Asia Pacific Digital Farming Software Market

Market Size in USD Billion

CAGR :

%

USD

1.37 Billion

USD

3.75 Billion

2025

2033

USD

1.37 Billion

USD

3.75 Billion

2025

2033

| 2026 –2033 | |

| USD 1.37 Billion | |

| USD 3.75 Billion | |

|

|

|

|

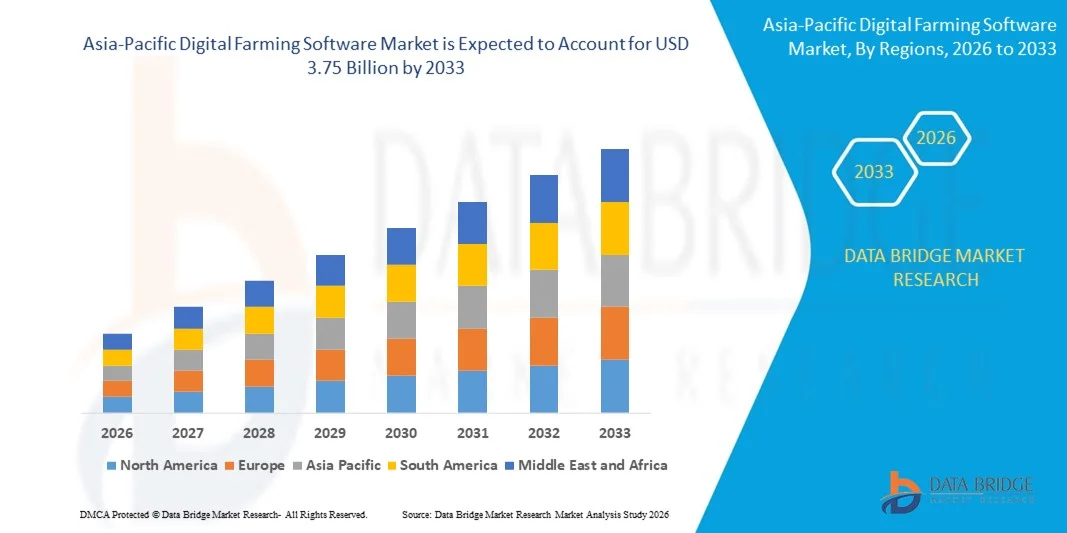

What is the Asia-Pacific Digital Farming Software Market Size and Growth Rate?

- The Asia-Pacific digital farming software market size was valued at USD 1.37 billion in 2025 and is expected to reach USD 3.75 billion by 2033, at a CAGR of 13.40% during the forecast period

- The market growth is largely fueled by the rising adoption of precision agriculture and smart farming practices, driven by the need to increase agricultural productivity, optimize resource usage, and address food security challenges through data-driven solutions

- Furthermore, increasing integration of advanced technologies such as IoT, AI, machine learning, and satellite imagery into farming operations is enabling real-time monitoring, predictive analytics, and automation, accelerating the shift toward digital farming

What are the Major Takeaways of Digital Farming Software Market?

- Digital farming software comprises tools and platforms that collect, analyze, and visualize farm data to support decision-making in crop management, soil monitoring, irrigation, and resource planning. These solutions enhance efficiency, sustainability, and profitability across various agricultural activities

- The demand for digital farming software is primarily fueled by growing pressure to improve crop yields, rising concerns over climate change impacts, and increasing government support for smart agriculture initiatives, especially in emerging markets

- China dominated the Asia-Pacific digital farming software market with the largest revenue share of 36.8% in 2024, driven by rapid adoption of smart agriculture solutions, rising food demand, and increasing government-led digital agriculture initiatives across emerging and developed economies

- The India digital farming software market is witnessing fastest growth at a CAGR of 8.1%, driven by rising smartphone penetration, government-backed digital agriculture programs, and growing awareness of precision farming among small and mid-sized farmers

- Software segment dominated the market with a market share of 58.5% in 2024, due to the increasing deployment of data-driven platforms that provide actionable insights for crop planning, yield estimation, and resource allocation. These solutions support farmers in decision-making through predictive analytics and historical trend analysis, thereby enhancing productivity and profitability. The adoption of comprehensive farm management software is accelerating due to its ability to centralize data from multiple sources, streamline operations, and comply with regulatory requirements

Report Scope and Digital Farming Software Market Segmentation

|

Attributes |

Digital Farming Software Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Digital Farming Software Market?

Growing Adoption of Precision Agriculture Solutions

- The digital farming software market is expanding rapidly as more producers embrace precision agriculture tools to improve farm productivity, resource efficiency, and data-driven decision-making. Farmers and agribusinesses are leveraging software to manage crop cycles, irrigation, pest control, and equipment deployment, driving overall sector modernization

- For instance, major market players such as Trimble and John Deere have developed advanced digital farming platforms that integrate sensor networks, GPS-guided equipment, and real-time analytics, enabling users to optimize inputs and yields across large and small-scale operations

- Key innovations include cloud-based solutions, seamless mobile applications, and the integration of AI and machine learning for farm automation, resulting in better cost savings, targeted resource use, and improved outcomes for diverse crops and livestock

- The rise of IoT-connected devices and big data analytics is further accelerating the development of comprehensive farm management systems, allowing producers to monitor crop and soil health, forecast weather, and automate critical tasks remotely

- Governments are actively supporting smart farming adoption through subsidies, digital infrastructure investments, and partnerships with technology vendors to boost food security and sustainability, especially in Asia-Pacific and other high-growth regions

- The increasing need to address climate change and adapt to unpredictable weather patterns is driving demand for precision technology that minimizes waste and environmental impact, making digital farming software a core enabler of resilience and risk mitigation across the agricultural value chai

What are the Key Drivers of Digital Farming Software Market?

- Growing global demand for food, concerns about environmental impact, and shifting consumer preferences for traceable, sustainable products are fueling the adoption of digital farming software that optimizes resource use and lowers chemical and water inputs

- For instance, leading firms such as Climate FieldView and Granular (a Corteva Agriscience company) are partnering with progressive farms to implement digital solutions for real-time monitoring of soil health, targeted irrigation, and variable-rate fertilization, directly supporting sustainability goals and compliance initiatives

- These platforms enable data-driven transparency and accountability, helping farmers meet regulatory requirements and access new markets, such as organic and eco-certified produce

- Integration of sustainability metrics, carbon accounting, and advanced reporting within digital farming tools allows businesses to measure and reduce their ecological footprint while maintaining profitability and yield

- Government programs and industry coalitions are increasingly mandating or incentivizing sustainable practices, making digital farming software an essential tool for compliance, risk reduction, and market competitiveness

Which Factor is Challenging the Growth of the Digital Farming Software Market?

- The high upfront costs associated with deploying comprehensive digital farming solutions—including hardware (sensors, drones), software licensing, and workforce training—present a significant barrier, especially for small- and medium-sized growers

- For instance, some producers hesitate to adopt advanced platforms from companies such as Trimble or John Deere due to costs related to equipment integration, software customization, and managing technology updates

- Limited access to capital and uncertainties around short-term returns on investment can delay digital transformation projects, particularly in regions with lower average farm income or fragmented land holdings

- Interoperability issues with legacy systems and the need for ongoing technical support and updates add to the total cost of ownership, making adoption more difficult for less-resourced operations

- Despite the long-term efficiency and sustainability gains, market growth may be tempered in certain segments until more affordable or scalable solutions are developed and accessible financing options become widespread

How is the Digital Farming Software Market Segmented?

The market is segmented on the basis of component, technology, and application.

- By Component

On the basis of component, the digital farming software market is segmented into software and services. The software segment dominated the largest market revenue share of 58.5% in 2024, attributed to the increasing deployment of data-driven platforms that provide actionable insights for crop planning, yield estimation, and resource allocation. These solutions support farmers in decision-making through predictive analytics and historical trend analysis, thereby enhancing productivity and profitability. The adoption of comprehensive farm management software is accelerating due to its ability to centralize data from multiple sources, streamline operations, and comply with regulatory requirements.

The services segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising demand for consulting, integration, and maintenance support. As farms embrace digital transformation, the need for tailored services to optimize software deployment and ensure seamless connectivity across devices is becoming critical. Furthermore, agronomic advisory services and real-time support for troubleshooting and calibration are gaining traction, particularly among small and medium-sized farms with limited in-house expertise.

- By Technology

On the basis of technology, the market is segmented into remote sensing, guidance technology, variable rate technology, machine learning, wireless connectivity, and others. The remote sensing segment held the largest revenue share in 2024, driven by its critical role in monitoring crop health, detecting anomalies, and managing inputs based on satellite or UAV imagery. The ability to assess vast farmland areas with high accuracy makes remote sensing invaluable for large-scale farms aiming for resource-efficient operations. It enables early detection of pest infestations, nutrient deficiencies, and water stress, supporting timely interventions.

Machine learning is projected to register the fastest CAGR from 2025 to 2032, as the industry shifts toward predictive and prescriptive analytics. Machine learning algorithms enhance yield forecasts, automate image recognition for plant diseases, and optimize irrigation schedules based on real-time sensor data. Its adaptive learning capability continuously improves system accuracy, enabling hyper-personalized recommendations. As data volumes increase, machine learning is emerging as the cornerstone for autonomous, intelligent farming ecosystems.

- By Application

On the basis of application, the market is segmented into drone analytics, precision farming, agriculture robots, livestock monitoring, greenhouse management, supply chain management, financial management, and others. The precision farming segment led the market share in 2024, owing to its widespread use in optimizing field-level management through variable input application, GPS-based guidance, and automated machinery. Growers increasingly rely on precision farming software to enhance yield while reducing costs, supported by detailed geospatial analytics and historical yield maps. This segment continues to dominate due to its broad applicability across row crops, permanent crops, and horticulture.

Drone analytics is anticipated to witness the fastest growth from 2025 to 2032, driven by the rising deployment of UAVs for aerial scouting, mapping, and real-time surveillance. Drone-captured imagery provides high-resolution insights into plant health, pest activity, and irrigation coverage, enabling rapid and data-informed decisions. Coupled with AI-powered analysis, drone analytics platforms are transforming field assessments from manual inspections to automated, scalable intelligence tools, significantly improving operational agility and efficiency.

Which Region Holds the Largest Share of the Digital Farming Software Market?

- China dominated the Asia-Pacific digital farming software market with the largest revenue share of 36.8% in 2024, driven by rapid adoption of smart agriculture solutions, rising food demand, and increasing government-led digital agriculture initiatives across emerging and developed economies

- Widespread deployment of precision farming tools, remote sensing technologies, and farm management platforms across large agricultural economies

- Strong public–private investments, expanding agri-tech startups, and integration of AI, IoT, and cloud-based platforms position China as most innovation-driven market for Digital Farming Software

India Digital Farming Software Market Insight

The India digital farming software market is witnessing fastest growth at a CAGR of 8.1%, driven by rising smartphone penetration, government-backed digital agriculture programs, and growing awareness of precision farming among small and mid-sized farmers. Adoption of mobile-based farm advisory platforms, drone analytics, and financial management software is improving decision-making and farm profitability. Continuous policy support, expanding agri-tech ecosystems, and partnerships between technology providers and agribusinesses are reinforcing India’s role as a high-growth market in the Asia-Pacific Digital Farming Software landscape.

Australia Digital Farming Software Market Insight

The Australia Digital Farming Software market is expanding steadily, supported by large farm sizes, high mechanization levels, and strong demand for data-driven agriculture solutions. Increasing adoption of precision farming, livestock monitoring systems, and cloud-based farm management software is driving market growth. Government support for sustainable agriculture, along with collaboration between research institutions and agri-tech companies, is positioning Australia as a key adopter and innovator within the Asia-Pacific Digital Farming Software market.

Which are the Top Companies in Digital Farming Software Market?

The digital farming software industry is primarily led by well-established companies, including:

- Bayer AG (Germany)

- CropX Inc. (U.S.)

- NETAFIM (a subsidiary of Orbia) (Israel)

- PrecisionHawk, Inc. (U.S.)

- eAgroop, Lda (Portugal)

- EZ Lab srl (Italy)

- Ag Leader Technology (U.S.)

- Accenture (Ireland)

- Infosys Limited (India)

- FarmFacts GmbH (Germany)

- Yara (Norway)

- Luda.Farm AB (Sweden)

- Granular, Inc. (a subsidiary of Corteva) (U.S.)

- Trimble Inc. (U.S.)

- Farmer's Business Network, Inc. (U.S.)

- DJI (China)

- Pix4D SA (Switzerland)

- Agremo (Croatia)

- Farmers Edge Inc. (Canada)

- BASF (Germany)

- Raven Industries, Inc. (U.S.)

- AGCO Corporation (U.S.)

- Gamaya (Switzerland)

- DRAGONFLY IT (Canada)

- BayWa AG (Germany)

- Syngenta (Switzerland)

- Hexagon Agriculture (a subsidiary of HEXAGON) (U.S.)

- Field Margin Ltd. (U.K.)

- AeroVironment, Inc. (U.S.)

- Deere & Company (U.S.)

What are the Recent Developments in Global Center Stack Display Market?

- In March 2024, TELUS Agriculture & Consumer Goods, a Canada-based digital farming software provider, acquired U.K.-based Proagrica to strengthen its market position by expanding its agronomic expertise and enhancing platform capabilities. The acquisition is expected to boost TELUS Agriculture's competitiveness by advancing customer digitization, improving data connectivity, and delivering deeper insights, thereby reinforcing its role in the global digital farming software market

- In June 2022, U.S.-based agri-tech firm Cropin launched Cropin Cloud, the first purpose-built industry cloud for agriculture, significantly impacting the market by setting a new standard for AI-driven agricultural intelligence. The platform enhances the scalability and efficiency of digital farming by offering secure, data-rich solutions for agribusinesses and governments, further solidifying Cropin's position as a key innovator in the digital farming software landscape

- In September 2020, Raven Industries, Inc. introduced Raven Autonomy for optimizing the operations in ecosystem for precision agriculture farming through VSN connected technology helping the farmer to increase their product portfolio. The company has enhanced its business portfolio through this launch of the product that generates more revenue

- In January 2020, CropX inc. announced acquisition of CropMetrics which is a cloud-based precision irrigation tools provider. Under this acquisition, the company combined CropX and CropMetrics offerings to provide customers with access to a combination of in-soil data, farm management analytics and decision-support tools. This has helped the company to enhance their offerings and their presence in the market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Asia Pacific Digital Farming Software Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Asia Pacific Digital Farming Software Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Asia Pacific Digital Farming Software Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.