Asia Pacific Cpap Devices Market

Market Size in USD Million

CAGR :

%

USD

598.21 Million

USD

1,132.10 Million

2024

2032

USD

598.21 Million

USD

1,132.10 Million

2024

2032

| 2025 –2032 | |

| USD 598.21 Million | |

| USD 1,132.10 Million | |

|

|

|

|

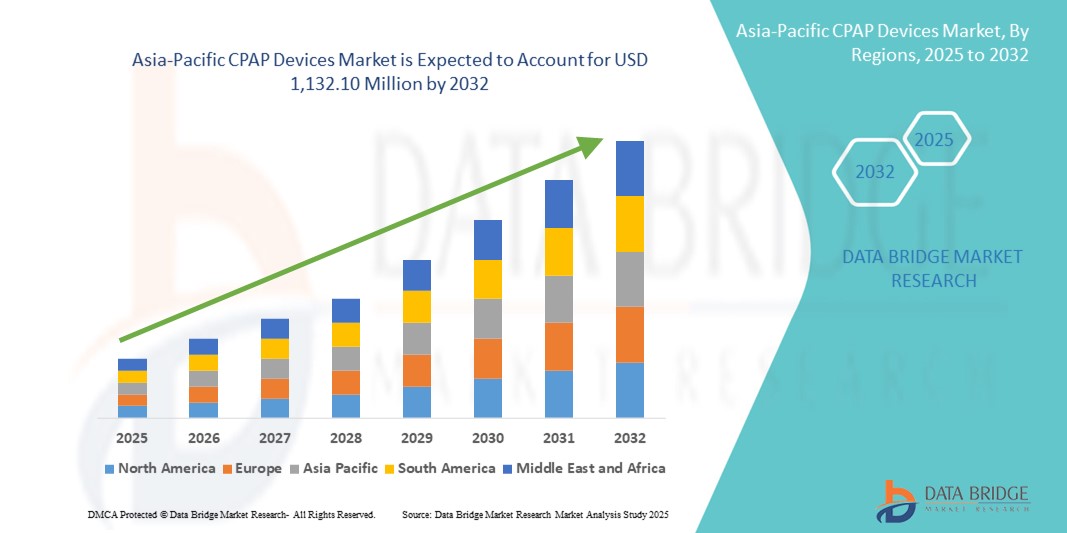

Asia-Pacific CPAP Devices Market Size

- The Asia-Pacific CPAP devices market size was valued at USD 598.21 million in 2024 and is expected to reach USD 1,132.10 million by 2032, at a CAGR of 8.30% during the forecast period

- The market growth is primarily driven by the increasing prevalence of sleep apnea and other respiratory disorders across aging populations, particularly in countries such as China, Japan, and India

- In addition, growing awareness of sleep-related health conditions, expanding healthcare infrastructure, and the rise in home-based sleep therapy adoption are supporting the widespread use of CPAP devices. These converging trends are propelling demand for CPAP solutions, thereby significantly enhancing the region’s market expansion

Asia-Pacific CPAP Devices Market Analysis

- CPAP devices, delivering continuous positive airway pressure to keep airways open during sleep, are increasingly essential for managing obstructive sleep apnea (OSA) and related respiratory disorders, especially in countries such as China, Japan, and India due to growing awareness of sleep health and rising prevalence of OSA

- The growing demand for CPAP devices is primarily driven by an aging population, rising diagnosis rates, and expanding access to sleep labs and home-based care across urban centers

- China dominated the Asia-Pacific CPAP devices market with the largest revenue share of 36.7% in 2024, supported by strong healthcare investments, a large undiagnosed patient base, and increasing public health initiatives addressing respiratory conditions

- India is projected to be the fastest-growing country in the Asia-Pacific CPAP devices market during the forecast period due to rapid urbanization, improved access to diagnostics, and growing affordability of home care solutions

- The CPAP Device segment dominated the Asia-Pacific CPAP devices market with a share of 60.8% in 2024, driven by increased adoption in hospitals and home settings for long-term sleep apnea management, while the Standalone modality remained dominant due to its clinical reliability and ease of use

Report Scope and Asia-Pacific CPAP Devices Market Segmentation

|

Attributes |

Asia-Pacific CPAP Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific CPAP Devices Market Trends

“Advancements in Smart Connectivity and Remote Monitoring”

- A significant and accelerating trend in the Asia-Pacific CPAP devices market is the integration of smart connectivity and cloud-based remote monitoring features, enabling real-time tracking of patient therapy data by healthcare providers and caregivers. This is enhancing treatment adherence and supporting the shift toward home-based care

- For instance, ResMed’s AirSense 11 and Philips’ DreamStation devices offer Bluetooth and cloud integration, allowing clinicians to adjust therapy settings remotely. Similarly, BMC Medical's G-series CPAP systems include Wi-Fi connectivity and app-based reporting, making therapy more accessible

- These features enable physicians to monitor breathing patterns, sleep duration, and mask fit remotely, especially important in countries such as India and China where large rural populations often lack direct access to specialized care. Moreover, smart apps help patients visualize progress and receive automated coaching

- The seamless integration of CPAP devices with digital health platforms allows centralized management of respiratory care, aligning with telehealth adoption in markets such as Australia, Japan, and South Korea

- This trend is fundamentally reshaping the delivery of sleep apnea therapy by emphasizing convenience, adherence, and early intervention through connected systems. As a result, companies are prioritizing digital capabilities and remote support features in new CPAP product launches

- The rising demand for devices that offer smart tracking and remote control is transforming CPAP therapy into a more patient-centered, digitally enabled experience, particularly across urban and tech-savvy populations in Asia-Pacific

Asia-Pacific CPAP Devices Market Dynamics

Driver

“Rising Prevalence of Sleep Apnea and Home-Based Therapy Demand”

- The increasing prevalence of obstructive sleep apnea (OSA), combined with greater diagnosis rates and expanding awareness, is a primary driver of CPAP device demand in Asia-Pacific countries such as China, India, and Japan

- For instance, China has seen large-scale initiatives promoting sleep health screening, while India is experiencing growing investment in diagnostic labs and respiratory care clinics. These developments are leading to more prescriptions for CPAP therapy

- As more patients and healthcare systems recognize the long-term health risks associated with untreated sleep apnea, CPAP devices are being increasingly adopted for continuous, non-invasive treatment

- In addition, the growing preference for home-based care, supported by improved internet access, mobile health tools, and rising patient comfort with in-home therapy, is fueling market growth

- Key players are focusing on portable and user-friendly device innovations to meet the rising demand for convenient and personalized therapy solutions at home, especially in densely populated urban centers across Asia-Pacific

Restraint/Challenge

“Affordability Barriers and Limited Awareness in Rural Areas”

- Affordability remains a significant challenge in many emerging Asia-Pacific markets, where high out-of-pocket healthcare costs and limited insurance coverage hinder widespread adoption of advanced CPAP devices

- For instance, in rural regions of India, Indonesia, and Vietnam, the relatively high cost of branded CPAP machines and accessories leads to underuse, while patients may delay or avoid treatment altogether

- Moreover, lack of awareness about sleep apnea and its serious health implications continues to limit diagnosis and therapy uptake in underdeveloped or underserved communities

- Some governments have yet to establish standardized diagnostic protocols or reimbursement policies for sleep-disordered breathing, creating additional barriers for both providers and patients

- Overcoming these challenges will require affordable device innovations, increased public education campaigns, and expanded access to diagnostic and sleep therapy services in both public and private sectors across the Asia-Pacific region

Asia-Pacific CPAP Devices Market Scope

The market is segmented on the basis of product type, modality, and end user.

- By Product Type

On the basis of product type, the Asia-Pacific CPAP devices market is segmented into CPAP devices and consumables. The CPAP devices segment dominated the market with the largest revenue share of 60.8% in 2024, driven by increased diagnosis of obstructive sleep apnea (OSA) and a growing emphasis on non-invasive respiratory therapy. These devices are considered essential for long-term management of sleep-related breathing disorders and are widely adopted in both clinical and home settings due to their proven effectiveness and technological advancements.

The consumables segment, which includes masks, tubing, and filters, is expected to witness significant growth during the forecast period, supported by the recurring need for replacement parts to maintain hygiene and ensure consistent therapy. Rising home use of CPAP devices further contributes to the steady demand for consumables across the region

- By Modality

On the basis of modality, the Asia-Pacific CPAP devices market is segmented into standalone and portable CPAP devices. The standalone segment held the largest market revenue share of 68.7% in 2024, attributed to its robust clinical performance, durable design, and preference for use in fixed settings such as sleep labs and home care environments. These systems are often equipped with advanced pressure regulation, humidification, and connectivity features, making them a standard choice for comprehensive therapy.

The portable segment is projected to experience the fastest growth from 2025 to 2032, driven by the rising demand for travel-friendly solutions and the increasing number of users seeking therapy continuity outside their primary residence. Lightweight design, battery operation, and ease of transport are key factors boosting adoption of portable CPAP devices across urban centers and among frequent travelers.

- By End User

On the basis of end user, the Asia-Pacific CPAP devices market is segmented into home care, hospitals, private clinics, and others. The home care segment dominated the Asia-Pacific CPAP devices market with the largest revenue share of 54.2% in 2024, owing to a growing preference for in-home treatment, patient comfort, and the rising availability of telehealth and remote monitoring options. Increasing awareness of sleep apnea and the convenience of self-administered therapy are major drivers for this segment.

The hospitals segment is expected to maintain strong growth during forecast period, particularly in countries with expanding healthcare infrastructure such as China and India. Hospitals continue to play a crucial role in diagnosis and initial therapy setup, especially for patients with severe sleep-disordered breathing. The private clinics segment is also gaining traction due to increased availability of specialized sleep services and outpatient treatment models.

Asia-Pacific CPAP Devices Market Regional Analysis

- China dominated the Asia-Pacific CPAP devices market with the largest revenue share of 36.7% in 2024, supported by strong healthcare investments, a large undiagnosed patient base, and increasing public health initiatives addressing respiratory conditions

- Consumers in China are increasingly adopting CPAP therapy due to growing health awareness, improved access to affordable devices, and the integration of digital monitoring features that support home-based care

- This dominant position is further supported by the country’s large aging population, urbanization trends, and government-backed programs aimed at managing chronic respiratory conditions, establishing China as a key growth engine in the regional CPAP devices market

The China CPAP Devices Market Insight

The China CPAP devices market captured the largest market revenue share in Asia-Pacific in 2024, supported by a high burden of untreated sleep apnea, strong public health initiatives, and rapid urbanization. Government-led awareness campaigns and growing investment in diagnostic facilities are significantly boosting early detection and treatment. Moreover, the integration of CPAP devices with digital platforms and mobile applications is enhancing therapy adherence, particularly in home care settings. Local manufacturers are expanding their footprint, making affordable and connected devices widely accessible.

Japan CPAP Devices Market Insight

The Japan CPAP devices market is experiencing stable growth, driven by the country’s aging population, high awareness of sleep-related disorders, and advanced healthcare system. Japan's strong emphasis on medical technology innovation and telehealth integration supports the widespread adoption of CPAP therapy in both clinical and home care environments. In addition, the availability of compact and user-friendly devices is helping meet the growing demand for in-home respiratory treatment, particularly among the elderly.

India CPAP Devices Market Insight

The India CPAP devices market is projected to grow at a noteworthy CAGR during the forecast period, fueled by increasing diagnosis of sleep apnea, a rising urban middle class, and expanding access to sleep clinics. As awareness of sleep health improves, particularly in metropolitan areas, CPAP therapy is becoming a preferred non-invasive treatment. The growth of home healthcare, supported by affordable device offerings and the entry of domestic manufacturers, is significantly driving market penetration across both residential and private clinical settings.

South Korea CPAP Devices Market Insight

The South Korea CPAP devices market is gaining momentum, supported by rising public awareness of sleep apnea and strong government investment in digital healthcare infrastructure. High internet penetration and widespread use of mobile health apps have made remote CPAP monitoring a viable and attractive solution for both patients and clinicians. South Korea’s advanced medical ecosystem, along with growing interest in preventive health measures and home-based therapy, is contributing to the expanding adoption of CPAP devices across the country.

Asia-Pacific CPAP Devices Market Share

The Asia-Pacific CPAP Devices industry is primarily led by well-established companies, including:

- ResMed Inc. (U.S.)

- Asia-Pacific CPAP devices market (Netherlands)

- Fisher & Paykel Healthcare Limited (New Zealand)

- BMC Medical Co., Ltd. (China)

- Apex Medical Corp. (Taiwan)

- Curative Medical Inc. (China)

- Lowenstein Medical Technology GmbH + Co. KG (Germany)

- Drive DeVilbiss Healthcare LLC (U.S.)

- Panasonic Healthcare Co., Ltd. (Japan)

- Nihon Kohden Corporation (Japan)

- Oventus Medical Ltd. (Australia)

- Weinmann Emergency Medical Technology GmbH + Co. KG (Germany)

- 3B Medical, Inc. (U.S.)

- Somnetics International Inc. (U.S.)

- Medtronic (Ireland)

- Braebon Medical Corporation (Canada)

- Heinen + Löwenstein GmbH & Co. KG (Germany)

- Yuwell-Jiangsu Yuyue Medical Equipment & Supply Co., Ltd. (China)

- Micomme Medical Technology Development Co., Ltd. (China)

- Koike Medical Co., Ltd. (Japan)

What are the Recent Developments in Asia-Pacific CPAP Devices Market?

- In April 2024, ResMed Inc., a global leader in sleep and respiratory care, expanded its digital health footprint in Asia-Pacific by launching a telemonitoring platform tailored for CPAP users in India and Southeast Asia. The platform enables real-time patient data tracking, fostering better compliance and outcomes in home therapy. This development underscores ResMed’s commitment to integrating digital tools into respiratory care and strengthening its market presence across emerging Asian economies

- In March 2024, Fisher & Paykel Healthcare introduced its next-generation CPAP interface, Vitera APAC Series, across Japan, South Korea, and Australia. Designed for superior comfort and breathability, this product reflects the company’s innovation focus in catering to regional anatomical diversity and user comfort preferences. The launch aligns with rising demand for user-friendly and technologically advanced CPAP solutions in the Asia-Pacific region

- In February 2024, BMC Medical Co., Ltd., a China-based respiratory device manufacturer, expanded its presence in Southeast Asia by establishing a regional distribution center in Malaysia. The new facility is aimed at improving supply chain efficiency and providing faster access to CPAP equipment across ASEAN countries. This strategic move highlights the company’s aim to strengthen its regional footprint and meet the surging demand for affordable sleep apnea solutions

- In January 2024, Philips Respironics launched a collaborative pilot program with sleep clinics in South Korea and Singapore to integrate AI-based diagnostics with CPAP device usage. The project aims to enhance personalized therapy and improve adherence rates through predictive analytics and user behavior insights. This initiative showcases Philips’ push toward AI-powered respiratory care in the Asia-Pacific healthcare ecosystem

- In December 2023, Lowenstein Medical Asia-Pacific initiated a strategic partnership with hospitals in Thailand and Vietnam to provide advanced CPAP therapy training and support programs. The initiative focuses on educating healthcare professionals and improving early diagnosis and treatment of obstructive sleep apnea in underserved regions. This partnership reflects the company’s regional expansion efforts and dedication to improving clinical outcomes through knowledge sharing and capacity building

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.