Asia Pacific Containerized Data Center Market

Market Size in USD Billion

CAGR :

%

USD

4.19 Billion

USD

16.10 Billion

2025

2033

USD

4.19 Billion

USD

16.10 Billion

2025

2033

| 2026 –2033 | |

| USD 4.19 Billion | |

| USD 16.10 Billion | |

|

|

|

|

Asia-Pacific Containerized Data Center Market Size

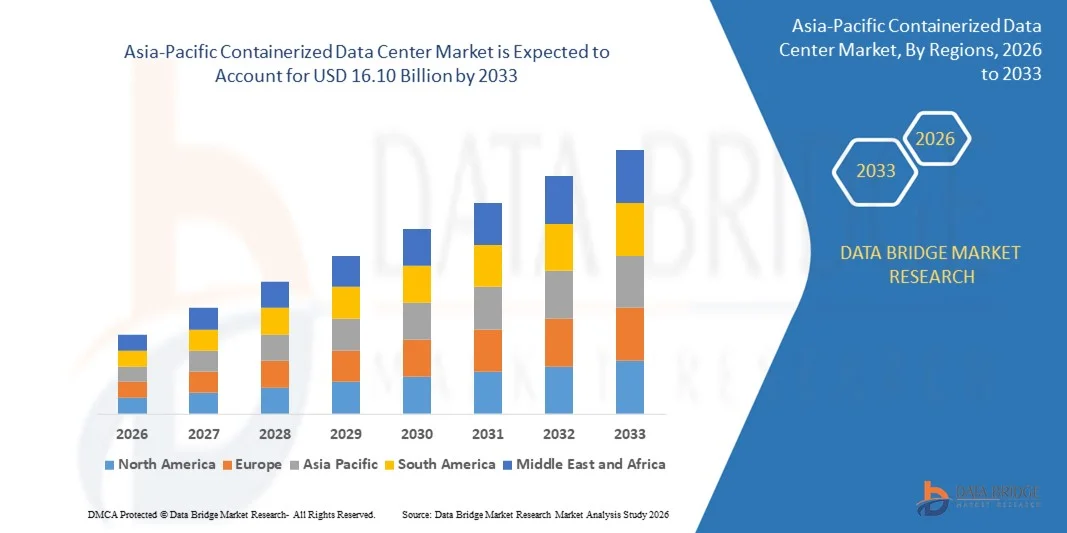

- The Asia-Pacific containerized data center market size was valued at USD 4.19 billion in 2025 and is expected to reach USD 16.10 billion by 2033, at a CAGR of 18.3% during the forecast period

- The market growth is largely driven by the rising demand for rapid deployment, scalable IT infrastructure, and reduced data center construction timelines across enterprises and service providers

- Furthermore, increasing adoption of cloud computing, edge computing, and digital transformation initiatives across industries is accelerating the deployment of containerized data centers, thereby significantly supporting overall market expansion

Asia-Pacific Containerized Data Center Market Analysis

- Containerized data centers are prefabricated, modular facilities that integrate IT equipment, power, cooling, and networking within standardized containers to enable fast, flexible, and efficient data center deployment

- The growing demand for containerized data centers is primarily fueled by the need for cost-effective infrastructure, improved energy efficiency, and the ability to quickly scale computing capacity in response to rising data volumes and evolving business requirements

- China dominated the containerized data center market in 2025, due to rapid digital transformation, large-scale cloud infrastructure expansion, and strong investments in data center development across major industries

- India is expected to be the fastest growing region in the containerized data center market during the forecast period due to rapid digitalization, expanding cloud adoption, and rising demand for data localization

- Hardware segment dominated the market with a market share of 62.9% in 2025, due to high demand for prefabricated IT infrastructure components such as servers, cooling systems, power distribution units, and networking equipment. Enterprises prefer hardware-centric deployments to achieve rapid data center setup, predictable performance, and reduced construction timelines. The standardization of containerized hardware modules further supports scalability and efficient capacity planning across diverse industries

Report Scope and Containerized Data Center Market Segmentation

|

Attributes |

Containerized Data Center Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Asia-Pacific Containerized Data Center Market Trends

Rising Adoption of Modular and Prefabricated Data Center Infrastructure

- A major trend in the containerized data center market is the growing adoption of modular and prefabricated infrastructure to support faster deployment and flexible IT capacity expansion. Organizations across industries are increasingly selecting containerized solutions to address space constraints, accelerate setup timelines, and reduce the complexity associated with traditional brick-and-mortar data centers

- For instance, Schneider Electric has deployed modular containerized data center solutions for enterprise and colocation customers seeking rapid scalability and standardized performance. These prefabricated systems enable quicker commissioning while maintaining consistent power and cooling efficiency across deployments

- The demand for containerized data centers is rising as enterprises seek agile infrastructure to support cloud services, data-intensive workloads, and distributed computing environments. Modular designs allow operators to scale capacity incrementally without disrupting ongoing operations

- Telecom operators are adopting containerized data centers to support network densification and edge computing requirements, where rapid rollout and mobility are essential. This trend aligns with the increasing need for low-latency processing closer to end users

- Government and public sector organizations are also deploying prefabricated data centers to support digital services and smart infrastructure initiatives. The standardized nature of containerized solutions simplifies compliance and enables predictable performance across multiple locations

- The continued shift toward modular infrastructure is reinforcing containerized data centers as a preferred approach for organizations prioritizing speed, scalability, and operational efficiency in modern IT environments

Asia-Pacific Containerized Data Center Market Dynamics

Driver

Growing Demand for Rapid Deployment and Scalable IT Infrastructure

- The increasing need for rapid deployment and scalable IT infrastructure is a key driver of the containerized data center market, as enterprises seek faster ways to support digital transformation initiatives. Containerized solutions significantly reduce construction time and allow organizations to respond quickly to changing workload requirements

- For instance, IBM has implemented containerized data center solutions to support enterprise clients requiring fast deployment for cloud and analytics workloads. These deployments enable businesses to expand computing capacity without lengthy infrastructure build cycles

- The expansion of cloud computing and data-driven applications is intensifying demand for infrastructure that can scale efficiently while maintaining reliability. Containerized data centers provide modular expansion capabilities that align with fluctuating data processing needs

- Industries such as BFSI and IT & telecom rely on scalable infrastructure to manage increasing transaction volumes and network traffic. The ability to deploy containerized units rapidly supports uninterrupted operations and service continuity

- Enterprises are increasingly prioritizing infrastructure flexibility to accommodate future growth and technological upgrades. This sustained need for scalable and quickly deployable solutions continues to strengthen the driver for containerized data center adoption

Restraint/Challenge

High Initial Capital Investment and Integration Complexity

- The containerized data center market faces challenges related to high initial capital investment and the complexity of integrating modular systems with existing IT infrastructure. While containerized solutions reduce long-term costs, the upfront expenditure for specialized hardware, power systems, and cooling infrastructure can be substantial

- For instance, large-scale deployments by companies such as Huawei involve advanced power distribution, cooling technologies, and customized configurations that increase initial investment requirements. Integrating these systems with legacy data center environments adds further complexity

- Organizations often encounter technical challenges related to interoperability with existing network architectures and management platforms. Ensuring seamless integration requires skilled personnel and detailed planning, which can delay deployment timelines

- The need for site preparation, regulatory compliance, and customized configurations further increases deployment complexity. These factors can discourage adoption among smaller organizations with limited technical expertise

- Managing the balance between high-performance requirements and cost efficiency remains a persistent challenge for market participants. Addressing integration and investment barriers is essential for broader adoption of containerized data center solutions across diverse end-user segments

Asia-Pacific Containerized Data Center Market Scope

The market is segmented on the basis of offering, ownership, container size, container type, organization size, application, and end user.

- By Offering

On the basis of offering, the containerized data center market is segmented into hardware and services. The hardware segment dominated the largest market revenue share of 62.9% in 2025, driven by high demand for prefabricated IT infrastructure components such as servers, cooling systems, power distribution units, and networking equipment. Enterprises prefer hardware-centric deployments to achieve rapid data center setup, predictable performance, and reduced construction timelines. The standardization of containerized hardware modules further supports scalability and efficient capacity planning across diverse industries.

The services segment is expected to witness the fastest growth from 2026 to 2033, fueled by rising demand for installation, integration, monitoring, and lifecycle management services. Organizations increasingly rely on service providers to manage operational complexity, optimize energy efficiency, and ensure regulatory compliance. The shift toward managed and subscription-based models is accelerating service adoption across both developed and emerging markets.

- By Ownership

On the basis of ownership, the market is segmented into lease and outsource. The lease segment dominated the market in 2025, supported by enterprises seeking capital expenditure optimization and faster deployment without long-term infrastructure commitments. Leasing enables organizations to quickly scale data center capacity in response to fluctuating workloads while maintaining financial flexibility. This model is widely adopted by IT service providers and enterprises with short- to medium-term data center requirements.

The outsource segment is projected to grow at the fastest rate during the forecast period, driven by increasing preference for third-party data center management. Outsourcing allows organizations to focus on core business operations while leveraging specialized expertise for data center operations. Growing complexity of IT environments and rising demand for high availability are key factors supporting this trend.

- By Container Size

On the basis of container size, the market is segmented into 20FT, 40FT, and 60FT. The 40FT container segment held the largest revenue share in 2025, owing to its optimal balance between capacity, mobility, and deployment flexibility. These containers are widely used for enterprise and colocation applications due to their ability to house higher IT loads while maintaining transport efficiency. Their compatibility with standardized logistics infrastructure further strengthens adoption.

The 60FT segment is anticipated to register the fastest growth from 2026 to 2033, driven by increasing demand for large-scale, high-density data processing. Hyperscale operators and government projects favor larger containers to consolidate infrastructure and improve operational efficiency. The growing need for edge and modular expansion also contributes to rising demand for larger container sizes.

- By Container Type

On the basis of container type, the market is segmented into customized container, compact all-in-one container, and standalone container. The customized container segment dominated the market in 2025, driven by enterprise demand for tailored power, cooling, and security configurations. Custom solutions allow organizations to align containerized data centers with specific workload requirements, regulatory standards, and site constraints. This flexibility makes customized containers highly attractive for critical and mission-sensitive applications.

The compact all-in-one container segment is expected to grow at the fastest pace over the forecast period, supported by rising adoption of plug-and-play data center solutions. These containers integrate IT, cooling, and power systems within a single enclosure, enabling rapid deployment and reduced operational complexity. Their suitability for edge computing and remote locations further accelerates growth.

- By Organization Size

On the basis of organization size, the containerized data center market is segmented into small & medium organization and large organization. The large organization segment dominated the revenue share in 2025, driven by extensive data processing requirements and high investment capacity. Large enterprises adopt containerized data centers to support digital transformation initiatives, cloud integration, and disaster recovery strategies. Their focus on scalability and reliability strongly supports market dominance.

The small & medium organization segment is expected to witness the fastest growth from 2026 to 2033, fueled by increasing awareness of modular data center benefits. SMEs are adopting containerized solutions to reduce upfront costs, improve IT agility, and support growing digital workloads. The availability of cost-effective and scalable solutions is a key growth driver for this segment.

- By Application

On the basis of application, the market is segmented into greenfield, brownfield, and upgrade and consolidation. The greenfield segment accounted for the largest market share in 2025, driven by rising investments in new data center infrastructure across emerging and developed economies. Containerized data centers are widely adopted in greenfield projects due to their speed of deployment and standardized design. This approach enables organizations to rapidly establish IT capacity in new locations.

The upgrade and consolidation segment is projected to grow at the fastest rate during the forecast period, supported by modernization of legacy data centers. Organizations are increasingly replacing traditional infrastructure with containerized modules to improve efficiency and reduce operational costs. The need to consolidate fragmented IT environments further accelerates adoption.

- By End User

On the basis of end user, the containerized data center market is segmented into IT & telecom, BFSI, healthcare, government, retail & ecommerce, energy & utilities, media & entertainment, military & defense, education, and others. The IT & telecom segment dominated the market in 2025, driven by high data traffic, cloud service expansion, and 5G deployment. These organizations require scalable and resilient infrastructure to support continuous network operations and low-latency services. Containerized data centers offer rapid expansion and efficient resource utilization for this sector.

The healthcare segment is expected to register the fastest growth from 2026 to 2033, fueled by increasing adoption of digital health records, telemedicine, and data-intensive diagnostic technologies. Healthcare providers are deploying containerized data centers to ensure data security, regulatory compliance, and uninterrupted access to critical information. The growing reliance on real-time data processing significantly supports segment growth.

Asia-Pacific Containerized Data Center Market Regional Analysis

- China dominated the containerized data center market with the largest revenue share in 2025, driven by rapid digital transformation, large-scale cloud infrastructure expansion, and strong investments in data center development across major industries

- Strong government support for digital infrastructure, increasing adoption of cloud services, and growing deployment of edge computing facilities reinforce China’s leadership in the regional market

- The presence of major domestic and global technology providers, large hyperscale data center projects, and rising demand from IT & telecom, BFSI, and government sectors continue to strengthen China’s dominant position during the forecast period. Expanding smart city initiatives and accelerated 5G rollout further support widespread adoption across urban and industrial regions

Japan Containerized Data Center Market Insight

The Japan market is anticipated to grow steadily from 2026 to 2033, supported by its advanced IT infrastructure and strong focus on data security and reliability. Japanese enterprises are increasingly adopting containerized data centers to support cloud computing, disaster recovery, and edge deployments, reflecting the country’s emphasis on operational resilience. The demand for compact and energy-efficient containerized solutions is rising due to space constraints and high real estate costs. Continuous investments by domestic technology companies and collaborations with global data center solution providers reinforce stable market growth. Japan’s focus on efficiency, reliability, and technological innovation underpins its solid regional position.s

India Containerized Data Center Market Insight

India is projected to register the fastest CAGR in the Asia Pacific containerized data center market during 2026–2033, fueled by rapid digitalization, expanding cloud adoption, and rising demand for data localization. Growth in internet usage, e-commerce, fintech, and digital government services is accelerating the need for scalable and rapidly deployable data center infrastructure. Containerized data centers are gaining traction due to their cost efficiency and shorter deployment timelines. Increasing investments by hyperscale cloud providers, expansion of edge data centers, and supportive government digital initiatives are improving infrastructure accessibility. These factors position India as the fastest-growing market in the region.

Asia-Pacific Containerized Data Center Market Share

The containerized data center industry is primarily led by well-established companies, including:

- IBM Corporation (U.S.)

- Cisco (U.S.)

- Retex (Italy)

- Rittal GMBH & CO. KG (Germany)

- Huawei Technologies Co. Ltd. (China)

- Vertiv (U.S.)

- Datacenter United (Belgium)

- Canovate (Turkey)

- Delta Power Solutions (Taiwan)

- ATOS SE (France)

- ZTE Corporation (China)

- Fuji Electric Co. (Japan)

- RZ-Product GmbH (Germany)

- Schneider Electric (France)

- American Portwell Technology Inc. (U.S.)

- PCX Corporation LLC (U.S.)

Latest Developments in Asia-Pacific Containerized Data Center Market

- In August 2024, Sustainable Metal Cloud (SMC), a Singapore-based AI cloud provider and Nvidia partner, launched HyperCubes—containerized GPU servers equipped with advanced immersion cooling technology. By submerging Nvidia-powered servers in synthetic oil, HyperCubes achieve 50% greater energy efficiency and 28% lower installation costs than traditional air-cooled systems. This innovation supports high-density GPU hosting, essential for AI workloads such as Nvidia’s Grace Blackwell platform, while addressing the growing demand for sustainable, high-performance data center infrastructure. SMC is also expanding into India and Thailand, backed by strategic partners including Nvidia, Deloitte, and ST Telemedia

- In July 2024, Syla Solar Co., Ltd. completed an absorption-style merger with its sister company, Syla Biotech Corporation, consolidating their operations under the Syla Solar brand. Syla Biotech, known for its containerized data centers powered entirely by renewable energy—including deployments in Niigata Prefecture—was integrated to strengthen Syla Solar’s capabilities in sustainable infrastructure. This strategic move, backed by Syla Technologies Co., Ltd., aligns with the group’s broader push into renewable energy and smart infrastructure, enhancing its position in the green data center market

- In March 2024, Delta Electronics launched a containerized data center solution in India, engineered for rapid deployment in edge computing environments. This prefabricated, plug-and-play system integrates critical subsystems—such as UPS, power distribution, cooling, and battery storage—into a compact, modular unit. While currently powered by grid electricity and backup batteries, Delta has announced plans to incorporate renewable energy sources into future deployments, particularly for remote or off-grid locations. This move aligns with the region’s push for sustainable, scalable IT infrastructure, especially in telecom and IoT-heavy sectors

- In November 2023, Sabey Data Centers and Eclairion entered a referral partnership to broaden their global market presence and deliver advanced containerized data center solutions. Eclairion, based in Paris, specializes in ecological, high-density modular data centers tailored for AI and HPC workloads, while Sabey brings decades of experience in multi-tenant data center infrastructure. The collaboration enables both companies to offer flexible, sustainable, and high-performance hosting solutions to clients worldwide—particularly those seeking rapid deployment and reduced carbon footprints

- In October 2023, Mitsubishi Heavy Industries, Ltd. (MHI) unveiled a 40kVA-class 12ft container-type data center featuring a hybrid cooling system that integrates immersion (25kVA), air (8kVA), and water (8kVA) cooling technologies. This modular solution is designed to accommodate diverse server workloads with varying power densities, making it ideal for edge computing and high-performance applications. The system demonstrated a Power Usage Effectiveness (PUE) as low as 1.05 under 40°C conditions using immersion cooling alone, and 1.14 when combined with air cooling—highlighting its energy efficiency. MHI plans to commercialize the unit following successful trials at its Yokohama Hardtech Hub

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.