11.5.4 RECENT UPDATE

11.6 GEM CO. LTD

11.6.1 COMPANY SNAPSHOT

11.6.2 PRODUCT PORTFOLIO

11.6.3 RECENT UPDATE

11.7 GLENCORE

11.7.1 COMPANY SNAPSHOT

11.7.2 REVENUE ANALYSIS

11.7.3 PRODUCT PORTFOLIO

11.7.4 RECENT UPDATES

11.8 ACCUREC-RECYCLING GMBH

11.8.1 COMPANY SNAPSHOT

11.8.2 PRODUCT PORTFOLIO

11.8.3 RECENT UPDATES

11.9 DUESENFELD GMBH

11.9.1 COMPANY SNAPSHOT

11.9.2 PRODUCT PORTFOLIO

11.9.3 RECENT UPDATES

11.1 ECOBAT

11.10.1 COMPANY SNAPSHOT

11.10.2 PRODUCT PORTFOLIO

11.10.3 RECENT UPDATES

11.11 LI-CYCLE CORP

11.11.1 COMPANY SNAPSHOT

11.11.2 REVENUE ANALYSIS

11.11.3 PRODUCT PORTFOLIO

11.11.4 RECENT UPDATE

11.12 LITHION RECYCLING

11.12.1 COMPANY SNAPSHOT

11.12.2 PRODUCT PORTFOLIO

11.12.3 RECENT UPDATES

11.13 NEOMETALS

11.13.1 COMPANY SNAPSHOT

11.13.2 REVENUE ANALYSIS

11.13.3 PRODUCT PORTFOLIO

11.13.4 RECENT UPDATE

11.14 RETRIEV TECHNOLOGIES

11.14.1 COMPANY SNAPSHOT

11.14.2 PRODUCT PORTFOLIO

11.14.3 RECENT UPDATE

11.15 TATA CHEMICALS LTD.

11.15.1 COMPANY SNAPSHOT

11.15.2 PRODUCT PORTFOLIO

11.15.3 RECENT UPDATES

12 QUESTIONNAIRE

13 RELATED REPORTS

List of Table

TABLE 1 WORLD BATTERY ELECTRIC VEHICLE SALE, 2010-2019 (MILLIONS)

TABLE 2 ASIA PACIFIC ELECTRIC VEHICLE LITHIUM-ION BATTERY RECYCLING MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

TABLE 3 ASIA PACIFIC ELECTRIC VEHICLE LITHIUM-ION BATTERY RECYCLING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 4 ASIA-PACIFIC ELECTRIC VEHICLE LITHIUM-ION BATTERY RECYCLING MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 5 ASIA-PACIFIC ELECTRIC VEHICLE LITHIUM-ION BATTERY RECYCLING MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

TABLE 6 ASIA-PACIFIC ELECTRIC VEHICLE LITHIUM-ION BATTERY RECYCLING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 7 CHINA ELECTRIC VEHICLE LITHIUM-ION BATTERY RECYCLING MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

TABLE 8 CHINA ELECTRIC VEHICLE LITHIUM-ION BATTERY RECYCLING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 9 JAPAN ELECTRIC VEHICLE LITHIUM-ION BATTERY RECYCLING MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

TABLE 10 JAPAN ELECTRIC VEHICLE LITHIUM-ION BATTERY RECYCLING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 11 SOUTH KOREA ELECTRIC VEHICLE LITHIUM-ION BATTERY RECYCLING MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

TABLE 12 SOUTH KOREA ELECTRIC VEHICLE LITHIUM-ION BATTERY RECYCLING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 13 INDIA ELECTRIC VEHICLE LITHIUM-ION BATTERY RECYCLING MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

TABLE 14 INDIA ELECTRIC VEHICLE LITHIUM-ION BATTERY RECYCLING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 15 AUSTRALIA & NEW ZEALAND ELECTRIC VEHICLE LITHIUM-ION BATTERY RECYCLING MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

TABLE 16 AUSTRALIA & NEW ZEALAND ELECTRIC VEHICLE LITHIUM-ION BATTERY RECYCLING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 17 SINGAPORE ELECTRIC VEHICLE LITHIUM-ION BATTERY RECYCLING MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

TABLE 18 SINGAPORE ELECTRIC VEHICLE LITHIUM-ION BATTERY RECYCLING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 19 INDONESIA ELECTRIC VEHICLE LITHIUM-ION BATTERY RECYCLING MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

TABLE 20 INDONESIA ELECTRIC VEHICLE LITHIUM-ION BATTERY RECYCLING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 21 THAILAND ELECTRIC VEHICLE LITHIUM-ION BATTERY RECYCLING MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

TABLE 22 THAILAND ELECTRIC VEHICLE LITHIUM-ION BATTERY RECYCLING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 23 MALAYSIA ELECTRIC VEHICLE LITHIUM-ION BATTERY RECYCLING MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

TABLE 24 MALAYSIA ELECTRIC VEHICLE LITHIUM-ION BATTERY RECYCLING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 25 PHILIPPINES ELECTRIC VEHICLE LITHIUM-ION BATTERY RECYCLING MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

TABLE 26 PHILIPPINES ELECTRIC VEHICLE LITHIUM-ION BATTERY RECYCLING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 27 REST OF ASIA-PACIFIC ELECTRIC VEHICLE LITHIUM-ION BATTERY RECYCLING MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

List of Figure

FIGURE 1 ASIA PACIFIC ELECTRIC VEHICLE LITHIUM-ION BATTERY RECYCLING MARKET

FIGURE 2 ASIA PACIFIC ELECTRIC VEHICLE LITHIUM-ION BATTERY RECYCLING MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC ELECTRIC VEHICLE LITHIUM-ION BATTERY RECYCLING MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC ELECTRIC VEHICLE LITHIUM-ION BATTERY RECYCLING MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC ELECTRIC VEHICLE LITHIUM-ION BATTERY RECYCLING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC ELECTRIC VEHICLE LITHIUM-ION BATTERY RECYCLING MARKET: THE TYPE LIFELINE CURVE

FIGURE 7 ASIA PACIFIC ELECTRIC VEHICLE LITHIUM-ION BATTERY RECYCLING MARKET: MULTIVARIATE MODELLING

FIGURE 8 ASIA PACIFIC ELECTRIC VEHICLE LITHIUM-ION BATTERY RECYCLING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 ASIA PACIFIC ELECTRIC VEHICLE LITHIUM-ION BATTERY RECYCLING MARKET: DBMR MARKET POSITION GRID

FIGURE 10 ASIA PACIFIC ELECTRIC VEHICLE LITHIUM-ION BATTERY RECYCLING MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 ASIA PACIFIC ELECTRIC VEHICLE LITHIUM-ION BATTERY RECYCLING MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 ASIA PACIFIC ELECTRIC VEHICLE LITHIUM-ION BATTERY RECYCLING MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 ASIA PACIFIC ELECTRIC VEHICLE LITHIUM-ION BATTERY RECYCLING MARKET: SEGMENTATION

FIGURE 14 DEVELOPING INFRASTRUCTURE FOR ELECTRIC VEHICLE PRODUCTION IN EMERGING ECONOMIES MAY DRIVE ASIA PACIFIC ELECTRIC VEHICLE LITHIUM-ION BATTERY RECYCLING MARKET IN THE FORECAST PERIOD

FIGURE 15 THE PYROMETALLURGICAL SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC ELECTRIC VEHICLE LITHIUM-ION BATTERY RECYCLING MARKET IN 2022 AND 2029

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF ASIA PACIFIC ELECTRIC VEHICLE LITHIUM-ION BATTERY RECYCLING MARKET

FIGURE 17 ASIA PACIFIC ELECTRIC VEHICLE LITHIUM-ION BATTERY RECYCLING MARKET, BY PROCESS, 2021

FIGURE 18 ASIA PACIFIC ELECTRIC VEHICLE LITHIUM-ION BATTERY RECYCLING MARKET, BY APPLICATION, 2021

FIGURE 19 ASIA-PACIFIC ELECTRIC VEHICLE LITHIUM-ION BATTERY RECYCLING MARKET: SNAPSHOT (2021)

FIGURE 20 ASIA-PACIFIC ELECTRIC VEHICLE LITHIUM-ION BATTERY RECYCLING MARKET: BY COUNTRY (2021)

FIGURE 21 ASIA-PACIFIC ELECTRIC VEHICLE LITHIUM-ION BATTERY RECYCLING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 22 ASIA-PACIFIC ELECTRIC VEHICLE LITHIUM-ION BATTERY RECYCLING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 23 ASIA-PACIFIC ELECTRIC VEHICLE LITHIUM-ION BATTERY RECYCLING MARKET: BY PROCESS (2022-2029)

FIGURE 24 ASIA PACIFIC ELECTRIC VEHICLE LITHIUM-ION BATTERY RECYCLING: COMPANY SHARE 2021 (%)

Asia Pacific Electric Vehicle Lithium Ion Battery Recycling Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Asia Pacific Electric Vehicle Lithium Ion Battery Recycling Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Asia Pacific Electric Vehicle Lithium Ion Battery Recycling Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.