Asia Pacific Depression Screening Market

Market Size in USD Million

CAGR :

%

USD

747.72 Million

USD

1,673.01 Million

2024

2032

USD

747.72 Million

USD

1,673.01 Million

2024

2032

| 2025 –2032 | |

| USD 747.72 Million | |

| USD 1,673.01 Million | |

|

|

|

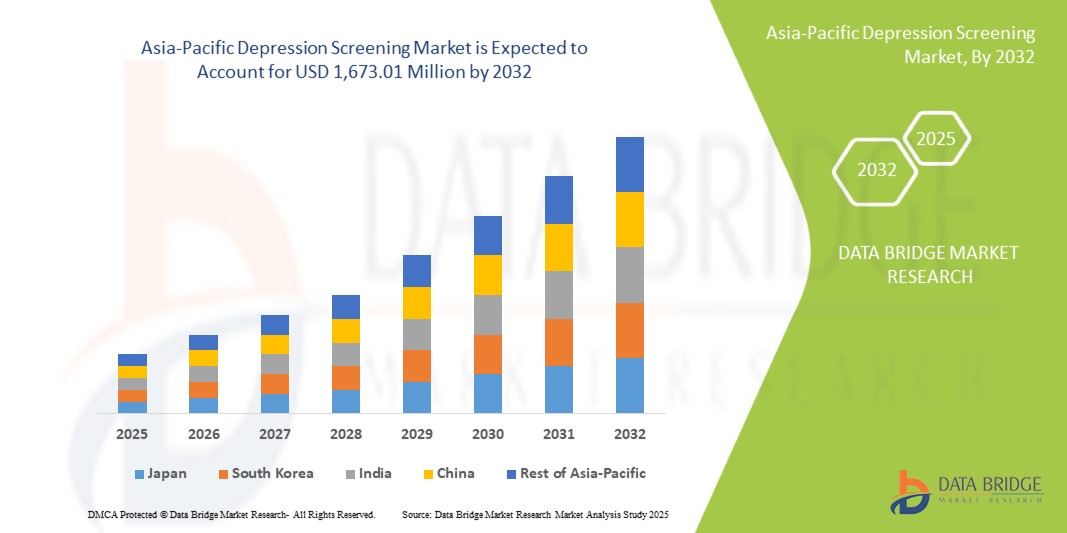

Depression Screening Market Analysis

Asia-Pacific depression screening market is rapidly growing due to increased mental health awareness, expanding healthcare infrastructure, and supportive government policies. The rising prevalence of depression across the region, especially in countries such as Japan, China, and India, is driving demand for early detection and screening tools. Technological advancements, including telehealth and AI-driven screening tools, have enhanced access and scalability, allowing for more effective outreach, particularly in rural or underserved areas. Furthermore, mental health is receiving greater recognition within workplaces, educational institutions, and healthcare programs, spurring initiatives for routine depression screening and early intervention.

Depression Screening Market Size

The Asia-Pacific Depression Screening Market size was valued at USD 747.72 million in 2024 and is projected to reach USD 1,673.01 million by 2032, with a CAGR of 10.59 % during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline.

Depression Screening Market Trends

“Rise in Focus on Integration of Digital and Mobile Health Screening Tools”

The prominent trend in the Asia-Pacific depression screening market is the growing integration of digital and mobile health screening tools to increase accessibility and early diagnosis. With the rising penetration of smartphones and internet access across the region, digital health platforms are offering mental health screening tools that make it easier for individuals to access resources without visiting a clinical setting. This trend is particularly relevant in countries where mental health stigma remains a barrier to seeking in-person care. By providing online questionnaires and self-assessment tools, digital platforms are empowering users to evaluate their mental health status confidentially and take the first step toward seeking professional help if needed. The convenience and privacy offered by digital screening tools are significantly expanding the reach of mental health services, especially among younger, tech-savvy populations.

Governments and healthcare organizations in countries such as Japan, China, and India are increasingly recognizing the potential of these tools and are partnering with digital health companies to support awareness campaigns and broaden mental health service delivery. The COVID-19 pandemic has further accelerated this shift, highlighting the importance of accessible mental health resources. Various mobile applications and telemedicine services have emerged, incorporating depression screening as a core feature. This trend not only aligns with the region’s digital health initiatives but also provides a scalable solution to address the growing mental health crisis, facilitating early intervention and potentially reducing the burden on healthcare systems.

Report Scope and Depression Screening Market Segmentation

|

Attributes |

Depression Screening Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

China, Japan, India, South Korea, Australia, Indonesia, Thailand, Singapore, Taiwan, Malaysia, Vietnam, Philippines, and Rest of Asia-Pacific |

|

Key Market Players |

Koninklijke Philips N.V. (Netherlands), Apple Inc. (U.S.), Google (U.S.), Lifetrack Medical Systems (Singapore), Genetic Technologies Limited (Australia), Headspace Inc. (U.S.), Pankhtech India Private Limited (India), and Pearson (India) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Depression Screening Market Definition

Depression screening is a brief, standardized process used to identify individuals who may be experiencing symptoms of depression. It typically involves questionnaires or checklists, such as the PHQ-9, to assess mood, behavior, and emotional well-being, helping healthcare providers determine if further evaluation or treatment is needed.

Depression Screening Market Dynamics

Drivers

- Increasing Prevalence of Depression and Anxiety Disorders

The increasing prevalence of depression and anxiety disorders across the Asia-Pacific region is a significant driver for the depression screening market, as rising cases of mental health issues amplify the need for accessible and effective diagnostic solutions. Socioeconomic stressors, rapid urbanization, and the ongoing pressures of modernization are contributing factors to the growing incidence of these disorders. In addition, changing social dynamics and increased awareness about mental health encourage individuals to seek diagnosis and support, thus driving demand for depression screening services. Governments and healthcare organizations in countries such as Japan, South Korea, and India are recognizing the mental health crisis, integrating depression screening into public health initiatives and policies to support early intervention and treatment. With advancements in digital health technologies, screening has become more accessible via mobile applications, telehealth platforms, and online consultations, expanding reach even to remote or underserved areas. As a result, the depression screening market in Asia-Pacific is experiencing growth driven by both public health mandates and rising mental health literacy, addressing the increasing need for timely and effective depression diagnosis.

For instance,

In March 2024, according to the article published by Nature, the analysis from "The Burden of Mental Disorders in Asian Countries, 1990–2019" reveals that mental disorders ranked as the eighth leading cause of disease burden in Asia, contributing to 5% of total Disability-Adjusted Life Years (DALYs) in 2019. Depression and anxiety disorders are prominent contributors, with depressive disorders accounting for 37.1% of mental disorder DALYs and anxiety disorders for 21.5%. These disorders also show high prevalence rates: anxiety disorders at 3258.72 per 100,000 population and depressive disorders at 3196.16 per 100,000. The findings indicate an urgent need for mental health resources and intervention strategies in Asia to address the growing burden of these conditions.

- Advancements in Depression Screening Technology

Advancements in depression screening technology are significantly driving the Asia-Pacific depression screening market by enhancing the accuracy, accessibility, and efficiency of mental health assessments. Innovations such as Artificial Intelligence (AI) and machine learning algorithms are being integrated into screening tools to analyze patient data more effectively, allowing for quicker and more accurate diagnoses. Moreover, the development of digital platforms and mobile applications has made screening more accessible, enabling individuals to conduct assessments from the comfort of their homes. These technologies can reach underserved populations in remote areas, reducing barriers to access and encouraging more people to seek help. In addition, telehealth services are being increasingly adopted, facilitating virtual consultations that integrate screening with professional support, thereby promoting early intervention. The convenience of real-time data collection and analysis not only streamlines the screening process but also allows healthcare providers to monitor patient progress over time. As these technological advancements continue to evolve, they are playing a crucial role in transforming the landscape of depression screening in the Asia-Pacific region, ultimately improving mental health outcomes and increasing the market's growth potential.

For instance,

In September 2024, according to the article published by JMIR Publications, advancements in depression screening technology through the application of Large Language Models (LLMs). This study validates the use of LLMs to analyze diary entries generated by users, demonstrating their capability to identify depressive symptoms effectively. The approach leverages natural language processing to interpret the nuances in text data, providing a novel, scalable method for digital mental health screening. By offering a more accessible and real-time assessment of depression, this technology enhances early detection and intervention strategies, ultimately improving mental health outcomes. The performance of leading LLMs, such as ChatGPT with GPT-3.5 and GPT-4, was assessed with and without GPT-3.5 fine-tuning on the training data set. GPT-3.5 fine-tuning demonstrated superior performance in depression detection, achieving an accuracy of 0.902 and a specificity of 0.955.

Opportunities

- Integration Depression Screenings with Primary Care

Integrating depression screenings into routine primary care represents a significant opportunity for the Asia-Pacific depression screening market, transforming the landscape of mental health care in the region. By embedding mental health assessments into regular health check-ups, healthcare providers enhance early detection and intervention, which is crucial in managing depression effectively. This approach not only normalizes discussions around mental health but also ensures that individuals receive comprehensive care that addresses both physical and emotional well-being. The existing network of primary care facilities provides an accessible platform for screenings, reaching diverse populations, including those in remote or underserved areas. As healthcare systems increasingly recognize the importance of mental health, collaboration among primary care providers, mental health professionals, and policymakers becomes essential. This synergy fosters a supportive environment for patients, encouraging them to seek help without stigma. The focus on integrated care models in the region further reinforces this opportunity, positioning primary care settings as vital touchpoints for improving mental health outcomes and expanding access to necessary support services. Overall, this integration paves the way for a more holistic approach to health care, ultimately benefiting individuals and communities throughout the Asia-Pacific region.

For instance,

In September 2021, according to the article published by NCBI, study involving 5,138 patients across 85 Australian general practices revealed that 1 in 16 patients had unidentified or untreated depressive or anxious symptoms. This highlights the critical need for mental health screening in primary care, positioning it alongside other routinely screened diseases. Such insights present a valuable opportunity to integrate depression screening in the Asia-Pacific market, driving growth and improved care.

- Increasing Adoption of Telehealth Services for Remote Depression Screening

The increasing adoption of telehealth services offers a transformative opportunity for the Asia-Pacific depression screening market. As healthcare providers embrace technology to enhance mental healthcare delivery, remote depression screening is becoming both practical and essential. This shift addresses significant barriers, particularly for individuals in remote or underserved areas who may otherwise lack access to mental health resources. With telehealth, patients can receive timely screenings and support from the comfort of their homes, reducing the stigma often associated with in-person visits. In addition, the flexibility of telehealth appointments allows for better scheduling, making it easier for people to seek help during times that suit them best. This accessibility is crucial for early detection and intervention, which are vital for effective mental health treatment. Furthermore, as more healthcare systems integrate depression screening into telehealth platforms, there is an opportunity for innovation in screening tools and methodologies, enhancing the overall effectiveness of care. Companies that develop tailored telehealth solutions focused on mental health can position themselves strategically in this growing market. As the demand for integrated and accessible mental health services continues to rise, the potential for expansion in the Asia-Pacific depression screening market is substantial, promising improved outcomes for communities across the region.

For instance,

In November 2023, according to the article published by Science Direct, remote cognitive-behavioral therapy (CBT) delivered via videoconference effectively improves depressive symptoms while achieving high patient satisfaction and a strong therapeutic alliance. These findings suggest that remote CBT is a viable option in Japanese clinical settings for treating major depression, highlighting a significant opportunity for remote depression screening in the Asia-Pacific market.

Restraints/Challenges

- Persistent Stigma Around Mental Health

The persistent stigma around mental health poses a significant challenge to the growth of the Asia-Pacific depression screening market. Despite rising awareness, many individuals continue to face societal prejudices that discourage them from seeking help. This stigma can lead to underreporting of depressive symptoms and a reluctance to participate in screening programs, ultimately hindering early detection and treatment. In cultures where mental health issues are often perceived as weaknesses, individuals may fear judgment or discrimination, which impacts their willingness to engage with mental health services. In addition, healthcare providers may also carry biases that affect their approach to diagnosing and treating depression, further perpetuating the cycle of stigma. This challenging environment can create barriers to effective communication between patients and providers, limiting the uptake and effectiveness of screening tools and interventions. As a result, the persistent stigma surrounding mental health remains a formidable obstacle to market growth in the Asia-Pacific region.

For instance,

In November 2022, according to the article published by the Australian Government Department of the Prime Minister and Cabinet, It is estimated that over four million Australians faced mental health-related stigma and discrimination in the past year. This pervasive stigma not only affects individuals' willingness to seek help but also limits the effectiveness of depression screening initiatives. Such widespread negative attitudes toward mental health present a significant challenge for the growth of the Asia-Pacific depression screening market.

- Safeguarding the Privacy and Security of Sensitive Mental Health Data

Safeguarding the privacy and security of sensitive mental health data represents a significant challenge for the Asia-Pacific depression screening market. As telehealth services and digital platforms become increasingly prevalent, the volume of personal health information being collected and shared has grown substantially. This rise brings with it heightened concerns about data breaches and unauthorized access, which can severely jeopardize patient confidentiality and trust in mental health services. In many cultures throughout the region, where stigma surrounding mental health remains a persistent issue, individuals may be particularly reluctant to disclose their personal information if they fear it could be exposed or misused. Such apprehensions can deter individuals from participating in screening programs, ultimately impacting the effectiveness of mental health initiatives. Furthermore, the potential for data misuse complicates regulatory compliance for healthcare providers, creating additional barriers to the implementation of effective screening measures. The intertwining of privacy concerns and cultural stigma not only poses risks to individual patients but can also hinder the overall growth of the depression screening market

For instance,

In January 2024, according to the article published by Law.asia Limited, the cyberattacks on AIIMS Delhi, a leading Indian healthcare institution, highlight the critical need for strong data privacy laws to protect health information and foster innovation. Currently, there is no comprehensive Indian law specifically regulating health data processing. This gap in legislation poses significant challenges for safeguarding sensitive mental health data, ultimately impacting the growth of the Asia-Pacific depression screening market.

The shortage of qualified IT workers capable of creating, deploying, and maintaining these technologies hinders innovation and makes it more difficult for the sector to adapt to changing healthcare demands as the demand for Depression Screening solutions rises. Healthcare organizations may find it difficult to improve patient care, streamline operations, and adjust to shifting regulatory requirements if they lack the talent to drive technology innovations and promote the adoption of Depression Screening solutions. Thus, the shortage of proficient experts for handling the software is expected to challenge market growth.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Depression Screening Market Scope

The market is segmented on the basis of depression type, diagnosis, and end-user. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Depression Type

- Major Depressive Disorder (MDD)

- Persistent Depressive Disorder (PDD)

- Others

Diagnosis

- Screening

- Clinical

- Telemedicine Platforms

- Brainwave Assessment Tools

- Others

- Non-Clinical

- PHQ-9 (Patient Health Questionnaire-9)

- Beck Depression Inventory (BDI)

- Psychological Test

- Geriatric Depression Scale (GDS)

- Clinical

- Lab Tests

- Genetic Test

- Bio marker Test

- Others

End User

- Hospital

- By Type

- Private

- Public

- By Size

- Large-Size Hospitals

- Medium-Size Hospitals

- Small-Size Hospitals

- By Type

- Specialty Clinics

- Medical Research Centers

- Others

Depression Screening Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, depression type, diagnosis, and end-user as referenced above.

The countries covered in the market report are Denmark, Spain, U.K., Sweden, Netherlands, Austria, Italy, Belgium, France, Germany, and the Rest of Europe.

China is expected to dominate the market due to its large population, increasing prevalence of mental health disorders, and growing government initiatives aimed at improving mental health awareness and access to screening services.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Depression Screening Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Depression Screening Market Leaders Operating in the Market Are:

- Koninklijke Philips N.V. (Netherlands)

- Apple Inc. (U.S.)

- Google (U.S.)

- Lifetrack Medical Systems (Singapore)

- Genetic Technologies Limited (Australia)

- Headspace Inc. (U.S.)

- Pankhtech India Private Limited (India)

- Pearson (India)

Latest Developments in Depression Screening Market

- In November 2023, Koninklijke Philips N.V. and NYU Langone Health has partnered with to adopt advanced health technology solutions aimed at enhancing patient safety, quality, and outcomes over multiple years. This collaboration will enable Philips to showcase its innovative technologies in a prominent healthcare setting, potentially leading to increased visibility, credibility, and market expansion within the healthcare sector

- In May 2021, Headspace Inc. is offering free one-year subscriptions to healthcare professionals in India amid the COVID-19 crisis. This initiative aims to combat stress and burnout by providing access to mindfulness tools and guided meditations, supporting the mental well-being of frontline workers

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.