Asia Pacific Computer Aided Design Computer Aided Manufacturing Dental Devices Market

Market Size in USD Million

CAGR :

%

USD

911.69 Million

USD

1,651.56 Million

2025

2033

USD

911.69 Million

USD

1,651.56 Million

2025

2033

| 2026 –2033 | |

| USD 911.69 Million | |

| USD 1,651.56 Million | |

|

|

|

|

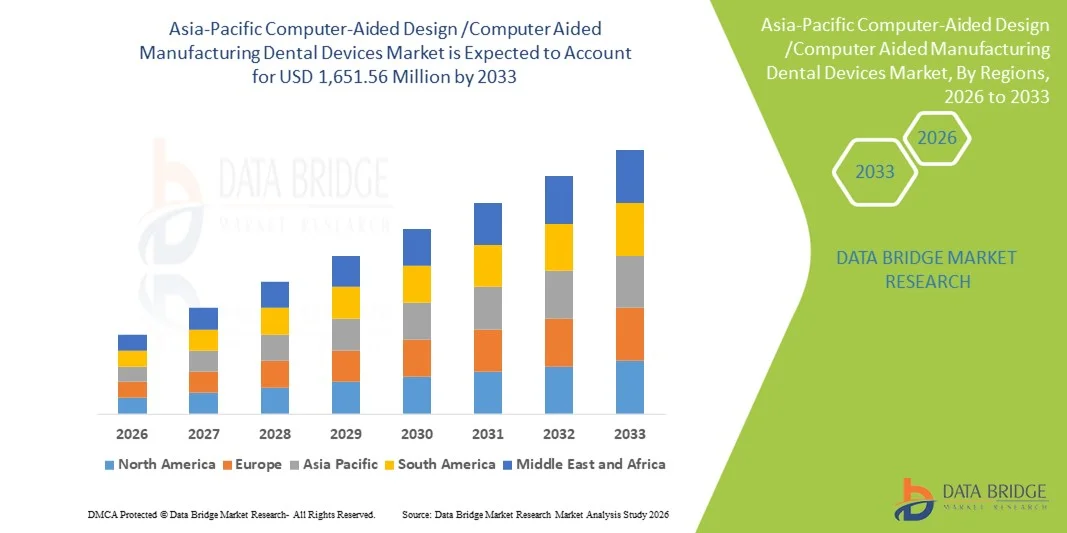

Asia-Pacific Computer-Aided Design /Computer Aided Manufacturing Dental Devices Market Size

- The Asia-Pacific computer-aided design /computer aided manufacturing dental devices market size was valued at USD 911.69 million in 2025 and is expected to reach USD 1,651.56 million by 2033, at a CAGR of 7.71% during the forecast period

- The market growth is largely driven by the rapid adoption of digital dentistry, continuous technological advancements in CAD/CAM systems, and increasing investments in modern dental infrastructure across both developed and emerging Asia-Pacific economies

- Furthermore, rising demand for precise, time-efficient, and patient-specific dental restorations, along with growing awareness among dental professionals and patients, is establishing CAD/CAM dental devices as the preferred solution in clinical workflows. These converging factors are accelerating the uptake of CAD/CAM technologies, thereby significantly boosting the regional market’s growth trajectory

Asia-Pacific Computer-Aided Design /Computer Aided Manufacturing Dental Devices Market Analysis

- Computer-aided design / computer aided manufacturing dental devices, enabling digitally designed and precisely manufactured dental restorations, are increasingly adopted across key Asia-Pacific countries due to their high accuracy, reduced treatment timelines, and ability to deliver customized dental solutions

- The growing demand for computer-aided design / computer aided manufacturing dental devices is primarily driven by the rapid penetration of digital dentistry, increasing prevalence of dental disorders, rising cosmetic dentistry procedures, and a strong preference among dental professionals for efficient and reliable restorative workflows

- China dominated the Asia-Pacific computer-aided design / computer aided manufacturing dental devices market with a revenue share of 34.6% in 2025, supported by a large patient base, expanding private dental clinic networks, rising healthcare investments, and strong domestic manufacturing capabilities in dental equipment and materials

- India is expected to be the fastest-growing country in the Asia-Pacific computer-aided design / computer aided manufacturing dental devices market during the forecast period driven by increasing disposable incomes, growing dental tourism, rapid urbanization, and accelerating adoption of advanced digital dental technologies

- The milling machines segment dominated the Asia-Pacific computer-aided design / computer aided manufacturing dental devices market with a market share of 41.3% in 2025, driven by their extensive use in dental laboratories and clinics for producing high-precision crowns, bridges, and prosthetic restorations

Report Scope and Asia-Pacific Computer-Aided Design /Computer Aided Manufacturing Dental Devices Market Segmentation

|

Attributes |

Asia-Pacific Computer-Aided Design /Computer Aided Manufacturing Dental Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Asia-Pacific Computer-Aided Design /Computer Aided Manufacturing Dental Devices Market Trends

Accelerated Shift Toward Chairside Digital Dentistry

- A significant and accelerating trend in the Asia-Pacific computer-aided design / computer aided manufacturing dental devices market is the growing adoption of chairside CAD/CAM systems that enable same-day dental restorations, significantly improving clinical efficiency and patient satisfaction

- For instance, chairside systems from companies such as Dentsply Sirona and Planmeca are increasingly adopted by dental clinics across Japan, South Korea, and Australia, allowing dentists to design, mill, and place restorations within a single appointment

- Advancements in scanning accuracy, milling precision, and material compatibility are enabling clinicians to deliver highly aesthetic and durable restorations. For instance, newer intraoral scanners paired with CAD/CAM software offer improved marginal accuracy and faster processing, reducing manual errors and remake rates

- The integration of CAD/CAM systems with digital imaging, practice management software, and cloud-based workflows supports streamlined case planning and data sharing between clinics and dental laboratories, creating a more connected digital dental ecosystem

- This trend toward faster, more precise, and digitally integrated dental workflows is reshaping treatment expectations across Asia-Pacific. Consequently, manufacturers are focusing on compact, user-friendly chairside CAD/CAM solutions tailored for space-constrained clinics and high patient volumes

- Increasing adoption of cloud-based CAD/CAM software platforms is enabling remote case collaboration between dental clinics and laboratories, improving design accuracy and reducing turnaround times across multi-location practices

- The demand for chairside CAD/CAM dental devices is growing rapidly across urban dental clinics and premium practices, as patients increasingly prefer minimally invasive, time-efficient, and technologically advanced dental treatments

Asia-Pacific Computer-Aided Design /Computer Aided Manufacturing Dental Devices Market Dynamics

Driver

Rising Demand for Aesthetic Dentistry and Digital Clinical Efficiency

- The increasing demand for aesthetic dental procedures combined with the need for higher clinical efficiency is a key driver accelerating the adoption of computer-aided design / computer aided manufacturing dental devices across Asia-Pacific

- For instance, in 2024, several private dental clinic chains in China and South Korea expanded their digital dentistry investments by upgrading CAD/CAM systems to meet rising demand for crowns, veneers, and implant-supported restorations

- As patient awareness of cosmetic dentistry grows, CAD/CAM devices enable clinicians to deliver consistent, high-quality restorations with superior aesthetics, strengthening their value proposition over conventional fabrication methods

- Furthermore, increasing patient volumes in urban centers are pushing clinics and dental laboratories to adopt automated and digitally driven manufacturing solutions to reduce turnaround times and improve workflow productivity

- The ability to standardize restorative outcomes, minimize manual labor, and reduce dependency on outsourced laboratories is making CAD/CAM dental devices a strategic investment for both clinics and dental labs

- Government-led initiatives supporting oral healthcare modernization and private healthcare investments across Asia-Pacific are accelerating the installation of advanced CAD/CAM systems in urban and semi-urban dental facilities

- The growing preference for digitally enabled dental practices, combined with expanding private healthcare infrastructure, is significantly driving market growth across emerging and developed Asia-Pacific economies

Restraint/Challenge

High Capital Investment and Skilled Workforce Limitations

- The high initial capital investment required for computer-aided design / computer aided manufacturing dental devices presents a notable challenge, particularly for small and mid-sized dental clinics across price-sensitive Asia-Pacific markets

- For instance, the cost of acquiring integrated CAD/CAM systems, including scanners, milling units, and software licenses, can deter independent clinics in countries such as Indonesia, Vietnam, and the Philippines from rapid adoption

- In addition, the effective use of CAD/CAM technology requires trained dental professionals and technicians, and the shortage of adequately skilled personnel can limit optimal system utilization

- Ongoing costs related to software upgrades, system maintenance, and material compatibility further increase the total cost of ownership, creating financial pressure for clinics with limited operating margins

- While manufacturers are introducing entry-level and modular CAD/CAM solutions, affordability and training gaps remain key barriers, especially outside major metropolitan areas

- Addressing these challenges through cost-effective system offerings, expanded training programs, and localized technical support will be essential for sustained adoption and long-term market growth

- Variability in reimbursement policies and limited insurance coverage for advanced dental procedures in several Asia-Pacific countries restrict patient affordability and slow CAD/CAM procedure adoption

- Regulatory complexity and delayed approval timelines for new dental devices and materials across different Asia-Pacific countries can hinder timely product launches and technology upgrades

Asia-Pacific Computer-Aided Design /Computer Aided Manufacturing Dental Devices Market Scope

The market is segmented on the basis of product type, component, application, end-user, and scale.

- By Product Type

On the basis of product type, the Asia-Pacific CAD/CAM dental devices market is segmented into In-lab and in-office systems. The In-Lab segment dominated the market with a revenue share of 57.4% in 2025, owing to the long-standing adoption of dental laboratories for high-volume, customized restorations. Laboratories often prefer in-lab systems due to their ability to produce multiple crowns, bridges, and dentures simultaneously with high precision. These systems also allow the use of a wider range of materials and advanced milling units. In-lab CAD/CAM solutions integrate seamlessly with cloud-based design software, enhancing collaboration between clinics and labs. Established dental labs in China, Japan, and South Korea are heavily investing in upgrading to in-lab CAD/CAM devices. In addition, the reliability, durability, and scalability of in-lab systems make them the preferred choice for large-scale operations and dental chains.

The In-Office segment is expected to witness the fastest growth with a CAGR of 22.1% from 2026 to 2033, driven by the rising adoption of chairside CAD/CAM systems in dental clinics. In-office systems allow same-day restorations, reducing patient visits and improving satisfaction. Growing awareness among patients and dentists regarding minimally invasive and time-efficient treatments is boosting this segment. Urban clinics in India, Australia, and Thailand are increasingly integrating in-office CAD/CAM solutions for veneers, crowns, and implant-supported restorations. Technological improvements in compact scanners and milling units are making in-office systems more accessible to mid-sized clinics. The convenience, reduced lab dependency, and rapid ROI potential are key factors contributing to its accelerated adoption.

- By Component

On the basis of component, the market is segmented into equipment, milling machines, scanners, and software. The Milling Machines segment dominated the market with a revenue share of 41.3% in 2025, as milling machines are crucial for transforming digital designs into precise, durable restorations. Dental labs and clinics rely on milling machines for high-quality crowns, bridges, and dentures. Advanced milling units offer multi-axis capabilities, enabling detailed and intricate designs with minimal material wastage. Leading brands such as Dentsply Sirona and Planmeca have upgraded their milling solutions to improve speed and material versatility. The robust performance and long service life of these machines make them indispensable for professional dental workflows. In addition, milling machines integrate with both in-lab and in-office setups, driving their continued dominance in the market.

The Scanners segment is expected to witness the fastest CAGR of 24.5% from 2026 to 2033, fueled by increasing adoption of intraoral scanners for precise digital impressions. Scanners reduce errors associated with traditional molds and improve patient comfort during procedures. Rapid advancements in scanning accuracy, speed, and user-friendliness are encouraging adoption in both clinics and labs. Growing awareness of digital dentistry and demand for chairside solutions in urban Asia-Pacific markets further supports this growth. In addition, scanners are integral for enabling seamless workflow integration with CAD software, allowing for quicker case planning and restoration fabrication.

- By Application

On the basis of application, the market is segmented into crowns, dentures, bridges, veneers, and inlays/on-lays. The Crowns segment dominated the market with a revenue share of 38.7% in 2025, driven by their frequent use in restorative and cosmetic dental procedures. Crowns require high precision and durability, which CAD/CAM technology provides through accurate digital impressions and milling. Dental labs and clinics across China, Japan, and South Korea heavily invest in CAD/CAM systems for crown production due to high patient demand. Crowns also offer significant margin potential for clinics, enhancing their adoption of digital solutions. Integration with advanced materials such as zirconia and lithium disilicate ensures aesthetic and functional superiority. In addition, crown production benefits from automation and standardization, reducing errors and improving patient outcomes.

The Veneers segment is expected to witness the fastest CAGR of 23.4% from 2026 to 2033, driven by rising demand for cosmetic dentistry and smile makeovers. Veneers require highly precise fabrication, which CAD/CAM devices enable with minimal manual intervention. Urban populations in India, Thailand, and Australia increasingly seek aesthetic enhancements, fueling demand. Clinics are investing in chairside solutions that can deliver same-day veneers, improving patient satisfaction. Technological advances in materials and milling accuracy make CAD/CAM veneers more durable and visually appealing. The growing awareness of cosmetic dentistry through social media and dental tourism is further accelerating adoption.

- By End-User

On the basis of end-user, the market is segmented into dental laboratories, milling centres, and dental clinics. The Dental Laboratories segment dominated the market with a revenue share of 52.1% in 2025, as labs provide high-volume, precision-oriented restorative services. Laboratories benefit from advanced CAD/CAM systems for multi-unit bridges, dentures, and implant cases. The ability to handle complex designs and diverse materials, coupled with integration of CAD/CAM software, drives this dominance. Established labs in China, Japan, and South Korea are early adopters of milling machines and scanners, optimizing productivity and reducing turnaround times. The professional expertise and infrastructure in labs allow them to extract maximum value from CAD/CAM investments. In addition, laboratories often service multiple clinics, reinforcing their high utilization rates and market share.

The Dental Clinics segment is expected to witness the fastest CAGR of 21.9% from 2026 to 2033, driven by the increasing adoption of chairside CAD/CAM systems for in-office restorations. Clinics in urban India, Thailand, and Australia prefer in-office systems for same-day crowns, veneers, and implant restorations. This adoption reduces dependency on external laboratories, enhances patient convenience, and improves operational efficiency. Training programs for dentists and technicians are expanding across the region, supporting faster uptake. Patients increasingly favor clinics that offer digital workflows, boosting the segment’s growth. The convenience, reduced procedural time, and enhanced aesthetic results are key drivers for this rapid expansion.

- By Scale

On the basis of scale, the market is segmented into complete systems and scanners. The Complete Systems segment dominated the market with a revenue share of 46.8% in 2025, due to its comprehensive integration of scanners, milling machines, and software in one solution. Complete systems provide end-to-end workflows, from digital impressions to final restorations, increasing efficiency and reducing errors. Dental laboratories and clinics prefer complete systems for consistent output and reliability. Major CAD/CAM suppliers in Japan, South Korea, and China offer modular complete systems that can be upgraded over time, making them attractive for long-term investment. Complete systems also facilitate better collaboration between clinicians and labs, supporting high-volume operations. Their robust design, multi-material compatibility, and automation features make them a preferred choice for professional applications.

The Scanners segment is expected to witness the fastest CAGR of 23.8% from 2026 to 2033, owing to the growing adoption of intraoral scanners in dental clinics for digital impressions. Scanners offer precise data capture, reduce procedural time, and enhance patient comfort compared with traditional molds. Rising awareness of chairside and in-office CAD/CAM applications in India, Thailand, and Australia is boosting scanner adoption. Integration with cloud-based software allows remote planning and collaboration with labs. Technological improvements, smaller footprints, and affordable pricing models are making scanners accessible to mid-sized clinics. Increasing demand for same-day restorations and digital workflow adoption is further accelerating growth in this segment.

Asia-Pacific Computer-Aided Design /Computer Aided Manufacturing Dental Devices Market Regional Analysis

- China dominated the Asia-Pacific computer-aided design / computer aided manufacturing dental devices market with a revenue share of 34.6% in 2025, supported by a large patient base, expanding private dental clinic networks, rising healthcare investments, and strong domestic manufacturing capabilities in dental equipment and materials

- Dental professionals and laboratories in China prioritize CAD/CAM devices for their precision, efficiency, and ability to deliver high-quality restorations such as crowns, bridges, and veneers, meeting the rising patient demand for cosmetic and restorative procedures

- The widespread adoption in China is further supported by a large patient base, rising disposable incomes, and strong domestic manufacturing capabilities, which enhance accessibility and reduce costs of CAD/CAM equipment, making it a preferred choice for clinics and laboratories across both urban and semi-urban areas

The China Computer-Aided Design / Computer-Aided Manufacturing Dental Devices Market Insight

The China computer-aided design / computer aided manufacturing dental devices market captured the largest revenue share of 34.6% in 2025, fueled by rapid investments in private dental clinics, expanding dental laboratory networks, and increasing patient awareness of cosmetic and restorative dentistry. Dental professionals prioritize computer-aided design / computer aided manufacturing dental devices for high-precision crowns, bridges, and dentures, while domestic manufacturing of equipment and materials ensures competitive pricing and widespread adoption across urban and semi-urban regions. Furthermore, strong collaboration between clinics and laboratories enhances operational efficiency and case throughput.

Japan Computer-Aided Design / Computer-Aided Manufacturing Dental Devices Market Insight

The Japan computer-aided design / computer aided manufacturing dental devices market is gaining momentum due to the country’s advanced healthcare infrastructure, high disposable incomes, and strong adoption of digital dental technologies. Japanese clinics emphasize precision and speed, integrating computer-aided design / computer aided manufacturing dental devices with intraoral scanners and milling machines to deliver same-day restorations. In addition, growing patient demand for cosmetic and minimally invasive dentistry, along with a culture of technology adoption, is driving the uptake of chairside and in-lab computer-aided design / computer aided manufacturing dental devices.

India Computer-Aided Design / Computer-Aided Manufacturing Dental Devices Market Insight

The India computer-aided design / computer aided manufacturing dental devices market accounted for a significant market revenue share in Asia-Pacific in 2025, attributed to the country’s expanding middle class, rapid urbanization, and rising number of private dental clinics. India is witnessing strong growth in both cosmetic and restorative dentistry, and the adoption of computer-aided design / computer aided manufacturing dental devices is supported by government initiatives for healthcare modernization and dental education programs. Increasing dental tourism, combined with affordable equipment options and domestic manufacturing, is further propelling the market.

South Korea Computer-Aided Design / Computer-Aided Manufacturing Dental Devices Market Insight

The South Korea computer-aided design / computer aided manufacturing dental devices market is expanding steadily, driven by the country’s advanced dental infrastructure, high technological awareness, and strong adoption of digital dental workflows. Clinics and laboratories are increasingly integrating computer-aided design / computer aided manufacturing dental devices, including scanners, milling machines, and CAD software, to enhance precision, reduce turnaround time, and meet growing demand for cosmetic and restorative procedures. Government support for healthcare technology adoption and widespread dental insurance coverage for restorative procedures are contributing factors to market growth

Asia-Pacific Computer-Aided Design /Computer Aided Manufacturing Dental Devices Market Share

The Asia-Pacific Computer-Aided Design /Computer Aided Manufacturing Dental Devices industry is primarily led by well-established companies, including:

- MEDIT Corp. (South Korea)

- Shining 3D (China)

- Planmeca Oy (Finland)

- Dentsply Sirona (U.S.)

- GC International AG (Switzerland)

- Align Technology, Inc. (U.S.)

- Zimmer Biomet (U.S.)

- Carestream Dental LLC (U.S.)

- 3M (U.S.)

- Roland DG Corporation (Japan)

- Vatech (South Korea)

- Kelkar Dynamics LLP (India)

- DATRON AG (Germany)

- Axsys Dental Solutions (U.S.)

- Institut Straumann AG (Switzerland)

- Nobel Biocare (Switzerland)

- Amann Girrbach AG (Austria)

- Ivoclar Vivadent AG (Liechtenstein)

- Zirkonzahn GmbH (Italy)

- Exocad GmbH (Germany)

What are the Recent Developments in Asia-Pacific Computer-Aided Design /Computer Aided Manufacturing Dental Devices Market?

- In October 2025, Align Technology announced new innovations for its iTero™ Digital Solutions, including enhanced chairside visualization and integrated software tools designed to improve diagnostics, patient engagement, and treatment planning, strengthening digital CAD/CAM workflows in dental clinics globally, including Asia‑Pacific

- In June 2025, Align Technology highlighted innovations at the 2025 Invisalign® Asia Pacific Summit in Bangkok, showcasing its latest digital dentistry solutions such as iTero™ intraoral scanners and exocad™ CAD/CAM software to more than 2,000 dental professionals, reinforcing adoption and education in digital workflows across the region

- In March 2025, Medit and Pearl announced a strategic collaboration to integrate Pearl’s AI‑powered diagnostic capabilities into the Medit Link intraoral scanning and software platform, enhancing intraoral scanning accuracy, workflow efficiency, and clinical communications for dental professionals in Asia‑Pacific and globally

- In March 2025, Medit showcased advanced chairside and lab digital dentistry solutions at IDS 2025, including the latest Medit i900 classic intraoral scanner and Medit SmartX ecosystem designed to streamline CAD/CAM workflows and improve precision in restorations and orthodontic planning

- In February 2025, Dentsply Sirona emphasized its leadership in digital dentistry innovations across the Asia‑Pacific region, with products such as Primescan 2 and the DS Core cloud platform showcased at DS World Tokyo 2024, aiming to elevate clinical precision, connected workflows, and dental practice efficiency

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.