Asia Pacific Contract Manufacturing Market

Market Size in USD Billion

CAGR :

%

USD

170.30 Billion

USD

267.36 Billion

2024

2032

USD

170.30 Billion

USD

267.36 Billion

2024

2032

| 2025 –2032 | |

| USD 170.30 Billion | |

| USD 267.36 Billion | |

|

|

|

|

Asia-Pacific Contract Manufacturing Market Size

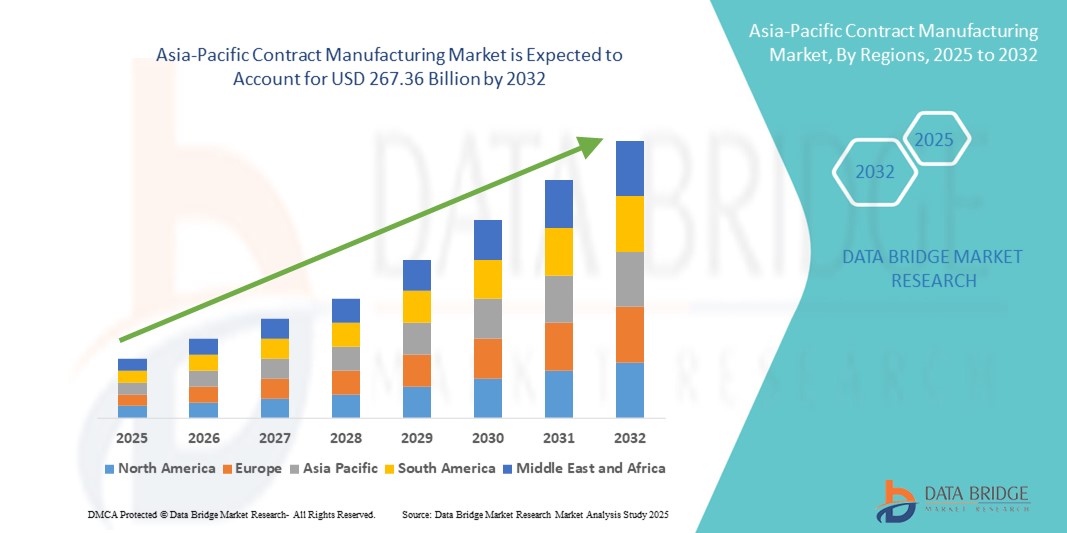

- The Asia-Pacific contract manufacturing market size was valued at USD 170.3 billion in 2024 and is expected to reach USD 267.36 billion by 2032, at a CAGR of 5.8% during the forecast period

- The market growth is largely fueled by increasing awareness, rising demand for biopharmaceuticals, and expansion of healthcare infrastructure across Asia-Pacific, enabling timely production and supply of high-quality therapeutics and diagnostics. The region is witnessing rapid growth in contract manufacturing services, particularly in countries such as India, China, and Singapore, contributing to the increasing adoption of outsourced manufacturing solutions

- Furthermore, escalating investments in advanced manufacturing facilities, implementation of Good Manufacturing Practices (GMP), and increasing public-private partnerships are driving innovation and availability of contract manufacturing services. Government initiatives to support pharmaceutical exports, coupled with the growing presence of international contract manufacturing organizations (CMOs) and local production capabilities, are significantly boosting the growth of the Asia-Pacific contract manufacturing market

Asia-Pacific Contract Manufacturing Market Analysis

- The Asia-Pacific contract manufacturing market is witnessing significant growth, driven by increasing outsourcing of pharmaceutical and biotechnology production, rising demand for cost-efficient manufacturing solutions, and expanding regulatory support for contract manufacturing organizations (CMOs) across the region. Countries such as China, India, Japan, and South Korea are leading the market due to their advanced manufacturing infrastructure, skilled workforce, and growing domestic and international demand for biopharmaceuticals

- The rising preference for outsourcing production over in-house manufacturing is supported by cost optimization, enhanced scalability, and access to advanced technologies such as biologics, cell and gene therapies, and high-potency APIs. In addition, increasing partnerships between global pharmaceutical companies and regional CMOs are further accelerating market growth

- China dominated the Asia-Pacific contract manufacturing market, accounting for the largest revenue share of 34.7% in 2024, supported by a mature manufacturing ecosystem, favorable government policies, and high demand from both domestic and international pharmaceutical clients

- India is projected to register the fastest CAGR of 12.9% in the Asia-Pacific contract manufacturing market during the forecast period, fueled by the growth of small and mid-sized pharmaceutical firms seeking cost-effective manufacturing solutions, expansion of specialized API and biologics facilities, and increasing private investments in contract development and manufacturing services. Government initiatives such as “Make in India” and biotech parks are also accelerating market adoption across both urban and semi-urban regions

- The pharmaceutical products manufacturing segment dominated the Asia-Pacific contract manufacturing market with a 58.4% share in 2024, owing to the increasing demand for outsourced drug production, biopharmaceutical expansion, and cost-efficient scaling of production lines

Report Scope and Asia-Pacific Contract Manufacturing Market Segmentation

|

Attributes |

Asia-Pacific Contract Manufacturing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Contract Manufacturing Market Trends

Growing Therapeutic Advancements and Increasing Biopharmaceutical Research

- A significant and accelerating trend in the Asia-Pacific contract manufacturing market is the increasing focus on therapeutic innovations and clinical research—particularly in biologics, small-molecule drugs, and advanced therapy medicinal products (ATMPs). Rising R&D investments are driving demand for flexible and specialized contract manufacturing solutions across the region

- Various pharmaceutical and biotechnology companies, as well as research institutes across Asia-Pacific, are investing in next-generation contract manufacturing capabilities, including high-containment facilities, sterile manufacturing, and continuous processing technologies. These developments aim to enhance production efficiency, reduce time-to-market, and maintain stringent quality standards

- The adoption of personalized medicine and niche therapies is enabling CMOs to provide more customized manufacturing services. This includes tailored production runs, process optimization, and regulatory support for clinical trial materials and commercial-scale manufacturing

- Partnerships between contract manufacturing organizations, global pharmaceutical companies, and government-backed programs are also helping to expand market reach. These collaborations improve regulatory compliance, accelerate technology transfer, and enhance workforce training to meet complex manufacturing requirements.

- As Asia-Pacific continues to prioritize innovation-driven healthcare solutions and scalable production of biopharmaceuticals, the Contract Manufacturing market is poised for sustained growth—driven by increasing outsourcing, advanced manufacturing capabilities, and growing demand for high-quality, cost-effective production services

Asia-Pacific Contract Manufacturing Market Dynamics

Driver

Growing Demand Driven by Rising Biopharmaceutical Production and Advancements in Cell & Gene Therapy

- The increasing prevalence of outsourcing for biopharmaceutical, small-molecule, and advanced therapy production across Asia-Pacific, supported by rising R&D investments and improved manufacturing infrastructure, is significantly driving market growth. Countries such as China, India, Japan, and South Korea are expanding their contract manufacturing capacities, enabling faster scale-up of novel therapies and commercial production

- For instance, in 2024, several regional CMOs reported successful scale-up of clinical and commercial production for cell and gene therapy candidates, reflecting the growing adoption of advanced manufacturing technologies such as viral vector production, sterile fill-finish, and high-containment biologics. These innovations are expected to accelerate the Asia-Pacific Contract Manufacturing market over the forecast period

- Rising interest in complex biologics, personalized medicines, and precision therapeutics is prompting a market shift from traditional contract production to more specialized, high-value manufacturing solutions, including aseptic processing, single-use systems, and continuous manufacturing platforms

- Regulatory bodies across Asia-Pacific, such as the Pharmaceuticals and Medical Devices Agency (PMDA) in Japan and the National Medical Products Administration (NMPA) in China, are increasingly supporting advanced manufacturing through fast-track approvals, process validation guidance, and clinical trial facilitation, fostering rapid market access for new therapies

- Collaborations among regional CMOs, global pharmaceutical companies, academic research centers, and government agencies are strengthening the innovation ecosystem in Asia-Pacific. These partnerships are instrumental in expanding production capacity, scaling clinical manufacturing initiatives, and ensuring timely access to novel therapies across diverse populations

Restraint/Challenge

Infrastructure Limitations and Variability in Manufacturing Capabilities

- High setup and operational costs associated with advanced biopharmaceutical and gene therapy manufacturing—including high-containment facilities, specialized equipment, and regulatory compliance—pose a substantial barrier to widespread CMO expansion, particularly in emerging markets within Asia-Pacific

- Complex production processes for biologics and cell & gene therapies often involve lengthy development timelines and highly skilled personnel, making them less accessible for smaller or early-stage manufacturers

- Specialized technical expertise, including process development scientists, quality assurance teams, and regulatory specialists, is often concentrated in urban manufacturing hubs. This geographic concentration limits capacity expansion in semi-urban or rural regions, slowing overall market growth

- In addition, variations in regulatory standards and the lack of standardized manufacturing protocols across Asia-Pacific create operational inconsistencies and pose challenges for CMOs seeking cross-border contracts

- To overcome these challenges, investments in infrastructure, workforce training, policy reforms, regional harmonization of regulatory frameworks, and partnerships between CMOs and government-backed innovation hubs will be critical to ensure sustainable growth in the Asia-Pacific Contract Manufacturing Market

Asia-Pacific Contract Manufacturing Market Scope

The market is segmented on the basis of product, end user, and distribution channel.

- By Product

On the basis of product, the Asia-Pacific contract manufacturing market is segmented into pharmaceutical products manufacturing and medical device manufacturing. The pharmaceutical products manufacturing segment dominated the market with a 58.4% share in 2024, largely due to the increasing reliance of pharmaceutical companies on outsourcing to meet rising global and regional drug demand. Growth in the biologics sector, combined with the need for cost-efficient production scalability and compliance with international regulatory standards, has significantly strengthened this segment. Furthermore, the expansion of generics and biosimilars manufacturing across countries like India, China, and South Korea continues to boost the outsourcing trend in pharmaceutical production.

The medical device manufacturing segment is anticipated to record the fastest CAGR of 11.2% from 2025 to 2032, driven by rising investments in advanced medical technologies, diagnostics, and wearable healthcare devices. Increasing demand for minimally invasive devices, home-based monitoring systems, and diagnostic tools is encouraging medical device companies to collaborate with contract manufacturers for faster time-to-market, cost savings, and regulatory support across the Asia-Pacific region.

- By End User

On the basis of end user, the Asia-Pacific contract manufacturing market is segmented into pharmaceutical companies, biotechnology companies, biopharma companies, medical device companies, original equipment manufacturers (OEMs), and research institutes. The pharmaceutical companies segment led the market in 2024 with a 44.7% share, as large-scale pharma organizations increasingly outsource manufacturing to optimize efficiency, manage costs, and expand their global reach. Outsourcing has become a critical strategy for managing rising demand for both domestic consumption and international exports, particularly for generics and specialty drugs.

The biotechnology and biopharma companies segment is projected to grow at the highest CAGR of 12.4% from 2025 to 2032, supported by surging R&D investments in biologics, monoclonal antibodies, and cell & gene therapies. Favorable government incentives, tax benefits, and infrastructure development across Asia-Pacific are further accelerating this trend. Additionally, medical device companies and OEMs are playing an increasingly important role in driving growth through specialized contract manufacturing agreements, strategic collaborations, and technology-sharing partnerships that support innovation while reducing operational costs.

- By Distribution Channel

On the basis of distribution channel, the Asia-Pacific contract manufacturing market is segmented into retail sales, direct tender, and others. The direct tender segment accounted for the largest share of 51.3% in 2024, attributed to centralized procurement systems adopted by public hospitals, government healthcare schemes, and large-scale research institutions. This model ensures bulk purchasing, compliance with quality standards, and streamlined supply of pharmaceutical products and medical devices to national health programs across the region.

The retail sales segment is expected to record the fastest CAGR of 10.7% from 2025 to 2032, driven by the growing penetration of e-commerce in healthcare supply chains, particularly in semi-urban and rural areas. The rise of online pharmacies, expansion of small and mid-sized healthcare providers outsourcing production, and the demand for ready-to-use medical devices and drugs are further fueling growth in this channel. Retail distribution is becoming a preferred choice for faster accessibility, affordability, and wider consumer reach.

Asia-Pacific Contract Manufacturing Market Regional Analysis

- Asia-Pacific dominated the global contract manufacturing market with the largest revenue share of 33% in 2024, driven by the region’s mature biopharmaceutical manufacturing ecosystem, increasing outsourcing of drug development and production, and rapid adoption of advanced manufacturing technologies

- Strong regulatory frameworks, streamlined approval processes, and government incentives are fostering growth across both public and private pharmaceutical sectors. Increased funding for biotech infrastructure, along with public-private initiatives to enhance clinical trial and commercial-scale manufacturing capacity, is accelerating CMO adoption in the region

- Furthermore, Asia-Pacific hosts several leading contract manufacturing organizations (CMOs) and research centers, facilitating continuous process innovation, technology transfer, and capacity expansion

China Asia-Pacific Contract Manufacturing Market Insight

The China contract manufacturing market held the largest share in the Asia-Pacific region at 34.7% in 2024, supported by a mature manufacturing ecosystem, favorable government policies, and high demand from both domestic and international pharmaceutical clients. Strong public and private sector investment in API, biologics, and sterile manufacturing facilities is encouraging expansion of advanced contract manufacturing capabilities. Local CMOs are increasingly focusing on innovation and process optimization to meet growing regional and global demand.

Japan Asia-Pacific Contract Manufacturing Market Insight

The Japan contract manufacturing market accounted for 21.5% of the Asia-Pacific market share in 2024, backed by its technologically advanced pharmaceutical infrastructure, strict quality standards, and strong regulatory environment. The country continues to be a hub for high-value biologics, sterile injectable production, and specialized contract development services. Established CMOs in Japan are leveraging expertise in precision manufacturing and regulatory compliance to maintain their competitive edge.

India Asia-Pacific Contract Manufacturing Market Insight

The India contract manufacturing market is projected to be the fastest-growing in Asia-Pacific with a CAGR of 12.9% from 2025 to 2032, driven by the expansion of small and mid-sized pharmaceutical firms seeking cost-effective manufacturing solutions, growth of specialized API and biologics facilities, and increasing private investments in contract development and manufacturing services. Government initiatives such as “Make in India” and biotech parks are further accelerating CMO adoption across both urban and semi-urban regions, positioning India as a regional hub for outsourced pharmaceutical manufacturing.

Asia-Pacific Contract Manufacturing Market Share

The Asia-Pacific contract manufacturing industry is primarily led by well-established companies, including:

- Aenova Group (Germany)

- Thermo Fisher Scientific Inc. (U.S.)

- Evonik Industries AG (Germany)

- Lonza Group AG (Switzerland)

- Boehringer Ingelheim International GmbH (Germany)

- Catalent, Inc. (U.S.)

- Samsung Biologics (South Korea)

- WuXi AppTec (China)

- Jubilant Pharmova Limited (India)

- Piramal (India)

- Neuland Laboratories Ltd. (India)

- Syngene International Limited (India)

- AmbioPharm Inc (U.S.)

- Cambrex Corporation (U.S.)

- Recipharm AB (Sweden)

- Fareva Group (France)

Latest Developments in Asia-Pacific Contract Manufacturing market

- In October 2021, Boehringer Ingelheim International gmbh., had inaugurated its state-of-the-art biopharmaceutical production facility Large Scale Cell Culture (LSCC) in Vienna, Austria, with an investment volume of more than 700 million EUR, which is the single largest investment in the company's history

- In March 2023, Evonik Industries AG has announced that it is opening a new GMP facility to manufacture lipids for advanced, pharmaceutical drug delivery applications. The lipid launch facility is located at the company’s site in Hanau, Germany and provides customers with quantities of lipids as needed for clinical and small-scale commercial manufacturing

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.