Asia Pacific Dental Aligners Market

Market Size in USD Billion

CAGR :

%

USD

1.64 Billion

USD

4.98 Billion

2025

2033

USD

1.64 Billion

USD

4.98 Billion

2025

2033

| 2026 –2033 | |

| USD 1.64 Billion | |

| USD 4.98 Billion | |

|

|

|

|

Asia-Pacific Dental Aligners Market Size

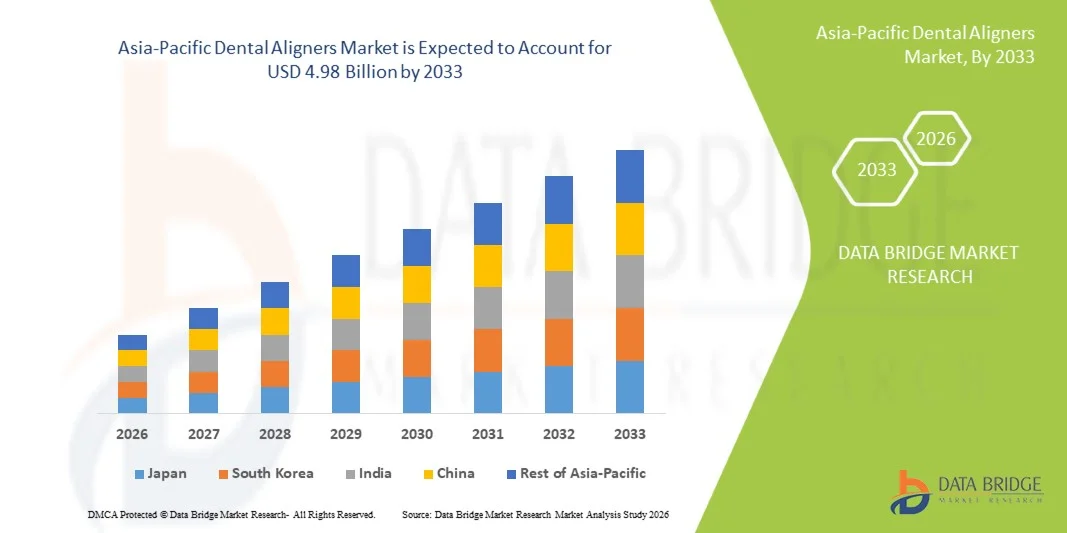

- The Asia-Pacific Dental Aligners Market size was valued at USD 1.64 billion in 2025 and is expected to reach USD 4.98 billion by 2033, at a CAGR of 14.90% during the forecast period

- The market growth is largely fueled by the growing adoption of advanced orthodontic technologies, increasing awareness of dental aesthetics, and rising preference for minimally invasive and comfortable treatment options, leading to greater acceptance of clear aligner solutions across both adult and adolescent populations

- Furthermore, rising consumer demand for discreet, convenient, and customized dental treatments is establishing dental aligners as the modern orthodontic solution of choice. These converging factors are accelerating the uptake of Dental Aligners solutions, thereby significantly boosting the industry’s growth

Asia-Pacific Dental Aligners Market Analysis

- Dental aligners, offering transparent and removable orthodontic solutions for teeth straightening, are increasingly vital components of modern dental care in both hospital and clinic settings due to their enhanced aesthetics, improved patient comfort, and seamless integration with digital dentistry workflows

- The escalating demand for dental aligners is primarily fueled by the growing adoption of cosmetic dentistry, increasing awareness of orthodontic aesthetics among adults and teenagers, and a rising preference for comfortable, nearly invisible teeth-straightening solutions

- China dominated the Asia-Pacific Dental Aligners Market with the largest revenue share of approximately 37.4% in 2025, supported by a large patient population, expanding private dental clinic networks, rising disposable incomes, and increasing adoption of digital orthodontic treatment planning technologies

- India is expected to be the fastest growing country in the Asia-Pacific Dental Aligners Market during the forecast period, driven by increasing awareness of cosmetic dental procedures, expanding dental tourism, improving accessibility of orthodontic treatments, and growing availability of cost-effective aligner brands

- The products segment dominated the market with a revenue share of 68.4% in 2025, driven by the high demand for clear aligner trays, attachments, and retainers used throughout orthodontic treatment

Report Scope and Asia-Pacific Dental Aligners Market Segmentation

|

Attributes |

Asia-Pacific Dental Aligners Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Asia-Pacific Dental Aligners Market Trends

“Increasing Adoption of Digital Orthodontics and Customized Treatment Planning”

- A significant and accelerating trend in the Asia-Pacific Dental Aligners Market is the growing integration of digital orthodontic technologies, including intraoral scanners, 3D imaging, artificial intelligence-based treatment planning software, and advanced 3D printing systems

- These technologies are transforming traditional orthodontic workflows by enabling highly precise, customized aligner design and faster treatment turnaround times, thereby improving clinical outcomes and patient satisfaction across the region

- For instance, several orthodontic clinics across Japan, South Korea, and urban centers in India and China are increasingly adopting chairside digital scanning and cloud-based treatment planning platforms that allow orthodontists to design personalized aligner sequences within hours instead of weeks. This digital workflow significantly reduces manual errors and enhances treatment predictability

- The expansion of digital dental laboratories and local manufacturing facilities is further accelerating the adoption of aligner therapy by reducing production costs and delivery timelines. Regional manufacturers are investing heavily in automated thermoforming and 3D-printing technologies to scale aligner production, making advanced orthodontic solutions more accessible to a wider patient population

- In addition, tele-orthodontics and remote monitoring platforms are emerging as important components of aligner therapy in Asia-Pacific, allowing orthodontists to track patient progress virtually and adjust treatment plans when necessary. This is particularly beneficial in densely populated urban markets where patients increasingly prefer convenient, low-visit treatment options

- As dental service providers continue to modernize their clinical infrastructure and integrate digital technologies into orthodontic practices, the demand for clear aligner solutions is expected to grow significantly, positioning digital orthodontics as a central trend shaping the future of the Asia-Pacific Dental Aligners Market

Asia-Pacific Dental Aligners Market Dynamics

Driver

“Rising Demand for Aesthetic Dentistry and Expanding Middle-Class Population”

- The growing emphasis on dental aesthetics, particularly among young adults and working professionals, is a major driver fueling demand for dental aligners across the Asia-Pacific region

- Increasing awareness regarding orthodontic treatment benefits, combined with the rising influence of social media and appearance-conscious lifestyles, is encouraging more individuals to opt for nearly invisible orthodontic solutions instead of traditional metal braces

- For instance, urban dental chains in China and India have reported a substantial rise in adult orthodontic consultations, with clear aligners increasingly preferred by professionals seeking discreet treatment options that do not interfere with daily activities or professional interactions

- Rapid urbanization, increasing disposable income, and the expansion of private dental care infrastructure are further enabling patients to access advanced orthodontic services. Many dental clinics are also offering flexible payment plans and bundled treatment packages, making aligner therapy more financially accessible to middle-income populations

- Moreover, the increasing number of trained orthodontists and specialized dental service providers across emerging Asia-Pacific economies is strengthening treatment availability, thereby accelerating overall market growth for dental aligners

Restraint/Challenge

“High Treatment Costs and Limited Awareness in Semi-Urban and Rural Areas”

- Despite strong growth prospects, the relatively high cost of clear aligner therapy compared to conventional braces remains a key restraint, particularly in price-sensitive developing markets

- Advanced digital scanning, customized manufacturing, and extended treatment monitoring contribute to higher overall treatment expenses, limiting adoption among lower-income patient groups

- For instance, in several Southeast Asian and South Asian countries, aligner treatment costs can be two to three times higher than traditional orthodontic solutions, leading many patients—especially in smaller cities—to continue opting for conventional braces despite the aesthetic advantages of aligners

- Limited awareness regarding the availability and effectiveness of clear aligner therapy in semi-urban and rural areas further constrains market penetration. In many regions, patients still associate orthodontic treatment primarily with metal braces, and lack of exposure to modern orthodontic solutions reduces treatment adoption rates

- Addressing these challenges through cost-efficient local manufacturing, broader dental insurance coverage, and patient education initiatives will be essential for expanding aligner adoption and sustaining long-term market growth across the Asia-Pacific region

Asia-Pacific Dental Aligners Market Scope

The market is segmented on the basis of product & services, age group, raw material, application, treatment plan, end user, and distribution channel.

• By Product and Services

On the basis of product and services, the Asia-Pacific Dental Aligners Market is segmented into products and services. The products segment dominated the market with a revenue share of 68.4% in 2025, driven by the high demand for clear aligner trays, attachments, and retainers used throughout orthodontic treatment. Increasing preference for aesthetically pleasing orthodontic solutions has significantly boosted product sales. Continuous advancements in aligner material technology, such as improved transparency and durability, further support dominance. High treatment volumes across dental and orthodontic clinics contribute to consistent product demand. Strong brand presence of leading manufacturers also strengthens this segment. Growing adoption of customized aligner solutions enhances value generation. The repeat requirement for multiple aligner sets per patient further increases revenue share. Rising disposable income supports affordability of aligner products. Expansion of direct-to-consumer brands also boosts sales. Product standardization ensures consistent outcomes. High replacement frequency supports recurring revenue. Strong clinician preference reinforces dominance.

The services segment is expected to witness the fastest CAGR of 23.1% from 2026 to 2033, driven by rising demand for digital treatment planning, scanning, monitoring, and post-treatment support services. Increased adoption of AI-based treatment simulation and remote monitoring platforms fuels growth. Dental professionals increasingly rely on software-driven services for precision and efficiency. Growing popularity of subscription-based aligner services supports expansion. Tele-orthodontics adoption further accelerates demand. Service offerings enhance treatment outcomes and patient compliance. Increased outsourcing of treatment planning by clinics boosts revenue. Continuous software upgrades support recurring income. Expansion of at-home aligner services increases service utilization. Rising focus on personalized care strengthens growth. Improved workflow efficiency attracts providers. This trend supports rapid CAGR growth.

• By Age Group

On the basis of age group, the Asia-Pacific Dental Aligners Market is segmented into adults, teenagers, and children. The adult segment dominated the market with a revenue share of 57.6% in 2025, driven by growing aesthetic awareness and increasing preference for discreet orthodontic treatments. Adults favor clear aligners due to professional and social considerations. Rising disposable income supports premium orthodontic solutions. Increasing prevalence of malocclusion in adults drives demand. Adults prefer shorter treatment duration offered by aligners. Workplace confidence concerns support adoption. Growing awareness through digital marketing fuels interest. Higher treatment compliance among adults improves outcomes. Insurance coverage expansion supports affordability. Adult patients increasingly seek smile correction later in life. Technological advancements improve adult treatment effectiveness. Strong demand sustains dominance.

The teenagers segment is projected to grow at the fastest CAGR of 22.4% from 2026 to 2033, supported by rising orthodontic awareness among parents and adolescents. Teenagers increasingly prefer aligners over metal braces for comfort and appearance. Social media influence drives demand. School-age orthodontic screenings support early adoption. Improved aligner durability makes them suitable for teens. Growing parental willingness to invest in orthodontic care fuels growth. Technological improvements address compliance concerns. Flexible treatment plans attract families. Expanding orthodontic clinic networks support access. Educational campaigns promote aligner benefits. Increased customization improves outcomes. This drives rapid CAGR growth.

• By Raw Material

On the basis of raw material, the Asia-Pacific Dental Aligners Market is segmented into Thermoplastic Polyurethanes (TPU), Polyethylene Terephthalate, Polyethylene Terephthalate Glycol, and Others. The thermoplastic polyurethanes (TPU) segment dominated with a revenue share of 46.9% in 2025, owing to its superior flexibility, transparency, and durability. TPU materials provide better patient comfort and precise tooth movement. High resistance to wear and tear supports repeated usage. Manufacturers prefer TPU for advanced aligner designs. Improved stain resistance enhances aesthetic appeal. TPU supports customized treatment planning. Consistent force application improves clinical outcomes. Regulatory approvals support widespread use. Cost-effectiveness boosts adoption. Growing R&D investments improve material quality. Strong supplier availability supports scalability. These factors sustain dominance.

The polyethylene terephthalate glycol segment is expected to grow at the fastest CAGR of 21.9% from 2026 to 2033, driven by increasing demand for highly transparent and crack-resistant materials. PETG offers excellent clarity and formability. Growing focus on patient comfort supports growth. Improved chemical resistance enhances aligner longevity. Manufacturers adopt PETG for premium aligner products. Advancements in thermoforming technology boost adoption. Lightweight properties improve wearability. Rising preference for eco-friendly materials supports demand. Increased production capacity lowers costs. High compatibility with digital manufacturing fuels expansion. Customization capabilities support growth. This drives strong CAGR.

• By Application

On the basis of application, the Asia-Pacific Dental Aligners Market is segmented into malocclusion, crowding, excessive spacing, and others. The crowding segment dominated the market with a revenue share of 41.3% in 2025, driven by the high prevalence of dental crowding across all age groups. Lifestyle changes and jaw size reduction contribute to incidence. Aligners offer effective correction for mild to moderate crowding. High treatment success rates support dominance. Early diagnosis increases adoption. Growing awareness of orthodontic health fuels demand. Shorter treatment timelines attract patients. Digital treatment planning improves precision. Widespread clinic availability supports access. Insurance coverage supports affordability. High patient satisfaction sustains demand. This maintains dominance.

The malocclusion segment is anticipated to grow at the fastest CAGR of 22.8% from 2026 to 2033, driven by rising awareness of bite correction and functional dental health. Increasing diagnosis rates support growth. Technological advancements enable complex malocclusion treatment with aligners. Growing pediatric and adolescent cases boost demand. Improved aligner biomechanics enhance outcomes. Dentist confidence in aligner efficacy increases adoption. Rising healthcare expenditure supports treatment uptake. Expansion of orthodontic clinics improves access. Educational initiatives raise awareness. Growing cosmetic concerns support correction. Innovation in attachments drives success. This fuels rapid CAGR growth.

• By Treatment Plan

On the basis of treatment plan, the Asia-Pacific Dental Aligners Market is segmented into in-office aligners and at-home aligners. The in-office aligners segment dominated with a revenue share of 63.8% in 2025, driven by professional supervision and higher clinical trust. Patients prefer dentist-guided treatment for safety and accuracy. Complex cases require in-office monitoring. Higher treatment success rates support dominance. Strong dentist-patient relationships encourage adoption. Regulatory oversight supports credibility. Advanced scanning technologies improve outcomes. Insurance acceptance favors in-office treatment. Customization enhances effectiveness. Established clinic networks support volume. Premium pricing boosts revenue. This ensures market leadership.

The at-home aligners segment is expected to grow at the fastest CAGR of 24.6% from 2026 to 2033, driven by convenience, affordability, and direct-to-consumer models. Rising digital adoption supports growth. Remote monitoring technologies improve outcomes. Increased marketing awareness boosts adoption. Flexible payment options attract users. Growing acceptance of tele-dentistry fuels demand. Younger demographics prefer home-based solutions. Reduced clinic visits improve accessibility. Improved quality standards increase trust. Expanding urban populations support growth. Subscription models boost revenue. This supports rapid CAGR expansion.

• By End User

On the basis of end user, the Asia-Pacific Dental Aligners Market is segmented into dental clinics, hospitals, orthodontic clinics, and others. The orthodontic clinics segment dominated with a revenue share of 44.7% in 2025, driven by specialization and high treatment volumes. Orthodontists prefer aligners for predictable outcomes. Advanced equipment supports precision treatment. High patient trust boosts adoption. Continuous case inflow sustains revenue. Customized treatment planning enhances results. Strong referral networks support volume. Technological adoption supports efficiency. Premium pricing strengthens margins. Skilled workforce ensures success. Educational focus improves outcomes. This supports dominance.

The dental clinics segment is projected to grow at the fastest CAGR of 21.5% from 2026 to 2033, driven by expanding general dentistry services. Clinics increasingly offer aligner treatments. Training programs enhance adoption. Rising patient footfall supports growth. Cost-effective services attract patients. Improved digital tools support implementation. Increased urban clinic expansion fuels demand. Insurance acceptance supports affordability. Growing cosmetic dentistry trend supports adoption. Technological partnerships boost capacity. Convenience drives patient preference. This fuels CAGR growth.

• By Distribution Channel

On the basis of distribution channel, the Asia-Pacific Dental Aligners Market is segmented into direct sales and third-party distributors. The direct sales segment dominated the market with a revenue share of 61.2% in 2025, driven by strong manufacturer–clinic relationships. Direct engagement ensures customization and quality control. Faster delivery supports efficiency. Higher margins boost revenue. Brand loyalty supports dominance. Direct training programs improve adoption. Strong after-sales support enhances satisfaction. Data integration improves outcomes. Predictable supply chains reduce delays. Regulatory compliance is easier. Long-term contracts support stability. This ensures leadership.

The third-party distributors segment is expected to grow at the fastest CAGR of 22.2% from 2026 to 2033, driven by market expansion in emerging regions. Distributors improve accessibility. Smaller clinics rely on distributors. Improved logistics support reach. Regional partnerships enhance penetration. Cost-effective supply boosts adoption. Distributor-led marketing increases awareness. Expansion into rural areas supports growth. Flexible purchasing options attract clinics. Improved inventory management supports efficiency. Growing demand in Asia-Pacific fuels expansion. This drives strong CAGR growth.

Asia-Pacific Dental Aligners Market Regional Analysis

- The Asia-Pacific Dental Aligners Market is poised to grow at the fastest CAGR of approximately 24% during the forecast period of 2026 to 2033, driven by increasing urbanization, rising disposable incomes, expanding private dental infrastructure, and rapid technological advancements in orthodontic treatment planning across countries such as China, Japan, and India

- The region’s growing focus on cosmetic dentistry, increasing awareness regarding aesthetic orthodontic solutions, and the rising availability of cost-effective aligner brands are significantly accelerating adoption

- Furthermore, as Asia-Pacific emerges as a key manufacturing hub for dental aligners and related digital orthodontic technologies, treatment affordability and accessibility are expanding to a wider patient population across both developed and emerging economies

China Asia-Pacific Dental Aligners Market Insight

The China Asia-Pacific Dental Aligners Market accounted for the largest market revenue share in Asia-Pacific, contributing approximately 37.4% in 2025, attributed to the country’s large patient population, rapidly expanding middle class, and the growing network of private dental clinics across urban centers. Increasing adoption of digital orthodontic treatment planning technologies, combined with the strong presence of domestic aligner manufacturers offering competitively priced products, is significantly accelerating market growth. Government support for healthcare modernization and the expansion of dental service infrastructure are further strengthening the adoption of advanced orthodontic solutions across residential and commercial dental care settings.

India Asia-Pacific Dental Aligners Market Insight

The India Asia-Pacific Dental Aligners Market is expected to be the fastest-growing country in the Asia-Pacific region during the forecast period, driven by increasing awareness of cosmetic dental procedures, rising disposable incomes among urban populations, and expanding accessibility of orthodontic treatments through private dental chains and specialty clinics. The rapid growth of dental tourism, the presence of cost-efficient aligner manufacturers, and the increasing availability of flexible treatment financing options are further encouraging patient adoption. In addition, government initiatives promoting healthcare accessibility and the growing penetration of digital dental technologies are expected to support long-term expansion of the Asia-Pacific Dental Aligners Market in India.

Asia-Pacific Dental Aligners Market Share

The Dental Aligners industry is primarily led by well-established companies, including:

- Align Technology (U.S.)

- Dentsply Sirona (U.S.)

- SmileDirectClub (U.S.)

- 3Shape (Denmark)

- Ormco (U.S.)

- ClearCorrect (U.S.)

- STRAUMANN Group (Switzerland)

- Planmeca (Finland)

- Digital Smile Design (Switzerland)

- AvaDent (U.S.)

- DrSmile (Germany)

- Angelalign (China)

- Synergy Aligners (India)

- Eon Aligner (South Korea)

- Gentle Dental (U.S.)

- Accusmile (China)

- Invisalign (U.S.)

- Orthocaps (Germany)

- Smilers (France)

- TianHeng Dental (China)

Latest Developments in Asia-Pacific Dental Aligners Market

- In February 2021, Align Technology announced the expansion of Invisalign training and treatment availability across Asia-Pacific, strengthening partnerships with orthodontists and dental clinics in markets such as India, China, and Southeast Asia. This initiative aimed to accelerate adoption of digital orthodontic workflows and improve patient access to clear aligner therapy across emerging APAC markets, supporting the company’s long-term regional growth strategy

- In May 2022, the Straumann Group expanded its orthodontics portfolio through the continued integration and development of clear aligner offerings, including investments in digital dentistry and aligner solutions targeted at Asia-Pacific markets. The company emphasized expanding orthodontic solutions alongside implant dentistry to capture the rapidly growing demand for aesthetic dental treatments in emerging Asian economies

- In March 2023, Align Technology launched new Invisalign system enhancements and digital orthodontic solutions across Asia-Pacific, enabling orthodontists to deliver more precise treatment planning through upgraded ClinCheck software and digital scanning workflows. The rollout supported improved patient outcomes and faster adoption of clear aligner therapy in countries such as Japan, South Korea, India, and Australia

- In September 2024, the Straumann Group announced strategic restructuring actions in its clear aligner business, including portfolio optimization and partnerships to strengthen competitiveness in global markets including Asia-Pacific. The move aimed to enhance operational efficiency and focus investments on high-growth orthodontic technologies and digital dentistry platforms

- In January 2025, Align Technology reported continued expansion of Invisalign adoption across Asia-Pacific through increased direct-to-consumer awareness campaigns and broader clinic penetration, highlighting APAC as one of the fastest-growing regional markets for clear aligners due to rising aesthetic awareness, expanding middle-class populations, and growing digital dentistry infrastructure

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.