Asia-Pacific Dermal Fillers Market Analysis and Insight

The dermal filler is gel-like substances that are injected underneath the skin to restore lost volume, often creases and smooth lines or enhance facial contours. Dermal fillers usage has rapidly grown in recent years because of various offerings in the enhancing aesthetic and rejuvenate improvements that were previously only achievable with surgeries. These are becoming very popular for facial rejuvenation methods. Being minimally invasive dermal filler shows instantaneous results in cosmetic volume replacement therapies. These devices provide volume to the face, boost and enhance the quality of the skin. Various methods such as injections are used for augmentation. These fillers can give fuller, plumper lips for aesthetic purposes. There are many types of dermal fillers that can be injected in lips and around mouth that keep the volume of lips either temporally or permanently depending on the type of product used. Some market players are involved in the new and innovative products, and their products are under pipelines. During the last few years, new innovative dermal fillers products have been developed for increasing the market growth of the dermal fillers market, and the market players are enhancing their product portfolio. Many market players are involved in the manufacturing of dermal fillers with innovations that pave the way for market growth.

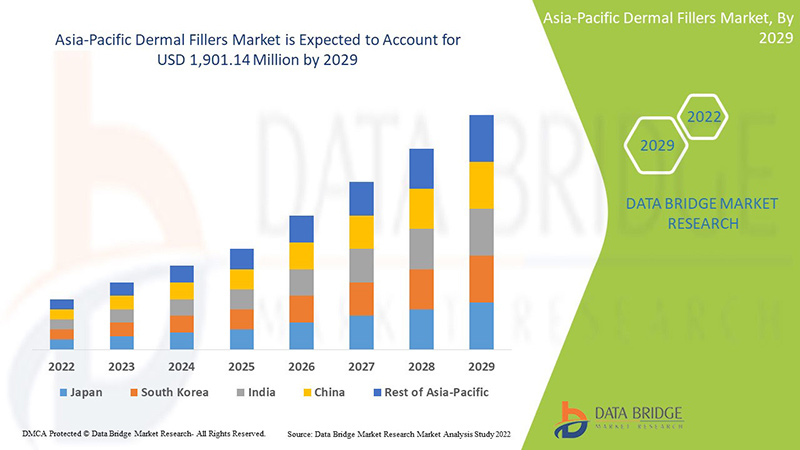

Data Bridge Market Research analyses that the dermal fillers market is expected to reach the value of USD 1,901.14 million by 2029, at a CAGR of 12.6% during the forecast period 2022-2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Year |

2020 (Customizable to 2019-2014) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

By Product Type (Biodegradable Dermal Fillers, Non-Biodegradable Dermal Fillers), Material Type (Natural Dermal Fillers, Synthetic Dermal Fillers), Application (Face Lift, Rhinoplasty, Reconstructive Surgery, Facial Line Correction, Lip Enhancement, Sagging Skin, Cheek Depression, Skin Smoothing, Dentistry, Aesthetic Restoration, Lip Plum, Scar Treatment, Chin Augmentation, Lipoatrophy Treatment, Earlobe Rejuvenation and Others), Drug Type (Branded, Generic), End User (Dermatology Clinics, Ambulatory Surgical Centers, Hospitals, Academic Research Institutes And Others), Distribution Channel (Direct Tender, Drug Stores, Retail Pharmacy, Online Pharmacy and Others) |

|

Countries Covered |

Japan, Australia, South Korea, China, India, Thailand, Singapore, Malaysia, Indonesia, Philippines and Rest of Asia-Pacific. |

|

Market Players Covered |

Allergan(A Subsidiary of Abbvie, Inc.), Prollenium Medical Technologies, Suneva Medical, Revance Therapeutics, Inc., FillMed Laboratories, Anika Therapeutics, Inc, Ipsen Pharma, BIOXIS Pharmaceuticals, Zimmer Aesthetic, Zhejiang Jingjia Medical Technology Co. Ltd., Medytox, Contura International ltd., Shanghai Reyoungel Medical Technology Company Limited, Humedix (A subsidiary of HUONS GLOBAL),Galderma Laboratories, L.P., Merz North America, Inc. (A Subsidiary of Merz Pharma),Croma-Pharma GmbH, Sinclair Pharma (A Subsidiary of Huadong Medicine Co., Ltd.),Teoxane, BioPlus Co., Ltd., Amalian, Givaudan, Mesoestetic, Sosum Global, DSM, IBSA Nordic ApS,among others. |

Market Definition

Dermal fillers are substances designed to be injected into the skin to add fullness and volume. The substances used in dermal fillers include Calcium hydroxylapatite (a mineral-like compound found in bones), Hyaluronic acid, Polyalkylimide, Polylactic acid, Polymethyl-methacrylate microspheres (PMMA). Dermal fillers can be classified based on several criteria, including the deep dermis, depth of implantation (a superficial midterms and upper, and subcutaneous levels); longevity of correction (temporary and permanent); allergenicity, the composition of the agent (allografts, semi/fully synthetic, xenografts, or autologous); and stimulatory behaviour (physiologic processes of endogenous tissue proliferation) versus replacement fillers (space-replacing effect).

Temporary dermal fillers such as HA and collagen are biodegradable and last from 4 to 9 months. The prospective side effects and dissatisfaction are also short-lived. Therefore, temporary fillers are always used as the first line of therapy to save long-lasting fillers for future patient visits.

Permanent fillers are essentially used in the alteration of deep lines and furrows of the skin, which are beyond normal facial wrinkles. They are considered an excellent option in facial rejuvenation, especially in HIV lipodystrophy. Polymethyl methacrylate (PMMA) is mostly used for safe, effective, and long-lasting effects.

Dermal Fillers Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

- Rising prevalence of minimally-invasive procedures

The use of minimally invasive procedures has been shifted as compared to traditional methods for aesthetic and cosmetics surgeries techniques including laser and other energy-based devices. For the use of surgical or non-surgical procedures, specially-designed instruments have been developed for minimally used procedures. These anti-aging devices help in reducing the visual effects of skin aging by revitalizing and tightening the skin, which gives a younger look.

Minimally-invasive surgery is a procedure conducted with the assistance of a scope of viewing and specially-equipped surgical instruments. It targets facial irregularities including wrinkles and fine lines, and decreases volume and contour, and unwanted fat. These have essentially no risk of serious adverse events as the procedures allow no cuts or minimal cuts with lesser recovery time which is increasing the demand for use of minimally invasive procedures. Minimally-invasive energy-based treatments for skin tightening, wrinkle reduction, face contouring, and skin rejuvenation have a high demand in the world. Other reasons driving the demand for these procedures are increasing aging people and rising requirement of healthcare facilities which can further result in decrease in burden on healthcare facilities.

With rising technological advancements and communications, people are more aware of aesthetic devices and procedures that are well performed in the healthcare field, impacting the adoption of minimally invasive procedures positively in the upcoming era. Thus, the increasing prevalence of minimally invasive procedures is expected to drive growth in the dermal fillers market.

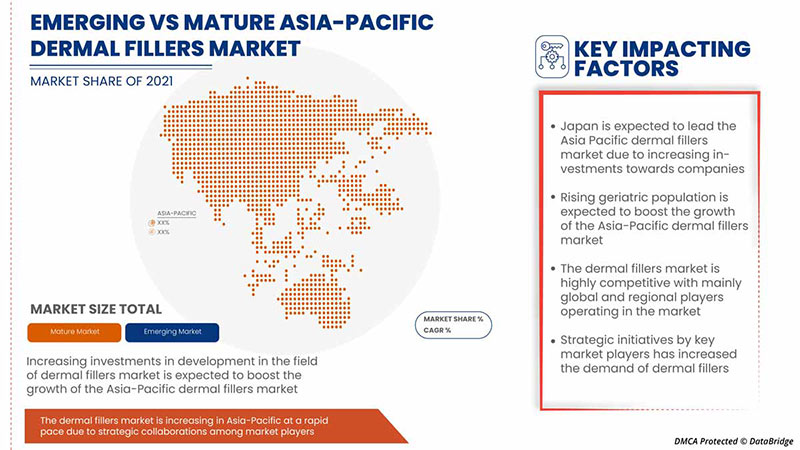

- Increasing geriatric population

The geriatric population is expanding for longer life span and is reported to have increasing skin ageing conditions. The speed of aging population is increasing exponentially in the world whereas European countries have certain cultural, social, and economic characteristics in common with similar aspirations. As people start aging, increase in appearance to appear as younger raises which ultimately develops interest in utilization of aesthetic procedures.

Rising improving healthcare delivery and its scenario in the Middle Eastern countries among the percentage of elderly people have resulted in better patients’ outcome services.

Opportunities

- Increasing funding activities for aesthetic research

Plastic surgery, unwanted hair removal, skin tightening, anti-aging, excess fat removal, body contouring, and several other cosmetic procedures that are to be performed through minimally invasive procedures follow under medical aesthetic devices that are used for increased appearances, beautification and other improvement part of body. Various foundations and government organizations are investing a large amount in aesthetic research.

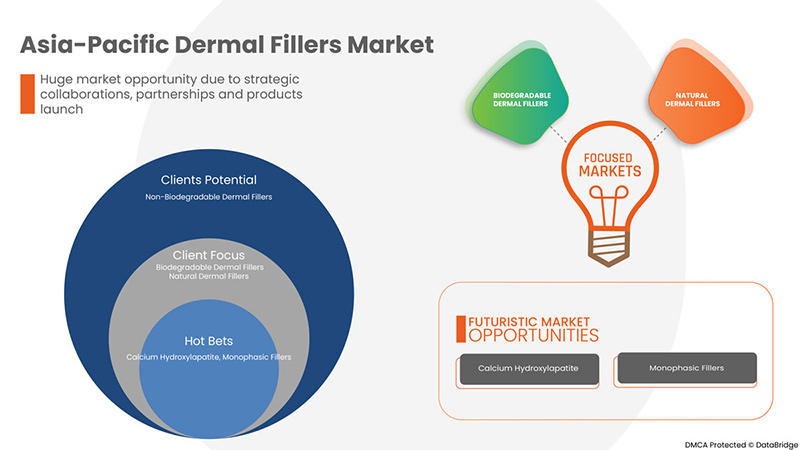

- Advancement in the new dermal fillers

Dermal fillers are in the form of gel-like substances, which are injected beneath the skin to restore the lost volume, soften creases and smooth lines. It is also used to enhance facial contours; each year more than 1 million people prefer this popular facial transformation treatment to restore the wrinkles and appearance of facial lines. Dermal fillers are an effective treatment way to look younger without downtime or surgery. Dermal fillers drug is injected into the skin which helps in filling the facial wrinkles. There are different types of dermal fillers drugs available, the most common types are Calcium hydroxylapatite, Hyaluronic acid, Polyalkylimide, Polylactic acid, and others. Advancement in the dermal fillers brands will help to boost the demand of the market.

Restrains/ Challenges

- High cost of aesthetic procedures

Cost is always a consideration in the elective procedure. The cost of dermal filler is depending on the type of filler and the amount is used in the treatment. Also, the treatment cost is based on the qualifications and expertise of the person performing the dermal fillers treatment. The cosmetic treatment of dermal filler is a safe outpatient procedure and it is a very popular treatment for restoring lost volume and treating some signs of aging, but the high cost of the procedures is expected to hamper the demand of the market

- Lack of skilled professionals

Aesthetic treatment procedures are of different type’s laser-based technology, energy-based technology, and intense pulse light among others. All such techniques need qualified interpersonal skills in order to carry out effective treatment.

Moreover, rapid technological advancement in this field also lead to lack of skilled professionals. Lack of skilled professionals pose major challenge while device handling and carrying out surgical procedures.

- Availability of alternatives

Various open surgical procedures act as an alternative treatment approach for hair removal and skin related surgeries. Aesthetic techniques using intense pulse light, lasers and other energy based devices poses several side effects and also costs too high which led the patients to look for other alternative treatment options such as resection, among others. Moreover, patient favorable conditions also reflect the need of resection procedure. Below provided study results depicts the importance of alternative treatment procedures.

Recent Developments

- In April 2022, Sinclair Pharma announced the company has received European CE mark for Perfectha Lidocaine in the treatment of wrinkle correction, facial contouring, and volume restoration. This CE certificate results in launch of Perfectha Lidocaine in the UK and all major European markets.

Dermal Fillers Market Segmentation

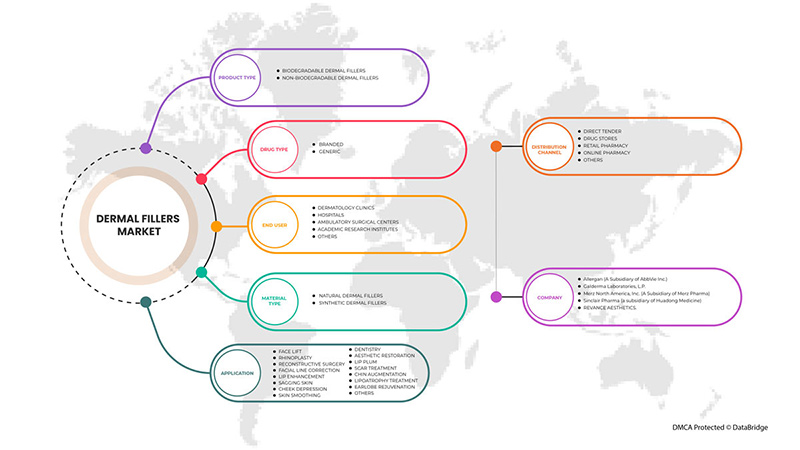

The dermal fillers market is segmented on the basis of product type, material type, application, drug type, end user, and distribution channel. The growth among segments helps you analyses niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

By Product Type

- Biodegradable Dermal Fillers

- Non-Biodegradable Dermal Fillers

On the basis of product type, the dermal fillers market is segmented into biodegradable dermal fillers and non-biodegradable dermal fillers.

By Material Type

- Natural Dermal Fillers

- Synthetic Dermal Fillers

On the basis of material type, the market is segmented into natural dermal fillers and synthetic dermal fillers.

By Application

- Face Lift

- Rhinoplasty

- Reconstructive Surgery

- Facial Line Correction

- Lip Enhancement

- Sagging Skin

- Cheek Depression

- Skin Smoothing

- Dentistry

- Aesthetic Restoration

- Lip Plum

- Scar Treatment

- Chin Augmentation

- Lipoatrophy Treatment

- Earlobe Rejuvenation

- Others

On the basis of application, the market is segmented into face lift, rhinoplasty, reconstructive surgery, facial line correction, lip enhancement, sagging skin, cheek depression, skin smoothing, dentistry, aesthetic restoration, scar treatment, chin augmentation, lipoatrophy treatment, earlobe rejuvenation and others.

By Drug Type

- Branded

- Generic

On the basis of drug type, the market is segmented into branded and generic.

By End User

- Dermatology Clinics

- Hospitals

- Ambulatory Surgical Centers

- Academic Research Institutes

- Others

On the basis of end user, the market is segmented into dermatology clinics, ambulatory surgical centers, hospitals, academic research institutes and others.

By Distribution Channel

- Direct Tender

- Drug Stores

- Retail Pharmacy

- Online Pharmacy

- Others

On the basis of distribution channel, the market is segmented into direct tender, drug stores, retail pharmacy, online pharmacy and others.

Dermal Fillers Market Regional Analysis/Insights

The dermal fillers market is analyzed and market size insights and trends are provided by country, product type, material type, application, drug type, end user, and distribution channel as referenced above.

The countries covered in the dermal fillers market report are Japan, Australia, South Korea, China, India, Thailand, Singapore, Malaysia, Indonesia, Philippines and Rest of Asia-Pacific.

Japan is expected to dominate the market due to healthcare infrastructure and strategic collaborations among key market players in the region.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Dermal Fillers Market Share Analysis

The dermal fillers market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus on the dermal fillers market.

Some of the major players operating in the market are Allergan(A Subsidiary of Abbvie, Inc.), Prollenium Medical Technologies, Suneva Medical, Revance Therapeutics, Inc., FillMed Laboratories, Anika Therapeutics, Inc, Ipsen Pharma, BIOXIS Pharmaceuticals, Zimmer Aesthetic, Zhejiang Jingjia Medical Technology Co. Ltd., Medytox, Contura International ltd., Shanghai Reyoungel Medical Technology Company Limited, Humedix (A subsidiary of HUONS GLOBAL),Galderma Laboratories, L.P., Merz North America, Inc. (A Subsidiary of Merz Pharma),Croma-Pharma GmbH, Sinclair Pharma (A Subsidiary of Huadong Medicine Co., Ltd.),Teoxane, BioPlus Co., Ltd., Amalian, Givaudan, Mesoestetic, Sosum Global, DSM, IBSA Nordic ApS,among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC DERMAL FILLERS MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCTS LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

4.3 EPIDEMIOLOGY PROCEDURES PER COUNTRY

5 REGULATIONS OF ASIA PACIFIC DERMAL FILLERS MARKET

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING PREVALENCE OF MINIMALLY INVASIVE PROCEDURES

6.1.2 INCREASING GERIATRIC POPULATION

6.1.3 TECHNOLOGICAL ADVANCEMENTS IN DERMAL FILLERS

6.1.4 STRATEGIC INITIATIVES BY MARKET PLAYERS

6.2 RESTRAINTS

6.2.1 HIGH COST OF AESTHETIC PROCEDURES

6.2.2 ESCALATING PRODUCT RECALL

6.2.3 FDA GUIDELINES FOR ADVANCED DERMAL FILLER INJECTORS

6.3 OPPORTUNITIES

6.3.1 INCREASING HEALTHCARE EXPENDITURE

6.3.2 INCREASING FUNDING ACTIVITIES FOR AESTHETIC RESEARCH

6.3.3 ADVANCEMENT IN THE NEW DERMAL FILLERS

6.3.4 INCREASING COMPENSATION AND ACCIDENTAL CLAIMS FOR DERMAL FILLER

6.4 CHALLENGES

6.4.1 LACK OF SKILLED PROFESSIONALS

6.4.2 AVAILABILITY OF ALTERNATIVES

7 ASIA PACIFIC DERMAL FILLERS MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 BIODEGRADABLE DERMAL FILLERS

7.2.1 TEMPORARY BIODEGRADABLE

7.2.2 SEMI-PERMANENT BIODEGRADABLE

7.3 NON-BIODEGRADABLE DERMAL FILLERS

8 ASIA PACIFIC DERMAL FILLERS MARKET, BY MATERIAL TYPE

8.1 OVERVIEW

8.2 NATURAL DERMAL FILLERS

8.2.1 HYALURONIC ACID

8.2.1.1 BY TYPE

8.2.1.1.1 MONOPHASIC FILLERS

8.2.1.2 BY TYPE

8.2.1.2.1 MONODENSIFIED

8.2.1.2.2 POLYDENSIFIED

8.2.1.2.3 BIPHASIC FILLERS

8.2.1.3 BY MATERIAL TYPE

8.2.1.3.1 SINGLE-PHASE

8.2.1.3.2 DUPLEX-PHASE

8.2.1.4 BY APPLICATION

8.2.1.4.1 FACE LIFT

8.2.1.4.2 RHINOPLASTY

8.2.1.4.3 RECONSTRUCTIVE SURGERY

8.2.1.4.4 FACIAL LINE CORRECTION

8.2.1.4.5 LIP ENHANCEMENT

8.2.1.4.6 SAGGING SKIN

8.2.1.4.7 CHEEK DEPRESSION

8.2.1.4.8 SKIN SMOOTHING

8.2.1.4.9 DENTISTRY

8.2.1.4.10 AESTHETIC RESTORATION

8.2.1.4.11 SCAR TREATMENT

8.2.1.4.12 CHIN AUGMENTATION

8.2.1.4.13 LIPOATROPHY TREATMENT

8.2.1.4.14 EARLOBE REJUVENATION

8.2.1.4.15 OTHERS

8.2.2 FAT

8.2.2.1 BY APPLICATION

8.2.2.1.1 FACE LIFT

8.2.2.1.2 RHINOPLASTY

8.2.2.1.3 RECONSTRUCTIVE SURGERY

8.2.2.1.4 FACIAL LINE CORRECTION

8.2.2.1.5 LIP ENHANCEMENT

8.2.2.1.6 SAGGING SKIN

8.2.2.1.7 CHEEK DEPRESSION

8.2.2.1.8 SKIN SMOOTHING

8.2.2.1.9 DENTISTRY

8.2.2.1.10 AESTHETIC RESTORATION

8.2.2.1.11 SCAR TREATMENT

8.2.2.1.12 CHIN AUGMENTATION

8.2.2.1.13 LIPOATROPHY TREATMENT

8.2.2.1.14 EARLOBE REJUVENATION

8.2.2.1.15 OTHERS

8.2.3 COLLAGEN

8.2.3.1 BY APPLICATION

8.2.3.1.1 FACE LIFT

8.2.3.1.2 RHINOPLASTY

8.2.3.1.3 RECONSTRUCTIVE SURGERY

8.2.3.1.4 FACIAL LINE CORRECTION

8.2.3.1.5 LIP ENHANCEMENT

8.2.3.1.6 SAGGING SKIN

8.2.3.1.7 CHEEK DEPRESSION

8.2.3.1.8 SKIN SMOOTHING

8.2.3.1.9 DENTISTRY

8.2.3.1.10 AESTHETIC RESTORATION

8.2.3.1.11 SCAR TREATMENT

8.2.3.1.12 CHIN AUGMENTATION

8.2.3.1.13 LIPOATROPHY TREATMENT

8.2.3.1.14 EARLOBE REJUVENATION

8.2.3.1.15 OTHERS

8.2.4 OTHERS

8.3 SYNTHETIC DERMAL FILLERS

8.3.1 POLY-L-LACTIC ACID

8.3.1.1 BY APPLICATION

8.3.1.1.1 FACE LIFT

8.3.1.1.2 RHINOPLASTY

8.3.1.1.3 RECONSTRUCTIVE SURGERY

8.3.1.1.4 FACIAL LINE CORRECTION

8.3.1.1.5 LIP ENHANCEMENT

8.3.1.1.6 SAGGING SKIN

8.3.1.1.7 CHEEK DEPRESSION

8.3.1.1.8 SKIN SMOOTHING

8.3.1.1.9 DENTISTRY

8.3.1.1.10 AESTHETIC RESTORATION

8.3.1.1.11 SCAR TREATMENT

8.3.1.1.12 CHIN AUGMENTATION

8.3.1.1.13 LIPOATROPHY TREATMENT

8.3.1.1.14 EARLOBE REJUVENATION

8.3.1.1.15 OTHERS

8.3.2 CALCIUM HYDROXYLAPATITE

8.3.2.1 BY APPLICATION

8.3.2.1.1 FACE LIFT

8.3.2.1.2 RHINOPLASTY

8.3.2.1.3 RECONSTRUCTIVE SURGERY

8.3.2.1.4 FACIAL LINE CORRECTION

8.3.2.1.5 LIP ENHANCEMENT

8.3.2.1.6 SAGGING SKIN

8.3.2.1.7 CHEEK DEPRESSION

8.3.2.1.8 SKIN SMOOTHING

8.3.2.1.9 DENTISTRY

8.3.2.1.10 AESTHETIC RESTORATION

8.3.2.1.11 SCAR TREATMENT

8.3.2.1.12 CHIN AUGMENTATION

8.3.2.1.13 LIPOATROPHY TREATMENT

8.3.2.1.14 EARLOBE REJUVENATION

8.3.2.1.15 OTHERS

8.3.3 POLYMETHYL-METHACRYLATE MICROSPHERES (PMMA)

8.3.3.1 BY APPLICATION

8.3.3.1.1 FACE LIFT

8.3.3.1.2 RHINOPLASTY

8.3.3.1.3 RECONSTRUCTIVE SURGERY

8.3.3.1.4 FACIAL LINE CORRECTION

8.3.3.1.5 LIP ENHANCEMENT

8.3.3.1.6 SAGGING SKIN

8.3.3.1.7 CHEEK DEPRESSION

8.3.3.1.8 SKIN SMOOTHING

8.3.3.1.9 DENTISTRY

8.3.3.1.10 AESTHETIC RESTORATION

8.3.3.1.11 SCAR TREATMENT

8.3.3.1.12 CHIN AUGMENTATION

8.3.3.1.13 LIPOATROPHY TREATMENT

8.3.3.1.14 EARLOBE REJUVENATION

8.3.3.1.15 OTHERS

8.3.4 POLYALKYLIMIDE

8.3.4.1 BY APPLICATION

8.3.4.1.1 FACE LIFT

8.3.4.1.2 RHINOPLASTY

8.3.4.1.3 RECONSTRUCTIVE SURGERY

8.3.4.1.4 FACIAL LINE CORRECTION

8.3.4.1.5 LIP ENHANCEMENT

8.3.4.1.6 SAGGING SKIN

8.3.4.1.7 CHEEK DEPRESSION

8.3.4.1.8 SKIN SMOOTHING

8.3.4.1.9 DENTISTRY

8.3.4.1.10 AESTHETIC RESTORATION

8.3.4.1.11 SCAR TREATMENT

8.3.4.1.12 CHIN AUGMENTATION

8.3.4.1.13 LIPOATROPHY TREATMENT

8.3.4.1.14 EARLOBE REJUVENATION

8.3.4.1.15 OTHERS

8.3.5 OTHERS

9 ASIA PACIFIC DERMAL FILLERS MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 FACE LIFT

9.2.1 DEEP PLANE/SMAS FACE

9.2.2 MINI FACE LIFT

9.2.3 MID-FACE LIFT

9.2.4 JAW LINE

9.2.5 CUTANEOUS LIFT

9.2.6 TEMPORAL OR BROW LIFT

9.2.7 LIQUID FACE LIFT

9.2.8 OTHERS

9.2.8.1 JUVEDERM

9.2.8.2 RESTYLANE

9.2.8.3 SCULPTRA

9.2.8.4 DYSPORT

9.2.8.5 OTHERS

9.3 RHINOPLASTY

9.3.1 JUVEDERM

9.3.1.1 JUVEDERM XC

9.3.1.2 JUVEDERM ULTRA XC

9.3.1.3 JUVEDERM VOLUMA

9.3.1.4 JUVEDERM VOLBELLA

9.3.1.5 JUVEDERM VOLLURE XC

9.3.2 RESTYLANE

9.3.2.1 RESTYLANE SILK

9.3.2.2 RESTYLANE LYFT

9.3.2.3 RESTYLANE REFYNE

9.3.2.4 RESTYLANE DEFYNE

9.3.2.5 RESTYLANE-L

9.3.3 OTHERS

9.4 RECONSTRUCTIVE SURGERY

9.4.1 JUVEDERM

9.4.2 RESTYLANE

9.4.3 OTHERS

9.5 FACIAL LINE CORRECTION

9.5.1 DYNAMIC WRINKLES

9.5.2 STATIC WRINKLES

9.5.3 WRINKLE FOLDS

9.5.3.1 FOREHEAD LINES

9.5.3.2 WORRY LINES

9.5.3.3 BUNNIES

9.5.3.4 CROW’S FEET

9.5.3.5 LAUGH LINES

9.5.3.6 LIP LINES

9.5.3.7 MARIONETTE LINES

9.5.3.8 OTHERS

9.5.3.8.1 JUVEDERM

9.5.3.8.2 RESTYLANE

9.5.3.8.3 RADIESSE

9.5.3.8.4 BELOTERO

9.5.3.8.5 OTHERS

9.6 LIP ENHANCEMENT

9.6.1 JUVEDERM

9.6.1.1 JUVÉDERM XC

9.6.1.2 JUVÉDERM ULTRA XC

9.6.1.3 JUVÉDERM VOLUMA

9.6.1.4 JUVÉDERM VOLBELLA

9.6.1.5 JUVÉDERM VOLLURE XC

9.6.2 RESTYLANE

9.6.2.1 RESTYLANE SILK

9.6.2.2 RESTYLANE LYFT

9.6.2.3 RESTYLANE REFYNE

9.6.2.4 RESTYLANE DEFYNE

9.6.2.5 RESTYLANE-L

9.6.3 BELOTERO BALANCE

9.6.4 REVANESSE VERSA

9.6.5 HYLAFORM

9.6.6 PREVELLE SILK

9.6.7 OTHERS

9.7 SAGGING SKIN

9.7.1 JUVEDERM

9.7.2 RESTYLANE

9.7.3 BELOTERO

9.7.4 OTHERS

9.8 CHEEK DEPRESSION

9.8.1 JUVEDERM VOLUMA

9.8.2 RESTYLANE-LYFT

9.8.3 SCULPTRA

9.8.4 RADIESSE

9.8.5 OTHERS

9.9 SKIN SMOOTHENING

9.9.1 RESTYLANE

9.9.2 BELOTERO

9.9.3 BELLAFIL

9.9.4 OTHERS

9.1 DENTISTRY

9.10.1 JUVEDERM

9.10.2 RESTYLANE

9.10.3 RADIESSE

9.10.4 OTHERS

9.11 AESTHETIC RESTORATION

9.11.1 JUVEDERM

9.11.1.1 JUVEDERM ULTRA XC

9.11.1.2 JUVEDERM VOLLURE XC

9.11.1.3 JUVEDERM VOLBELLA XC

9.11.2 RESTYLANE

9.11.2.1 RESTYLANE-L

9.11.2.2 RESTYLANE SILK

9.11.2.3 RESTYLANE REFYNE AND DEFYNE

9.11.2.4 RESTYLANE LYFT

9.12 REVANESSE VERSA

9.13 SCULPTRA

9.14 RHA

9.14.1 RHA 2

9.14.2 RHA 3

9.14.3 RHA 4

9.15 BELLAFIL

9.16 BELOTERO BALANCE

9.17 OTHERS

9.18 LIP PLUM

9.18.1 RESTYLANE

9.18.2 BELOTERO

9.18.3 OTHERS

9.19 SCAR TREATMENT

9.19.1 JUVEDERM

9.19.2 RESTYLANE

9.19.3 RADIESSE

9.19.4 BELOTERO

9.19.5 PERLANE

9.19.6 OTHERS

9.19.6.1 KELOID SCARS

9.19.6.2 CONTRACTURE SCARS

9.19.6.3 HYPERTROPHIC SCARS

9.19.6.4 ACNE SCARS

9.19.6.5 OTHERS

9.2 CHIN AUGMENTATION

9.20.1 JUVEDERM VOLUMA XC

9.20.2 RESTYLANE

9.20.3 OTHERS

9.21 LIPOATROPHY TREATMENT

9.21.1 SCULPTRA

9.21.2 OTHERS

9.22 EARLOBE REJUVENATION

9.22.1 JUVEDERM

9.22.2 RESTYLANE

9.22.3 SCULPTRA

9.22.4 BELOTERO

9.22.5 ELLANSE

9.22.6 OTHERS

9.23 OTHERS

10 ASIA PACIFIC DERMAL FILLERS MARKET, BY DRUG TYPE

10.1 OVERVIEW

10.2 BRANDED

10.2.1 JUVEDERM

10.2.1.1 JUVÉDERM XC

10.2.1.2 JUVÉDERM ULTRA XC

10.2.1.3 JUVÉDERM ULTRA PLUS XC

10.2.1.4 JUVÉDERM VOLBELLA

10.2.1.5 JUVÉDERM VOLUMA

10.2.1.6 JUVÉDERM VOLLURE

10.2.2 RESTYLANE

10.2.2.1 RESTYLANE-L

10.2.2.2 RESTYLANE REFYNE

10.2.2.3 RESTYLANE DEFYNE

10.2.2.4 RESTYLANE LYFT

10.2.2.5 RESTYLANE SILK

10.2.2.6 RESTYLANE KYSSE

10.2.2.7 RESTYLANE CONTOUR

10.2.3 RADIESSE

10.2.4 SCULPTRA

10.2.5 ELLANSE

10.2.5.1 ELLANSE-S

10.2.5.2 ELLANSE-M

10.2.5.3 ELLANSE-L

10.2.5.4 ELLANSE-E

10.2.6 BELLAFILL

10.2.7 AQUAMID

10.2.8 OTHERS

10.3 GENERIC

11 ASIA PACIFIC DERMAL FILLERS MARKET, BY END USER

11.1 OVERVIEW

11.2 DERMATOLOGY CLINICS

11.3 HOSPITALS

11.4 AMBULATORY SURGICAL CENTERS

11.5 ACADEMIC RESEARCH INSTITUTES

11.6 OTHERS

12 ASIA PACIFIC DERMAL FILLERS MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT TENDER

12.3 DRUG STORES

12.4 RETAIL PHARMACY

12.5 ONLINE PHARMACY

12.6 OTHERS

13 ASIA PACIFIC DERMAL FILLERS MARKET, BY GEOGRAPHY

13.1 ASIA-PACIFIC

13.1.1 JAPAN

13.1.2 AUSTRALIA

13.1.3 SOUTH KOREA

13.1.4 CHINA

13.1.5 INDIA

13.1.6 THAILAND

13.1.7 SINGAPORE

13.1.8 MALAYSIA

13.1.9 INDONESIA

13.1.10 PHILIPPINES

13.1.11 REST OF ASIA-PACIFIC

14 ASIA PACIFIC DERMA FILLERS MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 ALLERGAN (A SUBSIDIARY OF ABBVIE INC.)

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 GALDERMA LABORATORIES, L.P

16.2.1 COMPANY SNAPSHOT

16.2.2 COMPANY SHARE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENTS

16.3 MERZ NORTH AMERICA, INC (A SUBSIDIARY OF MERZ PHARMA)

16.3.1 COMPANY SNAPSHOT

16.3.2 COMPANY SHARE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENTS

16.4 SINCLAIR PHARMA (A SUBSIDIARY OF HUADONG MEDICINE)

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 REVANCE THERAPEUTICS, INC.

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 AMALIAN

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 ANIKA THERAPEUTICS, INC.

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 BIOPLUS CO., LTD.

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENTS

16.9 BIOXIS PHARMACEUTICALS

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 CONTURA INTERNATIONAL LTD.

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 CROMA-PHARMA GMBH

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 DSM

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 FILLMED

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 GIVAUDAN

16.14.1 COMPANY SNAPSHOT

16.14.2 RECENT FINANCIALS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENT

16.15 HUMEDIX (A SUBSIDIARY OF HUONS ASIA PACIFIC)

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENTS

16.16 IBSA FARMACEUTICI ITALIA SRL (A SUBSIDIARY OF IBSA INSTITUT BIOCHIMIQUE SA)

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENT

16.17 IPSEN PHARMA.

16.17.1 COMPANY SNAPSHOT

16.17.2 REVENUE ANALYSIS

16.17.3 PRODUCT PORTFOLIO

16.17.4 RECENT DEVELOPMENT

16.18 MEDYTROX

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENTS

16.19 MESOESTETIC

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENTS

16.2 PROLLENIUM MEDICAL TECHNOLOGIES

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENT

16.21 SHANGHAI REYOUNGEL MEDICAL TECHNOLOGY COMPANY LIMITED

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENTS

16.22 SOSUM ASIA PACIFIC

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENT

16.23 SUNEVA MEDICAL

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 RECENT DEVELOPMENT

16.24 TEOXANE SA

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 RECENT DEVELOPMENTS

16.25 ZHEJIANG JINGJIA MEDICAL TECHNOLOGY CO., LTD

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT DEVELOPMENT

16.26 ZIMMER AESTHETICS

16.26.1 COMPANY SNAPSHOT

16.26.2 PRODUCT PORTFOLIO

16.26.3 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 COST OF DERMAL FILLERS

TABLE 2 COST OF PROCEDURE

TABLE 3 ASAPS PROCEDURE FACTS

TABLE 4 COMPENSATION COST FOR DERMAL FILLERS

TABLE 5 ASIA PACIFIC DERMAL FILLERS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC DERMAL FILLERS MARKET, BY PRODUCT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 7 ASIA PACIFIC BIODEGRADABLE DERMAL FILLERS IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC BIODEGRADABLE DERMAL FILLERS IN DERMAL FILLERS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC BIODEGRADABLE DERMAL FILLERS IN DERMAL FILLERS MARKET, BY PRODUCT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 10 ASIA PACIFIC NON-BIODEGRADABLE DERMAL FILLERS IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC DERMAL FILLERS MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC NATURAL DERMAL FILLERS IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC NATURAL DERMAL FILLERS IN DERMAL FILLERS MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC HYALURONIC ACID IN DERMAL FILLERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC MONOPHASIC FILLERS IN DERMAL FILLERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC HYALURONIC ACID IN DERMAL FILLERS MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC HYALURONIC ACID IN DERMAL FILLERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC FAT IN DERMAL FILLERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC COLLAGEN IN DERMAL FILLERS MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC SYNTHETIC DERMAL FILLERS IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC SYNTHETIC DERMAL FILLERS IN DERMAL FILLERS MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC POLY-L-LACTIC ACID IN DERMAL FILLERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC CALCIUM HYDROXYLAPATITE IN DERMAL FILLERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC POLYMETHYL-METHACRYLATE MICROSPHERES (PMMA) IN DERMAL FILLERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 25 ASIA PACIFIC POLYALKYLIMIDE IN DERMAL FILLERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 26 ASIA PACIFIC DERMAL FILLERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 27 ASIA PACIFIC FACE LIFT IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 ASIA PACIFIC FACE LIFT IN DERMAL FILLERS MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 29 ASIA PACIFIC FACE LIFT IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 30 ASIA PACIFIC RHINOPLASTY IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 ASIA PACIFIC RHINOPLASTY IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 32 ASIA PACIFIC JUVEDERM IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 33 ASIA PACIFIC RESTYLANE IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 34 ASIA PACIFIC RECONSTRUCTIVE SURGERY IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 ASIA PACIFIC RECONSTRUCTIVE SURGERY IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 36 ASIA PACIFIC FACIAL LINE CORRECTION IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 ASIA PACIFIC FACIAL LINE CORRECTION IN DERMAL FILLERS MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 38 ASIA PACIFIC FACIAL LINE CORRECTION IN DERMAL FILLERS MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 39 ASIA PACIFIC FACIAL LINE CORRECTION IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 40 ASIA PACIFIC LIP ENHANCEMENT IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 ASIA PACIFIC LIP ENHANCEMENT IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 42 ASIA PACIFIC JUVEDERM IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 43 ASIA PACIFIC RESTYLANE IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 44 ASIA PACIFIC SAGGING SKIN IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 ASIA PACIFIC SAGGING SKIN IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 46 ASIA PACIFIC CHEEK DEPRESSION IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 47 ASIA PACIFIC CHEEK DEPRESSION IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 48 ASIA PACIFIC SKIN SMOOTHENING IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 49 ASIA PACIFIC SKIN SMOOTHENING IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 50 ASIA PACIFIC DENTISTRY IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 51 ASIA PACIFIC DENTISTRY IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 52 ASIA PACIFIC AESTHETIC RESTORATION IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 53 ASIA PACIFIC AESTHETIC RESTORATION IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 54 ASIA PACIFIC JUVEDERM IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 55 ASIA PACIFIC RESTYLANE IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 56 ASIA PACIFIC RHA IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 57 ASIA PACIFIC LIP PLUM IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 58 ASIA PACIFIC LIP PLUM IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 59 ASIA PACIFIC SCAR TREATMENT IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 60 ASIA PACIFIC SCAR TREATMENT IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 61 ASIA PACIFIC SCAR TREATMENT IN DERMAL FILLERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 ASIA PACIFIC CHIN AUGMENTATION IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 63 ASIA PACIFIC CHIN AUGMENTATION IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 64 ASIA PACIFIC LIPOATROPHY TREATMENT IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 65 ASIA PACIFIC LIPOATROPHY TREATMENT IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 66 ASIA PACIFIC EARLOBE REJUVENTION IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 67 ASIA PACIFIC EARLOBE REJUVENTION IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 68 ASIA PACIFIC OTHERS IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 69 ASIA PACIFIC DERMAL FILLERS MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 70 ASIA PACIFIC BRANDED IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 71 ASIA PACIFIC BRANDED IN DERMAL FILLERS MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 72 ASIA PACIFIC JUVEDERM IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 73 ASIA PACIFIC RESTYLANE IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 74 ASIA PACIFIC ELLANSE IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 75 ASIA PACIFIC GENERIC IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 76 ASIA PACIFIC DERMAL FILLERS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 77 ASIA PACIFIC DERMATOLOGY CLINICS IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 78 ASIA PACIFIC HOSPITALS IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 79 ASIA PACIFIC AMBULATORY SURGICAL CENTERS IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 80 ASIA PACIFIC ACADEMIC RESEARCH INSTITUTES IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 81 ASIA PACIFIC OTHERS IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 82 ASIA PACIFIC DERMAL FILLERS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 83 ASIA PACIFIC DIRECT TENDER IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 84 ASIA PACIFIC DRUG STORES IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 85 ASIA PACIFIC RETAIL PHARMACY IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 86 ASIA PACIFIC ONLINE PHARMACY IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 87 ASIA PACIFIC OTHERS IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 ASIA PACIFIC DERMAL FILLERS MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC DERMAL FILLERS MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC DERMAL FILLERS MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC DERMAL FILLERS MARKET : ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC DERMAL FILLERS MARKET : COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC DERMAL FILLERS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC DERMAL FILLERS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC DERMAL FILLERS MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 ASIA PACIFIC DERMAL FILLERS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 ASIA PACIFIC DERMAL FILLERS MARKET: SEGMENTATION

FIGURE 11 RISING DEMAND FOR ANTI-AGING DRUGS, AND GROWING POPULARITY OF NON-SURGICAL OR MINIMALLY INVASIVE AESTHETICS PROCEDURES ARE EXPECTED TO DRIVE THE ASIA PACIFIC DERMAL FILLERS MARKET IN THE FORECAST PERIOD 2022 TO 2029

FIGURE 12 BIODEGRADABLE DERMAL FILLER SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC DERMAL FILLERS MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF ASIA PACIFIC DERMAL FILLERS MARKET

FIGURE 14 ASIA PACIFIC DERMAL FILLERS MARKET: BY PRODUCT TYPE, 2021

FIGURE 15 ASIA PACIFIC DERMAL FILLERS MARKET: BY PRODUCT TYPE, 2022-2029 (USD MILLION)

FIGURE 16 ASIA PACIFIC DERMAL FILLERS MARKET: BY PRODUCT TYPE, CAGR (2022-2029)

FIGURE 17 ASIA PACIFIC DERMAL FILLERS MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 18 ASIA PACIFIC DERMAL FILLERS MARKET: BY MATERIAL TYPE, 2021

FIGURE 19 ASIA PACIFIC DERMAL FILLERS MARKET, BY MATERIAL TYPE, 2022-2029 (USD MILLION)

FIGURE 20 ASIA PACIFIC DERMAL FILLERS MARKET: BY MATERIAL TYPE, CAGR (2022-2029)

FIGURE 21 ASIA PACIFIC DERMAL FILLERS MARKET: BY MATERIAL TYPE, LIFELINE CURVE

FIGURE 22 ASIA PACIFIC DERMAL FILLERS MARKET : BY APPLICATION, 2021

FIGURE 23 ASIA PACIFIC DERMAL FILLERS MARKET : BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 24 ASIA PACIFIC DERMAL FILLERS MARKET : BY APPLICATION, CAGR (2022-2029)

FIGURE 25 ASIA PACIFIC DERMAL FILLERS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 26 ASIA PACIFIC DERMAL FILLERS MARKET: BY DRUG TYPE, 2021

FIGURE 27 ASIA PACIFIC DERMAL FILLERS MARKET, BY DRUG TYPE, 2022-2029 (USD MILLION)

FIGURE 28 ASIA PACIFIC DERMAL FILLERS MARKET: BY DRUG TYPE, CAGR (2022-2029)

FIGURE 29 ASIA PACIFIC DERMAL FILLERS MARKET: BY DRUG TYPE, LIFELINE CURVE

FIGURE 30 ASIA PACIFIC DERMAL FILLERS MARKET: BY END USER, 2021

FIGURE 31 ASIA PACIFIC DERMAL FILLERS MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 32 ASIA PACIFIC DERMAL FILLERS MARKET: BY END USER, CAGR (2022-2029)

FIGURE 33 ASIA PACIFIC DERMAL FILLERS MARKET: BY END USER, LIFELINE CURVE

FIGURE 34 ASIA PACIFIC DERMAL FILLERS MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 35 ASIA PACIFIC DERMAL FILLERS MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 36 ASIA PACIFIC DERMAL FILLERS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 37 ASIA PACIFIC DERMAL FILLERS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 38 ASIA-PACIFIC DERMAL FILLERS MARKET: SNAPSHOT (2021)

FIGURE 39 ASIA-PACIFIC DERMAL FILLERS MARKET: BY COUNTRY (2021)

FIGURE 40 ASIA-PACIFIC DERMAL FILLERS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 41 ASIA-PACIFIC DERMAL FILLERS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 42 ASIA-PACIFIC DERMAL FILLERS MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 43 ASIA PACIFIC DERMA FILLERS MARKET: COMPANY SHARE 2021 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.